Maharashtra Stamp Duty Amnesty Scheme (Abhay Yojana) 2023-24 | FAQ-based Guide

- Other Laws|Blog|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 23 January, 2024

Table of Contents

- Executive Summary

- Government Initiative

- What is the Maharashtra Stamp Duty Amnesty Scheme 2023-24?

- How is the Scheme Being Implemented?

- What are the Penalties Levied on Insufficient Stamp Duty?

- What is the Waiver and Relief Granted Under the Scheme?

- How does the Amnesty Scheme Impact Stamp Duty in Maharashtra?

- What is Maharashtra’s 2023 Stamp Duty Abhay Yojana?

- What are the Benefits of the Stamp Duty ‘Abhay Yojana, 2023’?

- Who Announced the Stamp Duty ‘Abhay Yojana, 2023’?

- Which Instruments are Eligible for the Exemption on Stamp Duty Under the Maharashtra Amnesty Scheme?

- What is the Role of the Revenue Department in the ‘Stamp Duty Amnesty Scheme-2023’?

Check out Taxmann's Maharashtra Stamp Duty Amnesty Scheme 2023-24 | Law & Practice which presents an insightful and practical discussion of the 'Maharashtra Stamp Duty Amnesty Scheme 2023-24.' It offers clarity on stamp duty, registration, and related provisions, presented in a user-friendly format with flow charts, FAQs, examples, and QR codes spread across four parts. The book serves as an essential reference for both non-specialists and professionals.

1. Executive Summary

| Sr. No. | Particulars | In Brief/Reference |

| 1. | Government Initiative | Announcement of the Amnesty scheme by GR 7th December, 2023 |

| 2. | Stamp Duty Amnesty Scheme | To regularize insufficiently stamped documents with minimum penalty |

| 3. | Implementation of the scheme in 2 phases | 1st Phase: 1-12-2023 to 31-01-2024

2nd Phase 1-02-2024 to 31-03-2024 |

| 4. | Penalties levied on insufficient Stamp duty | Penalty of 2% per month or part upto 400% penalties are levied on stamp duty due |

| 5. | Waiver or the relief granted | Based on the date of application and the date of the agreement & Stamp duty due |

| 6. | Impact of Stamp duty Amnesty Scheme | Govt. will get revenue and citizen will save huge penalties |

| 7. | Maharashtra’s 2023 Stamp Duty Abhay Yojana | Scheme to provide exemption on stamp duty and penalties for a wide range of instruments in the state. |

| 8. | Benefits of Stamp duty of Abhay Yojana, 2023 | Waiver of Stamp duty and Penalties depending on the date of application and the date of execution of the instruments |

| 9. | Scheme was announced by whom? | The scheme was announced by the Revenue & Forest department of Maharashtra. |

| 10. | Instruments covered under the Scheme | All instruments related to transfer of immovable property under Maharashtra Stamp Act, 1958 whether registered or not. Whether residential, Non-Residential, Industrial, Agricultural, Non-Agriculture etc.

Schedule I: Instruments executed between 1st January, 1980 to 31st December, 2000. Schedule II: Instruments executed between 1st January, 2001 to 31st December, 2020 |

| 11. | Role of the revenue Department | Revenue Department through Inspector of General of Registration and Collector of Stamps (IGR) implements the scheme. To receive application online, verify, adjudicate, issue demand notice, collect the deficit amount and then certify the instruments as duly stamped under the scheme. |

2. Government Initiative

Welcome to Maharashtra’s 2023-24 Stamp Duty Abhay Yojana: Amnesty Scheme Details and Benefits:

The Maharashtra Stamp Duty Abhay Yojana or popularly known as Maharashtra Stamp Duty Amnesty Scheme 2023-24 is a government initiative aimed at providing relief to individuals and entities by granting waiver or pardon on stamp duty and penalties. The scheme is set to bring significant benefits to those seeking to regularize their property and other instruments or documents by paying pending stamp duty payments and penalties. Under the scheme, the insufficiently paid documents will be certified by the department as properly paid. For this, the beneficiaries need to apply under the scheme on online and offline basis. The department will collect the stamp duty as applicable on the date of execution of the documents by offering relief in the stamp duty amount as well as penalty depending on the period at which such documents were executed and the date on which the application has been filed by the beneficiary to avail the benefit of the scheme.

3. What is the Maharashtra Stamp Duty Amnesty Scheme 2023-24?

The Amnesty Scheme offers a comprehensive approach in resolving pending stamp duty-related issues by providing a waiver on penalties and allowing exemptions on deficit stamp duty to eligible applicants. It presents an opportunity for individuals and organizations to rectify their non-compliances and fulfil previous stamp duty obligations by certifying that proper stamp duty has been paid on such documents who avail the benefits of the scheme.

Through this program, individuals/companies/firms have the opportunity to receive waivers and exemptions for penalty payments and stamp duty, offering essential relief for those struggling with unpaid stamp duty obligations. Eligibility for the Amnesty Scheme encompasses various criteria, covering a wide range of instruments which are applicable to avail the benefits of the scheme.

4. How is the Scheme Being Implemented?

The implementation of the amnesty scheme is structured in two phases, with each phase having specific key dates and processes designed to facilitate the smooth execution of the program. The Maharashtra government has outlined a clear plan for the phased implementation of the scheme based on the date of applying to avail the benefit of the scheme to ensure maximum participation and compliance.

Phase-1: First phase shall be the date on which applications are made by the applicants from 1st December, 2023 till 31st January, 2024 to enable proper ground work for a successful launch is ensuring initial implementation of the scheme.

Phase-2: The Second phase shall be the date on which applications are made by the applicants from 1st February, 2024 till 31st March, 2024 with an intention to extend the opportunities for availing benefits, providing individuals with additional time and resources to take advantage of the program.

5. What are the Penalties Levied on Insufficient Stamp Duty?

Non-compliance with stamp duty regulations may result in penalties as per section 39 of the Maharashtra Stamp Act, 1958. Penalty of 2% per month or part of the month is charged on deficit amount of stamp duty from the time stamp duty amount is due till the time the deficit stamp duty amount is paid. Maximum penalty is up to 400% i.e. 4 times of the stamp duty amount.

Example: If Stamp duty amount to be paid in year 1998 was Rs. 5,00,000/- which was not paid, the penalty amount will be Rs. 20,00,000/- (2% per month up to 400%) in 2014 or thereafter.

Understanding the penalties associated with non-compliance is crucial for individuals and entities seeking to regularize their stamp duty obligations and benefit from the scheme’s provisions.

6. What is the Waiver and Relief Granted Under the Scheme?

Exemptions available under the Abhay Yojana are designed to provide relief to eligible applicants, allowing them to benefit from waivers and reduced stamp duty obligations. The documents applied under the scheme is divided into two schedules considering the date on which such instruments or the documents were executed.

Schedule 1: Documents executed between 1st January, 1980 to 31st December, 2000

Schedule 2: Documents executed between 1st January, 2001 to 31st December, 2020.

By understanding the exemptions, individuals can leverage the scheme’s offerings to rectify any outstanding stamp duty issues. Below is the exemption limit available to individuals availing benefit of the scheme based on the date of execution of the documents (Schedule 1 or 2) and based on the date of applying to avail the benefits of the scheme (Phase-1 or 2).

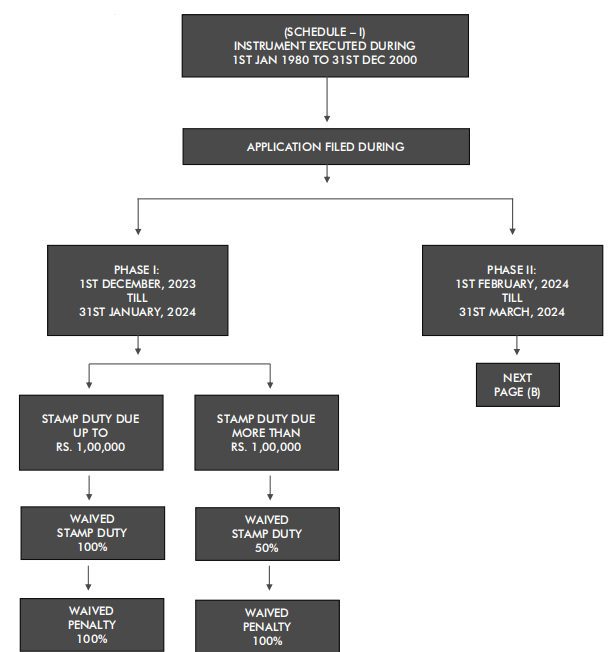

If Instrument is executed during 1st Jan. 1980 – 31st Dec. 2000 (Schedule – I)

(A) Application for Amnesty filed in Phase I: From 1st December 2023 to 31st January 2024

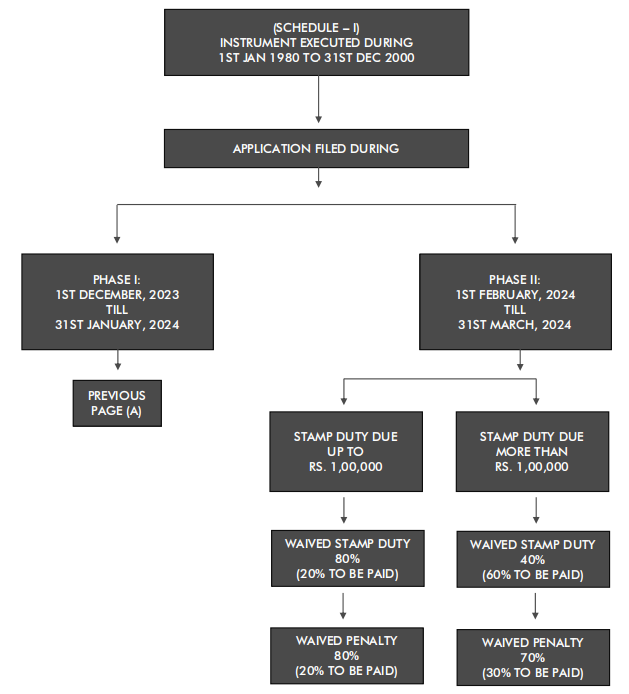

(B) Application for Amnesty filed in Phase II: From 28th February, 2023 to 31st March, 2024

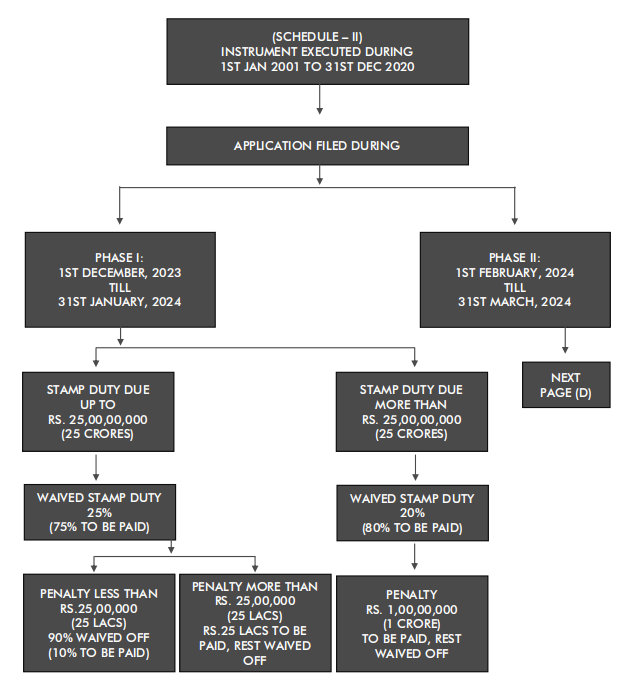

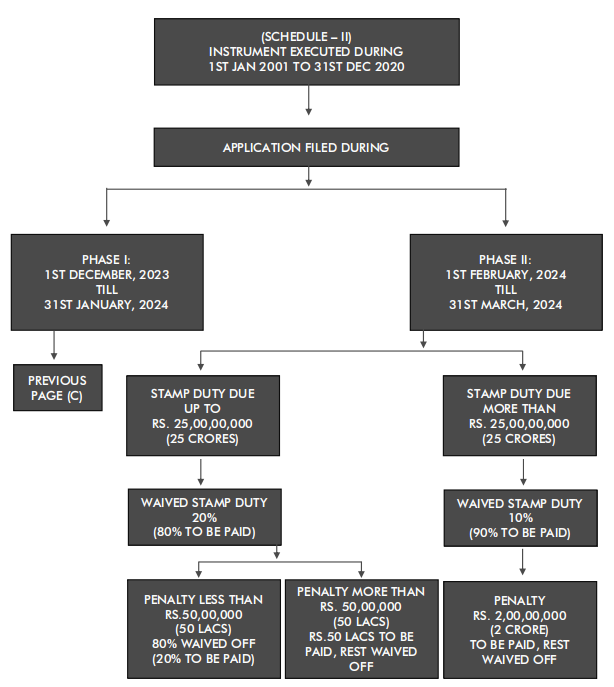

If Instrument is executed during 1st Jan. 2001 – 31st Dec. 2020 (Schedule – II)

(A) Application for Amnesty filed in Phase I: From 1st December 2023 to 31st January 2024

(B) Application for Amnesty filed in Phase II: From 1st February 2024 to 31st March 2024

7. How does the Amnesty Scheme Impact Stamp Duty in Maharashtra?

Maharashtra Government’s second highest revenue source is Stamp duty collection after Goods and Services tax. The introduction of the Stamp Duty Amnesty Scheme in Maharashtra brings significant changes to stamp duty payments and obligations during the scheme period. Understanding the impact of the scheme on stamp duty is essential for individuals and organizations operating within the state, as it directly influences their financial obligations and compliance with stamp duty provisions. With the implementation of the Amnesty Scheme, individuals and entities gain insights into the changes in stamp duty payments, penalties, and exemptions, thereby enabling them to make informed decisions and take necessary actions to benefit from the relief provided by the scheme. The insufficient Stamped instruments may be regularized by paying concessional stamp duty as applicable on the date of execution of the instruments and also maximum relief in the penalties. Thus make the instruments legally valid and which will be considered as evidence in the court of law in future, if required.

8. What is Maharashtra’s 2023 Stamp Duty Abhay Yojana?

Maharashtra’s 2023 Stamp Duty Abhay Yojana is an amnesty scheme or stamp duty waiver scheme announced by the Maharashtra Government on 29th November, 2023 after a Cabinet decision and by issuing the Government Resolution on 7th December, 2023 to provide exemption on stamp duty and penalties for a wide range of instruments in the state.

9. What are the Benefits of the Stamp Duty ‘Abhay Yojana, 2023’?

The scheme offers exemption on entire stamp duty and penalties for instruments executed during January 1, 1980 to December 31, 2000. Additionally, it provides a waiver on stamp duty up to 25% on stamp duty payable and up to 90% waiver in penalty (Maximum payable being Rs. 25 Lakhs) amount for instruments executed during between January 1, 2001 to December 31, 2020. The details are provided in the GR dated 7th December, 2023 in the appendix -1 in this book.

10. Who Announced the Stamp Duty ‘Abhay Yojana, 2023’?

The scheme was announced by the Government of Maharashtra headed by Hon’ble Chief Minister Eknath Shinde Deputy Chief Minister Devendra Fadnavis and Deputy Chief Minister Ajit Pawar after the cabinet decision in Mumbai on 29th November, 2023 notified in Government Gazette by a Government Order dated 7th December, 2023.

11. Which Instruments are Eligible for the Exemption on Stamp Duty Under the Maharashtra Amnesty Scheme?

The Scheme is applicable to the following instruments executed during 1st Jan. 1980 – 31st Dec. 2000 (as stated in Schedule – I of the Scheme) and the instruments executed during 1st Jan 2001 – 31st Dec 2020 (as stated in Schedule – II of the Scheme) which is part of Annexure to the Government order dated 7th December, 2023:

(a) Any type of Instrument related to the Conveyance or Agreement to sale or Lease or Sale Certificate or Gift or Agreement relating to deposit of title deeds, pawn, pledge or hypothecation of immovable property for the purpose of residential or non-residential or industrial use;

(b) Agreement or its records or Memorandum of agreement if relating to transfer of tenancy of immovable property for the purpose of residential use, Conveyance of allotment of residential or non-residential units or houses from the Maharashtra Housing and Area Development Authority (MHADA) and its Divisional Boards, the City and Industrial Development Corporation of Maharashtra Limited (CIDCO) and the Slum Rehabilitation Authority (SRA) to a slum dweller for the purposes of rehabilitation under approved Slum Rehabilitation Scheme and also Conveyance of allotment of residential or non-residential units or houses in registered Co-operative Housing Societies or any apartments whose deemed conveyance is pending;

(c) Any type of Development Agreement or Conveyance or Agreement to Sale or Instrument of transaction of Assignment of the rights to the developer regarding the redevelopment of any dilapidated old buildings or any building or immovable property whose redevelopment is necessary;

(d) Any type of Instrument in respect of the amalgamation, merger, demerger, arrangement or reconstruction of companies;

(e) Any type of Instrument executed by the Maharashtra Housing and Area Development Authority (MHADA) and its Divisional boards, the City and Industrial Development Corporation of Maharashtra Limited (CIDCO) and the Municipal Corporation, Municipal Council, Nagar Panchayat, by the various Development or Planning Authorities approved or constituted by the Government under the prescribed Regulations, the Maharashtra Industrial Development Corporation (MIDC), the Slum Rehabilitation Authority (SRA) etc. authorities;

(f) The First allotment letter or Share Certificate issued or executed regarding residential or non-residential units by the registered Co-operative Housing Society on the Government land or by the Maharashtra Housing and Area Development Authority (MHADA) and its Divisional boards or by the City and Industrial Development Corporation of Maharashtra Limited (CIDCO) or by the Municipal Corporation, Municipal Council, Nagar Panchayat or by the Development or Planning Authorities approved or constituted by the Government under the prescribed Regulations.

12. What is the Role of the Revenue Department in the ‘Stamp Duty Amnesty Scheme-2023’?

The Revenue Department of the Government of Maharashtra implements the ‘Stamp Duty Amnesty Scheme-2023’ through the administrative machinery of Inspector General of Registration & Controller of Stamps including Joint District Registrar & Collector of Stamps. Collector of Stamps is assigned the role of Adjudication of Stamp Duty and plays vital role in the Amnesty Scheme. The applications under ‘Stamp Duty Amnesty Scheme-2023’ are to be submitted in the office of Collector of Stamps who is also responsible for recovery of deficit stamp duty and penalty. The details are available on www.igrmaharashtra.gov.in website.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

It is most beneficial to the public and the individual can avail this great opportunity.

STEMP DUTY EMINITES SCHEME 2023-24 REQUIRED A SOFT COPY OF APPLICATION FORM