What is GST? Goods And Services Tax Explained With Benefits

- Blog|GST & Customs|

- 4 Min Read

- By Taxmann

- |

- Last Updated on 28 November, 2023

Goods And Services Tax:

GST (Goods and Services Tax) is the biggest indirect tax reform of India. GST is a single tax on the supply of goods and services. It is a destination based tax. GST will subsume Central Excise Law, Service Tax Law, VAT, Entry Tax, Octroi, etc.

Importance of GST in Indian Economy:

GST Regime:

GST is one of the biggest indirect tax reforms in the country. GST is expected to bring together state economies and improve overall economic growth of the nation.

GST is a comprehensive indirect tax levy on manufacture, sale and consumption of goods as well as services at the national level. It will replace all indirect taxes levied on goods and services by states and Central.

There are around 160 countries in the world that have GST in place. GST is a destination based taxed where the tax is collected by the State where goods are consumed. India is going to implement the GST from July 1, 2017 and it has adopted the Dual GST model in which both States and Central levies tax on Goods or Services or both.

SGST – State GST, collected by the State Govt.

CGST – Central GST, collected by the Central Govt.

IGST – Integrated GST, collected by the Central Govt.

GST Made Easy provides an Updated, Comprehensive & Simplified Analysis of each provision of the GST Law. The objective behind this book is that the understanding of GST should be as easy as ABC. This book provides answers to all your practical queries on GST.

Need for GST in India:

Introduction of GST is considered to be a significant step in the reform of indirect taxation in India. Amalgamating of various Central and State taxes into a single tax would help mitigate the double taxation, cascading, multiplicity of taxes, classification issues, taxable event, and etc., and leading to a common national market.

VAT rates and regulations differ from state to state. On the other hand, GST brings in uniform tax system across all the states. Here, the taxes would be divided between the Central and State government.

Browse GST Articles by Topic:

Benefits of GST:

|

To trade |

To Consumers |

|

|

· Reduction in multiplicity of taxes |

· Simpler Tax system

|

· Create unified common national market for India, giving a boost to Foreign investment and “Make in India” campaign |

|

· Mitigation of cascading/ double taxation

|

· Reduction in prices of goods & services due to elimination of cascading |

· Boost export and manufacturing activity and leading to substantive economic growth |

|

· More efficient neutralization of taxes especially for exports |

· Uniform prices throughout the country |

· Help in poverty eradication by generating more employment |

|

· Development of common national market |

· Transparency in taxation system |

· Uniform SGST and IGST rates to reduce the incentive for tax evasion |

|

· Simpler tax regime |

· Increase in employment opportunities |

|

|

· Fewer rates and exemptions |

|

|

|

· Distinction between Goods & Services no longer required |

|

|

Other Benefits of Goods And Services Tax:

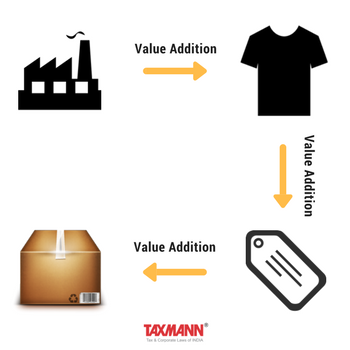

. Will prevent cascading of taxes as Input Tax Credit will be available across goods and services at every stage of supply.

·Harmonization of laws, procedures and rates of tax.

·More efficient neutralization of taxes especially for exports thereby making our products more competitive in the international market and give a boost to Indian Exports.

·Improve the overall investment climate in the country which will naturally benefit the development in the states.

·Average tax burden on companies is likely to come down which is expected to reduce prices and lower prices mean more consumption, which in turn means more production thereby helping in the growth of the industries. This will create India as a “Manufacturing hub”.

·Will improve the environment of compliance as all returns to be filed online, input credits to be verified online, encouraging more paper trail of transactions.

·Common procedures for registration of taxpayers, refund of taxes, uniform formats of tax return, common tax base, common system of classification of goods and services will lend greater certainty to taxation system.

·Timelines to be provided for important activities like obtaining registration, refunds, etc.

·GST will be beneficial with more transparency, efficient compliance, ramp up in GDP growth to the Centre, states, industrialists, manufacturers, the common man and the country at large.

Conclusion

GST will bring in transparent and corruption-free tax administration, removing the current shortcomings in the indirect tax structure. GST is business-friendly as well as consumer-friendly.GST in India is poised to drastically improve the positions of each of these stakeholders.We need a change in the taxation system which is better than earlier taxation. This need for change leads us to ‘need for GST’.

GST will allow India to better negotiate its terms in the international trade forums.GST aimed at increasing the taxpayer base by bringing SMEs and the unorganized sector under its compliance. This will make the Indian market more stable than before and Indian companies can compete with foreign companies.

Author Bio: CA Vishal Raheja is a writer and editor for GST Research and Development Department of Taxmann. He is also alumni of Shree Ram College of Commerce and qualified UGC-NET

Related Articles:

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

Comments are closed.