Ind AS 16 | Property, Plant and Equipment (PPE) with Illustrations

- Blog|Account & Audit|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 31 May, 2022

Topics covered in this article are as follows:

1. Objective of Ind AS 16 – Property, Plant and Equipment

2. Scope of Ind AS 16 – Property, Plant and Equipment

3. Recognition and Measurement of Ind AS 16 – Property, Plant and Equipment

4. Initial Recognition

Taxmann's Ind AS Ready Reckoner is a simple & practical workbook on Ind AS [as amended by the Companies (Indian Accounting Standards) Amendment Rules 2021] to guide the members in practice/employment in their day-to-day works. This book will help the professionals cope with various developments in the accounting standards’ area, which has become complex after Ind AS has started aligning with its global counterpart.

1. Objective of Ind AS 16 – Property, Plant and Equipment

-

- Generally, Property, Plant and Equipment (PPE) constitute a significant portion of the total assets of an entity; hence this Accounting Standard (AS) is important in the presentation of financial position.

- This standard discusses whether expenditure incurred should be capitalised as PPE or charged to P&L statement, depreciation, retirement of PPE and disposal accounting. This has material impact on Balance Sheet as well as on P&L.

2. Scope of Ind AS 16 – Property, Plant and Equipment

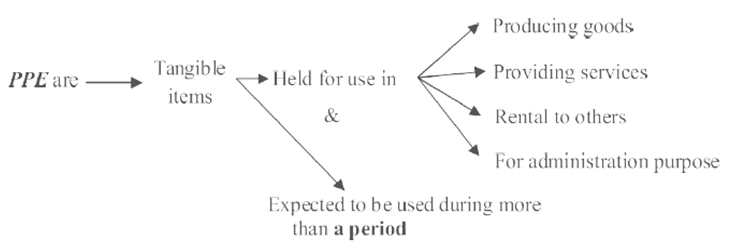

PPE are generally grouped into various categories/classes, like land, building, plant and machinery, furniture and fixtures, computers, etc.

This standard does NOT deal with the following:

(a) PPE classified as held for sale (dealt by Ind AS 105);

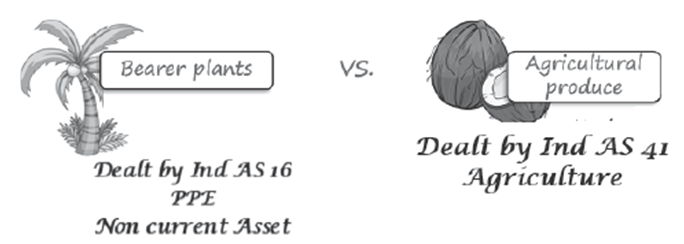

(b) Biological assets (a living animal or living plant like group of animals) related to agricultural activity other than bearer plants (See below for bearer plant definition). This Standard applies to bearer plant but it does not apply to the Agriculture produce on bearer plants (dealt by Ind AS 41 Agriculture);

(c) Recognition and Measurement of exploration and evaluation assets (Refer Ind AS 106);

(d) Mineral rights and mineral reserves such as oil, natural gas and similar non-regenerative resources; and

(e) If a PPE’s recognition & measurement is covered by any other Ind AS (like Ind AS 116 – finance lease) to that extent one should follow the respective standard.

Note: An individual PPE acquired to develop or maintain the activities covered in (b) to (d) above, and these are separable from the activities, are to be accounted for as per this Standard.

Investment property under Ind AS 40 shall use the cost model under this standard for owned investment property.

Bearer plant is a plant that:

(a) is used in the production/supply of agricultural produce;

(b) is expected to bear produce for more than a period; and (in a way life is spread between two financial years)

(c) has a remote likelihood of being sold as an agricultural produce, except for incidental scrap sales. The following picture helps you to understand

Definitions

| Illustration

A public limited company whose main object as stated in its MOA is to purchase, acquire, contract, develop, cultivate and sell agricultural and urban lands, buys large plots of virgin lands, develops and cultivates them and sells them in small plots. Land purchased by the company and the cost of development has been consistently grouped under Fixed assets in its BS. Comment. Answer As per Ind AS 16, PPE is a tangible asset which is held for (intention of usage) producing goods, providing services, rental to others or administration purpose. The main basis for classification is intention of usage of the asset rather than the nature of the entity. As per Ind AS 2, inventory is an asset which is held for sale in the ordinary course of business and etc. In the given case, the entity is purchasing the land to develop and sell it in the ordinary course of business. The land does not satisfy the definition of a PPE as per Ind AS 16. But it satisfies the definition of inventory as per Ind AS 2. Hence classifying it as inventory and presenting under current assets would be correct. The accounting treatment of the company is NOT correct. |

Carrying amount:

| Rs. | |

| Gross book value | XXX |

| Less: Accumulated depreciation | (XX) |

| Less: Accumulated impairment loss (if any) | (XX) |

| Carrying amount | XXX |

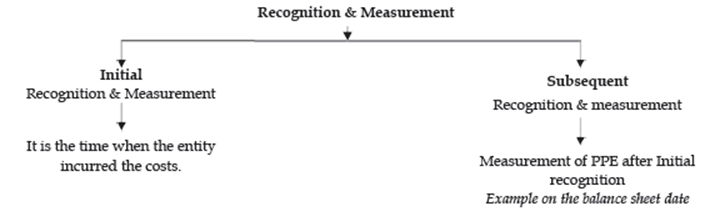

3. Recognition and Measurement of Ind AS 16 – Property, Plant and Equipment

PPE should be recognised in the books of account when it satisfies the following two conditions: (same as “ASSET” conditions)

-

- Probable future economic benefits inflows to the entity; and

- Cost should be measured reliably.

4. Initial Recognition

An item of PPE that qualifies for recognition as an asset should be measured at its COST.

Costs are incurred:

(a) At the time of initial acquisition or self construction of PPE;

(b) Subsequently to add/increase to the existing PPE, replace a part or service it.

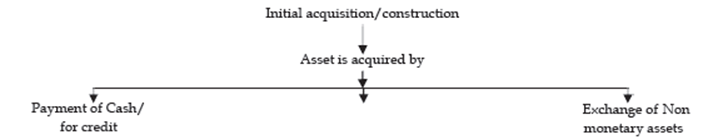

Amount to be capitalised is based on the nature of consideration paid for the asset. PPE can be acquired in the following ways:-

IF ASSET IS PURCHASED BY PAYMENT OF CASH/FOR CREDIT or SELF CONSTRUCTION

IF ASSET IS PURCHASED BY PAYMENT OF CASH/FOR CREDIT or SELF CONSTRUCTION

Cost of asset includes the following

| Particulars | Amount (Rs.) |

| Purchase price (Basic price) | XXX |

| (+) Non-refundable taxes & import duties; | XXX |

| (+) Initial delivery and handling costs; | XXX |

| (+) Cost of employee benefits arising from the construction or acquisition of PPE; | XXX |

| (+) Site preparation cost | XXX |

| (+) Installation and Assembly costs | XXX |

| (+) Cost of testing (Test run or Experimental production) whether the assets is functioning appropriately after deducting net proceeds of samples produced at the time of testing | |

| (+) Professional fees (e.g. fees of architects and engineers) | XXX |

| (+) Borrowing cost (If permitted by Ind AS 23) | XXX |

| (+) Leases of assets that are used to construct, add to, replace part of or service an item of PPE, such as depreciation of right-of-use asset (ROUA) as per Ind AS 116; | XXX |

| (+) PRESENT VALUE of Decommissioning, restoration costs (See below illustration) | |

| (+) Any directly attributable cost to bring the asset to the location & condition necessary to operate for its intended purpose | XXX |

| (+/-) Subsequent price adjustments | XXX |

| (+/-) Changes in duties and similar items | XXX |

| (-) Government grant received specific to the asset as per Ind AS 20 (as per the company’s accounting policy in this regard) | XXX |

| (-) Trade discounts and rebates (if included in above items) | (XXX) |

| Cost of PPE to be capitalised | XXXX |

Costs does not include

(a) costs of opening a new facility;

(b) costs of introducing a new product or service (including costs of advertising and promotional activities);

(c) costs of conducting business in a new location or with a new class of customer (including costs of staff training);

(d) administration and other general overhead costs;

(e) initial operating losses, such as those incurred while demand for the item’s output builds up;

(f) costs of relocating or reorganising part or all of an entity’s operations; and

(g) costs incurred while an item capable of operating in the manner intended by management has yet to be brought into use or is operated at less than full capacity;

General administration and other overhead expenses are usually excluded from the cost as they are not related to specific asset. However, any expense if directly attributable to construction of a project or acquisition of PPE or to bring it to working condition for its intended purpose, it should be included in the cost of PPE.

The cost of an item of PPE may include costs incurred relating to leases of assets that are used to construct, add to, replace part of or service an item of PPE, such as depreciation of right-of-use assets (Ind AS 116).

Note: Directly attributable expense means, these expenses would have not been incurred if the PPE is not acquired or constructed.

Other points to be noted

-

- Items such as spare parts, stand-by equipment and servicing equipment are recognised as per this Ind AS when they meet the definition of PPE. Otherwise, such items are classified as inventory and recognised in consumption whenever the entity started using the same;

- It may be appropriate to aggregate individually insignificant items, such as moulds, tools and dies, and to apply the criteria to the aggregate value;

- Assets acquired for safety or environmental reasons – it wont bring future economic benefits but these are necessary for the entity to bring future economic benefits from other assets – hence these are also recognised as PPE;

| Illustration

On 1 April 2015, X Limited began the construction of a new factory. Costs relating to the factory, incurred in the year ended 31 March 2016, are as follows: |

||||||||||||||||||||||||||||||||||||||||

Note 1: The factory was constructed in the eight months ended 30 November 2015. It was brought into use on 31 December 2015. The employment costs are for the nine months to 31 December 2015. The employees were engaged in construction and related activities. Note 2: Other costs directly related to the construction include an abnormal cost of Rs. . 200, in respect of repairing the damage which resulted from a gas leak. What will be the initial carrying value of the factory building? |

||||||||||||||||||||||||||||||||||||||||

| Answer

Calculation of cost of new factory

|

| Illustration

Madhava Ltd. purchased plant & machinery in the year 2016-17 for Rs. 45 lakh. A balance of Rs. 5 lakh is still payable to the suppliers for the same. The supplier waived off the balance amount during the financial year 2019-20. The company treated it as income and credited to profit & loss account during 2019-20. Is the accounting treatment of the company correct? If not, state with reasons. Answer As per Ind AS 16, the cost of PPE may undergo changes subsequent to its acquisition or construction on account of liabilities, price adjustments, and changes in duties or similar factors. The amount payable to the supplier is a financial liability as per Ind AS 109. Hence, we feel that treating as a gain on extinguishment of financial liability as per Ind AS 109 is appropriate and should be recognised as income in P&L; |

| Illustration

On 1-04-2016, Vishnu Limited installed a machine in the rented premises at a cost of Rs. 25 lakh, whose life is 3 years. As per the rental agreement, the machine should be decommissioned and the building should be brought into the original position. The company should incur Rs. 4,00,000 at the end of the 3rd year to restore the premises into the original position. Assume borrowing rate applicable to the entity is 10%. Answer As per Ind AS 16, costs include decommissioning or restoration costs. The entity should capitalise the present value of such costs to be incurred in the future. For discounting, we should use before tax borrowing rate applicable to the specific entity. Considering the above, present value decommissioning costs @ 10% (PVF = 0.751) = Rs. 4,00,000 × 0.751 = Rs. 3,00,400. (Refer Ind AS 37 for unwinding the discounting) Total cost of PPE to be capitalised = Rs. 25 lakh + Rs. 3,00,400 = Rs. 28,00,400. This point is discussed in depth again in Ind AS 37. Refer to Taxmann’s Ind AS Ready Reckoner |

| Illustration

As per the accounting policy of Vamana Ltd., it fully (100%) depreciates in the year of purchase the assets whose cost is less than Rs. 50,000 as it is immaterial for the company. Can the company do so? Answer As per Preface to Ind AS, any Ind AS is applicable only for material items. Materiality is a matter of professional judgment and it depends on size, nature and circumstances of every situation. As per Ind AS 16, Management of the entity may decide to expense an item to P&L which could otherwise have been included as property, plant and equipment, because the amount of the expenditure is not material. Considering the above discussion, management decision to charge the entire amount to P&L is acceptable. |

| Illustration

Trivikrama Ltd. purchased machinery for Rs. 80 lakhs from X Ltd. during 2017-18 and installed the same immediately. Price includes GST of Rs. 8 lakhs. During the year 2017-18, the company produced taxable goods on which GST of Rs. 17.20 lakhs was charged. Give necessary entries explaining the treatment of input tax credit (ITC). Answer As per Ind AS 16, non-refundable taxes should be capitalised as cost of the fixed asset. As per ITC rules, GST paid on capital goods can be utilised 100% when it is used for taxable goods/services. The entity should record the following journal entries

|

| Illustration

ABC Ltd. is setting up a new refinery outside the city limits. In order to facilitate the construction of the refinery and its operations, ABC Ltd. Is required to incur expenditure on the construction/development of railway siding, road and bridge. Though ABC Ltd. incurs (or contributes to) the expenditure on the construction/development, it will not have ownership rights on these items and they are also available for use to other entities and public at large. Whether ABC Ltd. can capitalise expenditure incurred on these items as property, plant and equipment (PPE)? If yes, how should these items be depreciated and presented in the financial statements of ABC Ltd.? |

| Answer

As per Ind AS 16, PPE should be recognised in the books of account when it satisfies the following two conditions: 1. Probable future economic benefits inflows to the entity; and 2. Cost should be measured reliably. The cost of PPE comprise any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management In the given case, railway siding, road and bridge are required to facilitate the construction of the refinery and for its operations. Expenditure on these items is required to be incurred in order to get future economic benefits from the project as a whole which can be considered as the unit of measure for the purpose of capitalisation of the said expenditure even though the company cannot restrict the access of others for using the assets individually. It is apparent that the aforesaid expenditure is directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management. In view of this, even though ABC Ltd. may not be able to recognise expenditure incurred on these assets as an individual item of PPE in many cases (where it cannot restrict others from using the asset), expenditure incurred may be capitalised as a part of overall cost of the project. From this, it can be concluded that, in the extant case the expenditure incurred on these assets, i.e., railway siding, road and bridge, should be considered as the cost of constructing the refinery and accordingly, expenditure incurred on these items should be allocated and capitalised as part of the items of PPE of the refinery. Depreciation

|

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA