MCQs on Financial and Strategic Management | Leverage

- Other Laws|Blog|

- 5 Min Read

- By Taxmann

- |

- Last Updated on 30 July, 2022

Table of Contents:

1. Practical Problem & Solution

1.1 MCQs ON THEORY

2. MCQs ON THEORY ( With Answer Key )

2.1 PRACTICAL MCQs

2.3 HINTS FOR IMPORTANT PRACTICAL MCQs

1. Practical Problem & Solution

Problem No. 1] Prepare the income statement and calculate the degree of operating leverage, degree of financial leverage, and the degree of combined leverage for the following companies:

| Company | P | Q | R |

| Output (units) | 3,00,000 | 75,000 | 5,00,000 |

| Fixed costs (Rs.) | 3,50,000 | 7,00,000 | 75,000 |

| Unit variable cost (Rs.) | 1.00 | 7.50 | 0.10 |

| Interest expenses (Rs.) | 25,000 | 40,000 | 25,000 |

| Unit selling price (Rs.) | 3.00 | 25.00 | 0.50 |

Applicable tax rate is 35%.

Ans.: Statement showing income & leverage of each company:

| Particulars | P | Q | R |

| Output (units) | 3,00,000 | 75,000 | 5,00,000 |

| Sales | 9,00,000 | 18,75,000 | 2,50,000 |

| Variable cost | (3,00,000) | (5,62,500) | (50,000) |

| Contribution | 6,00,000 | 13,12,500 | 2,00,000 |

| (-) Fixed cost | (3,50,000) | (7,00,000) | (75,000) |

| Earnings before interest & tax (EBIT) | 2,50,000 | 6,12,500 | 1,25,000 |

| (-) Interest | (25,000) | (40,000) | (25,000) |

| Earnings before tax (EBT) | 2,25,000 | 5,72,500 | 1,00,000 |

| (-) Tax @ 35% | (78,750) | (2,00,375) | (35,000) |

| Profit after tax (PAT) | 1,46,250 | 3,72,125 | 65,000 |

| Operating Leverage = | 2.40 | 2.1429 | 1.60 |

| Financial Leverage = | 1.11 | 1.0699 | 1.25 |

| Combined Leverage = | 2.67 | 2.2926 | 2.00 |

| Or (Operating Leverage × Financial Leverage) |

Problem No. 2] The capital structure of a company consists of the following securities.

| Rs. | |

| 10% Preference Share Capital | 1,00,000 |

| Equity Share Capital (Rs. 10 Shares) | 1,00,000 |

| 12% Debenture | 75,000 |

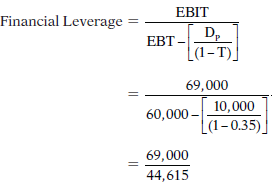

The amount of operating profit is Rs. 69,000. The company is in 35% tax bracket.

You are required to calculate the financial leverage of the company.

Ans.:

| Operating Profit (EBIT) | 69,000 |

| (-) Interest | (9,000) |

| Earnings before tax (EBT) | 60,000 |

| (-) Tax @ 35% | (21,000) |

| Profit after tax (PAT) | 39,000 |

If there are preference shares in capital structure then following formula has to be used to calculate the financial leverage.

= 1.5466

Problem No. 3] A company has the following capital structure

| Rs. | |

| 10,000 Equity Share of Rs. 10 each | 1,00,000 |

| 2,000 10% Preference Share of Rs. 100 each | 2,00,000 |

| 2,000 10% Debentures of Rs. 100 each | 2,00,000 |

Calculate the EPS for each of the following levels of EBIT:

(i) ` 1,00,000

(ii) ` 60,000 and

(iii) ` 1,40,000

The company in 50% tax bracket.

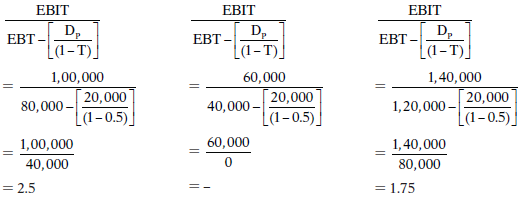

Calculate the financial leverage taking EBIT level under (i) base.

Ans.:

| Particulars | I | II | III |

| EBIT | 1,00,000 | 60,000 | 1,40,000 |

| (-) Interest | (20,000) | (20,000) | (20,000) |

| Earnings before tax (EBT) | 80,000 | 40,000 | 1,20,000 |

| (-) Tax @ 50% | (40,000) | (20,000) | (60,000) |

| Profit after tax (PAT) | 40,000 | 20,000 | 60,000 |

| (-) Preference dividend | (20,000) | (20,000) | (20,000) |

| Profit available for equity shareholders | 20,000 | – | 40,000 |

| No. of equity shares | 10,000 | 10,000 | 10,000 |

| EPS

(Profit available for equity shareholders/No. of shares) × 100 |

2 | – | 4 |

Computation of financial leverage under different level of EBIT:

Problem No. 4] The following data relate of company XYZ Ltd.

| Rs. | ||||

| Sales | 2,00,000 | |||

| Less: | Variable expenses (30%) | (60,000) | ||

| Contribution | 1,40,000 | |||

| Fixed operating expenses | (1,00,000) | |||

| EBIT | 40,000 | |||

| Less: | Interest | (5,000) | ||

| Taxable income | 35,000 |

(a) Using the concept of operating leverage state by what percentage will EBIT increase if there is a 10 per cent increase in sales?

(b) Using the concept of financial leverage, state by what percentage will taxable income increase if EBIT increases by 6%?

(c) Using the concept of combined leverage, State by what percentage taxable income will increase if sales increase by 6%.

Ans.:

| Operating Leverage = | = | = 3.5 | ||

| Financial Leverage = | = | = 1.1429 | ||

| Combined Leverage = | = | = 4.0 |

(1) Operating leverage is 3.5, this means that 1% change in sales will cause 3.5% change in EBIT.

(2) Financial leverage is 1.1429, this means that 1% change in EBIT will cause 1.1429% change in EBT.

(3) Combined leverage is 4, this means that 1% change in sales will cause 4% change in PAT/EPS.

Thus, answers to questions asked are follows:

(a) If there is a 10% increase in sale, EBIT increase by 35% (10 × 3.5). Concept of operating leverage applied.

(b) If EBIT increases by 6% taxable income increase by 6.9% (6 × 1.15). Concept of financial leverage applied.

(c) If sales increase by 6% taxable income will increase by 24% (6 × 4). Concept of combined leverage applied.

Problem No. 5] The balance sheet of Alpha Company is given below:

| Liabilities | Rs. | Assets | Rs. |

| Equity Capital (Rs. 10 per share) | 90,000 | Net Fixed Assets | 2,25,000 |

| 10% Long Term Debt | 1,20,000 | Current Assets | 75,000 |

| Retained Earnings | 30,000 | ||

| Current Liabilities | 60,000 | ||

| 3,00,000 | 3,00,000 |

The company’s total assets turnover ratio is 3, its fixed operating cost is Rs. 1,50,000 and its variable operating cost ratio is 50%. The income-tax rate is 50%.

Required to:

(i) Calculate the different type of leverages for the company.

(ii) Determine the likely level of sales & EBIT if EPS is:

(a) Rs. 1 (b) Rs. 2 (c) Rs. 0

Ans.:

Assets Turnover Ratio = ![]()

3 = ![]()

Sales = 9,00,000

| Sales | 9,00,000 |

| (-) Variable cost | (4,50,000) |

| Contribution | 4,50,000 |

| (-) Fixed cost | (1,50,000) |

| Earnings before interest & tax (EBIT) | 3,00,000 |

| (-) Interest | (12,000) |

| Earnings before tax (EBT) | 2,88,000 |

| (-) Tax @ 50% | (1,44,000) |

| Profit after Tax (PAT) | 1,44,000 |

| Operating Leverage = | Contribution/EBIT | = | 4,50,000/3,00,000 | = 1.5 |

| Financial Leverage = | Contribution/EBIT | = | 3,00,000/2,88,000 | = 1.042 |

| Combined Leverage = | Contribution/EBIT | = | 4,50,000/2,88,000 | = 1.5625 |

Statement showing the likely level of sales & EBIT if EPS is 1, 2 & 0:

| Sales |  |

3,60,000 | 3,96,000 | 3,24,000 |

| (-) Variable cost (@ 50% of sales) | (1,80,000) | (1,98,000) | (1,62,000) | |

| Contribution | 1,80,000 | 1,98,000 | 1,62,000 | |

| (-) Fixed cost | (1,50,000) | (1,50,000) | (1,50,000) | |

| Earnings before interest & tax (EBIT) | 30,000 | 48,000 | 12,000 | |

| (-) Interest | (12,000) | (12,000) | (12,000) | |

| Earnings before tax (EBT) | 18,000 | 36,000 | 0 | |

| (-) Tax @ 50% | (9,000) | (18,000) | 0 | |

| Profit after tax (PAT) | 9,000 | 18,000 | 0 | |

| No. of shares | 9,000 | 9,000 | 9,000 | |

| EPS | 1 | 2 | 0 |

Perform reverse working downward to upward.

Problem No. 6] Calculate operating leverage and financial leverage under situations A, B and C and financial Plans I, II, and III respectively from the following information relating to the operating and capital structure of XYZ Co. Also find out the combinations of operating and financial leverages which give the highest value and the least value. How are these calculations useful to the financial manager in a company?

| Installed capacity | 1,200 units | ||

| Actual production & sales | 800 units | ||

| Selling price per unit | Rs. 15 | ||

| Variable cost per unit | Rs. 10 | ||

| Fixed Cost: | |||

| Situation A | Rs. 1,000 | ||

| Situation B | Rs. 2,000 | ||

| Situation C | Rs. 3,000 |

| Capital Structure: | Financial Plan I | Financial Plan II | Financial Plan III | ||

| Equity | Rs. 5,000 | Rs. 7,500 | Rs. 2,500 | ||

| Debt | Rs. 5,000 | Rs. 2,500 | Rs. 7,500 | ||

| Cost of debt | 12% | 12% | 12% |

Ans.: Sales – Variable Cost = Contribution; 15 – 10 = 5

|

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.  Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava. The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

Everything on Tax and Corporate Laws of IndiaTo subscribe to our weekly newsletter please log in/register on Taxmann.com |

CA | CS | CMA

CA | CS | CMA