Category I & II AIFs Investment Strategies – Concept and Stages

- Blog|Company Law|

- 14 Min Read

- By Taxmann

- |

- Last Updated on 16 October, 2025

AIF Investment Strategies refers to the structured approaches adopted by Category I and II Alternative Investment Funds to identify, finance, and scale high-growth Indian businesses—ranging from early-stage start-ups and SMEs to infrastructure ventures—through instruments such as equity, convertible securities, venture capital, and private equity investments.

Table of Contents

- Stages of Fund-Raising for a Young Company

- Investment Strategies

- Difference Between Idea and Opportunity and the Process of Deal Sourcing

Check out Taxmann's X NISM Category I and II Alternative Investment Fund Managers which is the official preparatory text for the NISM-Series-XIX-D Certification Examination. It provides complete coverage of the AIF lifecycle—investment concepts, fund structuring, governance, valuation, reporting, taxation, and compliance with SEBI, FEMA, and PMLA regulations. Designed with exam-aligned content, case studies, and practice MCQs, the workbook equips professionals, fund managers, and aspirants with the knowledge, analytical skills, and regulatory insight required for effective AIF management.

Category I AIFs and Category II AIFs are primarily investing in unlisted and high-growth companies, which include early-stage start-ups, small and medium enterprises, infrastructure companies or companies planning to issue shares through an Initial Public Offering.

In order to understand the investment strategies used by Category I AIFs and Category II AIFs, let us understand the stages at which any company would typically require funding and how do these company raise funds:

1. Stages of Fund-Raising for a Young Company

1.1 Pre-seed Capital

Pre-seed capital is provided to entrepreneurs or start-up founders to help them develop an idea. At this stage, the entrepreneurs identify a problem statement and develop an innovative solution to solve the problem. To ensure that the idea is validated, the entrepreneurs also seek support from start-up incubators which provide them the required mentorships and connect with early-stage investors. The capital raised at this stage is invested to validate the idea and ensure that the idea is sustainable, scalable and saleable. Since the entrepreneurs only have an idea and not ongoing revenue, it becomes difficult to raise the initial investment from banks and investors. Investors at this stage are Family and Friends.

1.2 Seed Capital

Seed capital is the capital provided to help the entrepreneur develop their idea into an early-stage product. This is the stage at which the idea is validated, and the entrepreneur is willing to develop the innovative product/service offering, for selling it to potential customers. To ensure that customers like the product, the entrepreneur will be required to do necessary research and development (R&D) to identify the right product segment, market segments, customer profiles, enabling the entrepreneur to develop the initial product offering. At this stage also, banks and investors would be hesitant to invest in the company, as there are no revenues and profits.

After initial research, some entrepreneurs might receive a positive response from the market test-runs or initial customer feedbacks, based on their break-through products/service offerings. Hence, if a customer liked the product/service offerings, paid for the same and is willing to pay for it once again, then the entrepreneur has said to achieve “Product Market Fit”. At this stage, high net-worth individuals called “Angel Investors” would be willing to take the risk and invest in such product offerings in anticipation of growth. Generally, investors prefer investing through hybrid securities such as Convertible Debentures or Convertible Preference Shares, as it gives a fixed income flow for the initial years, especially in the first 3 to 5 years of the company; and also provides the benefit of equity-shareholding in the long term. Investors at this stage are High Networth Individuals (HNIs), Angel Investors or Angel Funds.

1.3 Early-Stage Capital

Early-stage capital is the capital provided to set up initial operation and basic production, as the company can get customers for their offering to help generate revenue. Early-stage capital supports product development, digital marketing, commercial manufacturing and initial customer outreach.

As the company starts generating revenues, it can raise funds from Venture Capital investors by issuing equity shares in a Pre-Series A, Series A or Series B round, or it can raise debt-funding from Venture Debt funds. Again, investors prefer investing through hybrid securities such as Convertible Debentures or Convertible Preference Shares, as it gives a fixed income flow for the initial years, especially in the first 3 to 5 years of the company; and also provides the benefit of equity-shareholding in the long term. At this stage, investors such as friends, family and early-stage angel investors, who invested in Stage 1 and Stage 2 funding, exit the company. This helps them to realize their profits by selling their holdings to new investors in the “Secondaries” market.

Some companies may require short-term financing to fund their working capital requirements between two rounds of funding. This is known as a “Bridge Round”. Banks, Debt Funds or even Venture Capital Funds provide such working capital funds. Investors at this stage are Venture Capital Funds, Debt Funds, Venture Debt Funds etc.

1.4 Later-Stage Capital

Later-stage capital is the capital provided in order to scale the business and expand in different markets, geographies, develop new product segments or acquire companies in order to increase their product offerings. This helps the company to increase their revenue and grow in scale.

This stage starts from raising Series C funds, in order to invest in product improvement, large-scale marketing campaigns, new acquisitions and launching new products. A company can raise funds through Series D, E, F and further rounds, till it announces its IPO and gets listed on a stock exchange. If the company does not wish to get listed, it may continue to raise funds from the private markets and also reach out to institutional investors, such as banks, insurance companies and mutual funds. At this junction, the initial angel investors and venture capital funds exit the company to realise their profits. Investors at this stage are Private Equity Funds, Institutional Investors etc.

1.5 Mezzanine Round

Mezzanine Round is required when the company wants to get listed on the stock exchange and requires funds to complete the listing formalities, such as appointing merchant bankers, legal counsels, auditors, registrar and transfer agents, among others. Investors include anchor investors who are allotted shares at a reasonable discount to the Issue Price of shares in the IPO. This Pre-IPO round of investment also provides an opportunity for employees having Employee Stock Option Plans (ESOPs) to exercise their option and sell shares to new investors in the company. Alternatively, the company may look at raising funds by issuing hybrid instruments such as convertible debentures or convertible preference shares. Investors at this stage are Anchor Investors, Institutional Investors, Retail Investors.

The stages at which a company raises funds may differ from industry to industry, based on the industry dynamics and execution plan of the management team. The above stages are representative of the life-cycle of the company, when it would typically require funding.

2. Investment Strategies

2.1 Angel Investments

Angel Investments are made at the initial stages, generally Stage 1 and Stage 2 of a company’s life cycle, as discussed above. Essentially angel investors are high net worth individuals (HNIs) who invest in their individual capacity or through their family offices with own funds. In most situations, start-up ventures find it difficult to establish the required confidence for Venture Capital funds to invest or banks to lend to them. Therefore, angels take the high risk and address the critical financing gap in the initial formative phase of a start-up business venture.

Angel investors primarily look at the potential growth of the start-up’s business idea, along with the team who will execute the business idea. When investing in nascent stages, the investors may not know whether the idea will sustain and scale-up. At this stage, they are simply seeing the team’s capabilities and experience which would ensure that the business scales. Angel investors will look at the Customer Acquisition Cost (CAC) and the Customer Lifetime Value (CLV) of the start-up. This measures that how much is the start-up spending per customer, to get its revenue from that person. If the CAC is very high, there are high chances that the start-up would not be able to make profits from its operations.

In India, the failure rate of start-ups is 90%, while 80% of start-ups fail in the first five years.1 On account of such high risk, angel investors prefer to have a portfolio of minimum 10 companies, out of which they expect 1 or 2 companies to give exponential growth and Net Return on Investments, after averaging the losses in other companies.

Angel Investing platforms have also gained popularity, wherein a group of small angel investors can pool in capital and form a syndicate, to invest collectively in a start-up. Some angel investors may have the capacity and willingness to make higher ticket sizes of investments, upwards of INR 25 lakh in one start-up, while small investors may want to invest not more than INR 5 lakh or INR 10 lakh in one start-up. By investing through syndicates, angel investors can invest in a diverse portfolio of start-ups or early-stage companies.

2.2 Venture Capital (VC) Investments

Venture capital can be termed as the first stage of institutional financing in an early-stage company or start-up, generally after the angel funds are successfully raised by such company or start-up. Venture Capitalists are always on investing in asset-light businesses that are intensive in technology, intellectual property or digital media applications.

The SEBI (Alternative Investment Funds) Regulations state that VC investments should be made in companies offering new products, new services, technology or intellectual property-based activities or a new business model. These nascent ventures show high potential to grow into large businesses or start to demonstrate growth at a very high growth rate year on year. Venture capital investments are therefore considered highly risky and rank as such among alternative investments.

Venture Capital investors invest in revenue-generating companies, as compared to Angel investors who invest their money on the Founding Team at the idea stage. Venture capital investors look at metrics like Monthly Run Rate (MRR) or Annual Run Rate (ARR), to gauge the consistency and sustainability of revenue generated by the investee companies. Venture Capital investors are also very cautious while investing in companies with a high Customer Acquisition Cost, as this can hamper long-term growth and sustainability of the investee company. At this stage, great emphasis is also given to study the direct and indirect competitors of the investee company.

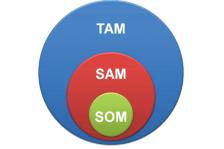

Presence of competition is a good sign for investors as it proves as a validation of a high Total Addressable Market (TAM) for the investor. If the market size is big and demand for the company’s offerings is growing, the investors will always show keen interest and focus their research on the ability of the founding team to execute the business model. This is captured by a metric called as Serviceable Available Market (SAM), which measures how much TAM can be realistically achieved by the investee company, based on its business model and revenue targets. The investors then actively look at the Serviceable Obtainable Market (SOM), which is percentage of the SAM that can be captured in the long run, with a sustainable marketing approach. Valuation of an investee company at this stage depends on high value of the SOM for the company.

2.3 Private Equity Investments

2.3 Private Equity Investments

PE Fund means “an AIF which invests primarily in equity or equity linked instruments or partnership interests of investee companies according to the stated objective of the fund”.2 It may be understood that private equity fund is primarily an equity-based investor but unlike venture capital funds which are focussed on early-stage investments, private equity funds are mostly involved in later stage financing in business entities that have established a business model and need to be scaled up for further growth.

The term ‘private equity’ (PE) has wider import and is a generic term used for direct investments in companies that are not listed on a stock exchange. Typically, PE investments are made into mature businesses in traditional industries in exchange for equity, or ownership stake. Growth investing is a common PE strategy, wherein an investor will acquire a minority stake, looking to further grow the company. These investments typically take place at the intersection of VC and PE, where companies are still growing but may have already shown some profitability. Generally, Private Equity Funds prefer to have a board seat on the investee companies and not dilute their shareholding on account of further fund-raising.

2.4 Syndication

Syndicates enable many small investors to pool their funds in a “Special Purpose Vehicle” and participate in an investment with other reputable and big ticket-size investors. The Special Purpose Vehicle makes a single investment in the target company, by subscribing to the equity shares, although the money is pooled from various investors. There are several platforms offering Syndicate services.

To initiate the process of syndication, there is a “Lead Investor” who gets high-risk, high return deal to invest in a potential start-up. Before syndication of funds happen, such Lead Investor ensures that thorough due diligence is done on the company, including Financial Due Diligence, Business Due Diligence, Operation Due Diligence and Technological Due Diligence. Once the Lead Investor is convinced that the start-up has growth potential, such investor will create a Syndicate and commit capital, to ensure skin-in-the-game. Once the syndicate is listed on the investment platform, the Lead Investor can start approaching other potential investors who are willing to co-invest.

As per SEBI (Alternative Investment Funds) Regulations, only Accredited Investors are permitted to invest in the syndicate deals. Hence, the lead investor will be required to ensure every investor is in compliance with the Accredited Investor Framework, as specified by SEBI. The Lead Investors generally charges a fee from syndicate investors, to compensate for their efforts of due diligence and deal scouting. This fees can vary across deals and investors. Some Lead Investors may charge a one-time fees, while others may take a share in the profits earned by the Syndicate, like Carried Interest.

For example, Mr A is a lead investor who wants to raise INR 25 crore for a Pre-series A round for Company XYZ. He created a Syndicate called ABC LLP and committed INR 5 crore himself and has approached other accredited investors who are willing to commit the balance INR 20 crore, with a Carry of 15%. If ABC LLP exits the start-up by selling its stake at INR 75 crore after 3 years, then the Syndicate investors (including Mr A) will pay 15% of the profit of INR 50 crore to Mr. A and the balance will be distributed to investors on a pro-rata basis, based on their committed capital in the syndicate.

2.5 Securitized Debt Instruments (SDIs)

Securitized debt instruments are financial securities that are created by securitizing loans (debt) given to companies, listed or to-be-listed debentures and other forms of structured financing such as sub-ordinate debt, working capital loans and mezzanine financing. Securitization is the process in which certain types of assets are pooled so that they can be repackaged into investable securities with a pre-determined periodic income.

Securitized Debt Instruments can be traded on the stock exchange in India. An SDI is almost similar to a Special Purpose Vehicle (SPV), which is created with the sole intention of pooling funds and investing in assets that can be further leased on to a target company, with an intent to receive periodic lease as well as the scrap value on sale of such assets, after the targeted tenure. The investors pool the money in such SPV with an intent to receive a fixed income from the lease payments, regularly. The target company, especially those which are capital-intensive (such as manufacturers of Drones, Electronic Vehicles, Charging Stations, Robots, etc.) can avoid paying interest on loans and directly lease the required assets from the SPV.

The originator, or sponsor, of the SDI is responsible to do due diligence on the target company which takes the assets on lease, to avoid default risk which can impact the investors’ return and principal investment. The Sponsor should do its reference checks on the management team of the target company and identify potential red flags in the company’s financial statements, key contracts taken, existing lenders, default history, compliance issues, pending litigations, among others. SDIs issued by such sponsor are also rated by credit rating agencies, based on the inherent risk, target companies, assets leased, lease amounts, tenure and returns.

Through an SDI investment, investors can get the benefit of investing in high-growth industries and sectors, while ensuring fixed timely payments with limited risks. SDI was introduced by SEBI in 2008 under the SEBI (Issue and Listing of Securitised Debt Instruments and Security Receipts) Regulations.

2.6 Leveraged Buy-out

Private equity (PE) also participates in more complex transactions involving control acquisitions (known as ‘buyout’) and Leveraged Buy Outs (LBOs) which comprise of doing buyouts with significant leverage. An LBO is a buyout where an acquiring company borrows funds to buy the target company, taking on significant debt, which is secured against the target company’s assets. LBOs are an attractive option for acquiring companies promising a high return on investment, with a smaller upfront investment. In such transactions, investors typically look to acquire controlling interests of either 51% or more of the share capital or voting rights of a target company.

Leveraged Buyouts are typically done when there is large forecast of cash flows contingent on the unlocking of value from a new project, business plan or corporate restructuring. In such a situation, the investor may take the view to lend against these future lumpy cash flows but require an adequate return to reflect the additional risk. Through the LBO deal, an investor can take a public company, private. Alternatively, a target company can spin-off an existing business vertical and sell it in the LBO deal.

Management Buyouts (MBOs) are a common form of Leveraged Buyouts, wherein a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is held by public shareholders. In the case of an MBO, the current management will purchase enough shares from the public so that it can end up holding at least 51 per cent of the stock. This strategy is used by management teams who have the expertise to operate the company in future.

3. Difference Between Idea and Opportunity and the Process of Deal Sourcing

There is a big difference between an idea and an opportunity in business. An idea is a concept that could be used to make money; however, an opportunity has proven commercial value. Knowing the difference between an idea and an opportunity is crucial to avoid wasting significant time and money of the investors, as well as the founders. An idea has the potential to become ‘an opportunity’ and a viable enterprise, if it has the potential to break even, generally within 36 months from ideation, has a passionate and dedicated team developing the idea, faces manageable risks and can forecast high gross margins.

3.1 Deal Sourcing for Private Equity Firms

Deal sourcing refers to the process of finding new companies to invest in. Private equity firms invest in private companies that aren’t part of the public stock exchange list. Therefore, it’s harder to find new opportunities. In private equity deal sourcing, a firm typically analyses at least 40 to 50 investee companies, before making 1 investment. Best practices for Private Equity Deal Sourcing:

(i) Growth Monitoring

Growth monitoring can be done through software subscriptions, which provide updated and reliable data on growth-stage companies. Such software provides data on business model, founding team, current investors, revenue model, Annual Run Rate (ARR)3, Cash Burn4, Product Segments, Market Segments and other key indicators for investors to make their investment decision. Some of the common indicators used to monitor growth are:

- Growth in team size

- Social media presence

- Revenue growth

- Market Share and Key Competitors

- Experienced Management Team

- Potential to become a leader of the market

- Unit Economics

(ii) Liquidity Indicators

There are several liquidity indicators that may signal why the company needs funds from a Private Equity investor. Some of them are:

- C-level employees nearing retirement or wanting an Exit, after achieving targeted growth.

- Expansion plans in multiple geographies and appointing a team of distributors.

- Rise of competition and a chance to acquire new players in the market.

- To allow existing Venture Capital or Angel investors to exit

(iii) Brand Presence

Building a solid brand presence is one of the most important aspects for Private Equity firms. Marketing and PR activities of the investee companies are closely observed by the PE funds. One of the main reasons behind this increase in brand-building rises from competition for the best deals. To build a stronger brand presence, it’s important to foster new and existing relationships.

Similarly, start-ups and investee companies may select a PE firm with a stronger brand presence. Early-stage start-ups also prefer to get investors who have the ability and willingness to help the business grow, by giving them the right market access at the right time.

3.2 Private Equity Deal Structure

The deal pipeline in private equity consists of the following steps:

(a) Deal sourcing – Dedicated professionals help a PE Fund to streamline the process and building lists of potential start-ups from research, emails, calls, and other sources. The start-ups so approached provide investor pitch to the PE Fund.

(b) Signing an NDA – After gaining interest in a start-up, a Private Equity firm will move on to signing a Non-Disclosure Agreement (NDA), so that their team can assess and examine the start-up’s records before proceeding.

(c) Initial due diligence – Due diligence process helps to gain a deeper understanding on how the start-up and its management is executing the plan that was pitched to the investor.

(d) Investment proposal and non-binding Letter of Intent (LOI) – After successful due diligence, the investors proceed to propose an investment and submit it to the Management Team of the start-up. The Private Equity Fund will provide a non-binding LOI with their proposed investment amount, start-up valuation and the stake in the company. The amount is usually defined in a range, not a specific value.

(e) Term Sheet negotiations – If the start-up has accepted the letter of intent, they sign on the Term Sheet and a Summary of Principle Terms (SOPT), which lays down the binding and non-binding clauses on both parties. At this stage, the investment has not been made yet in the start-up.

(f) Final due diligence – If the start-up has accepted the letter of intent and signed the term sheet, the Private Equity investor will get access to confidential information about their business and conduct their final due diligence. This includes financial due diligence, business due diligence, technological due diligence, and operational due diligence.

(g) Final Investment Memorandum – Once the investment committee of the PE Fund gives its final approval, they create a Final Investment Memorandum, and the deal team proposes a specific amount of valuation for the acquisition of the company. The start-up can negotiate on the final valuation, before signing the final agreements.

(h) Signing the Shareholder Agreement and Share Subscription Agreement – The Private Equity firm will hand over the cheque, while signing the Shareholder Agreement and Share Subscription Agreement, wherein the investor will be allotted the shares and receive the share certificates. The name of the investor will also appear on the Capitalisation Table of the start-up.

- https://startuptalky.com/startup-failure-success-rates-statistics/

- Equity linked instruments include instruments convertible into equity shares or share warrants, preference shares, debentures compulsorily or optionally convertible into equity.

- ARR is the yearly equivalent of MRR and represents the predictable revenue generated annually.

- Cash Burn is the rate at which a start-up spends its cash flows for business purpose.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

Everything on Tax and Corporate Laws of India

To subscribe to our weekly newsletter please log in/register on Taxmann.com

Author: Taxmann

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that's easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA