[Case Study] on Notice and Requisition under Income Tax Act

- Blog|Income Tax|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 2 May, 2023

Check out Taxmann's Tax Practice Manual which is an exhaustive (1,900 + pages), amended (by the Finance Act 2023) & practical guide (330+ case studies covering 30+ topics) for Tax Professionals. This book is divided into two parts, i.e., the law relating to Tax Procedures, including Tax Practice and Case Studies. This book will be helpful for Chartered Accountants, Lawyers/Advocates, and Tax Practitioners to assist them in their day-to-day tax work.

Case Study

| Gist | : | Response to notice and requisition issued u/s. 143(2)/142(1) |

| Facts | : | The case has been selected for Scrutiny for the following reasons:

i. Expenses incurred for earning exempt income. ii. Squared up loans |

Following are the steps involved for responding to the notice/requisition issued u/s. 143(2)/142(1) of the Income-tax Act, 1961 through faceless proceedings:

Step-1 Go to the Income Tax E-filing portal (eportal.incometax.gov.in) and login

Step-2 On your Dashboard, click Pending Actions > e-Proceedings.

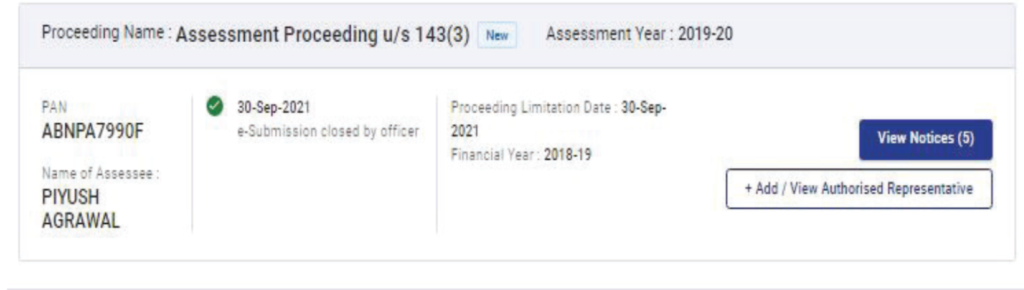

Step-3 A page showing details of the notices (if available) such as PAN, Assessment Year, Proceeding name, Proceeding Status, Proceeding limitation date, proceeding closure date and action will appear.

Step-4 Click on ‘view notices’ in the Assessment Proceeding u/s. 143(3) hyperlink available under Proceeding name column to view proceeding details.

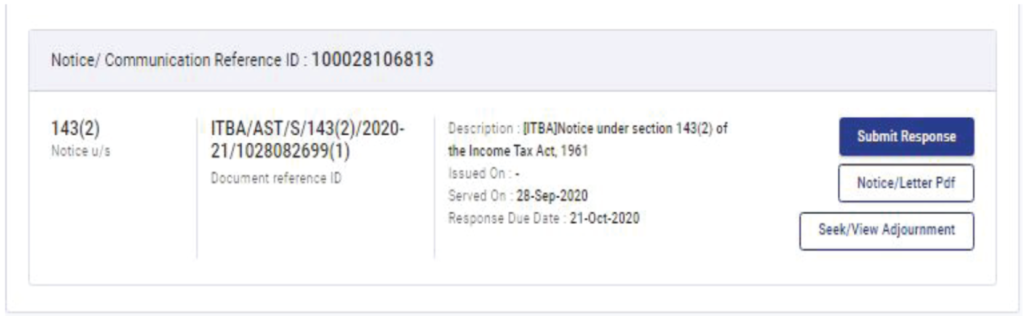

Step-5 Additional details such as Notice/Communication reference ID, Notice u/s., Description, issued on, Document ID, Served on, and Response Due Date will appear. To view the notice u/s. 143(2)/142(1), click on the Notice/Letter pdf and the same can be saved in PDF format.

Step-6 To submit the response to the notice, click on the “submit response” link.

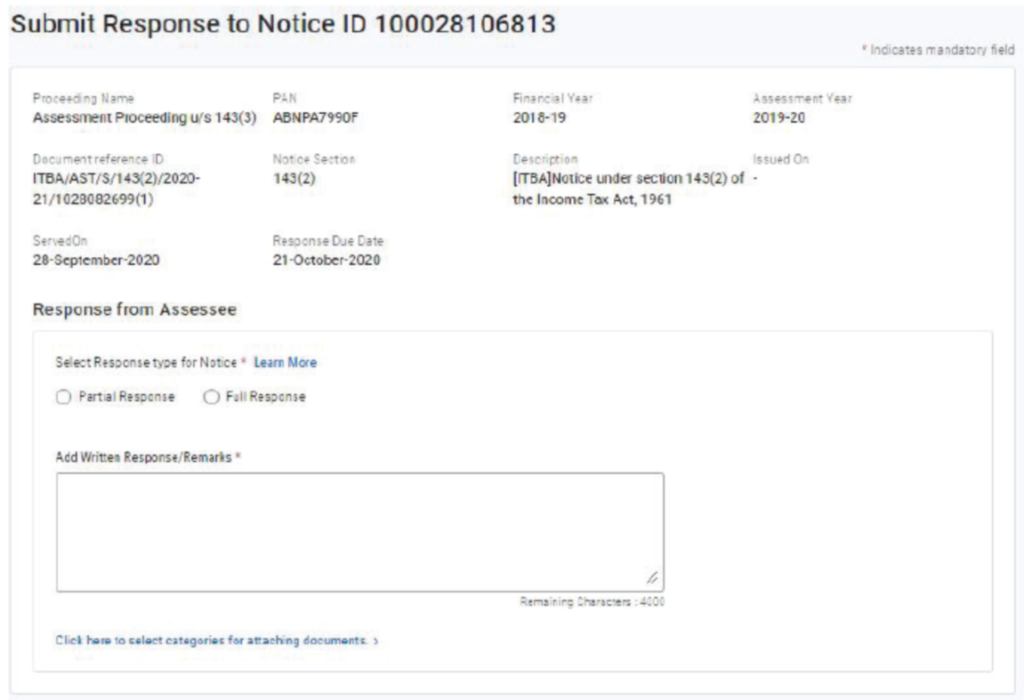

Step-7 A page will appear displaying details of the assessee such as PAN, Proceeding Name, Assessment Year, Document Reference ID, Notice Section, Response type and Response/Remarks, SI No. and Attachment Description.

Step-8 Under Response type option select “Full Response” and under the Response/Remarks option, details of Expenses incurred for earning exempt income and squared up loans shall be furnished.

Step-9 Documents shall also be attached evidencing genuineness of aforesaid details. For example, Copy of Bank Statement, Copy of External Confirmation regarding such loans, Copy of ITR and Balance sheet of the persons advancing such loans etc. For this purpose, click on ‘Click here to select categories for attaching documents,’ and attach relevant documents.

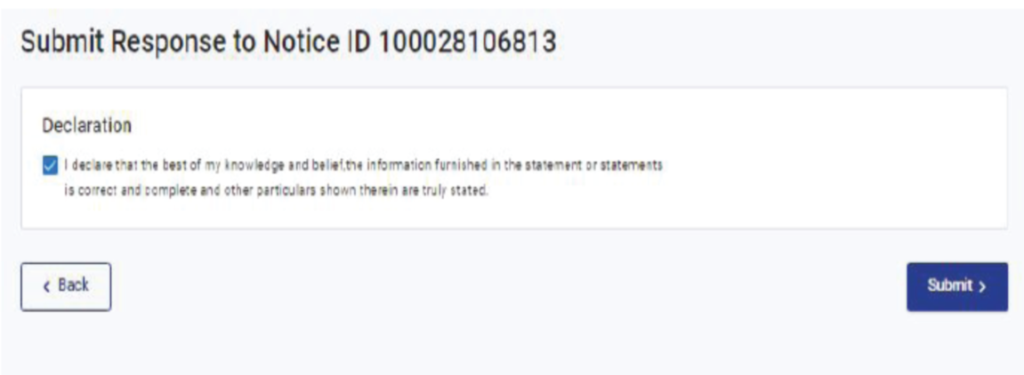

Step-10 Click continue after attaching documents and furnishing response Check the declaration box and submit.

Step-11 A pop up will come as to “Do you want to verify through EVC/DSC?”. Click on No and then a success window will appear with a Transaction ID which can be used for future reference.

The Specimen of an ideal ‘e-response’ to the Scrutiny Notice/Requisition under section 143(2)/142(1) of the Act, on the issue of disallowance of expenses incurred for earning exempt income and of squared up loans is reproduced below for the ready reference of the worthy readers.

December 10, 20XX

Tr.id- XXXXXX1526 dated 10.12.20XX

To

Assessing Officer

National Faceless Assessment Centre

Re.: ABC Private Limited

C-7/95-E, Jagatganj, Varanasi

PAN: AXXXX1234X

Assessment Year: 2015-16

Ref.: Notice u/s. 142(1) dt.5.12.20XX

Sub.: SUBMISSIONS

Sir,

Most respectfully, we submit as under:-

- Source of fund utilized for making advance to two directors and Simti Industries Ltd.: It is most humbly submitted that this assessee-company had sufficient non-interest bearing funds in the Reserves & Surplus, Capital account, Current Year Profits, Interest free Unsecured Loan and Sundry Creditors which are much more than the advances made to Simti Industries Limited and two directors, namely, Raman Singh and Smita Singh and fully cover the amounts advanced to directors and sister concern which can be enumerated as under:-

| S. No. | Particulars | Amount (` ) | Amount (` ) |

| 1. | Share capital | 5,08,85,000 | |

| 2. | Reserves and Surplus | 17,17,57,509 | |

| 3. | Interest free Advances – | ||

| From Customers | 2,28,67,373 | ||

| From Parties | 97,84,353 | 3,26,51,726 | |

| 4. | Interest free Unsecured Loans | 4,30,14,902 | |

| 5. | Sundry Creditors | 1,06,98,206 | |

| Total: | 30,90,07,343 |

- The above funds are interest-free and which have been utilised towards advances to sister concern and directors. As such, there is no question of making any disallowance out of interest paid to bank for business purposes as has been held by various High Courts and Tribunal.

- Sir, as in the case law quoted by your goodself of CIT v. H.R. Sugar Factory (P) Ltd. [1990] 53 TAXMAN 63 (ALL) it is proved that

“lending to such directors/shareholders was not for business purpose and had this money not advanced to directors, it would have been available to the assessee for its business purposes and to that extent it might not have been necessary to borrow from banks.”

As in present case under consideration it is already stated that assessee-company had sufficient non-interest bearing funds in the reserves & surplus, Capital account, Current year Profits, interest free unsecured loan and sundry creditors.

- Reasons for increase in Payment of interest to bank: Kindly appreciate that the business of the assessee-company is purchase and sale of Coal. More funds were required in view of heavy increase in volume of work during the year under consideration as compared to the immediately preceding year. The position of Turnover and Gross Profit for the two years is detailed below. Please appreciate that more borrowed funds were required to achieve substantial increase in volume of work. The funds have been raised for commercial expediency and the comparative details are as under:-

| Particulars | A.Y. 2014-15 | A.Y. 2015-16 | Remarks |

| Turnover | 9,30,14,186 | 48,45,91,140 | Substantial increase in business operation during the year under consideration. |

| Gross Profit | 87,98,862 | 2,46,31,441 | |

| Closing Stock | 3,57,913 | 2,02,92,759 | |

| Interest paid to Bank on Existing Loan A/c | 11,99,595 | 10,55,133 | |

| Interest paid to Bank on New CC Loan A/c | – | 27,54,397 | |

| 11,99,595 | 38,09,530 |

- From the above table it is very clear that interest is paid on old loan is very comparable to last year. A new CC account number 690330110000095 with Bank of India, Sigra, Varanasi has been opened this year in October, 2014. Out of total interest paid to bank `38,09,530 interest has been paid by the assessee-company `27,54,397 on this CC account. Out of this CC Account, no amount has been paid to directors or sister concern. Details of all the payments made from this CC Account is given here as under:

| Bank of India CC A/c. 690330110000095 | |||

| Date | Particulars | Payment | Nature of Payment |

| 20/01/2015 | N.C.L.C.S.R.A/C (BY ROAD) | 5604770.00 | Payment for Purchase of Coal |

| 20/01/2015 | N.C.L.C.S.R.A/C (BY ROAD) | 3235720.00 | Payment for Purchase of Coal |

| 23/01/2015 | N.C.L.C.S.R.A/C (BY ROAD) | 1202384.21 | Payment for Purchase of Coal |

| 23/01/2015 | N.C.L.C.S.R.A/C (BY ROAD) | 623800.00 | Payment for Purchase of Coal |

| 04/03/2015 | KALYANI INDIA (P) LTD. | 13000000.00 | Payment for Purchase of Coal |

| 28/10/2014 | INTT. PAID TO BANK | 57064.00 | Bank Interest |

| 28/11/2014 | INTT. PAID TO BANK | 347691.00 | Bank Interest |

| 27/12/2014 | INTT. PAID TO BANK | 481375.00 | Bank Interest |

| 28/01/2015 | INTT. PAID TO BANK | 596889.00 | Bank Interest |

| 27/03/2015 | N.C.L.C.S.R.A/C (BY ROAD) | 3002135.00 | Payment for Purchase of Coal |

| 21/02/2015 | M.S.T.C.LTD. | 5841000.00 | EMD for coal purchase |

| 13/03/2015 | M.S.T.C.LTD. | 1500000.00 | EMD for coal purchase |

| 22/12/2014 | M. JUNCTION SERVICES LTD. | 4400000.00 | EMD for coal purchase |

| 05/12/2014 | LEGAL EXP. | 1600.00 | ROC compliance |

| 13/02/2015 | KALYANI INDIA (P) LTD. | 5000000.00 | Payment for Purchase of Coal |

| 24/02/2015 | KALYANI INDIA (P) LTD. | 15000000.00 | Payment for Purchase of Coal |

| 04/03/2015 | KALYANI INDIA (P) LTD. | 13000000.00 | Payment for Purchase of Coal |

| 28/10/2014 | INTT. PAID TO BANK | 57064.00 | Bank Interest |

| 28/11/2014 | INTT. PAID TO BANK | 347691.00 | Bank Interest |

| 27/12/2014 | INTT. PAID TO BANK | 481375.00 | Bank Interest |

| 28/01/2015 | INTT. PAID TO BANK | 596889.00 | Bank Interest |

| 18/12/2014 | BANK CHARGE | 50.00 | Bank Charges |

| 18/12/2014 | BANK CHARGE | 50.00 | Bank Charges |

- Increase in bank interest payment is due to new cash credit facility taken from the bank which justified increase in the business significantly as evident from the table above. The new loan has been only utilized for the purpose of business as no single penny has been paid to directors or sister concern out of this new loan account. Therefore, it is an established fact that loan to directors has been provided out of companies own interest free funds. Therefore, there is no question for disallowance of interest paid to bank on credit facility provided by bank which has been utilized for the furtherance of business and commercial expediency.

- It has been repeatedly held by jurisdictional Hon’ble Allahabad High Court that it can be reasonably presumed that when the assessee has its own capital and interest-free advances, the same could have been utilised in the said non-business advances. It cannot, therefore, be presumed that the assessee has made interest-free advances out of funds borrowed from the bank on which interest has been paid. The overdraft from the bank has been clearly taken for working capital which has been totally used for the assessee’s business.

- The assessee company rely on following judgments by various high courts have held as under-

(a) When Sufficient interest free funds available :-

Facts of the Case:

-

-

- The Opening Balance as on 1.4.2014 is `7,99,07,192.Thus loan was given to sister concern in earlier years i.e. year ending on 31.03.2014 but no disallowance out of interest paid on borrowed funds from bank was disallowed in earlier years. This year the loan amount has been substantially reduced to `3,80,856.

- Assessee has sufficient funds on account of share capital, share application money, reserves & surplus other than borrowed money for giving the loan to its sister concern. Hence, no disallowance is called for u/s.36(1)(iii).

-

CIT v. Radico Khaitan Ltd. (2005) 274 ITR 354 (All) – Annexures 1-10

(b) When Sufficient interest free funds available:

Facts of the Case:

-

-

- Assessee-company had advanced money to sister concern.

- Assessee has interest free advances from the customers, reserves and share capital sufficient to cover the advances to sister concern.

- Held, no disallowance out of interest paid to bank on borrowed fund can be made.

-

CIT v. Prem Heavy Engineering Works P. Ltd. (2006) 285 ITR 554 (All) – Annexures 11-13

(c) When Sufficient interest free funds available:

Facts of the Case:

-

-

- The assessee was maintaining cash credit account and all proceeds from sale were being deposited in the said account.

- The entire profits were deposited in the overdraft account. It should be presumed that in its essence and true character the advances were made out of the profits of the relevant year and not out of the overdraft account for the running of the business.

- Where assessee own capital and current profits are substantially more than interest free advances to its sister concern, it provides absence of any nexus between funds borrowed on interest and such interest free advances. Held no disallowance u/s.36(1)(iii) out of interest paid to Bank.

-

Malwa Cotton Spinning Mills v. ACIT (2004) 89 ITD 65 (Chd.)

(d) No disallowance u/s.36(1)(iii) :

“… Where assessee had utilized its own surplus funds to give interest free loans to its sister concern, disallowance of interest payment made by Assessing Officer under section 36(1)(iii) was to be deleted.”

ACIT v. Apollo Hospital Enterprise Ltd. (2012) 139 ITD 594 (Chennai) (Trib.)– Annexures 14-18

(e) No Nexus between loans advances and Bank Interest:

The assessee has sufficient funds at its disposal and the interest free loans advanced to subsidiary companies were not from interest bearing funds from Banks. There was no nexus between the borrowed funds and interest free advances, merely because the loans advanced passed through the cash credit and current a/c of the assessee-company, it cannot be said that there is any nexus between the borrowed funds and advances made. Held, there can be no disallowance out of interest paid to bank.

“… It cannot be said that interest free loans advanced to subsidiary companies were out of interest bearing funds from the Bank merely because the loans advanced passed through the cash credit and current account of assessee company.”

CIT v. India Carbons Ltd. (2001) 247 ITR 510 (Gau) Annexures 19-24

- Besides, we also rely upon the under noted decisions wherein the Hon’ble High Courts held in the favour of the assessee as under –

(a) Business expenditure—Interest on borrowed capital—Interest free loans to subsidiaries—Tribunal has found that the interest-free funds available to the assessee were sufficient to meet its investment—Hence, it could be presumed that the investments were made from the interest-free funds available with the assessee—Issue raises a pure question of fact—Therefore, interest referable to funds given to subsidiaries is allowable as deduction under s. 36(1)(iii). CIT v. Reliance Industries Ltd. (2018) 161 DTR (Bom) 420 affirmed.

CIT. v. Reliance Industries Ltd. (2019) 410 ITR 466 (SC) Annexures 25-29

(b) “The entire profits were deposited in the overdraft account. It should be presumed that in its essence and true character the taxes were paid out of the profits of the relevant year and not out of the overdraft account for the running of the business.”

Woolcombers of India Ltd. v. CIT (1982) 134 ITR 219 (Cal) Annexures 30-39

(c) Appeal (High Court)—Substantial question of law—Interest on borrowed capital—Tribunal noted that lending to the related parties was worth ` 1.46 crore whereas the net worth of the company was of ` 4.96 crore—Company, thus, had sufficient interest free funds in excess of interest bearing loans—Balance sheet of the company would show that the company’s net worth was arrived at principally by taking into account its share capital, reserves and surplus and application money after adjusting the amounts transferred to P&L a/c—No substantial question of law arises.

P.CIT. v. JSB Securities Ltd. (2019) ITA No. 1702 with 1704 of 2016 (Bom.) Annexures 40-42

(d) Business expenditure—Interest on borrowed capital—Interest-free advances to sister-concerns—Assessee having interest-free funds in excess of interest-free advances given to sister-concern, AO was not justified in disallowing interest paid on borrowed funds by proportionately bifurcating the interest in the ratio of interest bearing and interest-free funds—Assessee is deemed to have granted the interest free loans to its subsidiary companies from its non-interest bearing funds available with it, which was in excess of the total loans granted by the assessee to the subsidiary companies.

CIT. v. Harrisons Malayalam Ltd. (2019) 414 ITR 344 (Ker) Annexures 43-51

- Considering the things in totality on the facts of the case and various jurisdictional pronouncement, no adverse inference can be drawn against this assessee as the assessee’s own funds (`30,90,07,343) were quite adequate to cover the advances given to both the directors (`12,21,65,532).

Need be of any further clarification, the same shall be submitted upon hearing from your good self.

Yours faithfully,

For ABC Pvt. Ltd.

Director

Encl.: Annexures 1 – 51

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA