70+ FAQs on Income-tax Returns (ITR) for Assessment Year 2023-24

- Blog|Income Tax|

- 45 Min Read

- By Taxmann

- |

- Last Updated on 24 September, 2025

Image

Filing Income-tax Returns is one of the most important annual compliance tasks for every taxpayer. With constant amendments, revised forms, and evolving disclosure requirements, it’s easy to get confused while preparing your return. To address these challenges, we’ve curated the FAQs on Income-tax Returns AY 2025-26, covering practical queries on eligibility, selection of the right ITR form, deductions, reporting of income, and filing deadlines.

Introduction

The filing of Income-tax Returns (ITRs) is more than just a statutory obligation—it is a crucial step in ensuring compliance, claiming refunds, and avoiding penalties. With each financial year, taxpayers face new disclosure requirements, revised forms, and complex reporting obligations. To simplify this evolving landscape, Taxmann presents the 11th Edition of 100+ FAQs on Income-tax Returns for AY 2025-26.

This handbook provides clear, practical, and authoritative answers to the most frequently asked questions on:

-

- Filing deadlines and choosing the correct ITR form

- Comparison of the old and new tax regimes under Section 115BAC

- Reporting obligations for F&O trading, cryptocurrencies, and online gaming income

- Rules for filing Updated Returns (ITR-U) with applicable additional tax

- Enhanced disclosure norms for deductions and claims, including HRA and housing loans

- Mandatory reporting of bank accounts, foreign assets, unlisted shares, and VDAs

- Step-by-step guidance on e-filing, verification, refunds, and rectification of errors

With concise explanations and practical illustrations, this guide is designed to be a ready reference for individuals, professionals, corporates, and tax practitioners alike.

Table of Contents

- ITR Filing Due Date4

- Income Tax Returns (ITR) Forms

- New Tax Regime vs Old Tax Regime – How Section 115BAC Impacts Your Taxes

- The ITR Compliance Guide – F&O | Crypto | Section 115BBJ

- New ITR Disclosure Rules for Tax Deductions – HRA | Education & Housing Loans | Penalty on Fake Claims

- Filing Updated Return of Income (ITR-U) – Eligibility | Deadlines | Additional Tax

- ITR Reporting Requirements – Bank Accounts | Foreign Assets | Unlisted Shares | Cryptocurrencies | Deductions

- Income Tax Returns (ITR) – Filing & Verification Complete Guide for Taxpayers

- Annual Information Statement (AIS) – Your Smart Tool for Hassle-Free ITR Filing

- Capital Gains in Income Tax Returns (ITR) – Shares | Property | Buy-Back

- Income-tax Refunds Made Easy – TDS | TCS | Payments | ITR Filing

- Income-Tax Reliefs & Deductions for Individuals – Salary | Arrears | HRA | Donations

- How to Set Off and Carry Forward Losses Under the Income Tax Act

- Clubbing of Income – Practical Guide to Filing ITR in Complex Situations

1. ITR Filing Due Date

FAQ 1. What are the Due Dates for Filing Income-tax Returns for the Assessment Year 2025-26?

The due dates for filing of ITRs for various types of assessees are as follows:

| Situations | Original due date |

| Assessee is required to furnish a report of transfer pricing (TP) Audit in Form No. 3CEB | 30-11-2025 |

| Assessee who is a partner in a firm required to furnish a report of TP Audit in Form No. 3CEB | 30-11-2025 |

| Individual who is a spouse of a person, being a partner in a firm, required to furnish a report of Transfer Pricing (TP) Audit in Form No. 3CEB and the provisions of section 5A apply to such spouse | 30-11-2025 |

| Company assessee is not required to furnish the TP Audit report in Form No. 3CEB | 31-10-2025 |

| Assessee required to get accounts audited under the Income-tax Act or any other law | 31-10-2025 |

| Assessee who is a partner in a firm whose accounts are required to be audited | 31-10-2025 |

| Individual who is a spouse of a person, being a partner in a firm whose accounts are required to be audited, and the provisions of section 5A apply to such spouse | 31-10-2025 |

| Any other case | 15-09-2025 [1] |

Click Here To Read The complete FAQ

2. Income Tax Returns (ITR) Forms

FAQ 2. Which Form Should a Taxpayer Use to File His Income Tax Return for the Assessment Year 2025-26?

| Nature of income |

ITR 1[2] |

ITR 2 | ITR 3 |

ITR 4[3] |

||||

Salary Income |

||||||||

| Income from salary/pension (for ordinarily resident person) |

✓ |

✓ | ✓ |

✓ |

||||

| Income from salary/pension (for not ordinarily resident and non-resident person) |

✓ |

✓ |

||||||

| Any individual who is a Director in any company |

✓ |

✓ |

||||||

| If payment of tax in respect of ESOPs allotted by an eligible start-up has been deferred |

✓ |

✓ |

||||||

Income from House Property |

||||||||

| Income or loss from one house property (excluding brought forward losses and losses to be carried forward) |

✓ |

✓ | ✓ |

✓ |

||||

| Individual has brought forward loss or losses to be carried forward under the head House Property |

✓ |

✓ |

||||||

| Income or loss from more than one house property |

✓ |

✓ |

||||||

Income from Business or Profession |

||||||||

| Income from business or profession |

✓ |

|||||||

| Income from presumptive business or profession covered under section 44AD, 44ADA and 44AE (for person resident in India) |

✓ |

|||||||

| Income from presumptive business or profession covered under section 44AD, 44ADA and 44AE (for not ordinarily resident and non-resident person) |

✓ |

|||||||

| Interest, salary, bonus, commission or share of profit received by a partner from a partnership firm |

✓ |

|||||||

Capital Gains |

||||||||

| Long-term capital gains taxable under Section 112A and not exceeding Rs. 1.25 lakhs | ✓ |

✓ |

✓ |

✓ | ||||

| Long-term capital gains taxable under the following provisions – |

✓ |

✓ |

||||||

Income from Other Sources |

||||||||

| Family Pension (for ordinarily resident person) |

✓ |

✓ | ✓ |

✓ |

||||

| Family Pension (for not ordinarily resident and non-resident person) |

✓ |

✓ |

||||||

| Income from other sources (other than income chargeable to tax at special rates including winnings from lottery and race horses or losses under this head) |

✓ |

✓ | ✓ |

✓ |

||||

| Income from other sources (including income chargeable to tax at special rates including winnings from lottery and race horses or losses under this head) |

✓ |

✓ |

||||||

| Dividend income exceeding Rs. 10 lakhs taxable under Section 115BBDA |

✓ |

✓ |

||||||

| Unexplained income (i.e., cash credit, unexplained investment, etc.) taxable at 60% under Section 115BBE |

✓ |

✓ |

||||||

| Person claiming deduction under Section 57 from income taxable under the head ‘Other Sources’ (other than deduction allowed from family pension) |

✓ |

✓ |

||||||

Deductions |

||||||||

| Person claiming deduction under Section 80QQB or 80RRB in respect of royalty from patent or books |

✓ |

✓ |

||||||

| Person claiming deduction under section 10AA or Part-C of Chapter VI-A |

✓ |

|||||||

Total Income |

||||||||

| Agricultural income exceeding Rs. 5,000 |

✓ |

✓ |

||||||

| Total income exceeding Rs. 50 lakhs |

✓ |

✓ |

||||||

| Assessee has any brought forward losses or losses to be carried forward under any head of income |

✓ |

✓ |

||||||

Computation of Tax liability |

||||||||

| If an individual is taxable in respect of an income but TDS in respect of such income has been deducted in hands of any other person (i.e., clubbing of income, Portuguese Civil Code, etc.) |

✓ |

✓ |

||||||

| Claiming relief of tax under sections 90, 90A or 91 |

✓ |

✓ |

||||||

Others |

||||||||

| Assessee has:

Income from foreign sources Foreign Assets including financial interest in any foreign entity Signing authority in any account outside India |

✓ |

✓ |

||||||

| Income has to be apportioned in accordance with Section 5A |

✓ |

✓ |

||||||

| If the tax has been deducted on cash withdrawal under Section 194N |

✓ |

✓ |

✓ |

|||||

| Person has deposited more than Rs. 1 crore in one or more current account |

✓ |

✓ |

✓ |

|||||

| Person has incurred more than Rs. 2 lakhs on foreign travelling |

✓ |

✓ | ✓ |

✓ |

||||

| Person has incurred more than Rs. 1 lakh towards payment of the electricity bill |

✓ |

✓ | ✓ |

✓ |

||||

| Person has turnover from business exceeding Rs. 60 lakhs |

✓ |

✓ |

||||||

| Person has gross receipts from profession exceeding Rs. 10 lakhs |

✓ |

✓ |

||||||

| Aggregate amount of TDS and TCS is Rs. 25,000 (Rs. 50,000 in case of senior citizen) or more |

✓ |

✓ | ✓ |

✓ |

||||

| Aggregate deposit in the saving bank account is Rs. 50 lakh or more |

✓ |

✓ | ✓ |

✓ |

||||

| * ITR-1 can be filed by an Individual only who is ordinarily resident in India. ITR-4 can be filed only by an Individual or HUF who is ordinarily resident in India and by a firm (other than LLP) resident in India. | ||||||||

Other Assessees |

||||||||

|

Status of Assessee |

ITR 4 | ITR 5 | ITR 6 |

ITR 7 |

||||

| Firm (excluding LLPs) opting for presumptive taxation scheme of section 44AD, 44ADA or 44AE |

✓ |

|||||||

| Firm (including LLPs) |

✓ |

|||||||

| Association of Persons (AOPs) |

✓ |

|||||||

| Body of Individuals (BOI) |

✓ |

|||||||

| Local Authority |

✓ |

|||||||

| Artificial Juridical Person |

✓ |

|||||||

| Companies other than companies claiming exemption under Section 11 |

✓ |

|||||||

| Persons including companies required to furnish return under:

Section 139(4A); Section 139(4B); Section 139(4C); Section 139(4D); |

✓ |

|||||||

| Business Trust |

✓ |

|||||||

| Investment Fund as referred to in Section 115UB |

✓ |

|||||||

|

Nature of Income |

ITR 1[2] | ITR 2 | ITR 3 | ITR 4[3] |

Salary Income |

||||

| Income from salary/pension (for ordinarily resident person) | ✓ | ✓ | ✓ | ✓ |

| Income from salary/pension (for not ordinarily resident and non-resident person) | ✓ | ✓ | ||

| Any individual who is a director in any company | ✓ | ✓ | ||

| If payment of tax in respect of ESOPs allotted by an eligible start-up has been deferred | ✓ | ✓ | ||

Income from House Property |

||||

| Income or loss from one house property (excluding brought forward losses and losses to be carried forward) | ✓ | ✓ | ✓ | ✓ |

| Individual has brought forward loss or losses to be carried forward under the head House Property | ✓ | ✓ | ||

| Income or loss from more than one house property | ✓ | ✓ | ||

Income from Business or Profession |

||||

| Income from business or profession | ✓ | |||

| Income from presumptive business or profession covered under sections 44AD, 44ADA and 44AE (for person resident in India) | ✓ | |||

| Income from presumptive business or profession covered under sections 44AD, 44ADA and 44AE (for not ordinarily resident and non-resident person) | ✓ | |||

| Interest, salary, bonus, commission, or share of profit received by a partner from a partnership firm | ✓ | |||

Capital Gains |

||||

| Long-term capital gains taxable under Section 112A and not exceeding Rs. 1.25 lakhs | ✓ | ✓ | ✓ | ✓ |

| Long-term capital gains taxable under the following provisions –

– Section 112A and it exceeds Rs. 1.25 lakhs – Section 112 |

✓ | ✓ | ||

| Short-term capital gains taxable under any provision | ✓ | ✓ | ||

| Taxpayer has held unlisted equity shares at any time during the previous year | ✓ | ✓ | ||

| Capital gains/loss on sale of investments/property | ✓ | ✓ | ||

Income from Other Sources |

||||

| Family Pension (for ordinarily resident person) | ✓ | ✓ | ✓ | ✓ |

| Family Pension (for not ordinarily resident and non-resident person) | ✓ | ✓ | ||

| Income from other sources (other than income chargeable to tax at special rates, including winnings from online games, lottery, and race horses or losses under this head) | ✓ | ✓ | ✓ | ✓ |

| Income from other sources (including income chargeable to tax at special rates, including winnings from lottery and race horses or losses under this head) | ✓ | ✓ | ||

| Dividend income exceeding Rs. 10 lakhs taxable under Section 115BBDA | ✓ | ✓ | ||

| Unexplained income (i.e., cash credit, unexplained investment, etc.) taxable at 60% under Section 115BBE | ✓ | ✓ | ||

| Person claiming deduction under Section 57 from income taxable under the head’ Other Sources’ (other than deduction allowed from the family pension) | ✓ | ✓ | ||

Deductions |

||||

| Person claiming deduction under Section 80QQB or 80RRB in respect of royalty from patent or books | ✓ | ✓ | ||

| Person claiming deduction under section 10AA or Part-C of Chapter VI-A | ✓ | |||

Total Income |

||||

| Agricultural income exceeding Rs. 5,000 | ✓ | ✓ | ||

| Total income exceeding Rs. 50 lakhs | ✓ | ✓ | ||

| Assessee has any brought forward losses or losses to be carried forward under any head of income | ✓ | ✓ | ||

Computation of Tax Liability |

||||

| If an individual is taxable in respect of an income but TDS in respect of such income has been deducted in the hands of any other person (i.e., clubbing of income, Portuguese Civil Code, etc.) | ✓ | ✓ | ||

| Claiming relief of tax under sections 90, 90A or 91 | ✓ | ✓ | ||

Others |

||||

| Assessee has –

– Income from foreign sources – Foreign Assets, including financial interest in any foreign entity – Signing authority in any account outside India |

✓ | ✓ | ||

| Income has to be apportioned in accordance with Section 5A | ✓ | ✓ | ||

| If the tax has been deducted on a cash withdrawal under Section 194N | ✓ | ✓ | ✓ | |

| A person has deposited more than Rs. 1 crore in one or more current accounts | ✓ | ✓ | ✓ | |

| A person has incurred more than Rs. 2 lakhs on foreign travelling | ✓ | ✓ | ✓ | ✓ |

| A person has incurred more than Rs. 1 lakh towards payment of the electricity bill | ✓ | ✓ | ✓ | ✓ |

| A person has turnover from the business exceeding Rs. 60 lakhs | ✓ | ✓ | ||

| A person has gross receipts from a profession exceeding Rs. 10 lakhs | ✓ | ✓ | ||

| Aggregate amount of TDS and TDS is Rs. 25,000 (Rs. 50,000 in case of a senior citizen) or more | ✓ | ✓ | ✓ | ✓ |

| Aggregate deposit in the savings bank account is Rs. 50 lakh or more | ✓ | ✓ | ✓ | ✓ |

Other Assessees |

||||

| Status of Assessee |

ITR 4 |

ITR 5 | ITR 6 |

ITR 7 |

| Firm (excluding LLPs) opting for presumptive taxation scheme of section 44AD, 44ADA or 44AE | ✓ | |||

| Firm (including LLPs) | ✓ | |||

| Association of Persons (AOPs) | ✓ | |||

| Body of Individuals (BOI) | ✓ | |||

| Local Authority | ✓ | |||

| Artificial Juridical Person | ✓ | |||

| Companies other than companies claiming exemption under Section 11 | ✓ | |||

| Persons, including companies, are required to furnish returns under –

– Section 139(4A) – Section 139(4B) – Section 139(4C) – Section 139(4D) |

✓ | |||

| Business Trust | ✓ | |||

| Investment Fund, as referred to in Section 115UB | ✓ | |||

Click Here To Read The complete FAQ

3. New Tax Regime vs Old Tax Regime

3.1 How Section 115 BAC Impacts Your Taxes

FAQ 1. What is the New Tax Regime under Section 115BAC?

Section 115BAC of the Income Tax Act provides an alternative tax regime (new tax regime) for Individuals, HUFs, AOPs, BOIs, and AJPs (‘eligible assesses’). Under this tax regime, eligible assesses have the option of being taxed at reduced rates based on their income brackets.

If an eligible assessee opts for this regime, the income shall be taxable at the following rate:

|

Total Income (Rs) |

Tax Rate |

| Up to 3,00,000 |

Nil |

| From 3,00,001 to 7,00,000 |

5% |

| From 7,00,001 to 10,00,000 |

10% |

| From 10,00,001 to 12,00,000 |

15% |

| From 12,00,001 to 15,00,000 |

20% |

| Above 15,00,000 |

30% |

Further, a resident individual who has opted for the new tax regime can claim a rebate of up to Rs. 60,000, provided his total income does not exceed Rs. 12,00,000. However, if the total income exceeds the threshold limit of Rs. 12,00,000, the marginal rebate is allowed.

Furthermore, an assessee opting for the new tax regime is required to satisfy the following conditions:

(a) The total income of the assessee is computed without claiming specified exemptions and deductions (discussed in FAQ 3)

(b) The total income of the assessee is computed without set-off of losses or depreciation carried forward from earlier years if such loss or depreciation is attributable to any of the specified exemptions and deductions

(c) The total income of the assessee is computed without set-off of any loss under the head “Income from house property” with any other head of income

(d) The total income of the assessee is calculated after claiming depreciation in the prescribed manner, and where the depreciation rate of any block of assets is more than 40%, it is restricted to 40%

(e) The total income of the assessee is computed without claiming any exemptions or deductions for allowances or perquisites provided under any other law for the time being in force

| Read More New Tax Regime for Individuals, HUFs, AOPs, BOIs or AJPs on Taxmann.com/Practice |

FAQ 2. How to Choose Between the Old and New Tax Regime?

The decision to opt for the new tax regime will depend on the amount of exemptions and deductions available to the assessee. If an individual has no deductions or exemptions to claim, it would always be beneficial for them to opt for the new tax regime.

On the other hand, if an individual is eligible to claim deductions/exemptions like Section 80C, Section 80D, House Rent Allowance or interest on a housing loan under Section 24, it is recommended that taxes be calculated under both regimes to determine which is more beneficial.

FAQ 3. What Are the Exemptions and Deductions Not Available in the New Tax Regime?

The option to pay tax at lower rates shall be available if the total income is computed without claiming the following exemptions or deductions:

(a) Leave Travel Concession [Section 10(5)]

(b) House Rent Allowance [Section 10(13A)]

(c) Official and Personal Allowances (Other Than Those as May Be Prescribed) [Section 10(14)]

(d) Allowances to MPs/MLAs [Section 10(17)]

(e) Exemption for Income of Minor [Section 10(32)]

(f) Deduction for Units Established in Special Economic Zones (SEZ) [Section 10AA]

(g) Entertainment Allowance [Section 16(ii)]

(h) Professional Tax [Section 16(iii)]

(i) Interest on Housing Loan (In Case of Property Referred Under Section 23(2), i.e. Self-Occupied House Property) [Section 24(b)]

(j) Additional Depreciation in Respect of New Plant and Machinery [Section 32(1)(iia)]

(k) Deduction for Investment in New Plant and Machinery in Notified Backwards Areas [Section 32AD]

(l) Deduction in Respect of Tea, Coffee or Rubber Business [Section 33AB]

(m) Deduction in Respect of Business Consisting of Prospecting or Extraction or Production of Petroleum or Natural Gas in India [Section 33ABA]

(n) Deduction for Donations Made to Approved Scientific Research Associations, Universities, Colleges or Other Institutes for Doing Scientific Research That May or May Not Be Related to Business [Section 35(1)(ii)]

(o) Deduction for Payment Made to an Indian Company for Doing Scientific Research Which May or May Not Be Related to Business [Section 35(1)(iia)]

(p) Deduction for Donations Made to Universities, Colleges, or Other Institutions for Doing Research in Social Science or Statistical Research [Section 35(1)(iii)]

(q) Deduction for Donations Made for or Expenditure on Scientific Research [Section 35(2AA)]

(r) Deduction for Capital Expenditure Incurred for Certain Specified Businesses, i.e., Cold Chain Facility, Warehousing Facility, etc. [Section 35AD]

(s) Deduction for Expenditure on Agriculture Extension Project [Section 35CCC]

(t) Deduction Under Sections 80C to 80U Other Than Specified Under Section 80JJAA, Section 80CCD(2), Section 80CCH(2), and Section 80LA(1A) [Chapter VI-A]

| Read More New Tax Regime for Individuals, HUFs, AOPs, BOIs or AJPs on Taxmann.com/Practice |

FAQ 4. What are the Break-Even Points of Deductions at Different Income Levels Where Tax Liability Is the Same Under Both Regimes?

The following table lists the break-even points for deductions at income levels of Rs. 8 lakhs, Rs. 9 lakhs, Rs. 10 lakhs, Rs. 12.50 lakhs, and Rs. 15 lakhs.

| Income (Rs) | Deductions Required for Break Even (Rs) | Tax Liability under New Tax Regime (Rs) |

Tax Liability under Old Tax Regime (Rs) |

Comments |

|

8,00,000 |

2,12,500 | 31,200 |

31,200 |

The new regime will be beneficial if the assessee is eligible to claim a deduction of less than Rs. 2,12,500 |

|

9,00,000 |

2,62,500 | 41,600 |

41,600 |

The new regime will be beneficial if the assessee is eligible to claim a deduction of less than Rs. 2,62,500 |

|

10,00,000 |

3,12,500 | 52,000 |

52,000 |

The new regime will be beneficial if the assessee is eligible to claim a deduction of less than Rs. 3,12,500 |

|

12,50,000 |

3,62,500 | 93,600 |

93,600 |

The new regime will be beneficial if the assessee is eligible to claim a deduction of less than Rs. 3,62,500 |

|

15,00,000 |

4,08,333 | 1,45,600 |

1,45,600 |

The new regime will be beneficial if the assessee is eligible to claim a deduction of less than Rs. 4,08,333 |

FAQ 5. I Earn a Salary of Rs. 14 Lakhs. In FY 2024-25, I Paid Rs. 4 Lakhs to Repay the Principal of the Home Loan, Rs. 50,000 for Health Insurance, and Rs. 1.5 Lakh Towards the Interest on the Home Loan. Which Tax Regime Should I Choose?

Here’s a comparison in a table format for an individual under 60 years of age:

|

Particulars |

Old Tax Regime (Rs.) |

New Tax Regime (Rs.) |

| Salary Income [A] |

14,00,000 |

14,00,000 |

| Eligible Deductions | ||

| • Standard Deduction |

50,000 |

75,000 |

| • Section 80C (Repayment of Home Loan) |

1,50,000 |

– |

| • Section 80D (Health Insurance Premium) |

50,000 |

– |

| • Section 24(b) (Interest on Home Loan for Self-Occupied House) |

1,50,000 |

– |

| Total Deductions [B] |

4,00,000 |

75,000 |

| Net Taxable Income after Deductions [C = A – B] |

10,00,000 |

13,25,000 |

| Tax Payable [D] |

1,12,500 |

1,05,000 |

| Add: Health and Education Cess (4%) [E = D * 4%] |

4,500 |

4,200 |

| Total Tax Liability [F = D + E] |

1,17,000 |

1,09,200 |

In this example, the new tax regime results in a lower tax liability (Rs. 1,09,200) compared to the old tax regime (Rs. 1,17,000). Therefore, you should opt for the new tax regime.

Click Here To Read The complete FAQ

4. The ITR Compliance Guide

4.1 F&O | Crypto | Section 115BBJ

FAQ 1. I am a Trader in Futures and Options (F&O). This Year, I Incurred a Loss in F&O Trading. Do I Still Need to File My Income Tax Return (ITR) Even Though My Income Is Below the Exemption Limit??

Individuals and HUFs must file an ITR if their income before claiming capital gain exemption and deductions under Chapter VI-A exceeds the maximum exemption limit.

Since you have incurred a loss during the year, you are not required to submit an ITR under normal circumstances. However, it is still necessary to file the ITR to carry forward the F&O losses. Therefore, you should file your return of income on or before the due date to carry forward the losses.

FAQ 2. I am a Salaried Employee. I trade in derivatives, such as Futures and Options. I Would Like to know the Deadline for Filing My Income Tax Return (ITR), whether it is 31st July or 31st October?

The gains or losses arising from trading in F&O are always taxable under the head of ‘Profits and Gains from Business or Profession’. Income or loss from F&O shall be deemed as normal business income (non-speculative business) even though delivery is not affected in such transactions.

As your income from F&O falls under the business head, it is important to calculate your turnover to determine whether you are required to have your accounts audited. The turnover computation is crucial because the requirement for a tax audit is based on turnover. If your turnover exceeds the specified limit, you must have your accounts audited. In such cases, the due date for filing your ITR will be 31st October. However, if your turnover is below the specified limit, the due date to file the ITR will be 15th September [4].

FAQ 3. How to Calculate the Turnover in the Case of F&O?

The Income-tax Act does not contain any provision or guidance for computing turnover in F&O trading. However, the ‘Guidance Note on Tax Audit’ issued by the ICAI prescribes the method of determining turnover. This method for computing turnover is only for the purpose of calculating ‘turnover’ for tax audit purposes. The turnover in such types of transactions is to be determined as follows:

(a) The total of favourable and unfavourable differences is taken as turnover.

(b) Premiums received on the sale of options are also included in turnover. However, where the premium received is included for determining net profit for transactions, it should not be included separately.

(c) In respect of any reverse trades, the difference thereon should also form part of the turnover.

(d) In case of an open position as at the end of the financial year (i.e., trades which are not squared off during the same financial year), the turnover arising from the said transaction should be considered in the financial year when the transaction has been actually squared off.

(e) In case of delivery-based settlement in a derivatives transaction, the difference between the trade price and the settlement price shall be considered as turnover. Further, in the hands of the transferor of the underlying asset, the entire sale value shall also be considered as business turnover where the underlying asset is held as stock in trade.

For example, Mr A enters into the following transaction during the financial year:

|

Security name |

Type | Premium received | Buy Amount | Sell Amount |

Profit/(Loss) |

|

Cipla |

Futures | – | 7,47,500 | 8,05,000 | 57,500 |

| Nifty | Call | – | 3,375 | 6,000 |

2,625 |

|

BHEL |

Call | – | 41,600 | 20,800 | (20,800) |

| ONGC | Futures | – | 3,48,500 | 3,28,000 |

(20,500) |

|

IOC |

Put (Sell) | 500 | – | – | 500 |

| ITC | Put (Sell) | 1,000 | 4,000 (Square Off Price) | – |

(3,000) |

|

Reliance Ltd. |

Put | – | 4,500 | 2,500 |

(2,000) |

In derivative transactions, the aggregate of both favourable and unfavourable differences (i.e., income and loss) is considered the turnover. Further, the premium received on the sale of options is also included in turnover if the same is not included while determining the net profit or loss from the transaction. Thus, the turnover of Mr. A shall be as follows:

|

Security Name |

Profit/(Loss) |

|

Cipla |

57,500 |

| Nifty |

2,625 |

| BHEL |

(20,800) |

|

ONGC |

(20,500) |

| IOC |

500 |

|

ITC [5] |

(3,000) |

| Reliance Ltd. |

(2,000) |

|

Total Turnover |

1,06,925 |

FAQ 4. I am a Senior Citizen, and My Only Source of Income Is the Interest Earned from Bank Deposits, Which Is Below the Maximum Exemption Limit. The Bank Has Already Deducted Tax (TDS) From This Income. Am I Required to File an ITR?

Filing an ITR is not mandatory since your income is below the maximum exemption limit. However, it is important to note that if the amount of tax paid by an individual exceeds his actual tax liability, the excess amount is considered an ‘income-tax refund’ that can be claimed by filing a return. If you are eligible for an income-tax refund, it can only be claimed by filing the ITR. Since the tax has been deducted from your interest income, filing the ITR to claim the refund of TDS is advisable. You cannot claim any refund if you do not file the return.

Click Here To Read The complete FAQ

5. New ITR Disclosure Rules for Tax Deductions

5.1 HRA | Education & Housing Loans | Penalty on Fake Claims

FAQ 1. What Are the New Disclosures Required in the ITR Forms While Claiming Certain Deductions?

To increase transparency and verify false claims, the ITR forms notified for the Assessment Year 2025-26 require taxpayers to provide additional details when claiming deductions under various provisions of the Income-tax Act. These enhanced disclosure requirements apply to the following deductions:

(a) House Rent Allowance (HRA) [Section 10(13A)]

(b) Interest on Home Loan [Section 24(b)]

(c) Investment-Linked Deductions [Section 80C]

(d) Medical Insurance [Section 80D]

(e) Interest on Loan Taken for Specific Purposes [Sections 80E, 80EE, 80EEA and 80EEB]

FAQ 2. What Information Does the ITR Form Seek While Claiming the Deduction of House Rent Allowance (HRA)?

To claim exemption for House Rent Allowance (HRA), taxpayers are now required to provide the following additional information:

(a) Place of Work (Metro or Non-Metro)

(b) Actual HRA Received

(c) Actual Rent Paid

(d) Salary Details as per Section 17(1)

(e) Enter the Amount in the Relevant Column of ‘50%/40% of Salary’

add

FAQ 3. What Details Does the ITR Form Seek if the Taxpayer Claims Home Loan Interest Under Section 24(b)?

To claim a deduction for interest on a home loan under Section 24(b) in the ITR, taxpayers are required to provide loan-related information, such as:

(a) Whether the Loan Is Taken From a Bank or Other Than a Bank?

(b) Name of the Bank/Institution/Person From Which the Loan Is Taken

(c) Loan Account Number of the Bank/Institution

(d) Date of Sanction of the Loan

(e) Total Amount of the Loan

(f) Loan Outstanding as on the Last Date of the Financial Year

(g) Interest on Borrowed Capital u/s 24(b)

To claim the deduction under Section 24(b), all the above-mentioned fields are mandatory. However, in the ITR forms for AY 2024-25, only the interest on borrowed capital was required to be furnished to avail the deduction.

FAQ 4. What Details Does the ITR Form Seek if the Taxpayer Claims Investment-Linked Deductions Under Section 80C?

Section 80C allows an Individual or HUF to claim a deduction of Rs. 1,50,000 for specific investments, deposits or payments. The deduction is allowed under this provision for making payments for life insurance, education expenses, contributions to the provident fund, repayment of housing loans, contributions to certain small saving schemes, contributions to pension funds, or fixed deposits. In the ITR, the Schedule 80C requires the following additional details from the taxpayers:

(a) Amount Eligible for Deduction

(b) Policy Number or Document Identification Number

add

FAQ 5. What Details Does the ITR Form Seek if the Taxpayer Claims a Deduction of Medical Insurance Under Section 80D?

Section 80D allows a deduction in respect of the amount paid for the health insurance policy, preventive health check-up, contribution to CGHS and expenditure on medical treatment. An individual can claim a deduction in respect of the amount incurred for himself, family or parents. A maximum deduction of Rs. 100,000 can be claimed under this provision. In the ITR, the Schedule 80D requires the following additional details from the taxpayers:

(a) Name of the Insurer (Insurance Company)

(b) Policy Number

Click Here To Read The complete FAQ

6. Filing Updated Return of Income (ITR-U)

FAQ 1. Mr. Aman Filed an Income Tax Return for the Assessment Year 2023-24 Within the Due Date. On 13-05-2025, He Found That He Failed to Report Interest Income in His ITR. Can He Revise His ITR for AY 2023-24?

Section 139(5) allows a taxpayer to file a revised income return if he discovers an omission or error in the original return. However, the revised return can be filed three months before the relevant assessment year or before the completion of the assessment, whichever is earlier.

Where an assessee missed the deadline to file the revised return or if there was no error or omission in the original return, Section 139(8A) allows filing of an updated return, which gives an assessee a longer duration to file the return of income. An updated return can be filed within 48 months from the end of the relevant assessment year (subject to certain conditions). An updated return can be filed, even after the expiry of the time limits specified for filing of the revised return, along with additional tax payable.

In the financial year 2025-26, a person can file an updated return for the assessment years 2020-21, 2021-22, 2022-23 and 2023-24.

| Read More Updated Return of Income on Taxmann.com/Practice) |

FAQ 2. Who Is Not Eligible to File an Updated Return?

All taxpayers are eligible to file an updated return. However, such a return cannot be filed in the following circumstances:

(a) If an updated return is a return of a loss

(b) In case an updated return results in a lower tax liability

(c) In case an updated return results in or increase in the refund

(d) In case of a search initiated against the assessee

(e) Where books of account or assets, etc., are requisitioned in case of the assessee

(f) In case a survey is conducted against the assessee

(g) Where documents or assets seized or requisitioned in case of any other person belong to the assessee

(h) In case an updated return has already been filed

(i) In case the assessment is pending or completed

(j) In case AO has information about the assessee under the specified Acts

(k) In case AO has information about the assessee under DTAA or TIEA

(l) In case any prosecution proceeding is initiated or

(m) In case of a person or class of persons as notified by the CBDT

Note- No updated return can be filed if a notice under section 148A is issued after 36 months from the end of the relevant AY. However, this restriction does not apply if it is held under section 148A(3) that issuing a notice under section 148 is not justified.

| Read More Updated Return of Income on Taxmann.com/Practice) |

FAQ 3. Is There Any Fee or Penalty Levied Upon the Taxpayer for Furnishing an Updated Return?

No penalty or fee is levied upon a person who wishes to furnish an updated return. However, he is required to pay an additional tax in accordance with Section 140B. The additional tax shall be equal to 25% of the aggregate of tax and interest payable by a person on the filing of the updated return, where such return is furnished after the expiry of the due date of filing of belated or revised return but before completion of a period of 12 months from the end of the relevant assessment year.

Where filed after 12 months but before the completion of 24 months, the additional tax shall be 50%. Where the return is filed after 24 months but within 36 months, the additional tax shall be 60%, and if filed after 36 months but within 48 months from the end of the relevant assessment year, the additional tax payable shall be 70% of the aggregate of tax and interest.

The table below enumerates the additional tax payable by an assessee on filing of the updated return after certain months from the expiry of the due date.

|

Additional Tax |

For which assessment year, the additional tax will be payable if the updated return is filed between 01-04-2025 and 31-12-2025 | For which assessment year, the additional tax will be payable if the updated return is filed between 01-01-2026 and 31-03-2026 |

|

25% |

Assessment Year 2024-25 | Assessment Years 2024-25 and 2025-26 |

|

50% |

Assessment Year 2023-24 |

Assessment Year 2023-24 |

| 60% | Assessment Year 2022-23 |

Assessment Year 2022-23 |

| 70% | Assessment Year 2021-22 |

Assessment Year 2021-22 |

Further, a fee under Section 234F shall be charged if such a person did not furnish a return of income for that Assessment Year for which he is furnishing an updated return.

| Read More Updated Return of Income on Taxmann.com/Practice) |

Click Here To Read The complete FAQ

7. ITR Reporting Requirements

FAQ 1. Are Taxpayers Required to Disclose All Bank Accounts Held During the Financial Year?

Yes, the ITR forms require taxpayers to disclose details of all bank accounts held in India at any time during the previous year. However, disclosing dormant accounts is excluded.

FAQ 2. What Should Be the ‘Relevant Accounting Period’ for Reporting Foreign Assets in Schedule FA?

Reporting in Schedule FA (Foreign Assets) is mandatory for a taxpayer who is a resident in India and:

(a) He holds any asset outside India;

(b) He has signing authority in any account located outside India; or

(c) He has income from any source outside India.

This schedule is not required to be filed by a taxpayer who is a non-resident (NR) or not ordinarily resident (NOR).

Schedule FA requires reporting of assets held outside India. Such reporting is required if those assets are held at any time during the relevant accounting period. Reporting is required even if the asset is held for a single day during the relevant accounting period.

The ITR Forms use the expression “calendar year ending as on 31st December 2024”. This implies that the assessee shall furnish the details of all foreign assets held between 01-01-2024 and 31-12-2024 in return to be filed for the assessment year 2025-26. Irrespective of the fiscal year followed in the foreign country (like, Australia follows July to June, Costa Rica follows October to September, etc.), the reporting will be made if the specified foreign assets are held on 31-12-2024.

|

Example 1 |

|

| Relevant previous year |

01-04-2024 to 31-03-2025 |

| Relevant calendar year |

01-01-2024 to 31-12-2024 |

| Date of purchase of shares of Google LLC |

January 2024 |

| Is the assessee required to furnish the details regarding the foreign assets acquired? |

Yes |

The assessee is required to furnish the details of Google LLC’s share in ITR applicable for the Assessment Year 2025-26 even if he has not held the foreign asset in the relevant previous year.

|

Example 2 |

|

| Relevant previous year |

01-04-2024 to 31-03-2025 |

| Relevant calendar year |

01-01-2024 to 31-12-2024 |

| Date of purchase of shares of Google LLC |

January 2025 |

| Is the assessee required to furnish the details regarding the foreign assets acquired? |

No |

The shares of Google LLC were acquired within the previous year, but after the end of the relevant calendar year. Thus, the assessee is not required to furnish the details of Google LLC’s share in the ITR applicable for the Assessment Year 2025-26. The disclosure requirement for such investment shall only arise in the Assessment Year 2026-27.

FAQ 3. I Paid Taxes in a Foreign Country While Working on a Project There for Three Months. How Can I Claim Credit for This in ITR?

If an assessee has paid tax in any foreign country or specified territory outside India, he shall be allowed a credit for the same by way of deduction or otherwise. The credit shall be allowed in the year in which the assessee offered such income to tax or assessed to tax in India. Rule 128 of Income-tax Rules 1962 lays down broad principles and conditions for the computation and claim of foreign taxes paid in overseas countries by the resident taxpayers.

A statement of foreign income offered to tax and the foreign tax deducted or paid on such income is required to be submitted in Form No. 67. The statement specifying the nature of income and foreign tax deducted or paid is required to be furnished as per the due dates mentioned below:

|

Return Filing Under |

Due Date of Filing Documents to Claim FTC |

|

Original Return (Section 139(1)) |

On or before the end of the assessment year |

|

Belated Return (Section 139(4)) |

On or before the end of the assessment year |

| Updated Return (Section 139(8A)) |

On or before the date of filing the return |

The form must be furnished electronically through the e-filing portal. Further, the details of relief claimed for taxes paid outside India must be reported in ‘Schedule TR’ of the ITR form.

FAQ 4. How to Report the “Cost of Acquisition” and “Sale Consideration” of the Unlisted Equity Shares Acquired During the Year by Gift, Will, Amalgamation, etc.?

To keep a check on the investment in closely held companies, a new table has been inserted in ITR forms [ITR-2, ITR-3 & ITR-5] to seek the following details in respect of unlisted equity shares held at any time during the previous year by an assessee:

(a) Name of the company

(b) Type of company

(c) PAN of the company

(d) No. and cost of acquisition of shares held at the beginning of the year

(e) No. of shares, face value, issue price (or purchase price), and date of purchase of shares acquired during the year

(f) No. and sale consideration of shares transferred during the year and

(g)No. and cost of acquisition of shares held at the end of the previous year

If the ‘cost of acquisition’ or ‘sale consideration’ of unlisted shares is not ascertainable because those shares were received under a gift, will, amalgamation, etc., then the assessee may enter zero or the appropriate value in respective fields.

The details furnished in this table are required only for reporting and are irrelevant to the computation of income or tax liability [8].

FAQ 5. A Person Held Shares Listed on the New York Stock Exchange. Should Such Shares Be Treated as Unlisted for Reporting in the ITR?

Instructions to ITR Forms clarified that if a person held shares of a company listed in a recognised stock exchange outside India during the previous year, the same shall not be considered unlisted shares for reporting in the ITR. However, it should be noted that the reporting of such holding shall be made in the Schedule FA.

FAQ 6. A Person Held Shares of a Cooperative Bank or Cooperative Society. Should Such Shares Be Treated as Unlisted Shares to Be Reported in ITR?

Instructions to ITR Forms clarified that a person is required to report the details of equity shareholding in entities registered under the Companies Act that are not listed on any recognised stock exchange. Thus, shares held in a cooperative bank or cooperative society are not considered unlisted shares for reporting in the ITR.

FAQ 7. Do I Need to Report Details of Unlisted Shares Even if I Have Them as Part of My Business’s Stock in Trade?

Yes, even if you held unlisted equity shares as stock‐in‐trade of a business during the previous year, you are required to report this.

FAQ 8. Should Details of Foreign Assets Be Reported in Schedule AL if They Have Been Duly Reported in Schedule FA?

Schedule AL in Income-tax returns form (ITR 2 and ITR 3) requires individuals/HUFs to declare the value of assets and liabilities if their total income exceeds Rs. 1 crore. Further, Schedule FA requires reporting of assets held outside India. Reporting in Schedule FA is mandatory for a taxpayer who is a resident in India. It is not required to be filed by a taxpayer who is a Non-resident (NR) or a Not-ordinarily Resident (NOR). Though both schedules require reporting yet, they serve different purposes. Schedule FA seeks details of foreign assets and income from any source outside India. An assessee has to enter details of foreign assets if they were held even for a single day during the relevant accounting period. On the other hand, Schedule AL seeks details of assets and liabilities the assessee holds at the end of the previous year. Therefore, details of foreign assets are to be reported in Schedule AL if the assessee holds the same at the end of the previous year.

FAQ 9. What Is the Meaning of Beneficial Owner or Beneficiary for Reporting in Schedule FA?

Explanation 4 to Section 139(1) of the Income-tax Act 1961 defines the meaning of ‘beneficial owner’. As per the Explanation, a beneficial owner means an individual who has provided, directly or indirectly, consideration for the asset. Further, if such asset is held for the immediate or future benefit of the individual providing the consideration or any other person.

FAQ 10. Table B of Schedule FA Seeks Details of ‘Financial Interest’ Held by the Assessee in Any Entity. What Is the Meaning of Financial Interest?

As per the instructions to ITR forms, financial interest would include, but is not limited to, any of the following cases:

(a) The resident assessee is the owner of record or holder of legal title of any financial account, irrespective of whether he is a beneficiary or not

(b) The owner of record or holder of the title in one of the following:

-

-

-

- An agent, nominee, attorney, or a person acting in some other capacity on behalf of the resident assessee with respect to the entity

- A corporation in which the resident assessee owns, directly or indirectly, any share or voting power

- A partnership in which the resident assessee owns, directly or indirectly, an interest in partnership profits or an interest in partnership capital

- A trust of which the resident assessee has a beneficial or ownership interest

- Any other entity in which the resident assessee owns, directly or indirectly, any voting power, equity interest or assets or interest in profits

-

-

Click Here To Read The complete FAQ

8. Income Tax Returns (ITR) – Filing & Verification

8.1 Complete Guide for Taxpayers

FAQ 1.How Can I Reset the Password If I Do Not Have Access to the Mobile Number Registered With the E-Filing Portal and Aadhaar?

If you do not have access to a mobile number registered with the e-filing portal or a mobile number linked with Aadhaar, you can reset your password using a valid DSC. A taxpayer can reset the password even if the DSC is not registered on the portal. However, the DSC should be linked to the taxpayer’s PAN. Alternatively, you can also log in directly using the Net Banking facility.

If these options are also unavailable, you can send a request to efilingwebmanager@incometax.gov.in. You must attach and share the following details in the request email:

-

- A scanned copy of the taxpayer’s PAN

-

- A scanned PDF copy of identity proof (such as passport, voter identity card, driving license, Aadhaar card, or bank passbook with photo)

-

- Scanned PDF copy of address proof (such as passport, voter identity card, driving license, Aadhaar card, or bank passbook with photo)

-

- A written letter requesting the password with valid reasons.

Attach the documents in ZIP format only; otherwise, your request will not be processed. All documents must be self-attested by the taxpayer. The request for password reset must come from the assessee’s registered email ID in the e-filing profile. Once the documents are validated, the reset password link will be sent to the email ID from which the request was received.

FAQ 2.What Are the Modes for Filing a Return of Income?

The filing of income tax returns must be electronic, either online or using the offline utility provided by the Income Tax Department. However, individuals aged 80 or above who are submitting returns in ITR-1 or ITR-4 have the option to file in paper mode.

If the return of income is filed through electronic mode, then the assessee has the following options:

(a) E-filing using a Digital Signature (DSC)

(b) E-filing without a Digital Signature or

(c) E-filing through Aadhaar OTP

(d) E-filing under Electronic Verification Code (EVC).

If the return of income is filed using a DSC, Aadhaar OTP or under EVC, then there is no requirement to send the signed copy, ITR-V (i.e., acknowledgement of return filed electronically) to Bengaluru CPC. However, where the return is filed without DSC, Aadhaar OTP or EVC, the assessee shall send the signed copy of ITR V to the following address either by ordinary post or by speed post only:

“Income Tax Department – Centralised Processing Centre, Income-tax Department, Bengaluru -560500”

FAQ 3. What Is the Time Limit for Sending a Signed Copy of ITR-V to CPC or Verifying the Return Furnished Online?

The time limit for e-verification or submission of ITR-V is 30 days from the date of filing of the return of income electronically [9]. If the return of income is not verified within 30 days from the date of uploading or by the due date for filing the return as specified in the IT Act, whichever is later, the return will be considered invalid due to non-verification [10]. It should be noted that if the return is filed before the due date but the return is verified after the expiry of 30 days, which falls after the due date for filing the return of income, the return shall be considered to be a belated return of income.

For instance, you upload your income tax return on 1st July, 2025. You’re required to verify it within 30 days, which means by 31st July, 2025. However, you can verify it until 31st December, 2025, which is the due date for filing a belated return. If you verify it after 15th September [11] but before 31st December, your return will be treated as a belated return.

FAQ 4. What Happens if I Do Not Verify My ITR by 31st December, 2025?

If you do not verify or submit the ITR-V by 31st December, 2025, which is the final verification date for the Assessment Year 2025-26, the return will be treated as invalid due to non-verification.

However, if you have a valid reason or a reasonable cause that prevented you from verifying the return, you can request the condonation of the delay by providing an appropriate explanation for the delay. However, the return will be verified and treated as valid only if the Income-tax Department approves the condonation request.

FAQ 5. What Are the Norms Related to the Verification Of ITR?

The CBDT12 has specified the guidelines for the ITR verification as follows:

(a) The date of uploading the ITR will be considered as the date of furnishing the return of income if e-verification/ITR-V of such return of income is submitted within 30 days of uploading.

(b) The date of e-verification/ITR-V submission shall be treated as the date of furnishing the return of income if the e-verification/ITR-V is submitted 30 days after uploading the return. Accordingly, all the consequences of the late filing of returns under the Income-tax Act shall follow.

| Example The due date for filing the ITR is 15th September, 2025. Mr. X filed his ITR on 5th September, 2025, and verified it on 2nd October, 2025, within 30 days of filing. Thus, the ITR filing date for Mr. X would be 5th September, 2025. However, if he verifies the ITR on 10th October, 2025, beyond the 30-day period, the verification date, 10th October, 2025, will be considered the filing date. In this case, the return will be treated as a belated return and consequences related to the furnishing of a belated return shall apply. |

FAQ 6. Mr. Raj Files His ITR on 10th September, 2025, and Sends the Signed ITR-V to CPC Bengaluru on 8th October, 2025. CPC Bengaluru Received It on 12th October, 2025. Will the ITR Be Treated as Verified Within 30 Days?

Previously, the date of dispatch of the speed post containing the duly verified ITR-V was used to determine the 30-day time limit. However, effective from 1st April 2024, the date on which the duly verified ITR-V is received at the CPC will be considered for determining the 30-day period from the date of uploading the ITR13. Therefore, in this case, the ITR will not be considered as duly verified within the 30-day period.

FAQ 7. I Have Uploaded an ITR, but I Found That I Missed Reporting a Few Details. Can I Cancel It and Upload a Fresh ITR?

Yes, the taxpayer can discard an ITR if he does not want to verify it so that the department cannot consider it for processing. Once a taxpayer discards an ITR, it is treated as never filed by him. The taxpayer can find the Discard option on the e-filing portal.

“www.incometax.gov.in → Login → e-File → Income Tax Return → E-Verify ITR → Discard”

This option is visible only against ITRs that have been pending verification. You cannot discard an ITR that has been verified.

FAQ 8. When Is It Mandatory to File the Return of Income for an Individual or HUF?

A. Income Exceeding the Threshold Limit

If the income of an individual or HUF (resident or non-resident), before claiming the following deductions or exemptions, exceeds the maximum exemption limit, then filing a return is mandatory:

(a) Exemption under Section 10(38)

(b) Deduction under Section 10A,10B,10BA

(c) Exemption under section 54, 54B, 54D, 54EC, 54F, 54G, 54GA or 54GB

(d) Deduction under Section 80C to 80U

B. Assets Outside India

An Individual (resident and ordinary resident in India) shall file his return of income, even if his income does not exceed the maximum exemption limit, if he:

(a) Holds, as a beneficial owner or otherwise, any asset (including any financial interest in any entity) located outside India

(b) Has signing authority in any account located outside India and

(c) Is a beneficiary of any asset (including any financial interest in any entity) located outside India.

C. Seventh Proviso to Section 139(1)

Filing of return of income is mandatory irrespective of gross total income if the assessee’s case is covered under the seventh proviso to Section 139(1). This provision requires every person who is otherwise not required to file the return due to the reason that his income does not exceed the maximum exemption limit to file the return of income if during the previous year:

(a) He has deposited more than Rs. 1 crore in one or more current accounts maintained with a bank or a cooperative bank

(b) He has incurred more than Rs. 2 lakh for himself or any other person for travel to a foreign country or

(c) He has incurred more than Rs. 1 lakh towards the payment of the electricity bill

(d) If total sales, turnover, or gross receipts of the business exceed Rs. 60 lakhs during the previous year

(e) If the total gross receipt in the profession exceeds Rs. 10 lakhs during the previous year

(f) If the total tax deducted and collected during the previous year is Rs. 25,000 or more. The threshold limit shall be Rs. 50,000 in case of a resident individual of the age of 60 years or more, or

(g) If the aggregate deposit in one or more savings bank accounts of the person is Rs. 50 lakh or more during the previous year.

Note: The situations mentioned in points (d) to (g) have been notified by the CBDT via Notification No. 37/2022, dated 21-04-2022.

| Read More Return of Income on Taxmann.com/Practice |

FAQ 9. When Is It Mandatory for a Non-Resident to File a Return of Income?

If a non-resident person has income that is taxable in India, the filing of an Income-tax return shall be done in accordance with the provisions applicable in the case of the corresponding resident assessee. However, suppose a firm is deemed a fiscally transparent entity according to the provisions of the DTAA signed between India and a foreign country (in which such firm is a resident). In that case, the return shall be filed in accordance with the status of the partner in that firm.

| Read More Filing of Income-tax Return by Non-residents on Taxmann.com/Practice |

Click Here To Read The complete FAQ

9. Annual Information Statement (AIS)

Your Smart Tool for Hassle-Free ITR Filing

FAQ 1. Certain Information About My Income and Deductions, etc., is Pre-filled in the Income-Tax Return. What is the Source of that Information?

The Government has enlarged the scope of Form 26AS to cover information regarding various transactions made by a person during the year. The CBDT has omitted Rule 31AB, and a new Rule 114-I has been inserted to provide that the authorities will upload the Annual Information Statement (AIS) in Form No. 26AS in the registered account of the assessee. Such form shall consist of the following information:

-

- Details of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS).

- Specified Financial Transactions (SFT).

- Tax payments.

- Details of demands and refunds.

- Status of pending proceedings.

- Information on completed proceedings.

- Data received from any authority or individual under any law or under agreements as per sections 90 and 90A, and any other relevant data deemed necessary for revenue interests.

This information in the AIS is used to pre-fill relevant sections of the Income-tax Return (ITR) form.

| Read More Annual Information Statement (AIS) on Taxmann.com/Practice) |

FAQ 2. Can a Taxpayer Access the Information Available in the Annual Information Statement (AIS)?

An assessee can access AIS information by logging into their income-tax e-filing account. If he feels that the information furnished in AIS is incorrect, duplicate, or relates to any other person, he can submit his feedback thereon.

An assessee can access and respond to AIS information from the income-tax e-filing portal. Alternatively, he can also use an offline utility.

FAQ 3. How to Access the Annual Information Statement (AIS) Online?

Follow these steps to access AIS information online:

Step 1 – Log in to the Income-tax e-filing website at https://www.incometax.gov.in/. New users must register first.

Step 2 – After logging in, navigate to Services > Annual Information Statement (AIS).

Step 3 – A prompt will appear; click ‘proceed’ to be redirected to the AIS homepage.

Step 4 – The next screen will show the AIS and Taxpayer Information Summary (TIS) instructions. The TIS categorises AIS data and shows original and revised values used to pre-fill the tax return.

Step 5 – Click on the ‘AIS‘ tab. You will see two options: Taxpayer Information Summary (TIS) and Annual Information Statement (AIS). Choose the financial year from the dropdown and click on the AIS tile to view the information.

Step 6 – AIS information is divided into Part A and Part B on the next screen.

-

- Part A includes general taxpayer information (e.g., PAN, Aadhaar, Name, Date of Birth, Mobile Number, Email ID, Address).

- Part B contains detailed financial data for the selected year, including:

-

-

- TDS/TCS Information

- SFT Information

- Tax Payments

- Demands and Refunds

- Other Information

-

Step 7 – AIS data can be downloaded in CSV, JSON, or PDF formats. CSV downloads are per transaction category, while the entire AIS can be downloaded in PDF or JSON. Note that PDFs are password-protected. The password combines the PAN (in lowercase) and the date of birth or incorporation, formatted as DDMMYYYY without spaces.

For example, if the PAN is AAAAA1234A and the date of birth is January 21, 1991, the password will be aaaaa1234a21011991.

| Read More How to access the Annual Information Statement (AIS) online? on Taxmann.com/Practice) |

Click Here To Read The complete FAQ

10. Capital Gains in Income Tax Returns (ITR) AY 2025-26

FAQ 1. I Have Earned Profit from Selling Listed Shares That I Have Held for More Than 12 Months. Will This Be Treated as Capital Gain or Business Profit?

According to Circular No. 6/2016, dated 29-2-2016, the CBDT has instructed the Assessing Officers to consider the following while deciding whether the surplus generated from the sale of listed shares or other securities is taxable as capital gains or business income:

-

- Where the assessee himself, irrespective of the period of holding of listed shares and securities, opts to treat them as stock-in-trade, the income arising from the transfer of such shares/securities would be treated as its business income.

- Regarding listed shares and securities held for more than 12 months immediately preceding the date of their transfer, if the assessee desires to treat the income arising from the transfer thereof as capital gains, the same shall not be put to dispute by the Assessing Officer. However, once taken by the assessee in a particular Assessment Year, this stand shall remain applicable in subsequent Assessment Years. The taxpayer shall not be allowed to adopt a different/contrary stand in this regard in subsequent years.

The CBDT has formulated the above principles to reduce litigation and maintain consistency in treating income derived from the transfer of shares and securities. All the relevant provisions of the Act shall continue to apply to the transactions involving the transfer of shares and securities.

The CBDT [1] has decided that the income arising from the transfer of unlisted shares would be considered under the head’ Capital Gains’, irrespective of the holding period, to avoid disputes/litigation and maintain a uniform approach.

FAQ 2. I Have Earned a Profit From Intra-Day Trading. Is It Taxable as Business Profit or Capital Gain?

Intra-day trading is considered a speculative business; the resultant gain or loss would be a speculative gain or loss. Speculative gain is taxed at normal rates, and speculative losses can only be set off against speculative profit.

FAQ 3. I Have Earned a Long-Term Capital Gain of Rs. 10 Lakhs, Which Is Taxable at 12.5% Under Section 112A. I Have Made an Eligible Investment of Rs. 1 Lakh for Section 80C Deductions. How Much Tax Do I Need to Pay on Such Income?

The benefit of the maximum exemption limit shall be available from long-term capital gains taxable under Section 112A. However, the assessee cannot take the benefit of the deduction available under Chapter VI-A. The taxable income and tax liability thereon shall be calculated as follows:

| Particulars |

Amount (Rs.) |

| Total income (long-term capital gains in excess of Rs. 1,25,000) |

8,75,000 |

| Less: maximum amount not chargeable to tax |

2,50,000 |

| Gross total income |

6,25,000 |

| Tax rate under Section 112A |

12.5% |

| Tax payable |

78,125 |

FAQ 4.Mr. X Has Transferred Equity Shares of Various Companies After Holding Them for More Than 12 Months. Does He Need to Enter the Details of Capital Gains for Each Scrip in the ITR?

The Finance Act 2018 has allowed exemption from the gains made on listed shares/specified units up to January 31, 2018, by introducing a grandfathering mechanism for the computation of long-term capital gains for these shares. With respect to Assessment Year 2020-21, the CBDT has clarified [2] that the scrip-wise details are required to be filled up for those shares/units that are eligible for grandfathering. Following the press release, we may conclude that the scrip-wise details are not required in income tax return forms for AY 2025-26 to compute gains that are not eligible for grandfathering.

FAQ 5. Should Property and Buyer Information Be Reported Under the Capital Gain Schedule if Such Property Is Situated Outside India and Sold to a Non-Resident?

Schedule CG of ITR requires the assessee to furnish details relating to the immovable property transferred during the year. To track all the transactions related to the sale of immovable properties, the schedule seeks the buyer’s information, such as the buyer’s name, PAN/Aadhaar No., address of the property, date of purchase and sale of land/building, country and zip code, etc.

It is mandatory to furnish these details regardless of whether the immovable property sold is situated in India or outside India. However, quoting the buyer’s PAN is mandatory only if tax is deducted under section 194-IA or is mentioned in the documents related to the sale of the property.

FAQ 6. I Am a Resident Individual. In FY 2024–25, I Sold Listed Equity Shares of Two Companies:

-

-

Company A: Purchased in June 2022 for Rs. 1,50,000 and sold in June 2024 for Rs. 3,00,000

-

Company B: Purchased in June 2022 for Rs. 1,00,000 and sold in August 2024 for Rs. 3,00,000

-

Both Transactions Were Subject to STT at the Time of Purchase and Sale. What Will Be the Capital Gain Tax Liability as per Section 112A?

The Finance (No. 2) Act, 2024, has provided a uniform tax rate of 12.5% on long-term capital gain arising from the transfer of any capital asset on or after 23-07-2024. Where the capital asset is transferred on or before 22-07-2024, the long-term capital gain shall be taxable at the rate of 20% or 10% (in case of certain securities, including listed shares).

Additionally, the exemption limit under Section 112A has been increased from Rs. 1,00,000 to Rs. 1,25,000 with effect from 23-07-2024. While computing this limit, the total long-term capital gains from all transfers during the period 01-04-2024 to 31-03-2025 must be aggregated.

As a result, gains from listed shares sold on or before 22-07-2024 will be taxed at 10% on the amount exceeding Rs. 1,25,000, and gains from sales on or after 23-07-2024 will be taxed at 12.5%.

| Particulars | Company A | Company B | Total |

| Purchase Date | June 2022 | June 2022 | — |

| Sale Date | June 2024 | August 2024 | — |

| Sale Value (A) | 3,00,000 | 3,00,000 | 6,00,000 |

| Purchase Value (B) | 1,50,000 | 1,00,000 | 2,50,000 |

| LTCG [C = A – B] | 1,50,000 | 2,00,000 | 3,50,000 |

| Exemption under section 112A (See note) (D) | 0 | 1,25,000 | 1,25,000 |

| Taxable LTCG [ E = C – D] | 1,50,000 | 75,000 | 2,25,000 |

| Applicable Tax Rate (F) | 10% | 12.5% | — |

| Tax Payable (G = E * F) | 15,000 | 9,375 | 24,375 |

| Note: The exemption of 1,25,000 from total long-term capital gains can be claimed against gains arising from the sale of shares either before or after 23-07-2024. To optimise tax liability, it is preferable to adjust this exemption against the gains taxed at the higher rate of 12.5%, i.e., the gains from the sale of shares of Company B. ITR utilities also follow this approach. | |||

Click Here To Read The complete FAQ

11. Income-tax Refunds Made Easy

TDS | TCS | Payments | ITR Filing

FAQ 1. Is pre-validating a bank account on the e-filing portal mandatory to claim a refund?

The Income-tax Department mandates that taxpayers pre-validate their bank accounts on the e-filing portal to enable direct crediting of tax refunds. This step ensures that the account is active and owned by the taxpayer, minimising errors and fraud.

To pre-validate a bank account, Go to Profile>> My Bank Account>> Add Bank Account>> Provide the correct required details and validate.

On successful submission, a request will be sent to the respective bank or NPCI for validation. Once validation is successful, a taxpayer can nominate the bank account for a refund.

FAQ 2. ITR forms require details of the Legal Entity Identifier (LEI). What is it, and who needs to report it?

The Legal Entity Identifier (LEI) is a 20-character alpha-numeric code that uniquely identifies parties in financial transactions worldwide. It has been implemented to improve the quality and accuracy of financial data reporting systems for better risk management.

As per the RBI Regulations, all single payment transactions of Rs. 50 crores and above undertaken by entities (non-individuals) should include remitter and beneficiary LEI information. This applies to transactions undertaken through the NEFT and RTGS payment systems.

In accordance with RBI regulations, the new ITR Forms incorporate a column for furnishing details of the LEI number. A taxpayer is required to furnish the LEI details if he is seeking a refund of Rs. 50 crores or more.

FAQ 3. Can I claim the credit of tax deducted in advance on income that is taxable in subsequent years?

Certain provisions of TDS (including TCS) require the deduction of tax at source at the time of payment or at the time of credit, whichever occurs earlier. Advance payments are also subject to TDS. The Schedule of TDS/TCS in the ITR forms provides columns to fill in the information on tax deducted in previous years, but credit for the same is to be claimed in the future year. One cannot claim credit of TDS pertaining to income that is taxable in the subsequent year. Thus, such TDS credit can be carried forward to the subsequent year and can be claimed in the year income is offered to tax.

FAQ 4. I filed an income tax return to claim a tax refund, but it failed because I mentioned an incorrect bank account number. How can I submit the correct bank account number?

To submit the correct bank account number for a tax refund re-issue, follow these steps:

-

- Log in to incometax.gov.in

- Go to ‘Services’ and select ‘Refund Re-issue’.

- Select ‘Create Refund Re-issue Request’.

- Choose the record for which you want to submit a refund re-issue request.

- Select the bank account where you want to receive the refund.

- Click ‘Proceed to Verification’.

FAQ 5. What should I do in case of a TDS mismatch?

Credit for TDS as claimed in return may match with the balance appearing in Form 26AS, but the Assessing Officer still raises demand for payment of the differential amount of TDS. The CBDT [1] has highlighted that such tax credit mismatches may happen due to the following mistakes:

-

- Invalid/incorrect TAN of deductor

- Furnishing the same TAN for more than one deductor

- Filing information in wrong TDS Schedules in the Return Form

- Furnishing wrong challan particulars regarding Advance tax, Self-assessment tax, etc.

- Tax deducted by one deductor was wrongly included in the amount of tax deducted by another deductor.

Consequently, the tax credit could not be allowed to the taxpayers while processing returns despite the tax credit being available in the Form 26AS statement. The CBDT, therefore, has directed the taxpayers to verify if the demand raised is due to tax credit mismatch on account of such incorrect particulars and submit rectification requests with correct particulars of TDS/tax claims for correction of these demands. The rectification requests have to be submitted to the jurisdictional Assessing Officer if such an officer processes the return or the taxpayer is informed by CPC, Bengaluru, that such rectification is to be carried out by the Jurisdictional Assessing Officer. In all other cases of processing by CPC, Bangalore, an online rectification request can be made in the following manner:

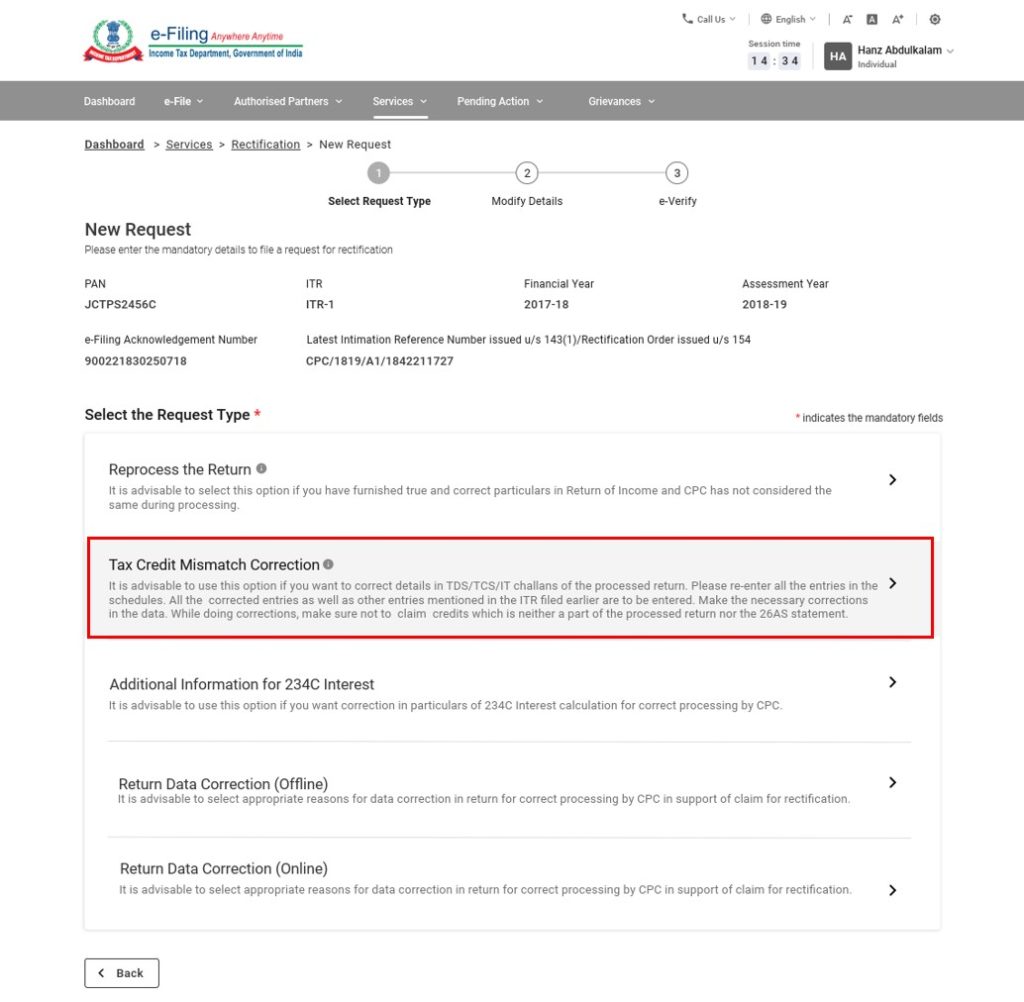

Step 1:–Log in to the e-filing portal.

Step 2–Click on Services > Rectification

Step 3–On the next page, click New Request.

Step 4– Select the Assessment Year from the drop-down. Click Continue.

Step 5– On the next screen, select the option of ‘Tax Credit Mismatch Correction’ from the following types of Income-tax rectification requests:

(a) Reprocess the return

(b) Tax credit mismatch correction

(c) Additional information for 234C interest

(d) Status Correction

(e) Exemption section correction

(f) Return data correction (Offline)

(g) Return data correction (Online)

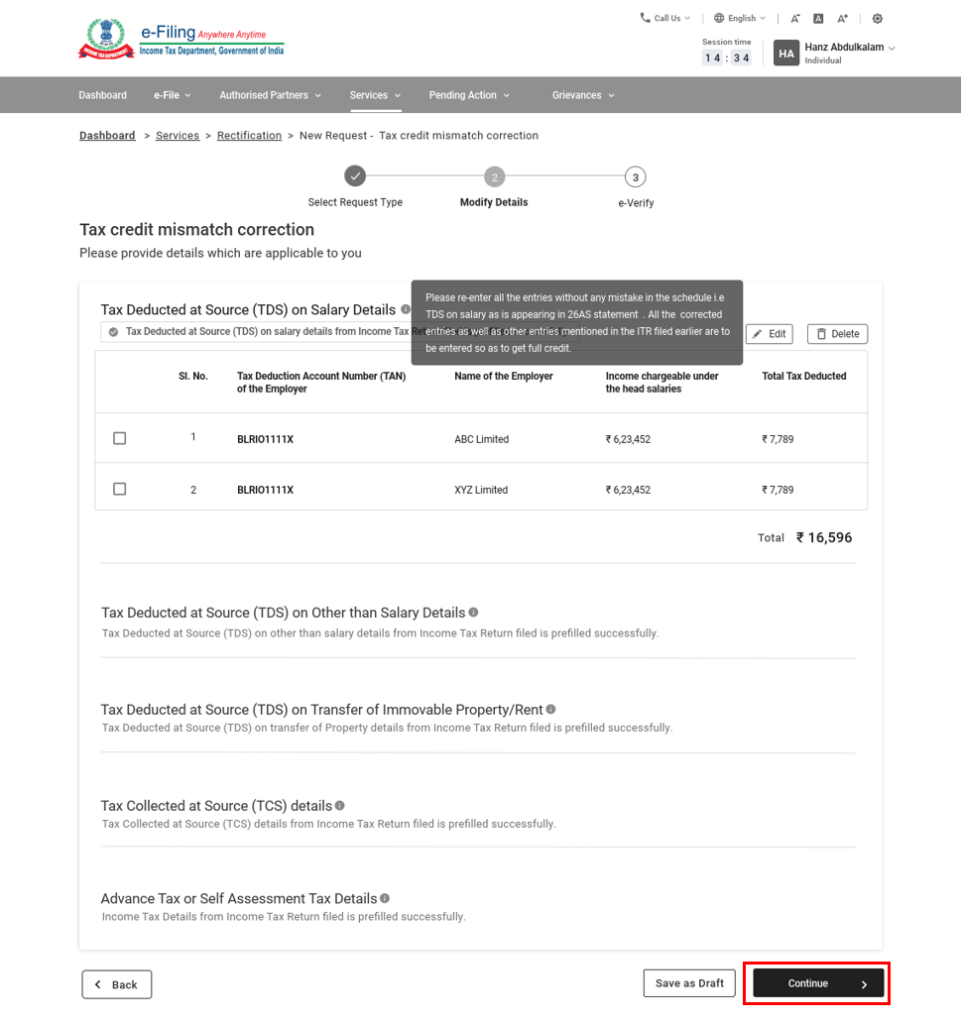

- Step 6 – The schedules under this request type are auto-populated based on the records available in the corresponding processed return. To edit or delete a schedule, select it and click Edit or Delete.

- Step 7 – Enter the correct details in the relevant schedules and click ‘Continue’ to submit the request.

On submission, you will be taken to the verification page.

Where the TDS mismatch is due to an error in the TDS return filed by the deductor, you should approach the deductor to rectify the TDS return.

FAQ 6. How can you claim TDS credit in ITR if the deductor did not deposit TDS?

A taxpayer should approach his deductor and request to deposit TDS with the Government and file a TDS statement. However, he has no legal power to enforce the deductor to do so. Thus, if the deductor has refused the taxpayer’s request, he can submit TDS proof to the dept.

The ITR forms are annexure-less. Hence, a taxpayer cannot attach any supporting documents along with the ITR to support the TDS claim. Thus, it is advisable to file the ITR, claim TDS credit, and wait for its processing. Once the ITR is processed, the taxpayer will receive notice of a TDS mismatch.

Upon receiving such notice, he can file a reply and supporting documents showing that the TDS has been duly deducted from his income. The taxpayer can submit the salary slips to support his claim. Further, he can submit the bank statement showing credit for his net salary/other income after the deduction of TDS.

AO may allow the taxpayer a TDS credit if the documents submitted are found correct and cancel the demand raised by the CPC. However, if he does not allow the TDS credit, the taxpayer’s only option is to approach the Court.

It is essential to note Instruction No. 275/29/2014, dated 01-06-2015. The CBDT has directed that, as per Section 205, the assessee shall not be called upon to pay the tax to the extent tax has been deducted from his income where the tax is deductible at source under the provisions of Chapter XVII. Thus, the Act puts a bar on direct demand against the assessee in such cases, and the demand on account of tax credit mismatch cannot be enforced coercively. This may be brought to the notice of all the Assessing Officers that if the facts of the case so justify, the assessees are not put at any inconvenience on account of a default of deposit of tax into the Government account by the deductor.

| Read More Can I claim credit of TDS deducted by the employer but not paid by it to Govt.? on Taxmann.com/Practice |

FAQ 7. I have a bank fixed deposit of Rs. 1,50,000. My total income (including accrued interest on FDs) is below the taxable limit. How can I avoid the deduction of tax on interest income?

You can file a self-declaration to the bank in Form 15H if you are a senior citizen. Otherwise, you can file a self-declaration in Form 15G.

FAQ 8. How can I avoid a tax deduction if I earn an interest income of Rs. 40,000 from savings deposits, and my total income, including such interest income, is below the taxable limit?

If the interest payable on time deposits exceeds Rs. 40,000, the tax will be deducted under Section 194A. Interest payable on saving deposits does not attract TDS. To avoid the deduction of tax at source under Section 194A, the individual can furnish a declaration under Section 197A in Form 15G or Form 15H, as the case may be. Such a declaration can be furnished if the relevant income, in respect of which he is eligible to file a declaration, does not exceed the maximum exemption limit, and tax on his estimated total income for the financial year in which such income is to be included is nil.

Click Here To Read The complete FAQ

12. Income-Tax Reliefs & Deductions for Individuals

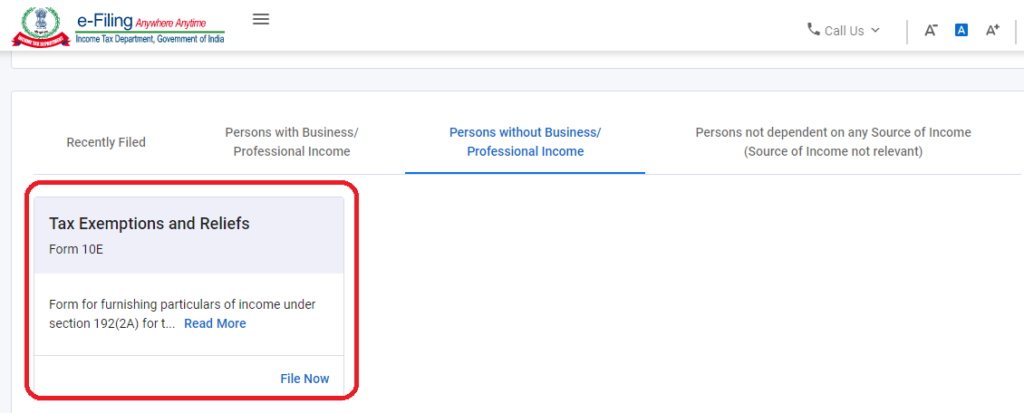

FAQ 1. I am a Government employee and have received arrears of salary as per recommendations of the 7th pay commission. Do I need to file any form to claim relief under Section 89?

If you want to claim relief under 89, filing Form 10E online on the e-filing website is mandatory. Taxpayers who claim relief under Section 89 without filing Form 10E will get a notice from the Income-tax Dept. stating,

“The relief under Section 89 has not been allowed in your case, as the online Form 10E has not been filed”.

Thus, you are required to file Form 10E online before filing your Income-tax return.If the employer fails to provide relief under section 89 and deducts excess tax, then you can claim such relief in your return of income and claim a refund of the excess tax deducted. However, filing Form 10E online on the e-filing website is mandatory.

FAQ 2. How to File Form 10E?

To file Form 10E online, follow these steps:

Step 1 – Log in to www.incometax.gov.in.

Step 2 – After logging in, go to the tab e-File > Income Tax Forms > File Income Tax Forms. On the landing page, select the appropriate options.

| Read More How do I file Form 10E online? on Taxmann.com/Practice |

FAQ 3. I Failed to Submit a Rent Receipt and Proof of Tax-Saving Investment to My Employer, Due to Which HRA Exemption and Certain Other Deductions Were Not Given to Me. How Can I Claim a Refund of Such Excess Tax Paid, as the Tax Deducted From My Income Is Higher Than My Actual Tax Liability?