Guide to Ind AS 7 | Cash Flow Statement

- Blog|Account & Audit|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 22 June, 2023

Table of Contents

- Introduction

- Objective and Benefits of Cash Flow

- Scope

- Definitions

- Presentation of Cash Flows from Operating activities

- Interest and Dividends

- Income Tax

- Cash Flows in Foreign Currency

- Investments in Subsidiaries, Associates and Joint Ventures

- Non-cash Items

- Components of Cash and Cash Equivalents

- Disclosures

Check out Taxmann's Ind AS Made Easy (FR) | Study Material is the most updated & amended self-study material providing the subject matter in simple and lucid language. It incorporates a conceptual understanding of each standard, a detailed explanation, and 1100+ questions & answers. CA-Final | Nov. 2023 Exam

1. Introduction

Statement of Cash Flow (SCF) is an additional information provided to the users of accounts in the form of a statement, which reflects various sources from where cash was generated (inflow of cash) by an entity during the relevant accounting year and how these inflows were utilised (outflow of cash) by the entity. This information is very useful to the users to evaluate the ability of an entity to generate cash and cash equivalents and the timing and certainty of their generation.

2. Objectives and Benefits of Cash Flow Statement

Statement of cash flow helps the users to assess the entity’s

- Ability to generate cash & cash equivalents;

- Utilisation of the cash flows;

- Further requirement of generating cash and cash equivalents;

- Timing, nature and certainty of generation of future cash flows and to check the past assessment accuracy; and

- The changes in the capital structure.

3. Scope

An entity shall prepare a statement of cash flows in accordance with the requirements of this Standard and shall present it as an integral part of its financial statements for each period for which financial statements are presented.

4. Definitions

Cash: Cash includes cash in hand, cash at bank & demand deposits with banks;

Demand deposits mean deposits which can be withdrawn without prior notice and penalty charges. Generally long term deposits are placed for a specific period in banks and these cannot be withdrawn without penalty, hence it cannot be classified as cash.

Cash equivalents: An asset can be called as a cash equivalent when it satisfies the following conditions:–

- Short term & highly liquid investments which are readily convertible into cash; and

- Conversion into cash is subject to insignificant risk of changes in value; (i.e., Insignificant loss because of conversion)

Short term investment is an investment which has a maturity of less than or equal to three months from the date of acquisition.

E.g.,

- Treasury bills, Government securities having maturity within 3 months from the date of acquisition (These items are redeemed at the same amount without any default – insignificant risk of change in value).

- Preference shares acquired also can be cash equivalent only when the entity acquired 3 months before their specified redemption date and subject to insignificant risk of failure of the company to repay the amount at maturity.

- Investment in equity shares cannot be cash equivalent as it has significant risk of change in value;

An entity should disclose the list of cash and cash equivalents (CE). If the amounts disclosed as cash equivalents do NOT match directly with the items in the financial statements, the entity should prepare reconciliation for the same. (Any change in list of Cash and CE – considered as change in accounting policy as per AS 5)

Note:

As per Division II Schedule III of the Companies Act, 2013, cash and cash equivalents classification is like this

As per the Guidance note –

- “The disclosure regarding ‘bank balances other than cash and cash equivalents’ should include items such as Balances with banks held as margin money or security against borrowings, guarantees, etc. and bank deposits with original maturity of more than three months but less than 12 months”.

- Bank deposits with more than 12 months maturity should be classified under “Other current Financial Assets” (read carefully) i.e., This presentation only when “Original term is more than 12 months but the remaining maturity is less than 12 months from the balance sheet date” ;

- If the Original maturity and remaining maturity from the balance sheet date is more than 12 months – it should be presented under “Other non-current financial assets”.

Presentation of Statement of Cash Flow (SCF)

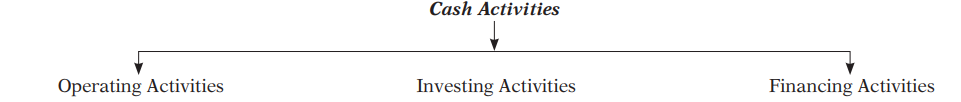

As per the standard, CASH ACTIVITIES of an entity are classified into three. Such classification should be most appropriate to its business. The classification is based on the nature of business of the entity.

These are

|

|

|

| Examples | ||

|

|

|

Broadly SCF is presented in the following manner. It is discussed in detail in the next paragraphs.

| Statement of cash flow of X Ltd. for the year ended 31-3-20XX | |

| Particulars | ` |

| Cash flows from OPERATING activities | XXX |

| Cash flows from INVESTING activities | XXX |

| Cash flows from FINANCING activities | XXX |

| Net cash flows | XXX |

| Add: Opening Cash and cash equivalents | XXX |

| Closing Cash and cash equivalents | XXX |

How does the presentation of SCF help the users of financial statements?

It helps the users in many ways while taking economic decisions. Benefits of classification from each activity are described as follows:

-

- Operating activities – To forecast future cash flows from its regular operations;

- Investment activities: Helps the users to estimate the future operating cash flows because of the current year investing activities and other income from the investment activities;

- Financing activities: It is useful to predict future claims by providers of funds by way of dividend, interest, etc.

When a contract is accounted for as a hedge of an identifiable position the cash flows of the contract are classified in the same manner as the cash flows of the position being hedged. (You understand this after studying Ind AS 109 – Financial instruments)

5. Presentation of Cash Flows from Operating Activities

Operating activities can be presented in TWO ways. They are:

- Direct method;

- Indirect method.

The standard gives an option to the entity in presentation of operating activities i.e., it can present either in direct method or indirect method. The standard encourages direct method.

5.1 Direct Method

Under the direct method, the entity gives information about major classes of

- Gross cash receipts; and

- Gross cash payments.

Gross cash receipts or payments of the entity can be obtained from either:

(a) Cash/bank book; or

(b) Alternatively non-cash and non operating items (i.e., investing or financing items) can be eliminated from P&L statement;

See the format of cash flows from operating activities under direct method:

| Cash flows from operating activities | ` |

| Cash receipts from customers | XXX |

| Cash paid to suppliers and employees | (XX) |

| Cash generated from operations | XXX |

| Income tax paid | (XX) |

| Cash flows from operating activities | ` |

| Cash flows before extraordinary item | XXX |

| Proceeds from earthquake disaster settlement | XX |

| Net cash from operating activities | XXX |

5.2 Indirect Method

Under this method, the net cash flows from operating activities are determined by adjusting (add/less) profit or loss before tax and before extraordinary/exceptional items with:

(a) Non-cash items such as depreciation, provisions, goodwill written off, etc

(b) Non-operating items i.e., investing or financing items which are considered in calculation of profit or loss before tax – such as interest receipt or payment, dividend receipt in case of non-financing entity, etc.;

(c) Changes in inventories and operating receivables and payables;

(d) Actual income tax payment;

(e) Receipts/payments from extraordinary/exceptional items.

See the below format of cash flows from operating activities under indirect method:

| Cash flows from operating activities | ` |

| Net profit before taxation and extraordinary items | XXXX |

| +/- Non-cash and non-operating items: | |

| Depreciation | XXX |

| Good will written off during the year | XXX |

| Interest income | (XXX) |

| Dividend income | (XXX) |

| Interest expense | XXX |

| Operating profit before working capital changes | XXX |

| Changes in operating assets and liabilities: | |

| Increase in sundry debtors | (XXX) |

| Decrease in inventories | XXX |

| Decrease in sundry creditors | (XXX) |

| Cash generated from operations | XXX |

| Income tax paid | (XXX) |

| Cash flow before special nature items (residuary) | XXX |

| Proceeds from earthquake disaster settlement | XXX |

| Net cash from operating activities | XXX |

6. Interest and Dividends

An entity presents cash flows from operating, investing and financing activities in a manner which is most appropriate to its business.

The following are the examples of classification of various activities:

| Particulars | Classification for reporting cash flows | |

| Banks and financial institutions | Other entities | |

| Interest received on loans and advances given | Operating | Investing |

| Interest paid on deposits and other borrowings | Operating | Financing |

| Interest and dividend received on investments in subsidiaries, associates and in other entities | Investing | Investing |

| Dividend paid on preference and equity shares, including tax on dividend paid on preference and equity shares by other entities | Financing | Financing |

| Finance charges paid by lessee under finance lease | Financing | Financing |

| Payment towards reduction of outstanding finance lease liability | Financing | Financing |

| Interest paid to vendor for acquiring fixed asset under deferred payment basis | Financing | Financing |

| Principal sum payment under deferred payment basis for acquisition of fixed assets | Investing | Investing |

| Penal interest received from customers for late payments | Operating | Operating |

| Penal interest paid to suppliers for late payments | Operating | Operating |

| Interest paid on delayed tax payments | Operating | Operating |

| Interest received on tax refunds | Operating | Operating |

The total amount of interest paid during a period is disclosed in the statement of cash flows whether it has been recognised as an expense in P&L or capitalised in accordance with Ind AS 23 – Borrowing Costs.

CARVE OUTS – Ind AS 7 Vs. IAS 7- Statement of cash flow

Interest: In case of other than financial entities, IAS 7 gives an option to classify the interest paid and interest and dividends received as item of operating cash flows. Ind AS 7 does not provide such an option and requires these items to be classified as items of financing activity and investing activity, respectively.

Dividend: IAS 7 gives an option to classify the dividend paid as an item of operating activity. However, Ind AS 7 requires it to be classified as a part of financing activity only.

7. Income Tax

- Income tax payment shall be classified under operating activities unless they can be specifically identified with financing and investing activities. It is often impracticable to separate tax payments between operating and other than operating activities.

- If it is practicable to separate the tax payments among different activities, it should be separated and presented accordingly under the respective activity.

- When tax cash flows are allocated over more than one class of activity, the total amount of taxes paid is disclosed.

8. Cash Flows in Foreign Currency

Receipts and payments of foreign currencies should be converted into the functional currency (i.e., Read either Basic concepts OR Ind AS 21) using the exchange rate on the date of cash flow. Entities can use any rate which approximates to the actual rate.

UNREALISED foreign exchange gain or loss are non-cash items, hence excluded from statement of cash flow.

However, the effect of exchange rate changes on cash and cash equivalents held or due in a foreign currency is reported in the Statement of cash flows in order to reconcile cash and cash equivalents at the beginning and the end of the period. This amount is presented separately from Statement of cash flows and includes the differences, if any, had those cash flows been reported at end of period exchange rates.

9. Investments in Subsidiaries, Associates and Joint Ventures

When accounting for an investment in an associate, a joint venture or a subsidiary accounted for by use of the equity or cost method, an investor restricts its reporting in the SCF to the cash flows between itself and the investee, for example, to dividends and advances.

An entity that reports its interest in an associate or a joint venture using the equity method includes in its SCF the cash flows in respect of its investments in the associate or joint venture, and distributions and other payments or receipts between it and the associate or joint venture.

Acquisition and disposal of subsidiaries and other business units

The aggregate cash flows arising from acquisitions and from disposals of subsidiaries or other business units should be presented separately under investing activities. It means cash inflows from disposal should NOT be deducted outflows of acquisitions.

In the case of acquisition and disposal, the entity should disclose the following:

(a) The total purchase consideration received or paid;

(b) Cash and cash equivalents paid/received as part of consideration;

(c) the amount of cash and cash equivalents in the subsidiaries or other businesses over which control is obtained or lost; and

(d) the amount of the assets and liabilities other than cash or cash equivalents in the subsidiaries or other businesses, over which control is obtained or lost, summarised by each major category.

Point (c & d) need not be disclosed when the investment in subsidiary is measured at FVTPL.

Changes in ownership interests in a subsidiary that do not result in a loss of control, such as the subsequent purchase or sale by a parent of a subsidiary’s equity instruments, are accounted for as equity transactions (see Ind AS 110) and presented as financing activities in SCF, unless the subsidiary is held by an investment entity and is required to be measured at fair value through profit or loss.

Accordingly, the resulting cash flows are classified as cash flows from financing activities.

10. Non-cash Items

Investing and financing transactions that do not require the use of cash or cash equivalents shall be excluded from an SCF. Such transactions shall be disclosed elsewhere in the financial statements in a way that provides all the relevant information about these investing and financing activities.

Examples of non-cash transactions are:

(a) the acquisition of assets either by assuming directly related liabilities or by means of a lease;

(b) the acquisition of an entity by means of an equity issue; and

(c) the conversion of debt to equity.

11. Components of Cash and Cash Equivalents

An entity shall disclose:

-

- The components of cash and cash equivalents

- Reconciliation between cash & cash equivalents in SCF and the items reported in balance sheet;

- The policy which it adopts in determining the composition of cash and cash equivalents; and

- If there is any change in such policy, it should be reported as per Ind AS 8.

12. Disclosures

-

- The amount of significant cash and cash equivalent balances held by the enterprise those are NOT available for use by it and management’s comment should be added to that.

Example: cash and cash equivalent balances held by a branch of the entity which operates in a foreign country where exchange controls or other legal restrictions apply as a result of which the balances are not available for use by the entity.

-

- Any additional information may be relevant to users in understanding the financial position and liquidity of an enterprise.

- The disclosure of segmental cash flows enables users to obtain a better understanding of the relationship between the cash flows of the business as a whole and those of its component parts and the availability and variability of segmental cash flows.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA