Company Auditor’s Qualifications, Disqualification & Appointment

- Blog|Company Law|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 14 July, 2023

Table of contents

- Chapter X of the Companies Act, 2013: AUDITORS

- Qualifications and Disqualifications of Auditor [Section 141]

- Qualifications of an Auditor [Section 141(1) & (2)]

- Disqualifications of Auditors

- Appointment of Auditors [Section 139]

- Appointment of the First Auditor [Sec. 139(6)]

- Appointment of the First Auditor of Government Company [Sec. 139(7)]

- Appointment of Subsequent Auditor/Reappointment of Auditor

- Manner and Procedure for Appointment

- Term & Rotation of Auditor

Check out Taxmann's Auditing & Assurance Made Easy (Auditing) | Study Material which is a self-learning study material providing the subject matter in simple & lucid language with a step-by-step approach. It provides a conceptual understanding of each point with detailed examples & summary of standards on auditing in diagrammatic presentations. CA-Inter | Nov. 2023 Exams

1. Chapter X of the Companies Act, 2013: Auditors

Companies Act, 2013 is a RULE based Act. One should follow the rules as given in the sections and rules of the Companies Act.

CA students should have very good knowledge on these provisions as these are going to be followed in practice. Broadly, in this chapter you will understand

“who can be appointed as an auditor under the Act, i.e., qualifications and disqualifications, the manner of appointment and removal of an auditor and rights and duties of an auditor”.

| Section of Companies Act, 2013 to be discussed in this chapter | |

| 139 | Appointment of Auditors |

| 140 | Removal, Resignation of auditor and giving of Special Notice |

| 141 | Eligibility, Qualifications and Disqualifications of Auditors |

| 142 | Remuneration of Auditors |

| 143 | Powers and Duties of Auditors and Auditing Standards |

| 144 | Auditor not to render certain services |

| 145 | Auditors to sign Audit Reports, etc. |

| 146 | Auditors to attend General Meeting |

| 147 | Punishment for contravention |

| 148 | Central Government to specify audit of items of Cost in respect of certain Companies |

2. Qualifications and Disqualifications of Auditor [Section 141]

The Section 141 has four sub-sections

141(1) & (2) – discuss about Qualifications;

141(3) & (4) – discuss about Disqualifications.

3. Qualifications of an auditor [Section 141(1) & (2)]

Section 141

(1) A person shall be eligible for appointment as an auditor of a company only if he is a chartered accountant within the meaning of the Chartered Accountants Act, 1949. [CA means a Chartered Accountant who holds valid Certificate of PRACTICE – Section 2(17)]

A firm whereof majority of partners practising in India are qualified for appointment as aforesaid may be appointed by its firm name to be auditor of a company.

In case of a partnership firm – Company appoints the “Firm” not the partner in individual capacity.

(2) Where a firm including a limited liability partnership (LLP) is appointed as an auditor of a company, only the partners who are chartered accountants shall be authorised to act and sign on behalf of the firm. [Section 141(2)]

4. Disqualifications of Auditors

[Section 141(3) and Rule 10 of Companies (Audit and Auditors) Rules, 2014]:

The following persons shall not be eligible for appointment as an auditor of a company, namely:

(a) “a body corporate other than a limited liability partnership (LLP) registered under the Limited Liability Partnership Act, 2008”;

Explanation

It means – If chartered accountants form a company (Whether public/private – like RK Private Ltd./RK Limited) – This Company of CAs cannot be qualified for appointment as auditor of another company.

What is body corporate?

Body corporate u/s 2(11) includes a company as per the Companies Act, 2013 and a foreign company which is incorporated outside India.

Logic behind why a body corporate is not eligible to be an auditor?

As you know a Limited company has “limited liability” & Separate legal entity – The members of the company are responsible only to the extent of unpaid capital (if any). In case of any issue – We cannot make members personally responsible.

In case of LLP, at least one partner will have unlimited liability; hence it is allowed to be auditor.

(b) an officer or employee of the company;

Explanation

As per Section 2(59), ‘Officer’ includes

-

-

- Any director;

- Manager;

- Key managerial personnel (KMP); or

- Any person in accordance with whose directions or instructions the BOD or any one or more of the directors is or are accustomed to act.

-

As per Section 2(51), ‘Key Managerial Personnel’, in relation to a company, means:

-

-

- the chief executive officer (CEO) or the managing director or the manager;

- the company secretary;

- the whole-time director;

- the chief financial officer (CFO); and

- such other officer as may be prescribed. Like Chief Operating Officer (COO), etc.

-

Reason

An officer or employee – cannot be independent – If those are appointed as auditors of the company, they cannot express independent opinion on the financial statements.

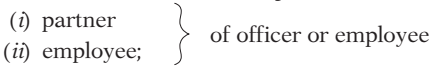

(c) a person who is a partner, or who is in the employment (employee), of an officer or employee of the company;

Explanation

In this case, two relations are possible i.e.,

Reason

These people have indirect relationship; hence they are not independent and cannot be appointed as auditor.

Clause (d) has three sub-clauses

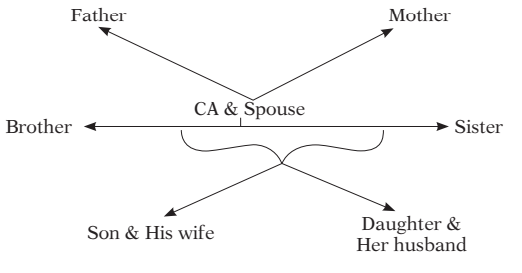

(d) a person who, or his relative or partner

(i) is holding any security of or interest in the company or its subsidiary, or of its holding or associate company or a subsidiary of such holding company;

(ii) is indebted to the company, or its subsidiary, or its holding or associate company or a subsidiary of such holding company, in excess of ` 5 Lacs; OR

(iii) has given a guarantee or provided any security in connection with the indebtedness of any third person to the company, or its subsidiary, or its holding or associate company or a subsidiary of such holding company, in excess of ` 1 Lac;

Who is relative as per the Companies Act, 2013?

As per section 2(77) & Rules

“Relative” includes

-

-

- Members of Hindu Undivided family;

- Step father, Step mother, Step brother, Step sister & Step son (except Step daughter).

-

This sub-section should be read with the rules (Follow instructions for better understanding).

First read the above sub-section (3) clause (i);

It says Auditor (himself) or his Relative or Partner should NOT hold

There is an exception to the above point- As per Rule 10 of the Company (Audit and Auditors) Rules, 2014,

-

-

- The relative may hold security or interest in the company of FACE VALUE ≤ ` 1,00,000; (Remember this exception is applicable only to relative but NOT to the auditor & Partner and also, this exception is not applicable if a relative holds security in any other group company such as H Co./S Co./A Co. Fellow S Co.)

- If the relative acquires any security or interest greater than ` 1,00,000 face value – Corrective action can be taken by the auditor within 60 days of such acquisition or interest.

-

What do you mean by Security as per the Securities Contracts (Regulation) Act, 1956?

The word “Securities” include – All Shares, scrips, bonds, debentures, stock, derivatives etc.

I hope you understood, clause (i); Let us get into clause (ii)

(ii) is indebted to the company, or its subsidiary, or its holding or associate company or a subsidiary of such holding company, in excess of ` 5 Lacs; OR

(iii) has given a guarantee or provided any security in connection with the indebtedness of any third person to the company, or its subsidiary, or its holding or associate company or a subsidiary of such holding company, in excess of ` 1 Lac.

I hope you understood the clause. Let us get into clause (e) of sub-section (3) of section 141- It says

(e) a person (auditor) or a firm who, whether directly or indirectly (through agent/relation), has business relationship with the company, or its subsidiary, or its holding or associate company or subsidiary of such holding company or associate company;

It says – Auditor or Firm should not have business relationship with the group either directly or indirectly.

What is business relationship? (As per rules)

‘Business relationship’ shall be understood as any transaction entered into for a commercial purpose, except (means the following are not treated as business relationship)

(i) commercial transactions which are in the nature of professional services permitted to be rendered by an auditor or audit firm under the Act and the Chartered Accountants Act, 1949 and the rules or the regulations made under those Acts;

(ii) commercial transactions which are in the ordinary course of business of the company at arm’s length price – like sale of products or services to the auditor, as customer, in the ordinary course of business, by companies engaged in the business of telecommunications, airlines, hospitals, hotels and such other similar businesses.

Just think,

Mr. A is a chartered accountant in practice – His wife (relative) is a director in ABC Ltd. and she has ` 50,000 face value equity shares in the company.

Can Mr. A be appointed as auditor for ABC Ltd.?

Answer is YES – as per so far clauses discussed. BUT your answer will be “NO” after reading the below clause.

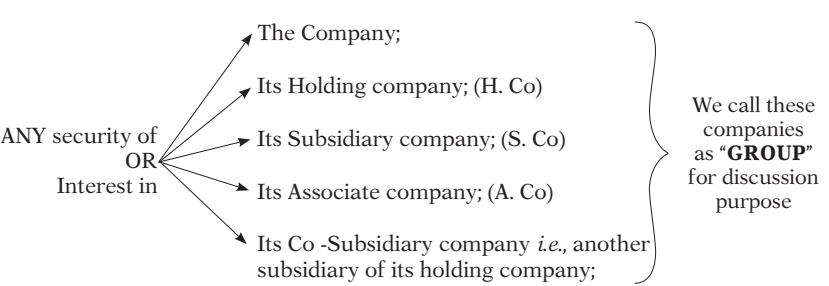

(f) A person

(In simple words – a person whose relative is a director or key managerial person of the company is disqualified)

(g) This clause has two points

Point (i) – A person who is in full time employment elsewhere;

Explanation – When a member is in full time employment – he cannot be in practice as per CA Act, 1949. If a person is not in practice – he is not eligible to be appointed as an auditor of a company.

OR

Point (ii) – A person or a partner of a firm holding appointment as its auditor, if such persons or partner is at the date of such appointment or reappointment holding appointment as auditor of more than 20 companies;

It means company cannot appoint a person as auditor if he is already auditor for 20 companies. It further means – one member cannot be auditor for more than 20 companies simultaneously.

I would like to discuss this point in detail at later part of this chapter. So just go ahead.

(h) A person who has been convicted by a court of an offence involving fraud and a period of ten years has not elapsed from the date of such conviction.

(i) A person who directly or indirectly rendered any service referred to in section 144 to the company, its holding or its subsidiary.

(Section 144 deals with prohibited services by auditor – we will discuss this at later part of this chapter).

Your sub-section (3) of section 141 is completed.

Section 141(4) – Says

If a person appointed as an auditor of a company incurs any of the disqualifications specified in Section 141(3), he shall be deemed to have vacated his office. Such vacation shall be deemed to be a casual vacancy in the office of the auditor.

It means – he must not attract disqualifications u/s 141(3) throughout the tenure of his office. At any time, if he does attract ANY disqualification, it is deemed that NO auditor exists in office. Auditor shall vacate the office immediately and no one need to serve any notice to auditor.

4.1 Frequently Asked Questions (FAQs)

FAQ 1. Whether a Non-Executive Director (Part time director OR independent director) be appointed as Auditor?

No. The reason is every director is covered under the term “Officer”.

FAQ2. Whether a Person who is Relative of Director or Employee of the Company be appointed as Auditor?

If relative is a director – NO as per Section 141(3)(f);

If Relative is an employee other than KMP – Yes; (As per Sec.141(3)(c), partner of an employee and employee of an employee are prohibited to be appointed as Auditor. Whereas, as per Sec.141(3)(f), relative of an employee is prohibited to be appointed as Auditor only when such employee is Director/KMP)

FAQ 3. Can an Auditor be said to be Indebted if he recovers travelling and other expenses in Advance?

Yes. It is treated as “indebted” and disqualified if the amount is greater than ` 5,00,000.

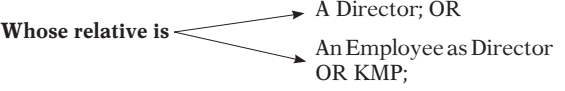

5. Appointment of Auditors [Section 139]

This section discusses appointment of first auditor, subsequent auditor, rotation of auditors and casual vacancy. Different sub-sections are applicable for Government Company and other than Government Company. Let us start with the discussion of first auditor.

![Appointment of Auditors [Section 139]](https://www.taxmann.com/post/wp-content/uploads/2023/01/Screenshot-2023-01-04-141159.png)

6. Appointment of the First Auditor [Sec. 139(6)]

-

- The first auditor of a company, other than a Government company, shall be appointed by the Board of Directors (only by BOD) within 30 days from the date of registration (i.e., Date of Incorporation) of the company.

- In the case of failure of the Board to appoint such auditor, it shall inform the members of the company, who shall appoint within 90 days at an extraordinary general meeting (EGM).

- The first auditor shall hold office from the date of appointment to till the conclusion of the first AGM.

7. Appointment of the First Auditor of Government Company [Sec. 139(7)]

For a government company; or

![Appointment of the First Auditor of Government Company [Sec. 139(7)]](https://www.taxmann.com/post/wp-content/uploads/2023/01/Screenshot-2023-01-04-141438.png)

-

- First auditor shall be appointed by the CAG within 60 days from the date of registration of the company.

- In case the CAG does not appoint such auditor within the said period, the Board of Directors of the company shall appoint such auditor within 30 days.

- In the case of failure of the Board to appoint such auditor, it shall inform the members of the company within the next 30 days and who shall appoint such auditor within the 60 days at an EGM.

- The auditor so appointed shall hold office from the date of appointment till the conclusion of the 1st AGM.

8. Appointment of Subsequent Auditor/Reappointment of Auditor

[Section 139(1) & Rules 3 and 4 of Companies (Audit and Auditors) Rules, 2014]

(1) Every company shall, at the First AGM, appoint an individual or a firm (includes LLP) as an auditor of the company.

-

-

- Every company means ALL the companies incorporated under the Act which includes one-person company, Sec. 8 company, etc.;

- Ordinary resolution is sufficient to appoint an auditor.

-

(2) The auditor shall hold office from the conclusion of 1st AGM till the conclusion of its 6th AGM (i.e., for 5 years); Appointment takes place only for 5 years, it means – No company can appoint auditor for less than 5 years. The AGM, in which he is appointed is counted as 1st AGM.

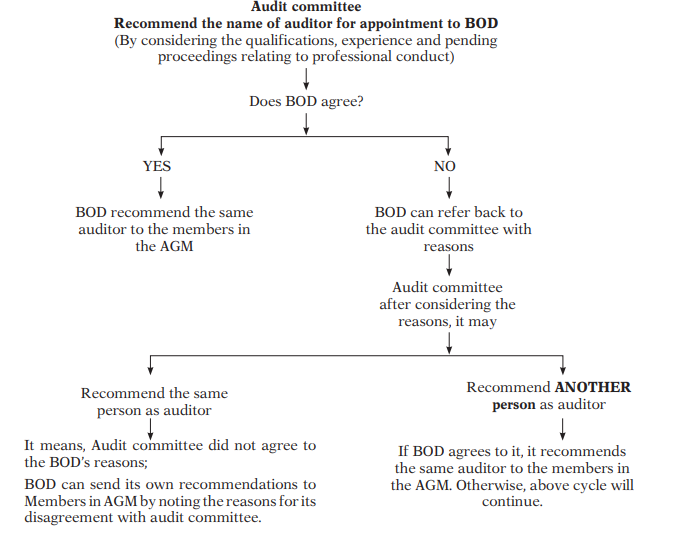

9. Manner and Procedure for Appointment

[Rule 3 of Companies (Audit and Auditor’s) Rules, 2014]

The competent authority to appoint auditor is Audit committee of the company (if the company has); If it does not have audit committee, Board of directors are competent authority.

-

- The entity should obtain written consent and a certificate before the appointment is made at AGM. Auditor should certify that

(a) Individual/firm is eligible for appointment and is not disqualified for appointment under

a. the Companies Act, 2013(i.e., compliance of Sec. 141);

b. the Chartered Accountants Act, 1949; and

c. the Rules or Regulations made there under;

(b) the proposed appointment is as per the term provided under the Act;

(c) the proposed appointment is within the limits laid down by or under the authority of the Act;

(d) the provided list of proceedings relating to professional matters of conduct against the auditor or audit firm or any partner of the audit firm pending with respect to is true and correct.

After this

Company appoints the auditor at AGM by passing ordinary resolution and thereafter, the company should

-

- Give the information of appointment to the auditor i.e., it should write a letter to the auditor by attaching “extract of resolution in the minutes of AGM”; and

- File Form ADT-1 of such appointment with the Registrar within 15 days of the meeting in which the auditor is appointed. Form ADT -1 will be filed by the company only once in 5 years.

We must note that:

Where a company is required to constitute an Audit Committee u/s 177, all appointments, including the filling of a casual vacancy of an auditor under this section shall be made after taking into account the recommendations of such committee.

Additional information

Which company should constitute audit committee? [Sec.177]

The following companies should constitute

-

- ALL Listed companies; and

- The following classes of companies

i. All public companies with a paid-up capital ≥ ` 10 crore;

ii. All public companies having turnover ≥ ` 100 crore;

iii. All public companies, having in aggregate, outstanding loans or borrowings or debentures or deposits >` 50 crore.

Explanation– The paid-up share capital or turnover or outstanding loans, or borrowings or debentures or deposits, as the case may be, as existing on the date of last audited Financial Statements shall be taken into account for the purposes of this rule.

10. Term & Rotation of Auditor

Sec. 139(2) & Rule 5 of Companies (Audit and Auditors) Rules, 2014

Rotation of auditors is a new topic introduced in the Companies Act, 2013. As per the section, a company should rotate auditors after specified time. It means, the same auditor cannot continue forever. Let us get into the details of the section.

TERM

Rotation is applicable only to

(1) Listed companies;

(2) Other prescribed class of companies (except One person & small companies)

(a) all unlisted public companies having paid up share capital ≥ ` 10 crore;

(b) all private limited companies having paid up share capital ≥ ` 50 crore; or

(c) all companies having public borrowings from financial institutions, banks or public deposits ≥ ` 50 crores.

The above companies shall not appoint or re-appoint:

(a) an individual as auditor for more than ONE term of five consecutive years; and

(b) an audit firm as auditor for more than TWO terms of five consecutive years

Cooling off Period

An auditor who completed the term as discussed above i.e., Individual (one term of 5 years)/Firm (two terms of 5 years each) is NOT eligible for re-appointment as auditor for 5 years.

Example: XYZ Ltd. which is a listed company appoints Mr. R (Individual) as an auditor in its AGM dated 29th September, 2014. Mr. R will hold office of Auditor from the conclusion of this meeting up to conclusion of sixth AGM i.e., AGM to be held in the year 2019. Now as per Section 139(2), Mr. R shall not be re-appointed as Auditor in XYZ Ltd. for further term of five years i.e., he cannot be appointed as Auditor up to year 2024.

Example: XYZ Ltd. which is a listed company appoints M/s R & Associates as an audit firm in its AGM dated 29th September, 2014. M/s R & Associates will hold office from the conclusion of this meeting up to conclusion of sixth AGM to be held in the year 2019. Now as per Section 139(2), M/s R & Associates can be appointed or re-appointed as auditor for one more term of five years i.e., up to year 2024. It shall not be re-appointed as Audit firm in XYZ Ltd. for further term of five years i.e., up to year 2029.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

for re-appointment criteria of

all companies having public borrowings from financial institutions, banks or public deposits ≥ ` 50 crores.

Rs.50 Crore or more should be considered as on which date i.e. latest audited financial statmenet before the rotation period

The limits should be determined based on the latest audited financial statements before the start of the rotation period.