GST Litigation on Mineral Transport Services – Transport | Renting | Mining | Cargo Handling

- Blog|GST & Customs|

- 10 Min Read

- By Taxmann

- |

- Last Updated on 17 July, 2023

Table of Content

- Transaction Background

- Relevant Legal Provisions

- Authorities Views

- Impact of Circular No 177

- Analysis & Views

- Conclusion

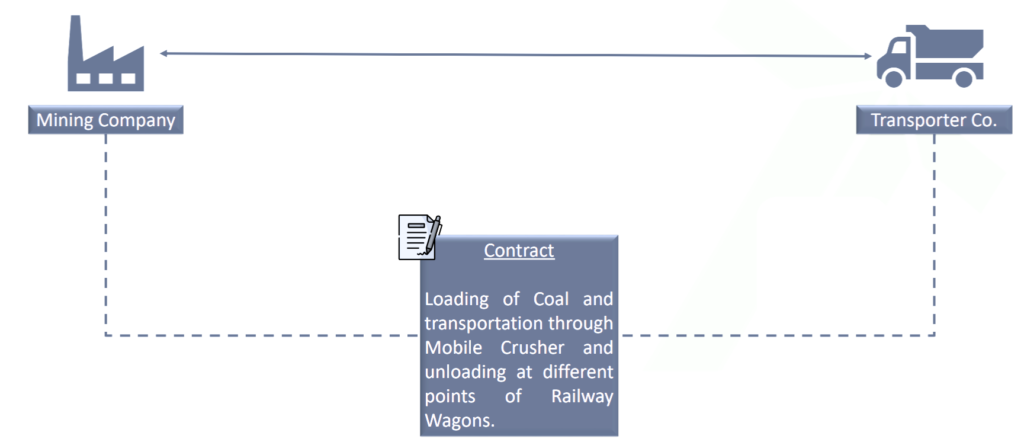

1. Transaction Background

1.1 Terms of Contract/Work Order

- Loading of Coal in to tippers/dumpers from crusher point -> transportation -> unloading at specified Railway sidings within mining areas

- Pre-determined quantity of Coal to be transported with specific conditions for transporting specified quantity per day/per week.

- Penalty clause for shortfall in quantum of transportation

- Maintenance of Private Roads (other than PWD roads) utilized for transportation is generally the responsibility of transporter

- Rates generally are not changed except change in the price of H.S.D.

- List of tippers/dumpers, pay loaders to be deployed at work are submitted by transporter

- Contractor deploys his agent/representative in charge at work who receives instructions on contractors behalf

- Tippers/Dumpers used for coal transportation mentions the following:

- ‘On X Coalfield Ltd duty’ in bold letters

- Name of Area

- Registration number of vehicle

- Period of Contract

1.2 Assumptions/Disclaimer

- Webinar would focus on litigation on Transportation charges (treatment of loading charges are not discussed)

- Discussion would primarily be on the merits of case

- Other aspects e.g. limitation period, validity of SCN, penalty applicability etc. are not discussed

- Discussion is based on a general terms of contracts, views may change due to specific change in terms

2. Relevant Legal Provisions

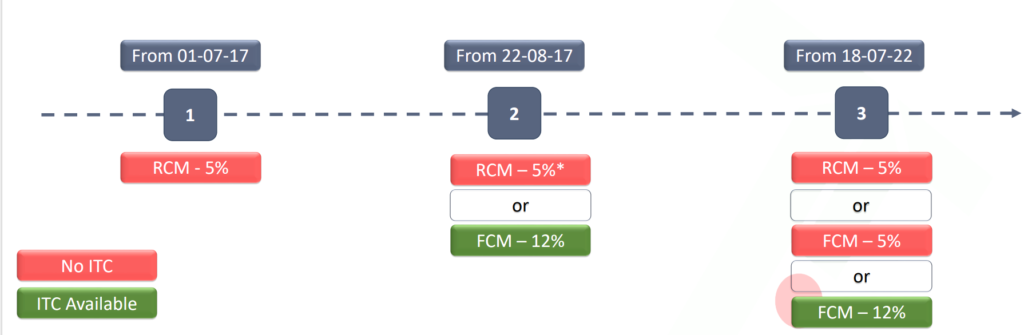

2.1 HSN 9965 – GTA (GST Rate & Liability)

General Note: Transportation of goods by Road (other than by GTA, Courier Agency) is exempt from GST under Sl. No. 18 of Notification No. 12/2017-CT (Rate), dated 28-6-2017.

* If GST is not paid by supplier under Forward Charge mechanism (FCM)

2.2 HSN 9966 – Renting (GST Rate & Liability)

2.3 GST Tariff Description

| Heading | Description of Service | Rate (%) | Condition |

| GST rate on GTA (22-08-17 to 18-07-22) | |||

|

9965 (GTA) |

(iii) Services of goods transport agency (GTA) in relation to transportation of goods (including used household goods for personal use).

Explanation.- “goods transport agency” means any person who provides service in relation to transport of goods by road and issues consignment note, by whatever name called. |

5 |

Provided that credit of input tax charged on goods and services used in supplying the service has not been taken. [Please refer to Explanation no. (iv)] |

| or | |||

|

12 |

Provided that the goods transport agency opting to pay integrated tax @ 12% under this entry shall, thenceforth, be liable to pay integrated tax @ 12% on all the services of GTA supplied by it. | ||

| GST rate on Rental (01-07-17 to 18-07-22) | |||

| 9966 | (iii) Rental services of transport vehicles with operators, other than (i) and (ii) above. | 18 | – |

2.4 Explanatory Notes (Scheme of Classification): 9966

9966 Rental services of transport vehicles with or without operators

99660 Rental services of transport vehicles with or without operators

996601 Rental services of road vehicles including buses, coaches, cars, trucks and other motor vehicles, with or without operator.

This service code includes rental of buses or coaches, trucks and other motorized freight vehicles, with/without operators for a period of time, not generally dependent on distance. The renter defines how and when the vehicles will be operated, determining schedules, routes, and other operational considerations.

This service code does not include:

- local, urban and suburban bus or coach charter services, cf. 996413

- long-distance bus or coach charter services, cf. 996422

2.5 Determining Criteria for HSN 9966

Period of Time

- Rental of vehicle for period of time (Say one month, one week etc.)

- Generally, does not dependent on distance

With or without operator

- Such vehicles can be given with or without operators

Control on vehicle

- Renter defines how and when the vehicles will be operated, determining schedules, routes, and other operational considerations

3. Authorities Views

3.1 Arguments of Authorities

Rental/Hire Arrangement

- Tippers, dumpers, loader, trucks are given on hire to mining lease operator. Expense for fuel are generally borne by recipient of services.

- Vehicles with driver are at disposal of mining lease operator for transport of minerals within mine areas (mining pit to railway siding, beneficiation plant ) as per his requirement during period of contract

Not a Transport of goods

- This is nothing but time charter of goods carriage or rental services of transport vehicles with operator which fall under heading 9966 and attract 18% GST. This is not a service of transport of goods by road.

4. Impact of Circular No 177

4.1 Circular No. 177/09/2022-TRU

- Vehicles such as tippers, dumpers, loader, trucks etc., are given on hire to mining lease operator. Expenses for fuel are generally borne by recipient.

- Vehicles with driver are at disposal of mining lease operator for transport of minerals within mine area as per his requirement during period of contract.

- Such services are nothing but ‘rental services of transport vehicles with operator’ which fall under heading 9966 and attract 18% GST.

- Person who takes vehicle on rent defines how & when vehicles will be operated, determines schedules, routes and other operational considerations. Its not a transport of goods

- Renting of trucks etc. with driver for a period of time is a service of renting of transport vehicles with operator falling under HSN 9966 & not service of transportation of goods by road.

4.2 Analysis of Circular No 177

- Is the mining operator in control of the vehicles, including determining how and when they will be operated, setting schedules, routes, and making other operational decisions? Is this control exercised unilaterally or is it mutually agreed upon under a contractual arrangement between the parties?

- Is the vehicle given to the mining operator for a specific time period, such as 10 days, or for a specific quantity, such as 1,00,000 MT (metric tons)?

- Once the vehicle is deployed at work, does the supplier lose the ability to operate it at their discretion?

- Are the risks and rewards independent of transportation, particularly when there is a liquidated damages (LD) clause in contracts for lesser transportation?

- Whether any possession of vehicle is given to mining operator?

5. Analysis & Views

5.1 Questions to Ponder

- What is the actual nature of the services being disputed – renting or transportation?

- If the services are classified as transportation, do the transporters meet the criteria to be considered a ‘Goods Transport Agency’? Is there a requirement to issue a consignment note for these services?

- How does the previous litigation of Service Tax under GST affect the current situation?

- What is the implication on mining companies if tax is not paid under reverse charge?

- What is the impact of reverse charge payments made by mining companies on supplier’s liability?

- What would be the exposure on ITC availed by mining companies if it is determined by the courts that tax was not payable under reverse charge?

5.2 Renting vs Transportation

CIT vs. Poompuhar Shipping Corpn. Ltd. (2006) 153 Taxman 486 (Mad)

The term ‘hire’ is not defined in the Income-tax Act. So, we have to take the normal meaning of the word ‘hire’. Normal hire is a contract by which one gives to another temporary possession and use of the property other than money for payment of compensation and the latter agrees to return the property after the expiry of the agreed period.

Dharmabhakti Travels v. CCE (2007) 9 STT 332 (CESTAT SMB)

Control + Possession both would be needed for renting:

Assessee was providing vehicles to BSNL on per Km basis. Driver was provided by appellant. A prima facie view was held that this is not rent-a-cab service – same prima facie view in Lok Priya Travels v. CST (2008) 14 STT 447/11 STR 148 (CESTAT)

Kuldip Singh Gill v. CCE (2005) 2 STT 34 (CESTAT)

Providing vehicles to companies for transport of their employees or children of employees and getting payment on per trip basis depending on distance, time etc. is not renting of cab. It is provision of transport service and is not taxable.

Shiva Travels v. CCE (2007) 7 STT 75 (CESTAT)

Whether giving a driver would make any difference?

Cab given with or without driver will come under taxable service. (argument of assessee was that cab was never given on rent as the control over cab was kept by the cab owner himself).

R S Travels v. CCE (2008) 15 STT 437 (CESTAT)

Control + Possession both would be needed for renting:

It was observed that in rent-a-cab scheme, the cab is given on rent with or without driver for a certain period. During that period, the vehicle is at disposal and under control of client. However, when cab is engaged only for carrying persons from one place to other, the control remains with the cab operator/driver. This is not a rent-a-cab service

CCE v. Sachin Malhotra (2014) 48 GST 738 / 51 taxmann.com 392 (Uttara HC DB)

Unless control of vehicle is made over to hirer and he is given possession for howsoever short a period to deal with vehicle, there would be no ‘renting’; hence, ‘hiring’ of vehicles on per km. basis without transfer of possession and control is not liable to service tax under ‘rent-a-cab services’

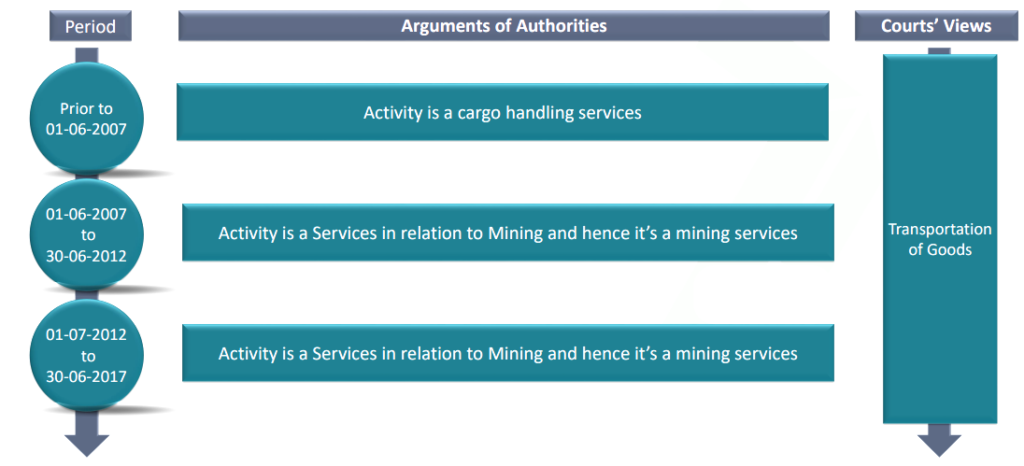

5.3 Renting vs Transportation – Service Tax Regime

Arjuna Carriers P Ltd vs Commissioner of ST, Raipur 2016 (41) S.T.R. 632 (Tri. – Del.)

Period Prior to 01-06-2007

Assessee only engaged in activity of transportation and not involved in loading or unloading of aforesaid goods from wagons or motor vehicles. Undisputedly, Service Tax under GTA being paid by service recipient and accepted by department. The assessee not liable to pay Service Tax under Cargo Handling Service.

CCE and ST, Raipur vs Singh Transporters 2017 (4) G.S.T.L. 3 (S.C.)

Period 01-07-2007 to 30-06-2012

Transportation of coal from the pit-heads to the railway sidings within the mining areas is more appropriately classifiable under the head ‘transport of goods by road service’ & does not involve any service in relation to “mining of mineral, oil or gas”.

Arjuna Carriers P Ltd vs Commissioner of ST, Raipur

2016 (41) S.T.R. 632 (Tri. – Del.)

Period 01-07-2012 to 30-06-2017

For period prior to negative list, the SC explicitly held that the impugned services are transportation of goods by road. However, it did not provide that whether transporters can be referred as a GTA or not. In the given case, the same was recognized and the controversy restricted to whether transporters qualify as GTA or not.

5.4 Transportation vs GTA

About GTA

- Meaning: Any person who provides service in relation to transport of goods by road and issues consignment note, by whatever name called.

About Consignment Note

- ‘Consignment note’ is not defined in GST Law.

- Rule 4B of erstwhile Service Tax Rules, 1994: Consignment note means a document, issued by a GTA against the receipt of goods for the purpose of transport of goods by road in a goods carriage, which is serially numbered, and contains the name of the consignor and consignee, registration number of the goods carriage in which the goods are transported, details of the goods transported, details of the place of origin and destination, person liable for paying service tax whether consignor, consignee or the goods transport agency.

Requirement of issuing Goods Receipt note under Carriage of Goods Road Act, 2007

- Common carrier shall issue a goods receipt after the goods are loaded by the consignor or after the goods are accepted by such carrier.

- The document is a prima facie evidence of the weight or measure and other particulars of the goods and the number of packages stated therein.

- Such goods receipt shall include an undertaking by the common carrier about the liability for loss of, or damage to the consignment.

(Section 9 of Carriage of Goods by Road Act, 2007)

Open Points about GTA

- Whether Weighment slip can be referred to as consignment note?

- Whether non-issuance of Consignment note by transporter absolves mining operators from GST liability?

5.5 Impact of GST liability due to non-issuance of CN

- Consignment note is issued to account for liability in case of damage or loss to the consignment.

- It transfers the lien of the goods to the carrier, making them responsible for the safe delivery.

- Only GTA services that assume agency functions are brought under the GST net. Individual truck/tempo operators who don’t issue consignment notes are not covered as GTAs.

- Rajasthan AAAR held that where liability for such consignment is resumed by the carrier and lien is transferred, mere non issuance of such consignment note wouldn’t result in non recognition of such carrier as a GTA.

- Madras High Court held that assessee was liable to pay service tax even after GTA’s failure to issue consignment note. The recipient of services couldn’t avoid payment of Service Tax taking advantage of the GTA ‘s failure to issue a consignment note.

5.5.1 Judgements under erstwhile law favorable for transporters

However, specifically to the mineral carrier transport industry, tribunals have consistently held that if consignment note is not issued by the transporter, the mining operator would not be liable to pay Service Tax under reverse charge.

- Northern Coalfields Ltd. v. CCE, Allahabad – [2018] 92 taxmann.com 219/67 GST 1/10 GSTL 245 (Allahabad – CESTAT)

- Nandganj Sihori Sugar Co. v. CCE, Lucknow – [2014] 47 taxmann.com 92/46 GST 570/34 STR 850 (New Delhi – CESTAT)

- South Eastern Coalfields Ltd. v. CCE Raipur – 2018 (10) G.S.T.L. 50 (Tri. – Del.)

- Shreenath Mhaskoba Sakhar Karkhana Ltd. v. C.C.E. Pune-III – 2017 (3) G.S.T.L. 169 (Tri. – Mumbai)

- Western Coalfields Ltd. v. CCE Nagpur – 2017 (4) G.S.T.L. 260 (Tri. – Del.).

5.5.2 Matter is pending before Supreme Court, however no stay is granted

Above decisions relied, wherein it has been held that consignment note is mandatory, is pending for consideration before the Hon’ble Supreme Court, as reported in Commissioner v. South Eastern Coalfields Ltd. 2017 (7) G.S.T.L. J39 (S.C.)

5.6 Impact of ITC of Mining Operators

Assuming comes in favor of transporters, whether there is any risk on mining operators who have paid GST under reverse charge? In other words, whether department can argue that since no tax was payable, therefore, credit of amount paid to government wouldn’t be allowed as ITC?

6. Conclusion

- Although the review of specific agreements is necessary, in general, the services meet the criteria for a transportation arrangement.

- Circular number 177 holds significant authority for tax authorities, and any disputes would likely be resolved at the High Court level.

- If the service recipient has not paid the tax under reverse charge, the matter would only be settled at the Supreme Court level since the matter of requirement of issuing a Consignment note is currently pending before the Supreme Court.

- CBIC is requested to reconsider the clarification in light of the legal principles established under the previous Service Tax Laws.

- Contractors and Mining operators are advised to examine the contractual obligations regarding the burden of GST from the contracts.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

The blog provides a comprehensive analysis of GST implications on mineral transport services, highlighting the distinction between ‘Goods Transport Agency’ and ‘rental services of transport vehicles with operators’.