Overview of Personal Guarantors Provisions under IBC

- Blog|Insolvency and Bankruptcy Code|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 26 December, 2023

Table of Contents

- Framework For Personal Guarantors under IBC

- Insolvency Resolution Process

- Insolvency Resolution Process

- Personal Guarantor

- Moratorium

- Section 104 – Preparation of List of Creditors

- Repayment Plan (Section 105 And Reg. 17)

- Insolvency of Personal Guarantor Rules

1. Framework For Personal Guarantors under IBC

In exercise of the powers conferred by sub-section (3) of Section 1 of the Insolvency and Bankruptcy Code, 2016 (31 of 2016), the Central Government hereby appoints the 1st day of December, 2019 as the date on which the following provisions of the said Code only in so far as they relate to personal guarantors to corporate debtors, shall come into force:

- clause (e) of section 2

- section 78 (except with regard to fresh start process) and section 79;

- sections 94 to 187 [both inclusive];

- clause (g) to clause (i) of sub-section (2) of section 239;

- clause (m) to clause (zc) of sub-section (2) of section 239;

- clause (zn) to clause (zs) of sub-section (2) of section 240; and

- section 249.

1.1 Framework

Insolvency Resolution Process

- Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Personal Guarantors to Corporate Debtors) Regulations, 2019.

- Insolvency and Bankruptcy (Application to Adjudicating Authority for Insolvency Resolution Process for Personal Guarantors to Corporate Debtors) Rules, 2019.

Bankruptcy Process

- Insolvency and Bankruptcy Board of India (Bankruptcy Process for Personal Guarantors to Corporate Debtors) Regulations, 2019.

- Insolvency and Bankruptcy (Application to Adjudicating Authority for Bankruptcy Processfor Personal Guarantors to Corporate Debtors) Rules, 2019.

1.2 Timeline

- 28.05.2016 – IBC enacted

- 15.11.2019 – Sections of the Code for Personal Guarantor notified

- 15.11.2019 – Rules for Personal Guarantor notified

- 20.11.2019 – Regulations for Personal Guarantor notified

- 01.12.2019 – Provisions along with Rules and Regulations For PG Insolvency Effective

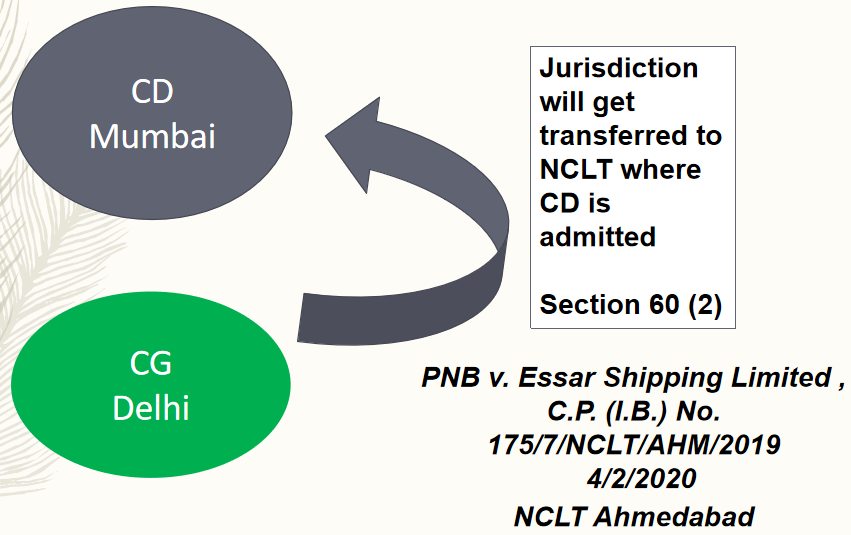

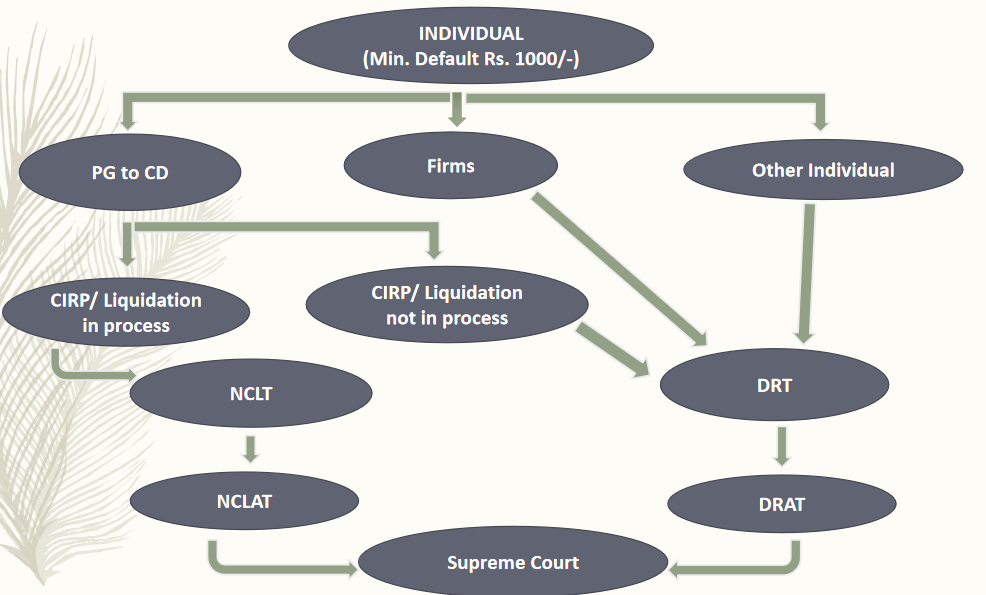

2. Jurisdiction of NCLT for Corporate Debtor, Corporate Guarantor and Personal Guarantor

Two applications can be maintained for the same debt against CG and CD

Dr. Vishnu Kumar Agarwal v. Piramal Enterprises Ltd. [2019] 101 taxmann.com 464/151 SCL 555 (NCLAT) & Shabad Khan v. Nisus Finance and Investment Manager [2020] 118 taxmann.com 315 (NCLAT)

If two Applications can be filed, for the same amount against Principal Borrower and Guarantor keeping in view the Sec. 60(2) & (3) of IBC, the Applications can also be maintained – State Bank of India v. Athena Energy Ventures Private Limited [2021] 123 taxmann.com 82/164 SCL 293 (NCLAT)

Whether a Bank/Financial Institution can institute or continue with proceedings against a Guarantor under the SARFAESI Act, when proceedings under the IBC have been initiated against the Principal Borrower & the same are pending adjudication –

Kiran Gupta v. State Bank of India [2020] 121 taxmann.com 23 (Delhi) & Industrial Investment Bank of India Ltd. v. Biswanath Jhunjhunwala [2011] 3 taxmann.com 77 (SC)

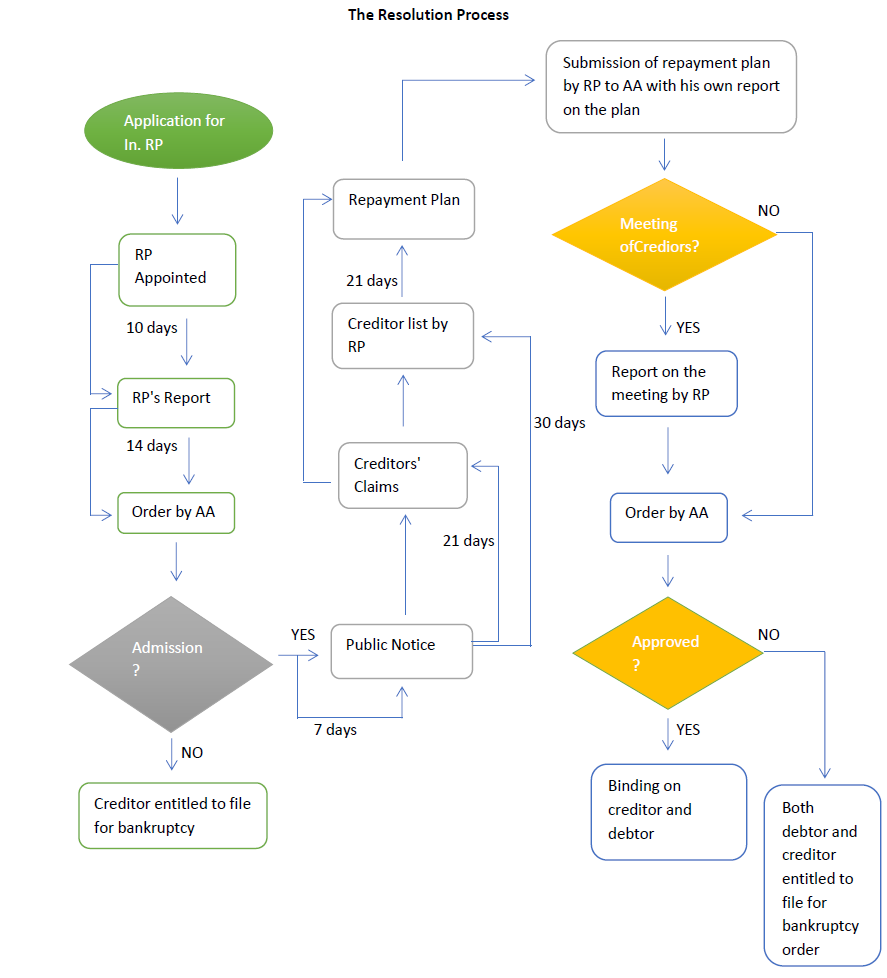

3. Insolvency Resolution Process

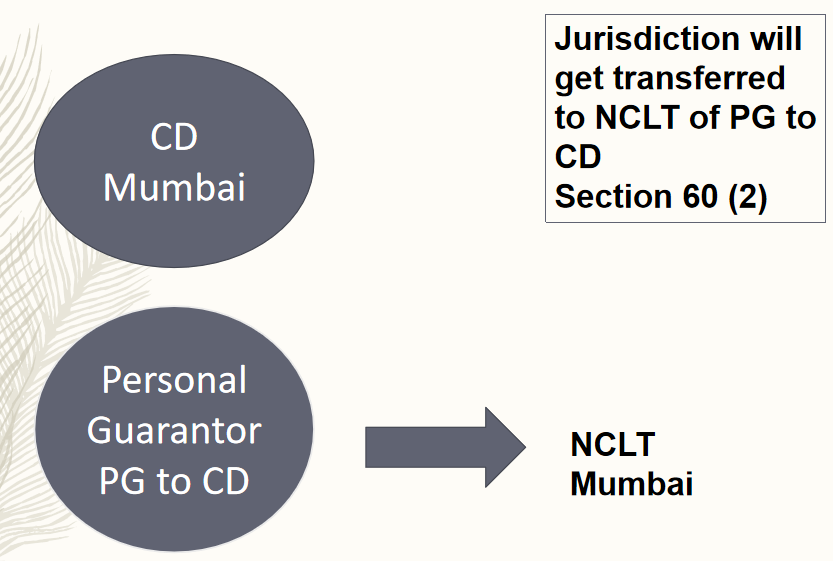

3.1 Section 60 Adjudication Authority for Corporate Persons

- The Adjudicating Authority, in relation to insolvency resolution and liquidation for corporate persons including corporate debtors and personal guarantors thereof shall be the National Company Law Tribunal having territorial jurisdiction over the place where the registered office of a corporate person is located.

- Without prejudice to sub-section (1) and notwithstanding anything to the contrary contained in this Code, where a corporate insolvency resolution process or liquidation proceeding of a corporate debtor is pending before a National Company Law Tribunal, an application relating to the insolvency resolution or liquidation or bankruptcy of a corporate guarantor or personal guarantor, as the case may be, of such corporate debtor shall be filed before the National Company Law Tribunal.

- An insolvency resolution process or liquidation or bankruptcy proceeding of a corporate guarantor or personal guarantor, as the case may be, of the corporate debtor] pending in any court or tribunal shall stand transferred to the Adjudicating Authority dealing with insolvency resolution process or liquidation proceeding of such corporate debtor.

- (4) The National Company Law Tribunal shall be vested with all the powers of the Debt Recovery Tribunal as contemplated under Part III of this Code for the purpose of sub-section (2).

- Notwithstanding anything contained in the Limitation Act, 1963 or in any other law for the time being in force, in computing the period of limitation specified for any suit or application by or against a corporate debtor for which an order of moratorium has been made under this Part, the period during which such moratorium is in place shall be excluded.

- Notwithstanding anything to the contrary contained in any other law for the time being in force, the National Company Law Tribunal shall have jurisdiction to entertain or dispose of:

(a) any application or proceeding by or against the corporate debtor or corporate person;

(b) any claim made by or against the corporate debtor or corporate person, including claims by or against any of its subsidiaries situated in India; and

(c) any question of priorities or any question of law or facts, arising out of or in relation to the insolvency resolution or liquidation proceedings of the corporate debtor or corporate person under this Code.

3.2 Insolvency Resolution Process for Personal Guarantors

4. Personal Guarantor

- Section 5 (22)

- “personal guarantor” means an individual who is the surety in a contract of guarantee to a corporate debtor

- Rule 3 (f) of IBBI (Application to AA) Rules

- Guarantor means a debtor who is personal guarantor to a CD and in respect of whom guarantee has been invoked by the creditor and remain unpaid in full or part.

4.1 SC upholds Insolvency Resolution Process for Personal Guarantors

Lalit Kumar Jain vs Union of India [2021] 127 taxmann.com 368/167 SCL 1 (SC)

- Surety and Principal liability are co-extensive

- Contract of surety and variation in terms with principal

- Resolution plan of CD

4.2 Insolvency Resolution Process for Personal Guarantors

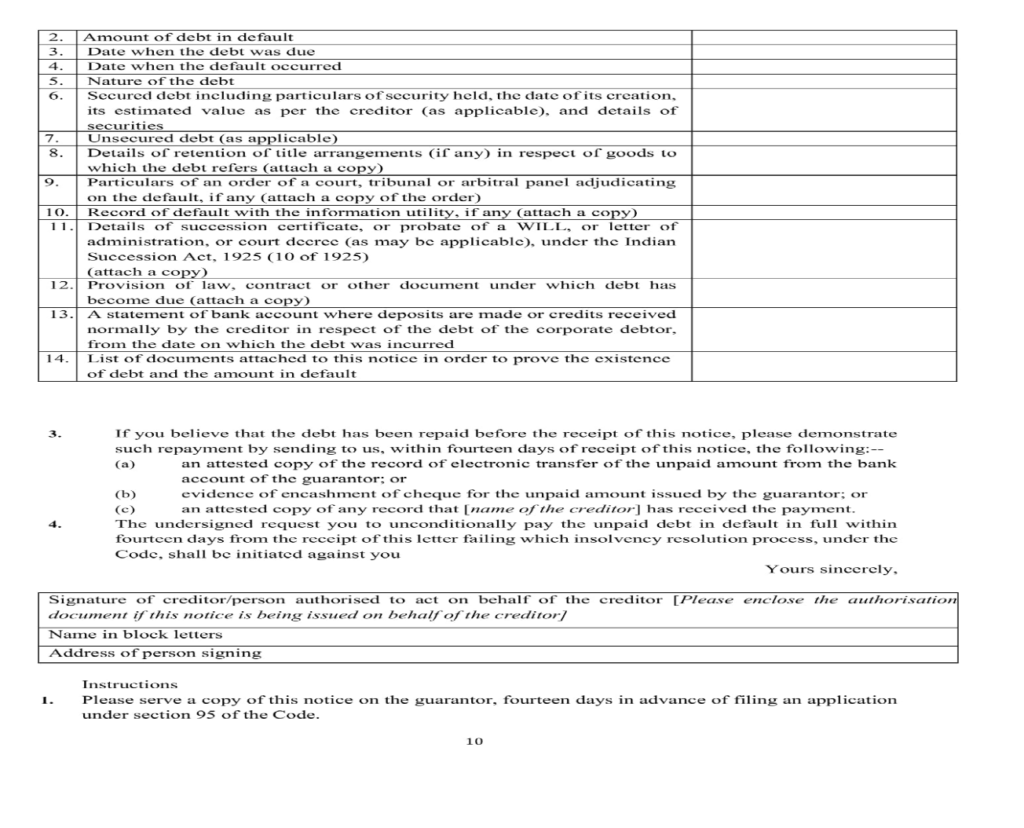

Application for Insolvency Resolution Process for personal guarantor-

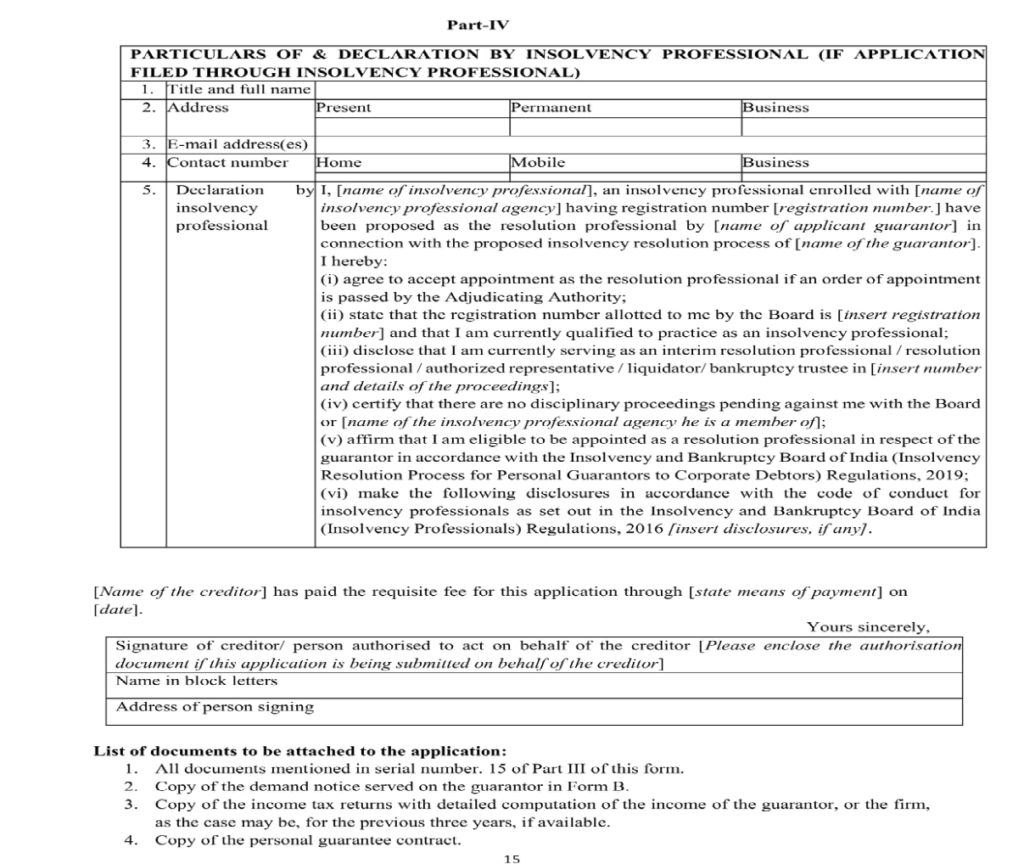

- by guarantor personally or through RP (Form A u/s 94) along-with two thousand rupees.

- By Creditor (Section 95)

-

- Demand notice by creditor personally demanding payment [Form B]

14 days

-

- Application by creditor personally or through RP (Form C u/s 95) along-with two thousand rupees after expiry of 14 days from the date of demand notice.

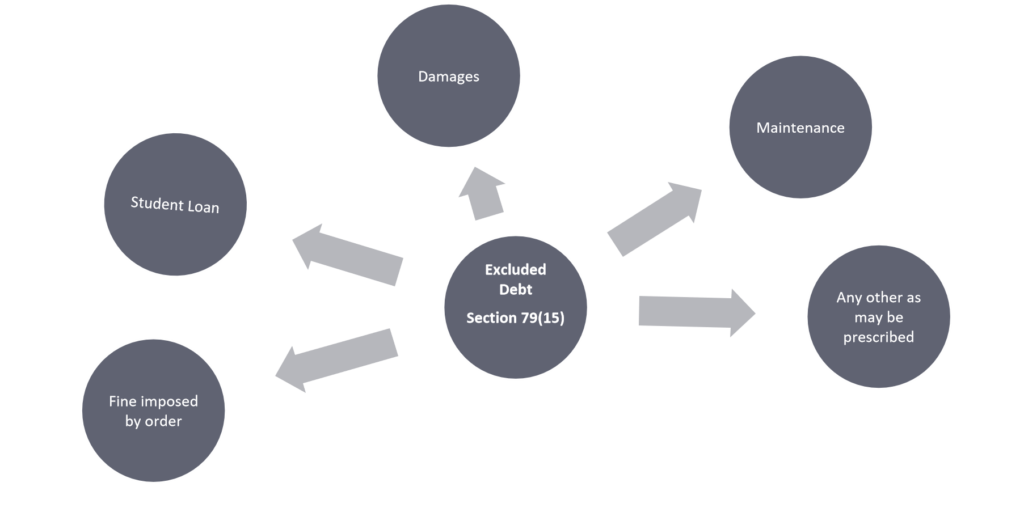

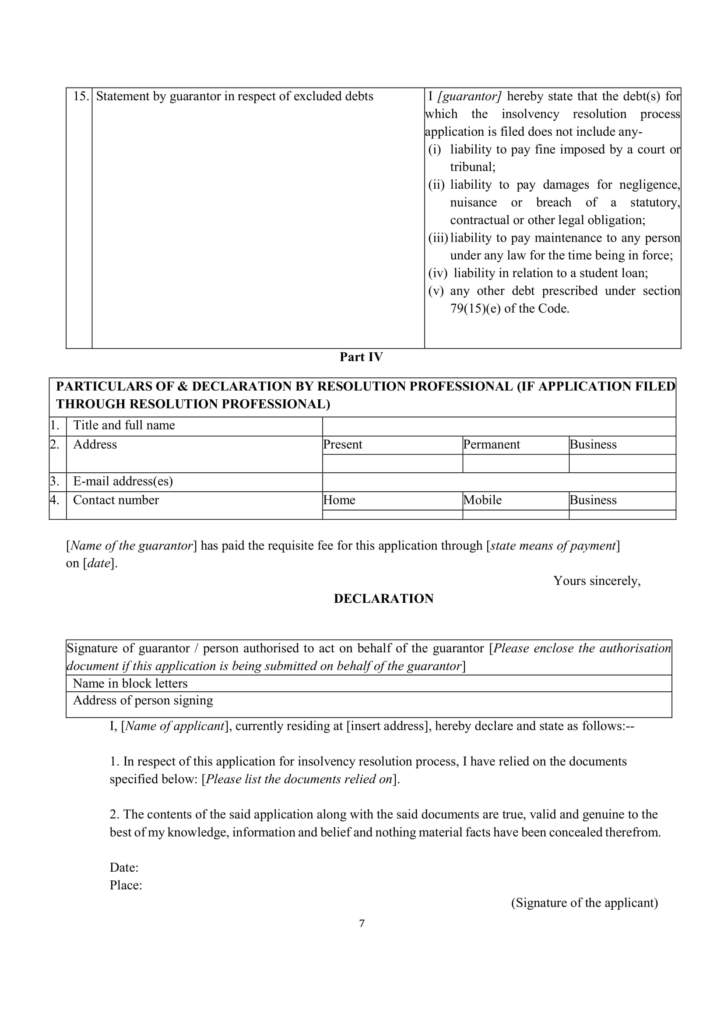

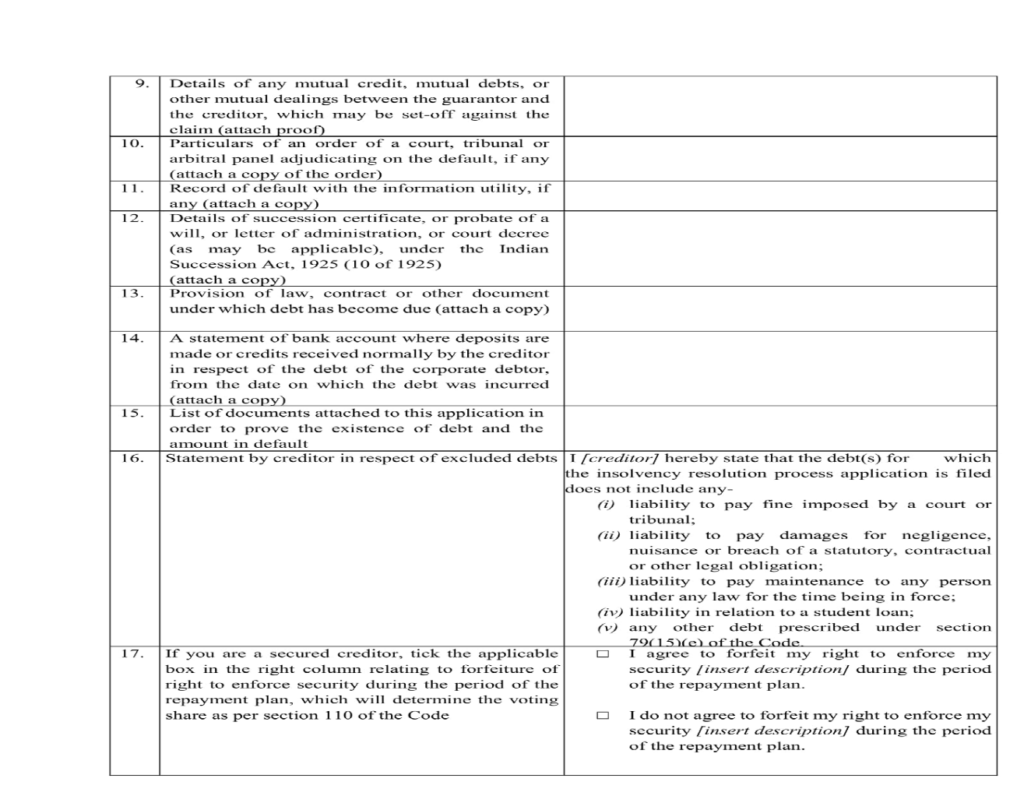

(15) “excluded debt” means

(a) liability to pay fine imposed by a court or tribunal;

(b) liability to pay damages for negligence, nuisance or breach of a statutory, contractual or other legal obligation;

(c) liability to pay maintenance to any person under any law for the time being in force;

(d) liability in relation to a student loan; and

(e) any other debt as may be prescribed;

Debtors not Able to File Application Section 94 (4)

- If debtor is an undischarged bankrupt

- undergoing a fresh start process

- undergoing an insolvency resolution process

- undergoing a bankruptcy process

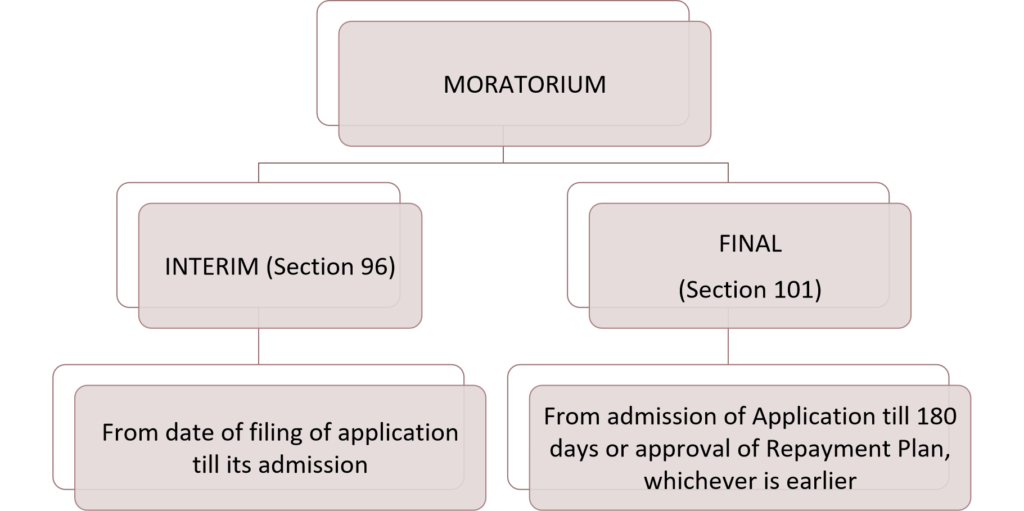

5. Moratorium

5.1 Interim Moratorium (Section 96)

During the interim-moratorium period –

- any pending legal action or proceeding in respect of any debt shall be deemed to have been stayed; and

- the creditors of the debtor shall not initiate any legal action or proceedings in respect of any debt.

5.2 Final Moratorium (Section 101)

During the moratorium period-

- any pending legal action or proceeding in respect of any debt shall be deemed to have been stayed;

- the creditors shall not initiate any legal action or legal proceedings in respect of any debt; and

- the debtor shall not transfer, alienate, encumber or dispose of any of the assets or his legal right or beneficial interest therein;

P. Mohanraj v. Shah Brothers Ispat (P.) Ltd. [2021] 125 taxmann.com 39/167 SCL 327 (SC)

Supreme Court held that the benefit of Section 14 shall apply to Corporate Debtor and not to the “natural persons”

In a way, no benefit to extend on directors/signatory

Vicarious liability

Strict Liability

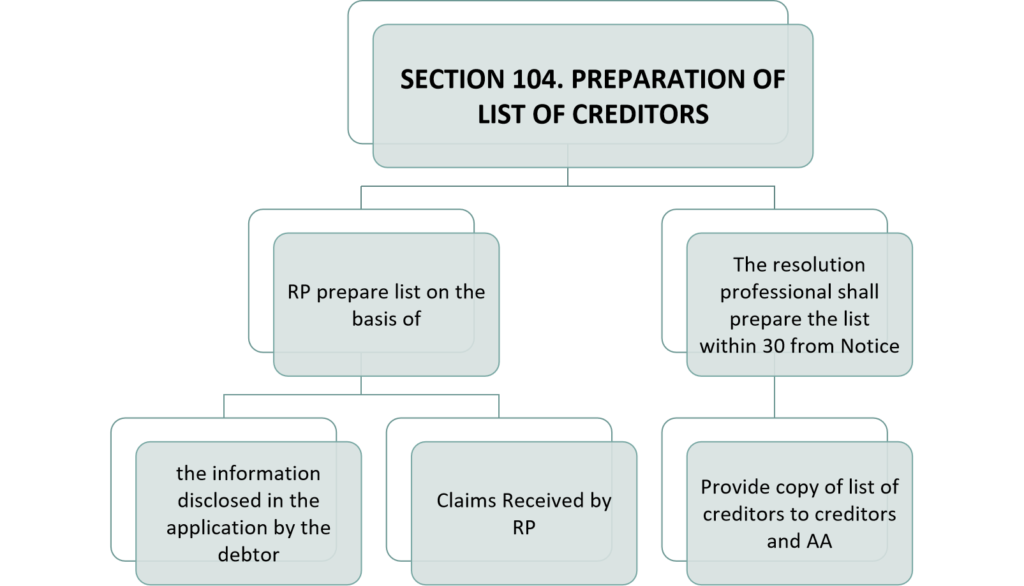

6. Section 104 – Preparation of List of Creditors

7. Repayment Plan (Section 105 And Reg. 17)

Section 105 (3)

(3) The repayment plan shall include the following, namely: –

(a) justification for preparation of such repayment plan and reasons on the basis of which the creditors may agree upon the plan;

(b) provision for payment of fee to the resolution professional;

(c) such other matters as may be specified.

Reg.17. Contents of repayment plan.

(1) The repayment plan shall provide the following –

(a) the term of the repayment plan and its implementation schedule, including the amounts to be repaid and dates of repayment to creditors;

(b) the source of funds that will be used to pay resolution process costs and that such payment shall be made in priority over any creditor;

(c) a minimum budget for the duration of the repayment plan, to cover the reasonable expenses of the guarantor and members of his immediate family to the extent they are dependent on him, provided that at least ten percent of the realisable income of the guarantor shall be utilised for repayment of debts;

(d) financing required for implementation of the repayment plan;

(e) if the guarantor has any business, the manner in which it is proposed to be conducted during the course of the repayment plan, and the role of the resolution professional;

(f) the manner in which funds held for the purposes of the repayment plan, invested or otherwise dealt with, pending repayment to creditors;

(g) the functions which are to be undertaken by the resolution professional, including supervision and implementation of the repayment plan;

(h) variation of onerous terms of a contract or transaction involving the guarantor;

(i) the details of excluded assets and excluded debts of the guarantor; and

(j) terms and conditions for the discharge of the guarantor.

(2) The repayment plan may provide for the following-

(a) transfer or sale of all or part of the assets of the guarantor along with the mode and manner of such sale;

(b) administration or disposal of any funds of the guarantor;

(c) satisfaction or modification of any security interest;

(d) reduction in the amount payable to creditors;

(e) curing or waiving of any breach of a debt due from the guarantor;

(f) modification in the terms of repayment of any debt due from the guarantor;

(g) part of the income of the guarantor to be used for the repayment of the debt, and the manner of calculating the income of the guarantor;

(h) the manner in which funds held for the purpose of repayment to creditors, and not so repaid at the end of the repayment plan, are to be dealt with; and

(i) such other matters as may be required by the creditors.

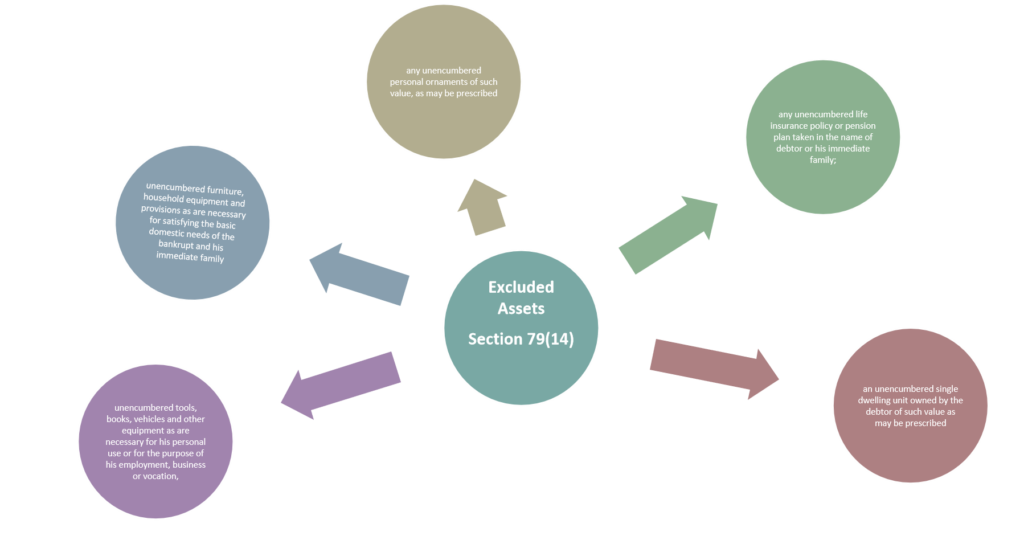

7.1 Excluded Assets – Section 79(14)

Unencumbered Single dwelling unit

10 lakhs – Rural

20 lakhs – Urban

7.2 Person prohibited to purchase assets (Reg. 18)

- the resolution professional or any partner or director of the insolvency professional entity of which the resolution professional is a partner or director

- any professional appointed by the resolution professional for the resolution process

- any creditor

- any company where the guarantor or a creditor is a promoter or director

- any associate of the guarantor, creditor or resolution professional

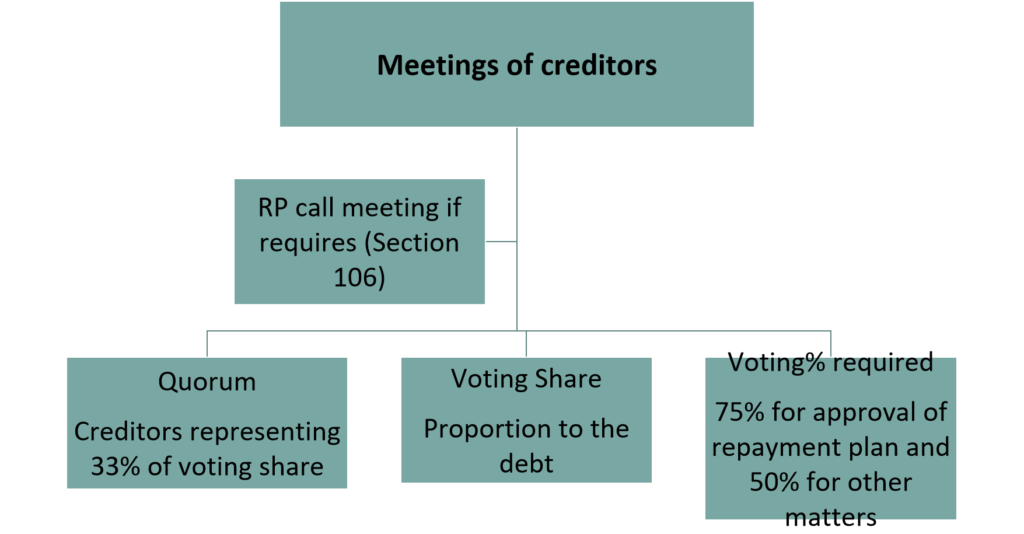

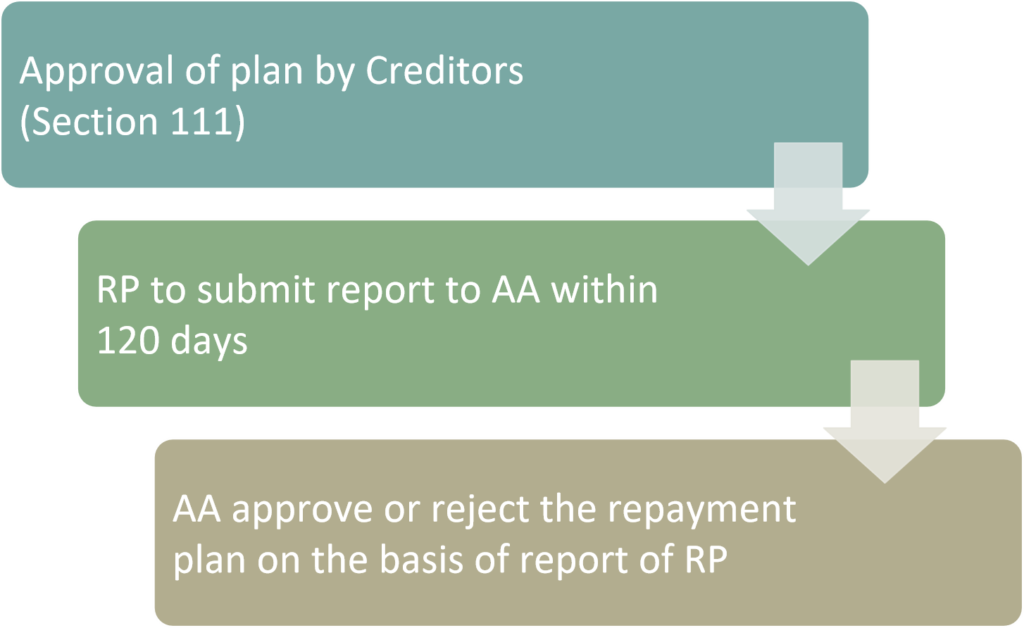

7.3 Report of RP on repayment plan (Section 106)

The report shall include that-

(a) the repayment plan is in compliance with the provisions of any law for the time being in force;

(b) the repayment plan has a reasonable prospect of being approved and implemented; and

(c) there is a necessity of summoning a meeting of the creditors, if required, to consider the repayment plan:

Provided that where the resolution professional recommends that a meeting of the creditors is NOT required to be summoned, reasons for the same shall be provided.

7.4 Report of meeting of creditors on repayment plan (Section 112)

The report under sub-section (1) shall contain –

(a) whether the repayment plan was approved or rejected and if approved, the list the modifications, if any;

(b) the resolutions which were proposed at the meeting and the decision on such resolutions;

(c) list of the creditors who were present or represented at the meeting, and the voting records of each creditor for all meetings of the creditors; and

(d) such other information as the resolution professional thinks appropriate to make known to the Adjudicating Authority.

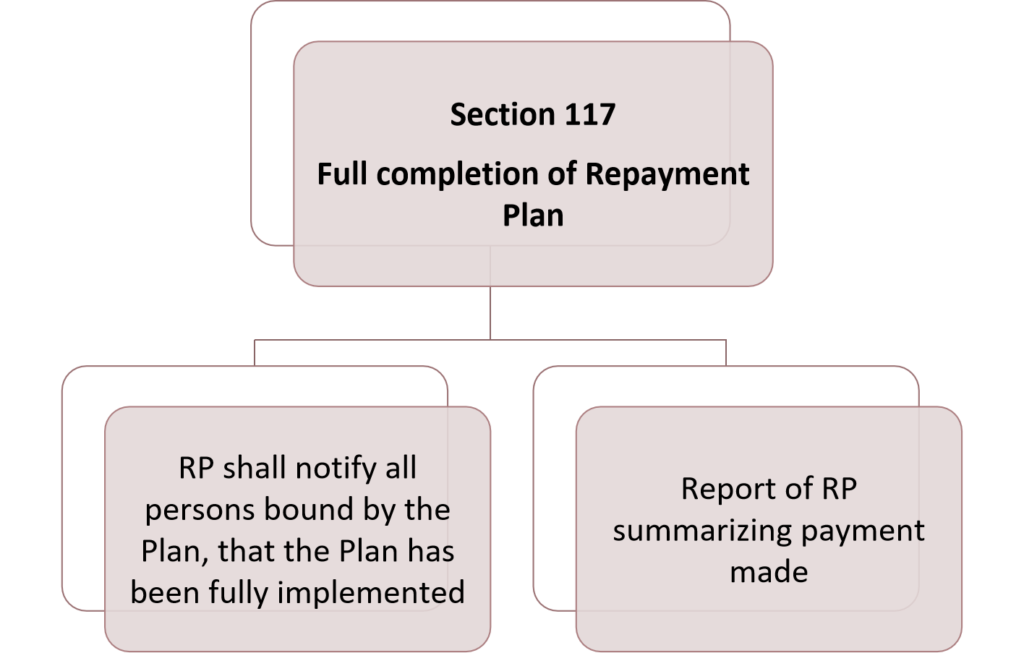

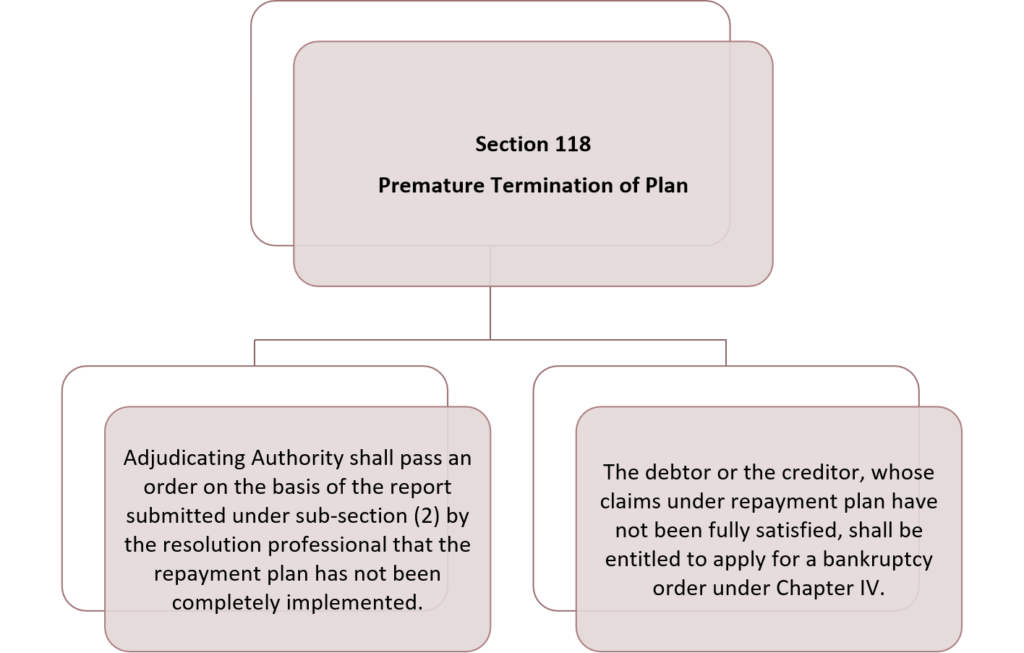

7.5 Discharge Order – (Section 119)

7.5 Discharge Order – (Section 119)

- On the basis of the repayment plan, the resolution professional shall apply to the Adjudicating Authority for a discharge order in relation to the debts mentioned in the repayment plan and the Adjudicating Authority may pass such discharge order.

- The repayment plan may provide for –

(a) early discharge; or

(b) discharge on complete implementation of the repayment plan

- The discharge order shall be forwarded to the Board, for the purpose of recording entries in the register referred to in section 196.

- The discharge order under sub-section (3) shall not discharge any other person from any liability in respect of his debt.

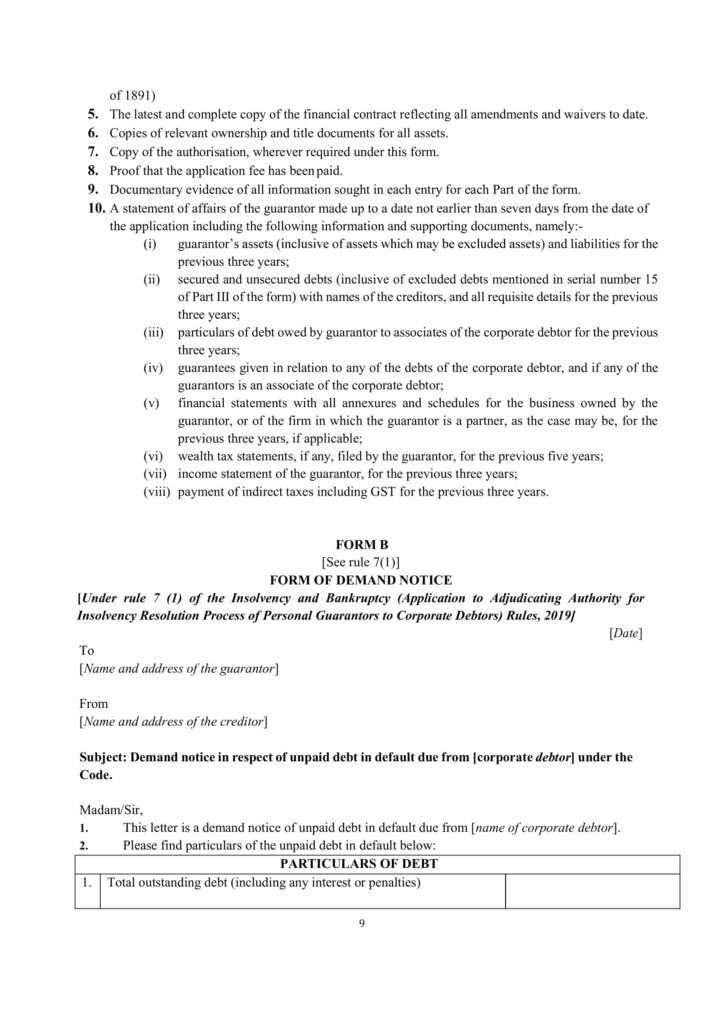

8. Insolvency of Personal Guarantor Rules

8.1 Who is Guarantor under Rules

As per Rule 3(e) of the rule “guarantor” means a debtor who is a personal guarantor to a corporate debtor and in respect of whom guarantee has been invoked by the creditor and remains unpaid in full or part;

Application to Adjudicating Authority under these rules can be filed By Two Persons;

- Application by Guarantors

- Application by Creditor

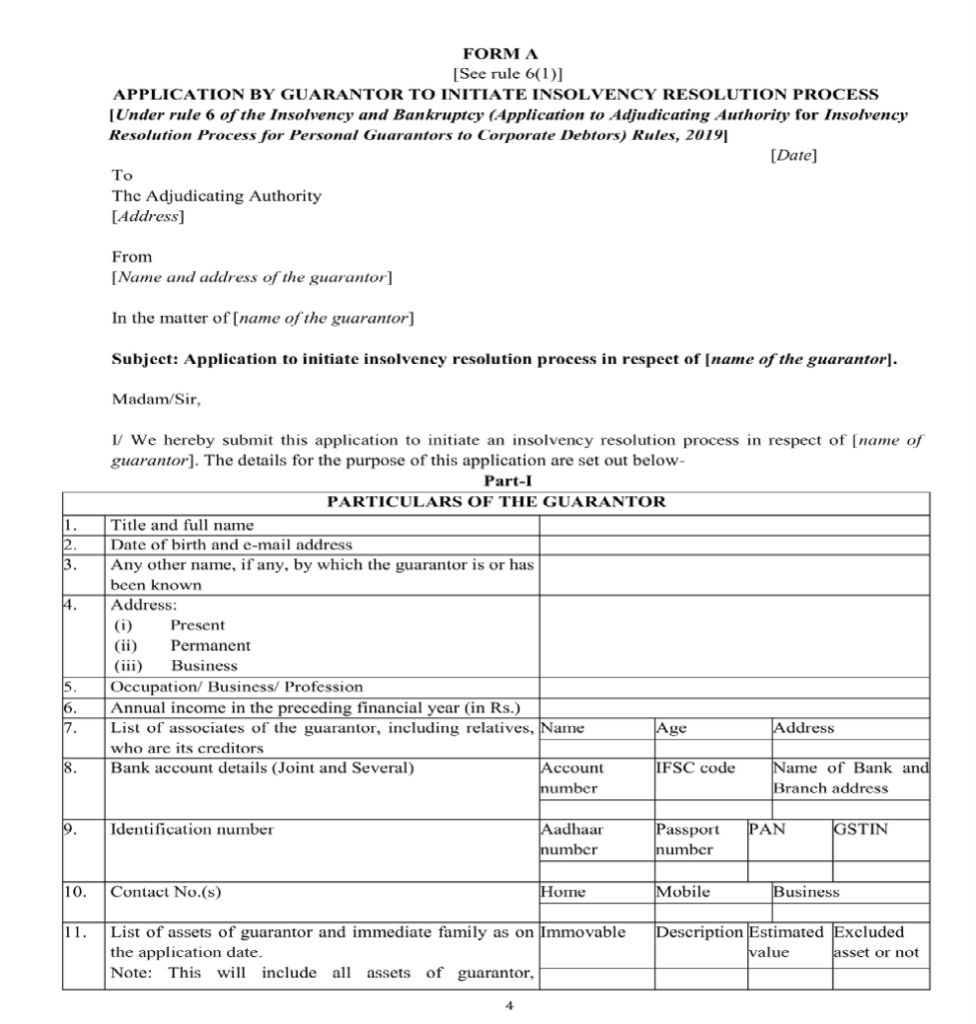

8.2 Application by Guarantor

- The Application can be filed under sec. 94(1)shall be submitted in Form A, along with an application fee of two thousand rupees.

- Copy of the application must be served to the application under sec. 94(1) shall be submitted in Form A, along with an application fee of two thousand rupees.

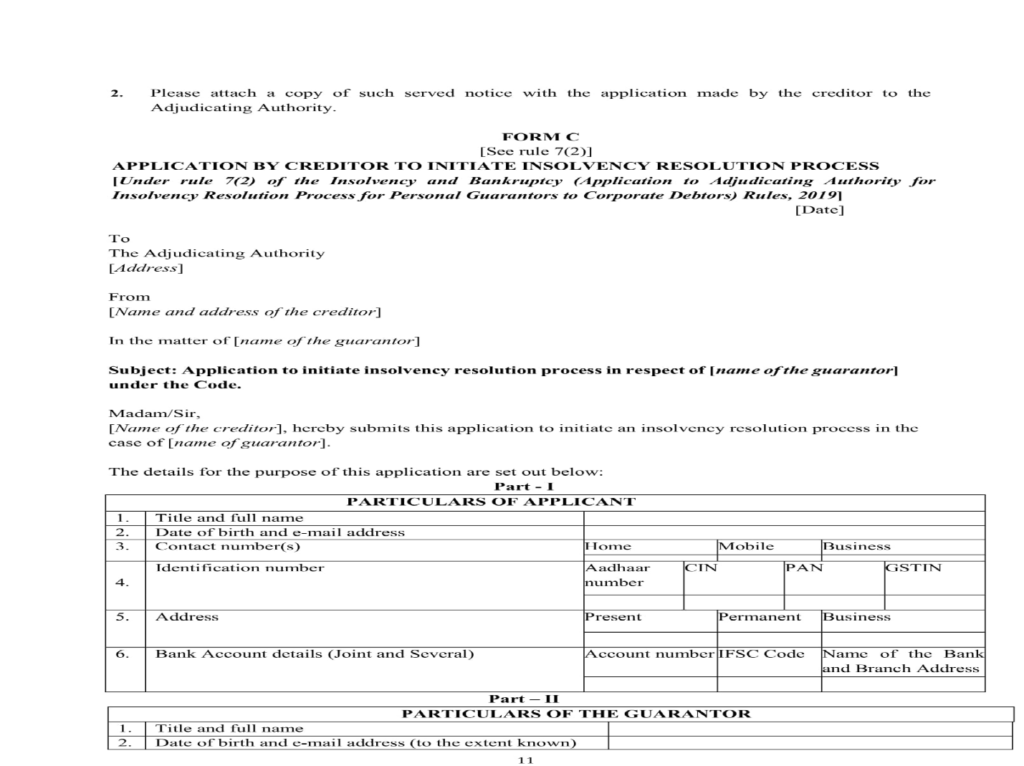

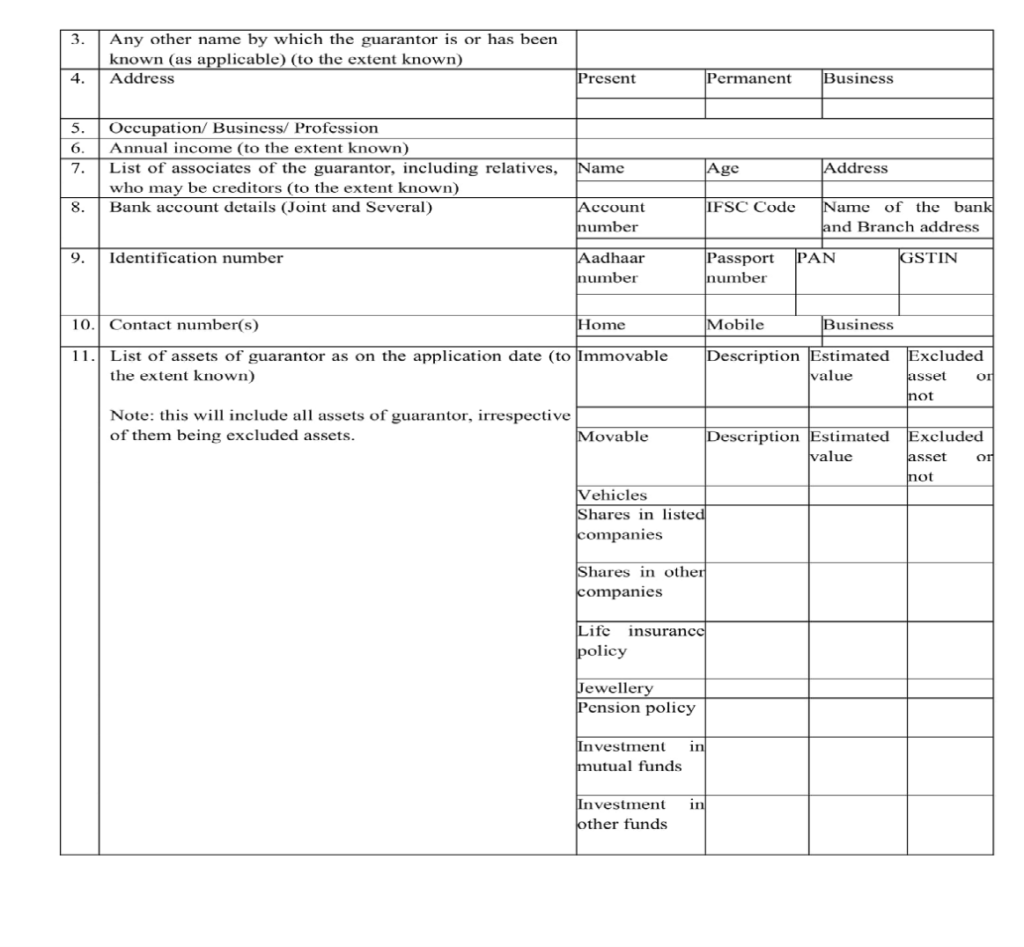

8.3 Application by Creditor

- The application under sub-section (1) of section 95 shall be submitted in Form C, along with a fee of two thousand rupees.

- A demand notice under clause (b) of sub-section (4) of section 95 shall be served on the guarantor demanding payment of the amount of default, in Form B.

- The copy of application must be served to the guarantor and the corporate debtor for whom the guarantor is a personal guarantor.

- In case of a joint application, the creditors may nominate one amongst themselves to act on behalf of all the creditors.

8.4 Confirmation or nomination of Insolvency Professional

- As per sec. 97(2) and 98(5) board may share the database of the insolvency professionals, including information about disciplinary proceedings against them, with the Adjudicating Authority from time to time.

- As per sec. 97(4) and 98 (3) the Board may share a panel of insolvency professionals, who may be appointed as resolution professionals, with the Adjudicating Authority.

8.5 Service of Petition to Resolution Professional

Applicant shall provide copy of application to the resolution professional if not provided earlier within three days of his appointment under sec. 97(5), and to the Board for its record.

8.6 Filing of Application and Documents

As there are no specific rules exist for Adjudicating Authority the applications under rules 6 and 7 shall be filed and dealt with by the Adjudicating Authority in accordance with:

- Rules 20, 21, 22, 23, 24 and 26 of Part III of the National Company Law Tribunal Rules, 2016 made under section 469 of the Companies Act, 2013 (18 of 2013); or

- Rule 3 of the Debt Recovery Tribunal (Procedure) Rules, 1993 made under section 36 of the Recovery of Debts and Bankruptcy Act, 1993 (51 of 1993) and regulations 3, 4, 5 and 11 of the Debt Recovery Tribunal Regulations, 2015 made under section 22 of the Recovery of Debts and Bankruptcy Act, 1993

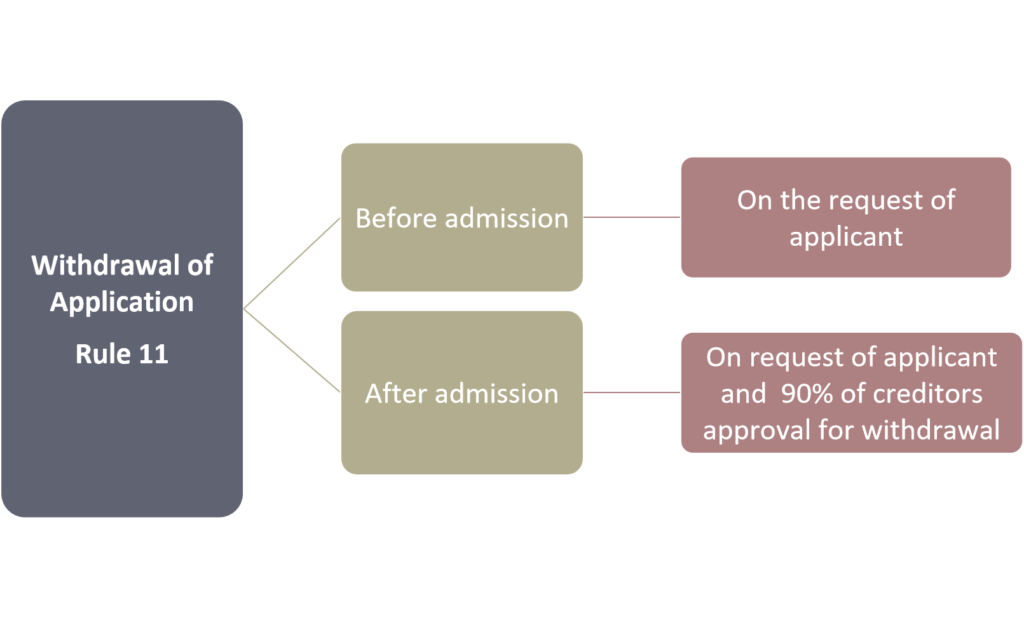

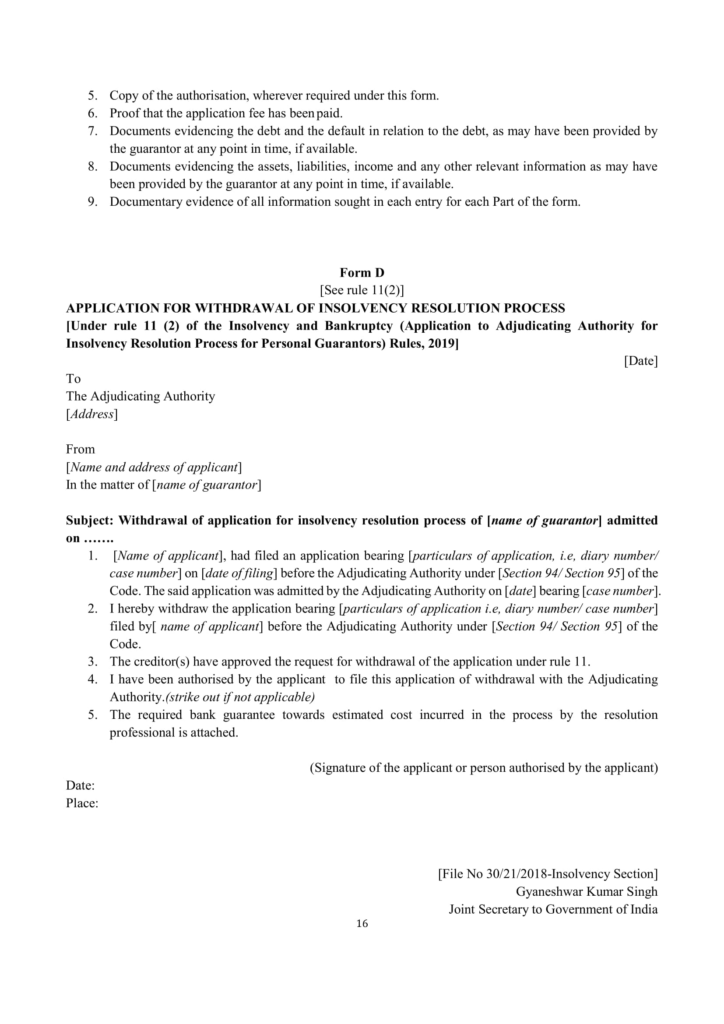

8.7 Withdrawal of Application

- The Adjudicating Authority may permit withdrawal of the application submitted under rule 6 or rule 7, as the case may be,-

(a) before its admission, on a request made by the applicant;

(b) after its admission, on the request made by the applicant, if ninety per cent of the creditors agree to such withdrawal.

- An application for withdrawal under clause (b) of sub-rule (1) shall be in Form D.

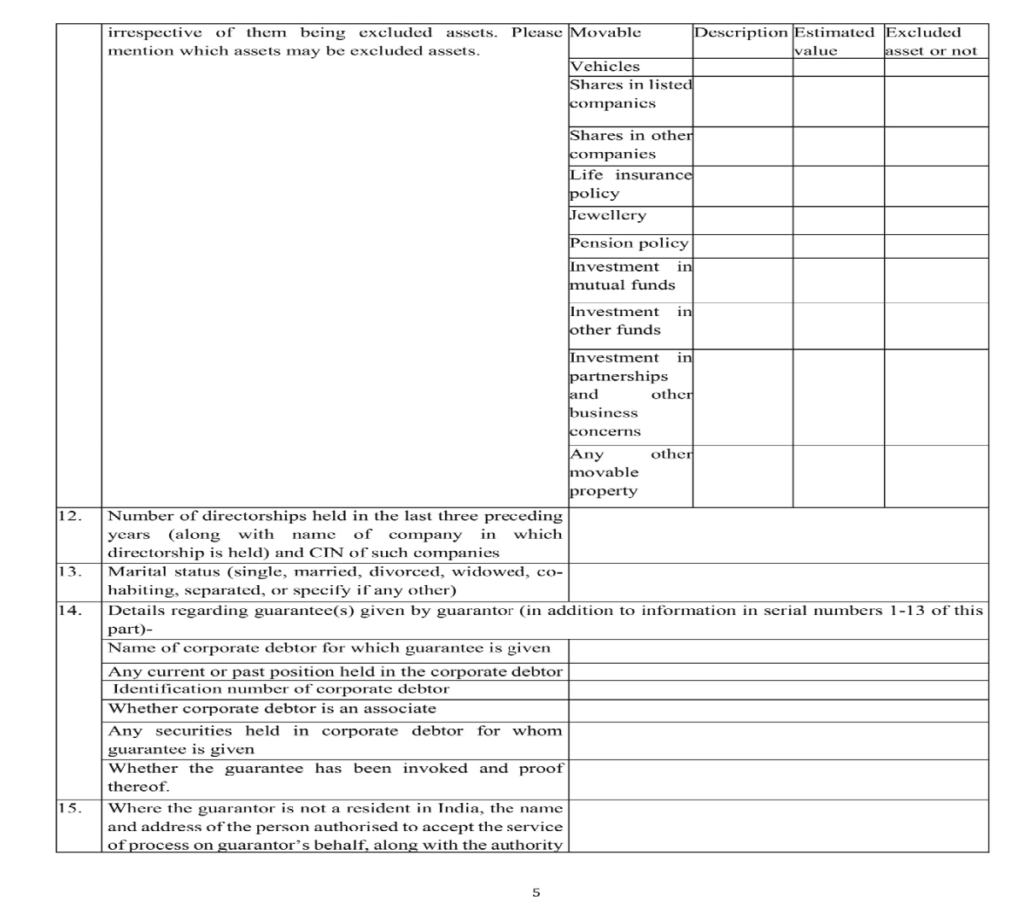

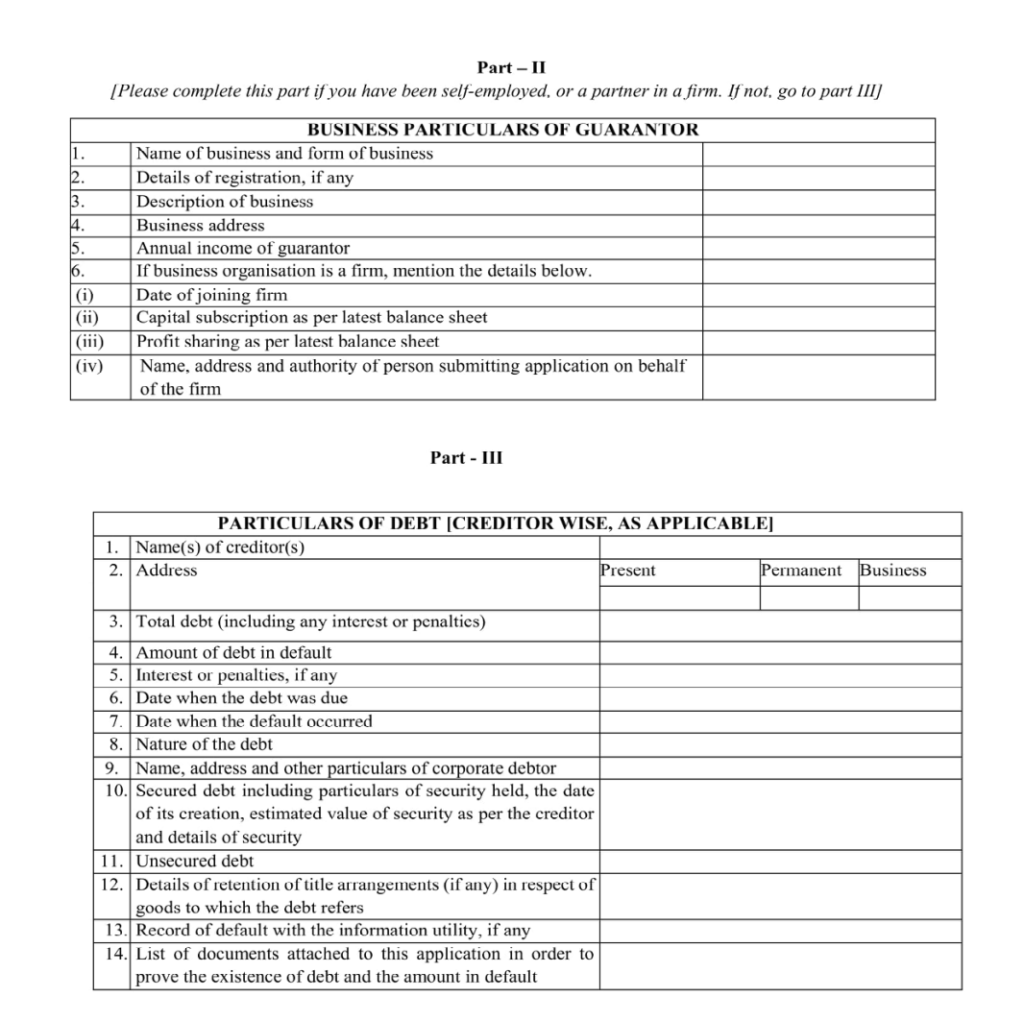

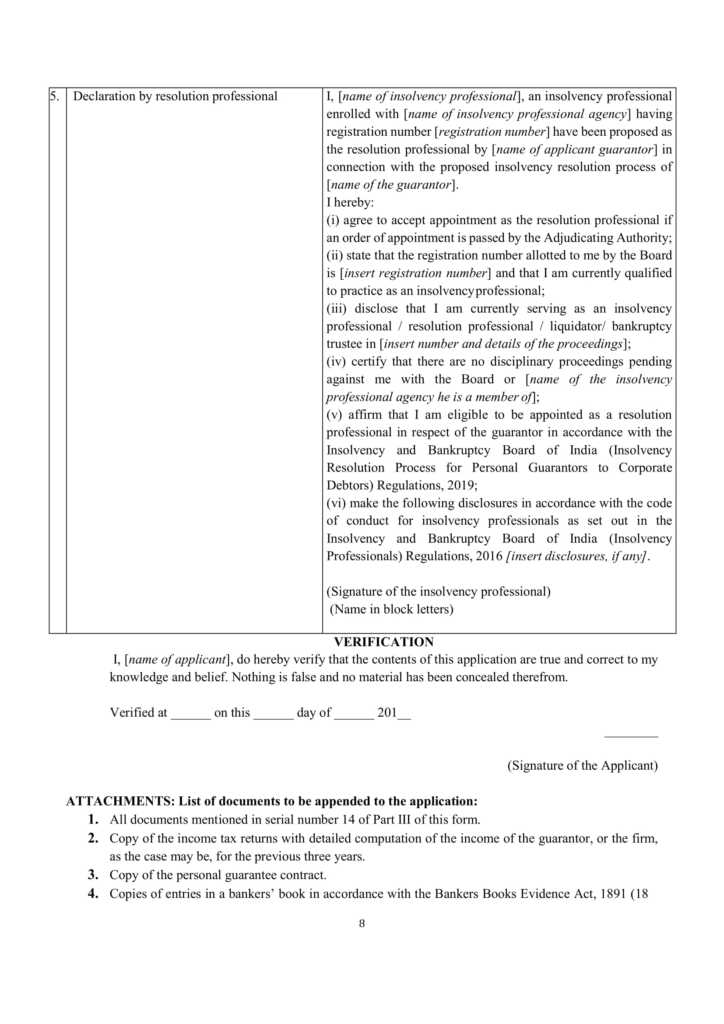

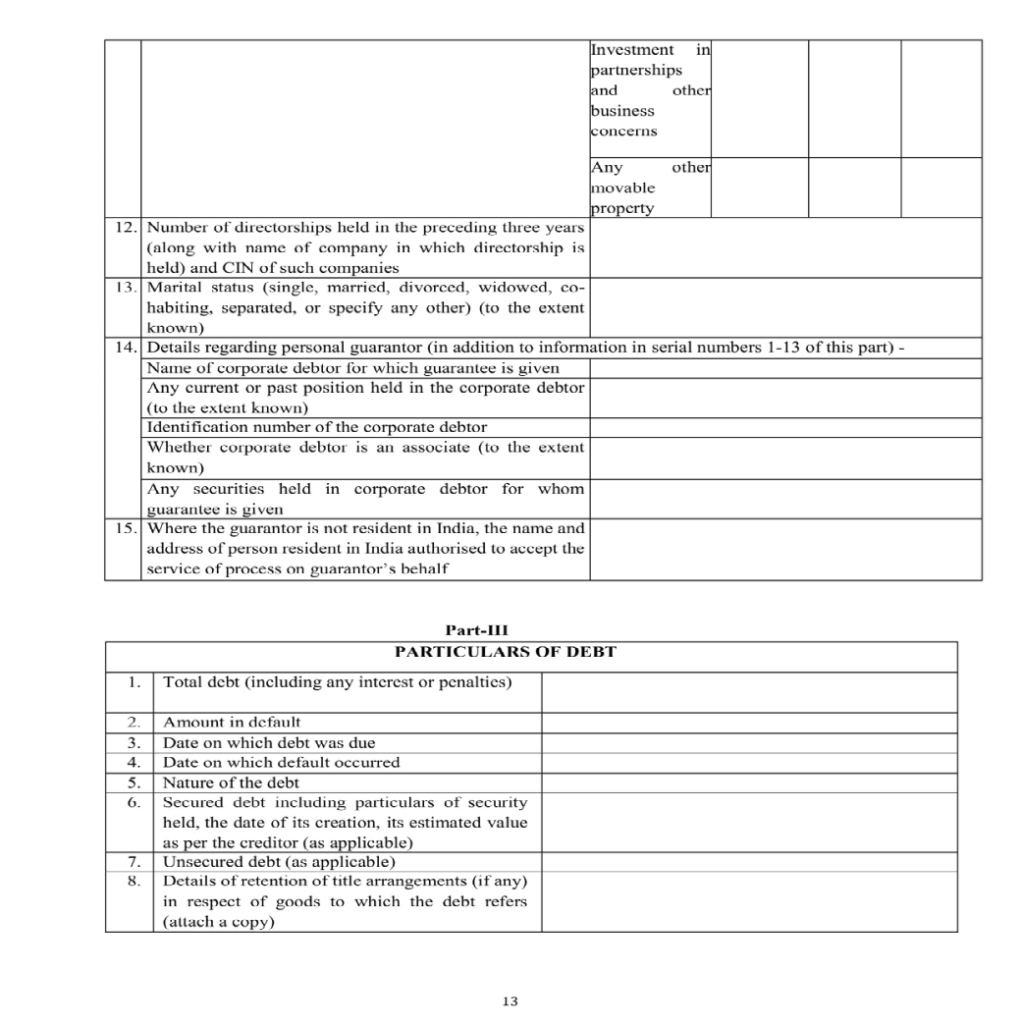

8.8 Various Forms Under Rules

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA