What Are Mutual Funds?

- Other Laws|Blog|

- 14 Min Read

- By Taxmann

- |

- Last Updated on 18 July, 2024

Topics covered under in this article are as follows:

1. Introduction

2. What is ‘NAV’?

3. Benefits of Mutual Funds

4. History of Mutual Funds in India

5. Organisation Structure of Mutual Funds in India

6. Types of Mutual Funds Schemes

7. Functional Classification of Mutual Funds

8. Portfolio Classification of Mutual Funds

9. Geographical Classification

10. Others

11. Role of Mutual Funds in Indian Capital Market development

12. Summary

Refer to Taxmann's Financial Markets Institutions & Services, which is a comprehensive & authentic book providing basic working knowledge in a simple & systematic manner, along with illustrations, practical case studies, illustrations, figures, graphs, tables, etc.

1. Mutual Funds Meaning

A mutual fund is a financial intermediary in capital market that pools collective investments in form of units from retail and corporate investors and maintain a portfolio of various schemes which invest that collective investments in equity and debt instruments on behalf of these investors. Mutual fund is expert entity which helps an investor invest in equity and debt instruments indirectly rather than taking risk of investing money directly in these instruments. An ordinary investor has no expertise or knowledge to invest money directly into equity market in India and most of the times investors lose their money due to wrong selection of equity shares, or bonds. Hence, mutual funds as intermediary provide expertise of portfolio management actively and diversify risk by spreading investments from all investors in various equity shares and debt instruments. This helps investors earn good returns at low risk compared to returns at high risk if investors invest on their own directly in capital market.

A mutual fund is a collective reservoir or pool of funds which is managed by a qualified and expert Fund Manager. It is a trust that takes funds from a number of investors who have a common investment goal and invests those funds in equities, bonds, money market instruments and other securities. The income generated from this combined portfolio is distributed proportionately amongst the investors after subtracting relevant expenses and levies, by calculating a scheme’s ‘Net Asset Value’ or NAV. Simply placed, the money pooled in by a large number of investors are allotted in units by a mutual fund scheme. This pooled money invested in equity or bonds or short term securities shall grow or go down depending upon the performance of these investments. This shall get reflected in the value of NAV.

Mutual funds are perfect for investors who either lack large sums for investment, or for those who neither have the knowledge nor the time to research the market, yet want to grow their wealth. In return, the fund house charges a small fee for their professional expertise which is subtracted from the investment. The fees charged by mutual funds are restricted to certain limits stated by the Securities and Exchange Board of India (SEBI).During the past few years mutual funds have achieved a favoured status when investors have been investing regularly in equity/balanced schemes through them.

2. What is NAV in Mutual Funds?

Just like an equity share has a market price which is determined through trading in stock exchanges, a mutual fund unit has Net Asset Value per Unit (NAV) based on closing price of shares and bonds which are part of respective portfolio of mutual fund scheme. The NAV is the combined market value of the shares, bonds and securities held by a fund on any particular day in a portfolio of particular mutual fund scheme (as reduced by legitimate expenses and charges). NAV per Unit denotes the market value of all the shares/debentures/bonds or any other instrument in a mutual fund scheme on a given day, net of all expenses and liabilities plus income accrued, divided by the outstanding number of Units in the scheme.

NAV = Market Price of Securities + Other Assets – Total Liabilities + Units Outstanding as at the NAV date

NAV = Net Assets of the Scheme + Number of units outstanding, that is, Market value of investments + Receivables + Other Accrued Income + Other Assets – Accrued Expenses – Other Payables – Other Liabilities + No. of units outstanding as at the NAV date

3. Benefits of Mutual Funds

Mutual funds are managed by professionals organised firm called AMC (Asset Management Company) through professional fund managers who actively manage investment portfolio of various mutual fund schemes which deliver following benefits to investors:

(1) Portfolio Diversification: Mutual Funds invest in a diversified portfolio of financial instruments which enables a small investor to hold a diversified investment portfolio even if the amount of investment is small.

(2) Low Risk: Even with a small amount of investment, Investors can acquire a diversified portfolio of financial instruments. The risk in a diversified portfolio of mutual fund scheme is lesser than investing directly in only 2 or 3 shares or bonds.

(3) Low Transaction Costs: Due to the economies of scale mutual funds incur lesser transaction costs. These benefits are shared with the investors.

(4) Liquidity: Units of a mutual fund can be redeemed easily with the funds being credited directly to the investors account though ECS payment.

(5) Choice: Mutual funds offer investors with variety of schemes with diverse investment objectives. Investors, therefore, have a plenty of investing in a scheme matching their financial goals. These schemes further provide various plans/options e.g. dividend option or growth option or reinvestment option etc.

(6) Transparency: Funds provide investors with latest information related to the markets and the schemes. All material facts are revealed to investors as per the guidelines of SEBI and AMFI. They provide on a daily basis latest NAV to investors.

(7) Flexibility: Investors are also provided flexibility by Mutual Funds. Investors can transfer their units from a debt scheme to an equity scheme or a balanced scheme through systematic transfer plan option (STP). Option of systematic investment through monthly/quarterly instalments (SIP) and systematic withdrawal at regular intervals (SWP) is also offered to the investors in open-ended schemes.

(8) Safety: Mutual Fund industry is fully regulated under SEBI rules where the interests of the investors are safeguarded. All funds have to be registered with SEBI and complete compliance with the rules and transparency is ensured.

(9) Professional management: Mutual funds portfolios are managed by expert professional managers possessing skills and qualifications to analyse the performance and prospects of companies. They actively manage portfolios through close monitoring on a daily basis, which is not possible for a retail investor.

4. History of Mutual Funds in India

A robust financial market with funds flowing from retail investors is essential for a developed economy. First mutual fund was set up in 1963, by Unit Trust of India (UTI), at the initiative of the Government of India and RBI with a view to boost savings and investments. Participation in the income, profits and gains earned by UTI from the acquisition, holding, management and disposal of securities was made available to retail investors.

First Phase: In 1978, UTI was de-linked from the RBI and IDBI took over the regulatory and administrative control of UTI.US-64 was the first scheme launched by UTI which was the best scheme of UTI for a long period of time.

Second Phase: SBI Mutual Fund was the first non-UTI mutual fund set up in June 1987, followed by Can bank Mutual Fund (Dec. 1987), PNB Mutual Fund (Aug. 1989), Indian Bank (Nov. 1989), Bank of India (Jun. 1990) and Bank of Baroda Mutual Fund (Oct. 1992).

Third Phase: The Former Kothari Pioneer (now merged with Franklin Templeton MF) was the first private sector MF registered in July 1993. A new era started in the Indian MF industry in 1993 when private sector mutual funds entered the fray, providing Indian investors a diverse choice of MF products.

Fourth Phase: In February 2003, the UTI Act, 1963 was repealed and UTI was bifurcated into two separate entities e.g. the Specified Undertaking of the Unit Trust of India (SUUTI) and UTI Mutual Fund which functions under the SEBI MF Regulations, 1996.

Fifth Phase since 2012: Taking note of the lack of penetration of Mutual Funds, especially in tier II and tier III cities, and keeping in view of the interest of various stakeholders, SEBI initiated several positive measures in September 2012 to revive the sluggish Indian Mutual Fund industry and to increase MFs’ penetration in the remote corners of the country.

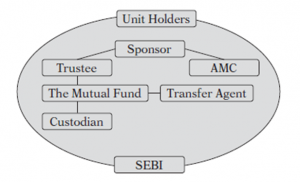

5. Organisation Structure of Mutual Funds in India

Source: https://www.amfiindia.com/

Three key players namely the sponsor, the AMC and the mutual fund trust are involved in setting up a mutual fund business in India. They are supported by banks, registrars, transfer agents, depository participants and custodians to perform mutual funds activities smoothly.

(1) Sponsor: Promoter of the Mutual Fund Company is known as sponsor of the mutual fund. Sponsor either on his own or in partnership with another company establishes a mutual fund with a purpose to earn money from fund management through its subsidiary company. The company which manages the funds as Investment Manager of the Fund is called as AMC.

(2) Trustee: Sponsors create trust through trust deed in the favour of trustees. Trustees manage the trust and they are primarily responsible as guardians to investors in Mutual Funds. Primary responsibility of Trustees is to ensure that due diligence is complied with. All Funds floated by the AMC have to be authorised by the trustees.

(3) AMC: Sponsor start Asset Management Company and AMC manages funds of the Trust. It charges small fee to manage trust funds. The AMC plans all schemes, launches the scheme and sources initial amount, manages the funds and give services to the investors. Fund Managers are appointed by AMC to manage various MF schemes floated by an AMC.

(4) Custodian: In Mutual funds, AMC purchases different securities like Shares, bonds, gold etc. in various schemes. These Securities are purchased in the name of Trust but they are not kept in the custody of the Trust. The responsibility of safe keeping the securities is with on the custodian Now a days the custody of financial securities are in demat form.

(5) Registrar & Transfer Agent: Registrar and Transfer agent is a separate entity. Registrar & Transfer agent has a responsibility of performing many administrative jobs like processing of applications of investors, generating units when new application is received, removing units when investors submit redemptions, managing full record of investors and processing dividend payments on behalf of its mutual fund client.

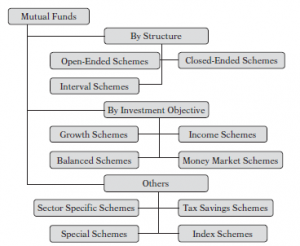

6. Types of Mutual Funds

The Purpose of mutual funds is to provide liquidity and higher returns with optimum degree of safety to investors at minimum risk. Based on these goals, various types of mutual fund schemes have evolved over a period of time.

Source: https://www.amfiindia.com/

7. Functional Classification of Mutual Funds

(1) Open-ended schemes: In case of open-ended schemes, investors can sell and buy its units at net asset value (NAV) or NAV based prices at any point of time. Investors can enter and exit the scheme any time during the life of the open-ended fund. The key nature of open-ended funds is liquidity. Since there is no lock in period these funds increase liquidity of the investors as the units can be bought and sold anytime.

(2) Close-ended schemes: Close-ended schemes have a fixed corpus and a defined maturity period ranging between 2 to 10 years. Investors can invest in the scheme when it is opened for subscription for few days as new fund offer (NFO). The scheme remains open for a limited time period not exceeding 45 days. The fund has no interaction with investors till redemption except for paying dividend or bonus. In exceptional cases some close ended mutual funds may announce buy back schemes like Morgan Stanley announced buy back scheme of its close ended mutual fund. There is a restriction on buying period in these schemes in form of buying lock in. These schemes are listed on stock market for trading.

(3) Interval Schemes: Interval schemes provide the features of both open-ended and close-ended schemes. They are open for sale or redemption during predetermined intervals at NAV related prices. They are also called partial open ended schemes.

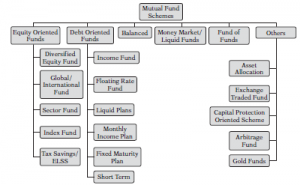

8. Portfolio Classification of Mutual Funds

(1) Growth Funds (Equity oriented funds): The main objective of growth funds is capital appreciation over the medium-to-long- term. They invest most of the corpus in equity shares with significant growth potential and they offer higher return to investors in the long-term at average risk. The risks associated with equity investments and no surety or assurance of returns are the features of these equity schemes. Growth funds can be further categorised into various schemes like large cap fund, mid cap fund and small cap fund, multi/diversified equity fund, equity linked saving scheme (ELSS), sectoral funds and index funds.

(2) Income Funds (Debt oriented funds): The purpose of income funds is to provide safety of investments along with regular income to investors. These schemes invest largely in income-bearing instruments like bonds, debentures, government securities, and commercial papers. The returns as well as the risks both are lower in income funds as compared to growth funds. Debt funds, liquid funds, Monthly income plans, fixed maturity plans and floating rate funds are different types of income fund schemes under the banner of income funds. These funds are also called fixed income or money funds. These funds too have some risk in case the corporate bond defaults.

(3) Balanced funds: The aim of balanced scheme is to provide both capital appreciation and regular income. They divide their investment between equity shares and fixed interest Debt instruments in such a ratio that the portfolios are balanced. These funds usually comprise of companies with good profit and dividend track records. The risk as well as rate of return is moderate.

(4) Money Market mutual funds: They specialise in investing in short-term money market instruments like treasury bills, and certificate of deposits. The aim of such funds is highest liquidity with lower rate of return at least possible risk.

9. Geographical Classification

(1) Domestic funds: Funds which mobilise funds from particular geographical locality like a country or a region are called domestic funds. The market is limited and restricted to the boundaries of a country in which the fund operates. They can invest only in the instruments which are issued and traded in the domestic financial markets. Indian Mutual fund investing in Indian securities is a domestic fund.

(2) Offshore funds: Offshore funds are funds which facilitate cross-border investment. Such mutual funds can invest in instruments of foreign companies and therefore provide investors the benefit of international diversification.

10. Others

(1) Sectoral Funds: These funds invest in particular core sectors like energy, telecommunications, IT, Banking, construction, transportation, Steel, FMCG and financial services etc.

(2) Tax Saving schemes: Tax-saving schemes provide special tax benefits to investors. Mutual funds have launched variety of tax saving schemes. These are close-ended funds and investments have lock-in period of at least 3 years. These schemes have various choices like dividend, growth or capital appreciation.

(3) ELSS: In order to boost investors to invest in equity market, the government has allowed tax benefits through special funds. Investment in these funds ensures the investor to claim an income tax deduction under section 80C, but these funds carry a 3 year lock-in period.

(4) Gilt funds: Mutual funds which deal only in gilts or government securities are called gilt funds. With a view to create a larger investor base for government securities, the RBI encourages setting up of gilt schemes.

(5) Index funds: An index fund is a mutual fund which invests in portfolio exactly following same ratio of securities in the index on which it is based e.g. S&P BSE Sensex or Nifty. It invests only in those shares which are part of the market index and in exactly the same ratio as the weightage in the index so that the value of such index schemes varies exactly with the market index. An index fund adopts a passive investment strategy as fund manager need not analyse stocks for investment or redemption in these schemes.

(6) Exchange traded funds (ETF): Exchange Traded Funds (ETFs) are a hybrid of open-ended mutual funds and stocks traded on stock exchanges. These funds can be purchased and sold like shares on stock exchanges at their changing current NAV on exchange. They are open-ended Mutual funds listed on stock exchanges.

11. Role of Mutual Funds in Indian Capital Market development

The Indian Mutual Fund segment is one of the fastest expanding segments of our Economy. During the last ten year period the industry has grown at nearly 22 per cent CAGR. With assets of US $ 125 billion, India ranks 19th and one of the rapid growing countries of the world. The factors leading to the development of the industry are large market Potential, high savings rate, comprehensive regulatory framework, tax policies, innovations of new schemes, aggressive role of distributors, investor education awareness by SEBI, and past performance. Mutual funds are not only providing growth to capital market through channelization of savings of retail investors but themselves playing active role as active investor in Indian companies in secondary as well as primary market. Let’s examine mutual funds role in capital market development in detail.

(1) Mutual fund as a source of household sector savings mobilization: Mutual fund industry has come a long way to assist the transfer of savings to the real sector of the economy. Total AUM of the mutual fund industry clocked a CAGR of 12.4 per cent over FY 07-16. That shows how mutual funds have played pivotal role in mobilising retail investors’ savings into capital market in last 10 years in India. By the end of March, 2017 AUM with Mutual funds are around Rs. 17.5 lakh crores. In 2017 itself, investors poured Rs. 3.4 lakh crores across all the categories of Mutual funds in India.

(2) Mutual Fund as Financial service or Intermediary: The financial services sector is the second-largest component after trade, hotels, transport and communication all combined together, and contributes around 15 per cent to India’s GDP. With the rapid growth, mutual funds have become increasingly important suppliers of debt and equity funds. In fact, corporations with access to the low interest rates and increased share prices of the capital markets have benefited from the expansion in mutual fund assets. In recent years, mutual funds as a group have been the largest net purchaser of equities and a major purchaser of corporate bonds. All the MFs collect funds from both individual investors and corporate to invest in the financial assets of other companies. The number of fund houses is also increasing each year in the fast growing Indian economy. As of FY16, 42 asset management companies were operating in the country.

(3) Mutual funds popularity among small investors: Small investors have lots of problems like limited funds, lack of expert advice, lack of access to information etc. Mutual funds have come as a great help to all retail investors. It is a special type of institutional mechanism or an investment method through which the small as well as large investors pool their savings which are invested under the advice of a team of professionals in large variety of portfolios of corporate securities Safety with good return on investment is the outcome of these professional investment in mutual funds. It forms a significant part of the capital market, providing the advantage of a well-diversified portfolio and expert fund manager to a large number, particularly retail investors. An ordinary investor who applies for shares in a IPO of any company is not sure of any guaranteed allotment. But mutual funds who invest in the particular capital issue made by companies get confirmed allotment of, shares, therefore, the investment in good IPO’s can be achieved though investment in a mutual fund.

(4) Mutual Funds as part of financial inclusion policy of Govt. of India: Now SEBI is motivating mutual funds to spread in smaller cities and in rural India to attract small savings and making rural people aware of new investment avenue like mutual fund providing good returns at low risk. So Govt. of India policy of financial inclusion to mobilise savings of unbanked people of India is being supported actively by mutual funds now. In its effort to encourage investments from smaller cities, SEBI allowed AMCs to hike expense ratio up to 0.3 per cent on the condition of generating more than 30 per cent inflow from smaller cities. Mutual funds and AMFI undertake Investor awareness programmes for this purpose of financial inclusion.

12. Summary

A mutual fund is a financial intermediary in capital market that pools collective investments in form of units from retail and corporate investors and maintain a portfolio of various schemes which invest that collective investments in equity and debt instruments on behalf of investors.

The NAV is the combined market value of the shares, bonds and securities held by a fund on any particular day in a portfolio of particular mutual fund scheme (as reduced by legitimate expenses and charges). NAV per Unit denotes the market value of all the shares/debentures/bonds or any other instrument in a mutual fund scheme on a given day, net of all expenses and liabilities plus income accrued, divided by the outstanding number of Units in the scheme.

| NAV = | Market Price + Other Assets – Total Liabilities |

| Units Outstanding as on NAV date |

Three key players namely the sponsor, the AMC and the mutual fund trust are involved in setting up a mutual fund business in India. They are supported by banks, registrars, transfer agents, depository participants and custodians to perform mutual funds activities smoothly.

On basis of structure Mutual funds can be classified into open ended and close ended funds. On basis of Portfolio Mutual funds can be classified as growth funds, Income funds, Balanced funds and money market mutual fund. On basis of geographical origin they can be called as Domestic funds and off shore funds. Specific funds are further classified as Index funds, gilt edged funds, ELSS funds, Real estate MFs, ETFs, Gold funds and fund of funds etc.

Dive Deeper:

Aadhar Card (आधार कार्ड) – Get Aadhaar Card Complete Information Online

Employees Provident Fund – EPF Interest Rate, Withdrawal, Passbook.

Saving Schemes: Types, Interest Rates & Comparisons

PAN Card – What is PAN, Documents, Eligibility, and How to Apply for PAN Card

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA