Overview of Financial Management – Strategies, Objectives, and Decisions

- Other Laws|Blog|

- 21 Min Read

- By Taxmann

- |

- Last Updated on 16 December, 2023

Table of Contents

- Essentials of Financial Management

- Approaches to Financial Management

- Objectives of Financial Management

- Financial Decisions

- Finance Function

Check out Taxmann's Financial Management | Theory | Problems | Cases which adopts a business-oriented approach to teaching financial management, combining the theory with practical applications and enabling readers to analyze company reports effectively. Tailored primarily for postgraduate business students but also beneficial for certain undergraduates, it features detailed explanations, case studies, practice questions, and MCQs, aligning learning with industry trends.

1. Essentials of Financial Management

Finance underpins every transaction in a business organisation. It is the life blood of a business firm. A firm may be a company, a partnership, a sole proprietorship or any other form of organization; it may be a large firm or a small firm; or it may be dealing in tangible goods or intangible services. The goal of every firm is to maximize present wealth of the owners. In case of company form of ownership, equity shareholders are the owners. No matter what the nature of business, every company has to make important financial decisions regarding

(a) how to raise money;

(b) what equity-debt ratio to be kept;

(c) what capital investments to make how much to invest in land, buildings, plant and machinery, IT, R&D, etc.;

(d) whether to and how much dividend should be returned back to its owners and how much should be retained by the company; and

(e) how to finance the day-to-day operations of the company.

The first four decisions pertain to long-term financing decisions and are called financing, investment and dividend decisions while the fifth decision is short term decision called working capital decisions. Corporate finance refers to the study of these decisions.

Milton Miller, known as the father of modern finance, identifies two approaches of finance:

(i) micro normative approach or the business school approach. According to this approach, ‘A decision maker, whether an individual investor or a corporate manager, is seen as maximizing some objective function, be it utility, expected return, or shareholder value, taking the prices of securities in the market as given’.

(ii) macro normative approach or economist approach. This approach assumes a world of micro optimizers and deduces how market prices actually evolve.

There are two approaches to financial management:

(a) traditional approach; and

(b) modern approach.

The traditional approach to financial management is primarily concerned with the process of procuring of financial resources to maximize the wealth of equity shareholders. But the modern approach to financial management has expanded its scope and involves the process of procuring funds and efficient and wise allocation of funds to various uses. The modern approach also takes into account new opportunities and challenges in the global economic environment.

Financial Management is concerned with efficient use of an important economic resource namely: capital funds. It is the study of the problems in the use of use and acquisition of funds.

Ezra Solomon (1978)

Tata Steel’s Takeover of Corus

Tata Steel Profile Tata steel is Asia’s first steel company founded by Jamsetji Nusserwanji Tata in 1907 at Jamshedpur, India. Tata steel is part of the Tata Group. India’s most respected business group and one of the largest business conglomerates. Tata Steel is currently India’s largest private steel company with a production of 8.5 million tons in the financial year 2005-06. It is also one of the world’s low-cost producers of steel. It has integrated operations across the value chain with self-sufficiency in raw materials like iron ore and coal. As part of its growth plan, it acquired the steel business of Nat Steel, a Singapore company, for US$ 486.4 mn. in August 2004. Through this acquisition it entered the markets of Australia, China, Malaysia, the Philippines, Singapore, Thailand and Vietnam. It also acquired Millennium Steel of Thailand for US$ 404 mn. Millennium Steel is the largest steel company in Thailand with a capacity of 1.9 million tons per annum (mtpa). Through this acquisition Tata Steel annexed the three manufacturing facilities of Millennium Steel in Saraburi, Rayong and Chon- buri provinces. These two acquisitions improved its presence in Southeast Asia. As part of its Greenfield Investment Plan, Tata Steel has proposed to setup facilities in Chhattisgarh, Jharkhand and Orissa with a total capacity of 23 mtpa. Tata Steel manufactures products like bearings, construction rebars, galvanized sheets, hot and cold-rolled coils and sheets, rings, tubes and wire rods. It owns brands like Tata Agrico, Tata Bearings, Tata Pipes, Tata Shaktee, Tata Steelium (the world’s first branded cold steel) and Wiron.

Corus Profile Corus was formed in 1999, when British Steel and Koninklijke Hoogovens of the Netherlands joined hands. It has plants in Britain, Netherlands, Germany, France, Norway and Belgium. It sells aluminium products worldwide and employs 47,300 people. It was Europe’s second largest Steel manufacturer with revenues in 2005, an outing to GBP 9.2 billion, and crude steel production of 18.2 million tons primarily in the UK and Netherlands, Corus is primarily involved in the semi-finished and finished Carbon Steel products. Its activities divided into three main departments, namely Strip products (including coated and uncoated strip and welded tubes, sold both as coil and sheet) long products (including sections, plates, wire rods, narrow strip and engineering steels) and the distribution and building systems division, which operates as a link between Corus, manufacturing operations and its customers.

On 17th October, 2006 Tata Steel made an announcement for an all cash bid of 455 pence a share for 100% of Anglo-Dutch Steel maker Corus Group. Tata’s bid came as a major surprise to the Steel industry, which was yet to digest the news and effect of Mittal Steel – Arcelor deal in June 2006. In November, 2006 Brazilian Steel maker CSN Ltd. had made a bid of 475 pence a share. CSN is Brazil’s 2nd largest Steel maker. It was founded as a State-owned enterprise in 1941 and was privatized in 1993. The CSN bid was postponed till the conduct of its extraordinary general meeting on December 20, 2006.

On December 10, 2006, Tata raised its bid to 500 pence per share amounting to US $9.2 billion. The very next day, CSN also raised its bid to 515 pence per share amounting to US $9.6 billion. To put an end for intense competition, US takeover panel watchdog entered into and conducted an auction on January 31, 2007, the takeover panel declared that Tata Steel has bagged Corus with 608 pence per share against CSN’s 603 pence per share. The value of Corus, at 608 pence per share, was at $13.5 billion. Tata Steel pays 7 times earnings before interest, taxes, depreciation and amortization (EBITDA) of Corus for 2005 and a higher EBITDA for 12 months ended 30th September, 2006. Financials: Before (B) and After (A) Merger (US $ mn.)

Particulars

Tata Steel Corus Combined Current market capitalization 6,510 8,227(B) 14,737(A)

Sales 5,007 19,367(B) 24,374(A)

EBITA 1,480 1,962(B) 3,442(A)

Net income 840 861(B) 1,701(A)

Crude steel production (million tons) 5.3 18.2(B) 23.5(A)

Note: Used financial year 2006 March year-end figures.

Global Big Merger and Takeover Deals in Steel Industry Target Buyer Value ($ bn.), Year

Arcelor Mittal Steel 32.2, 2006

NKK Corp Kawasaki Steel 14.1, 2001

LNM Holdings Ispat Intl. 13.3, 2004

Krupp AG Thyssen 8.3, 1997

Corus Tata Steel 8.0, 2006

Dofasco Arcelor 5.2, 2005

Intl. Steel Mittal Steel 4.8, 2005

Top Five Global Steel Ranking Company Capacity (million tons)

Arcelor – Mittal 110.0 Nippon Steel 32.0

Posco 30.5

JEF Steel 30.0

Tata Steel – Corus 27.7

Industry’s Response

The Tata Steel’s successful bid for Corus is a statement that Indian industry is coming of age and takes out merger and acquisition level to a different paradigm. This is a testimony of confidence and competence of Indian industry. The deal was welcomed by the Indian industry and the response from the industry leaders was overwhelming. It has boosted the confidence of Indian industry and described as a moment of fulfilment for India.

Shareholder’s Response

The shareholders of Tata Steel felt that the company has paid too much for Corus and the acquisition announcement has brought down the Tata Steel’s share price by about 8.1%. Credit rating agencies have downgraded the Tata Steel shares. Some analysts have felt that Tata Steel has overpaid for the deal. The trading volume was brisk on both NSE and BSE. In the derivatives segment, Tata Steel melted on the selling pressure.

Strategic Reasons

The strategic objective behind the acquisition deal of Corus are as follows:

(a) The significant increase in World Steel production accompanied by Strong demand and shift in growth from developed economies to emerging economies, has necessitated steel firms from developed markets to expand beyond their domestic horizons.

(b) Tata Steel now rates away the top low-cost manufacturers in the world. This means that there are lots of cost saving opportunities for Corus, a Past-acquisition by Tata Steel.

(c) For Tata’s, the acquisition would act as a gateway to Europe as well as a platform to launch itself as a global player. One of the major drivers of going international is to reduce our vulnerability to a single market.

(d) The Corus’s acquisition will fulfil Tata Steel’s prime objective of growth and globalization.

(e) The acquisition would bring it closer to markets for high and steel and also providing it with state-of the-art production and R&D facilities along with the most sophisticated customer base.

(f) There will be synergies in the form of cost benefits as a result of access to cheap raw materials such as iron ore and steel slabs.

(g) After takeover, the combined entity will position as the fifth largest steel company in the world by giving an opportunity to expand its market Horizon to Europe. The bigger and combined management team can organize production by producing slabs or primary steel in low cost facilities and manufacture high-end products in proximity to the client base both in Europe and India.

(h) The combined organization will have production capacity of 23.5 million tons of production capacity and will generate revenue of $24.4 billion with two-third of revenue contribution coming from Europe.

(i) The Corus immediately brings 19 million tons p.a. of Steel, whereas if Tata Steel wants to grow organically it may take more than a decade and it will cost more than what Tata has paid for Corus.

(j) Being a big player in Steel industry would help Tata Steel in processing raw materials with greater bargaining power.

(k) Through this acquisition, the production costs of Corus can be brought down to a significant level.

(l) Corus manufacturing facilities are more cost efficient than those of Tata Steel. Steel production per employee for Corus is about 402 tons per annum but it is just 120 tons for Tata Steel.

(m) One of the main attraction is that India is the fifth largest deposit of iron- ore; the main steel making ingredient.

(n) Tata Steel being the low cost steel produced in the world, should also help Corus in bringing about a more competitive cost structure, even though most of its plants are in high cost in Europe. The major factor leading to merger and takeover of companies is the combination of production capacity as increasing market share besides reasons like: synergistic operating economies, diversification, taxation, growth etc.

Discussion

This move by Tata Steel of acquiring Corus to enjoy expected synergies might seem a very simple business decision. But it is not so. There are many choices that have to be made and questions that have to be answers before going ahead with the acquisition. First and foremost is why acquire Corus and not some other business? What would be the return that is expected from this deal over the years? Expected returns over the years need to be compared with the investment made today. At what rate should the expected returns over the years be discounted in the light of expected risk? Another important decision that had to be taken by Tata Steel must have been to consider whether to invest using equity or whether to take borrow. Debt can be raised from financial institutions or from the public. Which route to take? Or it can be partly debt and partly equity. But, in what ratio? The answer definitely would depend to a large extent on the cost of raising funds from various sources. would be many to finance the acquisition. Also, the decision to acquire Corus is expected to impact the decision to declare dividends to the shareholders or to retain the earnings for growth.

Moreover, what will be the impact of this acquisition on Tata Steel Valuation? Would the shareholder value be maximized by this acquisition?

In short, we are primarily looking for answers for how to manage finances of a firm. We examine each of these questions and many more related concepts in this book on Financial Management through various chapters. We start by examining what we mean be financial management.

2. Approaches to Financial Management

2.1 Traditional Approach

According to the traditional approach, financial management is primarily concerned with acquisition of funds externally by the business concern to meet financing needs. Thus, finance manager of a business firm is required to perform the following functions:

(i) arrangement of short-term and long-term funds from financial institutions;

(ii) mobilization of funds through financial instruments like equity shares, preference shares, debentures, bonds etc.; and

(iii) orientation of finance function with the accounting function and compliance of legal provisions.

2.2 Modern Approach

With the increase in complexity of modern business environment, the role of a finance manager is not just confined to procurement of funds. His area of functioning is extended to judicious and efficient use of funds available to the firm, keeping in view the objectives of the firm and expectations of the providers of funds. In short, the focus of modern approach of financial management is on efficient and judicious use of resources to attain the desired objective of the firm.

Globalization has integrated the national economy with the world economy creating a new financial environment which has brings new opportunities and challenges to business concerns. This has led to total reformation of the finance function and its responsibilities in the organization. In India, financial management has changed substantially in scope and complexity due to recent government policy changes. Today, finance managers are faced with problems of financial distress and are trying to overcome it by innovative means. In the current economic scenario, financial management has assumed much greater significance. It is now a question of survival of entities in the total spectrum of economic activity, with pragmatic readjustment of financial management. The information age has also given a fresh perspective on the role of financial management and finance managers. With the shift in paradigm, it is imperative that the role of Chief Finance Officer (CFO) changes from that of a controller to a facilitator. Therefore, in modern times, a finance manager is expected to determine

(i) total funds required by the firm;

(ii) assets to be acquired; and

(iii) pattern of financing the assets.

Remember: The basic responsibility of the finance manager is not only to acquire funds needed by the firm but also to invest those funds in profitable ventures in order to maximize firm’s wealth.

3. Objectives of Financial Management

For long-range planning and management controls, a company establishes its overall objectives. Such objectives are developed by the top management and they usually consist of general statement or a series of statements in general terms stating what the company expects to achieve. Sometimes the objective set may be stated broadly, e.g., company aims to be a leader in technology in the industry, to achieve profits with a high level of manufacturing efficiency, a high degree of customer satisfaction etc. However, for the purpose of measuring performance and control, it is necessary to set objectives or goals in more precise terms. Objective setting is thus, an important activity for a business enterprise. The entire structure of strategies, policies and plans of a company rests upon correct objectives setting. The objectives are usually in quantitative terms and are set within a time-frame. The setting of physical targets to be achieved within a set time period provides the basis of conversion of the targets into financial objectives. In certain cases, both the physical targets and the financial targets go hand in hand. Financial objectives of a firm include

(i) earning return on capital employed or return on investment;

(ii) value addition and profitability;

(iii) growth in earnings per share and price/earnings ratio;

(iv) growth in the market value of the share;

(v) growth in dividends to shareholders;

(vi) optimum level of leverage;

(vii) survival and growth of the firm;

(viii) minimization of finance charges;

(ix) efficient utilization of short, medium and long-term finances etc.

3.1 Profit Maximization

Earning profit as an objective has emerged from economic theory. In the traditional economic theory, the typical firm is small, owner managed and competing with a large number of similar firms. Under these circumstances, profit is a rational objective of the business entity because:

(a) profit becomes the income of the owner. Maximization of profit then ensured the self-interests of the owner/manager, who both decide the actions of the firm and ensure that these are carried out.

(b) competitive forces require profit maximization to survive in business.

The true objective of the firm is closely related to earning profit. Often, the objective is tied to survival, security or the maintenance of liquid assets. Each of these objectives is complementary to profit, in that the maximization of profit ensures the attainment of that objective. The behaviour of the firm can then be modelled as if the firm was maximizing profit. It has traditionally been argued that since objective of a company is to earn profit, the objective of financial management is also maximization of profits. But, profit is only one of the many objectives of a modern firm. In real life, there are many different stake- holders. The profit maximization objective suffers from following limitations:

(i) concept of profit maximization is vague and narrow;

(ii) ignores the risk factor;

(iii) ignores the timing of returns;

(iv) may allow decisions to be taken at the cost of long-run stability and profitability of the concern;

(v) emphasizes the short-run profitability and short-term projects;

(vi) may cause to decrease in share price; and

(vii) fails to consider the social responsibility of business.

3.2 Wealth Maximization

Wealth maximization refers to maximizing the net present value (or wealth) of a course of action. The Net Present Value (NPV) of a course of action is the difference between the present value of its benefits and present value of its costs. A financial action which has a positive net present value creates wealth and, therefore, is desirable. A financial action resulting in negative net present value should be rejected. Out of a number of desirable mutually exclusive projects, the one with the higher net present value should be adopted. The maximization of wealth is possible by making those decisions which give benefits that exceed costs. The wealth maximization goal is advocated on the following grounds:

(i) it takes into consideration long-run survival and growth of the firm;

(ii) it is consistent with the objective of owners’ economic welfare;

(iii) it suggests the regular and consistent dividend payments to the shareholders;

(iv) financial decisions are taken with a view to improve the capital appreciation of the share price;

(v) it considers the risk and time value of money;

(vi) it considers all future cash flows, dividends and earnings per share;

(vii) maximization of firm’s value is reflected in the market price of share;

(viii) profit maximization partly enables the firm in wealth maximization; and

(ix) shareholders always prefer wealth maximization rather than maximization of inflow of profits.

Thus, wealth maximization is considered superior to the objective of profit maximization. Ezra Solomon explained the concept and calculation of wealth maximization as follows:

‘The gross present worth of a course of action is equal to the capitalized value of the flow of future expected benefit, discounted (or capitalized) at a rate which reflects certainty or uncertainty. Wealth or net present worth is the difference between gross present worth and the amount of capital investment required to achieve the benefits.’

According to Ezra Solomon, any activity that has a net present worth greater than zero that is, creates wealth, should be undertaken.

Symbolically,

Let W = Wealth (Net present worth); G = Gross present worth; and I = Investment (to purchase an asset or to start a new course of action).

Thus, W = G – I Also, G = E/C

E = Size of future benefits available to the suppliers of capital.

C = Capitalization (discount) rate reflecting the certainty or uncertainty and timing of

benefits attached to E.

Objective of financial management is wealth maximization = maximization of W.

W = A1/(1+k)1 + A2/(1+k)2 + A3/(1+k)3 + ….+ An/(1+k)n – I

where A1, A2, A3,.…, An. are cash flows expected from a proposed course of action over a period of time (life of the proposed action).

k is the discount according to risk and time.

I = Investment (to purchase an asset or to start a new course of action).

The wealth maximization objective of a firm is criticized as being narrow. Society’s resources are used by business firms and should be optimally allocated.

3.3 Value Maximization

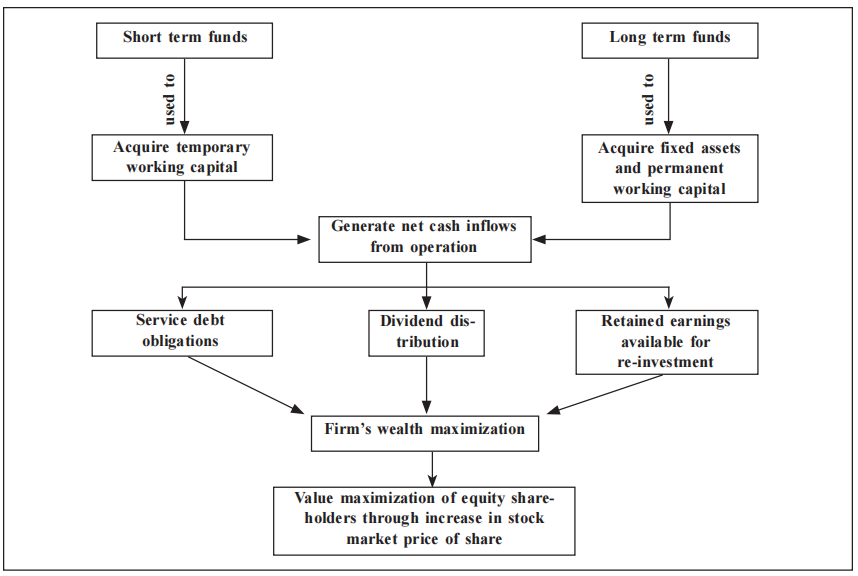

The objective of a company is to maximize the present wealth of the owners i.e., equity shareholders in a company. A company’s equity shares are actively traded in the stock mar- kets; the wealth of the equity shareholders is represented in the market value of the equity shares. The firm’s cash flow and its impact on value maximization is shown below

Firm’s Cash Flow And Value Maximization

Remember: The prime goal for company form of organization is to maximize the market value of equity shares of the company. The market price of a share serves as an index of the performance of the company. It takes into account present and prospective future earnings per share, risk associated with the business, dividend and retention policies of the firm, level of gearing etc. The shareholder’s wealth is maximized only when the market value of the share is maximized. In the present context, the term ‘wealth maximization’ of Financial Management is redefined as ‘value maximization’.

3.4 Other Objectives

There are various other objectives of a business other than the financial objectives. Some of them are explained briefly.

3.4.1 Sales Maximization

Maximization of sales revenue brings with it the benefits of growth, market share and status. The size of the firm, prestige, and aspirations are more closely identified with sales revenue than with profit.

3.4.2 Growth Maximization

Managers will seek the objectives which give them satisfaction, such as salary, prestige, status and job security. On the other hand, the owners of the firm (shareholders) are concerned with market values such as profit, sales and market share. These differing sets of objectives are reconciled by concentrating on the growth of the size of the firm, which brings with it higher salaries and status for managers and larger profits and market share for the owners of the firm.

3.4.3 Maximization of Return on Investment (ROI)

The strategic aim of a business enterprise is to earn a return on capital. If in any particular case, the return in the long run is not satisfactory, then the deficiency needs to be corrected or the activity be abandoned for a more favourable one. Measuring the historical performance of an investment centre calls for a comparison of the profit that has been earned with capital employed. The rate of return on investment is determined by dividing net profit or income by the capital employed or investment made to achieve that profit. Return on investment analysis provides a strong incentive for optimal utilization of the assets of the company. This encourages managers to obtain assets that will provide a satisfactory return on investment and to dispose off assets that are not providing an acceptable return. In selecting amongst alternative long-term investment proposals, ROI provides a suitable measure for assessment of profitability of each proposal.

3.4.4 Social Objectives

The business enterprise is an integral part of the functioning of a country. As such, in return for the privileges and rights granted to it by the state, the business firm should be made increasingly responsible for social objectives.

Earning profits are not merely an objective, they are the very reason for the existence of the business enterprise. The assumption of profit maximization has the enormous advantage of enabling decisions to be modelled. But at the same time non-profit maximizing theories cannot be ignored.

4. Financial Decisions

Financial management can be broken down into three major decisions as functions of finance:

(a) Investment Decisions,

(b) Financing Decisions, and

(c) Dividend Policy Decisions

4.1 Investment Decisions

Investment decisions are those which determine how scarce resources in terms of funds available are committed to projects. The project may be as small as purchase of an equipment or as big as acquisition of an entity. Investment in fixed assets require supporting investment in working capital in the form of inventory, receivables, cash etc. Investment which enhance internal growth is termed as ‘internal investment’ and acquisition of entities represents ‘external investment’. The investment decisions should aim at investment in assets only when they are expected to earn a return greater than a minimum acceptable return, which is also called as ‘hurdle rate’. The firm should select only those capital investment proposals whose net present value is positive and the rate of return on the projects exceeds the marginal cost of capital. In situations of capital rationing, the investment proposals are selected based on maximization of net present value. The profitability of each individual project will contribute to the overall profitability of the firm and leads to creation of wealth. The investment decisions of a finance manager cover the following areas:

- Ascertainment of total volume of funds, a firm can commit;

- Appraisal and selection of capital investment proposals;

- Measurement of risk and uncertainty in the investment proposals;

- Prioritizing of investment decisions;

- Funds allocation and its rationing;

- Determination of fixed assets to be acquired;

- Determination of levels and management of investments in current assets;

- Buy or lease decisions;

- Asset replacement decisions;

- Restructuring, reorganization, mergers and acquisitions; and

- Security analysis and portfolio management.

4.2 Financing Decisions

The financing objective asserts that the mix of debt and equity chosen to finance investments should maximize the value of investments made. The debt equity mix should minimise the hurdle rate. This allows the firm to take more new investments and increase the value of existing investments. Financing decisions relate to acquiring the optimum finance to meet financial objectives and seeing that working capital is effectively managed. The financing of capital investment proposals is generally done in two forms i.e. equity and debt. The finance decisions should consider the cost of finance available in different forms and the risks attached to it. The reduction in cost of capital of each component would lead to reduction in overall weighted average cost of capital. The principle of trading on equity should be kept in mind while selecting the debt-equity mix or the capital structure decisions. The relative advantages and risk attached to debt financing and equity financing should also be considered. The lower cost of capital and minimization of risks in financing will lead to profitability of the organization and create wealth for the owners. The finance manager is involved in numerous finance decisions. Some of them are:

(i) determination of degree or level of gearing;

(ii) determination of financing pattern of long-term funds requirement;

(iii) determination of financing pattern of medium and short-term funds requirement;

(iv) fund raising through issue of financial instruments viz., equity shares, preference shares, debentures etc.;

(v) arrangement of funds from banks and financial institutions for long-term, medium-term & short-term needs;

(vi) arrangement of finance for working capital requirement;

(vii) consideration of debt level changes and its impact on firm’s bankruptcy;

(viii) taking advantage of interest and depreciation in reducing the tax liability of the firm;

(ix) consideration of various modes of improving the earnings per share and the market value of the share;

(x) consideration of cost of capital of individual components and weighted average cost of capital to the firm;

(xi) analysis of impact of different levels of gearing on the firm and individual shareholder;

(xii) optimization of financing mix to improve return to the equity shareholders;

(xiii) maximization of wealth of the firm and value of the shareholders’ wealth;

(xiv) portfolio management;

(xv) consideration of impact of over capitalization and under capitalization on the firm’s profitability;

(xvi) consideration of foreign exchange risk exposure of the firm and decisions to hedge the risk;

(xvii) study of impact of stock market and economic conditions of the country on modes of financing;

(xviii) maintenance of balance between owners’ capital to outside capital;

(xix) maintenance of balance between long-term funds and short-term funds;

(xx) evaluation of alternative use of funds;

(xxi) setting of budgets and review of performance for control action;

(xxii) preparation of cash flow and funds flow statements; and

(xxiii) analysis of performance through ratios to identify the problem areas and its

correction.

4.3 Dividend Decisions

Dividend decisions is concerned with the determination of quantum of profits to be distributed to the owners and the frequency of such payments. Dividend decisions deal with

(a) the amount to be paid out and its influence on share price, and

(b) the amount of profit to be retained for internal investment which maximizes the value of firm and ultimately improves the share value of the firm.

The dividend distribution policies and retention of profits will have an effect on the firm’s wealth. The company can retain its profits in the form of reserves for financing its future growth and expansion schemes. The conservative dividend payments will adversely affect the firms’ share prices in the market. Therefore, an optimal dividend distribution policy is required to maximize shareholders’ wealth.

The finance manager will take the following dividend decisions:

(i) Determination of dividend and retention policies of the firm;

(ii) Consideration of impact of levels of dividend and retention of earnings on the market value of the share and the future earnings of the company;

(iii) Consideration of possible requirement of funds by the firm for expansion and diversification proposals for financing existing business requirements;

(iv) Reconsideration of distribution and retentions policies in boom and recession periods; and

(v) Considering the impact of legal and cash flow constraints on dividend decisions.

Remember: To Sum Up, the corporate finance theory has broadly categorized the financial decisions into investment, financing and dividend decisions. All these financial decisions aim at the maximization of shareholders’ wealth through maximization of firm’s wealth. The investment, finance and dividend decisions are interrelated to each other and, the Finance Manager while taking any decision, should consider the impact from all the three angles simultaneously.

The subject of Financial Management is based on following tenets:

(i) The owners will have primary interest in the firm’s success and growth;

(ii) The shareholder’s wealth is the determinant of current share price;

(iii) The firm will go on spending on capital investment proposals so long as it generates positive net present values; and

(iv) The firm’s capital structure and dividend decisions are irrelevant, since they are guided by the management control over firm and also depends on the efficiency of capital market.

5. Finance Function

Finance is a critical functional area. Although the ultimate responsibility of carrying out the activities of finance function lies with the top management, the work of every other functional manager is dependent on finance. Generally, in large organisations, finance function is handled by specialists.

5.1 Functions of a Finance Manager

The important functions of a Financial Controller in a large business firm consist of the following:

| Provision of Capital | to establish and execute programs for the provision of capital required by the business. |

| Investor Relations | to establish and maintain an adequate market for the company’s securities and to maintain adequate liaison with investment bankers, financial analysts and shareholders. |

| Short-term Financing | to maintain adequate sources for company’s current borrowing from commercial banks and other lending institutions. |

| Banking and Custody | to maintain banking arrangement, to receive, have custody of and disburse the company’s monies and securities. |

| Credit and Collections | to direct the granting of credit and the collection of accounts due to the company, including the supervision of required special arrangements for financing sales. |

| Insurance | to provide insurance coverage as required. |

| Investments | to achieve the company’s funds required, and to establish policies for investment in pension and other similar trusts. |

| Planning for Control | to establish, coordinate and administer an adequate plan for the control of operations. |

| Report & Interpret | to compare performance with operating plans and standards, and to report and interpret the results of operations to all levels of management and to the owners of the business. |

| Tax Administration | to establish and administer tax policies and procedures. |

| Evaluate & Consult | to consult with all segments of management responsible for policy or action concerning any phase of the operation of the business as it relates to the attainment of objectives and the effectiveness of policies, organization structure and procedures. |

| Government Reporting | to supervise or coordinate the preparation of reports to government agencies. |

| Protection of Assets | to ensure protection of assets for the business through internal control, internal auditing and proper insurance coverage. |

| Economic Appraisal | to appraise continuously economic, social forces and government influences, and to interpret their effect upon the business. |

| Managing Funds | to maintain sufficient funds to meet the financial obligations. |

| Measuring Return | to determine required rate of return for investment proposals. |

| Cost Control | to facilitate cost control and cost reduction by establishment of budgets and standards. |

| Price Setting | to supply necessary information for setting of prices of products and services of the concern. |

| Forecasting Profits | to collect relevant data to make forecast of future profit levels. |

| Forecast Cash flow | to forecast the sources of cash and its probable payments. |

5.2 Finance Manager as a Facilitator

The information age has given a fresh perspective to the role of finance managers. Due to the shift in paradigm, it is imperative that the role of Chief Finance Officer (CFO) changes from that of a controller to a facilitator. Today’s finance managers are faced with variety of financial problems and try to overcome them by innovative means. The finance man- ager’s role is like a catalyst in the fast changing economic environment who provides the necessary information for strategic planning of the enterprise.

He is required to transform from a functional head to a ‘strategic leader’ able to use net-working systems, face external environmental complexities, perform strategic financial planning aligning with strategic objectives of the group, hedge foreign exchange risk, raise low cost funds from global financial markets, meet regulatory provisions of international financial markets, disseminate financial information about the firm, improve the capital productivity in increasing the profitability of the firm, etc.

5.3 Need to Centralize Finance Function

The argument in favour of centralizing the finance function is based on the following reasons:

(i) Strategic Decisions

Many of the strategic decisions like setting up of financial goals, investment in capital projects, raising of finances through issue of variety of equity, semi-equity and debt instruments, constant appraisal of financial position, etc. are taken by the top level management. Since the finance manager (as part of top management team) is involved in strategic decision-making, centralization of finance function is required.

(ii) Cash Flow

Success of any firm depends on its ability to generate cash flows. Strict planning and control is required to generate cash inflows and cash outflows, to maintain liquidity as well as long-term solvency of firm. This requires the finance decisions to be taken at a single point.

(iii) External Orientation

Finance manager needs to liaison with external agencies like banks, financial institutions, shareholders, debenture holders, government, SEBI, RBI, tax authorities etc. This requires proper coordinated action, therefore, centralized finance function is a necessity.

(iv) Coordination

The efficiency of other functions in an organization like production, marketing, purchase, personnel etc. is linked with availability of funds in time. Finance manager acts as a coordinator or facilitator of all other functions, in achieving the organizational goals.

(v) Financial Discipline

Cash outflows should be according to plans/schedules and require necessary approvals to be taken from the higher level. Centralized finance function minimizes the risk of misappropriation of funds.

(vi) Information Flow

Timely and correct information reduces uncertainty in financial decisions. Information is required regularly from within and outside the organization. It is easier to access reliable and quick information through centralized finance function.

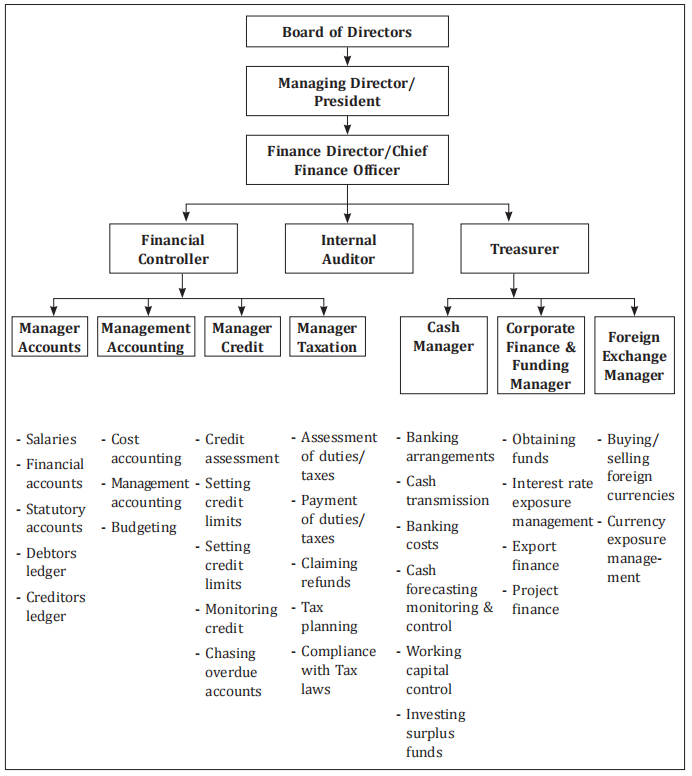

5.4 Organization Chart of Finance Function

A typical organization chart of a Finance Function of a big company is given below

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA