Practical Case Studies on Input Tax Credit (ITC)

- Blog|GST & Customs|

- 22 Min Read

- By Taxmann

- |

- Last Updated on 15 September, 2023

Table of Contents

- Nature of ITC – Concession or Right?

- Eligibility for Availing ITC

- ITC on Gift vis-à-vis- Sales promotion

- Case Study: Construction of Factory

- ITC on IPO Expenses

- Case Study: ITC availed under wrong head

- ITC Reversal – Payment not made within 180 days

- Case Studies on Rule 42/43

- ITC on Employee Related Expenses

- Departmental notices for difference between GSTR-2A and GSTR-3B – Whether reversal of ITC required?

1. Nature of ITC – Concession or Right?

1.1 Credit is a concession or a right?

| Concession | Right |

| It is in nature of benefit/ concession and can be received only as per the scheme of the Statute. | There exists a vested right in the credit lying unutilized, wherein such credit has already accrued. |

| Not admissible to all kinds of sales and certain specified sales are specifically excluded. | Right accrues on the day assessee pay tax on the inputs. |

| How much tax credit is to be given and under what circumstances, is the domain of the legislature. | Provision for facility of credit is as good as tax paid till tax is adjusted on future goods. |

|

|

Article 300A: No person shall be deprived of his property save by the authority of law.

2. Eligibility for Availing ITC

2.1 Section 16(1) – Eligibility for availing ITC

Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

2.2 Meaning of “in the course or furtherance of business”

CIT, Kerala v. Malayalam Plantation Ltd: Expression “for the purpose of the business” wider in scope than “for the purpose of earning profits”:

- It may take in not only the day to day running of a business but also rationalization of its administration and modernization of its machinery;

- Includes measures for preservation of business and for protection of its assets from expropriation, coercive process or assertion of hostile title;

- It may also comprehend payment of statutory dues and taxes imposed as a pre-condition to commence or for carrying on of business;

- It may comprehend many other acts incidental to carrying on of business.

The expenditure incurred shall be for carrying on the business and the assessee shall incur it in his capacity as a person carrying on the business.

2.3 Availing ITC – Conditions

Limiting factors

- Possession of tax invoice

- Receipt of Goods/Services

- ITC on last Lot/Installment

- Tax is paid to the Government

- Payment to supplier within 180 days

- Returns are filed appropriately

- No Credit beyond specified period

According to Section 16(4), ITC can be availed by

- 30th November following end of financial year to which invoice/debit note relates

- Filing of Annual Return (whichever is earlier)

Two new conditions inserted:

- Details of invoice or debit note are furnished by supplier in GSTR-1 and communicated to recipient [w.e.f. 01.01.2022]

- Details of ITC communicated to registered person under Sec. 38 has not been restricted [w.e.f. 01.10.2022]

3. ITC on Gift vis-à-vis- Sales promotion

3.1 Case Studies

- Foreign trips (Voluntary)

- Calendar/diaries/pens/crockery

- Poster/hoardings/brochures/price list

- Buy one get one

- Gifts on achievement of target:– Voluntary/scheme

3.2 Eligibility of ITC on Gifts & Free Samples

Section 17(5)(h)

Input tax credit in respect of goods lost, stolen, destroyed, written off, or disposed of by way of gifts or free samples shall not be available.

Free Samples

Free samples are small and packaged portion of merchandise distributed free, especially as an introduction to potential customers.

Gifts

Gift ordinarily means something which is given voluntarily to other person without consideration and the donor should not derive any advantage from such gift.

3.3 What is Gift?

- It is pertinent to mention that term ‘gift’ is not defined under the CGST Act, 2017. Hence, recourse can be taken from parallel legislations.

- As per Section 122 of Transfer of Property Act, 1882, “Gift” is the transfer of certain existing moveable or immoveable property made voluntarily and without consideration, by one person, called the donor, to another, called the donee, and accepted by or on behalf of the donee.

- Dictionary meanings-

- Merriam Webster Dictionary- “something voluntarily transferred by one person to another without compensation; the act, right, or power of giving.

- Black Law Dictionary- Gift is “a voluntary conveyance of land, or transfer of goods, from one person to another, made gratuitously, and not upon any consideration of blood or money.”

3.4 Voluntarily offered free foreign trips

Surfa Coats India Pvt Ltd – Karnataka AAR

- ITC on services procured for offering free trips is not available as it is similar to gift.

- The taxpayer is not eligible to avail ITC on the inward supplies of goods and services given as incentives in the form of gifts of goods and services to its dealers. Moreover, the AAR observed that free travel services provided to its dealers without consideration would not qualify as ‘supply’.

Input tax credit in respect of goods lost, stolen, destroyed, written off, or disposed of by way of gifts or free samples shall not be available.

3.5 Promotional items distributed free of Cost

BMW India Private Limited, 2021-VIL-91-AAR (HAR)

Brief facts – Availment of input tax credit on Goods Distributed as free of cost

Decision

- The promotional items procured by BMW and supplied during events on FOC basis qualify as gifts

- The company is ineligible to take the input tax credit on such goods owing to restriction under Section 17(5)(h) of CGST Act, 2017

Case Study

- Brochures/Price List/Means of Communication

- Diaries/Pen/Calendar

3.6 Promotional/marketing materials distributed free of Cost

M/s Page Industries Limited 2021-VIL-21-AAAR (KAR)

Observations

The applicant in the instant case disposes of/issues the distributable goods such as carry bags, calendars, diaries, marketing material such as displays, posters etc. free of cost to franchisees and distributors.

Rulings

The ITC denied on all such promotional and marketing items given to the franchisees and distributors on FOC basis as they same qualify as gift and restriction under Section 17(5)(h) of the GST Acts.

Schedule I- Deemed supply: Permanent transfer or disposal of business assets where input tax credit has been availed on such assets

Under UK VAT laws, Sl. No. 2.12 of VAT Notice 700/7 specifies “point of sale display material’ that: No VAT is due if you payable point of sale display material to retailers, or other business customers, for no considerations and the material provides direct promotional supports for your goods. Examples includes display stands, posters and other similar materials.

3.7 Goods on achievement of target

Sanofi India Ltd Maharashtra AAR

- Shubh Labh Trade Loyalty Program: In this scheme, the distributors/whole sellers earn reward points basis the quantity of goods purchased and goods sold by them. These points can then be redeemed in the form of items, to be selected basis the availability of the product and reward points earned

- Brand Reminder: As an advertisement tool, the company distributes products like pen, notepad, key chains etc. with their name engraved on it, for the purpose of their brand promotion

ITC denied as promotional items were given voluntary and not under contractual obligation, hence restriction under section 17(5)(h) applies

Clarification: Ireland Department and Customs on Mixed Supplies of Goods and Services:

If there is a requirement of the customer to pay a consideration in connection with the receipt of an product, even if the supplier describes part of that product as “gift” or as being “free”, it does not come within the term of gift for tax purposes. Where there is a consideration it is always referable to all the products supplied. Accordingly, the same will be categorized as Mixed Supply.

3.8 Circular no. 92/11/2019

- It may be appear at first glance that one item is being sold free of cost without any consideration. In fact, it is not an individual supply of free goods but a case of two or more individual supplies where a single price is charged for the entire supply. It can at best be treated as supplying two goods for the price of one.

- Taxability of such supply will be dependent upon whether the supply is a composite supply or a mixed supply and the rate of tax shall be determined as per the provisions of section 8 of the said Act.

- ITC shall be available to the supplier for the inputs, input services and capital goods used in relation to supply of goods or services or both as part of such offers.

3.9 Gifts on achievement of target

- Moksh Agarbatti Company, In re [2020] 120 taxmann.com 225/36 GSTL 135/[2021] 83 GST 559 (AAR – GUJARAT);

- Biostadt India Limited, In re [2019] 103 taxmann.com 127/73 GST 393/22 GSTL 551 (AAR – MAHARASHTRA)

Issue: Availment of input tax credit on Goods given under incentive scheme

Decision:

- Free goods offered on purchase of specific quantity of goods not satisfy the condition availment of ITC under section 16.

- Free goods offered on making payment as per defined schedule not eligible for availment of ITC under section 16.

- No written agreement with customers.

- Denial of ITC by AAR under sec. 17(5) in case where no GST is paid on output stage.

3.10 Sales promotion items given on reduced price

Kanahiya Realty (P.) Ltd., In re [2021] 132 taxmann.com 138/[2022] 89 GST 73/60 GSTL 473 (AAR – WEST BENGAL)

Issue: ITC of items being sold at nominal prices as a part of a sales promotion scheme

Decision:

- Goods were provided to retailers at certain consideration, though very nominal, upon fulfilment of specified criteria. Hence, goods not given as ‘gift’ and therefore restriction on ITC under Sec. 17(5)(h) shall not be applicable.

- Nominal value shall be assigned to goods under promotional scheme – shall not be supplied free of cost and therefore cannot be termed as ‘gift’.

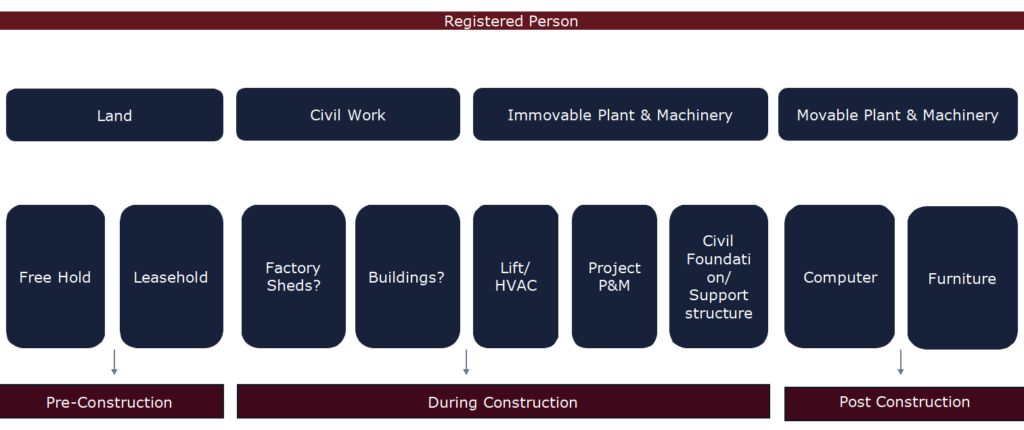

4. Case Study: Construction of Factory

4.1 ITC on Construction of Factory

- Say, a company engaged in manufacturing of goods is constructing a new factory

- Whether Company is eligible to avail ITC?

- The Company incurs expenses on civil works, machineries, land, etc.

4.2 Optimization of credit

4.3 Legal Provisions

Blocked Credit

Section 17(5)(c) – Works Contract Services when supplied for construction of immovable property (excluding Plant and Machinery) except where it is an input service for further supply of works contract service

Section 17(5)(d) – Goods or services or both received by taxable person for construction of immovable property (excluding Plant or Machinery) on his own account

Plant and Machinery

- Means apparatus, equipment and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports

- Excludes –

-

- land, building or any other civil structures;

- telecommunication towers; and

- pipelines laid outside the factory premises

4.4 Definitions

Works Contract

- A contract for building, construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation, alteration or commissioning of any immovable property wherein transfer of property in goods (whether as goods or in some other form) is involved in the execution of such contract.

Construction

- It includes re-construction, renovation, additions or alterations, or repairs, to the extent of capitalization, to the immovable property.

- This implies that if expenses of renovation, repairs, reconstruction or alterations are not capitalized in the books of account, the same would not qualify as construction and, therefore, ITC on the same can be availed.

Plant and Machinery

- Apparatus, equipment, and machinery fixed to earth by foundation or structural support

that are used for making outward supply of goods or services or both - and includes such foundation and structural supports

- but excludes

-

- Land, building or any other civil structures

- Telecommunication towers

- Pipelines laid outside the factory premises

Immovable Property

- The term immovable property has not been defined under GST legislation.

- The Central General Clauses Act, 1897 defines immovable property to include land, benefits to arise out of the land, and things attached to the earth, or permanently fastened to anything attached to the earth.

4.5 Pre-Construction Phase – Lease-hold land

- During pre-construction phase of an immovable property, land can be acquired either free hold or lease hold.

- The lease-hold land requires payment of GST on the lease amount.

- The GST law restricts ITC in respect of goods or services received by a taxable person for the construction of an immovable property (other than plant and machinery) on his own account.

Lease amount is paid before starting of construction of immovable property, thus, it can be viewed that it is not ‘for the construction of immovable property’ and ITC can be claimed.

4.6 Construction Phase – Civil Work – Pre-fabricated buildings/Pre-engineered structures

- Pre-fabricated technology is a construction method that makes building parts in pieces which are assembled at the construction sites. It can be dismantled and reconstructed at a different location saving a lot of time, effort and cost.

- The Central General Clauses Act, 1897 defines immovable property to include land, benefits to arise out of the land, and things attached to the earth, or permanently fastened to anything attached to the earth.

- Triveni Engineering and Indus. Ltd. v. CCE 2000 (120) ELT 273 (SC) – If a chattel is movable to another place of use in the same position, it must be a movable property. However, if the chattel has to be dismantled and re-erected at the other place of use, it is to be treated as permanently attached to the earth.

- CCE v. Solid & Correct Engineering Works Civil [2010] 252 E.L.T. 481 (SC) – In order for a chattel to be considered under the ambit of ‘immovable property’, it is important that the chattel is intended to be permanently attached to the said location.

Pre-fabricated buildings/Pre-engineered structures are intended to be permanently attached to the location, thus, it can be viewed that same is immovable property and ineligible for ITC.

4.7 ITC on Capital Goods

Construction Phase – Immovable Plant & Machinery – Lifts/HVAC

- Post construction, several plant & machineries and other movable items are installed such as – computers, furnitures etc.

- The GST law restricts ITC in respect of goods or services received by a taxable person for the construction of an immovable property (other than plant and machinery) on his own account.

- The Central General Clauses Act, 1897 defines immovable property to include … things attached to the earth, or permanently fastened to anything attached to the earth.

Lifts & HVAC systems, though immovable in nature per se, are indeed plant & machinery, thus, it can be viewed that same is eligible for ITC.

Foundation & structural supports are included in the definition of plant & machinery, thus, it can be viewed that same is eligible for ITC.

It is important to establish foundation and structural supports are meant for plant & machinery (and not building) by documentation like contract, PO & invoice.

4.8 Plant and machinery

Any apparatus/instruments used for a particular purpose or performing a particular function in relation to business

- Plant would include any article used for carrying on business – CC v. Gujarat Perstorp

Electronics Ltd., [2005] 2005 taxmann.com 1320 (SC) - Plant includes any apparatus or instruments used by a businessman for carrying on his business but not his stock-in-trade – CIT v. Bank of India, (1979) 118 ITR 809 (Bom.)

- Wires and cables are covered under the expression “Plant” as the same was necessary for the assessee to carry on his business – Jawahar Mills Ltd. v. CCE, 1999 (108) E.L.T 47/[1999] 1999 taxmann.com 1046 (CEGAT-LB)

4.9 ITC on Movable Goods

Post Construction Phase – Movable Plant & Machinery/Furniture

- During construction phase, several plant & machineries are erected/constructed such as – lifts, HVAC system.

- The GST law restricts ITC in respect of ‘works contract services’ goods/received when they are supplied for the ‘construction’ of ‘immovable property’ (other than ‘plant and machinery’).

- Plant & machinery means apparatus, equipment, and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports.

Computers/furnitures placed in the building cannot be termed as immovable per se, thus, it can be viewed that same is eligible for ITC.

4.10 Interpretation of Section 17(5)(d)

Safari Retreats (P.) Ltd. v. Chief Commissioner of Central Goods & Service Tax [2019] 105 taxmann.com 324/ 74 GST 500/25 GSTL 341 (Orrisa)

Facts:

- The petitioners were involved in the business of constructing shopping malls for the purpose of letting out of the same to numerous tenants and lessees.

Held:

- On a plain reading of Section 17(5)(d), it is clear that what it contemplates and provides for is a situation where inputs are consumed in the construction of an immovable property which is meant and intended to be sold.

- The denial of the input tax credit in respect of a building which is meant and intended to be let out would amount to treat it as identical to a building which is meant and intended to be sold.

- Denial of credit on narrow interpretation of Section 17(5)(d) would frustrate objective of GST law to prevent multi-taxation.

4.11 ITC on Construction of Shopping Malls

Tarun Realtors (P.) Ltd., In re [2020] 116 taxmann.com 201/35 GSTL 438/81 GST 103

(AAAR-KARNATAKA)

Issue:

ITC of goods and/or services used for installation of lifts, escalator and travellators in a shopping mall which is intended to lease/rent out for housing departmental stores, retail shops, food courts, multiplex cinema theatre complex and hypermarket.

Held:

- No doubt lifts, escalator and travellators are fixed to the earth with structural supports and they qualify as plant and machinery.

- However, supply of lifts and its installation at project site of the appellant are done by the vendor OTIS.

- In such a case, OTIS will not be hit by the restriction imposed under section 17(5)(d) since they are engaged in the construction of lift, escalator, travellator which qualifies as plant and machinery.

- However, the appellant will not be eligible for the credit of the tax paid on such procurements since the appellant is not doing the installation of the lifts, escalators and travellators.

5. ITC on IPO Expenses

Fresh Issue

Issuance of fresh shares by subscription

Sale of existing shares

Offloading of shares by existing shareholders

Illustrative

- Advertisement & marketing

- Registrar fee

- Processing fee

- Brokerage

- Legal fees

Issuance of shares is exempt supply for reversal under section 17(2)?

Where the goods or services or both are used by the registered person partly for effecting taxable supplies including zero-rated supplies under this Act or under the Integrated Goods and Services Tax Act and partly for effecting exempt supplies under the said Acts, the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies

The value of exempt supply under sub-section (2) shall be such as may be prescribed, and shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building

IPO expenses incurred in the course of furtherance of business?

Regulation Input tax credit- Section 16(1) states that a registered person shall be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business

ITC of expenses incurred by Companies for launching the IPO?

Goods – Every kind of movable property other than money and securities, thereby specifically excluding securities from the ambit of both goods and services

Services – include anything other than goods, money and securities

Securities – meaning as assigned to it in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956 which includes, inter alia, shares, scrips, stocks, bonds, debentures, debenture stock or other marketable securities of a like nature in or of any incorporated company or other body corporate

Taxability of transactions in securities- Neither supply of goods nor

supply of services, hence no GST

6. Case Study: ITC availed under wrong head

6.1 Revenue neutral situation

What if timeline prescribed under Section 16(4) for availing credit has been expired?

Scenario 1: When credit has been availed under CGST + SGST head instead of IGST

- This situation is revenue neutral

- The department does not lose or gain anything due to the availment of credit under

wrong tax head - However, this view is highly prone to disputes by department and relief is expected

at higher judicial authorities only.

6.2 Revenue neutrality not possible

Scenario 2: When credit has been availed under IGST head instead of CGST SGST

- Loss of revenue to the state as credit has been taken from that State. Hence, this is not revenue neutral

- IGST credit cannot be availed due to expiry of timeline

- CGST and SGST credit has to be reversed alongwith interest

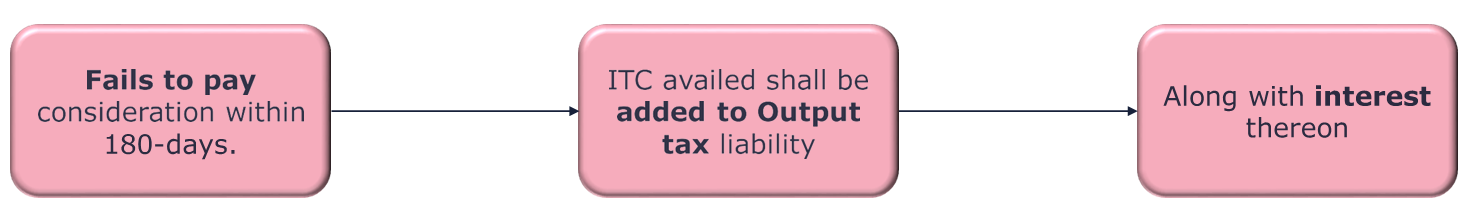

7. ITC Reversal – Payment not made within 180 days

7.1 Non-payment of consideration within 180 Days

- Section 16(2) – Where a recipient fails to pay to the supplier of goods or services or both, other than the supplies on which tax is payable on reverse charge basis, the amount towards the value of supply of goods or services along with the tax payable thereon, within a period of one hundred and eighty days from the date of issue of invoice by the supplier, the amount equal to input tax credit availed by the recipient shall be added to his output tax liability, along with interest thereon, in such manner as may be prescribed.

- The recipient shall be entitled to avail input tax credit on payment made by him of the amount towards the value of supply of goods or services or both along with tax payable thereon.

7.2 Amendments in Rule 37 w.e.f. 01st October, 2022

| Earlier Provision (Rule 37) | Amended Provision (Rule 37) |

| A registered person, who has availed of input tax credit on any inward supply of goods or services or both, but fails to pay to the supplier thereof, the value of such supply along with the tax payable thereon, within the time limit specified in the second proviso to sub-section (2) of section 16, shall furnish the details of such supply, the amount of value not paid and the amount of input tax credit availed of proportionate to such amount not paid to the supplier in FORM GSTR-2 for the month immediately following the period of one hundred and eighty days from the date of the issue of the invoice: | A registered person, who has availed of input tax credit on any inward supply of goods or services or both, other than the supplies on which tax is payable on reverse charge basis, but fails to pay to the supplier thereof, the amount towards the value of such supply along with the tax payable thereon, within the time limit specified in the second proviso to sub-section(2) of section 16, shall pay an amount equal to the input tax credit availed in respect of such supply along with interest payable thereon under section 50, while furnishing the return in FORM GSTR-3B for the tax period immediately following the period of one hundred and eighty days from the date of the issue of the invoice: |

| The amount of input tax credit referred to in sub-rule (1) shall be added to the output tax liability of the registered person for the month in which the details are furnished.” | Where the said registered person subsequently makes the payment of the amount towards the value of such supply along with tax payable thereon to the supplier thereof, he shall be entitled to re-avail the input tax credit referred to in sub-rule (1). |

| The registered person shall be liable to pay interest at the rate notified under sub-section (1) of section 50 for the period starting from the date of availing credit on such supplies till the date when the amount added to the output tax liability, as mentioned in sub-rule (2), is paid. | Omitted. |

7.3 Issues in dispute

- Pre-amendment (1st July 2017 – 30th September 2022)

- Validity of Rule 37 in the absence of Form GSTR-2

- “Failure to pay”- Payment terms in contract > 180 days from date of issuance of invoice

- Post amendment (1st October 2022 onwards)

- “Failure to pay”-Payment terms in contract > 180 days from date of issuance of invoice

- Reversal in case of proportionate payment to the vendor

- Date of applicability of interest u/s 50(3)-

- Date of availment?

- Completion of 180 days?

- Date of utilization?

7.4 Meaning of Non–Payment or failure to pay

Royal Calcutta Turf Club Vs. Wealth Tax Officer

The word failure means “Non-fulfilment of an obligation imposed”.

Kavungal Kooppakkattu Zeenath vs. Mundakkattu Sulfiker Ali

“Failure means not doing something that one is expected to do”

Ram Kishore vs. Bimla Devi and Ors.

The word fails cannot connote the meaning of voluntary refusal. These words do not give discretion or right to the person

Thattessara Subbaraya vs. Chinne Gowda & Ors.

Failure means there is an omission on the part of the person to do something which it is possible for him to do

In Malaysian Airlines vs. Union of India – Failure to pay means non-payment, which means failure to pay when due. In the said case, there is a penalty imposed if amount of foreign travel tax collected is not paid to the government, within fifteen days from the date of collection. It was held that failure to pay within this prescribed time frame would mean non-payment or failure to pay. If any person fails to pay within the statutory period, then such person is well within the sweep of the words “failure to pay’’

Once the statutory period is over and breach in payment of tax is committed, then it is immaterial when the defaulter in future is making the payment.

Applying the above ratio, second proviso of section 16(2) of the CGST Act should only trigger when payment is due/payable.

8. Case Studies on Rule 42/43

8.1 ITC Reversal- Rule 42/43

Section 17 of the CGST Act restricts the Input tax credit on goods or services or both to so much of the input tax attributable to the taxable supplies including zero rated-supplies made for the purpose of business.

The manner of reversal of Input tax credit is stated in the CGST Rules, 2017:

- Rule 42 – Reversal of credit received on Inputs and Input services

- Rule 43 – Reversal of credit received on Capital Goods

Important to note:

- The reversal of ITC to be done in every tax period.

- Total Input Tax Credit & Reversal of ITC to be declared in GSTR 3B for the said Tax period.

- At the year end, the reversal of ITC for the financial year to be calculated; and any short/excess reversal to be paid/claimed in GSTR 3B.

- Reversal is to be calculated separately for CGST, SGST, IGST and CESS.

8.2 ITC Reversal on Electricity Consumption

Transaction

- The company is engaged in generation of electricity. Electricity generated by the company is used for both captive consumption and supplying to other person

Erstwhile Law

- Reversal required to done on the basis of units consumed

GST

- Reversal on the basis of units or turnover?

Case Study

- Turnover of company (Supplier of steel): 100 crores

- Value of exempt supply/turnover in respect of supply of electricity: 1 crores

- Ratio of units consumed – Captive Consumption: Supply = 50:50

- Common Credit – 10 lacs

- Ratio for reversal: 50:50 or 1:100

8.3 ITC Reversal- Rule 42/43

Illustration:

| S.No | ITC on Input & Input Services (Rule-42) | CGST | SGST | IGST | Total | |

| T | Total Amount of Input Tax Credit | 1,00,000 | 1,00,000 | 2,00,000 | 4,00,000 | |

| T1 | Out of A, ITC – exclusively for Non Business purpose | 3,000 | 3,000 | 5,000 | 11,000 | |

| T2 | Out of A, ITC – exclusively for exempted Supply | 7,000 | 7,000 | 20,000 | 34,000 | |

| T3 | Out of A, ITC ineligible under sec 17(5) | 5,000 | 5,000 | 25,000 | 35,000 | |

| C1 | Amount to be credited to electronic credit ledger | {T-(T1+T2+T3)} | 85,000 | 85,000 | 1,50,000 | 3,20,000 |

| T4 | ITC -exclusively for Taxable supplies, including Zero Rated | 70,000 | 70,000 | 1,25,000 | 2,65,000 | |

| C2 | Common Input Tax Credit | (C1-T4) | 15,000 | 15,000 | 25,000 | 55,000 |

| D1 | Out of G input tax credit attributable to exempted supply | {C2×(E÷F)} | 1,132 | 1,132 | 1,887 | 4,151 |

| D2 | Common Input tax credit used for non business purpose | {C2×5%} | 750 | 750 | 1,250 | 2,750 |

| Eligible Common Credit | 13,118 | 13,118 | 21,863 | 48,099 | ||

| Total Input tax credit required to be reversed | T1+T2+T3+D1+D2 | 16,882 | 16,882 | 53,137 | 86,901 | |

| Total eligible Input tax credit | 83,118 | 83,118 | 1,46,863 | 3,13,099 | ||

| Assumptions | Amount | |

| Exempt Supplies during the period | E | 2,00,000 |

| Taxable Supplies Supplies during the period | F1 | 22,00,000 |

| Zero-rated Supplies during the period | F2 | 2,50,000 |

| Total Taxable Turnover | F= (F1+F2) | 24,50,000 |

| Total Turnover | (E+F) | 26,50,000 |

Whether Exempt supply includes:

- Interest

- Dividend

- Securities

Reversal on Capital Goods is to be done over 5 years

8.4 ITC Reversal on CC/OC

- Reversal of ITC Availed under GST

- Exempt supply includes Sale of Land; and Sale of building (after completion certificate or First occupancy.

- Reversal is to be done on the basis of carpet Area.

- For calculating proportionate common credit on exempt portion {C2 × (E÷F)}-

E = Carpet Area of :a. Apartments the construction of which is exempt.

b. Apartments remaining unsold on the date of completion certificate

F = Aggregate Carpet area of the project - Reversal is to be calculated finally, from commencement or 1st July 2017, till the date of completion certificate.

Calculation- Project wise or GSTIN wise

- Reversal of CENVAT Credit availed under service Tax

- Jurisprudence

- CCE, Pune v. Dai-Ichi Karkaria Ltd. 1999 (112) E.L.T. 353(S.C.)

- H.M.T. V. CCE, Panchkula 2008 (232) ELT 217 (Tri-LB) affirmed by the P&H HC in CCE, Panchkula v. HMT Ltd 2010 TIOL 316 HC P&H.

- Hindustan Zinc Ltd. V. UOI 2008 (223) ELT 149 (Raj)

- CCE & Cus, Cochini v. Premier Tyres Ltd 2008 (223) ELT 149 (Raj)

CENVAT Credit rules on Reversal??

- CESTAT

- M/s Alembic Ltd 2018-CESTATAT-AHM-ST and

- M/s Shreno Limited Vs C.C.E & ST

- Prajapati Developers vs CCT -CESTAT-Hyd

- Jurisprudence

- Reversal of Transitional ITC

8.5 ITC Reversal in real estate

| S.No | Description | Amount in crores |

| 1 | Total Cost of construction of the project | 100 |

| 2 | Service Tax Cenvat Credit availed in Pre-GST Regime | 10 |

| 3 | ITC (GST) availed from 1.07.2017 to 31.03.2019 | 3 |

| 4 | Date of OC | 31.3.2019 |

| 5 | Area unsold on date of OC | 33% |

| Reversals | ||

| 6 | Cenvat Credit to be reversed | ? |

| 7 | ITC (GST) to be reversed on receipt of OC | ? |

8.6 Availability of ITC on goods or services used in respect of supplying alcohol in restaurants

Input services/goods in restaurant

- Singers

- Professional Chef

- Professional bartender

- Crockery

- Furniture etc.

Which services/goods/capital goods would be considered as directly in relation to sale of alcohol?

Reversal requirement under rule 42/43 of CGST rules?

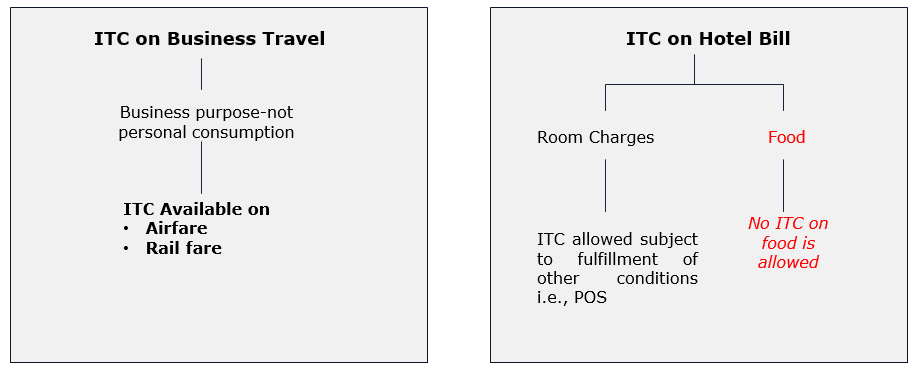

9. ITC on Employee Related Expenses

9.1 Employee benefits

- Food & beverage

- Uniforms/gloves & helmets/safety shoes/office laptop

- Hotel and travel expenses for business travel

9.2 Relevant provisions

Section 17(5)(b)(i)

Food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery, leasing, renting or hiring of motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) except when used for the purposes specified therein, life insurance and health insurance

Section 17(5)(g)

Goods or services or both used for personal consumption

Section 17(5)(h)

Goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples

9.3 Employee benefits

9.3.1 Uniforms/gloves & helmets/safety shoes/office laptop

- Not excluded under section 17 (5)(g) – exclusion on account of personal consumption is not qua the employees but is qua the taxpayer

- Not excluded under section 17(5)(h)- not gift as to be used during their employment, does not have any economic value, used for official purpose

Whether ITC is allowed on account of business use only?

9.3.2 Hotel and travel expenses for business travel

9.3.3 Canteen Services

Canteen services provided to employee at subsidized rate

- Definition of business includes any activity or transaction in connection with or incidental or ancillary to any trade, commerce, manufacture or profession

- The activity undertaken in the form of supply of food to the workers at the subsidized rate qualifies as supply on which GST is payable at 5%.

- ITC on food and beverage still not eligible because of restriction under Rate Notification

Free food and beverage

- Free supply of food and beverage to employees in the course of or in relation to his employment is not to be treated as deemed supply

- ITC not available of such food and beverage provided to employees unless mandatory under some law.

Troikaa Pharmaceuticals Ltd, In re [2023] 146 taxmann.com 128 (AAR – Gujarat)

- GST not payable on employees’ portion of canteen charges collected by employer and paid to canteen service provider as canteen service is provided as per contractual agreement

- Amount collected from contractual workers and paid to canteen service provider is subject to levy of GST as employer and contractual workers do not fall under ambit of employer-employee relationship

- ITC of canteen charges available as employer is under obligation to provide such facility as per Factories Act

- ITC of canteen services provided to contractual worker cannot be availed as employer/applicant and such workers will not fall under ambit of employer-employee relationship and employer not under legal obligation to provide such facility to such workers.

Bharat Oman Refineries Ltd., In re [2022] 142 taxmann.com 95 (AAAR-Madhya Pradesh)

- Appellant not carrying out the said activity of collecting employees’ portion of amount to be paid to the Canteen Service Provider, for any consideration, such transactions are without involving any ‘supply’ from the appellant to its employees and is therefore not leviable to GST.

- Canteen facilities would not fall under Schedule III. However, canteen services would not be leviable to GST at the hands of the employer because employer was merely a facilitator between canteen service provider and employee and employer was mandated to run canteen under Factories Act.

- ITC of GST paid to canteen service provider would be available where it is obligatory for an employer to provide the same to its employees under any law.

9.3.4 Hiring Transportation vehicle

Section 17(5)(a)

Motor Vehicles for transportation of persons having approved seating capacity of not more than thirteen persons (including the driver), except when they are used for making the following taxable supplies, namely:

(A) further supply of such motor vehicles; or

(B) transportation of passengers; or

(C) imparting training on driving such motor vehicles

10. Departmental notices for difference between GSTR-2A and GSTR-3B – Whether reversal of ITC required?

10.1 Legal provisions–GST Assessment & Audit

| Type | Description | Chapter | Section- CGST Act | Rule |

| Self Assessment | XIII | 59 | —- | |

| Provisional Assessment | XIIII | 60 | 98 | |

| Scrutiny of Returns | XIIII | 61 | 99 | |

| Assessment | Assessment of Non-filers of returns | XIIII | 62 | 100 |

| Assessment of unregistered persons | XIIII | 63 | 100 | |

| Summary Assessment in certain special cases | XIII | 64 | 100 | |

| Audit | Audit by Department | XIV | 65 | 101 |

| Special Audit by Department | XIV | 66 | 102 |

10.2 Mismatch in ITC between GSTR-3B vs GSTR-2A

| Particulars | Condition of ITC to be availed on the basis of 2A/2B as per law | Circulars |

| FY 2017-18 | Not applicable | Relaxation provided by Circular No. 183/15/2022– GST, dated 27.12.2022 to avail ITC if GSTR-3B filed by the supplier even if suject ITC not appearing in GSTR-2A/2B, subject to conditions |

| FY 2018-19 | Not applicable | |

| FY 2019-20: |

Not applicable |

|

|

||

|

120% of total ITC appearing in GSTR-2A as per Rule 36(4) however, no legal backing in CGST Act | |

|

110% of total ITC appearing in GSTR-2A as per Rule 36(4) however, no legal backing in CGST Act |

Above circular made applicable for FY 2019- 20 till 31.12.2021 subject to the restriction provided under rule 36(4) w.e.f. 9.10.2019. |

FY 2020-21

|

||

| 110% of total ITC appearing in GSTR-2A as per rule 36(4) however no legal backing in CGST Act | ||

|

105% of total ITC appearing in GSTR-2A as per rule 36(4) however no legal backing in CGST Act | |

FY 2021-22

|

105% of total ITC appearing in GSTR-2A as per rule 36(4) however, no legal backing in CGST Act | |

|

ITC to be availed only as per GSTR-2B. Section 16(2)(aa) also applicable |

Illustration:

|

Sr. No. |

Period |

ITC as per GSTR-3B |

ITC as per GSTR-2A |

Relaxation % as per Rule 36(4) |

Relaxation in ITC |

Total ITC in compliance of Rule 36(4) | CMA/CA certificate produced for ITC amount | ITC to be allowed as per the captioned circular |

| (a) | (b) | (c) | (d) | (e) | (f)=(d)*(e) | (g)=(d)+(f) | (i)=(g) | |

| 1 | 09.10.2019 to 31.12.2019 | 5,00,000 | 3,00,000 | 20% | 60,000 | 3,60,000 | 60,000 | 3,60,000 |

| 2 | 01.01.2020 to 31.12.2020 | 5,00,000 | 3,00,000 | 10% | 30,000 | 3,30,000 | 30,000 | 3,30,000 |

| 3 | 01.01.2021 to 31.12.2021 | 5,00,000 | 3,00,000 | 5% | 15,000 | 3,15,000 | 15,000 | 3,15,000 |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA