Employees Provident Fund – EPF Interest Rate, Withdrawal, Passbook.

- Blog|

- 17 Min Read

- By Taxmann

- |

- Last Updated on 5 September, 2023

Table of Content

- About Provident Fund

- How to Check PF Balance?

- Contribution to Provident Funds

- Taxability of Provident Funds

- Taxability of Premature Withdrawal from Provident Fund

- Conversion of Unrecognized PF to Recognized PF

- Different EPF Forms

- Details Required in EPF Claim Forms

- PF Account Number

- EPFO Online Claim in 2023

- FAQs on EPF Balance

1. About Provident Fund

1.1. Why are PF accounts operated?

The Provident Fund is a retirement savings strategy in which the employee and the employer contribute a fixed monthly sum. The amassed amount within this fund and the interest it accrues becomes accessible to the employee upon retirement. Nonetheless, under specific circumstances, employees can withdraw funds from their provident account before retiring. Two categories of provident funds exist: the Employee Provident Fund (EPF) and the Public Provident Fund (PPF).

Within the framework of the EPF system, a predetermined sum is subtracted from the employee’s monthly salary, and this sum is subsequently allocated to their provident fund account. Concurrently, the employer must contribute a designated monthly amount to the employee’s provident fund account.

The cumulative sum, which encompasses employee and employer contributions, is invested in Government Securities or retained within a bank. The interest accumulating from these investments is also appended to the employee’s account. As the contributions from both parties, alongside the interest, amass over time, the overall balance grows. This accumulated balance is disbursed to the employee upon their retirement or if they leave their position. In the unfortunate event of the employee’s demise, the accumulated balance is remitted to their legal beneficiaries.

1.2. Types of Provident Funds

1.2-1. Statutory Provident Fund

The Statutory Provident Fund was established under the Provident Fund Act of 1925. This fund is exclusively intended for individuals employed within Government or Semi-Government entities, local authorities, universities, recognised educational institutions, or railway systems.

1.2-2. Recognised Provident Fund

This is a provident fund that has been acknowledged and maintains its recognition by the Commissioner of Income-tax, adhering to the regulations outlined in Part A of the Fourth Schedule of the Income-tax Act. Additionally, it encompasses a fund established as per the Employees’ Provident Fund Act of 1952. These funds are upheld in banks, insurance companies, factories, and private sector businesses.

1.2-3. Unrecognised Provident Fund

Unrecognised Provident Funds lack recognition by the Commissioner of Income-tax, as outlined in the regulations in Part A of the Fourth Schedule of the Income-tax Act. Any private sector institution can uphold these funds.

1.2-4. Public Provident Fund

Participation in the Public Provident Fund (PPF) is open to any resident individual. Unlike the Employee Provident Fund (EPF), contributing to the PPF is a matter of personal choice, and only the individual can contribute to their PPF account. The sum deposited in PPF accounts qualifies for tax deduction under Section 80C, and the interest accrued on it is also exempt from taxation.

2. How to Check PF Balance?

There are multiple ways to check your PF balance, both with and without UAN. They are listed as follows:

- Using EPFO online portal

- Using UMANG mobile application

- EPF Balance Check using Mobile Number

- EPF Balance Check Through SMS Service

2.1 PF Balance Check Using EPFO Portal

To verify your EPF balance, ensure your employer has activated your Universal Account Number (UAN). The UAN is a distinctive identification number assigned to every employee participating in the EPF scheme. Regardless of the companies they transition between, employees should possess just one UAN throughout their professional tenure. The significance of the UAN stems from all procedures associated with EPF services being managed online. Thanks to the UAN, accessing various PF account services, including balance inquiries, withdrawals, and applying for EPF loans, has been simplified.

Once your UAN number is activated, follow these steps:

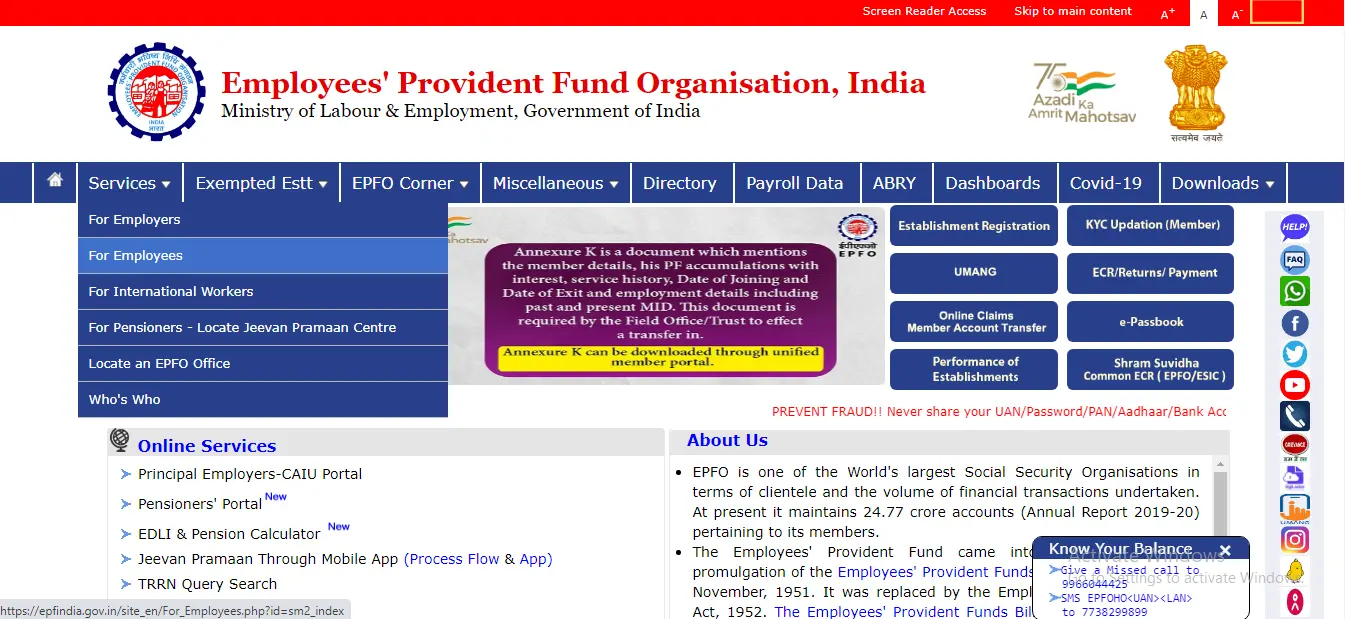

Step 1: Open the EPFO portal. Go to the ‘Our Services’ tab and select “For Employees” from the drop-down menu.

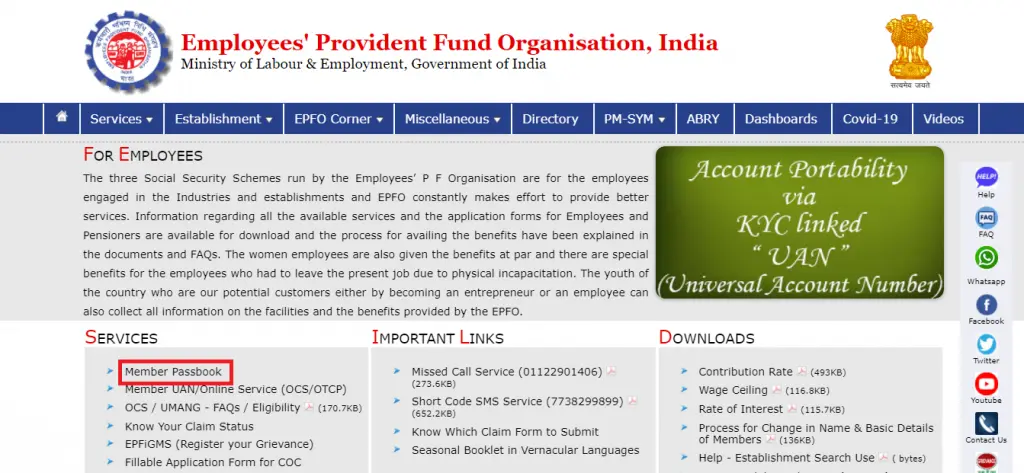

Step 2: Click the ” Member passbook” option under “Services.”

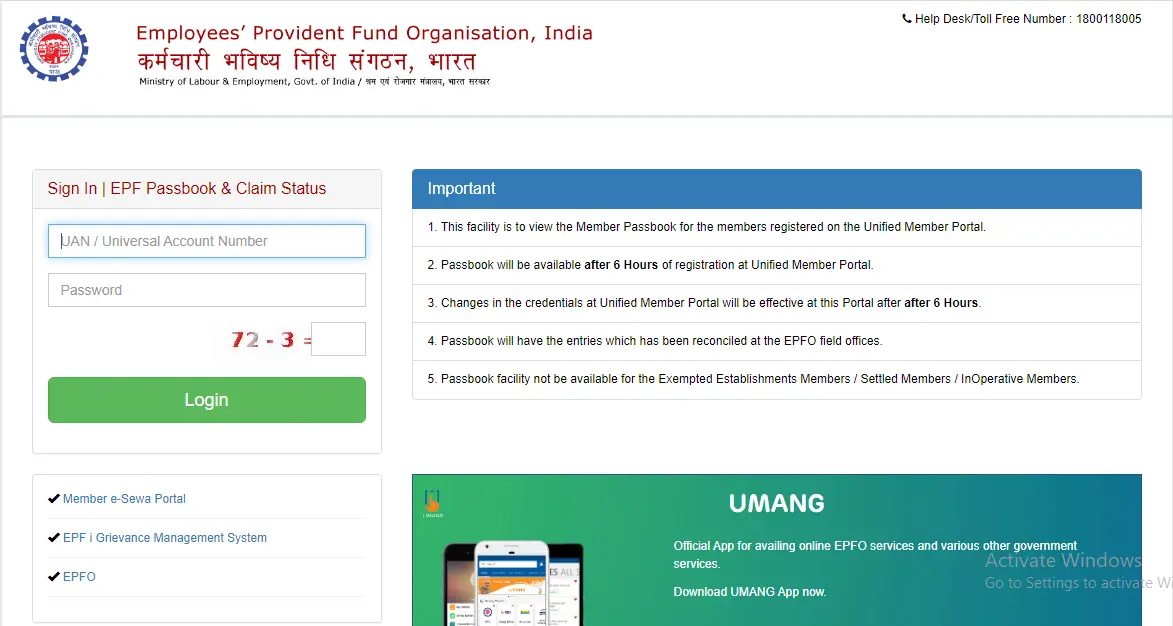

Step 3: Enter your UAN number and password here after it has been activated.

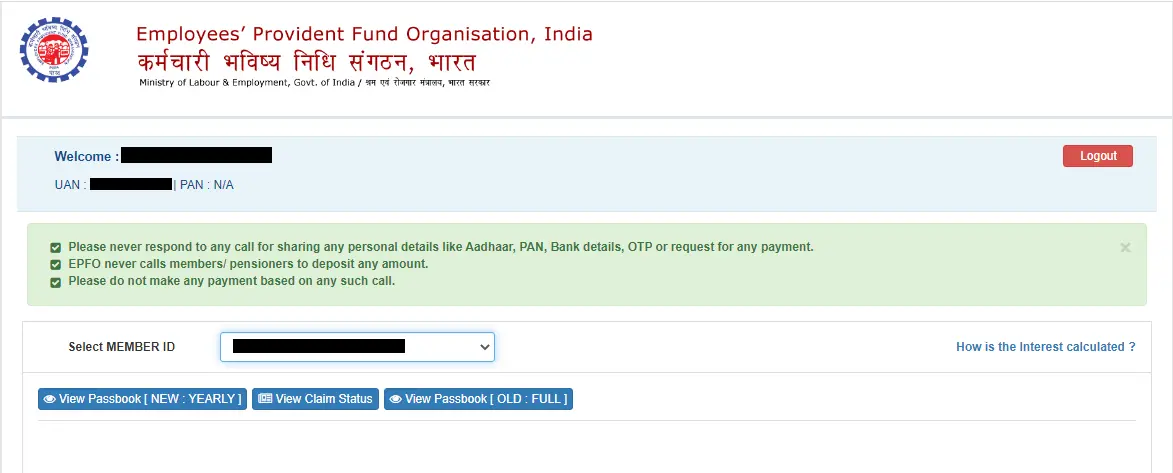

Step 4: Select the ‘Member ID’ and click the ‘View Password [Old: Full]’ option.

Step 5: The PF details will be displayed on the screen.

Step 6: You can download this passbook by clicking the ‘Download Passbook’ option.

2.2 PF Balance Check Using the UMANG/EPFO App

Workers can review their EPF balance using their mobile devices by installing the Unified Mobile Application for New-age Governance (UMANG) app. In addition to balance inquiries, this application facilitates the submission and monitoring of claims. Members must undergo a one-time registration procedure using their UAN-registered mobile number to utilise the app.

Here are the following steps mentioned to use the UMANG app to view your EPF transactions:

- Download the UMANG app from the Google Play Store or App Store.

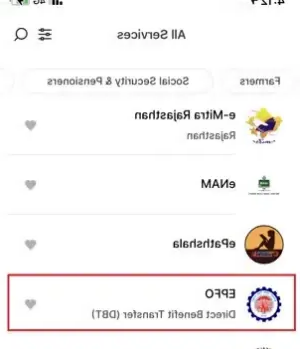

- Select the “EPFO” option under the ‘All Services’ tab.

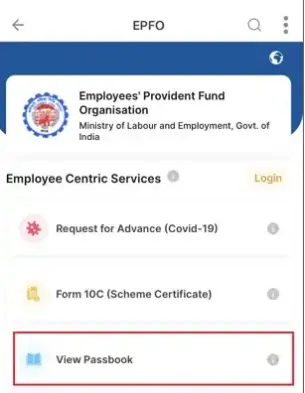

- Under ‘Employee Centric Service’, click on the ‘View Passbook.’

2.3 EPF Balance Check on Mobile Number

You can ascertain your EPF balance using the PF missed call service. Just provide a missed call to 9966044425 from the mobile number registered with your EPF account to retrieve your balance information.

Please remember that the employee’s Aadhaar Card, PAN, and bank account number must be securely linked with their UAN for this process.

2.4 EPF Balance Check Through SMS Service

When employees successfully activate their UAN, they can conveniently inquire about their balance through mobile SMS by sending a message to 7738299899. The SMS format should be EPFOHO UAN [preferred language]. The last three letters indicate the language preference, specifying the employee’s desired language for receiving the information.

This feature is accessible in various languages, including Marathi, Bengali, Kannada, Malayalam, Hindi, Tamil, Telugu, Gujarati, Punjabi, and English. Furthermore, the employee’s Aadhaar, PAN, and bank details must be linked to their UAN to utilise these services.

Dive Deeper:

Aadhar Card (आधार कार्ड) – Get Aadhaar Card Complete Information Online

PAN Card – What is PAN, Documents, Eligibility, and How to Apply for PAN Card

Saving Schemes: Types, Interest Rates & Comparisons

3. Contribution to Provident Funds

3.1. Who contributes to EPF?

3.1-1. In case of Government employee

Government employees do not contribute to EPF. Contribution to NPS Tier-I is mandatory for all Government servants joining Government service on or after 1-1-2004, whereas Tier-II will be optional. In Tier I, a Government servant must make a monthly contribution of 10% of his basic pay plus DA, which will be deducted from his salary. The Government will make an equal matching contribution.

3.1-2. In the case of Non-Government Employee

If an employee’s salary is less than Rs. 15,000, the employee and employer contribute equally to the provident fund account. If an employee’s salary exceeds Rs. 15,000, the employee shall not be obligated to contribute to his PF account. However, if the employee wishes to contribute to his PF account, the employer can deduct his contribution from his salary. This practice is generally followed in all companies for high-salary earners.

3.2. How much is to be contributed to EPF?

3.2-1. Employee’s Contribution

Employee shall contribute 12% of his salary, which shall be deposited entirely in his EPF Account.

3.2-2. Employer’s Contribution

The employer shall contribute 12.50% of the employee’s salary, which shall be utilised in the following proportion:

- 3.67% to be invested in Employee Provident Fund (EPF)

- 8.33% to be invested in Employee Pension Scheme (EPS)

- 0.5% to be invested in the Employees Deposit Linked Insurance Scheme (EDLS)

Employer also pays out from his pocket 0.50% of salary as EPF administrative charges to maintain the PF account of employees.

Note: Salary shall mean basic salary plus dearness allowance (if forms part of salary for computation of retirement benefits) and commission.

Every month, 15.67% of the salary (12% of the Employee’s and 3.67% of the Employer’s share) is deposited in the Employee Provident Fund Account. However, if the salary of an employee is more than Rs. 15,000 yet he chooses to contribute voluntarily to the provident fund, the employer will only contribute 8.33% of 15,000 (i.e. Rs. 1,250) to his EPS, and the balance goes into his EPF account. In other words, 8.33% of the lower Rs. 15,000 or salary is invested in EPS, and the remaining sum plus 3.67% of the salary is deposited in the employee PF account.

4. Taxability of Provident Funds

4.1. Employee’s Contribution

The amount contributed by an employee in his PF account is considered the application of income. Thus, no deduction is allowed for such contribution made by the employee from his salary. However, employees can claim a deduction under Section 80C for such contributions within the overall threshold limit of Rs. 1,50,000. The deduction is allowed only for contributions made in Recognized or Statutory Provident Funds.

4.2. Employer’s Contribution

Employer’s contribution, up to 12% of salary, in EPF account is not charged to tax in the hands of employees.

However, where the amount of aggregate contribution made by the employer to the account of the employee in a recognised provident fund in the National pension scheme referred under section 80CCD and in the approved superannuation fund exceeds Rs. 7,50,000, such excess shall be taxable as perquisites in the hands of the employee. Further, the annual accretion by way of interest, dividend or any other similar amount on such excess shall also be taxable as perquisites.

4.3. Interest on Accumulated Balance

Interest credited every year in the EPF or SPF account is also exempt from tax. However, if the provident fund pays interest above the notified rate, such excess interest is charged to tax.

Further, no exemption shall be allowed in respect of interest income accrued during the previous year in the EPF or SPF account to the extent it relates to the amount or the aggregate of amounts of the contribution made by the employee exceeding Rs. 2,50,000 in any previous year on or after 01-04-2021. The interest income accruing regarding the employee’s contribution over Rs. 2,50,000 shall be taxable under the head ‘Income from other sources’. However, if such a person has contributed to a fund in which there is no contribution by the employer, the limit of Rs. 2,50,000 shall be increased to Rs. 5,00,000. The method for the computation of such interest income has been prescribed under Rule 9D.

4.4. Withdrawal after 5 Years

The amount withdrawn from a recognised or statutory provident fund is exempt from tax if the amount is withdrawn on retirement or termination of a job after 5 years of service. In the case of unrecognised PF, the amount withdrawn to the extent of the employer’s contribution and interest is taxed as income from salary, and interest on the employee’s contribution is taxed as residuary income.

4.5. Withdrawal before 5 Years

If an employee has not rendered continuous service for 5 years, but his job is terminated because of his ill health or discontinuance of the employer’s business or reasons beyond the employee’s control, the amount withdrawn from the provident fund account will be tax-exempt. In other scenarios, the amount withdrawn from the account is charged to tax in the hands of the employees.

5. Taxability of Premature Withdrawal from Provident Fund

Withdrawal from a provident fund account before completing five years of service would have tax implications. Not only the amount received is charged to tax in the year of withdrawal, but all tax concessions availed by an employee in the years of contribution are also reversed. However, if the amount is withdrawn on the grounds of ill health or death or discontinuation of the business by the employer or if the entire balance is transferred to the employee’s NPS account under section 80CCD, the amount withdrawn shall be exempt from tax.

While calculating the number of 5 years, only those years shall be counted in which the employee has rendered his services and contributed to the Provident Fund account. If an employee leaves his job after 2 years and does not contribute to the PF account for the next 4 years, the tenure of the PF shall be counted as 2. In this situation, no tax exemption shall be given to the employee on withdrawal from the account.

5.1. Employer’s Contribution

Out of the total amount withdrawn, the amount equivalent to the contribution made by the employer in earlier years in the employee’s PF account is chargeable to tax as salary income in his hands.

5.2. Employee’s Contribution

Out of the total amount withdrawn, the amount equivalent to the contribution made by the employee in earlier years shall not be charged to tax if he has not claimed any Section 80C deduction in respect of such contribution. If Section 80C deduction is claimed for such contribution, the amount equivalent to the deduction claimed is taxable in the year of withdrawal.

5.3. Interest on Employer’s Contribution

Out of the total amount withdrawn, the amount equivalent to interest earned by the PF account on the contribution made by the employer in earlier years is chargeable to tax as salary income in the hands of the employees.

5.4. Interest on Employee’s Contribution

Out of the total amount withdrawn, the amount equivalent to interest earned by the PF account on the contribution made by the employee in earlier years is chargeable to tax as residual income in the hands of the employees.

5.5. Deduction of tax

If the total amount payable exceeds Rs. 50,000, tax shall be deducted from the total sum payable at the rate of 10% under Section 192A. However, if the employee does not furnish PAN, tax shall be deducted at the rate of 42.744%. The tax shall not be deducted in case of transfer of PF balance from one account to another PF account.

5.6. Section 89 Relief

As premature withdrawal from the provident fund account is taxable in the year of withdrawal, the employee can claim tax relief under Section 89.

6. Conversion of Unrecognized PF to Recognized PF

Where an unrecognised provident fund is accorded recognition by the Commissioner, the balance standing to the credit in such unrecognised provident fund before the date of recognition is transferred to the newly recognised provident fund.

6.1. Treatment of balance transfer

The amount so transferred is treated as if it was contributed to a recognised provident fund retrospectively from the date of institution of unrecognised provident fund. Thus, out of the balance so transferred, the aggregate of the employer’s contributions above 12% of salary and interest on the accumulated balance above the notified rate is deemed the income received by the employee in the previous year in which recognition takes place.

6.2. Treatment of balance not transferred

Any balance not transferred to a recognised provident fund is taxed on a payment basis. Repayment from an unrecognised provident fund to the extent of employer’s contribution and interest thereon is taxable under the head Salary, and interest on employee’s contribution is taxable under the head ‘Income from other sources‘.

6.3. Summary of taxability of contribution to provident funds

| Treatment of | Recognised Provident Fund (RPF) | Statutory Provident Fund (SPF) | Unrecognised Provident Fund (UPF) | Public Provident Fund (PPF) |

| Employer’s Contribution | Contribution up to 12% of basic salary + DA is exempt from tax. However, it shall be taxable in the following two scenarios:

(a) Any contribution above 12%; (b) Any contribution above Rs. 7,50,000[3] . |

– | Not Taxable | – |

| Employee’s Contribution | Eligible for deduction under Section 80C | Eligible for deduction under Section 80C | Not eligible for deduction under Section 80C | Eligible for deduction under Section 80C |

| Interest earned on PF | Exempt from tax. However, it shall be taxable in the following two scenarios:

(a) Interest above the notified rate; (b) Interest relating to the employee’s contribution above Rs. 5 lakh, in case the employer does not contribute; (c) Interest relating to the employee’s contribution above Rs. 2.5 lakh, in case the employer has also contributed to the fund. |

Exempt from tax. However, it shall be taxable in the following scenarios:

(a) Interest relating to the employee’s contribution above Rs. 5 lakh, in case no contribution is made by the employer; (b) Interest relating to the employee’s contribution above Rs. 2.5 lakh, in case the employer has also contributed to the fund. |

Not taxable at the time of accrual | Exempt from tax |

| Withdrawal after 5 years | Exempt from tax | Exempt from tax | Aggregate of the following shall be taxable:

(a) Employer’s contribution; (b) Interest on employer’s contribution; and (c) Interest on employee’s contribution |

Exempt from tax |

| Withdrawal before 5 years | Total income is computed as if the fund is not recognised from the beginning. | Exempt | Aggregate of the following shall be taxable:

(a) Employer’s contribution; (b) Interest on employer’s contribution; and (c) Interest on employee’s contribution |

– |

7. Different EPF Forms

Given in the table below are the different EPF Forms that are available:

| Form Name | Purpose |

| Form 19 | Used for settling a member’s final Provident Fund (PF) account. |

| Form 10C | Used to claim a scheme certificate or withdrawal benefits under the Employees’ Pension Scheme of 1995 (EPS’95). |

| Form 10D | Used to claim pension benefits. |

| Form 20 | Utilised by legal heirs or nominees to claim the PF balance in the event of the EPF member’s demise. |

| Form 51F | Employed by the legal heirs or nominees to claim the assurance benefit under the Employees’ Deposit Linked Insurance Scheme of 1976 (EDLI’76). |

| Form 31 | Used to claim advances or temporary withdrawals per the Employees’ Pension Scheme of 1952 (EPS’52). |

| Form 13 | Used for transferring PF or pension funds from one account to another. |

| Form 14 | Used for financing a life insurance policy through funds from the PF account. |

8. Details Required in EPF Claim Forms

Each category of the EPF claim forms necessitates employees to input distinct particulars. We have elucidated the specific details that are required to be filled out in each of these forms:

8.1 PF Withdrawal Form 19

The PF member should complete Form 19 to facilitate the ultimate closure of their PF account. This form is typically essential when a member departs from their job, retires, or experiences termination from employment due to factors such as illness. The subsequent information must be provided when completing this form-

- PF account number

- Bank account number

- IFSC code

- Date of Joining the organisation

- Date of leaving the organisation

- PAN

- Form 15G/15H (for senior citizens and members under income tax limit)

8.2 EPF Form 10C

To avail themselves of the benefits under the Employee Pension Scheme (EPS), employees need to furnish Form 10C. This form is necessary to request a refund of the employer’s EPS contribution and to secure the scheme certificate, which enables the retention of membership or withdrawal benefits. The ensuing particulars are essential for completing Form 10C-

- Name and address of the last employer

- PF account number

- Last working day with the current employer

- Full postal address

- Bank account details

Note that the above details need to be filled only in the first 2 out of 4 total pages in the form. The third page requires details of any advances you might have taken, and the last page is for administration purposes only.

8.3 Form 10D

This document needs to be completed to request pension benefits. It’s important to note that the pension benefits apply to only one of the following categories: an EPF member, an orphan, a widow, a widower, or a specifically nominated individual. The subsequent information is necessary for the submission of Form 10D-

- Name and address of the last employer

- PF account number

- Last working day with the current employer

- Full postal address

- Bank account details

- IFSC code

- Date of Joining the organisation

- PAN

- Form 15G/15H (for senior citizens and members under income tax limit)

8.4 Form 20

Form 20 serves the purpose of claiming PF (Provident Fund) on behalf of the nominee in the event of the unfortunate passing of the PF member. Therefore, this form must be completed by either a family member or the nominated individual as specified by the PF member’s last employer. The subsequent information needs to be furnished within this form-

- Name and address of the last employer

- PF account number

- Last working day with the current employer

- Full postal address

- Bank account details

- IFSC code

- Date of Joining the organisation

- PAN

- Form 15G/15H (for senior citizens and members under income tax limit)

Note that the nominee should also provide the above details in the form.

8.5 Form 51F

To receive the benefits of Employees’ Deposit Linked Insurance (EDLI), Form 51F needs to be submitted. This form should be completed by the nominee or legal heir of the EPF member. The subsequent information must be supplied as part of this process-

- Name and address of the last employer

- PF account number

- Last working day with the current employer

- Full postal address

- Bank account details

- IFSC code

- Date of Joining the organisation

- PAN

- Form 15G/15H (for senior citizens and members under income tax limit)

Note that the nominee/legal heir of the EPF member must also provide a few details about themselves while submitting this form.

8.6 EPF Withdrawal Form 31

EPF members are required to submit Form 31 when seeking advances from their PF balance. To claim these advances, employees need to provide the subsequent details as part of the process.-

- Composite Claim Form

- Identity Proof

- Address Proof

- Two revenue stamps

- One blank and cancelled cheque (should have visible IFSC and account number)

- Bank account statement (in the name of the EPF holder while they are alive)

- Personal details such as

- Father’s Name

- Date of birth

- ITR Forms 2 and 3, only if the employee withdraws his EPF corpus before 5 years of continuous service (This is required as proof of detailed breakup of the amount deposited in the PF account every year)

8.7 Form 14

Submitting this form by the PF member is necessary to fund a life insurance policy using funds from their PF account. The subsequent details need to be furnished as part of this process-

- Amount to be insured

- PF Account number

- Account balance

- LIC office address

- Other details about the life insurance plan

8.8 PF Form 13

PF Form 13 is designated to request the transfer of EPF from a previous employer to a new one. Whenever an employee changes jobs, transferring the PF account from the former employer to the current one is essential. To initiate this process, the employee is required to complete Form 13, providing the subsequent details-

- Employee’s Name

- Father’s/Husband’s Name of the employee

- Name and address of the previous employer

- PF account number with the previous employer

- Details of who maintained the EPF account in the previous organisation

- Date of Joining the organisation

- Date of leaving the organisation

- Date on which Form 13 is being filled and submitted

9. PF Account Number

The PF account number, also called the employee’s provident fund account number, is an allocated account identifier for employees. This number facilitates checking the status of their EPF account, reviewing the available balance, and more. Employees must possess the PF account number to withdraw from their EPF account.

9.1 How to get the PF Account Number ?

The implementation of the Universal Account Number (UAN) has greatly simplified the process of identifying the PF account number. UAN is an exclusive identification number assigned to each PF account holder and remains valid throughout their lifetime. As implied by its name, the UAN is distinct for each employee. Retrieving the UAN is effortless for employees – they can contact their employers. These are available methods to determine the PF account number:

- Visit the EPFO office– Employees can visit the EPFO office and get their UAN by visiting the EPF office and submitting their personal details to find their PF number or UAN. Presenting the identity proof and application form at the office is essential.

- Use the UAN Portal– Employees who know their UAN can easily find the PF account number by logging in to the EPFO portal.

- Contact the employer– Employees can also directly contact their employer (HR) to request the PF account number.

- Look at the salary slip– In most cases, the employers mention the PF account number on the employee’s salary slip.

9.2 How does the PF Account Number look like- PF Account Number Format

The PF account number is alphanumeric. It includes the details of the EPF account office that handles the operations of the employee’s EPF account and the organisation’s code. Here’s the standard format of a PF account number- TN MAS 054110 000 0054321

Here,

- The first two letters (TN) represent the state, Tamil Nadu, in this case

- The next three alphabets (MAS) represent the regional office; Chennai, in this case

- The first 7 numbers (054110 0) represent the establishment ID

- The next 3 numbers (00 0) represent the extension code of the establishment ID

- The last 7 numbers (054321) represent the actual PF account number

Note that-

- The establishment code can be a maximum of 7 numbers and not more

- For most employers, the establishment ID is unavailable; hence, an extension code would not be present. Only big organisations have an establishment ID; therefore, they have an extension code

- The PF account number can be a maximum of 7 digits and not more

10. EPFO Online Claim in 2023

In 2023, the procedure for claiming EPF online via the EPFO portal is straightforward. Here is a systematic guide to assist you through the process:

- Access the EPFO portal and navigate to the Member e-Sewa portal.

- Log in to your account using your UAN (Universal Account Number), password, and Captcha code for verification.

- Once logged in, click the ‘Online Services’ tab and select ‘Claim (Form-19, 31, 10C & 10D).’

- A new webpage will open, prompting you to provide your bank account details associated with your UAN. Ensure that you enter the correct bank account number.

- Click on the ‘Verify’ button to proceed.

- Once your bank account details are verified, you will be presented with the terms and conditions provided by EPFO. Carefully read and acknowledge them.

- Choose ‘Proceed For Online Claim’ to continue.

- On the next page, you will see a dropdown menu where you need to select the appropriate reasons for claiming EPF. The available options will be based on your eligibility.

- After selecting the reasons for withdrawal or advance, provide your address details as required.

- If you are applying for an advance, specify the amount and follow EPFO’s instructions to upload the necessary supporting documents.

- Review all the information provided and ensure its accuracy. Accept the terms and conditions by clicking on the relevant checkbox.

- Choose ‘Get Aadhaar OTP’ to initiate the verification process.

- An OTP (One-Time Password) will be sent to your registered mobile number linked with your Aadhaar card. Enter the OTP in the designated field.

- After successfully entering the OTP, your online EPF claim will be submitted for processing.

11. FAQs on EPF Balance

1. After registering for the Universal Account Number (UAN), how long does it take for individuals to begin receiving their EPF balance via SMS ?

Following the registration of their UAN on the Employees Provident Fund Organisation (EPFO) portal, individuals can receive their EPF balance through SMS after 48 hours.

2. Where can individuals obtain their UAN ?

Individuals can get their UAN from their employers, or it can be found on the salary slip.

3. Who should individuals contact for inquiries about UAN and Know Your Customer (KYC) ?

Regarding UAN and KYC queries, individuals can call EPFO Toll Free No. 1800 118 005.

4. Can apprentices become members of the EPF (Employees’ Provident Fund) ?

Apprentices are not eligible to be EPF members during their apprenticeship period. Nonetheless, once their apprenticeship concludes, they can be EPF members.

5. Do individuals need to compulsorily register their mobile number on the EPFO portal to receive their EPF balance through SMS ?

The ability for individuals to receive their EPF balance via SMS is contingent upon them linking their mobile number on the UAN portal.

6. What documents can be submitted for KYC ?

Bank account number

Permanent Account Number

Aadhaar

Passport

Election card

National Population Register

Driving License

7. What is the process to inquire about my EPF balance through a missed call ?

Yes, you can ascertain your EPF balance by simply giving a missed call to 011-22901406 using your registered mobile number.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA