Form 26AS in a New Avatar | How to Access Annual Information Statement (AIS) Online?

- Blog|Income Tax|

- 4 Min Read

- By Taxmann

- |

- Last Updated on 9 November, 2021

![]()

Annual information statement is a tax passbook which contains following information in respect of an assessee for a particular financial year:

-

- Information relating to TDS and TCS;

- Information relating to Specified Financial Transactions (SFT);

- Information relating to payment of taxes;

- Information relating to demand and refund;

- Information relating to pending proceedings;

- Information relating to completed proceedings; and

- Any other information which the prescribed income-tax authority is authorised to upload.

An assessee can access AIS information by logging to his income-tax e-filing account. If he feels that the information furnished in AIS is incorrect, duplicate or relates to any other person etc., he can submit his feedback thereon.

An assessee can access and respond to AIS information either directly from income-tax e-filing portal or he can also use an offline utility.

This tutorial explains how an assessee can access AIS information online.

For more such tutorials refer to Taxmann.com's newest product | Practice! The tutorial page covers step-by-step guides for all compliances, grievances, filings, registrations, etc. You can learn the compliance or file documents with the help of actual screenshots of the portals. All tutorials are updated on a real-time basis to give you only the latest and accurate information. You can also read the summary of the connected provision along with hyperlinks of the related reads. Start your Free Trial Now! 10,000+ Free Trials already taken in the last week! Start yours Now! https://taxmann.one/2YZB6cx

Watch the Video!

Steps to Access AIS Information Online

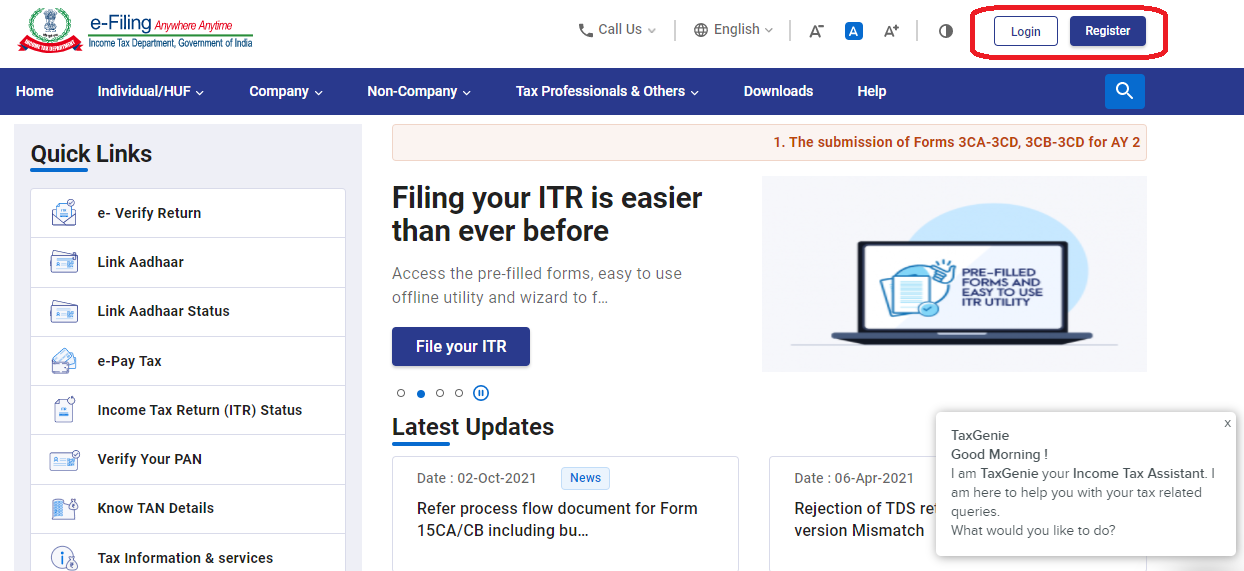

Step 1: Login to the Income-tax e-filing website at https://www.incometax.gov.in/

If you are a new user, you will be required to first register on the e-filing portal.

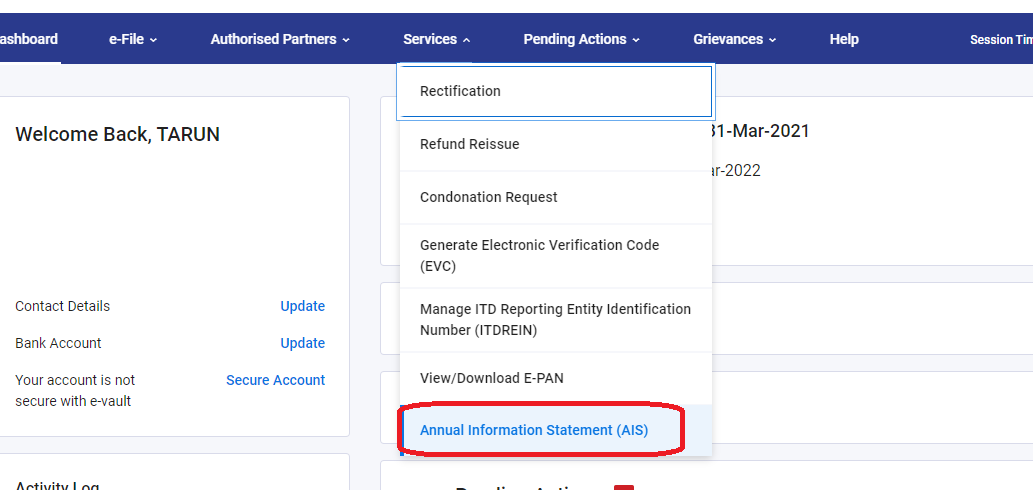

Step 2: After login, click on Services > Annual Information Statement (AIS)

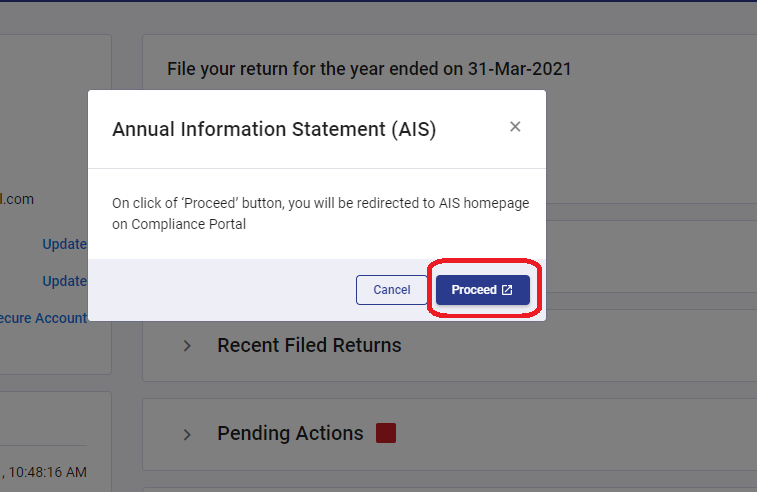

Step 3: A message shall appear that will prompt you to click on ‘proceed’ to redirect to AIS homepage.

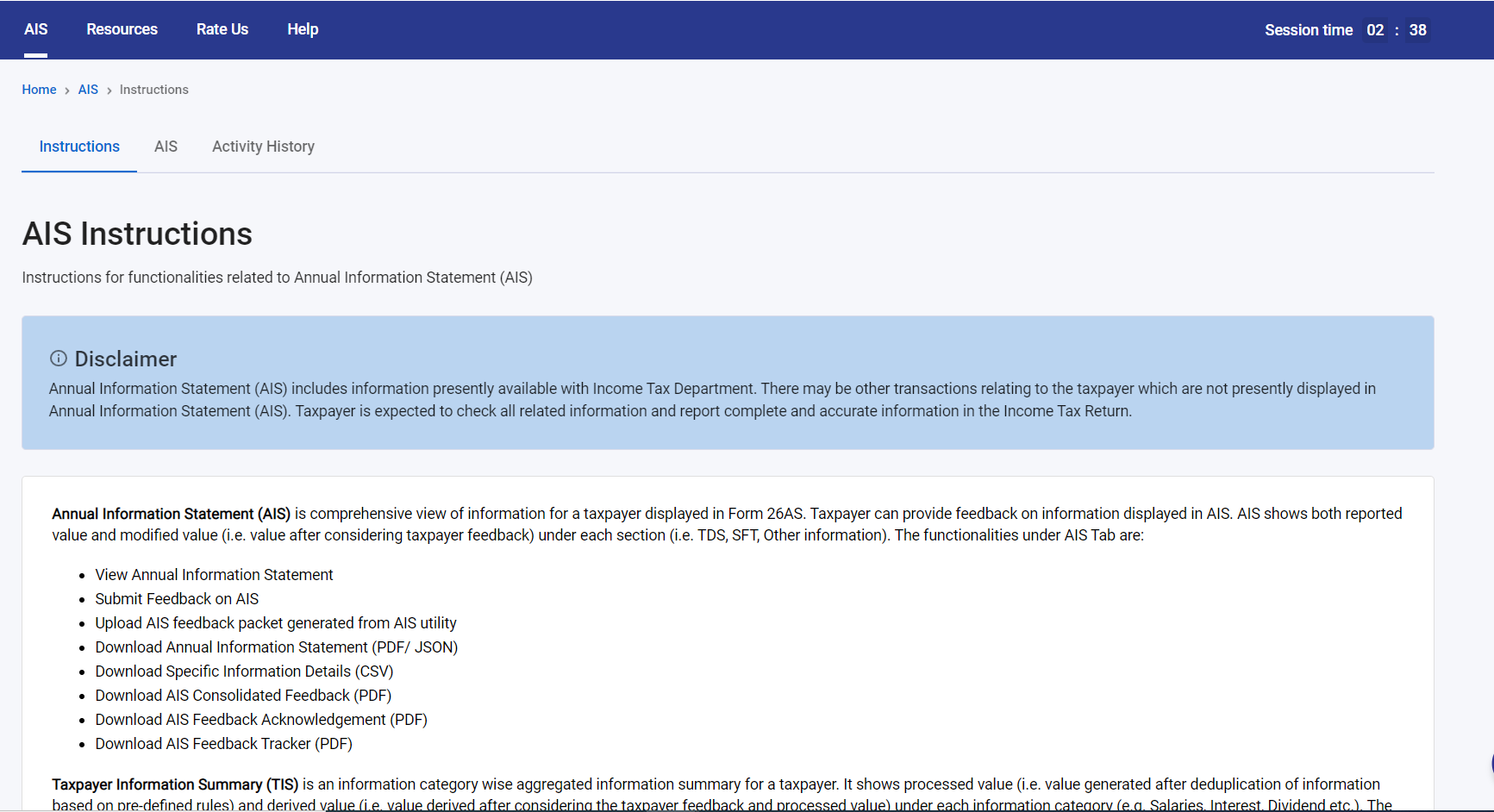

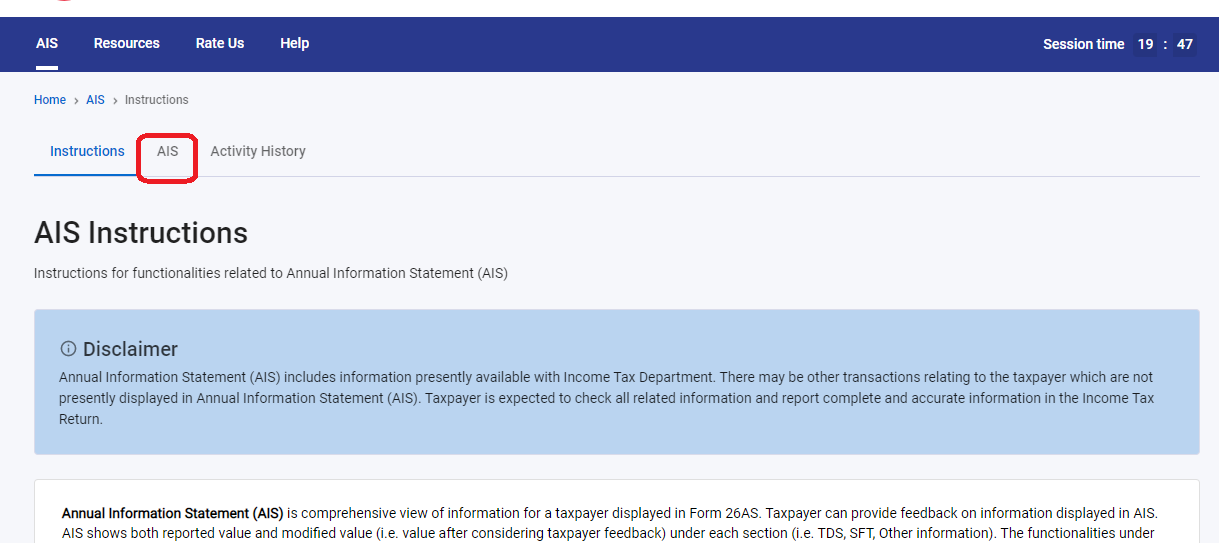

Step 4: The next screen provides key instructions relating to Annual Information Statement (AIS) and Taxpayer Information Summary (TIS). TIS displays the information available in AIS category-wise. It shows original value as well as revised value (i.e., value processed after taxpayer’s feedback). The revised values in TIS is used for prefilling of return.

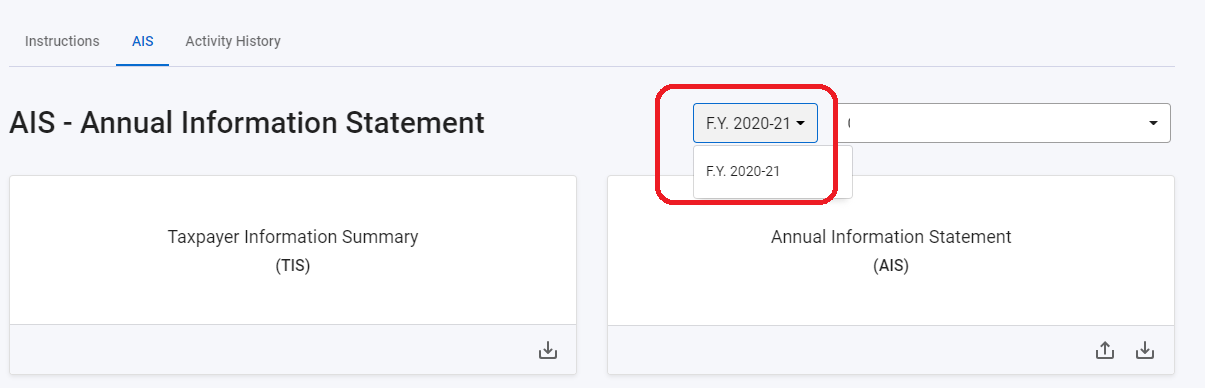

Step 5: Click on the next tab of ‘AIS’. On the redirected screen, two tiles shall appear – Taxpayer Information Summary (TIS) and Annual Information Statement (AIS). Select the relevant financial year from drop-down and click on AIS tile to view the information.

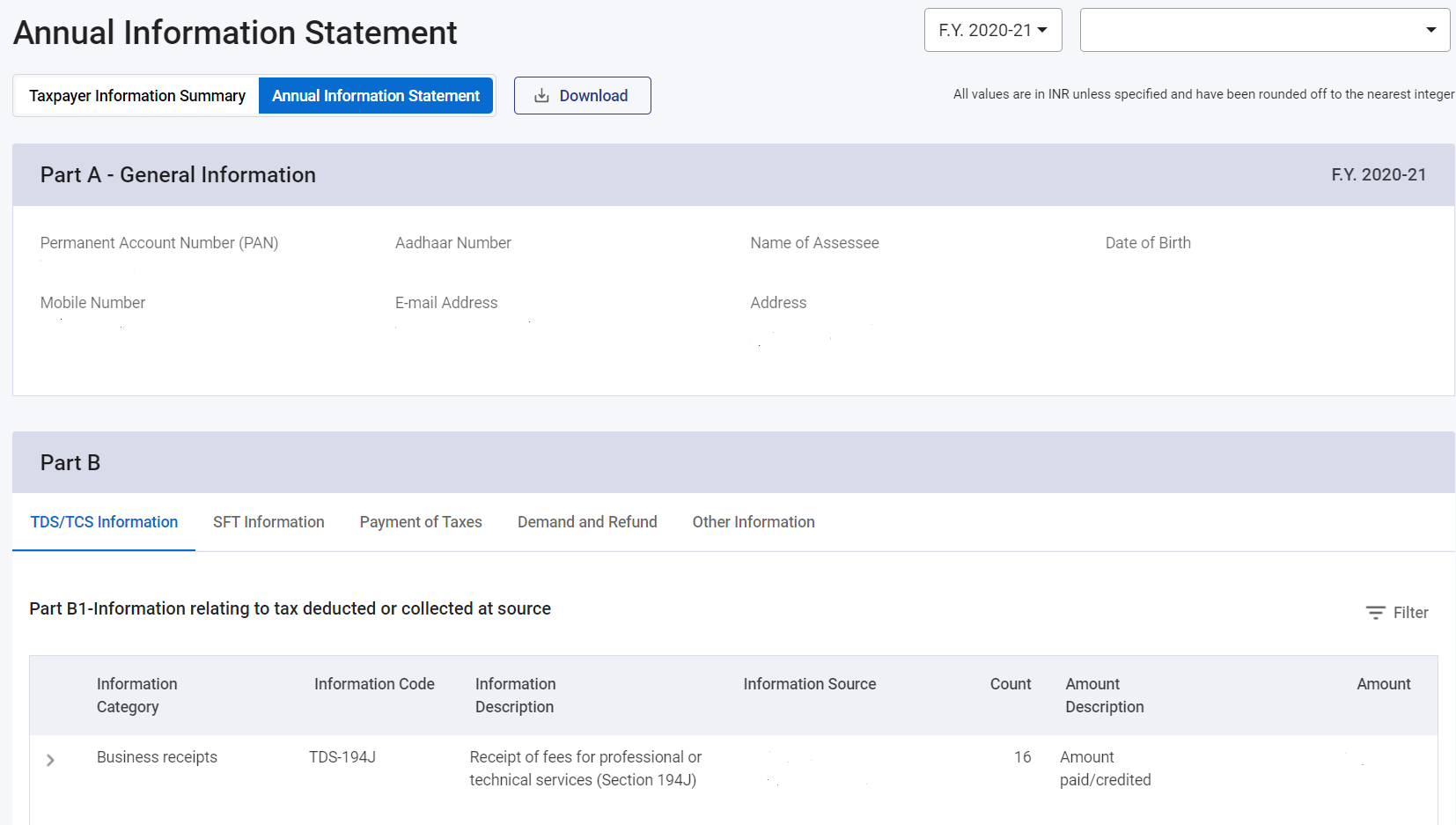

Step 6: On the next screen, the information available in AIS is displayed in Part A and Part B.

Part A contains the general information about a taxpayer (i.e., PAN, Aadhaar, Name, Date of Birth, Mobile Number, E-mail Id and Address).

Part B contains the comprehensive information of a taxpayer for the selected financial year as uploaded by the prescribed income-tax authority. The information in Part B is divided into following categories:

-

- TDS/TCS Information

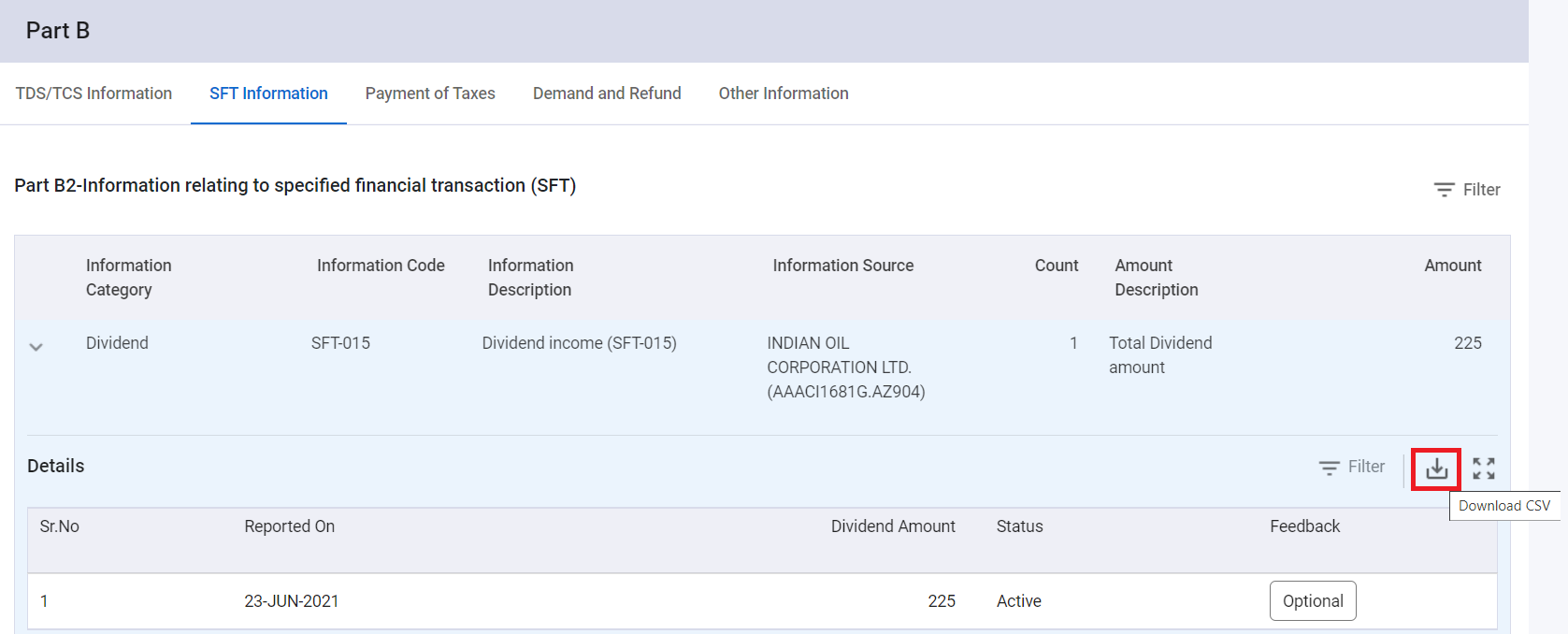

- SFT Information

- Payment of Taxes

- Demand and Refund

- Other Information

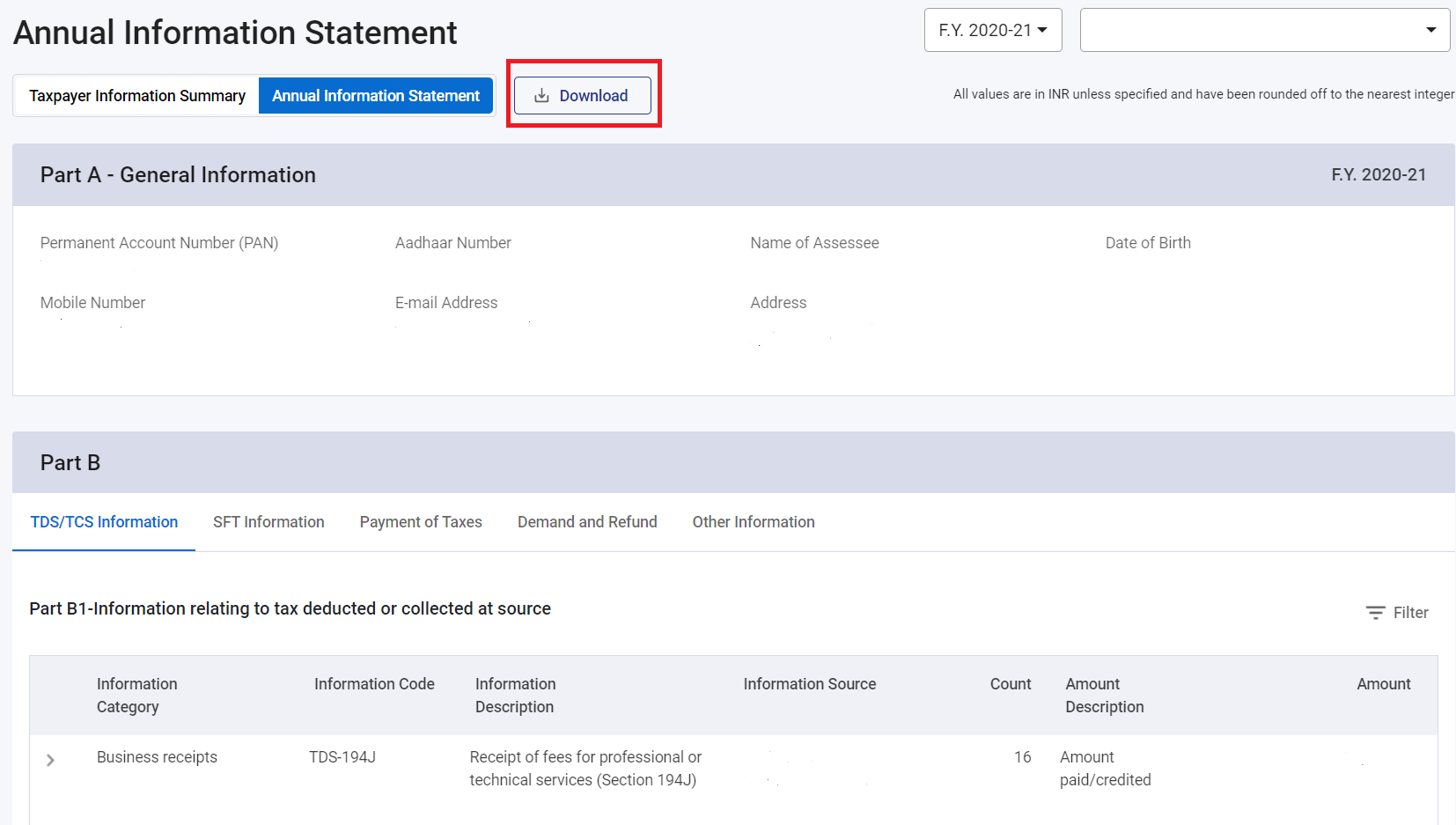

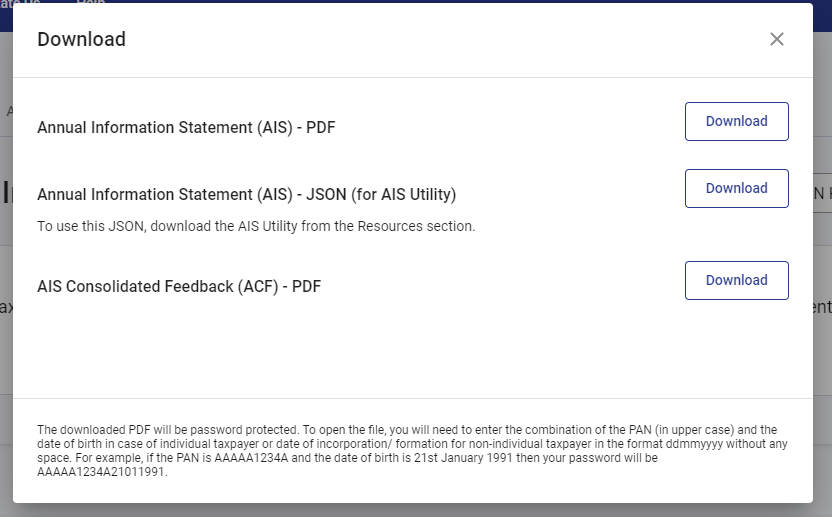

Step 7: The information available in AIS can be downloaded in Excel, JSON or PDF format. The user will have to download the transactions in Excel format for every category of transaction seperately. While as the entire AIS can be downloaded only in PDF or JSON.

Downloading AIS in PDF or JSON

Downloading AIS in excel

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA