[Opinion] ROC Penalizes Company Signatory for Defective E-form PAS-3 Filing and PCS for Wrong Certification – A Case Study

- Blog|News|Company Law|

- 3 Min Read

- By Taxmann

- |

- Last Updated on 23 February, 2024

[2024] 159 taxmann.com 561 (Article)

A small brief about this case

This is a case involving defective e-form Pas- 3 (return of allotment) filled with incorrect details by the company officials and also certified for its correctness by a practicing company secretary, the certifying professional of e-form PAS-3 for its correctness before the same is filed. The defect as pointed out by the Registrar of Companies / Adjudication Officer was that in the attachment to the board resolution to the PAS-3 e-form, the total consideration wasstated as Rs. 8,86,06,610 instead of Rs. 8,86,06,800 for the allotment 2,21,517 shares.

The company upon realizing the defective form which was duly certified was filed with the Registrar of Companies, filed an application for adjudication suo-moto to the Registrar of Companies seeking to adjudicate the matter. The Registrar accordingly followed the procedure of issuing the adjudication notice for which the signatories to the e-form PAS-3 i.e., the authorised signatory of the company i.e. the managing director who signed the form and the practicing company secretary who erroneously certified the e-form PAS-3 both accepted the violation committed by them in terms of Rule 8(3) of the Companies (Registration Offices and Fees) Rules 2014. The Adjudication officer passed the adjudication order on this matter by levying a penalty on both the signatories of the form. Let us go through this case in detail in order to understand the provisions of the Companies Act 2013 read with the relevant rules and consequences of default / non-compliance.

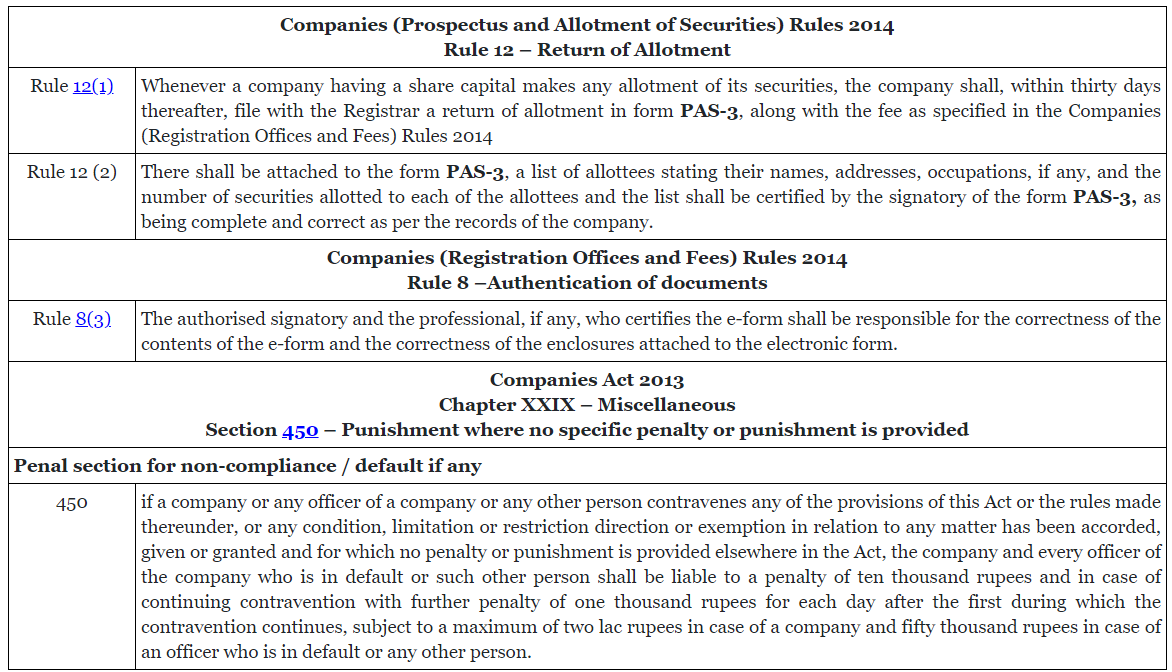

Provisions relating to this case under the Companies Act 2013.

The following are the relevant provisions under the Companies Act 2013, relevant to this case as given below.

Consequences of default/violation – action from the Regulator

To understand the consequences of any default / non-compliance relating to Rule 8(3) of the Companies (Registration Offices and Fees) Rules 2014 in filing the e-form PAS-3 (Return of allotment)let us go through the decided case law on this matter decided by the Registrar of Companies of NCT of Delhi & Haryana on 9th February 2024.

The relevant case law on this matter

We shall go through the adjudication order bearing no. ROC/D/Adyorder/718-721 passed by the Registrar of Companies, NCT of Delhi & Haryana on 9th February 2024 in the matter of M/s. Drishtee Development and Communication Limited – order of penalty pursuant to Rule 8(3) of the Companies (Registration Offices and Fees) Rules 2014.

Details of the company

M/s. Drishtee Development and Communication Limited was incorporated on 10th August 2000 under the provisions of the Companies Act 1956 having its registered office at 19/21, Shakti Nagar, NewDelhi in the union territory of Delhi. The company falls under the jurisdiction of the Registrar of Companies of NCT of Delhi & Haryana and the office of the Registrar is situated at Delhi. The company, as per the details shown at the MCA portal has three directors on its board out of which one of them is a managing director. The company had established kiosks that offer affordable Internet access, consumer products and community services to rural Indian villages.

Click Here To Read The Full Article

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA