CSEET Business Communication Prep Guide – Syllabus and Study Tips

- CSEET|CS|Exam|

- 3 Min Read

- By Taxmann

- |

- Last Updated on 5 June, 2025

Starting your CSEET journey? Paper 1—Business Communication—might seem tricky at first, especially if you're new to formal English or business writing. But don’t worry—this article breaks down the subject into manageable parts, from understanding the syllabus and mastering grammar to practicing real exam questions.

Table of Contents

- Introduction

- Know What Paper 1 Is All About

- Begin with the Official Syllabus & Study Material

- Focus on Grammar, Vocabulary, and Business Language

- Learn by Example – Practice Business Writing Formats

- Incorporate Daily Practice for Communication-Based Questions

- Learn Business Jargon Smartly

- Track Your Progress Through Solved Papers

- Use a Rapid Reviser for the Final Week

- Conclusion

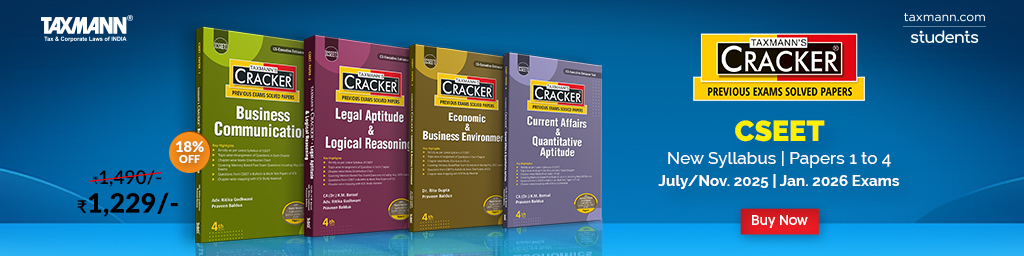

Check out Taxmann's Business Communication (Paper 1) | CRACKER which is a comprehensive study companion for CSEET Paper 1, applicable to July/Nov. 2025 & Jan. 2026 exams. Authored by Adv. Ritika Godhwani and Praveen Baldua strictly adhere to the latest syllabus, featuring topic-wise questions, memory-based papers (up to May 2025), and a handy Rapid Reviser. The book's chapter-wise marks distribution chart, alignment with ICSI study material, and coverage of e-bulletins & mock tests support thorough and targeted exam preparation. Combined with practice-oriented content and suggested answers, it is a one-stop solution for mastering Business Communication.

1. Introduction

Starting your CSEET preparation can feel overwhelming—especially with subjects like Business Communication, which demand both conceptual clarity and language accuracy. But with the right roadmap, resources, and consistent practice, even beginners can master this subject. Whether you’re from a commerce background or not, this guide will help you lay a strong foundation for CSEET Paper 1.

2. Know What Paper 1 Is All About

CSEET Paper 1 – Business Communication tests your understanding of English language skills in a corporate context. It includes grammar, business correspondence formats, communication models, and common business terminologies.

This paper is objective in nature and includes MCQs (Multiple Choice Questions) based on:

- Grammar rules

- Vocabulary

- Business writing

- Practical communication skills

3. Begin with the Official Syllabus & Study Material

The ICSI has clearly outlined the CSEET Business Communication syllabus, which includes four core chapters:

- Essentials of Good English

- Communication

- Business Correspondence

- Common Business Terminologies

Start with these chapters using ICSI’s official study material or reliable resources like Taxmann’s CRACKER for Business Communication, which follows the latest 2024–25 syllabus and includes additional tools like:

- Topic-wise questions

- Chapter-wise marks distribution

- Rapid Reviser for quick prep

4. Focus on Grammar, Vocabulary, and Business Language

If you’re a beginner, Essentials of Good English is where your journey begins. Focus on:

- Parts of speech (nouns, verbs, adjectives)

- Sentence structure and correction

- Tenses, articles, and punctuation

- Synonyms, antonyms, and idiomatic usage

You can also use CSEET mock tests or online grammar quizzes to strengthen your basics.

5. Learn by Example – Practice Business Writing Formats

Next, move to Business Correspondence, which includes the structure and language of:

- Business letters (inquiry, complaint, order, etc.)

- Emails and memos

- Notices, reports, and circulars

Understand the tone, structure, and purpose of each format. The CRACKER book by Taxmann includes sample formats, memory-based questions from previous exams, and suggested answers to help you build confidence.

6. Incorporate Daily Practice for Communication-Based Questions

The Communication chapter covers:

- Verbal vs non-verbal communication

- Listening skills

- Barriers to effective communication

- Communication cycle

Use visual examples and charts to understand these concepts. Solve MCQs at the end of each sub-topic to reinforce your understanding.

7. Learn Business Jargon Smartly

The last chapter on Common Business Terminologies includes frequently used terms in corporate and legal settings. Build flashcards or quick notes for these, and revise regularly.

8. Track Your Progress Through Solved Papers

Solving memory-based questions from the last few years (especially May 2025) will help you:

- Familiarise yourself with exam-level questions

- Learn how questions are framed

- Identify which topics are repeatedly asked

Taxmann’s CRACKER includes all of these with suggested answers and explanations.

9. Use a Rapid Reviser for the Final Week

Closer to your exam date, use a Rapid Reviser section to brush up key grammar rules, formats, definitions, and business terms. Avoid starting new topics; instead, strengthen what you already know.

10. Conclusion

CSEET Business Communication is not just about English—it’s about understanding how communication works in the corporate world. With a structured approach, regular revision, and a reliable practice tool like CRACKER, you can build both confidence and command over the subject.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA