[Analysis] Understanding the Tax Implications of NRI Investments in India

- Blog|Income Tax|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 15 October, 2024

NRI Investments in India encompass a wide array of opportunities tailored specifically for Non-Resident Indians seeking to invest in the Indian market. NRIs can engage in investments across various sectors, including real estate, stocks, bonds, and bank deposits, with each category offering different benefits under Indian tax laws. For instance, the Indian government provides concessional tax rates for certain types of income such as long-term capital gains from both listed and unlisted shares under specific sections of the Income Tax Act. Moreover, NRIs can benefit from treaties under the Double Tax Avoidance Agreement (DTAA), allowing them to opt for more favorable tax rates and avoid double taxation.

BY CA Darshak Shah – Partner | S N & Co.

Table of Contents

- Who is NRI – Residential status as per Income Tax

- Taxability of Income Based on Residential Status

- NRI Investments in India

- Mutual Fund Notional Loss – A Challenge to Indian Investors in US

- Foreign Exchange Fluctuation Adjustment

- Investment through AIF

- Investment in CAT 3 AIF

- Taxability in the Hands of Trust

- Taxability of Trust

- Case Study

1. Who is NRI – Residential status as per Income Tax

| Individual | Condition | Resident | RNOR |

| Any individual

|

– | 182 Days or more OR 60 days + 365 days in 4 PY |

NR in 9/10 PY OR 729 days or less in 7 PY |

| COI (leaves India)

|

|

182 +365 days in 4 PY | NR in 9/10 PY OR 729 days or less in 7 PY |

| COI/POI

|

|

182 +365 days in 4 PY 120 +365 days in 4 PY |

The Period of 120 days to 181 days

|

| COI | Total Income (other than FI) of Rs 15 Lakh or more and not liable to tax in any other country | – | Always R-NOR |

2. Taxability of Income Based on Residential Status

| Taxability of income | Resident | R-NOR | Non-resident |

| Income received or deemed to be received in India | Taxable | Taxable |

Taxable |

| Income accrue/arise or deemed to accrue/arise in India |

Taxable |

Taxable |

Taxable |

| Income (other than above) earned outside India from business controlled from India or profession set up in India | Taxable | Taxable | Non-Taxable |

| Income accrue or arise outside India | Taxable | Non-Taxable | Non-Taxable |

3. NRI Investments in India

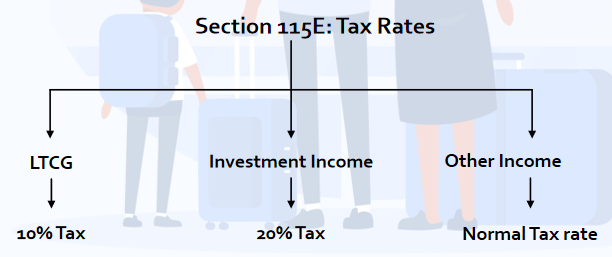

3.1 Is there any situation where I will get beneficial tax rates?

- Yes, there beneficial tax rates available for certain incomes

- If rates are beneficial in DTAA can be opted

- For listed shares LTCG – this rate is as per 115E

- For unlisted shares LTCG – 112 (C) (iii)

3.2 Can I avail above tax rates even if interest is received in INR from NRO a/c?

- Even when my interest received in NRO a/c is taxed at 20 %

- V Ravi Narayanan, In re [2008] 168 Taxman 65 (AAR)

- Foreign Exchange Asset: Non-Resident Ordinary (NRO) deposit acquired with convertible foreign exchange in a banking company, Interest on such NRO deposit shall be treated as investment income under section 115C(c) which is liable to be taxed at rate of 20 per cent under section 115E

3.3 Can I avail above tax rates even if payment is made in INR from NRO a/c?

- CIT v. M. C. George [2011] 198 Taxman 466 (Ker.)

- If the original source of the deposit is convertible foreign exchange, the transfer of such foreign exchange asset, assessee was entitled to concessional rate of tax on the interest earned from NR deposits under section 115H read with section 115E.

3.4 Do I need to file ITR even though proper TDS is deducted on my income?

Section 115G – Exemption from the filing of Return of Income ROI not required to be filed if:

(a) Total Income include only investment & LTCG

(b) TDS already deducted

Non-residents not required to file return in India Section 115A(5):

Clause (a) – Dividend and interest

Clause (b) – Royalty & Fees for technical services

(a) TDS deducted as per IT Act

3.5 I am an NRI and have a PIS account with a bank. Is there any provision for TDS on sale transaction of shares for an NRE PIS Account?

- TDS deduction on the PIS will be done by the bank on the profits made

- The tax rate will depend on the period of holding of the investment

- Period < 12m, Tax @ 15%

- Period >= 12m, Tax @ 10%

3.6 Do I need to report my global income while filing ITR in India? Will I get Foreign Tax Credit on the taxes paid in India?

- No, you have to report only Indian income while filing the ITR

- Also, there is no need to report details of Assets and Liabilities in Schedule AL while filing the ITR

- Yes, you will get Foreign Tax Credit on the taxes paid in India

- However, taxation might change in foreign country where taxation is as per Calendar Year and accordingly proportionate credit can be claimed

3.7 Why UAE residents will not pay tax on MF gains

- As per UAE – DTAA Article 13(5) – Other than Shares & Immovable Property all other Capital Gains will be taxed in the state where Seller is Resident

- This will cover capital gains on selling of Mutual Fund Units, Debt fund units, Bonds.

- As MFs units are not shares as per Cos Act/SEBI

- Deputy Commissioner of Income-tax (International Taxation), Kochi v K.E. Faizal [2019] 108 taxmann.com 545 (Cochin – Trib.)

- The same clause is covered in Singapore, Mauritius

- For Switzerland, in case of ITO v Satish Beharilal Raheja [2013] 37 taxmann.com 296 (Mum. – Trib.), held that gains would not be taxable in India as the equity oriented mutual funds are not shares

- Will this will still be applicable when units of AIF sold?

4. Mutual Fund Notional Loss – A Challenge to Indian Investors in US

- Countries like USA tax international MF on unrealised gain

- A resident of USA can be taxed on unrealised gain in Yr1 in COR and Yr3 on realisation in COS

- Issue is about FTC of tax paid in Yr3 in COS

4.1 TDS u/s 195 on Gross or NET?

CIT v Samsung Electronics Co. Ltd. [2009] 185 Taxman 313 (Karn.):

- Held that tax at source must be deducted on the gross sum payable.

- Incorrectly applied the Supreme Court ruling in Transmission Corpn. of AP Ltd., which required obtaining an order under Section 195(2) to determine taxable income in a composite payment.

Supreme Court (GE India Technology Cen (P.) Ltd. v. CIT [2010] 187 Taxman 110 (SC)):

- Corrected the above ruling.

- Held that tax deduction at source should be limited to the portion of income chargeable under the Act that is part of the gross payment to the non-resident.

Bengaluru Tribunal Recent Decisions:

- Syed Aslam Hashmi v ITO [2012] 26 taxmann.com 6 (Bang – Trib.):

- Followed the Karnataka High Court decision in Samsung Electronics.

- Held that tax should be deducted on the whole consideration.

- R. Prakash v ITO [2013] 38 taxmann.com 123 (Bang – Trib.):

- Upheld computation of interest under Section 201(1A) on tax payable on the whole consideration amount, not just the gain.

- Both Bengaluru Tribunal decisions are incorrect in law.

- They did not consider the Supreme Court ruling in GE Technology Cen. P. Ltd., which specifies that tax should be deducted only on the income portion within the payment.

4.2 Can the payer himself determine the amount of tax to be deducted at source?

- If proper details are available, the payer can compute the gain and deduct taxes without approaching the tax officer for an order under Section 195(2).

- The department’s FAQs for QFIs indicate that approaching the tax department is not necessary in every case of deduction under Section 195.

- it is not mandatory that in each and every case, they should obtain 195(2) order before deducting TDS. However, in case a complex issue, it is advisable to do so. This is because the liability to deduct proper taxes remains on the deductor.

- Instruction – 02/2014 -The CBDT has directed AOs u/s 119 that in a case where the assessee fails to deduct TDS u/s 195, the AO cannot treat the whole sum remitted to the non-resident as being chargeable to tax but he has to determine the appropriate proportion of the sum chargeable to tax as mentioned in s. 195(1) for treating the assessee as being in default u/s 201.

- Circular No. – 03/2015 – For the purpose of making disallowance of “other sum chargeable” under sec 40(a)(i), the appropriate portion of the sum which is chargeable to tax shall form the basis of such disallowance.

5. Foreign Exchange Fluctuation Adjustment

- A investor has invested USD (US Dollars) 1,000 at a rate of Rs. 65 per USD in 2015, i.e., Rs. 65,000. If the value of his investment appreciates to Rs. 80,000 by 2022, he would earn

- Rs. 25,000 in Rupee terms on sale of the securities. However, in USD terms, he would not have earned any gain.

| Sr. No. | Particulars | In Rupees |

In USD |

| a. | Cost (at Rs. 65 per USD) | 65,000 | 1,000 |

| b. | Sale consideration (at Rs. 80 per USD) | 80,000 | 1,000 |

| c. | Gain ( b – a ) | 25,000 | Nil |

| d. | Taxable gain as per application of first proviso to Section 48 | Nil |

5.1 Does the tax payer have an option to choose applicability of this provision?

- The Central Board of Direct Taxes (CBDT) has issued a circular at the time of enactment of this provision-3.

- It states that –

“The non-resident Indians who invest in shares and debentures of Indian companies have been representing that due to the fall in the value of the Indian rupee vis-a-vis the foreign currency in which the investment is made by them, they are adversely affected when they sell such shares or debentures. In order to overcome this situation, sub-section (1) of section 48 of the Income-tax Act has been amended …”.

- Provision merely states that capital gain is to be calculated in foreign currency. It does not mention that the conversion is to be done only in case of devaluation of rupee.

| Sr. No. | Particulars | In Rupees |

In USD |

| a. | Cost (at Rs. 65 per USD) | 65,000 | 1,000 |

| b. | Sale consideration (at Rs. 40 per USD) | 80,000 | 2,000 |

| c. | Gain ( b – a ) | 25,000 | 1,000 |

| d. | Gain on account of application of first proviso to Section 48 (USD 1,000 at Rs. 40) | 40,000 | |

| e. | Additional Gain taxable on account of appreciation in value of Rupee ( d – c ) | 15,000 |

- Is this benefit available to shares or debentures gifted or inherited?

- The proviso nowhere mentions any condition for purchase of the shares or debentures, except for the fact that it should be out of utilisation of foreign currency.

- So if the original buyer invests in Forex than the seller should should also get the benefit

- Is proviso applicable if the amount is reinvested?

- The provision states that

“the aforesaid manner of computation of capital gains shall be applicable in respect of capital gains accruing or arising from every reinvestment thereafter …”

- Objective to give benefit of Forex to NRs

- So where initial remitance is from Forex than gain on reinvestment should also be computed as per this proviso

5.2 Whether Lower rate of tax @ 10% available for “foreign currency” securities?

| Case | Authority | Rate |

| Timken France, In re [2007] 164 Taxman 354 (AAR – New Delhi) | AAR |

10% |

| McLeod Russel India Ltd., In re [2008] 168 Taxman 175 (AAR) | AAR | |

| Compagnie Financiere Hamon, In re [2009] 177 Taxman 511 (AAR – New Delhi) | AAR | |

| Alcan Inc. v. DDIT [2008] 110 ITD 15 (Mum.) | ITAT | |

| Cairn UK Holdings Ltd. v. Director of Income-tax [2013] 38 taxmann.com 179 (Delhi) | ITAT | |

| AAR No.950 of 2010 | AAR |

20% |

| Cairn U.K. Holdings Ltd., In re [2011] 12 taxmann.com 266 (AAR – New Delhi) | AAR | |

| BASF Aktiengesselschaft vs. DDIT (293 ITR 1) | ITAT |

6. Investment through AIF

- CAT 1 & 2 AIF are given special pass through status where income will be charged under the same heads of income but in the hands of the Investors

- What tax rates are applicable to the NR investors

- Business income @ MMR in the hands of AIF (if company/firm = 25%/30%)

- When income will be taxed – Accrual or distribution

- What happens when income gets distributed

7. Investment in CAT 3 AIF

- CAT 3 AIF is only fund where Hedging transactions are allowed

- What is difference between CAT 1/2 & 3 AIF

- Income is taxable in the hands of Funds only @ MMR if set up as an Indeterminant trust (if company/firm = 25%/30%)

- Which is the best set up for NR investor to go invest in?

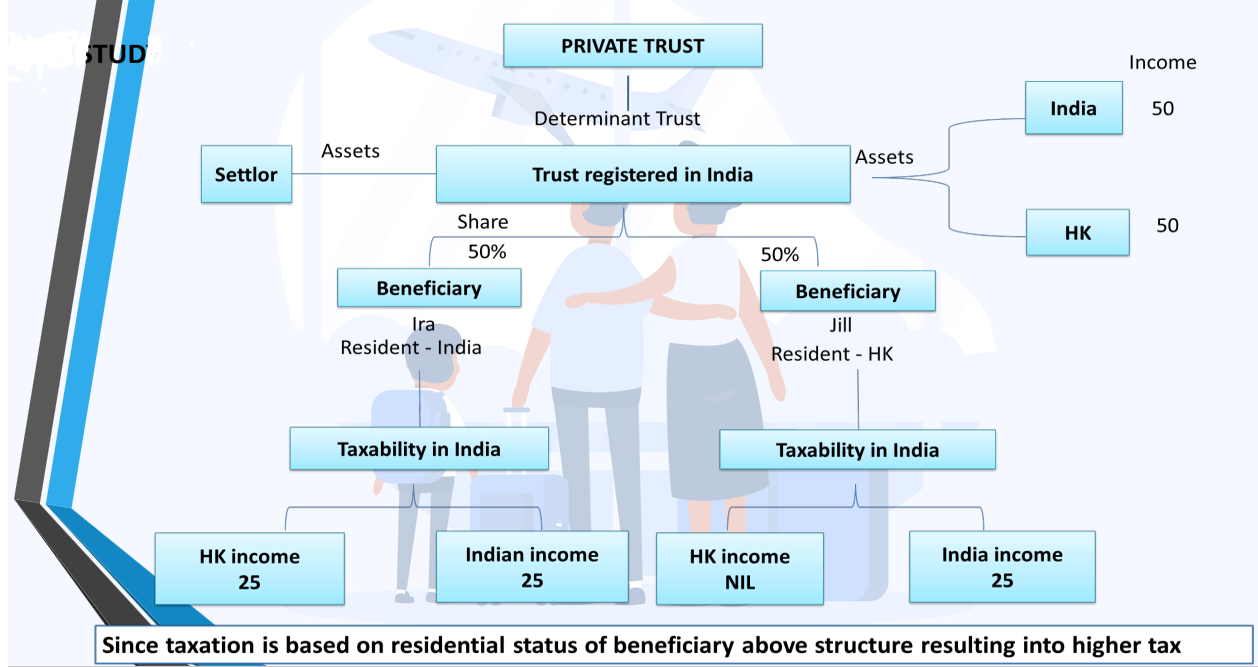

8. Taxability in the Hands of Trust

| Determinate | Discretionary | Foreign | |

| Status of trust | Beneficiary to extent of share | Beneficiary to extent of share | Beneficiary to extent of share |

| If different then status of trustee | |||

| Residential Status | Beneficiary to extent of share | Beneficiary to extent of share If different then status of trustee | Beneficiary to extent of share |

| Taxability in hands of | Trustee or beneficiary | Income distributed – Beneficial/trustee | |

| Income not distributed – Trustee | |||

| Rate of Tax | Normal rate of beneficiary [B&P @ MMR] | MMR |

9. Taxability of Trust

- An HNI NRI family has immovable property & other Investments assets in India which will have Rental-Capital Gains-Dividend Income in India

- How these incomes will be taxed in the hands of the beneficiaries or Trust

- What will be the status of Trust?

- What tax rates are applicable to the income?

- Who will file the ITR?

- When will the Trust model benefit?

10. Case Study

10.1 Will I get benefit of concessional rates for my Indian assets which were acquired when I was NR

- CIT v. N.P. Mathew [2005] 147 TAXMAN 670 (KER.)

- Assessee, a non-resident, deposited money in non-resident account with various banks in India and on his return to India, he claimed concessional rate of tax under section 115H, his claim was to be allowed; there is no merit in contention that in order to get benefit of section 115H assessee should be a non-resident and should have been assessed as such in previous year. (A.Y. 1991-92)

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

CA | CS | CMA

CA | CS | CMA

NRIs investing in India must understand the tax rules on income types like interest, capital gains, and dividends. Tax implications vary based on residency status, holding period, and DTAA benefits.