Insights of Valuation Provisions under GST

- Blog|GST & Customs|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 2 June, 2023

Table of Contents

- Valuation Rules

- Purpose of Valuation under GST

- Time & Value of Supply

- S.15(2): Transaction Value to Include

- S.15(3): Transaction Value not to Include

- Various Kinds of Discounts

- Open Market Value

1. Valuation Rules

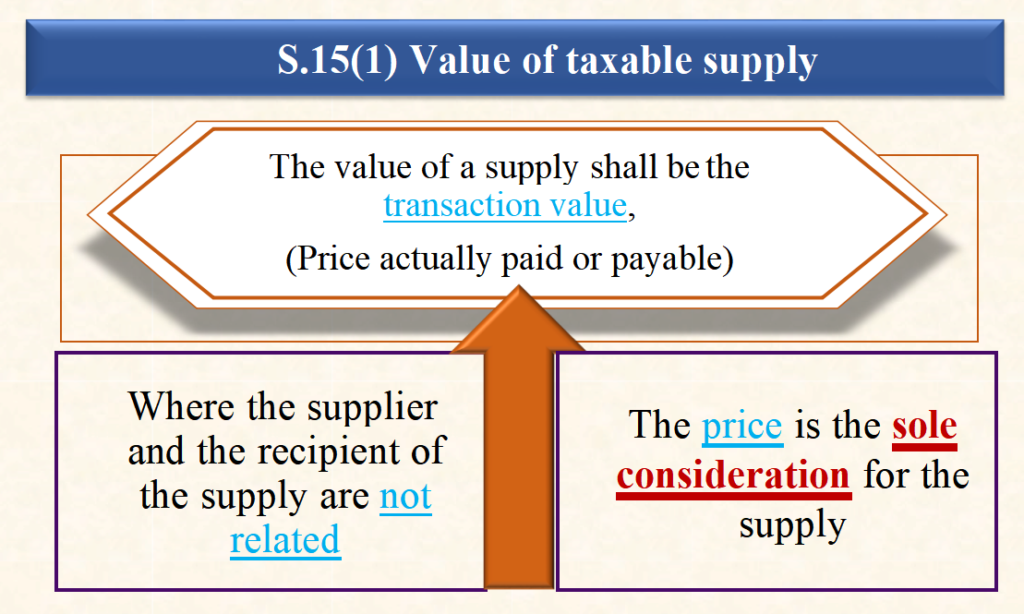

Section 15 – Value of taxable supply

R.27 – Consideration is not wholly in money

R.28 – Supply to related persons; not agent

R.29 – Supply of goods through an agent

R.30 – Value of supply at cost

R.31 – Residual method

R.31A – Lottery, betting etc.

R.32 – Supplies-Travel agents etc.

R.32A – Kerala Flood Cess cases

R.33 – Pure agent services

R.34 – Currency exchange

R.35 – Value inclusive of tax

2. Purpose of Valuation under GST

Principle of quid pro quo: Valuation is the study of all those contractual obligations having impact on the value of a transaction

2.1 Consideration v. Sole Consideration

- Definition of transaction value

- Money is the sole consideration

- There can be a consideration in non-monetary terms

- Consideration is defined under S.2(31)

2.2 Absence of Consideration v. Presence of Non-monetary Consideration

- Moulds & dies supplied by the OEM free of cost – indirect consideration

- [Circular No. 47/21/2018-GST, dated 8-June-2018]

3. Time & Value of Supply

Situation A:

Moulds and Dies: Owned by OEM-say, Maruti sent on FOC basis to a component Mfr.

Say, K. K. Ind., and it was the obligation of the OEM to provide Moulds and Dies to the Mfr.

Q.1 Whether such supply in the hands of the OEM is taxable?

A. No, since there is no consideration.

Q.2 Whether ITC in the hands of OEM to be reversed?

A. No, since it is used for the furtherance of the business.

Q.3 Whether it will impact the valuation of supply made by the Mfr. to the OEM?

A. No, since it was the obligation of the OEM to provide the Moulds and Dies.

Situation B:

Now, it is not the obligation of the OEM to provide Moulds and Dies to the Mfr.-

Q.4 Whether it will impact the valuation of supply made by the Mfr. to the OEM?

A. Yes, the amortized value of the Moulds and Dies are to be added in the value.

Q.5 Whether ITC in the hands of OEM to be reversed?

A. Yes, since it is not used for the furtherance of the business.

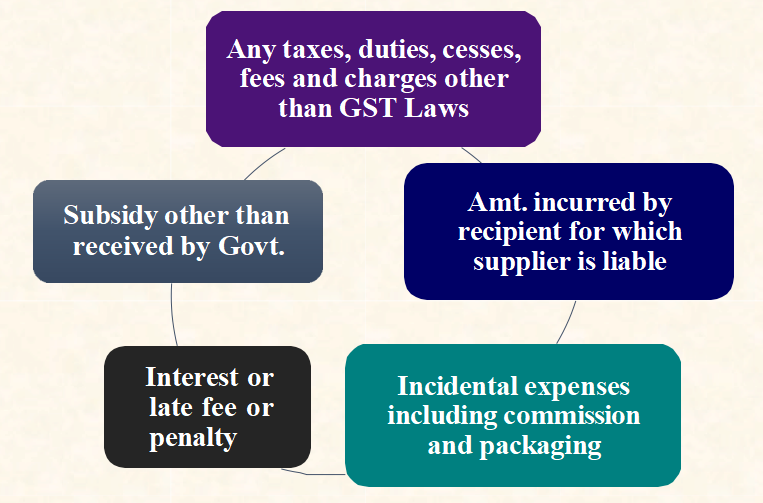

4. S.15(2): Transaction Value to Include

4.1 S.15(2)(a): Taxes & Duties

- Any taxes, duties, cesses, fees and charges levied under any statute

- Other than GST laws

Ex.1 Any municipal taxes not subsumed in GST

Ex.2 Excise duty on Tobacco

Ex.3 Passenger service fees and User development fees

4.2 S.15(2)(b): Amount incurred by recipient

- any amount that the supplier is liable to pay

- in relation to such supply

- but which has been incurred by the recipient of the supply

- and not included in the price actually paid for the goods/services

Ex.1 Demurrage charges paid by the purchaser on behalf of supplier

Ex.2 Freight/insurance paid by the purchaser in case of CIF supply

4.3 S.15(2)(c): Incidental expenses

- Incidental expenses, including commission and packing, charged by the supplier

- to the recipient of a supply,

- and any amount charged for anything done by the supplier in respect of supply at the time of, or before delivery of goods or supply of services

Ex.1 Car seller providing services like number plate, registration, handling charges etc. before the delivery of the car

Ex.2 Packing charges, commission, freight, insurance, handling charges like loading and unloading, demurrage charges, C&F expenses, bailment charges, local levies like municipal taxes etc.

Ex.3 Home delivery charges of food, if any

Ex.4 Packing charges of a show piece at a gift shop

5. S.15(3): Transaction Value not to Include

5.1 S.15(3): Discount

The value of the supply shall not include any discount that is given-

a) before or at the time of the supply if such discount has been duly recorded in the invoice, and

b) after the supply has been effected, if-

(i) such discount is established in terms of an agreement entered into at or before the time of such supply and specifically linked to relevant invoices; and

(ii) input tax credit as is attributable to the discount on the basis of document issued by the supplier has been reversed by recipient.

6. Various Kinds of Discounts

- ‘In-bill’ discounts: Normally allowed

- ‘Off-bill’ discounts: Through CN; S. 15(3) conditions must be fulfilled

- Cash discounts: GST outward reversal not allowed

- Quantity discounts: Allowed subject to S.15(3)

- Aggressive Discounts: [Fiat India Ltd. (SC)][2012 (8) TMI 791] S. 15 (3)

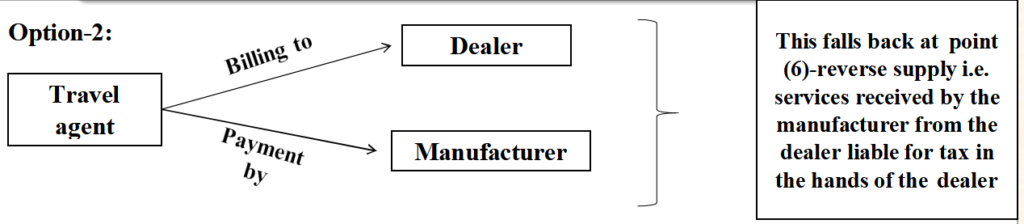

- Reverse Supplies: Supply of services by the dealer to manufacturer

- Discounts ‘in-kind’: S. 15(3) difficult to comply

Holiday packages/Gold coins/Motor Vehicle

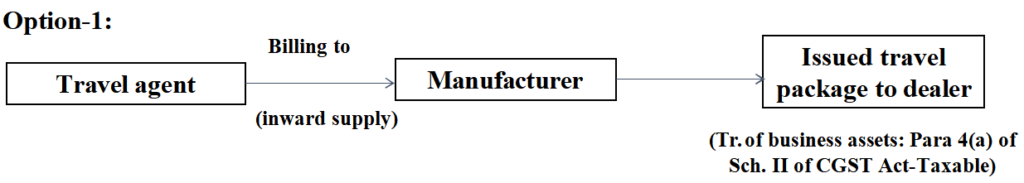

Example: Holiday package by manufacturer to a dealer

- Free Stocks: Similar to discount ‘in-kind’. These free supplies are not only taxable in the hands of manufacturer but ITC is also not available to the dealers. So, it is tax inefficient transaction.

- ‘Buy one-take two’: It is not the case where the two units of stocks are bundled together with a single price assigned to them. Therefore, unless bundled together (e.g. 4 bars of soap) with pre-selected units of stock and a single price affixed, all other transactions of “buy one- take two” are individually taxable-the paid unit at the price paid and the free unit at the price determined by the valuation rules.

- ‘Cashback coupons in product packaging’: The product being supplied to a customer contains cashback coupons. It will not reduce the output tax liability. Cash-back may represent the marketing expenses.

- ‘Cashback coupons provided by person other than supplier’: Like benefits given by e-com operators. These are only marketing expenses of the e-com operators.

- ‘Gift vouchers valid for subsequent supplies’: The customer is given credit points to avail on subsequent purchases. Subsequent sales value can be reduced.

- ‘Free ancillary articles’: Free bag with laptop. No tax on bag. No ITC reversal. These are only marketing expenses.

- ‘Nominal value supplies’: The value as per Rule 27. Second proviso to R. 28 may fail while passing through the test of “sole consideration”.

- Liquidated damages: [Cir. 178, dt. 3-Aug-22]

[I] S. 7 read with Para 5(e) of Schedule-II, has 3 limbs

(a) Agreeing to the obligation to refrain from an act- Like-

- non-compete agreements,

- builder refraining from constructing more than a certain number of floors.

(b) Agreeing to the obligation to tolerate an act- Like-

- a shopkeeper allowing a hawker to operate from the common pavement in front of his shop against a monthly payment,

- RWA tolerating the use of loud speakers.

(c) Agreeing to the obligation to do an act- Like-

- industrial unit agrees to install equipment for zero emission/discharge at the behest of the RWA.

[II] Some examples

(a) Liquidated damages paid for breach of contract;

(b) Compensation given to previous allottees of coal blocks for cancellation of their licenses pursuant to SC Order;

(c) Cheque dis-honour penalty charged by a Discom from the customers;

(d) Penalty paid by a mining company to SG for unaccounted stock of river bed material;

(e) Bond amount recovered from an employee leaving before the agreed period;

(f) Late payment charges collected by any service provider for late payment of bills;

(g) Fixed charges collected by a Electicity DISCOM from (SEBs) or individual customer;

(h) Cancellation charges recovered by railways for cancellation of tickets, etc.

[III] Service Tax Law-Education Guide

(a) The element of contractual relationship, where one supplies goods or services at the desire of another, is an essential element of supply.

(b) Para 5 (e) of Schedule II of CGST Act is strikingly similar to the definition of contract in the Contract Act, 1872.

[IV] Para-5(e)-Sch-II

A perusal of the entry at serial 5(e) of Schedule II would reveal that it comprises the aforementioned three different sets of activities viz.-

(a) the obligation to refrain from an act,

(b) obligation to tolerate an act or a situation, and

(c) obligation to do an act.

All the three activities must be under an “agreement” or a “contract” (whether express or implied) to fall within the ambit of the said entry.

[V] Agreement to do or refrain from an act should not be presumed to exist-just because there is a flow of money from one party to another

- Payments such as liquidated damages for breach of contract,

- Penalties under the mining act for excess stock found with the mining company,

- Forfeiture of salary or payment of amount as per the employment bond for leaving the employment before the minimum agreed period, and

- Penalty for cheque dishonour etc. are not a consideration for tolerating an act or situation.

- They are rather amounts recovered for not tolerating an act or situation and to deter such acts;

- Such amounts are for preventing breach of contract or non-performance and are thus mere ‘events’ in a contract.

[VI] Liquidated Damages

- Breach or non-performance of contract by one party results in loss and damages to the other party.

- Therefore, the law provides in S.73 of the Contract Act, 1872 that when a contract has been broken, the party which suffers by such breach is entitled to receive from the other party compensation for any loss or damage caused to him by such breach.

- The compensation is not by way of consideration for any other independent activity;

it is just an event in the course of performance of that contract.

S. 74 of the Contract Act, 1872 provides that when a contract is broken, if a sum has been named or a penalty stipulated in the contract as the amount or penalty to be paid in case of breach, the aggrieved party shall be entitled to receive reasonable compensation not exceeding the amount so named or the penalty so stipulated.

- It is argued that performance is the essence of a contract.

- Liquidated damages cannot be said to be a consideration received for tolerating the breach or non-performance of contract.

- They are rather payments for not tolerating the breach of contract.

- Liquidated damages are a measure of loss and damage that the parties agree would arise due to breach of contract.

- In such cases liquidated damages are mere a flow of money from the party who causes breach of the contract to the party who suffers loss or damage due to such breach.

- Such payments do not constitute consideration for a supply and are not taxable.

Examples

- damage to property,

- negligence,

- piracy,

- unauthorized use of trade name,

- copyright,

- penalty stipulated in a contract for delayed construction,

- forfeiture of earnest money by a seller in case of breach of ‘an agreement to sell’ an immovable property.

- Forfeiture of Earnest money is stipulated in such cases not as a consideration for tolerating the breach of contract but as a compensation for the losses suffered and as a penalty for discouraging the non-serious buyers or bidders.

- Such payments being merely flow of money are not a consideration for any supply and are not taxable.

- If the payment is merely an event in the course of the performance of the agreement and it does not represent the ‘object’, as such, of the contract then it cannot be considered ‘consideration’.

- a contract may provide that payment by the recipient of goods or services shall be made before a certain date and failure to make payment by the due date shall attract late fee or penalty.

- A contract for transport of passengers may stipulate that the ticket amount shall be

partly or wholly forfeited if the passenger does not show up. - A contract for package tour may stipulate forfeiture of security deposit in the event of cancellation of tour by the customer.

- Similarly, a contract for lease of movable or immovable property may stipulate that the lessee shall not terminate the lease before a certain period and if he does so he will have to pay certain amount as early termination fee or penalty.

- Some banks similarly charge pre-payment penalty if the borrower wishes to repay the loan before the maturity of the loan period.

Such amounts paid for acceptance of late payment, early termination of lease or for pre- payment of loan or the amounts forfeited on cancellation of service by the customer as contemplated by the contract as part of commercial terms agreed to by the parties, constitute consideration for the supply of a facility, namely, of acceptance of late payment, early termination of a lease agreement, of prepayment of loan and of making arrangements for the intended supply by the tour operator respectively.

- Therefore, such payments, even though they may be referred to as fine or penalty, are actually payments that amount to consideration for supply, and are subject to GST, in cases where such supply is taxable.

- Since these supplies are ancillary to the principal supply for which the contract is signed, they shall be eligible to be assessed as the principal supply.

[VII] Compensation for cancellation of coal blocks

Old allottees of mines were given compensation in the year 2016 towards the transfer of their rights/titles in the land, mine infrastructure, geological reports, consents, approvals etc. to the new entity (successful bidder) as per the directions of Hon’ble Supreme Court. The allottees had no option but to accept the cancellation.

Therefore, the compensation paid for cancellation of coal blocks pursuant to the order of the Supreme Court in the above case was not taxable.

[VIII] Cheque dishonor fine/penalty

The fine or penalty that the supplier or a banker imposes, for dishonour of a cheque, is a penalty imposed not for tolerating the act or situation but a fine, or penalty imposed for not tolerating, penalizing and thereby deterring and discouraging such an act or situation. Therefore, cheque dishonor fine or penalty is not a consideration for any service and not taxable.

[IX] Penalty imposed for violation of laws

Laws are not framed for tolerating their violation. There is no agreement between the Government and the violator specifying that violation would be allowed or permitted against payment of fine or penalty. Education guide-2012, explained that fines and penalties paid for violation of provisions of law are not considerations as no service is received in lieu of payment of such fines and penalties.

It was also clarified vide Circular No. 192/02/2016-Service Tax, dated 13-4-2016 that fines and penalty chargeable by Government or a local authority imposed for violation of a statute, bye-laws, rules or regulations are not leviable to Service Tax. The same holds true for GST also.

[X] Forfeiture of salary or payment of bond amount in the event of the employee leaving the employment before the minimum agreed period

The provisions for forfeiture of salary or recovery of bond amount in the event of the employee leaving the employment before the minimum agreed period are incorporated in the employment contract to discourage non-serious candidates from taking up employment. The said amounts are recovered by the employer not as a consideration for tolerating the act of such premature quitting of employment but as penalties for dissuading the non-serious employees from taking up employment and to discourage and deter such a situation.

Therefore, such amounts recovered by the employer are not taxable as consideration for

the service of agreeing to tolerate an act or a situation.

[XI] Compensation for not collecting toll charges

A question arose whether the compensation paid to the concessionaire by project authorities (NHAI) in lieu of suspension of toll collection during the demonetization period (from 8.11.2016 to 1.12.2016) was taxable as a service by way of agreeing to refrain from collection of toll from users. The service of access to a road or bridge continued to be provided without collection of toll from users. Consideration came from the project authority. Hence, taxable.

[XII] Late payment surcharge or fee

The facility of accepting late payments with interest or late payment fee, fine or penalty is a facility granted by supplier naturally bundled with the main supply. Almost all service providers across the world provide the facility of accepting late payments with late fine or penalty. And, therefore, should be assessed as the principal supply. Ex. electricity, water, telecommunication, cooking gas, insurance etc.

[XIII] Fixed Capacity charges for Power

A minimum fixed charge (or capacity charge) and variable per unit charge. Fixed charges have to be paid by the SEBs/DISCOMS/individual customers irrespective of the quantity of electricity scheduled or purchased by them during a month. The variable charges are charged per unit of electricity purchased and increase or decrease every month depending on the quantity of electricity consumed. Both the components of the price, the minimum fixed charges/capacity charges and the variable/energy charges are charged for sale of electricity and are thus not taxable as electricity is exempt from GST.

[XIV] Cancellation charges

Hotel accommodation, entertainment event, a journey, may be cancelled by a customer, on payment of cancellation fee as per commercial terms of the contract. Facilitation supply of allowing cancellation of an intended supply against payment of cancellation fee should be assessed as the principal supply.

However, forfeiture of earnest money by a supplier in case of breach of ‘an agreement to sell’ an immovable property. Such payments being merely flow of money are not a consideration for any supply and are not taxable.

7. Open Market Value

“Open market value” of a supply means the full value in money, excluding the integrated tax, central tax, State tax, Union territory tax and the cess payable by a person in a transaction, where the supplier and the recipient of the supply are not related and price is the sole consideration, to obtain such supply at the same time when the supply being valued is made.

Note: OMV is not comparable price to unrelated customers

7.1 Supply of goods or services or both of like kind and quality

It means any other supply made under similar circumstances that, in respect of the:

(i) characteristics,

(ii) quality,

(iii) quantity,

(iv) functional components,

(v) materials, and

(vi) reputation

of the goods or services or both first mentioned, is the same as, or closely or substantially resembles, that supply of goods or services or both.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA