Income Tax on Online Gaming in India | Detailing Provisions for Taxation and TDS on Winnings

- Blog|Advisory|Income Tax|

- 4 Min Read

- By Taxmann

- |

- Last Updated on 25 April, 2024

Table of Contents

- Background

- What is Online Gaming?

- Section 115BBJ – Charging Section

- Section 194BA – TDS on Winnings from Online Games

- Need for Introduction of Provisions

- Circular for Removal of Difficulties under Section 194BA

- Illustration

- Conclusion

1. Background

Online gaming industry has experienced a massive upsurge in the recent past in India, attracting huge investments in companies offering these services. With almost every individual having their personal smartphones and computers, the scope of online activities has widened, games being the most attractive one among all the age-groups. Celebrities are fully involved in promoting/publicizing such games viz, Dream11, Rummy Circle, My11Circle, Pokerbaazi, First Games, etc.

Looking at the current scenario, the government has launched new provisions vide Finance Act, 2023 for the taxability of winnings from online games. The government introduced section 115BBJ – the charging section and section 194BA – TDS on winnings from online games.

2. What is Online Gaming?

A game that is offered on the internet and is accessible by a user through a computer resource including any telecommunication device is termed as an online game.

3. Section 115BBJ – Charging Section

- Winnings from any online game shall be charged to tax under this section of the Income Tax Act, 1961.

- The rate of taxon such income shall be 30% excluding surcharge and cess.

- The section was applicable from 1st April, 2023, i.e., any income from online games from the said date shall be taxable under this section.

4. Section 194BA – TDS on Winnings from Online Games

- Any person responsible for paying to any person any income by way of winnings from any online game during the financial year shall deduct income-tax on the net winnings in his user account under the said section of Income Tax Act, 1961.

- The applicable rate of TDS shall be 30% at the time of withdrawal (without any threshold) of such winning amount.

- “Any Person” here means the one making payments of winnings or online gaming intermediary.

- “Net Winnings” is A – (B + C), where A is the amount withdrawn, B is the aggregate of non-tax deposits made by the user until the time of withdrawal and C is the opening balance at the beginning of the financial year.

- “User Account” means a user who has registered with an online gaming intermediary, delivering one or more online games.

- The section was applicable from 1st July, 2023, i.e., tax shall be deducted from any income from online games from the said date.

5. Need for Introduction of Provisions

Taxability of such winnings before the introduction of section 115BBJ and section 194BA was governed by section 115BB – taxability of income from lottery, crossword puzzles, etc. and section 194B – TDS on income from lottery, crossword puzzles, etc. Considering the distinctive nature of online games, the government decided to separate the taxability of tax winnings from online games.

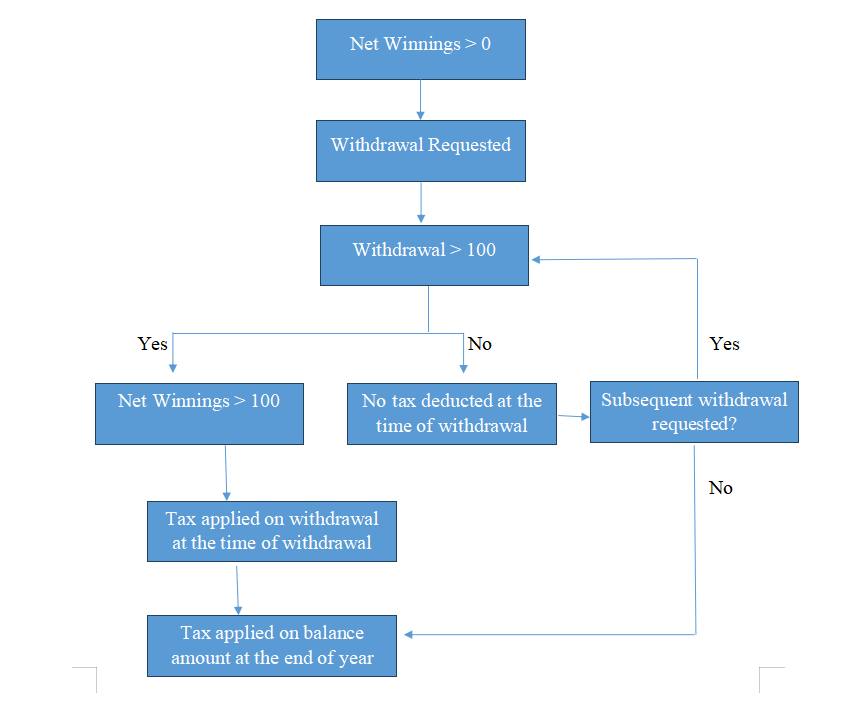

6. Circular for Removal of Difficulties under Section 194BA

Circular No. 5 of 2023 was issued by the Central Board of Direct Taxes (CBDT) on 22nd May, 2023, providing guidelines for the implementation of section 194BA of the Income Tax Act, 1961. Clarifications offered by the circular have been summarized below:

The aforesaid circular can be referred at https://incometaxindia.gov.in/communications/circular/circular-5-2023.pdf.

Note: Withdrawal of such income is allowed only after TDS on such income has been deducted by the intermediary controlling the gaming applications.

7. Illustration

Mr M has an annual income of Rs. 2 lakhs and has earned Rs. 30,000 from online gaming. Despite Mr M’s income being below the basic exemption limit i.e., Rs. 2.5 lakhs, he shall still have to pay tax at the rate of 30% (plus cess) on Rs. 30,000. No further deduction under section 80C/ 80D or any expenditure shall be allowed to be applied to such income.

The entity distributing the prize is required to deduct TDS at the rate of 30% under section 194BA of the Income Tax Act if it exceeds the threshold of Rs. 100. The beneficiary i.e., Mr. M shall be required to show the amount so deducted while filing the annual Income Tax Return.

8. Conclusion

Online gaming in India has emerged as a field wherein people are not only engaging into merely for the sake of entertainment, but a larger population is getting into it for earning money at the comfort of their homes. Exponential growth can be expected in this sector in the years to come, paving way as a new career path and employment opportunities for individuals. Thus, it becomes quite essential for a sector having such great earning potential to be covered under the ambit of Income Tax Act and taxed separately. CBDT may provide further clarifications on certain issues in order to prevent any unnecessary litigation in future with regard to taxation of online gaming.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA