Quirky Governance – Insider Trading and Whistle-Blowing

- Blog|Company Law|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 7 January, 2026

Check out Taxmann's Corporate Governance which is a thoroughly revised, syllabus-driven textbook that blends theory, law, ethics, and case studies to offer a holistic understanding of governance in both Indian and global contexts. This 2nd Edition integrates the latest updates to the Companies Act 2013, SEBI LODR 2015, and post-Kotak reforms, reflecting contemporary expectations of board effectiveness and transparency. Tailored to the NEP-aligned B.Com. curriculum, the book provides clear learning objectives, structured pedagogy, and extensive assessment support. Through its rich theoretical frameworks, comparative models, and analyses of major corporate failures, it serves as an indispensable resource for students, educators, and governance professionals.

1. Introduction

Every corporate has a number of stakeholders and some of them have better access to valuable non-public information than others which they can use to their advantage. Examples of two such important instances are – first, when some people trade on the basis of price sensitive non-public information (insider trading) and second, when someone makes public information, especially negative, about corporate conduct and corporate performance (whistle blowing). Macey (2008) has labelled these two along with short selling as quirky governance.

2. Insider Trading

2.1 Meaning

Insider trading is transacting in securities of the company by an insider on the basis of unpublished price sensitive information (UPSI).

Key definitions as per SEBI (Prohibition of Insider Trading) Regulations, 2015:

- Insider – A “connected person” or a person possessing or having access to unpublished price sensitive information;

- Connected Person – One who has been associated with the company in any capacity such as a director, officer or employee or in a contractual or fiduciary relationship with the company; and includes a list of “deemed connected persons”;

- Unpublished Price Sensitive Information (UPSI) – Any information relating to securities of a company that is not generally available, and, upon being available, is likely to materially affect the price of the company’s securities. It includes matters such as financial results, dividends, changes in capital structure, significant corporate transactions and changes in key managerial personnel.

2.2 Legal Position

Insider Trading in India is an offence on the basis of non-public price sensitive information according to SEBI (Prohibition of Insider Trading) Regulations, 2015.1

2.3 Rationale for Insider Trading Regulations

Most of the countries in the world prohibit insider trading in some form or the other. Some of the important reasons for doing it are as follows:

(i) Preserving Capital Market Efficiency – Efficient capital markets are essential for encouraging investors to invest in securities. In an efficient market information, all the market participants should be able to access information equally. Insider trading results in distortions in capital markets as some participants have superior information than others.

(ii) Undermines Investor Confidence – Insider trading results in an unexplained and sudden increase or decrease in prices of the securities. Such unjustified volatility in prices undermines investors’ confidence in the company.

(iii) Against Good Corporate Governance Practices – Insider trading is unfair as it enriches few at the cost of wider stakeholders. Transparency and business ethics are also sacrificed. High standards of corporate governance cannot be, therefore, attained.

2.4 SEBI (Prohibition of Insider Trading) Regulations, 2015

The Securities and Exchange Board of India (SEBI) has notified the SEBI (Prohibition of Insider Trading) Regulations, 2015 on 15th January, 2015. These supersede the Regulations related to Insider Trading in 1992 by SEBI. The new Regulations are stricter and have imposed huge penalties for non-compliance and contravention. Some of the important provisions of these Regulations are

(i) Role of Compliance Officer – The major responsibility for monitoring and implementing the Codes of Conduct is upon the Compliance Officer.

(ii) Prohibition on the Exercise of ESOPs – Designated persons have been prohibited to exercise ESOPs during six months after sale of shares.

(iii) Threshold Limit for Disclosures – Certain persons, as specified under Regulations, on crossing the set limit of value of the securities traded in a certain period shall disclose it to the Compliance Officer.

(iv) Formulation of a Trading Plan by an Insider2 – The concept of a trading plan allows insiders to trade in compliance with the regulations without violating the prohibitions imposed. A ‘trading plan’ refers to a plan framed by an insider for trades to be executed at a future date. It is particularly suitable for individuals within an organisation who may, by way of their position, seniority, or any other reason, be in possession of UPSI at all times. Since the Regulations prohibit trading when in possession of UPSI, trading plans serve as an exemption to such prohibition. An insider can formulate a trading plan and present it to the compliance officer for approval and public disclosure. Based on the approved plan, trades may be carried out on behalf of the insider. The time gap for the commencement of trading from the date of public disclosure of the trading plan is 120 calendar days. The compliance officer must approve or reject the plan within two trading days of receipt.

(v) Maintenance of Disclosures – The disclosures made under these regulations shall be maintained by the company for a minimum period of eight years in a structured digital database. In this database, records about the persons who possess UPSI are kept. The data on SDD must be managed with a trusted database software instead of using software such as MS Word, MS Excel, MS PowerPoint, where the data can be edited.

(vi) Formulation of Whistle Blower Policy – Regulations created an obligation on listed companies to formulate a Whistle-Blower Policy. In 2019, SEBI introduced a mechanism for informants to file complaints directly with it. In 2021, SEBI raised the compensation for whistle-blowers in insider trading cases to ₹10 crore from ₹1 crore.

These new Regulations have been issued by SEBI to ensure a level playing field in the securities market for all the investors and to safeguard their interest as well.

3. Whistle Blowing

3.1 Introduction

The act of an insider making public acts of corruption, illegal practices, and other forms of unethical behaviour by organisations is common throughout the World. For such acts, U.S. civic activist Ralph Nader, gave the term whistle blowing in 1970’s and such insiders are called whistle-blowers. The scope of the term has become wider over the years. Since 1990’s, the act of an employee raising these concerns internally outside the normal chain of command are also being termed as whistle blowing.

3.2 Definition

According to Vandekerckhove (2006),

“A whistle-blower is a person who exposes any kind of information or activity that is deemed illegal, unethical, or not correct within an organization that is either private or public.”

Important features of whistle-blowing, on the basis of above definition, are as follows:

(i) A whistle-blower can be an employee or a former employee or any other person in a contractual relationship with a company.

(ii) He makes public wrongful acts/information to the outside world or internally outside the usual hierarchical line.

(iii) He reports these acts to someone who is in a position to take action or has an authority to do so.

(iv) Whistle blowing can happen in public or private organisations.

3.3 Types of Whistle-Blowing

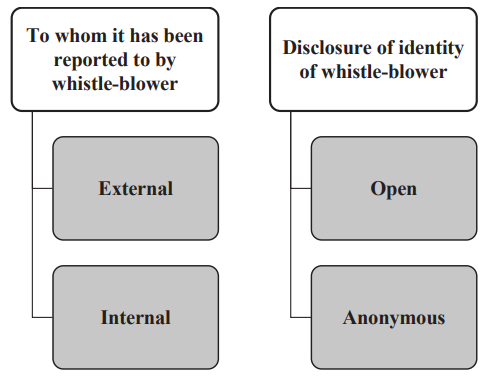

Whistle blowing can be classified on the basis of:

3.3.1 External Whistle-Blowing and Internal Whistle-Blowing

(a) If the whistle-blower reports misconduct to a person outside the organisation, such as regulatory agency or the media, it is termed as external whistle-blowing. Internal whistle-blowing is a situation when a whistle-blower reports misconduct to another person within the organisation but outside the usual line of command.

One of the famous external whistleblowers is Erin Brockovich, a legal clerk and environmental advocate who gained recognition for uncovering the contamination of groundwater in Hinkley, California, by Pacific Gas & Electric (PG&E). The contaminant was hexavalent chromium, a harmful chemical linked to severe health issues in the community. In the 1990s, Brockovich spearheaded efforts to investigate the issue, bringing to light PG&E’s responsibility for pollution. Her work played a key role in securing a $333 million settlement for the affected residents, one of the largest environmental settlements in U.S. history, and raised awareness about corporate environmental misconduct. Cynthia Coppers, who blew the lid off WorldCom Scam, was an employee of the company and is an example of an internal whistle blower.

(b) From a corporate’s point of view both types reflect whistle-blower’s disillusionment with and distrust of the system. However, the damage to reputation of the entity done by external whistle blowing is much more than the latter. It may result in heavy fines and penalties imposed by regulatory authorities.

Types of Whistle-blowing

3.3.2 Open Whistle-Blowing and Anonymous Whistle-Blowing

(a) When whistle-blower reveal his identity as he conveys the information, it is said to be open whistle-blowing and if identity is concealed, it is termed as anonymous whistle-blowing. The main advantage with open whistle-blowing is that the security can be provided to such a person and he/she can be contacted for further information.

(b) In many situations, open whistle blowers have been hugely rewarded in terms of money and, thus, the real motive behind whistle-blowing by such remains doubtful. Anonymous whistle blowing may not be taken seriously by the regulators or the organization and burden of protection of whistle-blower is also not there.

3.4 Pros and Cons of Whistle-Blowing

Whistle-blowing can be a rewarding experience for some whistle-blowers. But others may have to face a backlash or mistrust of others:

3.4.1 Pros of Whistle-Blowing

(a) Financial Compensation – Many times, whistle-blower law/policy has a provision of rewarding the whistle-blower financially. For example, whistle-blowers in the US are, generally, entitled to a part of a settlement collected by the Government. Dinesh Thakur, the whistle-blower who helped the US Government show systemic product-testing failures at Ranbaxy and which led to the $500 million settlement in 2013, received $48 million. In US, the Dodd-Frank Act offers financial rewards for whistleblowers who expose securities fraud.

(b) Legal Protection – Many people face retaliation when they become a whistle-blower. Organisational policies and laws can protect them from adverse consequences. To take an example, in India Whistle Blowers Protection Act, 2014 seeks to protect whistle blower who has made a public interest disclosure related to an act of corruption, misuse of power, or criminal offense by a public servant.

(c) Reduces Risk – One of the main reasons to blow the whistle on any illegal or unethical activity is to protect colleagues and other stakeholders or public at large from certain risks. Whistle-blowing acts as a safeguard.

(d) Ethical Responsibility – Whistle-blower may have been pushed to do so by his sense of right and wrong. For example, Sherron Watkins, the former Vice-President of Enron Corporation in US and whistle-blower alerted then-CEO Ken Lay in August 2001 to accounting irregularities within the company. She testified before Congressional Committees from the House and Senate investigating Enron’s demise.

3.4.2 Cons of Whistle-blowing

(a) Retaliation – Whistle-blower may have to face potential retaliation from management, colleagues or even Government. The case of Edward Snowden is an example of a backlash. He leaked details of several top-secret United States mass surveillance programs to the media and was forced to flee the country and seek asylum in Russia to escape prosecution by the US Government. In June 2024, the outgoing CEO of Boeing Dave Calhoun accepted at a Senate hearing in US that Boeing is trying to protect whistle-blowers at his company but still they have faced retaliation.3

(b) Conflict of Interest – Many whistle-blowers face an ethical dilemma – whether to protect the short-term interest of colleagues and the organisation or to protect the public at large; whether to be disloyal, whether to protect short-term interest of the shareholders or caution future investors. Cynthia Cooper, while serving as Vice President of Internal Audit at WorldCom, played a pivotal role in exposing what was, at the time, the largest case of corporate fraud too faced an ethical dilemma. Recalling the time, she was contemplating exposure she said in a talk, “There were times when I was scared to death. I remember my hands shaking.”4 She knew after the exposure; thousands of employees would lose their jobs and retirement savings. Mississippi, where WorldCom was based, would also lose millions in revenue. Despite being sure that she was right, Cooper struggled with depression and found it difficult to move forward from the scandal even after disclosure, as the fallout affected not just the company, but also her own personal and professional life.

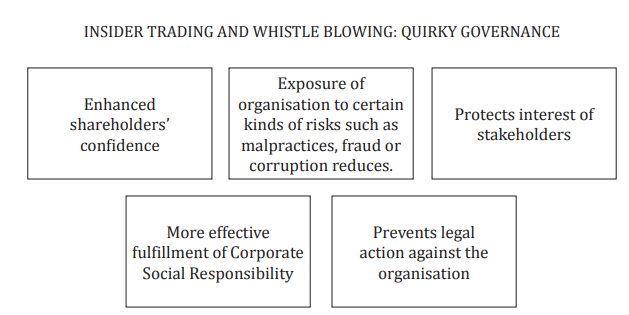

3.5 Advantages of a Good Whistle-Blower Policy to an Organisation

The revelation made by the whistle-blower should be handled promptly by the organisation. Many large-scale corporate frauds have come to light through internal whistle-blowing. To ensure transparency and continuous trust and support from all the stakeholders, it is imperative for every organisation to lay down a clear and comprehensive whistle blowing policy. Some of the advantages that may accrue to it by such a policy are listed below:

Advantages of Whistle-Blower Policy

3.6 Whistle-Blowing Laws in India

Regulations in India have been laid down relating to whistle-blowing and protection of whistle-blowers. The Companies Act, 2013 and SEBI’s Listing Agreement Requirements have included provisions related to whistle-blowing/ vigil mechanism. The Indian Parliament has also passed Whistle-blowers Protection Act, 2014.

3.6.1 The Companies Act, 2013 and Whistle-Blowing

The Companies Act, 2013, has been framed in the backdrop of various corporate scandals. It prescribes stricter compliance, vigil and disclosure norms than laid by previous Companies Acts. Some examples are as below:

Section 177(9) and 177(10) read with Rule 7 of the Companies (Meetings of Board and its Powers) Rules, 2014 and Schedule IV provides for requirements of Vigil Mechanism as under:

(a) Establishment of Vigil Mechanism

- Every listed company and the companies belonging to the following class or classes shall establish a vigil mechanism for their directors and employees to report their genuine concerns or grievances:

-

- the companies which accept deposits from the public

- the companies which have borrowed money from banks and public financial institutions more than fifty crore rupees

- It may be noted that while section 177(9) of the Act mandates to establish vigil mechanism for directors and employees to report genuine concerns, in case of a listed company, such mechanism is available to all stakeholders.

(b) Overseeing of Vigil Mechanism

- The companies which are required to constitute an Audit Committee shall oversee the vigil mechanism through the committee and if any of the members of the Committee have a conflict of interest in each case, they should recuse themselves and the others on the committee would deal with the matter on hand.

- In case of other companies, the Board of Directors shall nominate a director to play the role of audit committee for the purpose of mechanism to whom other directors and employees may represent concerns.

(c) Safeguard Against Victimisation and Direct Access

- Policy against victimisation of employees and directors who avail of the mechanism should be laid.

- Provide for direct access to the chairperson of the Audit Committee or the director nominated to play the role committee in exceptional cases.

(d) Disclosure

The company must disclose details of the mechanism on its website and in the Board’s report.

(e) Safeguard Against Frivolous Complaints

- In case of repeated frivolous complaints being filed by a director or an employee, the Audit Committee or the director nominated to play the role of Audit Committee may take suitable action against concerned director or employee including reprimand.

(f) Role of Independent Directors – Schedule IV – Code for Independent Directors

- Ascertain and ensure that the company has an adequate and functional vigil mechanism.

- Ensure that interests of a person who uses the mechanisms are not affected.

3.6.2 SEBI and Whistle-Blowing

- EBI has introduced the concept of whistleblowing by adding Chapter IIIA to the SEBI (Prohibition of Insider Trading) Regulations, 2015 (PIT Regulations). This enables whistleblowers to report insider trading violations directly to SEBI, circumventing the internal reporting mechanisms of companies. The goal is to externalise the reporting process, thereby enhancing the security and anonymity of whistleblowers, which is expected to lead to an increase in reported violations.

- Additionally, SEBI has announced financial rewards to further encourage whistleblowing. SEBI retains the sole discretion to declare an informant eligible for a reward and will notify the informant or their legal representative to file an application in the specified format to claim the reward. The reward is set at 10% of the monetary sanctions, capped at INR 10 crores, or a higher amount as may be specified by SEBI from time to time

3.6.3 Whistle-Blowers Protection Act, 2014

On May 14, 2014, the Whistle-Blowers Protection Act, 2014 received Presidential assent. The salient features of this Act are:

(a) The Act seeks to protect persons making a public interest disclosure (whistle-blowers) related to an act of corruption, misuse of power, or criminal offence by a public servant.

(b) The Central Vigilance Commission (CVC) is empowered to receive complaints, assess public disclosure requests, and safeguard complainants.

(c) Every complaint must include the identity of the complainant.

(d) It ensures confidentiality of the complainant and penalises any public official who reveals a complainant’s identity, without proper approval.

(e) The Act prescribes penalties for knowingly making false complaints.

The Whistle-Blower Protection Act has attempted to balance two conflicting interests—the need to protect the whistle-blowers against the need to protect public officials from unnecessary harassment.

- Section 195 of the Companies Act, 2013 that dealt with insider trading of securities has been omitted by the Companies Amendment Act, 2017.

- https://www.taxmann.com/post/blog/analysis-sebis-new-insider-trading-regulations-key-changes-and-implications

- https://www.latimes.com/business/story/2024-10-08/boeing-whistleblower-lawsuit-story

- https://www.jmu.edu/news/2013/11/14-cooper-demonstrates-power-of-choice-in-business-ethics.shtml

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA