GST e-Invoicing – Concept, Process & Guidance

- Blog|GST & Customs|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 9 November, 2023

Table of Contents

1. Background of GST e-Invoicing

Check out Taxmann's GST e-Invoicing which is a comprehensive guide on e-Invoicing. It assists the reader in understanding the background, concepts, and issues. This book serves as a ready referencer for persons handling the execution of the e-Invoicing module in the existing accounting software

1. Background of GST e-Invoicing

GST E-invoicing is a rapidly expanding technology and today’s business models are evolving gradually from conventional paper-based systems to digital processing. Electronic Invoicing is a best practice followed internationally by various tax administrations and several countries have adopted Electronic Invoicing as part of their national digitalization programs.

Since opting of the E-invoicing procedure by the business entities, it helps in cost savings, efficiency gains, many private businesses are turning themselves to E-Invoice. Thus, digital transformation is no longer just an option, but an eventuality.

Try Taxmann’s GST Rate Finder Tool

2. India’s GST E-Invoicing

Accordingly, Indian Government is also looking forward to align the compliance process with private business practices with this transformation requiring organizations to exchange and share copies of invoices electronically with effect from 1st October, 2020 for taxpayers whose aggregate turnover exceeds INR 10 crore in a FY for B2B (including exports) segment covering documents like tax invoice, debit note and credit note. The implementation has been planned in phased manner based on aggregate turnover limit and type of transaction.

Exemption has been given qua business and not qua taxpayer to SEZ Unit, insurer, banking company, financial institution including NBFC, GTA, passenger transport service and admission to exhibition of cinematograph films in multiplex screens. Currently, the option is not available for B2C supplies and in fact taxpayer cannot opt voluntarily for e-invoice.

3. Creation of an e-Invoice

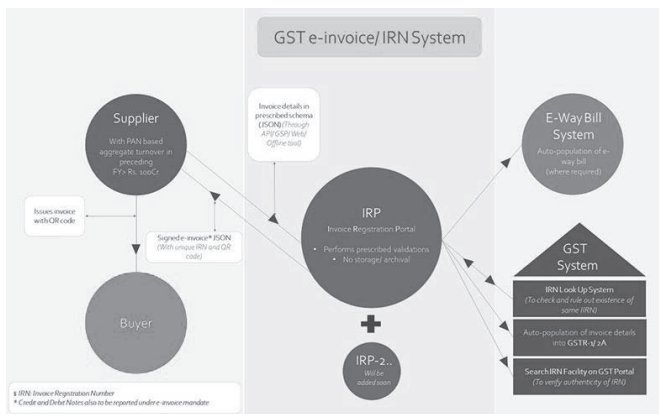

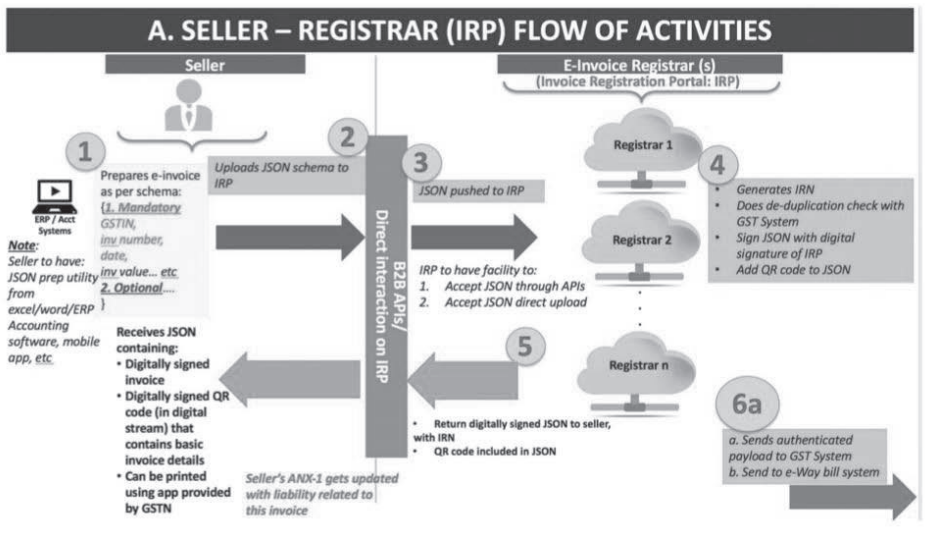

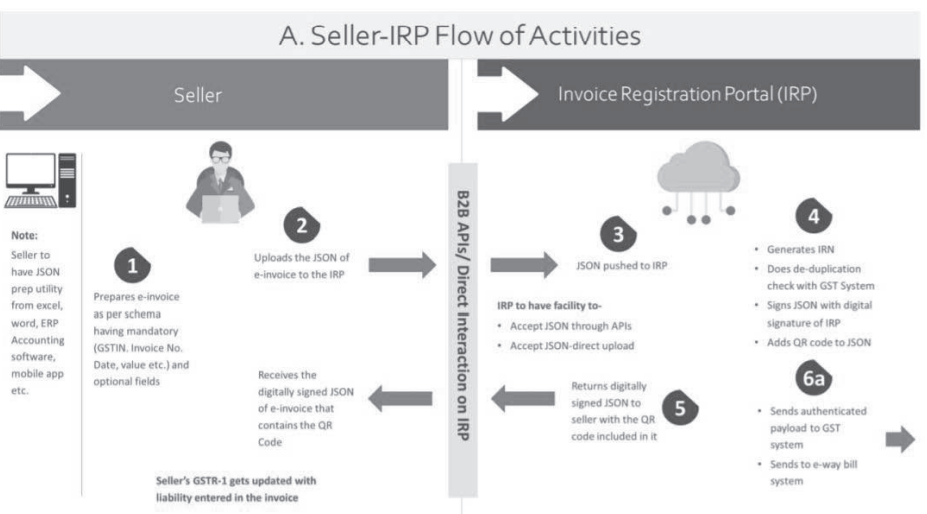

The flow of the e-invoice generation, registration and receipt of confirmation can be logically divided into two major parts:

(a) The first part being the interaction between the business (supplier in case of invoice) and the Invoice Registration Portal (IRP).

(b) The second part is the interaction between the IRP and the GST/E-Way Bill Systems and the Buyer.

The overall workflow of ‘e-invoice’ system as displayed on www.gstn.org.in is shown below:

Part A: Flow from Supplier (commonly known as seller) to IRP.

STEP 1:

-

- Generation of the invoice by the seller in his own accounting or billing system (it can be any software utility that generates invoice including those using excel or GSTN’s provided Offline Utility).

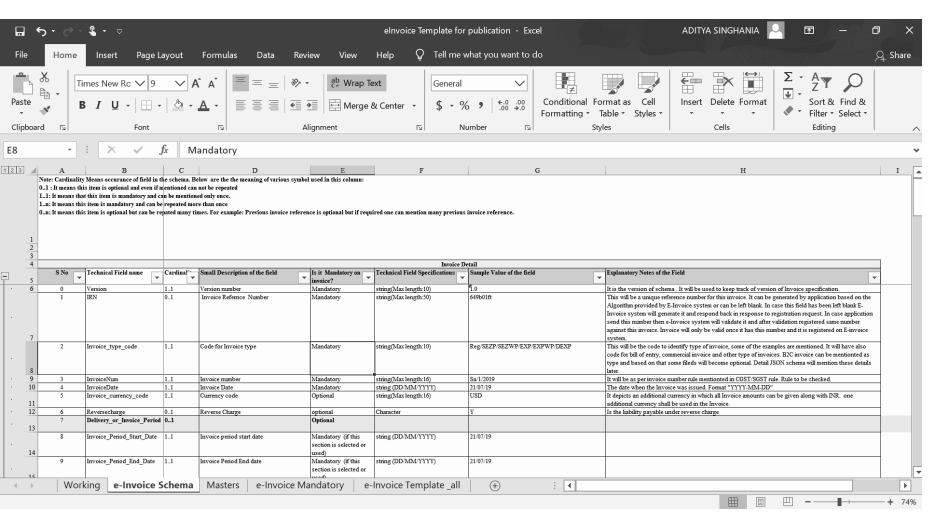

- The invoice must follow to the e-invoice schema (standards) that is published and have the mandatory parameters. The optional parameters can be according to the business need of the supplier. The supplier’s (seller’s) software should be capable to generate a JSON of the final invoice that is ready to be uploaded to the IRP. The IRP will only take JSON of the e-invoice.

| Situation:

Does the taxpayer needs to mention the “mandatory parameters” as stated in the e-invoice schema/standards/APIs? |

| Solution:

Absolutely No. An e-Invoice Template [Excel File] has been released on the GSTN website which contains various worksheet. One such worksheet is named as “E-Schema” which prescribes various field out of which some fields are mandatory and others are optional. It may please be noted that these details are only required for generation of JSON for e-Invoice and not required to be mentioned in the invoice generated. Only the details stipulated in section 31 read with corresponding rules 46 to 55A needs to be mentioned. Undoubtedly, these mandatory fields need to be maintained and furnished for the purpose of uploading JSON on IRP. It is very important to note that now the Schema for e-invoice has been notified vide Notification No. 60/2020-Central Tax dated 30th July, 2020. |

| Situation:

How small taxpayers will adopt the e-invoicing in case they do not have the accounting software? |

| Solution:

Seller should have a utility that will output invoice data in JSON format, either from his accounting or billing software or his ERP or excel/word document or even a mobile app. Those who do not use any accounting software or IT tool to generate the invoice, will be provided an offline tool to key-in data of invoice and then submit the same. The small and medium size taxpayers (having annual turnover below ` 1.5 Crores) can avail accounting and billing system being offered by GSTN free of cost which come in both flavours, online (cloud based) as well as offline (installed on the computer system of the user). |

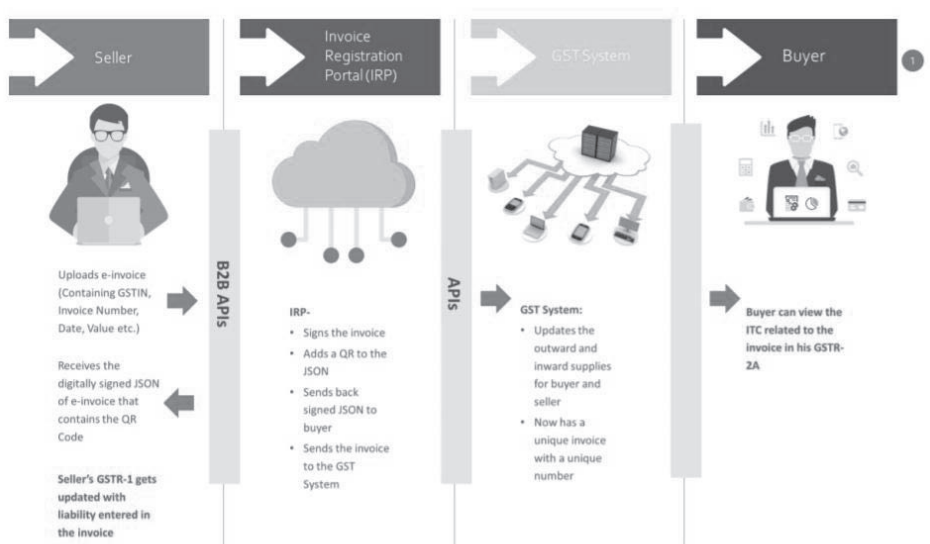

Note: It is important to note that the proposed New GST Returns has been scrapped and the existing returns mechanism is modified. Accordingly, the above flow of communication to the extent of auto-population in GST ANX-1 may get changed to GSTR 1 and buyer can view the ITC related to the e-invoice in his GSTR 2A/2B instead of GST ANX-2.

The aforesaid view on account of modified GST return has been duly answered in the updated image as shown below which is available on www.gstn.org.in

STEP 2:

-

- Generate the unique Invoice Reference Number (IRN) (in technical terms hash of 3 parameters using a standard and well known hash generation algorithm e.g. SHA256).

- This is an optional step. However, vide the revised document “Proposed e-invoicing System” dated 12th February, 2020, it has been noted that the Step 2 has been removed. Therefore, it appears that the option to generate the IRN) or HASH by the seller (though the same would have been verified by the IRP) has been removed.

| Situation:

Can the taxpayer generate the IRN by his own and print the invoice? |

| Solution:

The unique IRN will be based on the computation of hash of GSTIN of generator of document (invoice or credit note etc.), Year and Document number like invoice number. This hash will be as published in the e-invoice standard and unique for this combination. This way hash will always be the same irrespective of the registrar who processes it. The hash could also be generated by the taxpayers based on above algorithm. The providers of accounting and billing software are being separately asked to incorporate this feature in their product. One can pre-generate and print it on the invoice book, however, the same will not make the invoice valid unless it is registered on the portal along with invoice details. However, vide the revised document “Proposed e-invoicing System” dated 12th February, 2020, it has been noted that the aforesaid option to generate HASH directly by the taxpayer has been removed, hence, Hash can be generated only the IRP system. |

Unique Invoice Reference Number [IRN], also known as HASH: Every invoice registered at the IRP will get a unique IRN which needs to be maintained by the supplier himself. Only when an invoice has this unique IRN, then only it will be considered as a legal invoice.

| Situation:

Meaning of hash generation algorithm e.g. SHA256 |

| Solution: SHA, a cryptographic hash stands for Secure Hash Algorithm. A cryptographic hash (sometimes called ‘digest’) is a kind of ‘signature’ for a text or a data file. A hash is not ‘encryption’ i.e., it cannot be decrypted back to the original text (it is a ‘one-way’ cryptographic function, and is a fixed size for any size of source text). However, hash functions are not appropriate for storing encrypted passwords, as they are designed to be fast to serve the purpose. SHA-256 is a member of the SHA-2 cryptographic hash functions designed by the United States National Security Agency (NSA) and is one of the strongest hash functions available. SHA-256 converts a text of any length into an almost unique string of 256-bit (32-byte). This is known as the Hashing function or it can be said that it is a cryptographically secure hashing function because knowing the output tells the user very little about the input. Top of Form For example: SHA-256 hash of ‘abc’ would be: ba7816bf8f01cfea414140de5dae2223b00361a396177a9cb410ff61f20015ad. |

| Situation:

Does the 3 parameters set the uniqueness of the IRN sufficient or does it require any other parameter to set in? |

| Solution:

Since E-Invoicing is also applicable on Debit Note and Credit Note also, therefore, it may happen that the serial number of Tax Invoice & Debit Note is same, for instance, say 1001, then in such a case there will be duplicity error from the portal, therefore, it appears that if “Document Type” is added as an additional parameter uniqueness may increase. In this regard, it has been clarified by the FAQ E-invoice Roll-out by GSTN released on 26th December, 2019 that the e-invoice schema is capturing the type of document which are addressing the issues raised. However, vide the revised document “Proposed e-invoicing System” dated 12th February, 2020, it has been clearly stipulated that “Document Type” shall also be used for generating the HASH. |

STEP 3:

-

- Seller will upload the JSON of the e-invoice into the IRP.

- The JSON may be uploaded directly on the IRP or through GSPs or through third party provided Apps.

| Situation:

How conversion of invoice details will happen in JSON format that needs to be uploaded on the IRP. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Solution:

The question which may arise is that how the details will be uploaded at the IRP i.e. the format in which the same needs to be uploaded? In this regard, it is not the excel file/invoice generated from the software, that needs to be uploaded at the IRP but the data needs to be converted in the JSON format and then it needs to be uploaded on IRP. Now, the question arise that how the same will be converted in JSON format? For this purpose, GSTN has proposed to provide the following channels: API Based: Taxpayers with Aggregate Turnover of < Rs. 500 Crores:

GST Suvidha Providers/ERPs

Taxpayers with Aggregate Turnover of > Rs. 500 Crores: In addition to above modes, they will have direct access, as follows:

Offline Utility Based: Some businesses may not have their own ERP/Accounting Software or have few invoices to report. They can download the free offline utility (‘bulk generation tool’) from e-invoice portal. Using this, invoice data can be easily uploaded on IRP for generation of IRN. While the portal gives back ‘machine-readable’ invoice in JSON format, there is a facility to generate ‘human-readable’ PDF copy of invoice (for save/print/e-mail etc.). Web based: The details of invoices can be directly furnished on the IRP basis which unique Invoice Reference Number (IRN) is generated. It is important to note that GST e-invoice system FAQ version 1.4 dated 31-3-2021 states that mobile -app based modes will also be provided in future. SMS based: The details of invoices can be directly furnished on the SMS basis which unique Invoice Reference Number (IRN) is generated. However, vide the revised document “Proposed e-invoicing System” dated 12th February, 2020, the said mode of generation of e-invoice has been removed. Mobile App based: The details of invoices can be directly furnished on the Mobile App basis which unique Invoice Reference Number (IRN) is generated. However, vide the revised document “Proposed e-invoicing System” dated 12th February, 2020, the said mode of generation of e-invoice has been removed. It is important to note that GST e-invoice system FAQ version 1.4 dated 31-3-2021 states that mobile -app based modes will also be provided in future. |

STEP 4:

-

- The IRP will also generate the hash.

- The IRP will check the hash from the Central Registry of GST System to ensure that the same invoice from the same supplier pertaining to same Financial Year is not being uploaded again.

- On receipt of confirmation from Central Registry, IRP will add its signature on the Invoice Data as well as a QR code to the JSON.

- The QR code will contain GSTIN of seller and buyer, Invoice number, invoice date, number of line items, HSN of major commodity contained in the invoice as per value, hash etc.

- The hash computed by IRP will become the IRN (Invoice Reference Number) of the e-invoice. This shall be unique to each invoice and hence be the unique identity for each invoice for the entire financial year in the entire GST System for a taxpayer. [GST Systems will create a central registry where hash sent by all IRPs will be kept to ensure uniqueness of the same].

- In case the same document has been uploaded earlier, the IRP will send an error code back to the seller, when he tries to upload a duplicate e-invoice.

| Facts about IRN |

|

-

- The QR code will enable quick view, validation and access of the invoices from the GST system from hand held devices.

| Situation:

What is the use of QR Code? How QR Code can be used to verify the details of invoices? Can the user print the e-invoice using the QR Code? |

| Solution:

The IRP will also generate a QR code containing the unique IRN (hash) along with some important parameters of invoice and digital signature so that it can be verified on the central portal as well as by an Offline App. This will be helpful for tax officers checking the invoice on the roadside where Internet may not be available all the time. The web user will get a printable form with all details including QR code. The seller will be returned a signed JSON with all details including a QR Code. The QR code will consist of the following e-invoice parameters: a. GSTIN of supplier b. GSTIN of Recipient c. Invoice number as given by Supplier d. Date of generation of invoice e. Invoice value (taxable value and gross tax) f. Number of line items. g. HSN Code of main item (the line item having highest taxable value) h. Unique Invoice Reference Number (hash) i. IRN Generation Date [as stipulated in Q80 of GST e-invoice System – FAQs – Version 1.4 Dt. 30-3-2021] An offline app will be provided for anyone to download to authenticate the QR code of the e-invoice offline and its basic details. The facility to view the e-invoice will be provided to buyers or tax officers, on the GST system/e-way bill system. The facility of e-invoice verification is planned to be made available only through the GST System and not the IRP. This is because the IRP will not have the mandate to store invoices for more than 24 hours. In order to achieve speed and efficiency, the IRP will be a lean and focused portal for providing invoice registration and verification service, IRN and the QR codes. Hence, storing of the invoices will not be a feature of the IRP. |

Dive Deeper:

E-invoicing under GST – What is e-Invoicing & it’s Applicability

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

Comments are closed.