[FAQs] Income Tax Returns (ITR) | Clubbing of Income in Special Cases – Minors | Deceased Persons | Legal Heirs

- ITR Week 2025-26|Blog|Income Tax|

- 4 Min Read

- By Taxmann

- |

- Last Updated on 15 September, 2025

Clubbing of Income under the Income Tax Act refers to the inclusion of another person's income in the taxpayer's income for tax purposes. This usually applies in cases where individuals try to reduce their tax liability by transferring assets or income sources to family members. For example, the income of a minor child (except when earned through skill, talent, or specialised knowledge) is added to the income of the parent. Similarly, income transferred to a spouse or a son's wife without adequate consideration may also be clubbed. These provisions are designed to prevent tax avoidance and ensure fair taxation.

FAQ 1. My Minor Daughter Earned Rs. 10,00,000 by Participating in a Skill-Based Competition. Is She Required to File an ITR for the Concerned Year?

The income of a minor child is generally added to the income of the parents. However, if the minor child earns income through their own skill, talent, or specialised knowledge, it is exempt from this clubbing provision. Therefore, the minor child must be assessed independently for such income through their guardian.

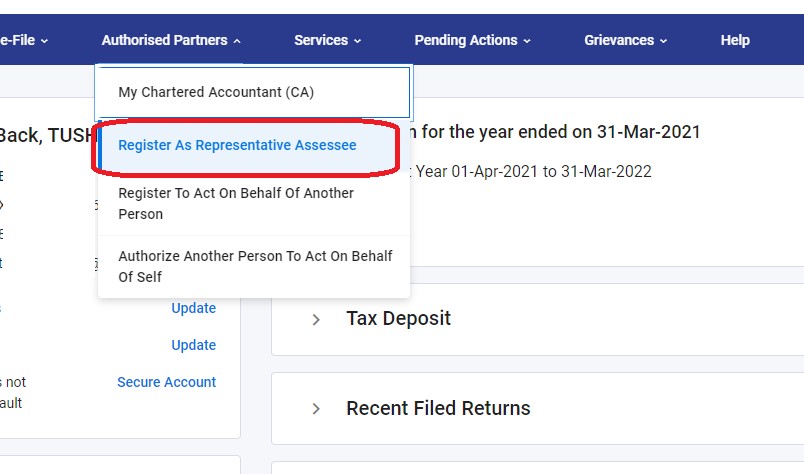

You will need to apply for a PAN (Permanent Account Number) on your daughter’s behalf using Form 49A. After obtaining the PAN, you should register on the e-filing portal as her representative assessee and file the Income Tax Return (ITR) for the relevant assessment year. The PAN application for a minor child must be completed and signed by a representative assessee on the minor’s behalf, including providing details of both the minor and the representative assessee in the PAN application form.

FAQ 2. I Have Received Some Income on Behalf of My Deceased Father in My Account During the Year. My Father Failed to Write His Will Before Dying, and the Partition Has Not Yet Taken Place. In Whose Hands Will Such Income Be Taxed?

When a person dies intestate (without leaving a will), their estate immediately devolves to their legal heirs according to the personal law applicable to the deceased. In this situation, any income accrued or received by the deceased from the date of death until the end of the financial year will be considered the income of the legal heirs and must be disclosed in their Income Tax Return (ITR).

FAQ 3. Mr. X Died on 23-08-2023. Before His Death, He Received a Salary Income of Rs. 12 Lakhs. After His Death, Some Interest Income Accrued in His Account. Is an ITR Required to Be Filed for the Relevant Year?

Yes, an ITR must be filed in this case, and the responsibilities are as follows:

a) Income Accruing Before Mr X’s Death:

The ITR must be filed in the name of the deceased (Mr X) using his PAN by his legal representative. The legal representative must file the ITR for the salary income of Rs. 12 lakhs.

b) Income Accruing After Mr X’s Death:

If Mr X had prepared a will before his death, the executor would be required to file an ITR before distributing the estate. After that, the legal representatives would file the return in their personal capacity. Since Mr X did not leave a will, his legal heirs must file the ITR in their personal capacity. Therefore, the interest income will be added to the income of the legal representatives or heirs, as applicable.

FAQ 4.Can a Legal Heir File the Return of the Deceased Assessee if a Digital Signature Certificate (DSC) Is Mandatory?

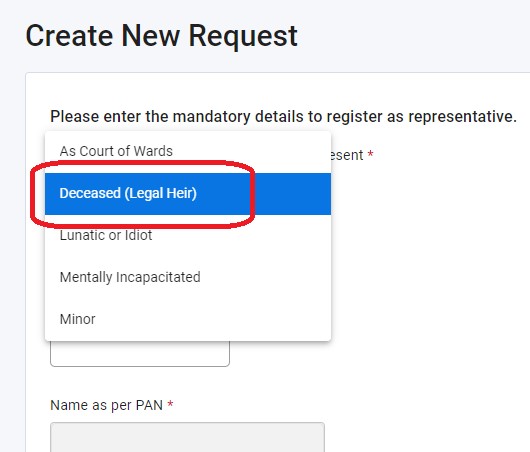

Yes, a legal heir can file a return on behalf of the deceased assessee, even if a DSC is mandatory. The legal heir must obtain a DSC in their capacity to file such a return. To file the return on behalf of the deceased, one must first register as a legal heir on the Income-tax India e-filing website.

You will need to enter the deceased person’s name, PAN, and date of death and upload a scanned copy of the following documents in a zip file:

-

- Copy of the deceased’s PAN card

- Copy of the death certificate

- Proof of legal heir status as per the norms

- Copy of a letter of indemnity (optional)

The Income-tax department will verify the request. Once the request is approved, the legal heir will be able to perform all e-filing-related services on behalf of the deceased.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA