Certified Management Accountant (CMA) – New Syllabus

- Exam|CMA|

- 5 Min Read

- By Taxmann

- |

- Last Updated on 26 December, 2023

The Institute of Cost Accountants of India (ICMAI) is a statutory professional body established by a special act of Parliament – the Cost and Works Accountants Act, 1959, with the objects of promoting, regulating and developing the profession of Cost and Management Accountancy.

Cost Accountancy is one of the much in-demand professional qualifications in the country. A Cost Accountant is a person who offers to perform or performs services involving the costing or pricing of goods and services or the preparation, verification or certification of cost accounting and related statements, among other things.

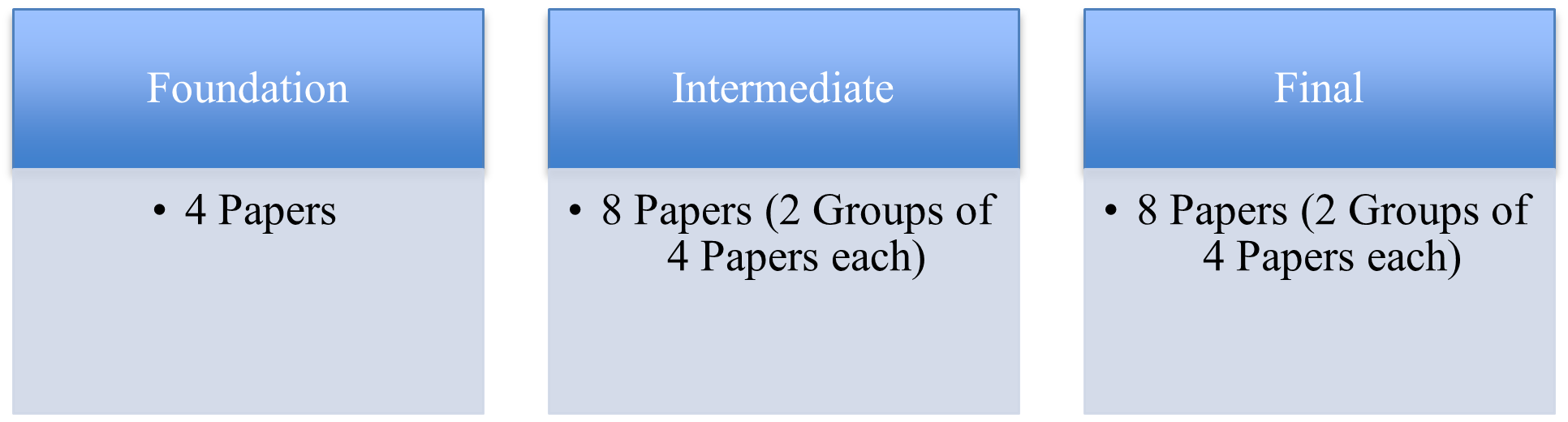

In order to complete the Cost and Management Accountancy (CMA) Course, candidates are required to clear the CMA examinations conducted by the Institute of Cost Accountants of India (ICMAI) in three stages – Foundation, Intermediate and Final besides successfully completing the necessary trainings.

ICMAI introduced the New Syllabus 2022 for Foundation, Intermediate and Final Course, which shall be effective from June 2023 term of examinations and onwards. It must be noted that the Syllabus 2016 shall be continued till December 2023 Exam term.

Old students seeking conversion into New Syllabus 2022 shall be given a one-time option to be exercised at least 6 months prior to examination for necessary verification and approval.

Check Out Taxmann's Direct Taxes Law & Practice which is a 'go-to-guide' for Students & Professional Practitioners for over 40 years. This book aims to make the reader understand the Law and develop the ability to apply the Law. This book will be helpful for students appearing in CA, CS, ICWA, M.Com., LL.B., and MBA examinations. It will also be helpful for those appearing in the income-tax departmental examination.

Some of the major changes in the CMA New Syllabus 2022 include changes in the subjects of the Papers; where some papers have been merged and some removed with majority being change in only the sequence of Papers. However, the ultimate number of Papers at different levels of CMA course as presented remain the same.

Following are the changes in Papers at different levels as introduced by the New Syllabus 2022:

| CMA Level | Changes in Papers |

| Foundation |

|

| Intermediate |

|

| Final |

|

Below are the complete details of the Papers covered at different levels:

| Sr. No. | CMA Course Level | Papers | Marks Per Paper |

| 1. | Foundation (4 Papers) | Paper 1: Fundamentals of Business Laws and Business Communication

Paper 2: Fundamentals of Financial and Cost Accounting Paper 3: Fundamentals of Business Mathematics and Statistics Paper 4: Fundamentals of Business Economics and Management |

100 Marks

100 Marks

100 Marks

100 Marks

Total: 400 marks |

| 2. | Intermediate

(2 Groups of 4 Papers each) |

Group 1

Paper 5: Business Laws and Ethics Paper 6: Financial Accounting Paper 7: Direct and Indirect Taxation Paper 8: Cost Accounting

Group II: Paper 9: Operations Management & Strategic Management Paper 10: Corporate Accounting and Auditing Paper 11: Financial Management and Business Data Analytics Paper 12: Management Accounting

|

100 Marks

100 Marks

100 Marks 100 Marks Total: 400 marks

100 Marks

100 Marks

100 Marks

100 Marks Total: 400 Marks |

| 3. | Final (2 Groups of 4 Papers each) | Group III:

Paper 13: Corporate and Economic Laws Paper 14: Strategic Financial Management Paper 15: Direct Tax Laws and International Taxation Paper 16: Strategic Cost Management

Group IV: Paper 17: Cost and Management Audit Paper 18: Corporate Financial Reporting Paper 19: Indirect Tax Laws and Practice Paper 20: Elective (Any one) 20A: Strategic Performance Management and Business Valuation 20B: Risk Management in Banking and Insurance 20C: Entrepreneurship and Start Up

|

100 Marks

100 Marks

100 Marks

100 Marks Total: 400 Marks

100 Marks

100 Marks

100 Marks

Total: 400 Marks |

The students are required to complete their Skills Training, Practical Training and Industry Oriented Training Program (IOTP) as usual. The details on each of the trainings are as follows:

| Skills Training | ‘Skills Training’ is designed to provide students with the targeted training they need to gain the knowledge and abilities necessary to fulfil the specific requirements of their job positions.

‘Skills Training’ comprises of following modules which are designed to be accessed and completed via online mode as and when conducted by ICMAI in different batches round the year:

In all, it is a 140-hours training which is required to be completed along with the assessment test in order to be eligible to appear for Intermediate examination. |

| Practical Training | An important feature of the CMA curriculum is the compulsory practical training of minimum 15 months out of a total training period of 3 years, which helps the students to appreciate the underlying practical applications of the theoretical education scheme.

This practical training is helpful in developing and nourishing a pool of future-ready professionals to ensure that students have an opportunity to acquire on-the-job work experience of a professional nature. |

| IOTP | Industry Oriented Training Program (IOTP) is a 7-days training program which a candidate is required to compulsorily complete after registering for CMA Final course and before filling up the form for Final Examination.

It will cover training on compliance requirements and their preparation under various statutes. |

For more information about CMA New Syllabus, click on https://icmai.in/studentswebsite/News_Updates.php.

Thus, the new syllabus introduced by ICMAI emphasized mainly on building global ready CMAs. It is robust, industry relevant and aligned with global trends.

Taxmann Academy presents:

Tax and Accounts Professional (TAP) Course!

Enrol in the Foundation Level of TAP course and get practical training in book-keeping, Income-tax returns, GST returns, TDS returns, Payroll, MS-Office, Labour Laws, and much more.

𝐉𝐨𝐢𝐧 𝐭𝐡𝐞 𝐓𝐚𝐱𝐦𝐚𝐧𝐧 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 𝐍𝐨𝐰!

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied