Portfolio Management Process – Asset Allocation | Correlation | Investment Strategies

- Blog|Company Law|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 10 January, 2025

Portfolio Management involves overseeing a collection of investments to meet specific financial goals. This process includes strategizing the investment mix, matching investments to objectives, asset allocation for individuals and institutions, and balancing risk against performance. Portfolio management can be active, where the manager makes specific investments with the goal of outperforming an investment benchmark index, or passive, where the manager replicates the performance of a specific index or benchmark. The main aim is to maximize returns and minimize risk to achieve a desired investment outcome.

Table of Contents

- Importance of Asset Allocation Decision

- Understanding Correlation Across Asset Classes and Securities

- Steps in Portfolio Management Process

Check out NISM X Taxmann's Portfolio Management Services (PMS) Distributors which covers various aspects, such as stock investments, fixed-income securities, derivatives, and mutual funds, along with an in-depth look at portfolio managers' roles and operational intricacies. The book also discusses the critical areas of taxation, regulatory frameworks, governance, and ethical considerations in portfolio management.

1. Importance of Asset Allocation Decision

Asset allocation is the process of deciding how to distribute an investor’s wealth into different asset classes for investment purposes. An asset class is defined as a collection of securities that have similar characteristics, attributes, and risk/return relationships for example, bonds, equities, cash and cash like securities etc. A broad asset class, such as “bonds,” can be divided into sub-asset classes, like treasury bonds, corporate bonds, and junk bonds. Equity can further be divided into large cap, mid cap & small cap.

Asset allocation decision is a very important investment decision. Professional investment experience has been suggesting that in the long run, asset-allocation decision majorly influences the performance of investment portfolios. The asset allocation decision is not an isolated decision, it is a component of portfolio management process.

2. Understanding Correlation Across Asset Classes and Securities

Correlation measures the strength and direction of relationship between two variables. Correlation coefficients vary in the range −1 to +1. A value of +1 (–1) indicates a perfect positive (negative) relationship between the two variables. A positive relationship between two variables means that they both move together in the same direction, either in an upward trend or downward trend. Negative relationship means the opposite. The value of the correlation coefficient indicates the strength of the relationship between the two variables. Understanding correlation across asset classes is very crucial in making asset allocation decision. As described in section 1, an asset class is described based on the similarity of characteristics of the assets, and as a natural consequence investments that are part of same asset class are sensitive to the same major economic and/or investment factors. Hence, the correlation between assets that are part of the same asset class is expected to be high where correlation between two different asset classes is expected to be low. These assumptions hold good in normal circumstance that is when the economy, industry are stable. In situations of distress, like COVID-19 pandemic, the all-round fear, uncertainty, speculation about gloomy prospects, impacts all the asset classes in a similar way to a large extent, however this relationship reverses once the normalcy is regained.

Correlation is the most relevant factor in reaping the benefits of risk diversification i.e. in reducing portfolio risk. Correlations among asset class returns can and do change over time and also in different economic situations. Asset return correlation in future may also differ from those observed in the past because of changing economic and market regimes.

Investors should take these factors into consideration while making asset allocation decisions and should not solely depend on past correlation metrics1.

3. Steps in Portfolio Management Process

Portfolio management process involves a set of integrated activities undertaken in a logical, orderly and consistent manner to create and maintain optimum portfolio.

The elements in the portfolio management process are planning, execution and feedback as discussed below:

- The first step in portfolio management process is development of policy statement for the portfolio. It is a road map that identifies investors risk appetite and defines investment objectives, goals and investment constraints.

- The second step involves study of current financial conditions and forecast future trends.

- The third step is construction of portfolio after taking into consideration policy statement and financial markets forecast. Investor needs and financial market forecasts being dynamic, portfolio requires continuous monitoring and rebalancing.

- The fourth step in portfolio management process is performance measurement & evaluation.

Thus, the portfolio management process moves from planning through execution and then to feedback.

3.1 Investment Policy Statement (IPS)

Development of Investment Policy Statement (IPS) is the key step in the portfolio management process. IPS is the road map that guides the investment process. Either investors or their advisors draft the IPS specifying their investment objectives, goals, constraints, preferences and risks they are willing to take. All investment decision are based on IPS considering investors’ goal and objectives, risk appetite etc. Since investors requirement’s change over a period time, IPS also needs to be updated and revised periodically. IPS forms the basis for strategic asset allocation which is essentially an interaction between investors risk-return requirements and expected investments’ return.

3.2 Need for IPS

IPS is an important planning tool which help investors understand their requirements and also help portfolio managers in creating and maintaining optimum portfolios for the investors. Preparation of IPS inculcates a disciplined system and process in managing investments. It reduces the possibility of making inappropriate decisions.

There are four important purposes the policy statement serves:

- It enables investors to have realistic return expectation from their

- It enables portfolio manager to make effective investment

- It provides a framework for portfolio managers evaluation with respect to the

- It protects the investor against portfolio manager’s inappropriate investment decisions or unethical behaviour.

In summary, a well-defined policy portfolio goes a long way in serving the investor’s interest. It enables construction of an optimal investment portfolio.

3.3 Constituents of IPS

Since IPS is the most important document, it needs to be prepared with caution. The investor has be upfront with the advisor or portfolio management with regard to their financial situations, requirements and risk bearing temperament. The advisor or the manager preparing the IPS is also required to show utmost patience to obtain deep understanding of the investor’s profile.

3.4 Investment Objectives

Investors’ objectives are identified in relation to risk-return-liquidity. Risk is the variability in the expected returns. Return is the additional amount an investor generates over and above the initial investment, that is expressed as a percentage and per annum. Liquidity can be explained as the preference of an investor to convert her investment into cash, whenever required, without much delay, and loss in value of the investment. When this preference is sought after in an asset, then the same is expressed as a feature or characteristic of that asset, which makes it readily and easily sold out to another investor without much decline in its quoted value. Indirectly it conveys that the phenomenon of liquidity in finance needs a stable and vibrant financial market, with buyers and sellers always ready to invest and disinvest.

Investors may state their investment objectives in terms of desired return in absolute or relative sense. The desired absolute return is the return of the investment, measured on a standalone basis without any comparison with any other asset. Like an investor’s objective could be “to generate 15% p.a. on her investment for the next ‘n’ number of years”. The same objective can also be expressed as “to generate 5% p.a. more than the return on NIFTY 50 each year on the investment for the next ‘n’ number of years”.

An investor needs to bear in mind that risk and return typically have a positive relationship. Higher the risk, higher would be the associated return. On the other hand, liquidity has an inverse relationship with return (when expressed as a discount rate). Higher the liquidity, lower would be discount, and vice versa. It operates like this, when an asset can be sold and bought in the market readily and very easily without much price discount, then the difference between the quoted price to sell and the actual realised price when the trade is complete would be minimal.

Generally, investors invest for preservation of capital, regular income, and capital appreciation. Sometimes investors also choose investments to save taxes, however it may be noted that tax saving is not appreciated as the sole motto of investment. The investment objectives lead to asset allocation decision. If the investment objective is capital appreciation, then investments need to be high return investments (like equity). Of course, these investments will have higher risk than government securities or bank fixed deposits. On the other hand, if capital preservation is the primary investment objective, asset allocation will be tilted towards safe bonds and debt securities. If regular income is the investment objective, funds will be invested in asset classes generating periodical income like dividend paying stocks, interest paying bond or/and rent paying realty.

3.5 Investment Constraints

Constraints are limitations on investors to take exposure to certain investment opportunities. Constraints relates to investors liquidity needs, time horizon, and other unique needs and preferences.

3.5.1 Liquidity constraint

Different investors have different liquidity requirements. Younger people usually have lesser liquidity requirements than older people. Some may have some health or medical concerns which require them to maintain certain liquid funds. Others may have requirements of college fees or wedding in the family or some other needs. Generally investors prefer to have liquid funds to meet their day to day expenses. Additionally they may like to keep some amount of liquidity to meet contingency requirements like sudden medical expenses etc.

The needs for liquidity fall into following categories:

- Emergency Cash: The emergency cash reserve is usually measured as two to three months’ spending, but it could be more if the individual’s source of income is at risk or volatile.

- Near term goal: These needs vary with the individual. For known goals due within a year, the amount needed to achieve these goals should be in assets with relatively good liquidity.

- Investment Flexibility: The ability to take advantage of market opportunities as asset classes become overvalued and undervalued would require greater degree of liquidity.

To meet such requirements, some portion of the portfolio should be in cash or cash like securities. The advisor or the manager needs to make detailed assessment of the liquidity needs of the investors. Keeping too much money for liquidity may hit the overall portfolio return. On the other hand, not maintaining sufficient liquidity will lead to inconvenience and selling of other investments untimely. The liquidity constraints of the investor need to be clearly specified in the IPS.

3.5.2 Regulatory constraints

Generally individual investors do not have many regulatory constraints. But if there are any, they need to be followed. Regulations can also constraint the investment choices available to the investors. For example, as per the Reserve Bank of India’s notification, Liberalised Remittance Scheme (LRS), an Indian resident individual can only invest up to $250,000 overseas per year2. Indian resident individual investors cannot make investments greater than the amount specified by the regulator. Another example is the sale or purchase of securities on the basis of information that is not publicly known. Usually people who have access to such information are insiders of the company and they are prohibited from trading on the basis of insider information.

3.5.3 Tax Constraint

Investment process is complicated by tax concerns. Tax plays a very important role in portfolio management and drives investment decisions. Different investments and different kinds of income are taxed differently. Return in form of income like interest, dividend and rents versus return in form of capital appreciation are taxed differently. The same form of return may attract different tax liability depending on the tax bracket, the recipient belongs to. Hence a thorough understanding of the tax code applicable to the investor needs to be part of the IPS.

3.5.4 Exposures limits to different sectors, Entities and Asset Classes

As per the SEBI PMS Regulations, 2020 the agreement between the portfolio manager and the investor should include the investment approach. An investment approach is a broad outlay of the type of securities and permissible instruments to be invested in by the portfolio management for the investor, taking into account factors specific to investor and securities. It should also include the type of instruments and proportion of exposure.

After taking into consideration the investor’s objective, risk appetite, liquidity needs, tax and other regulatory constraints, time horizon for investment, exposure limits to specific sectors, entities and asset classes can be set to avoid the concentration risk. The portfolio manager needs to adhere to these exposure limits while managing investments.

3.5.5 Unique needs and preferences

Sometimes investors have idiosyncratic concerns. They may have personal, social ethical, cultural and preferences beliefs. For example an investor, may not want her money to be invested in the stocks of companies selling environmentally harmful products. Another example could be of an investor owning stocks of company in which he/she is working and is reluctant to sell the same even when it is financially prudent, due to emotional attachment. The point is that each investor is unique and if he/she has any specific preference, the same should be clearly specified in the IPS.

In addition to the above mentioned section, the IPS may also include reporting requirements, portfolio rebalancing schedules, frequency of performance communication, investment strategy and styles etc.

3.6 Assessments of needs and requirements of investor

Investors invest to meet their various goals and objectives. Assessment of the needs and requirements of the investors is critical in making investment decisions. People have many financial goals, some are to be achieved in near term, some are medium or long term goals. The goals also have different priority – some are high priority goals where as others may not be very important to achieve. Investors can put their needs and goals down along with the priority and the time frame for each of those goals, with the funds needed for the same. A proforma for creating a goal sheet is shown in Exhibit 1.

| No. | Goal | Priority | Time period | Amount needed |

EXHIBIT 1: PROFORMA GOAL SHEET

Near-Term High Priority Goals have a high emotional priority which the investor wishes to achieve within just a few years at most. As a result, investment vehicles for these goals tend to be either cash equivalents or fixed-income instruments with maturity dates that match the goal date. For people of limited to modest means, the cost of not achieving those goals is just too great to take a risk with more-volatile approaches.

For many investors building a retirement corpus is a long-term high priority goal. When investors start planning for this goal well in advance, they have enough time to accumulate the corpus. Because of the long-term nature of such goals, a diversified approach utilizing several different classes of assets is usually preferred.

People also have many low priority goals. There are goals that are not particularly painful if they are not achieved. These could range from buying a farm house to a luxury car. For these goals, more-aggressive investment approaches are usually taken.

3.7 Analysing the financial position of the investor

A convenient way to analyse the financial position is by constructing personal financial statements. This helps in organizing financial data in a systematic way.

Personal financial statements include a statement of net worth-balance sheet and income-expense statements.

For calculating net worth, all the assets the investor owns, i.e. the house, the car, the investments in stocks, bonds & mutual fund, balance in the saving accounts, value of the jewels owned and the value of all other financial assets and real assets are to be recorded at the estimated market value. Then all the liabilities need to be subtracted from the assets. Liabilities may include the outstanding car loan amount, credit card loans, home loan and any other amount he owes like the personal loan, education loan etc. The difference between the value of assets and the liability is net worth.

It is suggested that net worth is to be calculated periodically, at least once in a year. The next step is calculating whether the person’s present income exceeds spending and by how much amount. This is the amount which would be available periodically for investment purposes. The income expenditure statement can be prepared on monthly basis.

3.8 Psychographic analysis of investor

In investment process, investor’s behavioural traits and personality characteristics also play an important role in setting investors risk profile.

Psychographic analysis of investor bridges the gap between standard finance which treats investors as rational human beings and behavioural finance which view them as normal human beings who have biases and make cognitive errors. In other words, psychographic analysis of investor recognizes investors as normal human beings who are susceptible to biased or irrational behaviour.

All investors have unique personalities. Though it is difficult to categorize the personalities because they all are human beings and they are so different; some basic classification system has evolved after years of research. There are many frameworks available to perform psychographic analysis. For illustration purpose, given below is the framework given by Bailard, Biehl & Kaiser (BB&K).

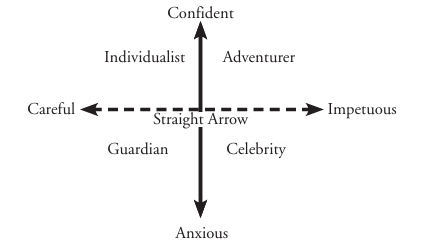

Bailard, Biehl & Kaiser (BB&K) classifies investor personalities by focusing on two aspects: the level of confidence and the method of action. The first deals with how the investor approaches life in terms of career, wealth or money. The second element deals with whether investor is careful, methodical and analytical in the approach towards life. The two elements can be thought of as two “axis” of individual psychology: one axis is the confidence/anxiousness the other is carefulness/impetuousness.

The different personality characteristics are shown through Exhibit 2

EXHIBIT 2: INVESTOR PERSONALITY CHARACTERISTICS

The Five Personalities

The upper-right corner of Exhibit 2 represents the adventurer-people who are willing to put it all in one major bet and “go for it” because they have confidence. As far as they are concerned, it is a carefully considered decision. They are confident as well as impetuous. In that quadrant, one typically will find entrepreneurial people, people who are willing to stick their necks out in their careers or in their money management strategies. They normally have their own ideas about investing. They are willing to take risks, and they normally do not go for the investment advisers. They prefer concentrating their bets.

The lower-right quadrant of the exhibit is the Celebrity quadrant. These people like to be where the action is. They are afraid of being left out. These investors will keep bringing up the latest hot topic, asking, “Should I be in this, or should I be in that?” They really do not have their own ideas about investments. These people normally go for investment advisers. However, they are the most difficult investors because of their own belief.

The Individualist is in the upper-left quadrant. These people have certain degree of confidence about them, but they are also careful, methodical, and analytical. Individualists like to do their own research and tend to avoid extreme volatility. They are often contrarian investors because they do sit back and think about where they want to go and which investments make good value sense.

- Financial services data integrators like Bloomberg, Capital IQ etc., provide information on correlation coefficient between various assets and securities. Alternatively, users can calculate correlation coefficient using simple Microsoft excel Functions.

- Under the Liberalised Remittance Scheme, all resident individuals, including minors, are allowed to freely remit up to USD 2,50,000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both. Further, resident individuals can avail of foreign exchange facility for the purposes mentioned in Para 1 of Schedule III of FEM (CAT) Amendment Rules 2015, dated May 26, 2015, within the limit of USD 2,50,000 only. The Scheme was introduced on February 4, 2004, with a limit of USD 25,000. The LRS limit has been revised in stages consistent with prevailing macro and micro economic conditions.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA