Guide to Dealing with Income Tax Notices Received by Donors of RUPPs

- Blog|Income Tax|

- 7 Min Read

- By Taxmann

- |

- Last Updated on 22 May, 2023

Table of Contents

- Search on ‘RUPPs group of Ahmedabad’ which unearthed the bogus donation racket

- Notices u/s 148A(d)

- Reassessment Notices in standard format appear to have been sent to all donors of 23 RUPPs who claimed deduction u/s 80GGB/80GGC

- How to respond to these SCNs?

Check out Taxmann's Taxation of Political Donations with How to Respond to Notices Concerning Bogus Political Donations which is a comprehensive book guides claiming deductions under Sections 80GGB and 80GGC for political donations and discusses relevant provisions of the Income-tax Act, Companies Act, and Representation of People Act. It offers checklists, case studies, and strategies for responding to notices on bogus political donations, divided into three key divisions that cover legal provisions, political party registration, and handling notices.

1. Search on ‘RUPPs group of Ahmedabad’ which unearthed the bogus donation racket

A search was conducted ‘RUPPs group of Ahmedabad’ on 7-9-2022.

In this search, a total of 23 Registered Unrecognized Political Parties, 35 bogus intermediary entities and 3 major exit providers were covered which was combinedly called as RUPP group of Ahmedabad. The 23 RUPPs, inter alia, covered in the action, are as hereunder:

| S.No. | Related Party Name | PAN |

| 1 | Bhartiya Rashtriya Tantra Party | AAABB3797P |

| 2 | Rashtrawadi Jantaraj Party | AAAJR1481J |

| 3 | Navsarjan Bharat Party | AAEAN5387L |

| 4 | Jantawadi Congress Party | AAJAJ0413M |

| 5 | Satta Kalyan Party | ABRAS6162Q |

| 6 | Bharatiya Jan Kranti Dal (Democratic) | AAEAB7390P |

| 7 | Apna Desh Party | AADAA0672J |

| 8 | Rashtriya Samajwadi Party (Secular) | AAAAR7090L |

| 9 | Sardar Vallbhbhai Patel Party | AADAS3620A |

| 10 | Lok Kalyan Party | AACAL8619H |

| 11 | Rashtriya Krantikari Samajwadi Party | AABTR7907G |

| 12 | Jan Sangharsh Virat Party | AABAJ6067E |

| 13 | Yuva Jan Jagruti Party | AAAAY6318A |

| 14 | Saurashtra Janta Paksha | ADYFS7965H |

| 15 | Motherland National Party | AAJAM9531E |

| 16 | Loktantra Jagrut Party | AADAL0354J |

| 17 | Bhartiya Kisan Parivartan Party | AACTB7511M |

| 18 | Rashtriya Komi Ekta Party | AABAR0883N |

| 19 | Lok Shahi Satta Party | AAAJL2386C |

| 20 | Garvi Gujarat Party | AAFAG1608L |

| 21 | Indian Swarna Samaj Party | AACAI0784Q |

| 22 | Jan Man Party | AAABJ4925D |

| 23 | Gujarat Janta Panchayat Party | AAABG3949A |

During the course of search action, large number of incriminating documents related to bogus donation receipts, diaries containing details of commission charged, loose papers containing vital information and WhatsApp chats in the mobile phones of the office bearers of the RUPPs and their key handlers confirming the allegations, were found. Documentary and digital evidences collected during the course of search action, were confronted with the key persons of the group and subsequently seized.

The modus operandi detected in course of the search operation revealed the following:

(1) The donation is received through cheque/RTGS/NEFT in the RUPP’s bank account. This money is then re-routed through various layers, and returned to the original donors, primarily in the form of cash, in lieu of some commission that ranges from 3.5% to 5%. It is pertinent to mention here that the political party doesn’t pay any tax since it is exempt u/s 13A of the Act. Further, the donors claim deduction u/s 80GGB/80GGC of the Income-tax Act, 1961. Thereby, the income earned by the donors is escaped from the tax-net in the guise of political donations.

(2) Donations received by RUPPs through Cheque/RTGS/NEFT are routed to an intermediary in the form of expenses towards political and social welfare activities.

(3) Such intermediaries are shell entities which are specifically formed for the purpose of layering funds through their bank accounts without carrying out any business activities. These entities are either formed and controlled by the same persons running the political parties or by certain other individuals who create and manage multiple bogus entities by using credentials of other men/women of no means by paying them meagre amounts.

(4) These bogus entities have no physical/business existence, and they are solely used for providing accommodation entries.

(5) It is also observed that bank accounts of new intermediary entities are created for this purpose, used for few years to route crores of funds and then bank accounts are either closed suo motu by the handlers to escape the eyes of law or closed subsequent to actions by Law enforcement agencies. Thus, the handlers of the intermediaries keep forming new namesake/bogus entities and open their bank accounts, use it for providing accommodation entries, close it down and start with new bogus entities.

(6) These bogus entities are formed on one hand to layer unaccounted moneys and evade tax and on the other hand earn commission on all the funds routed through it.

(7) Huge funds get transferred to these bogus intermediary entities from the bank accounts of the RUPPs under the veil of political and social expenditure. However, the said expenses shown in the books of account of the RUPPs are bogus and non-genuine and these are done only to transfer the moneys into the account of the intermediary in order to return the same to the original donors and earn commission in the process. Such individuals/proprietary concerns/companies are active agents in this scam and comprise the points at which either cash is withdrawn or again transferred to another bogus layering entity to get converted to cash or to return to the original donors through banking channel. Thus, the whole process is bogus and non-genuine.

(8) Further, during the course of pre as well as post search it has been established that these RUPPs were involved in the activity of providing accommodation entry by way of bogus donation. Thereafter, on the basis of bank account statements of these RUPPs, beneficiaries/donors who had availed deduction for the bogus donation made to these RUPPs have been identified.

2. Notices u/s 148A(d) sent to donors of 23 RUPPs for AY 2019-20 asking them why reassessment notices should not be issued to them for withdrawing deductions under section 80GGB/80GGC

Show Cause Notices u/s 148A(b) have been sent to donors of 23 RUPPs who are part of ‘RUPPs group of Ahmedabad’. The SCNs ask these donors to show cause as to why reassessment notices should not be issued to them u/s 148 for Assessment Year 2019-20 for withdrawal of deductions granted to them under section 80GGB/80GGC for donations to one or more of these RUPPs. Revenue could not issue such SCNs for assessment years prior to AY 2019-20 in view of the 3 years time-limit imposed u/s 149(1)(b) where income escaping assessment is less than ` 50,00,000.

The SCNs narrate all the ‘information’ about modus operandi in Para 10.1 above in Paras 1 to 4 of ‘Annexure’ to the SCN. Paras 5 to 7 of the Annexure ask the assessee donor to show cause by submitting explanation along with relevant documents. Paras 5 to 7 read as under:

5. As per information, assessee ……………………………PAN………………… has obtained accommodation entry in form of political donation of `……… during FY 2018-19 relevant to AY 2019-20. Further, on going through return of income filed by you for AY 2019-20, it is noticed that you have claimed donation of `……… u/s 80GGB/80GGC/80G of the Act. Thus, donation shown to above-mentioned Political Parties by you is bogus and claim of deduction u/s 80GGB/80GGC of the Act on the basis of such bogus donation is not allowable.

6. As stated in preceding paras, there is sufficient information available on records which clearly suggest that income chargeable to tax to the extent of `.………… has been escaped the assessment within the meaning of provision of section 147 of the IT Act, 1961 for the assessment year 2019-20.

7. In view of above, an opportunity of being heard is provided to you videthis Show Cause notice and you are requested to submit your explanation alongwith supporting documents.

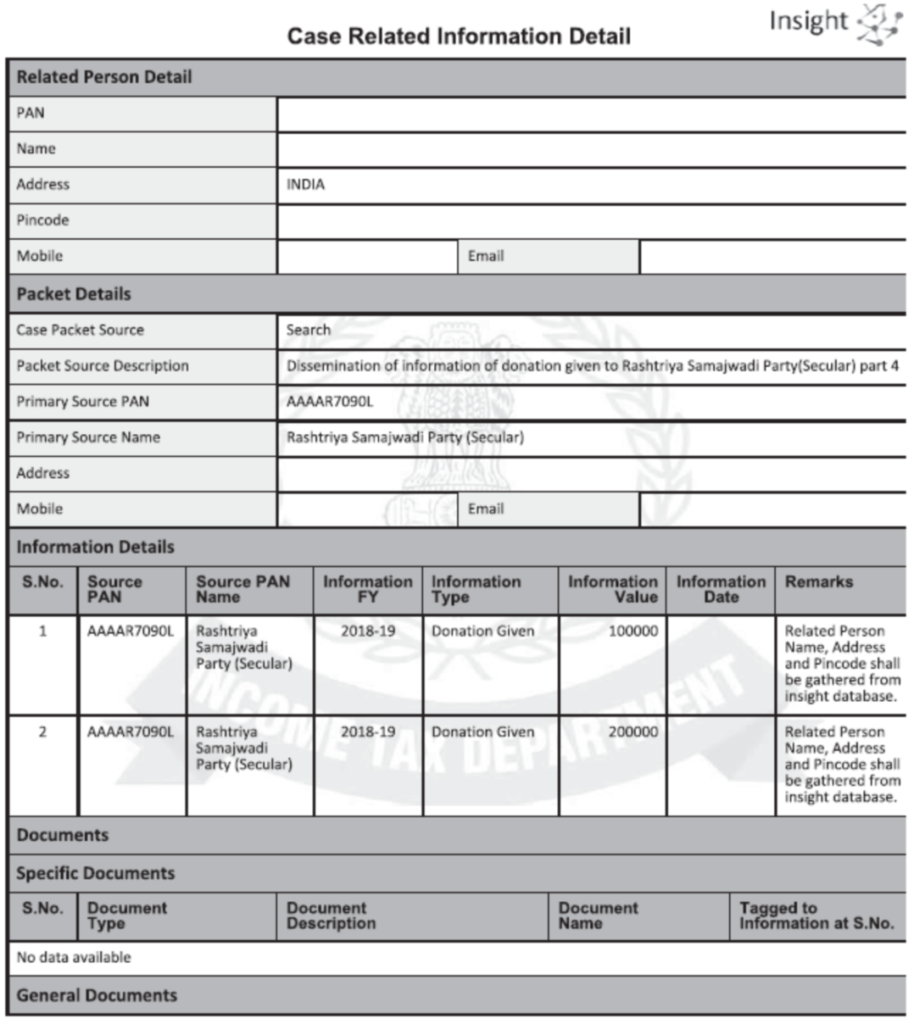

The Show Cause Notice enclose relevant ‘information’ from Department’s Insight Portal as under:

3. Reassessment Notices in standard format appear to have been sent to all donors of 23 RUPPs who claimed deduction u/s 80GGB/80GGC

Reassessment notices appear to have been sent in standard format to every donor who donated to any of these 23 RUPPs on the assumption that every donor who claimed deduction for his donation under section 80GGB/80GGC was complicit in this bogus donation racket and got his donation back in cashless a small commission. It appears that the only point where thing where application of mind has taken place is the relevant section in “section 80GGB/80GGC/80G” in Para 5 of Annexure to SCN is highlighted in bold. There appears to have been no serious attempt to analyse facts about the profile of the noticee donor (his profile, amount of income returned by him, proportion of political donation to total returned income, quantum of taxes paid by him), before issuing the SCN. The page from Insight Portal attached to SCN refers to two documents – Appraisal report and clarification note for AOs.

4. How to respond to these SCNs?

The following principles need to be kept in mind in drafting an effective response :

- There is no way a noticee donor can give evidence of a negative – i.e. he did not get cash back. Therefore, he will have to find out first the material on the basis of which the Department have issued SCN to him.

- To be able to respond effectively to SCN, he would need to know the basis on which Department has formed the opinion that his donation was a bogus donation where he got cash back and thus income has escaped assessment.

- As the Insight page refers to Appraisal report and clarification note for AOs, he needs to get relevant portions of these for giving an effective response. Therefore, he should request for the relevant portions of these reports cited in Insight Portal as pertaining to himself.

As regards request for above reports, the following principles laid down by Supreme Court in T.Takano v. SEBI [2022] 135 taxmann.com 25 are relevant:

- At the stage of issuing Show Cause Notice to determine whether any enquiry should be initiated against the noticee, it is sufficient if only the material relied upon by the authority is disclosed.

- At the adjudication stage, however, the noticee has a right to be furnished all material relevant to the proceedings initiated against him. It is not sufficient to furnish only the material relied upon by the authority.

- Ipse dixit of the authority that certain material is not relied upon will not exempt disclosure of the material if it is relevant to and has a nexus that is taken by the authority. In all probability, such material would have influenced the decision reached by the authority.

- Thus, the actual test is whether the material that is required to be disclosed is relevant for purpose of adjudication. If it is, then the principles of natural justice require its due disclosure.

- Such relevant material must be furnished even if it is only internal communication within the department.

- The disclosure of material serves a three-fold purpose of decreasing the error in the verdict, protecting the fairness of the proceedings, and enhancing the transparency of the investigatory bodies and judicial institutions.

- The noticee’s right of disclosure of material is not absolute. In view of clauses (d), (e) and (h) of sub-section (1) of section 8 of the RTI Act, the requirement of compliance with the principles of natural justice cannot therefore be read to encompass the right to a roving disclosure on matters unconnected or as regards the dealings of third parties.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA