Manual vs Computerised Accounting – Features and Comparison

- Blog|Account & Audit|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 11 June, 2025

Manual Accounting is the traditional method of recording financial transactions by hand in physical books or registers. It involves processes such as journal entries, ledger posting, preparation of trial balance, and financial statements—all performed manually by accountants. This method is time-consuming, prone to human error, and requires significant storage space for physical records. Computerised Accounting, on the other hand, uses accounting software and digital tools to record, process, and report financial data. Once a transaction is entered through a voucher, the system automatically posts it to relevant ledgers, generates trial balance, profit & loss accounts, balance sheets, and other financial reports. It ensures greater speed, accuracy, scalability, and instant data retrieval, though it requires technical infrastructure and trained personnel.

Table of Contents

- Manual v. Computerised Accounting

- Advantages of the Computerised Accounting System

- Limitations of Computerised Accounting System

- Grouping of Accounts

- Basis of Grouping

- Format for Profit and Loss Account

- Format for Balance Sheet

Check out Taxmann's Financial Accounting which offers a comprehensive and updated coverage of financial accounting principles, fully aligned with the latest UGCF and NEP guidelines. Authored by Bhushan Kumar Goyal and Dr H.N. Tiwari, it is tailored to the University of Delhi's syllabus (including NCWEB and SOL) but remains equally relevant for universities across India. Divided into two volumes, the book provides a learner-centric approach with numerous solved illustrations, practical assignments, and recent exam question papers. Volume I emphasises theoretical clarity, while Volume II delivers extensive practice, ensuring a thorough grasp of Ind AS, GST, and related standards. Ideal for undergraduates, postgraduates, professionals, and faculty, it seamlessly blends theory with problem-solving techniques.

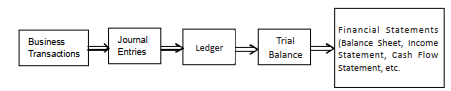

Accounting is a necessary function for all the business concerns be it a trading concern, manufacturing concern or a service provider. It is the method in which financial information is gathered, processed and summarised into financial statements and reports that provides information for decision making. The process of accounting can be explained with the help of the following diagram:

Process of Accounting

With the increasing number of transactions (for the business concerns), the manual method of keeping and maintaining records has become unmanageable. That is why, firms are replacing manual method of accounting by computerised accounting. Now, with the help of computers and accounting software, the accountants just need to do the voucher entry. The computer takes care of posting these entries to the respective ledgers and prepares Trial Balance, Profit and Loss Account, Balance Sheets, and calculates major financial ratios with a great speed and accuracy. The accounting programs carry out functions such as invoicing, dealing with payments, paying wages and provides regular accounting reports such as Trading and Profit and Loss account, Balance Sheets, etc. They provide instant reports like Stock valuation, Sales analysis, VAT returns, Budget analysis, etc. to the managers for decision making.

If we take it as an information system, it is one of the transaction processing systems that is concerned with financial transactions of a business enterprise only. It is concerned with data entry, data validation (ensuring accuracy and reliability of data), processing and revalidation (ensuring valid data has been fed to the system), storage, information generation and reporting it to the people concerned. It is a computer based information system as it uses both human resources and computer resources for generation of the information.

1. Manual v. Computerised Accounting

The manual accounting system starts with book keeping. We prepare journal book, sales book, purchase book, cash book, etc. Then we open accounts with their opening balances (if any).

We pass journal entries for the transactions that take place during an accounting year and then these journal entries are posted in their respective ledgers. To check the accuracy of the accounts a trial balance is prepared. Then we pass adjustment entries and prepare Trading and Profit and Loss Account and a Balance sheet. To analyse the performance, we calculate various financial ratios. All the steps explained above are performed by the human beings and hence, it is prone to errors.

In computerised accounting system, the entire lengthy process of a manual accounting is reduced to the following four steps:

- Creation of a Company – At this step, the basic information about the company is fed in the software and the configuration is set as per the business process of the company (it is explained with the help of Tally later).

- Creations of Groups – At this step, various groups are created for the accounts and the inventories. In accounting software packages generally the groups are defined but they also allow creation of new groups (if required).

- Ledger creation – After the groups are defined we need to create various ledgers in different groups. For example individual ledger accounts of different debtors are created under the group ‘debtors’. The above explained three steps are required for the first time only. Unless a new group or a new ledger is required the accountants continue working with these groups and ledgers.

- Voucher Entry – Voucher entry is the last step in the computerised accounting system. The computerised ledgers are fully integrated. When a business transaction is inputted on the computer through various vouchers, it is recorded in all the respective ledgers automatically. After the voucher entry is done all other functions like summarising the ledgers, preparation of trial balance, profit and loss account and balance sheet is done by the computer on its own after every transaction. The difference between the manual accounting system and computerised accounting system is explained below with the help of the following table:

Difference between manual accounting and computerised accounting system.

| Basis | Manual Accounting System | Computerised Accounting System |

| Recording | The financial transactions are recorded through the books of original entry | The financial transactions are stored in a well-designed database. |

| Classification | The transactions recorded in the books of original entry are posted into respective ledger accounts. | The ledger accounts are produced, after processing the transactions stored in the database, in the form of a report. |

| Summarising | The ledgers are summarised (and their balances are ascertained) to prepare the trial balance | The computer does not generate ledger accounts to prepare trial balance. It automatically generates trial balance as a report. |

| Adjustment entries | To Adhere to the matching concept, the adjusting entries are passed. | In computerised accounting system, there is nothing like adjustment entries for errors and rectification. |

| Trial Balance for Financial Statements | The trial balance is required for the preparation of financial statements. | The financial statements are prepared by the computer independent of availability of trial balance. |

In nutshell, we can say that in computerised accounting system, voucher entry is the end of the accounting process.

2. Advantages of the Computerised Accounting System

The computerised accounting system offers various advantages to the business organisations in handling a large number of transactions that a modern business organisation is expected to deal with. There are three major advantages that a computerised accounting system offers speed, accuracy and instant reports.

- Speed – When manual accounting system is adopted each and every transaction which is passed in the books of account is required to be posted in the respective ledger accounts manually by the accountant. With volumes of transactions, their process requires a good amount of time and accounting staff. But, with a computerised accounting system as the voucher entry is completed the accounting process is over and the software takes care of other functions that reduces time and staff requirement.

- Accuracy – In manual accounting system, the recording, classifying, and summarising functions are performed manually by the human beings which is error prone. But in case of computerised accounting system there is lesser or negligible room for errors as only one entry has to be passed and other functions are automatically performed by the computer system.

- Instant Reports – As compared to manual system, it is easier to produce the end of the period reports like profit and loss account, balance sheet, etc. As soon as an entry is passed, the software reflects its impact in profit and loss account and in the balance sheet. Therefore, after every transaction the reports can be generated and printed with click of a mouse. There are several other advantages also of using computerised accounting system.

- Reduced Paperwork – By adopting computerised accounting system, the transactions are stored on hard disk unlike manual accounting system in which volumes of accounting records in paper form are kept that requires huge storage space. Also the retrieval of transaction details are easier in computerised accounting system than manual accounting system.

- Up-to-date Information – The accounting records are automatically updated and therefore, the various ledger balances like customer’s accounts, etc. remain up to date. The balances can be known just with a click of mouse within seconds.

- Lower Cost – The cost of maintaining books of account under computerised accounting system is very low as compared to the cost of processing and storing accounting data in manual accounting system.

- Management Information – The managers can have accounting information as and when required to monitor and control the business activities. For example, they can have information about the debtors whose balances are overdue and can take some decisions to recover the amount (may be by offering some more discount, etc.)

- Scalability – The computerised accounting system easily adopts to the present and future needs of the business enterprise irrespective of the size and the business process of the firm. The requirement of additional manpower with growth of the firm is restricted to only the data operators required for storing additional vouchers.

- Online Processing – Computerised accounting system offers online processing facility to store and process the accounting data. It also facilitates online retrieval of information and viewing financial reports.

- Security – Under manual accounting system it is very difficult to secure business information from unauthorised access. But in computerised accounting system. With the password protection facility, only the authorised persons can access the accounting data and hence, it brings security to the accounting information of the business.

3. Limitations of Computerised Accounting System

The computerised accounting system also suffers from the following limitations:

- Human errors – The computerised accounting system is dependent upon the human beings who deal with it. The computer do not possess any IQ and therefore the old saying relating to the computers “garbage-in-garbage-out” also applies to computerised accounting system. If the accountant makes mistakes the computer cannot correct that on its own.

- High cost – The purchasing and maintenance cost of computerised accounting packages are still very high. Also, the organisations need to spend to train their employees to deal with these packages.

- Security threats – In spite of the fact that almost all the computerised accounting packages come with user Id and password protection facility, the hackers had intruded and had unauthorised access of computerised data of small business. This point is based on the reports of Kiplinger Magazine.

- Power supply – The computerised accounting packages run on computers that requires constant power supply. In absence of power supply, the accounting function is not possible to take place.

4. Grouping of Accounts

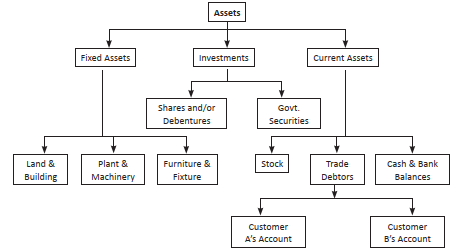

Classification of accounts (ledgers) on the basis of some common characteristics) is known as grouping. The grouping is at centre stage in developing a well-structured, flexible and informative accounting system. The objective of grouping is to have a control over the subsidiary ledgers and to provide quick information and expedite reporting.

For example “Trade Debtors” is a group of the ledgers of the customers who have bought from us on credit. The sum of the ledger balances of all the customers gives the amount of total debtors that can be used in framing policies to manage and control debtors.

There are four objectives of grouping the ledgers.

- Summarisation – Grouping helps in finding out the sum of ledger balances in a group that helps managers taking control actions.

- Accounting analysis and control – In accounting analysis the groups are decomposed to understand and analyse the formation of the group. For example, a group named “Sales” will show overall sales made by the organisation but decomposing the total sales into various regions will help managers analyse performance of regional offices and in taking corrective measures, if the actual performance deviates from the standards set for the regional office.

- Reconciliation – Grouping helps in reconciliation of improperly posted transactions as, when the periodic balances of the groups are taken the total of individual ledgers do not match and the corrective entries are passed to correct the errors. The grouping is core of a computerised accounting system. When in the later sections the computerised accounting will be discussed with the help of a software you will find and understand the importance of grouping. By grouping the accounts we can form “accounting tree structure” which is used in both manual as well as computerised accounting system. Before forming an accounting tree one should know about, Super-group, Sub-group and relationship between the Super-group and Sub-group.

- Super Group – A super-group consists of a number of sub-groups. It is created on the basis of some common characteristic(s) of a group of accounts. For example, fixed assets, current assets, etc.

- Sub-group – A group when becomes a part of another group it becomes a sub-group. For example, the current assets is a super-group or group for debtors, cash, inventories, etc. but when we take assets as super-group it becomes a sub-group as assets consists of current assets, fixed assets, investments, etc.

- Relationship – The relationship between a super-group and a sub-group is of a parent and a child. A super-group may include many sub-groups but a sub-group cannot belong to more than one super-group, just like a parent who can have many children but the same child cannot have many parents.

In fact, this relationship forms an accounting tree.

To illustrate the above discussed concepts an accounting tree has been produced here for assets.

Accounting tree for assets

The above accounting tree is for illustrative purpose only. It may include many more accounts and levels of super-groups and sub-groups.

In the above accounting tree ‘Assets’ is a super-group as well as Parent for ‘Fixed assets’, ‘investments’, and ‘current assets’ which are sub-groups and children of ‘Assets’. But for land and building, Plant and Machinery and Furniture and Fixture the ‘Fixed Assets’ becomes super-group and parent for these accounts. These three accounts are now sub-group and children of fixed assets. The other relationships can also be read in the same manner.

5. Basis of Grouping

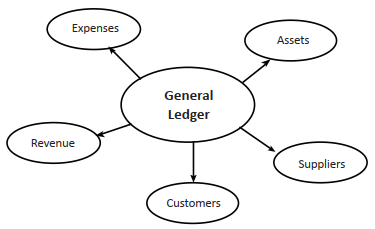

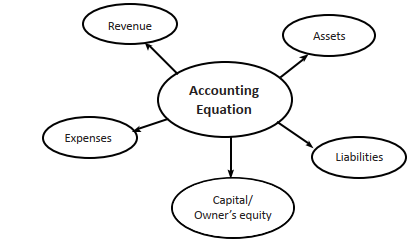

There are three different approaches (basis) that are used to group the accounts General Ledger approach, Accounting Equation approach and accounting reports.

The first two groupings are shown below by way of the following two diagrams.

General Ledger Approach

Accounting Equation Approach

Accounting equation

Assets = Capital + Liabilities

The third approach which is based on the financial reports consists of Profit and Loss account and Balance Sheet because of their information interdependence. In such system each account belongs to a particular section of these reports. To understand the grouping hierarchy, the schedule of Profit and Loss Account and Balance Sheet is produced here.

6. Format for Profit and Loss Account

Profit and Loss Account

of M/s …………

for the year ended ……

| Expenses | Amount (`) | Revenues | Amount (`) |

| Direct Expenses | × × × | Direct Revenues | |

| Opening Stock | × × × | Net Sales | × × × |

| Net Purchases | × × × | Closing Stock | × × × |

| Wages | × × × | ||

| Cartage Inwards | × × × | ||

| Gross Profit | × × × | ||

| Total | × × × | Total | × × × |

| Indirect Expenses | × × × | Other Incomes | × × × |

| Interest Expense | × × × | Gross Profit | × × × |

| Office and Administrative Expenses | |||

| Salaries | × × × | ||

| Office Rent | × × × | Discount Received | × × × |

| Office Lighting | × × × | Net Loss | × × × |

| Office Telephones | × × × | ||

| Legal Expenses | × × × | ||

| Repairs | × × × | ||

| Depreciation | × × × | ||

| Misc. Expenses | × × × | ||

| Selling and Distribution Expenses | × × × | ||

| Discount Allowed | × × × | ||

| Carriage Outwards | × × × | ||

| Sales Commission | × × × | ||

| Advertisement | × × × | ||

| Net Profit | × × × | ||

| Total | × × × | Total | × × × |

7. Format for Balance Sheet

of M/s …………

As on ……

| Liabilities | Amount (`) | Assets | Amount (`) | |

| Share Capital | Fixed Assets | |||

| Authorised …… Shares of ` …each | × × × | Goodwill | × × × | |

| Issued …… Shares of ` … each | × × × | Land | × × × | |

| Subscribed …… Shares of ` Each | × × × | Buildings | × × × | |

| Called Up Share Capital | Leaseholds | × × × | ||

| Share @ ` … each | × × × | Plant and Machinery | × × × | |

| Less: Calls unpaid | × × × | Furniture and Fittings | × × × | |

| Paid-up share Capital | × × × | × × × | Investments | |

| Reserves and Surplus | Govt. and Trust Securities | × × × | ||

| Capital Reserve | × × × | Shares, Debentures and Bonds | × × × | |

| Capital Redemption Reserve | × × × | Current Assets | ||

| Securities Premium | × × × | Loans and Advances | ||

| General Reserve | × × × | (A) Current Assets | ||

| Profit and Loss A/c (Cr. Balance) | × × × | Interest Accrued on Investments | × × × | |

| Proposed Additions to Reserve | × × × | Stores and Spares | × × × | |

| Sinking Fund | × × × | Loose Tools | × × × | |

| Secured Loans | Stock in Trade | × × × | ||

| Debentures | × × × | Sundry Debtors | × × × | |

| Loans and Advances from Banks | × × × | Cash and Bank | × × × | |

| Loans and Adv. from Subsidiaries | × × × | (B) Loans and Advances | ||

| Others | × × × | Loans and Advances to Subsidiaries | × × × | |

| Unsecured Loans | Loans and Advance to Firms | × × × | ||

| Fixed Deposits | × × × | Bills of Exchange | × × × | |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA