How to do Income-tax Research using Master Guide to Income Tax Act

- Blog|Income Tax|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 14 December, 2022

Introduction

Income-tax research can prove to be a daunting task unless you are equipped with the necessary tools to get the job done. Since, Income-tax law in India changes very frequently, it becomes difficult to keep a track of all the changes.

With this background, Taxmann, every year releases a book titled Master Guide to Income Tax Act, which in our opinion is an essential book for Income-tax professionals to learn about the implications and intricacies of the amendments made by the Finance Act 2022.

It also helps you begin the research or find the loose ends in your submissions with a digest of all circulars, notifications and landmark case laws.

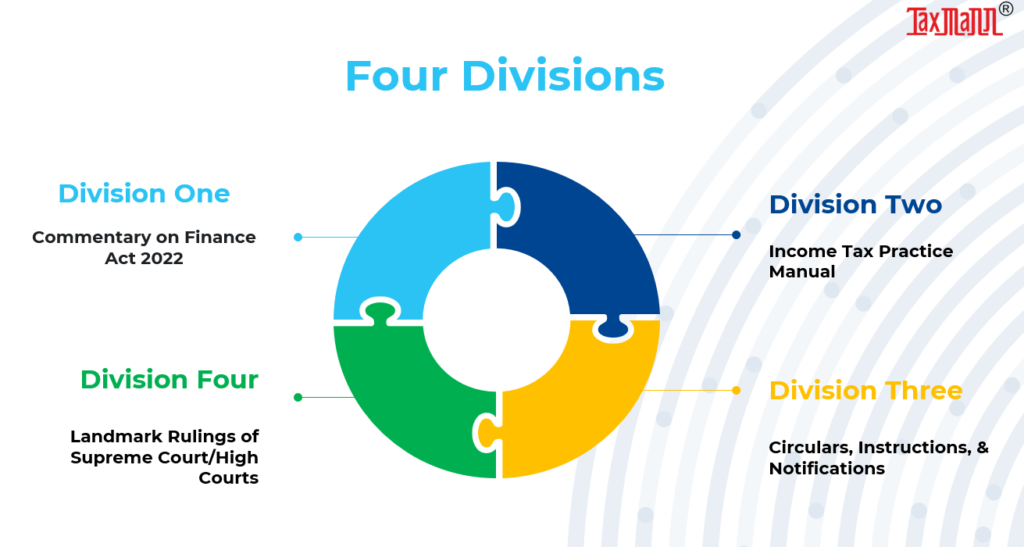

Contents of the Book

Division 1: A Commentary on the Finance Act 2022

Know the finest points, repercussions and analysis of each amendment made by the Finance Act 2022.

-

- This division covers the commentary on the Finance Act 2022.

- This book has been helping the tax professionals since 1993 to understand the real implications of the Finance Acts.

- It brings you the finest points, repercussions, and analysis of each amendment made by the Finance Act.

- The Finance Act 2022 has inserted 12 new Sections and amended or substituted the existing 72 Sections.

- Each discussion on an amendment highlights the date from which it shall come into force and how it impacts the existing law.

- The authors have highlighted the indiscernible questions arising due to an amendment, their widespread implications, and the ways to safeguard your clients from the thunderstorm.

- The background of each provision has been given, before an amendment is explained. This helps you understand the old provision and the difficulties in implementing them.

- The authors follow a cohesive approach to help you find the connected and related discussion in one place.

- A thorough discussion has been made on the defence a taxpayer can have from the juggernauts of retrospective amendments.

- All technical jargons have been explained with the help of supporting case laws.

- All complex provisions have been explained with conceptual examples and comprehensive illustrations.

List of Chapters

-

- Taxation of Virtual Digital Asset

- Income and Tax Computation

- Taxation of Charitable Trusts

- Profits and Gains from Business or Profession

- Capital Gains

- Deductions and Exemptions

- Carry forward and Set-off of losses

- Unexplained Income and Search

- TDS/TCS

- Updated Return of Income

- Return, Assessment and Re-Assessment

- Appeals and Dispute Resolution

- Liability in Special Cases

- Penalties and Prosecutions

- Reporting Obligation under Section 285B

Some of the finest points discussed in the commentary.

Relating to Taxation of Virtual Digital Assets (VDA)

-

- The authors have explained the taxonomy of Crypto Assets, Non-Fungible Tokens (NFTs), Blockchain Technology, Distributed Ledger Technology (DLT), etc., before explaining the new scheme for the taxation of VDA.

- All foreign currencies have been kept out of the meaning of VDA. Then why Bitcoin is a VDA even when El Salvador has adopted Bitcoin as its official currency?

- How to determine the situs of VDA for taxability in the hands of a non-resident?

- Head in which the income from transfer of VDA should be taxed?

- Why income from the lending of cryptocurrencies is not taxed at flat rate of 30%?

- Whether mining of cryptocurrencies is a taxable event?

- How to determine the cost of acquisition of mined cryptocurrencies?

- Tax implications if VDAs are lost or stolen

- How to determine the fair market value of VDAs?

- Whether Section 87A rebate and maximum exemption limit allowed from income from VDAs?

- Treatment of losses incurred from transfer of VDAs on or before 31-03-2022

Relating to Disallowance under Section 37(1)

-

- Explanation 3 to Section 37(1) disallows expenditure incurred for any purpose which is an offence or is prohibited as per Indian law or law outside India.

- Should an act be regarded an offence only when all the legal remedies available at the disposal of the assessee have been exhausted?

- How can Presumption of Innocence rescue the assessee from an alleged offence?

- Who will be the deciding authority for offence committed under other laws? Whether Income-tax authorities or the authorities specified under the relevant Act?

- How prohibited by law is different from regulated by law?

Relating to Disallowance of other business expenditure

-

- Impact of disallowing surcharge and education cess with retrospective effect.

- Section 43B disallows interest converted into debentures. What would be the implications if such interest is converted to equity shares or preference shares?

Relating to COVID-19 Compensation

-

- What should be the tax implication if an employee gets compensation from the employer and reimbursement from an insurance co. for the treatment of Covid-19?

- Can post-covid-19 ailments be treated as illness relating to Covid-19?

- What if a person commits to pay the Covid-19 death compensation but pays the same after 12 months?

Relating to Unexplained Income and Search

-

- How to explain the source of source of borrowings?

- What are the implications of the requirement to explain source of source of deposits, debentures, secured borrowings or borrowing from banks?

- Section 79A prohibits the set-off of any loss or unabsorbed depreciation against undisclosed income detected in a search, survey, or requisition. Whether it impacts the current year’s depreciation, legitimate expenditure and brought forward losses?

- Whether the threshold of Rs. 50 lakhs of issuing reassessment notice should spread over assets, expenditure or book entries separately or in aggregate?

Relating to TDS

-

- How to determine the value of benefits or perquisites for TDS under Section 194R?

- How to ensure tax deduction from benefits or perquisites if no cash component is involved?

- At what stage tax should be deducted under Section 194R? At the time of provisioning in accounts, paying for the benefits to a third party, bringing the benefits under the recipient’s control, or at any other stage.

- How to deduct tax in case benefits or perquisites are being provided continuously over a period of time?

- Why is nexus of benefit or perquisite with business or profession carried on by recipient necessary to deduct tax under Section 194R?

- Applicability of Section 194R to non-monetary benefits given to the partner by a firm.

- Applicability of Section 194R to asset transferred to a retiring partner by a firm.

- Applicability of Section 194R to freebies given by pharma companies to doctor

- What will be the TDS implications if an insurance company organises foreign travel for its agents?

- Whether the order levying interest for default in TDS/TCS payments is sacrosanct?

- For Section 239A, is standard EULA an agreement to claim a refund of tax deducted under Section 195?

- Can interest be claimed on TDS refunded under Section 239A?

Relating to Updated Return

-

- Can an updated return be filed by persons covered under section 139(4A) to (4F)?

- Can a return filed under sub-section (3) of section 139 (return of loss) be updated?

- Can an application under section 119 be made for condonation of delay in filing the updated return?

- How can the losses be set off in the updated return?

- Does a “return of a loss” include a return with unabsorbed depreciation?

- Can an updated return be filed if the tax liability in an updated return and earlier return is the same?

- When is a search considered to be initiated to restrict an assessee from filing an updated return?

- Does conducting an inquiry under section 148A amount to “assessment is pending” to restrict an assessee from filing an updated return?

- How to compute tax and interest on additional income declared in an updated return?

Relating to reporting under Section 285B

-

- Why does the production of advertisements also require reporting under Section 285B?

- Why is the photoshoot not covered for reporting requirement of Section 285B?

- Whether Instagram, TikTok, YouTube or Facebook are OTT platforms for reporting under Section 285B?

- How to compute the threshold limit for reporting under Section 285B?

- Is reporting under Section 285B distinct from the requirement of deduction or collection of tax at source?

Division 2: Income Tax Practice Module

Tabular presentation of all important Income-tax compliances and procedures.

- This division provides you with the tabular presentation of all important Income-tax compliances and procedures.

- All these procedures have been bifurcated in twelve chapters and are updated up to the Finance Act 2022 and Income-tax (Third Amendment) Rules, 2022.

- All provisions have been explained in simple language with prominent headings in every chapter.

- A reference to every change by the Finance Act 2022 and Income-tax (Third Amendment) Rules 2022 has been given in the footnote.

List of Chapters

-

- Tax Deduction of tax at Source (TDS);

- Tax Collection at Source (TCS);

- Return of Income;

- Assessment/Reassessment;

- Rectification of Mistakes;

- Payment of Tax/Interest & Refund of Taxes;

- PAN and Aadhaar;

- Statement of Financial Transaction (SFT);

- Advance Tax;

- Interest and Fees;

- Refunds; and

- Faceless Proceedings.

Division 3: Circulars, Instructions and Notifications

A section-wise ready referencer of all circulars and notifications in force.

- This division provides a section-wise ready referencer of all circulars and notifications.

- It contains the gist of all circulars, clarifications and notifications issued by the Income-tax department since 1961 which are still in force.

- The gist has been bifurcated section-wise and subject-wise, which helps you find the required record in a split of a second.

- This division helps you begin your research and find the relevant circulars and notifications that could be included in your submissions.

Division 4: Landmark Rulings of Supreme Court/High Courts

Gist of all landmark rulings pronounced by the Supreme Court and High Courts in the last 100 years.

- This division covers all landmark rulings on Income-tax pronounced by the Supreme Court and High Courts in the last 100 years, i.e., from 1922 to 2022.

- All landmark rulings are arranged section-wise and subject-wise, which helps you easily find the relevant ruling on any issue.

- The ratios of landmark rulings are summarised in short paragraphs that help you quickly understand the case.

- All rulings are grouped into various subjects to make it easy to find the relevant case law on any particular matter.

- Citation is provided with every landmark ruling.

- Get the complete copy of any judgment from www.taxmann.com/research.

- This division helps you begin your research and find the relevant case laws that could be included in your submissions.

Click Here to Get Started!

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA