The Apprentices Act, 1961

- Blog|Indian Acts|

- 4 Min Read

- By Taxmann

- |

- Last Updated on 10 May, 2022

1. Definition of Apprentices Act

An Act to provide for the regulation and control of training of apprentices and for matters connected therewith.

2. Purpose of Apprentices Act 1961

The main purpose of the Act is to provide practical training to technically qualified persons in various trades. The objective is promotion of new skilled manpower. The scheme is also extended to engineers and diploma holders. The Act has got added importance in view of thrust of present Government on training and employment generation. The slogan of Modi Government is ‘Seekho Hunar, Bano Honhaar’. The intention is to make India the Skill Capital of the world. ‘Make in India’. As per basic scheme of the Apprentices Act, every employer is required to provide training to apprentice [section 8 of the Act]. The appointment of apprentices may be for designated trade or optional trades. In addition to designated trade, an employer is free to have ‘optional trades’. He himself can design syllabus for such optional trades.

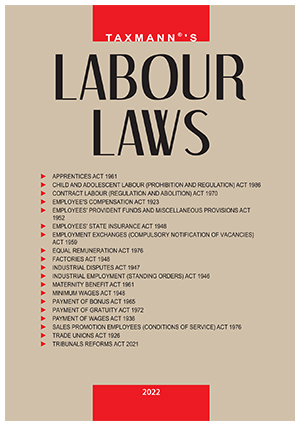

This book provides the complete code on the Laws governing the following:

· Labour,

· Wages, and

· Industrial Disputes in India

This book also includes a guide [short-commentary] on the labour laws to get an insight into the impact of new labour laws.

The Present Publication is the Latest Edition incorporating 19 up-to date Acts. The Book has been divided into 3 divisions as under:

· Guide to Labour Laws [Commentary]

· Labour Laws, which includes the following:

o Apprentices Act, 1961

o Child and Adolescent Labour (Prohibition and Regulation) Act, 1986

o Contract Labour (Regulation and Abolition) Act, 1971

o Employee’s Compensation Act, 1923

o Employees’ Provident Funds and Miscellaneous Provisions Act, 1952

o Employees’ State Insurance Act, 1948

o Employment Exchanges (Compulsory Notification of Vacancies) Act, 1959

o Equal Remuneration Act, 1976*

o Factories Act, 1948

o Industrial Disputes Act, 1947

o Industrial Employment (Standing Orders) Act, 1946

o Industrial Tribunals

o Labour Laws (Simplification of Procedure for Furnishing Returns and Maintaining Registers by Certain Establishments) Act, 1988

o Maternity Benefit Act, 1961

o Minimum Wages Act, 1948*

o Payment of Bonus Act, 1965*

o Payment of Gratuity Act, 1972

o Payment of Wages Act, 1936*

o Sales, Promotion Employees (Condition of Service) Act, 1976

o Trade Unions Act, 1926

· Codes on Wages, 2019

o Code on Wages, 2019

* Shall be repealed by Code on Wages, 2019 with effect from a date yet to be notified.

The scheme is applicable to engineering, non-engineering, technology or any vocational course. The employer is required to provide training facilities to apprentices. Multiple employers to come together, either themselves or through an approved agency to provide apprenticeship training to apprentices under them. Thus, the facilities of training apprentices in theoretical subjects can be shared among employers. The employer is required to pay minimum stipend to apprentice.

In some cases, burden of part of stipend is borne by Government. The number of apprentices to be trained will be on the basis of number of workers employed in that industry, directly or indirectly (i.e. direct employment or through contractor). The period of training for each designated trade has been specified.

The apprentice should have specified educational qualification and minimum physical fitness as specified. Employer is required to enter into Apprenticeship Contract with Apprentice. The contract is required to be registered with Apprenticeship Adviser. Hours of work and leave of apprentices will be as per the discretion or policy of the employer. A portal site is being developed to use Information Technology to file Apprenticeship Contract, periodic returns, etc.

The employer is liable for compensation in case of injury to the Apprentice, as per provisions of Employee’s Compensation Act. Labour laws like ESI, PF, Minimum Wages Act, Industrial Disputes Act etc. are not applicable to the apprentices. However, health, safety and welfare regulations as contained in Factories Act, Mines Act etc. Are applicable in respect of apprentices also. After the training, the trade apprentice may appear for the test (on optional basis) conducted by National Council. The employer is not bound to offer employment to the trainees after their training period is over, but can have its own policy for recruiting apprentices who have completed the apprenticeship training.

It is not mandatory to offer employment to the apprentices after training. Central Government shall be ‘Appropriate Government’ for

-

- Establishments which are operating business or trade from locations situated in four or more States

- Establishments owned, controlled or managed by Central Government

- Public Sector Companies owned by Central Government.

In other cases, State Government will be the ‘Appropriate Government’.

3. Amendments made to Apprentices Act in 2014

Major amendments have been made in December 2014 in the Apprentices Act. The Amendment Act has received assent of President on 5-12-2014. The major amendments are as follows:

-

- Non-engineering areas covered under the provisions of Apprentices Act.

- Employer allowed to provide for ‘optional trades’. He can design his own syllabus for that purpose.

- Multiple employers can join either themselves or through an agency to provide apprentices training.

- Hours of work and leave will be as per the discretion or policy of the employer.

- If employer is employing 500 or more workers, he is required to make provisions of basic training to those who had not undergone any institutional training. In other cases, the basic training will be provided by institution having adequate facilities.

- Details are to be filed electronically on ‘portal site’ to be developed.

- Punishment for offences will be fine (no imprisonment).

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA