Overview of GST Appellate Tribunal

- Blog|GST & Customs|

- 4 Min Read

- By Taxmann

- |

- Last Updated on 3 May, 2024

Table of Contents

- GST – Journey so far

- Appellate Structure

- Goods and Service Tax Appellate Tribunal (GSTAT)

- Issues Faced in the Constitution of GSTAT

- Initiatives Taken by the Government to set up GSTAT

- Key Amendments Proposed by GoM

- Constitution of Benches Pre and Post Finance Act 2023

- Forthcoming Challenges

1. GST – Journey so far

- Introduced in July 2017, replacing a set of Central and State taxes such as Central excise, State value added tax (VAT), Service tax etc.

- Destination-based consumption tax wherein Centre and State simultaneously levy tax on a common base

- Significant increase in number of compliant GST payers with average monthly GST collection of INR 1.5 lakh crore in FY 2022-23

- Sharpened checks and balances by tax authorities, with significant reduction of manual intervention

- Integrated technology and introduced e-invoicing, e-filing of refunds, online appeals and auto approved letter of undertaking (LUT) etc.

- GST Appellate Tribunal (GSTAT) to be set-up for smooth functionating of GST

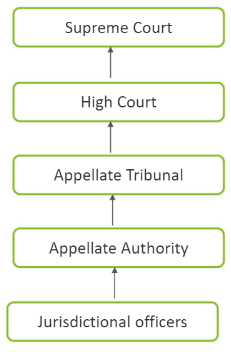

2. Appellate Structure

Supreme Court

- Cases decided by principal bench of appellate tribunal

- HighCourt

High Court

- Appeal against the order passed by state appellate tribunal

- Appeal for cases involving question of law

Appellate Tribunal

- Appeal against order passed by appellate authority and revisional authority

- Consisting of State benches and Principal bench

Appellate Authority

- Consist of Commissioner (Appeals) or Joint Commissioner (Appeals)

- Appeal against order passed by adjudicating authorities

Jurisdictional Officers

- Order to be passed within 3 years (5 years in case of fraud) from the due date of annual return

3. Goods and Service Tax Appellate Tribunal (GSTAT)

Significance of GSTAT

- First common forum for resolving disputes from State & Centre perspective

Increasing Trend in GST disputes

- Disputes regarding levy, valuation, classification, eligibility of credit (including transitional credits) and refunds are increasing

- Departmental audit, investigation, enquiry and scrutiny leading to increased disputes

Hardships Faced by Taxpayers

- Aggrieved taxpayer has to approach High Court through writ, post receipt of an order from an Appellate Authority

- Due to pending backlog, High Courts are unable to dispose off the matters expeditiously

GSTAT – Pressing Priority

- Almost 6 years of implementation of GST, discussions around setting up GSTAT are still in progress

- Expected to see increase in number of litigations in near future as the limitation period of three years from the due date of the annual return for FY 17-18 and FY 18-19 is fast approaching

4. Issues Faced in the Constitution of GSTAT

- Parity of share of members between State and Center

- Qualification and experience criteria of technical members

- Number and constitution of benches

- Constitution of a search cum selection committee

- Ratio of judicial and technical members

- Eligibility of lawyers to be appointed as judicial members

In the absence of GST Tribunal, taxpayers are compelled to evaluate the appropriateness of approaching High Court based on the merits, monetary impact and potential exposure.

5. Initiatives Taken by the Government to set up GSTAT

- Constitution of Group of Ministers (GoM) to recommend necessary amendments

- Amendments proposed in Finance Bill 2023 presented before Lok Sabha

- Extension of timeline to file appeal, based upon setting up of GST appellate tribunal

- Resolved issue relating to the ratio between judicial and technical members and parity of share of members between state and center

6. Key Amendments Proposed by GoM

- Principal bench of tribunal with state level benches across the country

- Each bench consist of judicial and technical member in equal proportion

- States with less than 5 crore population should have maximum 2 benches and no State to have more than 5 benches

- Qualification of members and terms of appointment and re-appointment

7. Constitution of Benches Pre and Post Finance Act 2023

| Before the proposed amendment in Finance Act, 2023 | After the proposed amendment in Finance Act, 2023 | ||

| Bench | Constitution | Bench | Constitution |

| National bench (In New Delhi) | A president and one technical member each from State and Centre | Principal bench A president, a judicial (In New Delhi) | A president, a judicial member and one technical member each from State and Centre

Place of supply cases to be heard by this bench only |

| Regional bench (based on notification issued by Government)

State bench Area bench |

A judicial member and one technical member each from State and Centre | State bench (based on the request of States and two technical members recommendations of Council) | Two judicial members and two technical members representing the State and Centre |

8. Forthcoming Challenges

Eligibility of lawyers for selection of judicial member

- Advocates having more than ten years of experience are being considered for selection as judicial members in Income TaxAppellate Tribunal, CESTAT, the Sales Tax/VAT Tribunals

- Proposed amendment can be challenged by lawyers

Amendments to be notified

- Proposed amendments are yet to be notified

- Another 10 months will be required for GSTAT to be fully functional

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA