Comprehensive Guide to Startup India Scheme – Definition | Lifecycle | Tax Benefits

- Blog|Income Tax|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 31 January, 2024

Table of Contents

- What is Startup?

- Introduction of Startup India Scheme

- Startup Definition as per DPIIT

- Journey of 8 Years (2016 to 2023)

- Non-tax benefits of recognition

- Income tax benefits

1. What is Startup?

1.1 Define Startup

A startup is a new business that explores creative ideas, takes risks, and seeks rapid growth by offering something unique or special through its innovative approach. Startups are usually in the early stages of their life cycle and are recognized for their dynamic, agile, and entrepreneurial nature.

1.2 Features of Startup

- A startup is a newly established business

- Characterized by its innovative approach to address a specific market need, problem, or opportunity

- Often associated with technology and innovation

- Typically in the early stages of development

- Known for agility, risk-taking, and potential for rapid growth

- Common challenges include securing funding, building a customer base, and navigating the competitive landscape

- Often still in the process of finding its market fit and establishing a sustainable business model

1.3 Life cycle stages of a startup

- Ideation Stage/Finding a Problem-Solution Fit

- Minimum viable product (MVP) Stage

- Validation/Development stage

- Scaling/Growth Stage

- Maturity Stage

- Exit Stage

1.4 What do investors look for in startups?

- Objective and Problem Solving: The offering of any startup should be differentiated to solve a unique customer problem or to meet specific customer needs. Ideas or products that are patented show high growth potential for investors.

- Management & Team: The passion, experience, and skills of the founders as well as the management team to drive the company forward are equally crucial in addition to all the factors mentioned above.

- Market Landscape: Market size, obtainable market share, product adoption rate, historical and forecasted market growth rates, macroeconomic drivers for the market Market size, obtainable market your plans to target.

- Scalability & Sustainability: Startups should showcase the potential to scale in the near future, along with a sustainable and stable business plan. They should also consider barriers to entry, imitation costs, growth rate, and expansion plans.

- Customers & Suppliers: Clear identification of your buyers and suppliers. Consider customer relationships, stickiness to your product, vendor terms as well as existing vendors.

- Competitive Analysis: Consider the number of players in a market, the market share, obtainable share in the near future, product mapping to highlight similarities as well as differences between different competitor offerings.

- Sales & Marketing: No matter how good your product or service may be, if it does not find any end-use, it is no good. Consider things like a sales forecast, targeted audiences, product mix, conversion and retention ratio, etc.

- Financial Assessment: A detailed financial business model that showcases cash inflows over the years, investments required key milestones, break-even points, and growth rates. Assumptions used at this stage should be reasonable and clearly mentioned.

- Exit Avenues: A startup showcasing potential future acquirers or alliance partners becomes a valuable decision parameter for the investor. Initial public offerings, acquisitions, subsequent rounds of funding are all examples of exit options.

2. Introduction of Startup India Scheme

How our youths become new entrepreneurs, how our youths become new producers, how a complete network of start-up by these new entrepreneurs is set up in the whole country?

There should not be any district, any block in Hindustan where there are not start-up initiated in the coming days. Whether India cannot dream that India becomes number one in the world of start-up. Today we are not at that position. Brothers and Sisters, I have to provide strength to start-up and, therefore, I resolve that in the coming days “Start-up India” and “Stand-up India” will be there or the future of the country.

Prime Minister, Shri Narendra Modi (Address to the Nation on 69th Independence Day on 15 Aug 2015)

2.1 Startup India Scheme

- Launched on 16th January, 2016 (National Startup Day)

- With an aim to support entrepreneurs and build a robust startup ecosystem

- Goal: Transform India into a nation of job creators instead of job seekers

2.2 Action Plan was introduced divided across the following areas

- Simplification and Handholding: To reduce the regulatory burden on Startups thereby allowing them to focus on their core business and keep compliance cost low

- Funding Support and Incentives: To provide funding support for development and growth of innovation driven enterprises

- Industry-Academia Partnership and Incubation: To galvanize the Startup ecosystem and to provide national and international visibility to the Startup ecosystem in India

3. Startup Definition as per DPIIT

3.1 Definition of Startup

- Only for the purpose of Government schemes

- An entity shall be eligible to get recognition from DPIIT if it satisfies the 5 conditions

- DPIIT is the Department for Promotion of Industry and Internal Trade (Ministry of Commerce and Industry)

- DPIIT has a charge for matters related to Startups

- Under the Startup India initiative, eligible entities can be recognised as Startups by DPIIT to access a host of tax benefits, easier compliance, IPR fast-tracking and more

Condition 1: Legal Structure

- Private Limited Company

- Registered Partnership Firm

- Limited Liability Partnership

Condition 2: Age of Entity

Period of existence and operations should not exceed 10 years from the Date of Incorporation

Condition 3: Annual Turnover

Should have an annual turnover not exceeding Rs. 100 crore for any of the financial years since its Incorporation

Condition 4: Original Entity

Entity should not have been formed by splitting up or reconstructing an already existing business

Condition 5: Innovation & Scalable

- Should work towards the development or improvement of a product, process or service; and/or

- have a scalable business model with high potential for the creation of wealth or employment generation

3.2 How to get DPIIT recognition?

- Create an account on the National Single Window System portal (nsws.gov.in) and add the form ‘Registration as a Startup’

- Start-ups that meet the definition criteria are eligible to apply for recognition under the program

- Start-ups have to provide support documents at the time of application

- No Application/Govt fee to apply

3.3 Documents Required

- Copy of certificate of registration or incorporation

- Write up about the nature of the business, highlighting how it is working towards innovation, development or improvement of products or processes or services, or its scalability in terms of employment generation or wealth creation

- Additional documents providing website links, pitch desk, patents, etc., shall also be attached to support the application

- Information about any award received by the entity, if any

- Proof of funding received by the entity, if any

4. Journey of 8 Years (2016 to 2023)

1,19,250 Startups Recognised till Date!

2,977 Income Tax Exemptions!

2.5% of Total Recognised Startups are eligible for Tax Exemptions!

4.1 Key Statistics

DPIIT Recognition

- 1,19,250 startups recognised till date

- 50% Startups from tier 2/tier 3 cities

- 80 Startups, on an average are recognised per day

- 670+ districts have at least 1 recognised startup

Income Tax Exemptions

- 2,977 startups recognised for Income tax exemption

- Only 2.5% of the recognised startups have been granted tax exemption

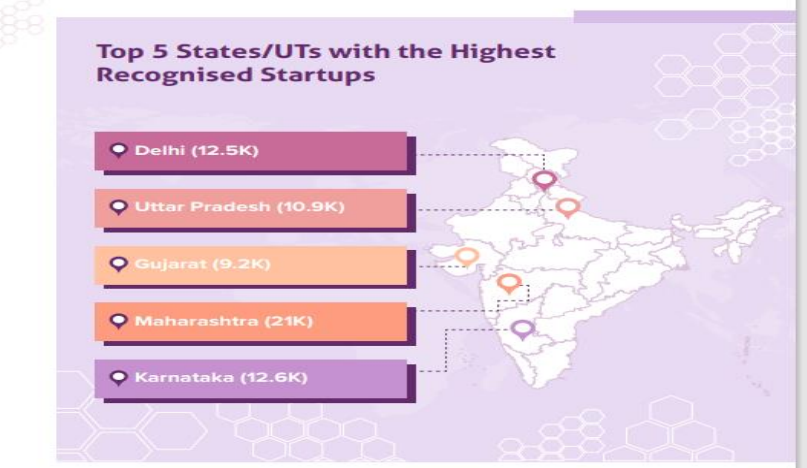

4.2 Top 5 States/UTs with the Highest Recognised Startups

5. Non-tax benefits of recognition

5.1 Non-tax benefits

- Self Certification

- Startup Patent Application & IPR Application

- Easier Public Procurement Norms

- Easy winding up of company

- Startup India Seed Fund Scheme

5.2 Self Certification

- To reduce the regulatory burden on Startups, thereby allowing them to focus on their core

business - Startups shall be allowed to self-certify compliance with 6 Labour Laws and 3 Environmental Laws through a simple online procedure

- In the case of labour laws, no inspections will be conducted for a period of 5 years. Startups may be inspected only on receipt of credible and verifiable complaint of violation, filed in writing and approved by at least one level senior to the inspecting officer

- In the case of environment laws, startups which fall under the ‘white category’ (as defined by the Central Pollution Control Board (CPCB)) would be able to self-certify compliance and only random checks would be carried out in such cases

5.3 Patent and IPR Application

Innovation is the bread and butter of startups. Since patents are a way of protecting innovative new ideas that give your company a competitive edge, patenting your product or process can dramatically increase its value and the value of your company.

Benefits:

- Fast-tracking of Startup Patent Applications

- Panel of facilitators to assist in filing of IP applications

- Government to bear facilitation cost

- Rebate on filing of application

5.4 Public Procurement Norms

Public procurement refers to the process by which governments and state-owned enterprises purchase goods and services from the private sector.

Benefits:

- Opportunity to list your product on Government e-Marketplace

- Exemption from Prior Experience/Turnover

- Earnest Money Deposit (EMD) or bid security Exemption

5.5 Easy winding up of Companies

To make it easier for Startups to shut down or wind up operations.

Benefits:

- As per the Insolvency and Bankruptcy Code, 2016, startups with simple debt structures, or those meeting certain income-specified criteria* can be wound up within 90 days of filing an application for insolvency

- An insolvency professional shall be appointed for the Startup

- Upon appointment of the insolvency professional, the liquidator shall be responsible for the swift closure of the business, sale of assets and repayment of creditors in accordance with the distribution waterfall set out in the IBC

5.6 Startup India Seed Fund Scheme

- A startup, recognized by DPIIT, incorporated not more than 2 years ago at the time of application

- Startup must have a business idea to develop a product or a service with a market fit, viable commercialization, and scope of scaling

- Startup should be using technology in its core product or service, or business model, or distribution model, or methodology to solve the problem being targeted

- Preference would be given to startups creating innovative solutions in sectors such as social impact, waste management, water management, financial inclusion, education, agriculture, food processing, biotechnology, healthcare, energy, mobility, defence, space, railways, oil and gas, textiles, etc

- A startup applicant can receive up to Rs. 20 Lakhs as a grant for Proof of Concept validation, prototype development, or product trials, disbursed in milestone-based installments, and up to Rs. 50 Lakhs of investment for market entry, commercialization, or scaling up.

6. Income tax benefits

6.1 Benefits under Income Tax

- Exemption to the company from levy of angel tax under Section 56(2)(viib)

- Deductions under Section 80-IAC to the start-up

- Liberalised regime of Section 79 to carry forward and set off the losses of start-up

- Deferment of tax on perquisites value of ESOPs

6.2 Exemption from Angel Tax

- Angel tax is a term used for the tax payable by a closely held company under Section 56(2)(viib)

- If unquoted shares are issued at a premium by a closely held company, the excess premium over the fair market value of the shares shall be taxable as income from other sources in the hands of the company

- A Start-up recognised by DPIIT shall get immunity from the provisions of Section 56(2)(viib) after fulfilling certain conditions and submitting a declaration

- Consideration of shares received by eligible startups shall be exempt upto an aggregate limit of INR 25 Crore

- Startup should not be investing in specified asset classes

6.3 Section 80-IAC Tax Exemption

- Deduction under Section 80-IAC is allowed to an eligible start-up to the extent of 100% of profits and gains for 3 consecutive assessment years out of the 10 years beginning from the year of incorporation or registration

- Only to company or LLP if incorporated between 01-04-2016 and 31-03-2024

- Value of second-hand plant and machinery should not exceed 20% of the total value of plant and machinery used in the business

- Get approval from the Inter-Ministerial Board (IMB)

- Audit of Accounts in Form 10CCB

- File ITR before the due date

6.4 Carry forward and set-off the losses

Losses incurred by a closely held company in any year prior to the previous year shall not be carried forward and set-off against the income of the previous year, unless the shares of the company carrying at least 51% of the voting power are beneficially held by the same persons on the following two dates:

- On the last day of the previous year in which loss was incurred;

- On the last day of the previous year in which such brought forward loss has to be set-off

6.5 Relaxed Condition for Startups to Set-off Losses

Condition 1: Continued 51% shareholding

In the year of set-off of losses, at least 51% of voting power is beneficially held by the same persons who held them as on the last day of the year in which loss was incurred; or

Condition 2: Continued 100% shareholders

100% of shareholders, on the last day of the previous year in which loss was incurred, should continue to hold their shares on the last day of the previous year in which loss is to be set-off. Further, such losses should have been incurred during the period of 10 years beginning from the year of incorporation of company

6.6 Tax on perquisites value of ESOPs

ESOPs are a significant component in the compensation of the employees of startups as it allows start-ups to employ highly talented employees at a relatively low salary amount, with the balance being paid via ESOPs.

The taxability of ESOPs arises in the hands of the employee at two stages. Firstly, when securities are allotted to the employee and, secondly, when the same are sold.

6.7 Deferment of Tax on perquisites value of ESOPs

An eligible start-up shall deduct tax from income arising in the nature of perquisites from ESOPs within 14 days from the happening of any of the following events (whichever is earlier):

- On the expiry of 48 months from the end of the assessment year in which securities

are allotted under ESOPs; - From the date the assessee ceases to be an employee of the organisation; or

- From the date of sale of securities allotted under ESOP.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA