Business Combination Under Ind AS-103 – Definition and Accounting Treatment

- Blog|Account & Audit|

- 10 Min Read

- By Taxmann

- |

- Last Updated on 9 June, 2025

A business combination, as defined under Ind AS-103 (Business Combinations), is a transaction or other event in which an acquirer obtains control of one or more businesses. This includes not just mergers and acquisitions in the traditional sense but also any transaction that results in an entity gaining control over another entity that qualifies as a business.

Table of Contents

- Introduction

- Meaning of Business

- Meaning of Business Combination

- What is the Difference Between Ind AS-103 and Ind AS-110 ‘Consolidated Financial Statements’?

- Accounting for Business Combination

Check out Taxmann's Students' Guide to Ind ASs [Converged IFRS] | Study Material which is a comprehensive resource on Indian Accounting Standards converged with IFRS, tailored for CA Final and CMA Final (Sept. 2025/Jan. 2026). Authored by Dr D.S. Rawat & CA. Jinender Jain offers structured learning across forty-two chapters, progressing from fundamental principles to advanced topics like financial instruments and consolidation. Updated till 30th April 2025, the book provides exam-focused clarity, practical illustrations, summaries, revision points, and a curated question bank. Its logical flow and real-world insights make it indispensable for students, practitioners, and researchers aiming to master India's IFRS-converged standards.

1. Introduction

Business combination is the process under which two or more business organisations or their net assets are brought under common control in a single business entity. Generally, companies doing similar type of business or involved in similar line of activities may go for business combination to get the economies of large scale production and to minimise the possibility of cut-throat competition. Business combination result the growth. Other terms applied to business combination are merger and acquisition. A ‘merger’ refers to a situation where two or more than two companies of similar nature combine willingly while an ‘acquisition’ or ‘takeover’ refers to the situation where a bigger company takes over a smaller company. Business combination can take place either through amalgamation or through absorption.

Under the existing Accounting Standard the corresponding Standard is AS-14 ‘Amalgamations’ however Ind AS-103 ‘Business Combination’ is substantially different from AS-14 ‘Amalgamations’. Ind AS-103 lays down the accounting principles for business combination and not for asset combination. To apply the Ind AS-103, there should be transaction which meets the definition of business combination. Before discussing the accounting principles, the meaning of the business should be clearly understood.

2. Meaning of Business

(a) An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing goods or services to customers, generating investment income (such as dividends or interest) or generating other income from ordinary activities.

A business consists of inputs and processes applied to those inputs that have the ability to contribute to the creation of outputs. The three elements of a business are defined as follows:

- Input – Any economic resource that creates outputs, or has the ability to contribute to the creations of outputs, when one or more processes are applied to it. Examples include non-current assets (including intangible assets or rights to use non-current assets), intellectual property, and the ability to obtain access to necessary materials or rights and employees.

- Process – Any system, standard, protocol, convention or rule that, when applied to an input or inputs, creates outputs or has the ability to contribute to the creations of outputs. Examples include strategic management processes, operational processes and resource management processes. These processes typically are documented, but the intellectual capacity of an organised workforce having the necessary skills and experience following rules and conventions may provide the necessary processes that are capable of being applied to inputs to create outputs. (Accounting, billing, payroll and other administrative systems typically are not processes used to create outputs.)

- Output – The result of inputs and processes applied to those inputs that provide goods or services to customers, generate investment income (such as dividends or interest) or generate other income from ordinary activities.

An entity can apply a ‘concentration test’ that, if met, eliminates the need for further assessment. Under this optional test, where substantially all of the fair value of gross assets acquired is concentrated in a single asset (or a group of similar assets), the assets acquired would not represent a business. An Entity may make such an election separately for each transaction or other event.

(b) Determining whether a particular set of assets and activities is a business should be based on whether the integrated set is capable of being conducted and managed as a business by a market participant. Thus, in evaluating whether a particular set is a business, it is not relevant whether a seller operated the set as a business or whether the acquirer intends to operate the set as a business.

(c) In the absence of evidence to the contrary, a particular set of assets and activities in which goodwill is present shall be presumed to be a business. However, a business need not have goodwill.

2.1 What is the Impact and For Whom?

The changes to the definition of a business will likely result in more acquisitions being accounted for as asset acquisitions across all industries, particularly real estate, pharmaceutical, and oil and gas. Application of the changes would also affect the accounting for disposal transactions.

Differences in accounting between business combinations and asset acquisitions include, among other things, the recognition of goodwill, recognition and measurement of contingent consideration, accounting for transaction costs, and deferred tax accounting.

2.2 Business Acquisition vs. Asset Acquisition

For a transaction to meet the definition of a business combination (and for the acquisition method of accounting to apply), the entity must gain control of an integrated set of assets and activities that is more than a collection of assets or a combination of assets and liabilities. Some of the key differences between a business combination and an asset acquisition are summarized in the table below.

| Area | Business Combination | Asset or group of asset Acquisition |

| Measurement of assets and liabilities | Recorded at fair value. | Recorded at cost; cost is allocated over the group of assets based on relative fair value. |

| Transaction costs | Expenses as incurred. | Capitalised as part of the cost. |

| Contingent liabilities assumed | Recognised if represents present obligation that arises from past events and its fair value can be measured reliably with subsequent changes to profit or loss. | Not recognised; subject to Ind AS- 37. |

| Goodwill | May be recognised. | Not recognised. |

| Deferred taxes | Deferred tax assets and liabilities, related to any temporary differences, tax carry forwards are recorded. | Initial recognition exception applies; deferred tax assets and liabilities for temporary differences are not recognised. |

Example 1 – (Asset Acquisition) PK Ltd. purchased from JK Ltd. a group of assets comprising of plant and machinery, furniture, equipment and software at a combined price of ` 400 lakhs. Assets do not constitute business as per Ind AS-103. How would PK Ltd. measure these assets for the purpose of initial recognition?

The fair value of these assets determined applying Ind AS-113 Fair value measurement is:

| Amt. (`) | |

| Plant and Machinery | 200 lakhs |

| Furniture | 30 lakhs |

| Equipment | 50 lakhs |

| Licenses | 70 lakhs |

| Total | 350 lakhs |

| (Amt. in lakhs) | ||

| Fair Value | Allocation of composite Transaction price | |

| Plant and Machinery | 200.00 | 228.57 |

| Furniture | 30.00 | 34.29 |

| Equipment | 50.00 | 57.14 |

| License | 70.00 | 80.00 |

| 350.00 | 400.00 |

No goodwill is recognised. Excess of the transaction price over fair value is adjusted in the cost of individual asset.

Example 2 – (Business Acquisition) JP Ltd. is a garment manufacture and has been in operation for last 10 years. The company produces a wide-range of garments and employs a workforce of designers, machine operators, quality checkers, and other operational, marketing and administrative staff. It owns and operates a factory, warehouse and machinery and holds raw material inventory and finished products. On 1st April 2017, DP Ltd. paid ` 50 crores to acquire 100% of the ordinary voting shares of JP Ltd. no other type of shares has been issued by JP Ltd.

In this case, it is clear that JP Ltd. is business. It operates a trade with a variety of assets that are used by its employees in a number of related activities. These assets and activities are necessarily integrated in order to create and sell the company’s products. The acquisition of shares of JP Ltd. by DP Ltd. to obtain control on 1st April 2017 is acquisition of business.

2.3 Scope

This Ind AS applies to a transaction or other event that meets the definition of a business combination. This Ind AS does not apply to:

- The accounting for the formation of a joint arrangement in the financial statements of the joint arrangement itself.

- The acquisition of an asset or a group of assets that does not constitute a business. The acquisition by an investment entity, as defined in Ind AS 110, Consolidated Financial Statements, of an investment in a subsidiary that is required to be measured at fair value through profit or loss.

However Appendix C of this Standard deals with the accounting for combination of entities or businesses under common control. This is carve in of Ind AS and there is no corresponding provision in IFRS 3.

2.4 Accounting for Acquisition of Group of Assets

When group of assets are acquired instead of business, the Ind AS-103 does not apply for such acquisition. In that case accounting for acquisition of assets will be as under:

- The acquirer shall identify and recognise the individual identifiable assets acquired (including those assets that meet the definition of, and recognition criteria for, intangible assets in Ind AS 38, Intangible Assets) and liabilities assumed.

- The cost of the group shall be allocated to the individual identifiable assets and liabilities on the basis of their relative fair values at the date of purchase.

- Such assets acquisition does not give rise to goodwill.

3. Meaning of Business Combination

Appendix-A of Ind AS-103 defines the Business Combination- A transaction or other event in which an acquirer obtains control of one or more businesses. Transactions sometimes referred to as ‘true mergers’ or ‘mergers of equals’ are also business combinations as that term is used in this Ind AS.

A business combination is an act of bringing together of separate entities or businesses into one reporting unit. The result of business combination is one entity (the acquirer) obtains control of one or more businesses. If an entity obtains control over other entities which are not businesses, the act is not a business combination.

A business combination in which all the combining entities or businesses are ultimately controlled by the same parties before and after the combination is excluded from the scope of the business combination, such a transaction is accounted for applying Appendix C to Ind AS-103 by pooling interest method.

From the definition of Business Combination, it is clear that for business combination, the control by one entity of another is sufficient and both the entity may continue to exist which is not the case in AS-14 ‘Amalgamations’. For example, if X Ltd. acquires 70% shares of Y Ltd., then it is a case of business combination even if X Ltd. and Y Ltd. will continue to exist however X Ltd. becomes a holding (Parent) company of Y Ltd. and therefore, they becomes one reporting entity by reporting consolidated financial statements.

4. What is the Difference Between Ind AS-103 and Ind AS-110 ‘Consolidated Financial Statements’?

From the above explanation of the business combination question arise what is the difference between Ind AS-103 and Ind AS-110. Although it may seem that the Ind AS-110 Consolidated Financial Statements and Ind AS-103 Business Combinations deal with the same thing that is not the whole truth.

Both standards deal with business combinations and their financial statements,

But while Ind AS-110 defines a control and prescribes specific consolidation procedures, Ind AS-103 is more about the measurement of the items in the consolidated financial statements, such as goodwill, non-controlling interest etc.

If you need to deal with the consolidation, first you have to apply Ind AS-103 for measurement of assets and liabilities acquired, non-controlling interest and goodwill/bargain purchase then the consolidation procedure as per Ind AS-110.

5. Accounting for Business Combination

A business combination is accounted for applying acquisition method. Application of acquisition method has the following steps:

(1) Identifying the acquirer

(2) Determining the acquisition date

(3) Recognising and measuring the identifiable assets acquired and liabilities assumed and any non-controlling interest in the acquiree

(4) Recognising and measurement goodwill or gain from bargain purchase

(5) Disclosures

5.1 Identify the Acquirer

Most of the time, it is straightforward – the acquirer is usually the investor who acquires an investment or a subsidiary. The acquiree is the business that the acquirer obtains control of in business combination.

Sometimes, it is not so clear. The most common example is a merger. When two companies merge together and create just one company, the acquirer is usually the bigger one with larger fair value.

While applying the guidance in Ind AS-110 does not clearly indicate which of the combining entities is the acquirer, the following factors as described in Ind AS-103 shall be considered in making that determination:

- In a business combination effected primarily by transferring cash or other assets or by incurring liabilities, the acquirer is usually the entity that transfers the cash or other assets or incurs the liabilities.

- In a business combination effected primarily by exchanging equity interests, the acquirer is usually the entity that issues its equity interests. However, in some business combinations, commonly called ‘reverse acquisitions’, the issuing entity is the acquiree.

- The acquirer is usually the combining entity whose relative size (measured in, for example, assets, revenues or profit) is significantly greater than that of the other combining entity or entities.

- In a business combination involving more than two entities, determining the acquirer shall include a consideration of, among other things, which of the combining entities initiated the combination, as well as the relative size of the combining entities.

- A new entity formed to effect a business combination is not necessarily the acquirer. If a new entity is formed to issue equity interests to effect a business combination, one of the combining entities that existed before the business combination shall be identified as the acquirer. In contrast, a new entity that transfers cash or other assets or incurs liabilities as consideration may be the acquirer.

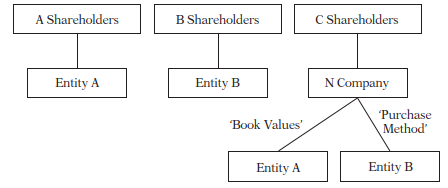

Example 3 – The shareholders of Entity A and B agree to merge, to benefit from lower delivery and distribution costs. The business combination is carried out by setting up a new entity (N Company), that issued 100 shares to entity A’s shareholders and 50 shares to entity B’s shareholders in exchange for the transfer of the shares in those entities. The number of shares reflects the relative fair values of the entities before the combination.

Is N Company the acquirer? If not, which entity is acquirer, and how is the combination accounted for?

No, N company is not the acquirer. The transaction has brought together Entities A and B. Legally, it has been effected by N Company acquiring entities A and B, rather than one of these entities acquiring the other. N company is a new entity that has been formed to issue equity instruments to effect a business combination. One of the combining entities that existed before the combination is identified as the acquirer.

Entity A seems to be the acquirer – it is the largest entity, and its previous owners control the combined group, with 67% of the shares (100/150)

N company’s consolidated financial statements reflect entity A as the acquirer; using entity A’s book values. Entity B is the acquiree, and acquisition accounting is applied to Entity B’s assets and liabilities.

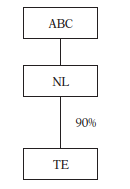

Example 4 – Business Combination effected through new entity.

Fact Pattern

- ABC intends to acquire majority voting shares and control the Target Entity (TE). To give effect to the acquisition. ABC incorporates a new company (NL)

- ABC subscribe equity capital of NL and provides a loan at commercial interest rates to NL uses these funds to acquire 90% voting shares of TE in an arm’s length transaction. The group structure post transaction is as follows:

Who is the acquirer?

NL will be the acquirer as NL has paid cash to give the effect of business combination under Ind AS-103.

A reverse acquisition occurs when the entity that issues securities (the legal acquirer) is identified as the acquiree for accounting purposes. The entity whose equity interests are acquired (the legal acquiree) must be the acquirer for accounting purposes for the transaction to be considered a reverse acquisition. For example, reverse acquisitions sometimes occur when a private operating entity wants to become a public entity but does not want to register its equity shares. To accomplish that, the private entity will arrange for a public entity to acquire its equity interests in exchange for the equity interests of the public entity. In this example, the public entity is the legal acquirer because it issued its equity interests, and the private entity is the legal acquiree because its equity interests were acquired.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA