GST Implications on Joint Development Agreements for Builders & Developers

- Blog|GST & Customs|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 25 October, 2023

Table of Contents

- Real Estate Sector in GST Regime

- GST on or after 01.04.2019 [Post Amendments vide Notification 03 to 09 – Central Tax (Rate) dated 29.03.2019]

- Affordable Residential Apartment

- Conditions for Concessional Rate of Tax under New Scheme of Taxation

- Taxability of Development Rights, FSI, TDR, and Lease Premium

- Joint Development Arrangements (JDA) – Area Sharing

- Joint Development Arrangements (JDA) – Revenue Sharing

- Relevant Legal Precedents

1. Real Estate Sector in GST Regime

| Period | Tax rates |

| 01.07.2017 to 31.03.2019 | GST on Sale of under-construction affordable units- 8% with ITC of inputs, input services and capital goods

GST on Sale of under-construction units (residential & commercial) – 12% with ITC of inputs, input services and capital goods |

| 01.04.2019 onwards | GST on Sale of under-construction affordable units- 1% without ITC GST on Sale of under-construction residential units – 5% without ITC

GST on Sale of under-construction commercial units in RREP project: 5% without ITC GST on Sale of under-construction commercial units in REP project or in an exclusive commercial project: 12% with ITC |

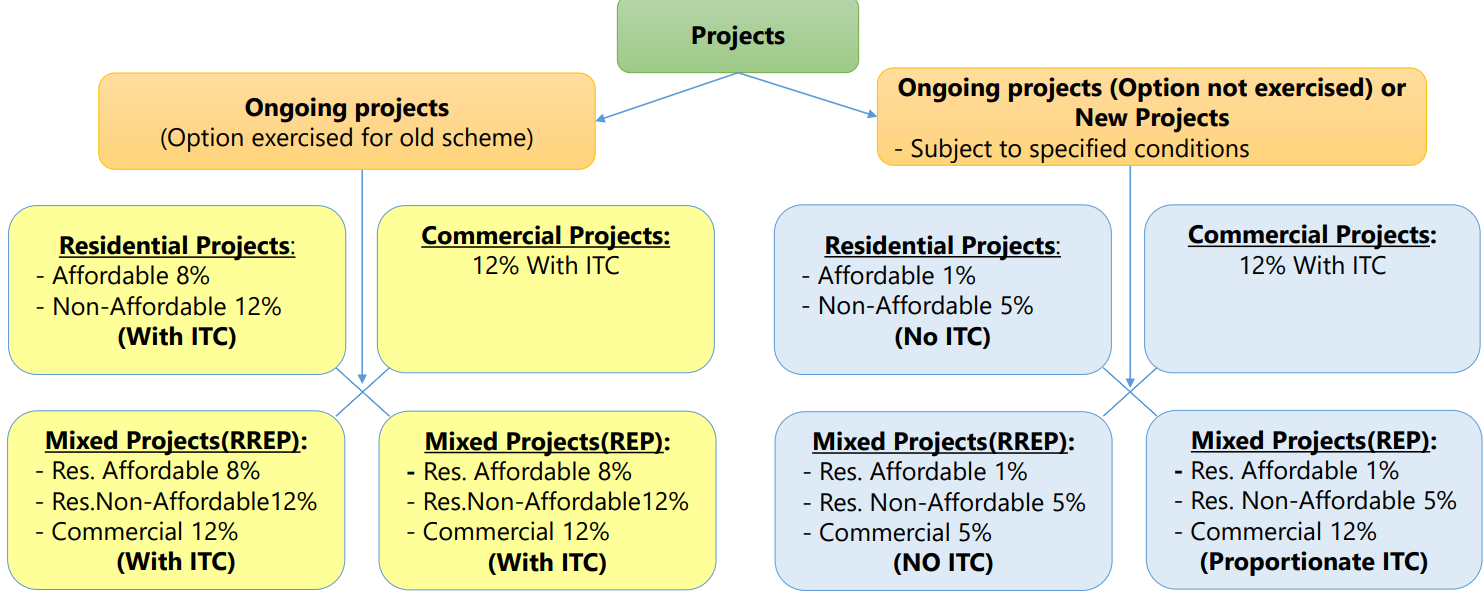

2. GST on or after 01.04.2019 [Post Amendments vide Notification 03 to 09 – Central Tax (Rate) dated 29.03.2019]

2.1 One-Time Option for Ongoing Projects

- Builders to have one-time option for Ongoing Projects:

- To pay tax at existing effective rates i.e. 8% (affordable houses) or 12% (others) with Input tax credit (‘ITC’); or

- To pay tax at new rate i.e. 1% (affordable houses) or 5% (others) without ITC

- Option to be exercised by filing notified form on or before 10th May, 2019 (which was further extended to 20th May, 2019)

- In case of failure to exercise option, new taxation scheme will apply

- Above option is not available for projects:

- Other than ongoing project

- New Projects commencing on or after 1st April, 2019

- Ongoing project is a project satisfying stipulated conditions in notification

2.2 Tax Implications on or after 01.04.2019 – Ongoing Projects Opting for Old Scheme

| Particulars | Effective Tax Rate |

| Sale of under-construction residential affordable house | 8% (with ITC) |

| Sale of under-construction residential units (other than affordable) | 12% (with ITC) |

| Sale of under-construction commercial units | 12% (with ITC) |

| Sale of Completed Flats/units Post OC | Nil |

- Accumulated ITC as on 31st March, 2019 remains intact

- Credit of tax paid for inputs, input services and capital goods procured on or after 1st April, 2019 can be availed

- Output tax liability can be discharged from ITC balance

- No stipulation as to procurement of 80% of input and input services from registered vendors

- No stipulation for payment under RCM on procurement from unregistered vendors

- ITC proportionate to unsold units needs to be reversed U/R 42 on completion of the project

2.3 Tax Implications on or after 01.04.2019 – Ongoing Projects (Not Opting for Old Scheme) and New Projects

| Particulars | Effective Tax Rate | Mode of payment |

| Sale of under-construction residential affordable house (Including houses under Specified Schemes) | 1% (without ITC) | Cash |

| Sale of under-construction residential units (other than affordable) | 5% (without ITC) | Cash |

| Sale of under-construction commercial units (in RREP i.e. up to 15% of total carpet area) | 5% (without ITC) | Cash |

| Sale of under-construction commercial units (in REP) | 12% (proportionate ITC) | Cash/Credit |

| Sale of under-construction commercial units (in exclusive commercial complex) | 12% (with ITC) | Cash/Credit |

| Sale of completed flats/Units Post OC | Nil | NA |

- Builder is not entitled to ITC in respect of services taxed at concessional rate

- Mandatory procurement to the extent of 80% from Registered Person and tax payable under RCM on shortfall

2.4 Amended Scheme of Taxation

- Sale of completed flats/commercial units (Post OC) – Not liable to GST

3. Affordable Residential Apartment

| Particulars | Conditions |

| Metropolitan Cities* | House having carpet area upto 60 sq. mt. (approx. 644 sq. ft. – RERA Carpet); and having Gross amount upto Rs. 45 Lacs |

| Non-metropolitan cities/towns | House having carpet area upto 90 sq. mt. (approx. 968 sq. ft. – RERA Carpet); and having Gross amount upto Rs. 45 Lacs |

| An apartment in an ongoing project | Covered under specified schemes [Under Notification No. 11/2017-CT(R)] for which the promoter has not exercised option to pay tax under old scheme |

*Metropolitan cities include following:

Bengaluru, Chennai, Delhi NCR (limited to Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, Faridabad), Hyderabad, Kolkata, Mumbai (whole of Mumbai Metropolitan region (MMR) i.e. consists of 8 Municipal corporation and 9 Municipal councils around Mumbai)

3.1 Value of Affordable Residential Apartment

- Determination of threshold value (i.e. Gross amount) of Rs. 45 lakhs:

- Consideration charged for services

- Amount charged for the transfer of land or undivided share of land, including by way of lease or sublease

- Following to be included for calculating threshold:

| Development charges | Parking charges | Preferential Location Charges | Common Facility charges | Similar Charges |

- Whether following should be included for calculating threshold of 45 lakhs?

| Infrastructure Charges | Extra amenities | Club House Charges | Furniture |

| Society formation charges | Share capital contribution | Advance maintenance | Legal charges |

4. Conditions for Concessional Rate of Tax under New Scheme of Taxation

4.1 Non–Availment of ITC

- Builder not entitled to ITC related to supply used in construction services taxed at 1% or 5%

- Builder not entitled to utilize ITC for discharging tax liability

- ITC not availed shall be reported every month by reporting the same as ineligible credit in GSTR-3B

- Builder to reverse the ITC availed from 01.07.2017 (or from inception of project if started after 01.07.2017) till 31.03.2019 which is attributable to installments due on or after 1st April, 2019 (to be taxed at concessional rate) As per formula given in Notification No. 03/2019- CT (R), transitional credit needs to be taken into account for above referred reversal

- Reversal to be worked out project wise as per formula provided in NN 3/2019 – CT (R) dated 29.03.2019`

– How to allocate Transitional credit between the projects? - Reversal to be done before due date for filing of return for September, 2019 (i.e. 20th October, 2019)

- Reversal can be done by utilizing ITC balance lying in the electronic credit ledger and/or by making cash payment

4.2 Procurement from Registered Persons

- Eighty percent (80%) of value of input and input services used for supplying construction services [taxed at concessional rate] to be procured from registered persons

- For calculating shortfall, following procurement should be excluded:

| Development rights | High speed diesel | Electricity |

| Motor spirit | Natural gas | FSI |

Long term lease of land (against upfront payment in the form of premium, salami, development charges etc.)

- GST to be paid under RCM at 18% on inputs (other than cement) and input services in case of shortfall of purchases of 80% from registered person (irrespective of applicable tax rates)

- GST to be paid under RCM on following procurements from unregistered person (irrespective of stipulated shortfall):

- Capital goods at applicable rate [Notification No. 7/2019 – CT (R)]

- 28% on Cement

- Builder shall maintain project-wise account of inward supplies from registered and unregistered supplier and calculate tax payments on the shortfall at the end of the financial year (or up to date of completion of project)

- Builder shall submit the above details in the prescribed form electronically on the common portal by end of the quarter (30th June) following the financial year (Form – not yet notified)

- Tax liability on the shortfall of inward supplies from unregistered person (except cement and capital goods) to be added to output tax liability in the month of June following the end of the financial year.

- Monthly payment of tax under RCM on procurement of following from unregistered persons:

- Cement at 28%;

- Capital goods at applicable rates

5. Taxability of Development Rights, FSI, TDR, and Lease Premium

5.1 Between 01.07.2017 to 31.03.2019

- Taxability:

- Department View – Such rights are not land per se and hence liable to GST at 18%

- Legal View – Rights in land is land per se and hence not liable to GST.

- Person liable to pay tax – Landowner, Supplier, Lessor under Forward charge

- Time of Supply – Point of time when Development Rights/TDR/Lease Rights are transferred irrevocably

- Value of Supply:

- If in cash- Transaction value [Section 15(1) of CGST Act] in case of non-related party

- If in Kind- Market value of such rights i.e. reckoner value or stamp duty valuation [ Rule 27(a) of CGST Rules]

- Tax Rate – 18% under HSN code 999799 (Other services nowhere else classified)

- Service recipient (Builder or Developer) was entitled to ITC thereof

5.2 Transfer of DR/TDR/FSI/Lease on or after 01.04.2019 for Construction of Residential apartments

| Taxability [Notification No. 04/2019 – CT (R)] – presuming it is a supply (not falling under Sch. III of CGST Act) and hence leviable to tax |

|

| Due date for Payment of Tax – In area sharing, revenue sharing or outright purchase of DR/TDR/FSI/Lease |

Not later than tax period in which Completion certificate is issued or First occupation in the project whichever is earlier [Notification No. 6/2019 – CT (R) amended by Notification No. 03/2021 – CT (R) dated 02.06.2021] |

| Person liable to pay Tax | Promoter – Developer (to be paid under RCM) |

| Credit of tax paid under RCM by Developer on or after 01.04.2019 | New Scheme – ITC not eligible; Old Scheme – ITC eligible |

| Tax on transfer of DR/TDR/FSI/Lease pertaining to unsold flats on completion of project | Lower of: [Notification No. 04/2019 – CT (R)]

|

* Valuation of DR/TDR/FSI/Lease

** Value of unsold flats is deemed as equal to value of similar apartments charged by the promoter nearest to the date of completion certificate or first occupation, whichever is earlier |

|

5.3 Transfer of DR/TDR/FSI/Lease on or after 01.04.2019 for Construction of Commercial apartments

| Taxability | Taxable |

| Due date for payment of Tax | Outright purchase: Date of transfer of DR/TDR/FSI/Lease Area Sharing:

Whichever is earlier Revenue Sharing (probable views):

|

| Person liable to pay Tax | Promoter – Developer (to be paid under RCM) |

| Tax rate | 18% on Value of DR/TDR/FSI/Lease |

| Valuation of DR/TDR/FSI | Outright purchase: value of monetary consideration paid for outright purchase Revenue sharing: monetary consideration paid to the Landowner as revenue share; Area sharing: value of similar apartments charged by promoter from independent buyers nearest to the date of transfer of DR/TDR/FSI; |

| Credit of tax paid under RCM by Developer | For exclusive commercial projects – ITC is eligible [subject to reversal on completion of project u/R 42] For REP – ITC attributable to Commercial portion can be claimed [subject to reversal on completion of project u/R 42] For RREP (with Commercial portion less than 15%) – ITC not eligible for developer opting New scheme. However, same is eligible for developer opting Old scheme; |

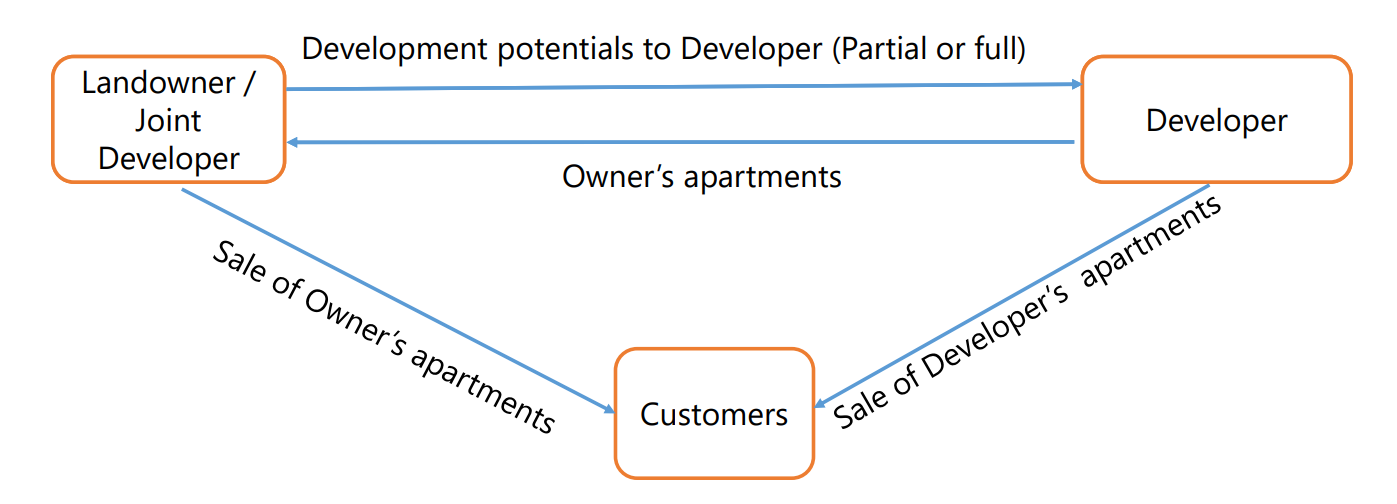

6. Joint Development Arrangements (JDA) – Area Sharing

- What are the tax implications of above arrangement for residential or commercial complex?

6.1 Transfer of Development Right/TDR/ FSI/Lease premium in JDA (Area sharing) [On or after 1st April 2019]

- Landowner transfers development rights to Developer

- Landowner receives consideration in form of constructed apartments (Owner’s Area)

- Time of supply arises on irrevocable transfer of development rights

- Due date of payment – on completion of project [Notification No. 6/2019-CT(R) dated 29.03.2019]

- Transfer of development rights/TDR/FSI/Lease rights on or after 01.04.2019 is exempt where it is used for construction of residential apartments sold before issuance of completion certificate

- Development rights, TDR, FSI, lease premium used for following is not exempt:

- Construction of commercial premises including those in RREP (to be paid by developer under RCM)

- Construction of residential apartments to be sold after completion i.e. unsold apartments as on date of OC (payable by developer under RCM)

- Onus is not on landowner to discharge GST on transfer of DR/TDR/FSI/Lease rights on or after 01.04.2019

6.2 Transfer of Development Right in JDA (Area sharing) On or after 1st April 2019

GST payable by developer under RCM on development rights relatable to:

| Apartments | Taxability |

| Construction of commercial apartments | Value of Development Rights shall be deemed to be value of similar commercial apartments charged by promoter from Independent buyer nearest to date of transfer of Development Rights or FSI. Tax rate will be 18% thereof – Clause iii of Notification No. 04/2019-CT(R) dated 29.03.2019 |

| Residential apartments remained unsold on completion |

|

6.3 GST on Area Allotted to Landowner in JDA (Area sharing) [on or after 1st April 2019]

Developer

- Construction of owner’s apartments is a service by developer to landowner which is liable to GST [subject to final verdict of Honourable Supreme Court in case of Vasantha Green Projects where in Hyderabad CESTAT held that service tax is not payable by developer on owner’s area]

- Developer shall pay tax on owner’s area at the time of completion certificate or first occupation, whichever is earlier

- Notification No. 3/2021-Central Tax (Rate) dated 02.06.2021 allows developer to prepone tax payment on landowners’ area to enable landowner to claim ITC thereof

- GST to be paid on the value of total amount charged for similar apartments in the project to independent buyers nearest to the date of transfer of development rights

- Developer is liable to GST on sale of under-construction apartments/units at 5% or 1% or 12% subject to conditions mentioned in Notification 3/2019 – CT(R)

6.4 GST on Sale of Owner’s Apartment by Landowner in JDA (Area sharing) on or after 1st April 2019

- Landowner is liable to GST on sale of under-construction apartments/units at 5% or 1% or 12%

- Developer will charge GST @ 5% or 1% or 12% on apartments allotted to landowner

- Developer can pay GST on earlier of date of completion of project or first occupation

- Landowner is entitled to input tax credit of GST levied by developer on construction of owner’s flat subject to cap of output tax payable on Residential or commercial apartments (in RREP) sold under construction

- If developer pays tax on completion of the project, landowner will not be in a position to avail or utilise ITC Notification No. 3/2021-Central Tax (Rate) dated 02.06.2021 allows developer to prepone tax payment on landowners area

- GST in respect of apartments/units remaining unsold in the hands of landowner on the date of OC will become cost to landowner where developer has charged GST on area allotted to him

6.5 GST payable on Salable Area on or after 1st April 2019

Developer

- GST payable on sale of under construction apartments/units at 1% or 5% or 12% as applicable

- ITC not available for inputs and input services (including development rights) relatable to residential/commercial units sold at concessional rate of 1% or 5%

- Proportionate ITC relatable to under construction commercial units (to be taxed at 12%) is allowable

- ITC reversal on unsold commercial units to be done as per Rule 42 and 43:

- On area basis; and

- For entire project period (excluding pre-GST credit and transitional credit)

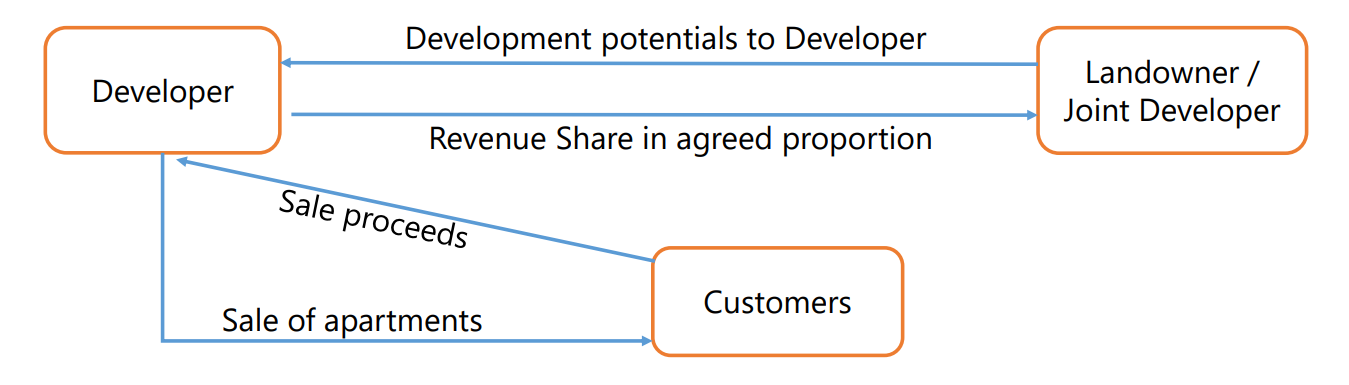

7. Joint Development Arrangements (JDA) – Revenue Sharing

- Revenue Share could be on:

- Top Line (Sales proceeds/Realization); or

- Bottom Line (Project Profit); or

- Any other basis

- What are the tax implications of above arrangement?

7.1 GST on Transfer of Development Rights in JDA (Revenue sharing) on or after 1st April 2019

Landowner

- Landowner transfers development rights to Developer

- Landowner receives consideration in form of revenue share

- Transfer of development rights on or after 01.04.2019 is exempt where it is used for construction of:

- residential apartments to be sold before issuance of completion certificate; and

- Such apartments are liable to GST

- Development rights, TDR, FSI used for following will still be liable to GST:

- Construction of commercial premises (to be paid by developer under RCM)

- Construction of Residential Complex intended for sale after completion (to be paid by developer under RCM)

- Onus is not on landowner to discharge GST on transfer of DR/TDR/FSI/Lease rights on or after 01.04.2019 whether it pertains to residential or commercial construction

7.2 GST on Apartments/Units Sold to Ultimate Customers in JDA (Revenue sharing) [On or after 1st April 2019]

Developer

- GST payable on sale of all under construction apartments/units at 5% or 1% or 12% as applicable

- ITC not available for inputs and input services (including development rights) relatable to residential/ commercial units sold at concessional rate of 1% or 5%

- Proportionate ITC relatable to under construction commercial units to be taxed at 12% is allowable

- ITC reversal on unsold commercial units to be done as per Rule 42 and 43:

- On area basis; and

- For entire project period (excluding pre-GST period and transit credit)

7.3 GST Payable by Developer Under RCM on Development Rights in JDA (Revenue sharing) On or after 1st April 2019

| Particulars | Taxability |

| Construction of commercial apartments | GST at 18% will be payable under RCM on actual revenue share paid to landowner (How to determine this on the date of transfer of Development Rights?) |

| Residential apartments remained unsold on completion |

|

8. Relevant Legal Precedents

- Honorable Hyderabad Tribunal in the case of Vasantha Green Projects v. Commissioner of Central Tax, GST [2018] 95 taxmann.com 317/[2019] 20 GSTL 568 (Hyd. – CESTAT): “it can be observed that service tax is liable to be paid on gross amount charged i.e. to say consideration received from land owners in kind and consideration received from prospective customers i.e. total gross amount. In the case in hand, the amount attributable to the consideration received by appellant in the form of land rights from the land owner stands included in the value of villas sold to prospective customer which would mean that whatever consideration was received by the appellant in form of developmental right was considered in assessable value”

- Order in Appeal no. PVNS/309/APPEALS THANE/TH/2018-19/5808 dated 27-11-2018 in case of Veena Realcon Pvt. Ltd was the case of society redevelopment wherein Hon. Commissioner held that service tax is not payable on the free flats given to the existing members of the society

- Imperial Dream Homes [Order in Appeal No. PVNS/466/Appeals-Thane/TH/2018-19/845 dated 28.03.2019] where in the authority has held that service tax is not payable on the free flats given to the existing members of the society

- Ethics Infra Development Private Limited vide Order in Original No. V/Adj/SCN/15-51/Ethics/CGST Thane/2018-19/5174 dated 26.11.2019 also held that held that construction of rehab services is not taxable.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA