Working Capital Management – Meaning | Types | Needs

- Other Laws|Blog|

- 21 Min Read

- By Taxmann

- |

- Last Updated on 2 June, 2025

Working Capital Management refers to the process of managing a company’s short-term assets and liabilities to ensure efficient day-to-day operations and maintain financial stability. It involves monitoring and optimising current assets like cash, receivables, and inventory, as well as current liabilities such as payables and short-term debts, to strike the right balance between liquidity and profitability.

Table of Contents

- Introduction

- The Operating Cycle and Working Capital Needs

- Factors Determining Working Capital Requirement

- Need For Adequate Working Capital

- Working Capital Policy and Management

Check out Taxmann's Fundamentals of Financial Management which is a NEP-aligned textbook that integrates core finance theories with practical applications, notably through Excel-based examples. It covers capital budgeting, cost of capital, dividend decisions, working capital management, and valuation, reinforced by solved illustrations, MCQs, and assignments. Each chapter provides concise synopses, points to remember, and step-by-step guidance to strengthen conceptual understanding. Ideal for undergraduates, educators, and professionals, it combines academic rigour with practical pedagogy for effective financial decision-making. The author's decades of teaching experience ensure a thorough yet accessible approach to all essential aspects of financial management.

“Working Capital, also called net current assets, is the excess of current assets over current liabilities. All organizations have to carry working capital in one form or the other. The efficient management of working capital is important from the point of view of both liquidity and profitability. Poor management of working capital means that funds are unnecessarily tied up in idle assets hence reducing liquidity and also reducing the ability to invest in productive assets such as plant and machinery, so affecting the profitability.”

1. Introduction

The working capital management refers to management of the working capital, or to be more precise, the management of current assets. A firm’s working capital consists of its investment in current assets which include short term assets such as cash and bank balance, inventories, receivables (including debtors and bills), and marketable securities. Working capital management refers to the management of the level of all these individual current assets. The need for working capital management arises from two considerations. First, existence of working capital is imperative in any firm. The fixed assets which usually require a large chunk of total funds, can be used at an optimum level only if supported by sufficient working capital, and second, the working capital involves investment of funds of the firm. If the working capital level is not properly maintained and managed, then it may result in unnecessary blocking of scarce resources of the firm. The insufficient working capital, on the other hand, put different hindrances in smooth working of the firm. Therefore, the working capital management needs attention of all the financial managers.

The working capital management includes the management of the level of individual current assets as well as the management of total working capital. However, each individual current assets has unique characteristics which the financial manager must consider in deciding how much money should be invested in each of these current assets. In other words, he must decide the level of all the current assets. The management of individual current assets i.e., cash and bank balance, marketable securities, receivables and inventories has been taken up in subsequent chapters.

1.1 Nature and Types of Working Capital

The term working capital refers to current assets which may be defined as (i) those which are convertible into cash or equivalents within a period of one year, and (ii) those which are required to meet day-to-day operations. The fixed assets as well as the current assets, both requires investment of funds. So, the management of working capital and of fixed assets, apparently, seem to involve same types of considerations but it is not so.

The management of working capital involves different concepts and methodology than the techniques used in fixed assets management. The reason for this difference is obvious. The very basics of fixed assets decision process (i.e., the capital budgeting) and the working capital decision process are different. The fixed assets involve long-period perspective and therefore, the concept of time value of money is applied in order to discount the future cash flows; whereas in working capital the time horizon is limited, in general, to one year only and the time value of money concept is not considered. The fixed assets affect the long-term profitability of the firm while the current assets affect the short-term liquidity position. The fixed assets decisions, as already discussed in Chapter 8, are irreversible and affect the growth of the firm, whereas the working capital decisions can be changed and modified without much implications.

Managing current assets may require more attention than managing fixed assets. The financial manager cannot simply decide the level of the current assets and stop there. The level of investment in each of the current assets varies from day to day, and the financial manager must therefore, continuously monitor these assets to ensure that the desired levels are being maintained. Since, the amount of money invested in current assets can change rapidly, so does the financing required. Mismanagement of current assets can be costly. Too large an investment in current assets means tying up funds that can be productively used elsewhere (or it means added interest cost if the firm has borrowed funds to finance the investment in current assets). Excess investment may also expose the firm to undue risk e.g., in case, the inventory cannot be sold or the receivables cannot be collected.

On the other hand, too little investment also can be expensive. For example, insufficient inventory may mean that sales are lost as the goods which a customer wants are not available. The result is that the financial managers spend a large chunk of their time managing the current assets because level of these assets changes quickly and a lack of attention paid to them may result in appreciably lower profits for the firm. So, in the working capital management, a financial manager is faced with a decision involving some of the considerations as follows:

- What should be the total investment in working capital of the firm?

- What should be the level of individual current assets?

- What should be the relative proportion of different sources to finance the working capital requirements?

Thus, the working capital management may be defined as the management of firm’s sources and uses of working capital in order to maximize the wealth of the shareholders. The proper working capital management requires both the medium term planning (say up to three years) and also the immediate adaptations to changes arising due to fluctuations in operating levels of the firm.

The term working capital may be used in two different ways:

(i) Gross Working Capital (or Total Working Capital) – The gross working capital refers to the firm’s investment in all the current assets taken together. The total of investments in all the individual current assets is the gross working capital. For example, if a firm has a cash balance of ` 50,000, debtors of ` 70,000 and inventory of raw material and finished goods has been assessed at ` 1,00,000, then the gross working capital of the firm is ` 2,20,000 (i.e., `50,000 + `70,000 + ` 1,00,000).

(ii) Net Working Capital – The term net working capital may be defined as the excess of total current assets over total current liabilities. It may be noted that the current liabilities refer to those liabilities which are payable within a period of 1 year. The extent, to which the payments to these current liabilities are delayed, the firm gets the availability of funds for that period. So, a part of the funds required to maintain current assets is provided by the current liabilities and the firm will be required to invest the funds in only those current assets which are not financed by the current liabilities.

The net working capital may either be positive or negative. If the total current assets are more than total current liabilities, then the difference is known as positive net working capital, otherwise the difference is known as negative net working capital. The net working capital measures the firm’s liquidity. The greater the margin (i.e., net working capital) by which the firm’s current assets cover its current liabilities, the better it will be. Although the firm’s current assets may not be converted into cash precisely when they are needed, still greater net working capital assures that in all likelihood some current assets will be converted into cash to pay the current liabilities.

The distinction between gross working capital and net working capital does not in any way undermine the relevance of the concepts of either gross or net working capital. A financial manager must consider both of them because they provide different interpretations. The gross working capital denotes the total working capital or the total investment in current assets. A firm should maintain an optimum level of gross working capital. This will help avoiding:

(i) the unnecessarily stoppage of work or chance of liquidation due to insufficient working capital, and

(ii) effect on profitability (because over flowing working capital implies cost).

Therefore, a firm should have just adequate level of total current assets. The gross working capital also gives an idea of total funds required for maintaining current assets.

On the other hand, net working capital refers to the amount of funds that must be invested by the firm, more or less, regularly in current assets. The remaining portion of current assets being financed by the current liabilities. The net working capital also denotes the net liquidity being maintained by the firm. This also gives an idea of buffer available to the current liabilities.

Both concepts of working capital i.e., the gross working capital and the net working capital have their own relevance and a financial manager should give due attention to both of these.

2. The Operating Cycle and Working Capital Needs

The working capital requirement of a firm depends, to a great extent upon the operating cycle of the firm. The operating cycle may be defined as the time duration starting from the procurement of goods or raw materials and ending with the sales realisation. The length and nature of the operating cycle may differ from one firm to another depending upon the size and nature of the firm.

In a trading concern, there is a series of activities starting from procurement of goods (saleable goods) and ending with the realisation of sales revenue (at the time of sale itself in case of cash sales and at the time of debtors realisations in case of credit sales). Similarly, in case of manufacturing concern, this series starts from procurement of raw materials and ending with the sales realisation of finished goods (after going through the different stages of production). In both the cases, however, there is a time gap between the happening of the first event and the happening of the last event. This time gap is called the Operating Cycle.

Thus, the operating cycle of a firm consists of the time required for the completion of the chronological sequence of some or all of the following:

- Procurement of raw materials and services.

- Conversion of raw materials into work-in-progress.

- Conversion of work-in-progress into finished goods.

- Sale of finished goods (cash or credit).

- Conversion of receivables into cash.

These activities create and necessitate cash flows which are neither synchronised nor certain. The relevant cash flows are not synchronised because the cash disbursements (i.e., payment for purchases) take place before the cash inflows (from sales realisations). These cash flows are uncertain because these depend upon the future costs and sales. Of course, the cash outflows relating to payment for purchases and payment for wages and other expenses are less uncertain with respect to time as well as quantum. What is required on the part of a firm is to make adjustments and arrangements so that the uncertainty and synchronisation of these cash flows can be taken care of.

The firm is often required to extend credit facilities to customers. The finished goods must be kept in store to take care of the orders and a minimum cash balance must be maintained. It must also have a minimum of raw materials to have smooth and uninterrupted production process. So, in order to have a proper and smooth running of the business activities, the firm must make investments in all these current assets. This requirement of funds depends upon the operating cycle period of the firm and is also denoted as the working capital needs of the firm.

2.1 Operating Cycle Period

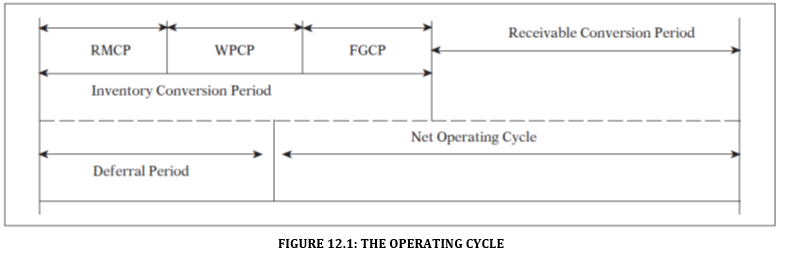

The length or time duration of the operating cycle of any firm can be defined as the sum of its inventory conversion period and the receivable conversion period.

(i) Inventory Conversion Period (ICP) – It is the time required for the conversion of raw materials into finished goods sales. In a manufacturing firm the ICP is consisting of Raw Material Conversion Period (RMCP), Work-in-Progress Conversion Period (WPCP), and the Finished Goods Conversion Period (FGCP). The RMCP refers to the period for which the raw material is generally kept in stores before it is issued to the production department. The WPCP refers to the period for which the raw materials remain in the production process before it is taken out as a finished unit. The FGCP refers to the period for which finished units remain in stores before being sold to customers.

(ii) Receivables Conversion Period (RCP) – It is the time required to convert the credit sales into cash realisation. It refers to the period between the occurrence of credit sales and collection of debtors.

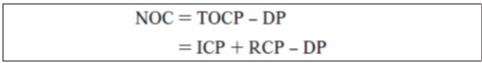

The total of ICP and RCP is also known as Total Operating Cycle Period (TOCP). The firm might be getting some credit facilities from the supplier of raw materials, wage earners etc. The period for which the payments to these parties are deferred or delayed is known as Deferral Period (DP). The Net Operating Cycle (NOC) of the firm is arrived at by deducting the DP from the TOCP. Thus,

The operating cycle of a firm has been shown in Figure 12.1.

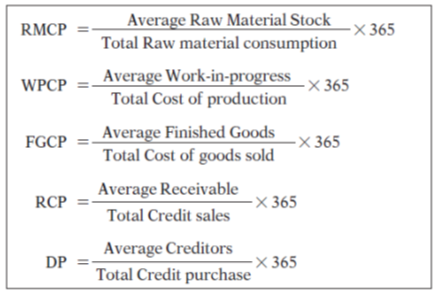

For calculation of TOCP and NOC, various conversion periods may be calculated as follows:

In respect of these formulations, the following points are worth noting:

- The ‘Average’ value in the numerator is the average of opening balance and closing balance of the respective item. However, if only the closing balance is available, then even the closing balance may be taken as the ‘Average’.

- The figure ‘365’ represents number of days in a year. However, there is no hard and fast rule and sometimes even 360 days are considered.

- The ‘Total’ figure in the denominator refers to the total value of the item in a particular year, and

- In the calculation of RMCP, WPCP, and FGCP, the denominator is calculated at cost-basis and the profit margin has been excluded. The reason being that there is no investment of funds in profit as such.

On the basis of above conversion periods, the TOCP and NOC may be ascertained as follows:

| Particulars | Number of Days |

| RMCP | …….. Days |

| +WPCP | …….. Days |

| +FGCP | …….. Days |

| +RCP | …….. Days |

| TOCP | …….. Days |

| –DP | …….. Days |

| NOC | …….. Days |

The TOCP and NOC do not measure the absolute amount of funds invested in working capital. However, a longer NOC will generally indicate a requirement for more working capital. Lesser amount of working capital will be required at the beginning of the operating cycle than at the end because most of the expenses are incurred well after initial raw materials are procured and introduced in the production process. The operating cycle for an individual component keeps on changing from time to time, particularly the RCP and the DP. Therefore, a regular attention and review is required. It would be extremely difficult to determine an optimum operating cycle for a particular firm. The comparison of firm’s operating cycle for a period with that of the previous period and with that of the operating cycle of other firms may help in maintaining and controlling the length of the operating cycle.

3. Factors Determining Working Capital Requirement

The working capital needs of a firm are determined and influenced by various factors. A wide variety of considerations may affect the quantum of working capital required and these considerations may vary from time to time. The working capital needed at one point of time may not be good enough for some other situation. The determination of working capital requirement is a continuous process and must be undertaken on a regular basis in the light of the changing situations. Following are some of the factors which are relevant in determining the working capital needs of the firm:

- Basic Nature of Business – The working capital requirement is closely related to the nature of the business of the firm. In case of a retail shop or a trading firm, the amount of working capital required is small enough. Most of the transactions are undertaken in cash and the length of the operating cycle is generally small. The trading concerns usually have smaller needs of working capital, however, in certain cases, large inventories of goods may be required and consequently the working capital may be large. In case of financial concerns (engaged in financial business) there may not be stock of goods but these firms do have to maintain sufficient liquidity all the times. In case of manufacturing concerns, different types of production processes are performed. One unit of raw material introduced in the production schedule may take a long period before it is available as finished goods for sale. Funds are blocked not only in raw materials but also in labour expenses and overheads at every stage of production. So, in case of manufacturing concerns, there is a requirement of substantial working capital.

- Business Cycle Fluctuations – Different phases of business cycle i.e., boom, recession, recovery etc. also affect the working capital requirement. In case of boom conditions, inflationary pressure appears and business activities expand. As a result, the overall need for cash, inventories etc. increases resulting in more and more funds blocked in these current assets. In case of recession period however, there is usually a dullness in business activities and there will be an opposite effect on the level of working capital requirement. There will be a fall in inventories and cash requirement etc.

- Seasonal Operations – If a firm is operating in goods and services having seasonal fluctuations in demand, then the working capital requirement will also fluctuate with every change. In a cold drink factory, the demand will certainly be higher during summer season and therefore, more working capital is required to maintain higher production, in the form of larger inventories and bigger receivables. On the other hand, if the operations are smooth and even throughout the year then the working capital requirement will be constant and will not be affected by the seasonal factors.

- Market Competitiveness – The market competitiveness has an important bearing on the working capital needs of a firm. In view of the competitive conditions prevailing in the market, the firm may have to offer liberal credit terms to the customers resulting in higher debtors. Even larger inventories may be maintained to serve an order as and when received; otherwise the customer may go to some other supplier. Thus, the working capital tends to be high as a result of greater investment in inventories and receivables. On the other hand, a monopolistic firm may not require larger working capital. It may ask the customers to pay in advance or to wait for some time after placing the order.

- Credit Policy – The credit policy means the totality of terms and conditions on which goods are sold and purchased. A firm has to interact with two types of credit policies at a time. One, the credit policy of the supplier of raw materials, goods etc., and two, the credit policy relating to credit which it extends to its customers. In both the cases, however, the firm while deciding its credit policy, has to take care of the credit policy of the market. For example, a firm might be purchasing goods and services on credit terms but selling goods only for cash. The working capital requirement of this firm will be lower than that of a firm which is purchasing cash but has to sell on credit basis.

- Supply Conditions – The time taken by a supplier of raw materials, goods etc. after placing an order, also determines the working capital requirement. If goods are received as soon as or in a short period after placing an order, then the purchaser will not like to maintain a high level of inventory of that goods. Otherwise, larger inventories should be kept e.g., in case of imported goods. It is often seen that the shopkeepers may not be keeping stock of all items, but whenever there is a demand, they procure from the wholesaler/producer and supply it to their customers.

Thus, the working capital requirement of a firm is determined by a host of factors. Every consideration is to be weighted relatively to determine the working capital requirement. Further, the determination of working capital requirement is not once a while exercise, rather a continuous review must be made in order to assess the working capital requirement in the changing situation. There are various reasons which may require the review of the working capital requirement e.g., change in credit policy, change in sales volume, etc.

4. Need For Adequate Working Capital

The need and importance of adequate working capital for day to day operations can hardly be underestimated. Every firm must maintain a sound working capital position otherwise, its business activities may be adversely affected. The financial manager must see that the firm has sufficient working capital as and when required so that the fixed assets of the firm are optionally used. The objective of financial management i.e., to maximise the wealth of the shareholder cannot be attained if the operations of the firm are not optimized. Thus, every firm must have adequate working capital. It should have neither the excessive working capital nor inadequate working capital. Both situations are risky and may have dangerous outcome. The excessive working capital, when the investment in working capital is more than the required level, may result in

- Unnecessary accumulation of inventories resulting in waste, theft, damage etc.

- Delays in collection of receivables resulting in more liberal credit terms to customers than warranted by the market conditions.

- Adverse influence on the performance of the management.

On the other hand, inadequate working capital situation, when the firm does not have sufficient working capital to support its operations, is also not good for the firm. Such a situation may have following consequences:

- The fixed assets may not be optimally used.

- Firms growth may stagnate.

- Interruptions in production schedule may occur ultimately resulting in lowering of the profit of the firm.

- The firm may not be able to take benefit of an opportunity.

- Firm’s goodwill in the market is affected if it is not in a position to meet its liabilities on time.

In view of the above, it can be said that the management of a firm in general and the financial manager in particular, must understand the importance of adequate working capital. In other words, the working capital level of a firm must be maintained and managed at an appropriate level. The financial manager must establish

(i) a well-defined working capital policy and

(ii) a self-sufficient working capital management system.

While designing the working capital policy, the financial manager should take care of the following aspects:

- What should be the level of total and individual current assets in view of the expected sales level?

- The financing pattern of the total working capital needs.

The working capital system should be established to take care of management of all aspects of the current assets. Efforts should be made to establish a built-in internal control system to take note of the level as well as fluctuations in all components of the working capital. Different aspects of working capital policy and management have been discussed in the following section.

5. Working Capital – Policy and Management

The working capital management includes and refers to the procedures and policies required to manage the working capital. It may be noted that the long-term profitability of a firm, undoubtedly, depends upon the investment decisions of a firm. The investment decisions determine the pattern of sales growth and sales in turn, determine the profitability. However, the investment decisions and other decisions have two important implications for working capital management. First, the sales forecast of goods and services being produced by the firm allow the financial manager to estimate the working capital needs and level of different current assets. Second, the working capital management helps maximise the shareholders wealth by providing and maintaining firm’s liquidity. The working capital management need not necessarily have a target of increasing the wealth of the shareholders, nevertheless it helps attaining the objective by providing sufficient liquidity to the firm.

The importance of working capital management, thus, can be expressed in terms of the following points:

- The level of current assets changes constantly and regularly depending upon the level of actual and forecasted sales. This requires that the decisions to bring a level of current assets to the desired levels of current assets should be made at the earliest opportunity and as frequently as required.

- The changing levels of current assets may also require review of the financing pattern. How much working capital needs to be financed by different sources of financing must be periodically reviewed.

- Inefficient working capital management may result in loss of sales and consequently decline in profits of the firm.

- Inefficient working capital management may also lead to insolvency of the firm if it is not in a position to meet its liabilities and commitments.

- Current assets usually represent a substantial portion of the total assets of the firm, resulting in investment of a larger chunk of funds in the current assets.

- There is an obvious and inevitable relationship between the sales growth and the level of current assets. The target sales level can be achieved only if supported by adequate working capital. The increase in sales level requires increase in working capital and thus the financial manager must be able to respond quickly in providing and arranging additional working capital.

Thus, efficient working capital management is important from the point of view of both liquidity and profitability. Poor and inefficient working capital management means that funds are unnecessarily tied up in idle assets. This reduces the liquidity as well as the ability to invest funds in productive assets, so affecting the profitability. Keeping in view the importance of working capital management, the financial manager should look into the framing of a suitable working capital policy for the firm. Following are some of the important aspects of a working capital policy.

5.1 Determining the Ratio of Current Assets to Sales

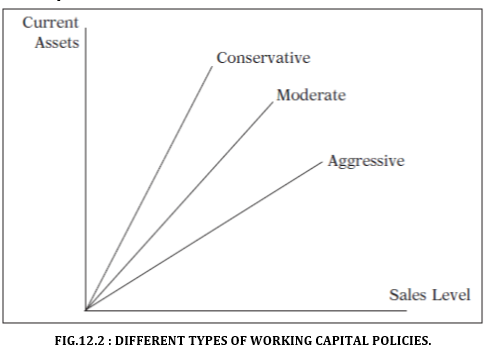

As already said that there is an inevitable relationship, between the sales and the current assets. The actual and the forecasted sales have a major impact on the amount of current assets which the firm must maintain. So, depending upon the sale forecast, the financial manager should also estimate the requirement of current assets. However, as the sales forecast cannot be certain, so is the case with the forecast of current assets also. This uncertainty may result in spontaneous increase in current assets in line with the increase in sales level, and may bring the firm to face tight working capital position. In order to overcome this uncertainty, the financial manager may establish a minimum level as well as a safety component for each of the current assets for different levels of sales. But how much should be this safety component? It may be noted that in fact, this safety component determines the type of working capital policy a firm is pursuing. There are three types of working capital policies which a firm may adopt i.e., moderate working capital policy, conservative working capital policy and aggressive working capital policy. These policies describe the relationship between sales level and the level of current assets and have been shown in Figure 12.2.

Figure 12.2 shows that in case of moderate working capital policy, the increase in sales level will be coupled with proportionate increase in level of current assets also e.g., if the sales increase or are expected to increase by 10%, then the level of current assets will also be increased by 10%. In case of conservative working capital policy, the firm does not like to take risk. For every increase in sales, the level of current assets will be increased more than proportionately. Such a policy tends to reduce the risk of shortage of working capital by increasing the safety component of current assets. The conservative working capital policy also reduces the risk of non-payment to liabilities.

On the other hand, a firm is said to have adopted an aggressive working capital policy if the increase in sales does not result in proportionate increase in current assets. For example, for 10% increase in sales the level of current assets is increased by 7% only. This type of aggressive policy has many implications. First, the risk of insolvency of the firm increases as the firm maintains lower liquidity. Second, the firm is exposed to greater risk as it may not be able to face unexpected change market and, third, reduced investment in current assets will result in increase in profitability of the firm.

5.2 Liquidity v. Profitability – A Risk-Return Trade-off

Another important aspect of a working capital policy is to maintain and provide sufficient liquidity to the firm. Like most corporate financial decisions, the decision on how much working capital be maintained involves a trade-off because having a large net working capital may reduce the liquidity-risk faced by the firm, but it can have a negative effect on the cash flows. Therefore, the net effect on the value of the firm should be used to determine the optimal amount of working capital. A firm must maintain enough cash balance or other liquid assets so that it never faces problems of payment to liabilities. Does it mean that a firm should maintain unnecessarily large liquidity to pay its creditors? Can a firm adopt such a policy? Certainly not. There is also another side of the coin. Greater liquidity makes the firm meeting easily its payment commitments, but simultaneously greater liquidity involves cost also.

The risk-return trade-off involved in managing the firm’s working capital is a trade-off between the firm’s liquidity and its profitability. By maintaining a large investment in current assets like cash, inventory, etc., the firm reduces the chances of:

(i) production stoppages and the lost sales from the inventory shortages, and

(ii) the inability to pay the creditors on time.

However, as the firm increases its investment in working capital, there is not a corresponding increase in its expected returns. This means that the firm’s return on investment drops because the profit are unchanged while the investment in current assets increases.

In addition to the above, the firm’s use of current liability versus long term debt also involves a risk-return trade-off. Other things being equal, the greater the firm’s reliance on the short term debts or current liabilities in financing its current assets, the greater the risk of illiquidity. On the other hand, the use of current liability can be advantageous as it is less costly and flexible means of financing. A firm can reduce its risk of illiquidity through the use of long term debts at the cost of reduction in its return on investment. The risk-return trade-off thus involves an increased risk of illiquidity and the Profitability.

In order to discuss the risk-return trade-off, the following assumptions are made:

- That the current assets are less profitable than the fixed assets,

- Short term funds are cheaper than long term funds, and

- The firm has a fixed level of total funds inclusive of long term funds and short term funds; and a fixed level of total assets inclusive of current assets and fixed assets.

The effect of changing levels of current assets on the risk-return trade-off can be demonstrated as follows:

For a given firm, if the level of current assets is increased (it impliedly means that the fixed assets will reduce by the same amount) then the liquidity position of the firm will also increase and it will be easily meeting its payment commitments. But simultaneously its profit will decrease as the level of fixed assets has gone down. In other words, when the level of current assets is increased, the liquidity of the firm increases but there is always a cost associated with the increased liquidity. More and more funds will be blocked in current assets which are less profitable and therefore, the profitability of the firm will suffer.

Now, in order to increase the profitability, the firm reduces the current assets (and thereby increasing the fixed assets). Consequently, the profitability of the firm will increase but the liquidity will be reduced. The firm is now exposed to a greater risk of insolvency. The risk return syndrome can be summed up as follows – When liquidity increases, the risk of insolvency is reduced but the profitability is also reduced. However, when the liquidity is reduced, the profitability increases but the risk of insolvency also increases. So, the profitability and risk move in the same direction. What is required on the part of the financial manager is to maintain a balance between risk and profitability. Neither too much of risk nor too much of profitability is good.

5.3 Types of Working Capital Needs

Another important aspect of working capital management is to analyse the total working capital needs of the firm in order to find out the permanent and temporary working capital. It has already been discussed that the working capital is required because of existence of operating cycle. Moreover, the lengthier the operating cycle, greater would be the need for working capital. The operating cycle is a continuous process and therefore, the working capital is needed constantly and regularly. However, the magnitude and quantum of working capital required will not be same all the times, rather it will fluctuate.

The need for current assets tends to shift over time. Some of these changes reflect permanent changes in the firm as is the case when the inventory and receivables increase as the firm grows and the sales becomes higher and higher. Other changes are seasonal as is the case with increased inventory required for a particular festival season. Still others are random, reflecting the uncertainty associated with growth in sales due to firm specific or general economic factors. The working capital need therefore, can be bifurcated into permanent working capital and temporary working capital as follows:

5.3.1 Permanent Working Capital

There is always a minimum level of working capital which is continuously required by a firm in order to maintain its activities. Every firm must have a minimum of cash, stock and other current assets in order to meet its business requirements irrespective of the level of operations. Even during slack season, every firm maintains some current assets. This minimum level of current assets which must be maintained by any firm all the times, is known as permanent working capital for that firm. This amount of working capital is constantly and regularly required in the same way as fixed assets are required. So, it may also be called fixed working capital.

5.3.2 Temporary Working Capital

Over and above the permanent working capital, the firm may also require additional working capital in order to meet the requirements arising out of fluctuations in sales volume. This extra working capital needed to support the increased volume of sales is known as temporary or fluctuations working capital. For example, in case of spurt in sales, more stock must be maintained in order to meet the demand. This additional inventory may become excess when the normal sales level reappears after some time.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA