[Opinion] Drastic Changes in Trust Audit Report

- Blog|News|Income Tax|

- 3 Min Read

- By Taxmann

- |

- Last Updated on 28 February, 2023

CA Chunauti H. Dholakia – [2023] 147 taxmann.com 550 (Article)

Since introduction of old Form 10B and 10BB, many amendments have been made in the Income Tax Act in relation to provisions applicable to Charitable and Religious Trusts approved under section 10(23C) and registered under section 12AB and approved under section 80G. Also, many landmark judicial rulings also issued. Hence there was need to reflect these changes by amending format of the form for audit report of charitable and religious trusts. CBDT vide notification No. 07/2023, made drastic change in format of trust audit report. Also, Rule 16CC applicable for form of audit report prescribed under tenth proviso to section 10(23C) and Rule 17B applicable for audit report in the case of charitable or religious trusts is also amended. Many new details are incorporated in the format. These amendments are discussed in detail hereunder.

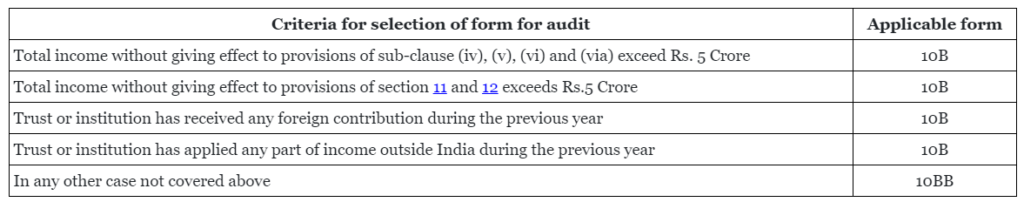

Selection of Form for Audit Report

Before this amendment Form 10B was applicable to the trusts or institutions registered under section 12A and Form 10BB was applicable to trusts or institutions approved under section 10BB. Now the focus is shifted from type of registration to amount of total income of the trust. Hence now form of audit report should be selected considering following amended provisions of Rule 16CC and Rule 147B.

Changes made in Form 10B

Details required to be reported in Form 10B as well as in Form 10BB

- Details of the authors/founders/settlors/trustees/member of society/member of the governing council/directors/shareholders (including non-individual person) holding 5% or more shareholdings/office bearers of the auditee at any time during the year including Name, relation, Unique Identification Number, address etc.

- Details of commencement of activity. If the trust has commenced the activity, details of application for registration/approval.

- Details of books of accounts maintained by the trust including nature of books of accounts, whether maintained in computer system, whether maintained at registered office, if maintained at any other place, details of such place and intimation to AO about the decision and whether the books of accounts have been audited.

- Details of filing of form 10BD including amount of donation reported and not reported in Form 10BD and donation not required to be reported.

- Details of voluntary contributions received during the year. The amount reported here should be matched with amount reported and not reported in Form 10BD.

- Details of foreign contribution out of voluntary contribution.

- Voluntary contribution forming part of the corpus.

- Details of anonymous donation taxable @30% under section 115BBC.

- Details of income applied outside India.

- Details of income other than voluntary contributions reported above.

- Details of application of income

(1) Amount not actually paid during the year, amount actually paid during the year, which accrued during the year but not claimed as application of income in earlier previous year, amount invested or deposited back to corpus which was applied during the previous year and nor claimed as application during that previous year, repayment of loan or borrowing during the previous year which was earlier applied and not claimed as application of income during that previous year.

(2) Amount to be disallowed from application being amount disallowed under section 40A(ia), 40A(3)(3A), donation to other trusts towards corpus, donation to other trusts not having same objects, donation to any unregistered trust, application outside India, application beyond trust objects, any other disallowance, amount deemed to have been applied and amount accumulated.

(3) Application out of income of earlier previous year or out of corpus and borrowed fund.

- Taxable income under section 115BBI

- Application of income out of income deemed to be applied in any preceding year, income of earlier previous year out of 15% accumulated or set apart, application out of corpus and borrowed fund.

- Details of transactions with specified persons referred to in section 13(3) and 13(2).

- Details of specified persons as referred to in section 13(3).

- Details of income/property referred to in section 13(2).

- Details of specified violations

- Details of depreciation on asset, acquisition of which is claimed as application of income.

- Details of TDS deducted ot TCS collected by the trust.

Click Here To Read The Full Article

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA