Guide to Investment Funds in IFSC | Overview of Tax Regime

- Blog|Company Law|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 30 January, 2024

Table of Contents

- Introduction to IFSC

- Snapshot of the New Fund Regime in IFSC

- Fund Management Entity

- Taxation of Category I and II AIFs and Investors

- Category III AIF | Tax Nuance

- Relocation of Offshore Fund to IFSC

- Offshore Fund vs IFSC Fund

- Family Investment Fund

1. Introduction to IFSC

- GIFT City special economic zone is India’s maiden International Financial Services Centre (IFSC) introduced to act as a global financial hub

- IFSC caters to a wide plethora of financial services such as asset management, banking, insurance, capital market, etc. as well as family offices

- Deemed foreign territory for the purpose of foreign exchange laws in India. However, continues to be treated as Indian resident for the purposes of (Indian) Income Tax Act 1961

- Offshore Funds – both global and/or India centric pooling vehicles may be set up in IFSC. So far approx. 89 schemes have been launched in IFSC

- The new fund management regulations enables IFSC to compete well globally with other popular fund havens such as Cayman Islands, Mauritius, Luxembourg, Singapore etc

- IFSC’s competitive legal, regulatory and tax regime vis-à-vis other offshore financial services jurisdictions makes IFSC lucrative for domestic and Indian financial players

1.1 Gift City in the News!

2. Snapshot of the New Fund Regime in IFSC

- IFSC Funds are governed by IFSC Authority (Fund Management) Regulations, 2022 (FME Regulations)

- The FME Regulations have overhauled the previous fund regime in IFSC, which was based on the SEBI (Alternative Investment Funds) Regulations 2012

- FME Regulations seek to regulate the fund managers i.e., fund management entity (FME) while prescribing operating guidelines for the funds

- IFSCA has benchmarked the funds regime with the global best practices

- Consolidated registration and compliance requirements for FME while prescribing operating guidelines for funds/ancillary fund management activities

3. Fund Management Entity

3.1 Overview

- To engage in the fund management business, FME may seek registration under the following categories:

(a) Authorised FME: For investment in start-ups/early stage ventures through venture capital scheme

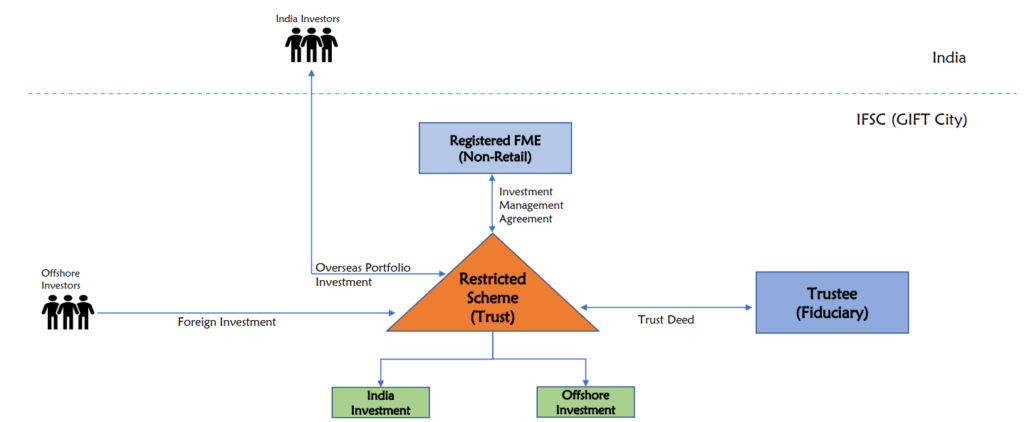

(b) Registered FME (Non-retail): To pool in funds from accredited investors, for investment in securities, financial products, undertake portfolio management service, private placement of REITs/InvITs, etc through restricted scheme.

(c) Registered FME (Retail): To pool in funds from all investors for investment in securities, financial products, etc. through retail or restricted scheme

- Venture capital scheme is filed as Category I AIF and Restricted scheme can be filed as Category I/II/III AIF depending on investment strategy. Retail schemes are not treated as AIF

- FME could be set up either as a company or an LLP or a branch thereof

3.2 Tax Considerations

|

Key parameters |

Company | LLP |

Branch |

| Corporate tax on management fee | Tax holiday for 10 years | ||

| Minimum Alternate Tax (MAT)/Alternative Minimum Tax (AMT) | MAT is payable at 9% unless it opts for concessional tax regime | AMT is applicable at 9% | Same as company/LLP |

| Distribution of profit by FME | Taxed as dividend in the hands of shareholders | Exempt from tax | Not taxable |

3.3 IFSC AIF | Classical Structure

4. Taxation of Category I and II AIFs and Investors

Pass Through Status and Levy of Tax

- Trusts, LLP and companies which are registered as a Category I or II AIF under FME Regulations are treated as ‘investment funds’ under Indian tax law

- Investment funds have been accorded partial tax pass through status – Investment income is taxable directly in the hands of investors on a pass through basis; Business income is taxable at AIF level

- Tax on investors is levied as if investment was made directly by such investors

- Characterization of income for the investor is same as that of AIF

- Obligation on AIF to withhold tax at (a) 10% for Indian resident investors; (b) applicable rate for non-resident investors

- Business income (if any): Taxable at ordinary rate for AIF (being a company/LLP) and maximum marginal rate for AIF being a trust; subject to tax holiday

- Business loss is carried forward at AIF level. Other losses allowed to be carried forward to investor holding units for at least 12 months

- Income on transfer of AIF units is taxable for investors at applicable capital gains tax rate

- Exemption for non-resident investors from obtaining Permanent Account Number and filing tax return (subject to certain conditions)

|

Income stream |

Indian resident investor |

Non-resident (NR) investor* |

| Dividend |

Ordinary rate (maximum 30%) |

20% |

| Interest |

Ordinary rate (maximum 30%) |

20% (on foreign currency debt) |

| Capital gain |

20% to 30% |

10% to 40% |

5. Category III AIF | Tax Nuance

| Parameter | Category III AIF

(determinate trust: Indian resident + NR Investors) |

Category III AIF

(All NR investors, except for units held by the sponsor/manager) |

| General tax regime | Income is taxed in the hands of the trustee as representative assessee of the investors | NR Investors are tax exempt whereas AIF is liable to pay tax on certain specified income discussed below |

| Income from India investments | Income attributable to NR Investors: Taxable at following rates (subject to tax treaty benefit)

|

1. Tax exemption for income arising on:

2. Interest and dividend is taxable @ 10%. Capital gain on equity shares is taxable at the rate ranging from 10% to 30% |

| Income from offshore investments | Income attributable to Indian resident investors:

Income attributable to NR Investors: Not taxable |

Exempt from tax |

| Transfer of AIF units | Taxable at the rates ranging from 10% to 40% | Exempt from tax |

| >Tax filings | No exemption | Exemption to NR Investors (subject to conditions) |

6. Relocation of Offshore Fund to IFSC

To encourage the Offshore Funds to shift their base to IFSC, the relocation has been made tax neutral subject to certain conditions:

- Offshore Fund should be tax resident of a country with which India has a tax treaty

- Activities of Offshore Fund should be subject to applicable investor protection regulations in the domicile country

- Relocation should be undertaken by 31 March 2025

- IFSC Fund to discharge consideration by issuing shares/units to the Offshore Fund or investors

Effect of Relocation

- Tax implications for income earned by the IFSC Fund – same as mentioned in the preceding slides

- Cost of acquisition and period of holding of the assets is continued

- Losses are allowed to be carried forward

- In case of IFSC Fund being Category I/II AIF, tax will be paid at respective investor level whereas for Category III AIF, tax will continue to be paid at Fund level

- Investors are exempt from obtaining PAN and filing tax return (subject to certain conditions)

7. Offshore Fund vs IFSC Fund

|

Key parameters |

Offshore Fund | IFSC Fund (Category I/II AIF) |

IFSC Fund (Category III AIF with only NR Investors) |

| Tax regime | Tax is paid at Fund level | Tax is paid at Investor level | Tax is paid at Fund level and Investors are tax exempt |

| Tax liability (subject to tax treaty benefit) | (a) Interest (on foreign currency debt) and dividend is taxable at 20%

(b) Capital gain is taxable at 10% to 40% |

Same as Offshore Fund | (a) Interest and dividend is taxable at 10%

(b) Capital gain (on shares of Indian company) is taxable at 10% to 30% (c) Capital gain on other assets is tax exempt |

| Tax credit (subject to domestic tax law) | Taxes paid by the Fund may not be creditable for Investors | Tax paid at Investor level and hence, credit should be allowed | Tax paid at Fund level and hence, may not be creditable for Investors |

| Distributions by Fund to NR Investors | (a) Dividend distribution: Not taxable

(b) Redemption: Taxable if Fund derives at least 50% value from India (subject to certain exceptions) |

Subject to withholding of tax payable by the Investors | Exempt from tax |

8. Family Investment Fund

8.1 Overview

- FIFs are self-managed pooling vehicles for the family and Indian entities wherein the family members hold substantial economic interest

- FIF may be set up either as a contributory trust or company or an LLP. In case of a trust, the beneficiaries and their respective beneficial interest must be fixed and identifiable at all times

- Capital can be pooled only from a single family (defined to include group of individuals who are the lineal descendants of a common ancestor and includes their spouses and entities owned and controlled by them)

- Exchange control regulations allows 50% of net worth of Indian entity to remit funds to GIFT City entity

- An FIF is required to maintain a minimum corpus of USD 10 Million within a period of 3 (three) years from date of registration as an FIF

- An FIF may borrow or engage in leveraging activities as per its defined risk management policy

8.2 Tax Considerations

|

Key parameters |

Trust | LLP |

Company |

| Tax regime | Trustee liable to tax as representative assessee of the beneficiaries | Tax payable at LLP. Distribution of profit is exempt from tax | Tax to be paid by Company as well as on subsequent distribution to shareholders |

| Capital gain | Taxable at 20% to 30% | Taxable at 20% to 30% | Taxable at 20% to 30% |

| Dividend and Interest Income | Taxable at maximum of 30% | Taxable at 30% | Taxable at 22% to 30% |

| Distribution of profit by FIF to beneficiaries/partners/shareholders | Not taxable | Not taxable | Dividend distribution is taxable at 30% in the hands of shareholders |

| Business Income | Tax holiday for 10 years. However, potential risk of other income being taxed at maximum marginal rate | Tax holiday for 10 years | Tax holiday for 10 years |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA