Overview of Capital Budgeting – Techniques | Decisions | Valuation Methods

- Other Laws|Blog|

- 8 Min Read

- By Taxmann

- |

- Last Updated on 18 November, 2024

Capital budgeting is the process of evaluating and selecting long-term investment projects that require significant capital expenditure, such as purchasing fixed assets, launching new projects, or replacing existing equipment. It involves analyzing potential investments using techniques like Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, and Profitability Index to determine their feasibility and profitability. The goal of capital budgeting is to allocate resources efficiently to maximize returns while minimizing risks over the project's lifespan.

Table of Contents

- Capital Budgeting Decisions

- Capital Budgeting

- Importance of Capital Budgeting Decisions

- Capital Budgeting Techniques

- Book Profit v. Cash Flow

- Cash Flow & Discounted Cash Flow (DCF)

- Accounting/AverageRate of Return (ARR)

- Payback Period (Traditional)

- Discounted Payback Period

- Net Present Value (NPV)

- Profitability Index (PI)/Desirability Factor (DF)/Present Value Index Method

- Internal Rate of Return (IRR)

- Modified Internal Rate of Return (MIRR)

- Replacement Decision

- Capital Rationing

- Unequal Life of Projects

- Decision Under Various Techniques

- Special Points

- Frequently Asked Questions

Check out Financial Management & Strategic Management (FM and SM | FM SM) | CRACKER which offers detailed answers to solved past exam questions (including the Sept. 2024 exam), model test papers, and sub-topic-wise questions for enhanced understanding. It includes chapter-wise summaries with key formulae, a marks distribution guide, and exam trend analysis, offering insights from recent exams. Additionally, it provides a comparison with ICAI study material, ensuring comprehensive and targeted exam preparation. CA-Inter | New Syllabus | Jan./May 2025 Exams

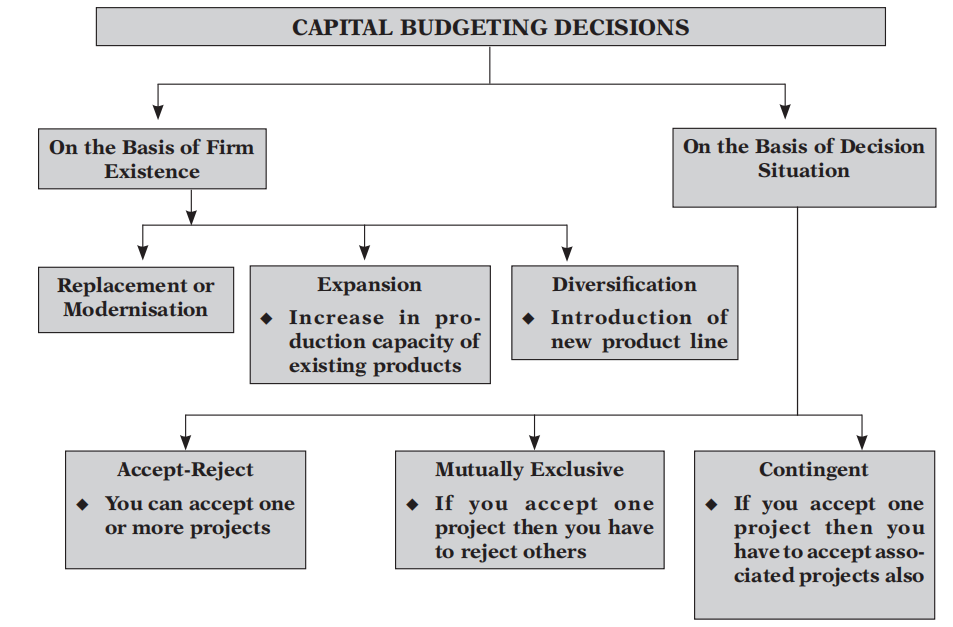

1. Capital Budgeting Decisions

Capital budgeting decision refers to the decision in respect of purchase or sale of fixed assets and long term.

2. Capital Budgeting

Capital budgeting refers to application of appropriate capital budgeting technique (one or more) to evaluate any capital budgeting proposal and take capital budgeting decision.

3. Importance of Capital Budgeting Decisions

- Involvement of Substantial Expenditure

- Long-TermEffect/Growth

- Involvement of High Risk

- Irreversibility

- Complex Decisions

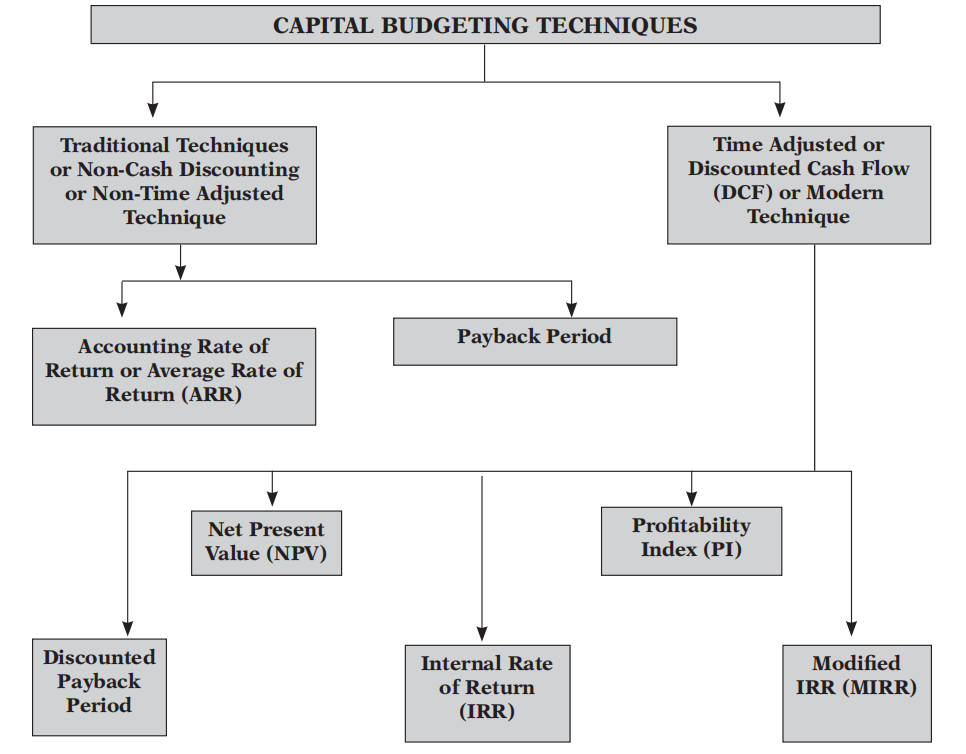

4. Capital Budgeting Techniques

5. Book Profit v. Cash Flow

Book Profit: It is also known as accounting profit.

Cash Flow: It is focused on cash inflow and outflow and ignore all non-cash activities

Proforma Book Profit and Cash Flow After Tax

| Particulars |

`₹ |

| Sales |

XXX |

| Less: Variable Cost (Always Cash) |

(XXX) |

| Contribution |

XXX |

| Less: Cash Fixed Cost |

(XXX) |

| Less: Depreciation (Non-Cash Item) |

(XXX) |

| Profit Before Tax (Accounting or Book Profit) |

XXX |

| Less: Tax @ 50% |

(XXX) |

| Profit After Tax (Accounting or Book Profit) |

XXX |

| Add: Depreciation (Non-Cash Item) | (XXX) |

| Cash Flow After Tax (CFAT)/Cash Receipts After Tax | XXX |

Cash Flow After Tax (CFAT):

- CFAT = PAT + Depreciation

- CFAT = Cash Receipt Before Tax (1 – t) + Depreciation × t

- CFAT = Cash Receipt Before Tax (1 – t) + Tax Shield on Dep.

- CFAT = Cash Receipt Before Tax – Tax on PBT

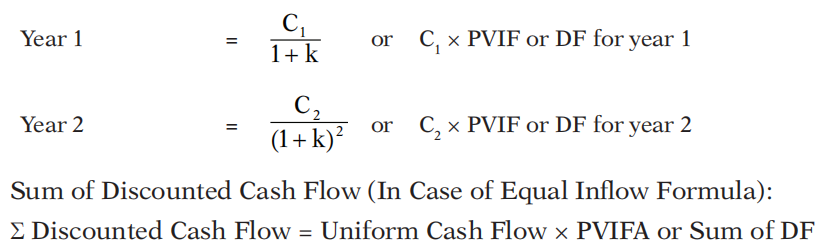

6. Cash Flow & Discounted Cash Flow (DCF):

Cash Flow: Cash flow without considering time value of money.

Discounted Cash Flow: Cash flow after considering time value of money.

Discounted Cash Flow (Formulae):

Note:

- ARR Technique is based on Accounting/Book Profit

- Payback Period is based on Cash Flow (Non-Discounted)

- Discounted Payback, NPV, PI and IRR Techniques are based on Discounted Cash Flow

- MIRR technique if based on Future/Compounded Cash Flow

- DiscountedCash Flow is also known as Present Value of Cash Flow

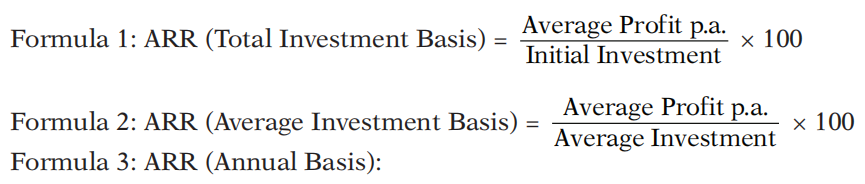

7. Accounting/AverageRate of Return (ARR)

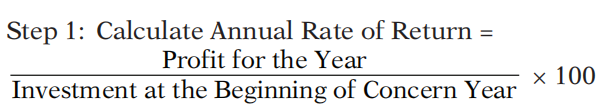

ARR is the rate of return in terms of average book profit on It can be calculated by using one of the following three methods:

Step 2: Calculate Average Rate of Return of Annual ARR in Step 1

Note:

- Average Investment = ½ × (Initial Investment + Salvage) + Additional Working Capital (If Any)

Or

- Average Investment = (½ × Depreciable Investment) + Salvage + Additional Working Capital

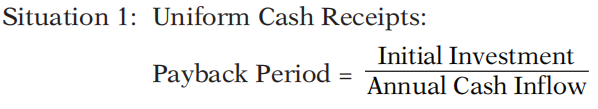

8. Payback Period (Traditional)

It is refers to the period within which entire amount of investment is expected to be recovered in form of Cash.

Situation 2: Unequal Cash Receipts:

Step 1: Calculate Cumulative Cash Inflow

Step 2: Calculate Payback Period

9. Discounted Payback Period

It is referred to the period within which entire amount of investment is expected to be recovered in form of Discounted

Step 1: Calculate Cumulative Discounted Cash Inflow

Step 2: Calculate Discounted Payback Period

10. Net Present Value (NPV)

The net present value of a project is the amount, in current value of amount, the investment earns after paying cost of capital in each period.

NPV = PV of Inflow – PV of Outflow/Initial Investment Or

NPV = (PI – 1) × PV of Outflow/Initial Investment

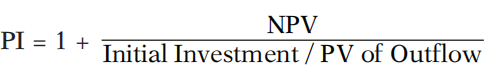

11. Profitability Index (PI)/Desirability Factor (DF)/Present Value Index Method

PI = PV of Inflow ÷ PV of Outflow/Initial investment Or

Note: PI technique is useful:

- In case of Capital Rationing with indivisible projects

- In case of equal NPV under mutually exclusive projects

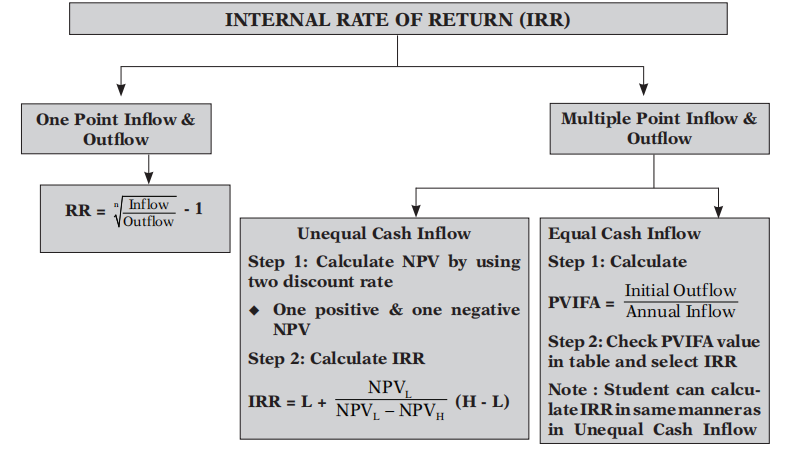

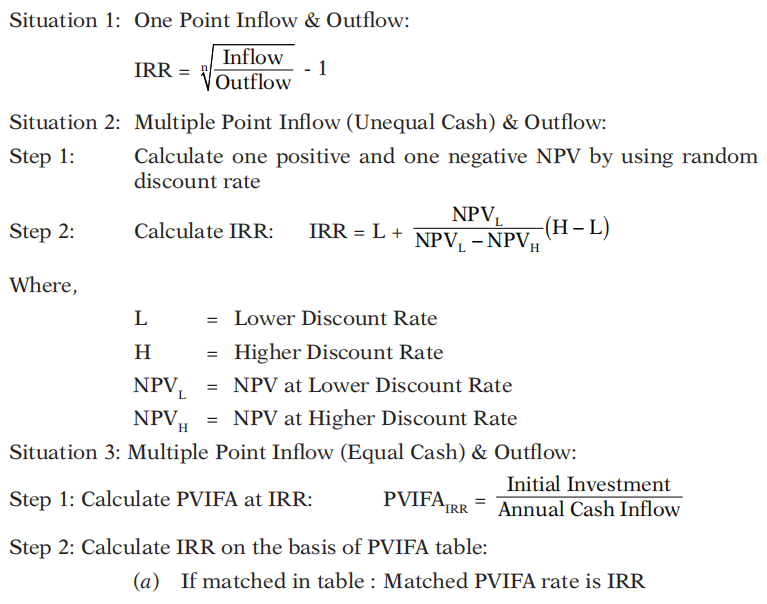

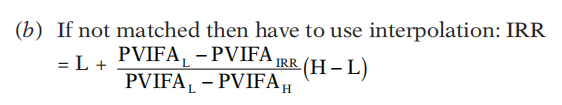

12. Internal Rate of Return (IRR)

Internal rate of return refers to the actual rate of return generated by the project. Internal rate of return for an investment proposal is the discount rate that equates the present value of the expected cash inflows with the initial cash outflow.

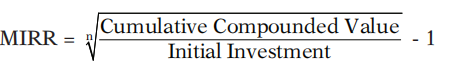

13. Modified Internal Rate of Return (MIRR)

The MIRR is obtained by assuming a single outflow in the zero year and the terminal cash inflow.

Step 1: Calculate cumulative compounded value of intermediate cash inflow by using cost of capital as rate of compounding.

Step 2: Calculate MIRR:

14. Replacement Decision

Decision in respect of replacement of an existing working machine with new one having higher production capacity or lower operating cost or both.

Step 1: Calculate Initial Outflow:

| Particulars | ``₹ |

| Purchase Cost of New Machine | XXX |

| Less: Sale Value of Old Machine | (XXX) |

| Less: Tax Saving on Loss on Sale of Old Machine | (XXX) |

| Add: Tax Payment on Profit on Sale of Old Machine | XXX |

| Add: Increase In Working Capital | XXX |

| Less: Decrease in Working Capital | (XXX) |

| Initial Outflow | XXX |

Step 2: Calculate Incremental CFAT.

Step 3: Calculate Incremental Terminal Value (net of tax).

Step 4: Calculate Incremental NPV and Take Replacement Decision.

15. Capital Rationing

Capital rationing refers to the process of selection ofoptimal combination of projects out of many subject to availability of funds.

Situation 1: Projects are Divisible:

Step 1: Calculate PI of all the available projects

Step 2: Give Rank to all projects on the basis of PI

Step 3: Select Projects on the basis of Rank

Situation 2: Projects are Indivisible:

Step 1: Calculate all possible combinations

Step 2: Select combination of projects having higher combined NPV

16. Unequal Life of Projects

In case of comparison between two projects having different life we can solve the problem by using Equivalent Annualized Criterion:

Step 1: Calculate NPV of the projects or PV of outflow of the projects.

Step 2: Calculate Equivalent Annualized NPV or Outflow:

Equivalent Annualised NPV or Outflow = NPV or PV of Outflow/PVIFA

Step 3: Select the proposal having higher annualised NPV or Lower annualised outflow.

Note: Such problems can also be solved by using Common Life/Replacement Chain Method

17. Decision Under Various Techniques

| Techniques | Yes | No |

| ARR | ARR ≥ Desired Return | ARR < Desired Return |

| Traditional Payback | Payback ≤ Desired Payback | Payback > Desired Payback |

| Discounted Payback | Payback ≤ Desired Payback | Payback > Desired Payback |

| NPV | NPV ≥ 0 | NPV < 0 |

| PI | PI ≥ 1 | PI < 1 |

| IRR | IRR ≥ Cost of Capital | IRR < Cost of Capital |

| MIRR | MIRR ≥ Cost of Capital | MIRR < Cost of Capital |

18. Special Points

- Sunk Cost and Allocated Overheads are irrelevant in Capital Budgeting.

- Opportunity Cost is considered in Capital Budgeting.

- Working Capital introduced at the beginning of project (cash outflow) and recover (cash inflow) at the end of the project life.

- Running Cost: Always Cash Cost.

- Operating Cost: Variable Cost plus Fixed Cost (Including Depreciation) subject to operating cost must be > Depreciation.

- Depreciation: Only as per Tax is relevant.

- If nothing is specified: Depreciation as per books is assumed to be depreciation as per tax and Losses can be carry forwarded for tax benefit.

19. Frequently Asked Questions

FAQ 1. What is the between Net Present Value method and Internal Rate of Return method?

NPV: NPV or net present value refers to the net balance after subtract- ing present value of outflows from the present value of inflows. Present value is calculated by using cost of capital as discount rate. As per NPV technique internal cash inflows are re-invested at cost of capital rate. NPV higher than zero indicates that project will provide return higher than cost of capital, zero NPV indicates that expected cash inflow will provide return equal to cost of capital and negative NPV indicates that project will fail to recover even cost of funds to be invested in proposal. Negative NPV leads to rejection of proposal. NPV is expressed in financial values and fails to provide actual rate of return associated with proposal.

IRR: IRR technique refers to actual rate of return associated with proposal. IRR refers to rate of discount at which present value of inflows and outflows are same or NPV is zero. IRR is expressed in percentage terms. As per IRR technique internal cash inflows are reinvested at IRR rate. IRR rate is compared with desired rate of return. Proposal is accepted when IRR is higher than desired rate of return and rejected when it is lower than desired rate of return.

There may be contradictory results under NPV and IRR techniques in some situations due to size disparity problem, time disparity problem and unequal expected lives.

FAQ 2. What is ‘Internal Rate of Return’?

IRR technique refers to actual rate of return associated with proposal. IRR refers to rate of discount at which present value of inflows and outflows are same or NPV is zero. IRR is expressed in percentage terms. As per IRR technique internal cash inflows are re-invested at IRR rate. IRR rate is compared with desired rate of return. Proposal is accepted when IRR is higher than desired rate of return and rejected when it is lower than desired rate of return.

FAQ 3. Which method of comparing a number of investment proposals is most suited if each proposal involves different amount of cash inflows? What are its limitations?

The best technique to compare number of investment proposals involves different amount of cash inflows is Profitability Index or Desirability Factor. In this technique present value of cash inflows is compared with present value of outflow and project is accepted if PI is 1 or above. It is calculated as :

Desirability Factor or Profitability index = PV of Inflows/PV of outflows

Limitations of Profitability Index:

- This technique cannot be used in case of capital rationing with indivisible

- Many times single large project with high NPV is selected and ignored various small projects with higher cumulative NPV than selected single

- There is a situation where a project with a lower profitability index may generate cash flows in such a way that another project can be also taken after one or two years later, the total NPV in such case will be higher than NPV of another project with highest Profitability Index today.

FAQ 4. What are the steps while using the equivalent annualized criterion?

Following are the steps involved in Equivalent Annualised Criterion:

Step 1: Calculate NPV of the projects or PV of outflow of the projects.

Step 2: Calculate Equivalent Annualized NPV or Outflow:

Equivalent Annualised NPV or Outflow = NPV or PV of Outflow/PVIFA

Step 3: Select the proposal having higher annualised NPV or Lower annualised outflow.

FAQ 5. What are the limitations of the Average Rate of Return?

Following are the limitations of ARR:

- The accounting rate of return technique, like the payback period technique, ignores the time value of money and considers the value of all cash flows to be equal.

- The technique uses accounting numbers that are dependent on the organization’s choice of accounting procedures, and different accounting procedures, g., depreciation methods, can lead to substantially different amounts for an investment’s net income and book values.

- The method uses net income rather than cash flows; while net income is a useful measure of profitability, the net cash flow is a better measure of an investment’s performance.

- Furthermore, the inclusion of only the book value of the invested asset ignores the fact that a project can require commitments of working capital and other outlays that are not included in the book value of the project.

FAQ 6. What are the limitations of the Internal Rate of Return?

Followings are the limitations of IRR:

- The calculation process is tedious if there is more than one cash outflow interspersed between the cash inflows; there can be multiple IRR, the interpretation of which is difficult.

- The IRR approach creates a peculiar situation if we compare two projects with different inflow/outflow patterns.

- It is assumed that under this method all the future cash inflows of a pro- posal are reinvested at a rate equal to the It ignores a firm’s ability to re-invest in portfolio of different rates.

- If mutually exclusive projects are considered as investment options which have considerably different cash outlays. A project with a larger fund commitment but lower IRR contributes more in terms of absolute NPV and increases the shareholders’ wealth. In such situation decisions based only on IRR criterion may not be correct.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA