Periodic Table of Tax Deducted at Source (TDS)

- Blog|Income Tax|

- 3 Min Read

- By Taxmann

- |

- Last Updated on 5 April, 2023

Table of Contents

2. Content of Periodic Table of TDS

3. How can the Periodic Table of TDS help you?

4. What’s new in the latest edition?

1. Concept of TDS

For a quick and efficient collection of taxes, a system of deduction of tax at the point of generation of income is incorporated under the Income-tax Act. This system is called ‘Tax Deducted at Source’, commonly known as TDS. TDS is introduced to ensure a regular flow of revenue to the Government.

Under this system, the payer of income is required to deduct tax from certain payments at the prescribed rates and deposit it to the credit of the Central Government within the prescribed time.

The TDS provisions apply to several payments like salary, interest, commission, brokerage, professional fees, royalty, etc.

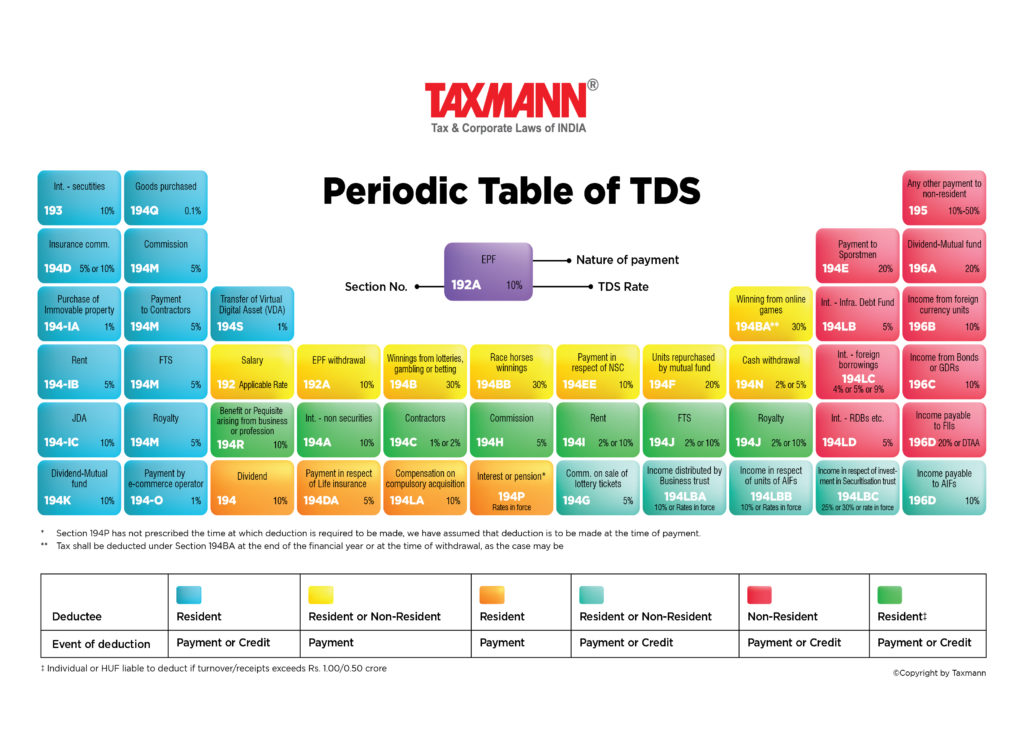

2. Content of Periodic Table of TDS

The periodic table of TDS covers the following details:

a. Section Number

Every provision relating to TDS is covered under the periodic table, highlighting the relevant section of the Income-tax Act.

b. Nature of Payment

Through this periodic table, one can quickly identify the nature of payment in respect of which tax is required to be deducted under a particular section. For example, tax is required to be deducted under section 192 in respect of salary.

c. TDS rate

The table highlights the rate at which tax is required to be deducted under the relevant section.

d. Deductee

Deductee means a person from whose income or receipt the tax is deductible at the source. The deductee can be resident or non-resident in India. This table can be helpful to know the applicability of relevant provisions in the case of a deductee.

e. Event or Time of deduction of tax

Event or Time of deduction of tax means when the tax should be deducted under the relevant section. i.e., whether at the time of payment or at the time of credit of sum to the account of deductee or earlier of the two.

3. How can the Periodic Table of TDS help you?

By using the periodic table of TDS, a person can easily identify which section is applicable to the transaction made or to be made by him and the rate at which tax is required to be deducted. Further, all sections under this table are given and highlighted in different coloured boxes to easily identify the applicability thereof in case of deductee and the time of deduction of tax at source under the said section.

4. What’s new in the latest edition?

The latest edition of the Periodic Table of TDS has been updated with the amendment made by the Finance Act 2023, namely:

(a) A second proviso has been inserted into Section 194LC(1) to provide a TDS rate of 9% from interest on a long-term or rupee-denominated bond listed on a recognised stock exchange located in an IFSC;

(b) Section 194B of the Act has been amended to exclude from its scope the winning from online games and include the winnings from gambling and betting;

(c) A new Section 194BA has been inserted in the Act to require the deduction of tax at the rate of 30% from the winning from online games.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA