[Opinion] Charitable Trust – Managing Application of Income on Actual Payment Basis

- Blog|News|Income Tax|

- 2 Min Read

- By Taxmann

- |

- Last Updated on 27 December, 2022

CA Naresh Kumar Kabra & Nikhil Agarwal – [2022] 145 taxmann.com 565 (Article)

“Now, the expense has to be done in reality”

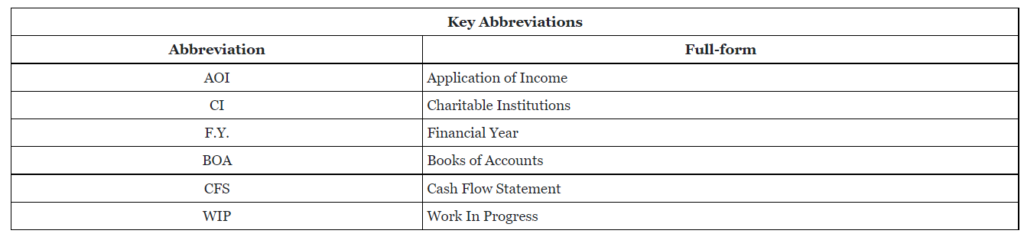

We know that tax is one of the major sources of government revenue. But, Charitable Institutions (CIs) are enjoying a huge tax benefit for a long time. The CI covered under section 10(23C) and section 11 of the Income Tax Act, 1961 are exempt from paying income tax, after fulfilling certain conditions.

The CIs have to apply 85% of their income towards charitable objectives, however before the introduction of the Finance Act, 2022; there was no specific condition in the law that this application of income has to be calculated on an accrual basis or actually paid basis. It was the choice of CI, if CI is maintaining its Books of Accounts (BOA) on an accrual basis, then 85% of income was to be applied on the accrual basis and if BOA is maintained on a cash basis, then 85% of income was to be applied on actual payment basis.

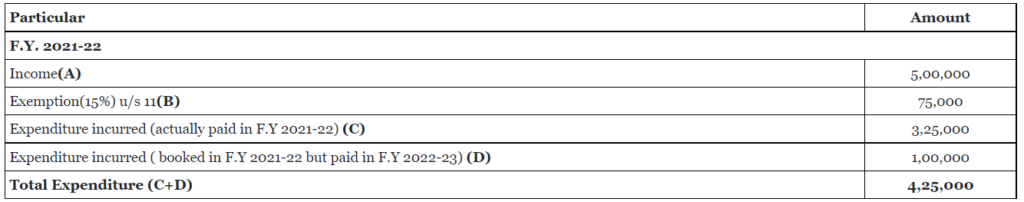

Let’s understand the above scenario with an example.

For example, Dayalu Trust is maintaining its BOA on the accrual basis and the following is the data for F.Y 2021-22

In the above example, AOI is 85% which meets the threshold for claiming tax exemption, and hence the Tax payable is Nil.

However, with the introduction of the Finance Act, 2022, an amendment has been brought which has completely changed the law of Taxation of CIs which was in existence since its inception. Now, only those expenses which have been actually paid during the relevant F.Y. will be considered for the calculation of AOI to the tune of 85%. [Explanation 3 to clause (23C) of section 10 and Explanation to section 11].

Click Here To Read The Full Article

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA