[Opinion] ROC Slaps Rs.16 Lakh Penalty on Co. And Its Directors for Exceeding Prescribed Director’s Remuneration Limit – A Case Study

- News|Blog|Company Law|

- 2 Min Read

- By Taxmann

- |

- Last Updated on 21 February, 2024

1. Background of the case

This case pertains to a violation committed by the company in the matter relating to the excess remuneration payment to its directors beyond the prescribed limits under the provisions of the Companies Act 2013. Though the provisions of the Companies Act 2013 permit the companies to make directors remuneration in excess of the limit after obtaining the approval of the members by way of a special resolution, however, in this case, the company did not comply with the same and yet paid excessive remuneration beyond the prescribed limit for a period of two years.

It happened with M/s Seva Parmodharmah Samajik Nidhi Limited, incorporated in Bihar in the year 2016 whose records were scrutinized by the Registrar of Companies for its financial statements for the financial years ending on 31st March 2019, and 31st March 2020. The investigation revealed that the company had paid the director’s remuneration for both financial years surpassing the eleven percent limit of net profits of the company. Moreover, the company failed to file MGT-14, indicating a lack of special resolution regarding managerial remuneration. The above lead to the legal violation of the provisions of section 197(9) of the Companies Act 2013 which stipulates that directors who receive remuneration exceeding the prescribed limit without requisite approval must refund the excess amount to the company.

In this case, the directors of Seva Parmodharmah Samajik Nidhi Limited did not refund the excess remuneration, resulting in a violation of Section 197(1) of the Companies Act, 2013. The Registrar of Companies / Adjudication Officer after following the adjudication procedures penalized the company and its directors to the tune of Rs.16 lakhs for the violation committed by the company and its defaulting directors. Let us go through the details of this case in order to understand the provisions relating to the directors remuneration, procedure to be followed and the consequences of non-compliance.

2. Relevant provisions under the Companies Act 2013

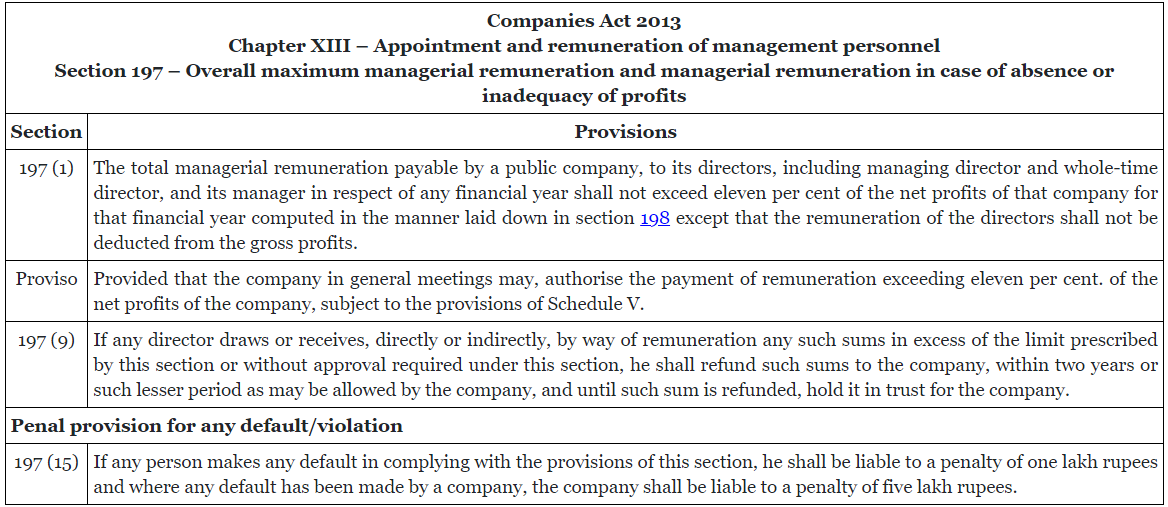

Section 197 of the Companies Act 2013 is the relevant provision on this matter in Chapter XIII – Appointment and Remuneration of Management Personnel. The relevant extracts of the provisions relating to this case are given below

3. Consequences of default/violation – action from the Regulator

To understand the consequences of any default / non-compliance while complying with the provisions of section 197 of the Companies Act 2013 relating to remuneration payable to the directors, let us go through the decided case law by the Registrar of Companies of Patna on this matter on 31st January 2024.

Click Here To Read The Full Article

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA