Finance Act 2023 | Increase in Rate of Royalty and Fees for Technical Services

- Blog|International Tax|

- 2 Min Read

- By Taxmann

- |

- Last Updated on 14 August, 2023

Table of Contents

1. Amendment

1.1 Law till 31 March 2023

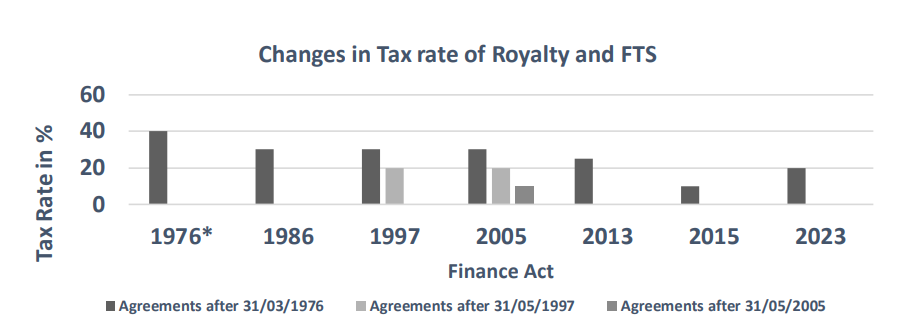

Tax rate for royalty or FTS as per domestic tax law was 10% (plus applicable surcharge and cess) for cases for non- residents not having a PE in India

[effective tax rate of 10.92%*]

1.2 Finance Act, 2023 – Amendment w.e.f 1 April 2023

Tax rate on royalty and fees for technical services income for non-resident taxpayers (not having PE in India) has been increased from 10% to 20% (plus applicable surcharge and cess)

[effective tax rate of 21.84%*]

- A non-resident has an option to opt for tax rates under the domestic law, or treaty, whichever is more beneficial

- However, exemption from filing tax return for non-resident is available for specific income if tax is withheld as per rates under the domestic act

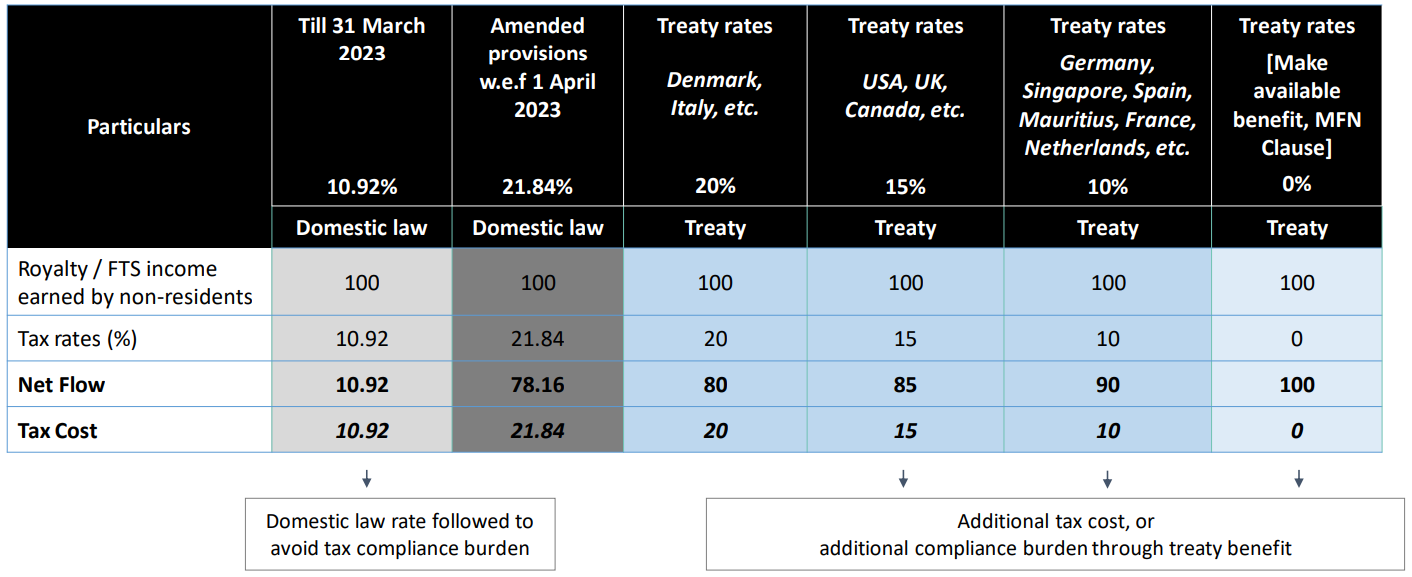

2. Tax treaties

Tax rates on royalty / FTS under tax treaty

3. Implications

Obtaining tax rate for royalty and FTS under tax treaties

- Documentation requirement:

- Tax residency certificate

- Electronic Form 10F

- No PE declaration

- Tax registrations:

- Obtaining Permanent Account Number (PAN)

- Registration on the online portal

- Digital Signature certificate

- Compliance requirement:

- Furnishing return of income

- Transfer Pricing compliance – TP report/documentation

- Treaty eligibility:

- Evaluate eligibility such as beneficial ownership, substance requirement

- Tax certainty:

- Whether advisable to apply for an advance ruling before entering into such a

transaction, especially for treaties with MFN clause?

- Whether advisable to apply for an advance ruling before entering into such a

- Tax credit in home country:

- If voluntary payment of tax is done at 21.84% – evaluating whether tax credit will be available in home/resident country

- Tax cost through grossing up:

- Higher tax cost if the tax cost is to be borne by Indian Companies through gross up arrangements

* Assuming highest rate of surcharge

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA