[Analysis] SEBI Clears Adani in Milestone–Rehvar Probe – Regulatory Lessons from the Hindenburg Fallout

- Blog|News|Advisory|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 26 September, 2025

SEBI has given a clean chit to the Adani Group in the Hindenburg-linked probe involving Milestone Tradelinks and Rehvar Infrastructure. The regulator found that the loans and fund transfers in question did not qualify as related-party transactions under the law applicable at the time, and all were repaid with interest. As a result, SEBI dismissed the allegations of fund diversion or regulatory breach and closed the proceedings. Critics, however, note that the case highlights earlier regulatory blind spots that allowed opaque fund flows, which have since been tightened through amendments.

Table of Contents

1. Introduction

2. Key Parties Involved

3. The Allegations in SEBI’s Show Cause Notice

4. The Real Issue – Hidden Related Party Dealings?

5. Relevant Statutory and Regulatory Provisions

6. SEBI’s Final Order in the Adani–Milestone–Rehvar Case

7. Cases Referred and Their Significance

8. Closing Note

9. Implication of the Order

1. Introduction

On January 24, 2023, a US-based short-seller released a report that rattled India’s financial markets. Within days, over Rs. 10 lakh crores of market value were wiped out from Adani Group companies. The ‘Hindenburg Report’ alleged, among other things, that the Group had used little-known firms like Milestone Tradelinks and Rehvar Infrastructure, to route funds in a way that concealed related party transactions.

This event prompted the Supreme Court of India to intervene, directing SEBI to conduct a thorough and detailed investigation. The allegations sparked one of the most high-profile regulatory investigations in recent years. The SEBI, accordingly, launched a probe into loan and funding transactions carried out between FY 2018–19 and FY 2022–23, covering Adani Ports & SEZ (APSEZ), Adani Power, Adani Enterprises, and key individuals from the Group.

At the heart of the matter was a critical question: Were these financial arrangements legitimate transactions with unrelated parties, or were they carefully designed structures to bypass disclosure norms under SEBI’s Listing Obligations and Disclosure Requirements (LODR) Regulations?

2. Key Parties Involved

The proceedings named the following companies and individuals as noticees in the matter:

| Noticee no. | Name of the Noticee |

| 1 | Adani Ports & Special Economic Zone Limited |

| 2 | Adani Power Limited |

| 3 | Adani Enterprises Limited |

| 4 | Mr. Rajesh Shantilal Adani |

| 5 | Mr. Gautam Shantilal Adani |

| 6 | Mr. Jugeshinder Singh |

| 7 | Milestone Tradelinks Private Limited |

| 8 | Rehvar Infrastructure Private Limited |

3. The Allegations in SEBI’s Show Cause Notice

After an investigation spanning several months, SEBI issued a Show Cause Notice (SCN) in January 2024 to Adani Ports (APSEZ), Adani Power, Adani Enterprises, their senior management, and Milestone and Rehvar. The allegations made are summarised as follows:

-

- Adani Ports (APSEZ) lent large sums to Milestone Tradelinks and Rehvar Infrastructure.

- These conduit firms then advanced the funds onward to Adani Power and Adani Enterprises, and at times to other Adani entities.

- Repayments also cycled back through Milestone and Rehvar to APSEZ, creating a loop.

- The loans were not disclosed as Related Party Transactions (RPTs) despite being, in substance, intra-group dealings.

- Audit Committee and shareholder approvals were allegedly bypassed.

- Key promoters and the Group CFO were accused of approving and facilitating these arrangements.

- Milestone and Rehvar, with negligible net worth, were alleged to be conduit entities used to mask related party flows.

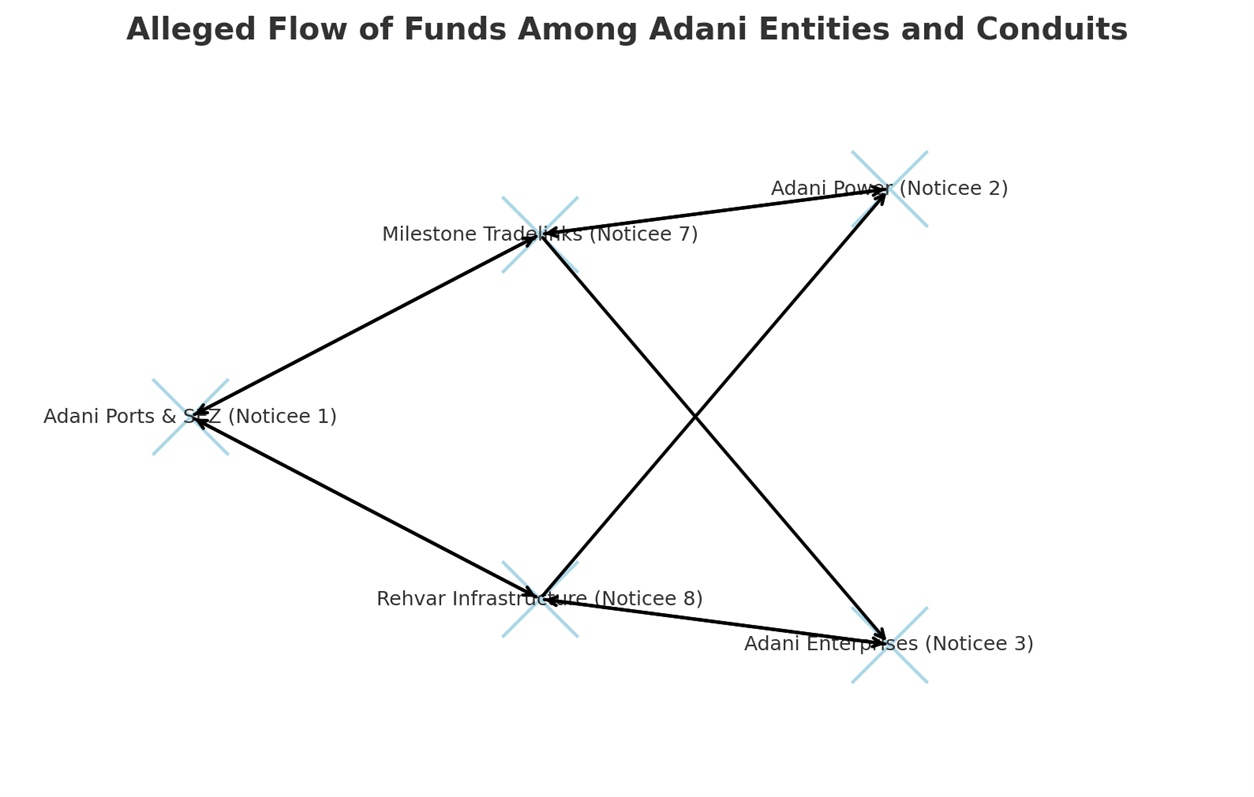

Flow of money is explained through following chart:

The financial data for the key transactions is summarized in the following tables:

Table 1 – Loans Extended by Adani Ports & Special Economic Zone Limited (APSEZ) to Milestone Tradelinks Pvt. Ltd. (MTPL)

| F.Y. | Opening Balance (INR Cr) | Loan Given (INR Cr) | Interest for the Year (INR Cr) | Loan Repaid (INR Cr) | Closing Balance (INR Cr) | Rate of Interest |

| 2018-19 | 547.9 | 7,196.18 | 280.61 | 7,684.40 | 59.68 | 11.75% |

| 2019-20 | 59.68 | 10,434.07 | 129.41 | 10,493.31 | 0.43 | 10.00% |

| 2020-21 | 0.43 | 5,221.53 | 134.15 | 5,221.96 | 0 | 8.00% |

| 2021-22 | 0 | 11,264.63 | 101.03 | 11,264.63 | 0 | 8.00% |

| 2022-23 | 0 | 5,600.00 | 35.56 | 5,600.00 | 0 | 8.00% |

Table 2 – Loans Extended by Adani Ports & Special Economic Zone Limited (APSEZ) to Rehvar Infrastructure Pvt. Ltd. (RIPL)

| F.Y. | Opening Balance (INR Cr) | Loan Given (INR Cr) | Interest for the Year (INR Cr) | Loan Repaid (INR Cr) | Closing Balance (INR Cr) | Rate of Interest |

| 2018-19 | 0 | 468 | 21.16 | 360 | 108 | 10.80% |

| 2019-20 | 108 | 4,711.00 | 182.31 | 4,815.10 | 3.9 | 10.00% |

| 2020-21 | 3.9 | 2,219.50 | 73.31 | 1,971.78 | 251.62 | 8.00% |

| 2021-22 | 251.62 | 4,185.00 | 152.91 | 4,436.62 | 0 | 8.00% |

| 2022-23 | 0 | 5,383.00 | 145.8 | 5,383.00 | 0 | 8.00% |

4. The Real Issue – Hidden Related Party Dealings?

At the core of the case was whether Milestone Tradelinks and Rehvar Infrastructure — though not technically related parties on paper — were in fact functioning as conduits for Adani Group companies. Hindenburg argued the structures masked intra-group financing, placing the burden on Adani to prove the transactions were genuine and not concealed related party dealings.

5. Relevant Statutory and Regulatory Provisions

The final order was passed under the authority of several key legal frameworks governing the Indian securities market. The primary legislation is the Securities and Exchange Board of India Act, 1992 (SEBI Act), under which the order was issued pursuant to sub-sections (1) and (4) of Section 11, sub-section (4A) of Section 11, and sub-sections (1) and (2) of Section 11B. These sections collectively grant SEBI broad powers to protect investors, regulate the securities market, and issue directions to ensure compliance. The SCN also invoked Section 12A of the SEBI Act, which prohibits fraudulent and unfair trade practices, and Section 27, which deals with the vicarious liability of individuals for a company’s violations.

A central focus of the SCN was the alleged circumvention of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (LODR Regulations). The allegations specifically pointed to a violation of Regulation 23, which mandates Audit Committee and shareholder approval for RPTs, and Regulation 34(3), which requires disclosure of such transactions in annual reports. The core of the matter, however, rests on the interpretation of Regulation 2(1)(zc), the definition of “related party transaction”. The SCN alleged that while the transactions were not legally structured as RPTs, they were RPTs in “substance” and should have been disclosed.

The SEBI (Prohibition of Fraudulent and Unfair Trade Practices Relating to Securities Market) Regulations, 2003 (PFUTP Regulations) were also invoked, with the SCN alleging violations of Regulation 3 (prohibition of fraud) and Regulation 4 (prohibition of manipulative, fraudulent, and unfair trade practices). The SCN contended that by using conduit entities to avoid disclosure and approval requirements, the Noticees were engaged in a fraudulent scheme to mislead investors.

6. SEBI’s Final Order in the Adani–Milestone–Rehvar Case

6.1. Fund Flow Through Conduits

The investigation established that Adani Ports and SEZ (APSEZ) advanced substantial loans to Milestone Tradelinks and Rehvar Infrastructure. These sums were, on many occasions, transferred onward on the same day to Adani Power and Adani Enterprises. Repayments of these loans also travelled back through the same route, thereby creating a cycle of fund movement.

While such routing raised concerns regarding the economic substance of the transactions, the SEBI observed that all amounts advanced were repaid during the investigation period, together with applicable interest. Further, the maximum outstanding at any given point was significantly lower than the aggregate figures suggested. On this basis, SEBI did not find diversion or misapplication of funds.

6.2. Non-disclosure of Related Party Transactions

The central issue in the matter concerned the classification of these transactions as related party transactions (RPTs). The SCN alleged that by interposing Milestone and Rehvar, the Adani companies avoided treating them as RPTs and thereby did not seek approval of audit committees or shareholders.

The SEBI examined the regulatory framework applicable during FY 2018–19 to 2022–23. Under the then prevailing provisions of the SEBI (LODR) Regulations, only direct transactions with related parties were required to be classified and disclosed. The wider definition covering indirect transactions, including routing through unrelated parties, became effective only from April 1, 2023.

Accordingly, the SEBI held that the transactions under review could not be retrospectively brought within the ambit of RPTs. The principle of “substance over form” could not override the explicit scope of the regulation as it then stood. Consequently, the charge of non-disclosure and non-obtaining of approvals did not sustain.

6.3. Audit Committee and Shareholder Approval

The SCN alleged that the structuring enabled avoidance of approvals. SEBI observed that since the transactions were not RPTs under the law during the relevant period, the consequential requirement for approvals was not triggered. The allegation was therefore not sustainable.

6.4. Role of Promoters and CFO

Promoters Gautam Adani and Rajesh Adani, as well as Group CFO Jugeshinder Singh, were alleged to have knowingly approved and facilitated the fund flows, while certifying financial statements that did not classify the transactions as RPTs.

The SEBI noted that directors and KMPs can be held vicariously liable only where the company itself has committed a contravention. In the absence of an underlying violation, personal liability could not be fastened. Further, the SEBI observed that financial statements had disclosed the loans as borrowings and lendings; the dispute was limited to classification, which was governed by the law at that time.

6.5. Conduit Entities – Milestone and Rehvar

It was alleged that Milestone and Rehvar were merely conduits, with no meaningful financial capacity, and that they enabled the circumvention of disclosure norms.

SEBI acknowledged their limited net worth and the fact that their profits arose largely from Adani-linked loans. However, SEBI also noted that all transactions were contractually documented, carried interest, and were duly repaid. Low net worth or business dependence alone was not sufficient to conclude that they were sham entities. Accordingly, no violation was established against them.

6.6. Fraud and PFUTP Regulations

The SCN further alleged that the structure amounted to a fraudulent device under the SEBI Act and the PFUTP Regulations.

SEBI reiterated that for fraud to be established, there must be intent to mislead investors or to manipulate securities. In the present case, all loans were repaid with interest, no funds were siphoned, and no evidence was led to show that investors were induced to trade in the securities of the Adani companies based on these transactions.

In the absence of investor harm or market manipulation, SEBI concluded that the elements of fraud were not established, and the PFUTP allegations did not stand.

6.7. Allegations Regarding Avoidance of Shareholder Knowledge

It was alleged that the structuring allowed one group company with weaker financial health to borrow from another with stronger credit without the knowledge of the shareholders. The SEBI noted this concern but reiterated that without the legal classification of these transactions as RPTs, there was no requirement under law to seek shareholder approval or disclosure during the period under review.

7. Cases Referred and Their Significance

The SEBI order, in its analysis, engages with several key legal precedents that directly shaped its final determination.

The Noticees successfully leveraged the principle established in the Supreme Court case of Vodafone International Holdings B.V. vs. Union of India. This case is a landmark in Indian law for its emphasis on the “plain language” principle, which holds that if the legal provisions are clear, regulatory bodies cannot invoke the doctrine of “substance over form” to interpret a transaction in a manner that contradicts the law’s literal meaning. The Noticees argued that since the pre-amendment LODR Regulations did not explicitly cover indirect transactions with an unrelated party, SEBI could not retroactively apply a broader interpretation.

The most impactful legal development referenced in the order is the Supreme Court’s judgment in the matter of Vishal Tiwari vs. Union of India, which followed the recommendations of an expert committee. The expert committee, after a detailed briefing from SEBI, found that the 2021 amendments to the LODR Regulations were a substantive, prospective change and that there was no regulatory failure on SEBI’s part in giving them a deferred effective date. The Supreme Court accepted these findings and explicitly rejected the petitioners’ plea to revoke the amendments, holding that SEBI’s procedure was not tainted by any illegality. This judicial validation of SEBI’s legislative process provides a powerful legal basis for the regulator’s conclusion that the pre-amendment law did not cover the transactions in question. It also confirms that since SEBI chose to apply the new definition prospectively, it would be legally impermissible to apply it to past transactions.

Furthermore, the Noticees cited other relevant judicial pronouncements, such as Sedco Forex International Drill Inc. & Ors. vs. Commissioner of Income Tax Dehrardun and Another and Virtual Soft Systems Ltd. vs. Commission of Income Tax, Delhi, to buttress their argument against the retrospective application of substantive regulations. They also referred to a past SEBI order in

ITC vs. SEBI, where SEBI itself had previously argued that a transaction with a third party could not be classified as a related party transaction. This consistency in legal interpretation, both from the judiciary and from SEBI itself in earlier cases, served to reinforce the Noticees’ position.

8. Closing Note

SEBI’s order makes two points stand out clearly.

First, the transactions routed through Milestone and Rehvar certainly gave the appearance of related party dealings, and the optics were far from ideal. However, under the regulatory framework in force between FY 2018–19 and FY 2022–23, only direct related party transactions required disclosure. The wider definition which would have covered such routing became effective only from April 2023.

Second, while the fund flows raised questions on governance, SEBI found no diversion of money, no investor harm, and no evidence of market manipulation. All loans were repaid with interest, and therefore, the allegations of fraud or unfair trade practice could not be sustained.

Put simply, it appears that the Adani Group may not have faced liability earlier as the rules at that time were limited. However, under the current framework, such structures are more likely to fall within the scope of disclosure, and regulators may adopt a stricter approach.

9. Implication of the Order

The broader implications of this order are significant for both regulatory consistency and corporate governance in India. The ruling validates SEBI’s own regulatory process and its alignment with the directives of the Supreme Court, creating a clear and consistent legal precedent for how future regulatory changes will be interpreted. The final order removes the regulatory uncertainty that has persisted since the Hindenburg report was published in January 2023, as reflected in the positive market reaction to the news. By definitively closing the proceedings without any findings of liability, SEBI has provided a clear and conclusive end to this chapter, re-affirming its role as a principled and evidence-based regulator.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA