Guide to applicability of Section 194R to discounts, rebates, gifts, incentives & cashbacks

- Blog|Income Tax|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 5 August, 2022

FAQ 1. Whether sales discount, cash discount, rebates, gifts, incentives to buyers/customers are benefit or perquisite for the purposes of Section 194R?

The following points emerge from CBDT’s clarification in its Circular No.12/2022, dated 16.06.2022:

-

- No tax is required to be deducted under section 194R of the Act on sales discount, cash discount and rebates allowed to customers.

- Where a seller is selling its items from its stock in trade to a buyer and the seller offers two items free with purchase of 10 items, there would be no benefit or perquisite and no tax is to be deducted under section 194R since this is in substance selling items at a discount. The seller offers two items free with purchase of 10 items. In substance, the seller is actually selling 12 items at a price of 10 items. Let us assume that the price of each item is ` 12. In such a case, in substance, seller is selling 12 items at a discounted price of ` 10 per item. Therefore, this is discount/rebate and will not attract TDS under section 194R.

- The above relaxation will not apply when a person gives incentives (other than discount, rebate) in the form of cash or kind such as car, TV, computers, gold coin, mobile phone etc. In other words, additional free items of the same item which is sold will be treated as discount.

- If different item is given away free with item sold and the item given away free is from stock-in-trade of seller, TDS u/s 194R is not applicable. If item given away free by seller to buyer is not from his stock-in-trade or any cash incentive is given by seller to buyer, TDS u/s 194R is applicable.

CBDT’s response to Question 4 in CBDT’s Circular No.12/2022, dated 16.06.2022, is reproduced hereunder for ready reference.

Question. Whether sales discount, cash discount and rebates are benefit or perquisite?

Sales discounts, cash discount or rebates allowed to customers from the listed retail price represent lesser realization of the sale price itself. To that extent, purchase price of customer is also reduced.

Logically these are also benefits though related to sales/purchase. Since TDS under section 194R of the Act is applicable on all forms of benefit/perquisite, tax is required to be deducted. However, it is seen that subjecting these to tax deduction would put seller to difficulty. To remove such difficulty, it is clarified that no tax is required to be deducted under section 194R of the Act on sales discount, cash discount and rebates allowed to customers.

There could be another situation, where a seller is selling its items from its stock in trade to a buyer. The seller offers two items free with purchase of 10 items. In substance, the seller is actually selling 12 items at a price of 10 items. Let us assume that the price of each item is ` 12. In this case, the selling price for the seller would be ` 120 for 12 items. For buyer, he has purchased 12 items at a price of 10. Just like seller, the purchase price for the buyer is ` 120 for 12 items and he is expected to record so in his books. In such a situation, again there could be difficulty in applying section 194R provision. Hence, to remove difficulty it is clarified that on the above facts no tax is required to be deducted under section 194R of the Act. It is clarified that situation is different when free samples are given and the above relaxation would not apply to a situation of free samples.

Similarly, this relaxation should not be extended to other benefits provided by the seller in connection with its sale. To illustrate, the following are some of the examples of benefits/perquisites on which tax is required to be deducted under section 194R of the Act (the list is not exhaustive):

-

- When a person gives incentives (other than discount, rebate) in the form of cash or kind such as car, TV, computers, gold coin, mobile phone etc.

- When a person sponsors a trip for the recipient and his/her relatives upon achieving certain targets

- When a person provides free ticket for an event

- When a person gives medicine samples free to medical practitioners.

The above examples are only illustrative. The relaxation provided from non-deduction of tax for sales discount and rebate is only on those items and should not be extended to others.

It is further clarified that these benefits/perquisites may be used by owner/director/employee of the recipient entity or their relatives who in their individual capacity may not be carrying on business or exercising a profession. However, the tax is required to be deducted by the person in the name of recipient entity since the usage by owner/director/employee/relative is by virtue of their relation with the recipient entity and in substance the benefit/perquisite has been provided by the person to the recipient entity.

To illustrate, the free medicine sample may be provided by a company to a doctor who is an employee of a hospital. The TDS under section 194R of the Act is required to be deducted by the company in the hands of hospital as the benefit/perquisite is provided to the doctor on account of him being the employee of the hospital. Thus, in substance, the benefit/perquisite is provided to the hospital. The hospital may subsequently treat this benefit/perquisite as the perquisite given to its employees (if the person who used it is his employee) under section 17 of the Act and deduct tax under section 192 of the Act. In such a case it would be first taxable in the hands of the hospital and then allowed as deduction as salary expenditure.

Thus, ultimately the amount would get taxed in the hands of the employee and not in the hands of the hospital. Hospital can get credit of tax deducted under section 194R of the Act by furnishing its tax return. It is further clarified that the threshold of twenty thousand rupees in the second proviso to sub-section (1) of section 194R of the Act is also required to be seen with respect to the recipient entity. Similarly, the tax is required to be deducted under section 194R of the Act if the benefit or perquisite is provided to a doctor who is working as a consultant in the hospital. In this case the benefit or perquisite provider may deduct tax under section 194R of the Act with hospital as recipient and then hospital may again deduct tax under section 194R of the Act for providing the same benefit or perquisite to the consultant. To remove difficulty, as an alternative, the original benefit or perquisite provider may directly deduct tax under section 194R of the Act in the case of the consultant as a recipient. The provision of section 194R of the Act shall not apply if the benefit or perquisite is being provided to a Government entity, like Government hospital, not carrying on business or profession.

FAQ 2. Whether incentives to buyer in the form of free items other than items from his stock-in-trade or cash incentives will attract TDS under section 194R?

In response to Question No.4 in Circular 12/2022, dated 16.06.2022, CBDT has clarified that

“The provision of section 194R of the Act shall not apply if the benefit or perquisite is being provided to a Government entity, like Government hospital, not carrying on business or profession.”

Thus, the question of section 194R does not arise if the resident recipient is not carrying on any business or exercising a profession.

The second paragraph of CBDT’s Circular 12/2022, dated 16.06.2022 clarifies as under:

“The new section mandates a person, who is responsible for providing any benefit or perquisite to resident, to deduct tax at source @ 10 % of the value or aggregate of value of such benefit or perquisite, before providing such benefit or perquisite. The benefit or perquisite may or may not be convertible into money but should arise either from carrying out of business, or from exercising a profession, by such resident.”

The position that emerges from second paragraph of CBDT’s Circular No. 12/2022 and response to Question 4 of the Circular, is as under:

(a) CBDT in its reply to Question No.4 as above has clarified that

“The provision of section 194R of the Act shall not apply if the benefit or perquisite is being provided to a Government entity, like Government hospital, not carrying on business or profession.”

Further, CBDT has clarified that section 194R is not attracted in case of employee doctors of the hospital. TDS under section 192 is attracted on benefits/perquisites to employee doctors.TDS under section 194R is attracted only in respect of benefits/perquisites to consultant doctors. It follows that if a resident customer is not carrying on any business or profession, such gift cannot be said to be a benefit or perquisite arising from business or exercising of a profession by the resident recipient. Clearly, the gift here has a nexus only with the business or profession of the provider, not of the resident recipient. Here, obviously, there is no question of any nexus with the business or profession of the resident recipient as he is not carrying on any business or profession. Hence, there is no question of TDS under section 194R.

(b) In the opening paragraph of Circular No. 12/2022, CBDT has clarified that

“The benefit or perquisite may or may not be convertible into money but should arise either from carrying out of business, or from exercising a profession, by such resident.”

Thus, in order to attract section 194R, the perquisite or benefit must have nexus to the business or profession of the resident recipient. If such purchases by customers are in connection with personal purchases as distinct from purchases for their business or profession, there is no question of TDS under 194R. Clearly, the gift here has a nexus only with the business or profession of the provider. The gift in this case has no nexus with the business or profession of the resident recipient. The resident recipient here would have received the gifts qua customer or buyer whether or not he was carrying on any business or profession. As such, there is no question of TDS under section 194R in this case also.

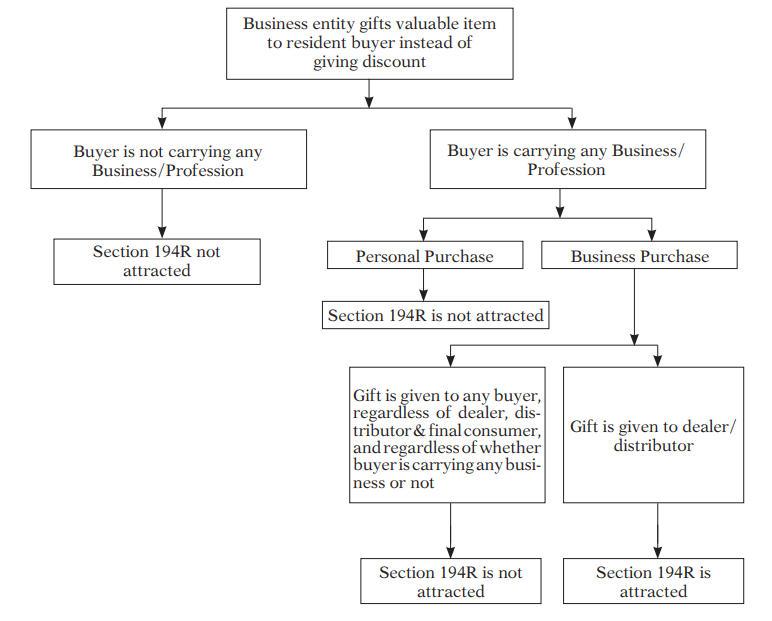

(c) If such gifts are in connection with business/professional purchases of customers, a question would certainly arise if such gift is ‘benefit or perquisite arising from business or profession’. The following will be the position in such a case:

-

- If the gifts are offered to any buyer, whether he is carrying on any business/profession or not and regardless of whether he is dealer or distributor or final consumer, then the gift cannot be said to be arising from the exercise of business or profession. Suppose a tour operator offers a gift of a 5 gm gold coin to anyone booking a package during a particular season, and it is offered to any buyer of a package, then section 194R is not attracted. The tour operator will not have to ensure deduction of tax under section 194R in respect of such gift of the gold coin;

- If gifts are to dealer or distributor, then the question arises whether such gifts can be said to arise from business or exercise of a profession and whether section 194R is attracted? In this case, it can be argued that such gifts are arising from business or profession as it can be said that the gift would not have been received but for carrying on the business of dealer/distributor. Going by the plain language of section 194R, there appears to be no bar to the application of section 194R in such cases. It would appear that the obligation under section 194R would apply in such cases to the provider of gifts.

Overview of the net legal position that emerges is as under:

In view of the requirement that benefit or perquisite “should arise either from carrying out of business, or from exercising a profession, by such resident” in order to attract TDS under section 194R, it is clear that clarifications in Question No. 4 of the Circular cannot be applied without having regard to the following:

(a) Whether the buyer is carrying on any business or exercising any profession? If not, obviously, the perquisite or benefit cannot be said to “arise either from carrying out of business, or from exercising a profession, by such resident”. In such a case, TDS under section 194R will not be attracted in respect of any cash incentive to buyer or in respect of any incentive to him in the form of free items other than the items sold.

(b) Where the buyer is carrying on any business or exercising any profession, even then the cash incentive given to him or other freebies given to him will attract section 194R only if it has nexus with his business or profession. The test to be applied is whether the gifts are offered to any buyer, whether he is carrying on any business/profession or not and regardless of whether he is dealer or distributor or final consumer. If yes, then the nexus of business or profession with carrying on business or exercise of profession is absent. If gifts are to dealer or distributor, then the question arises whether such gifts can be said to arise from business or exercise of a profession and whether section 194R is attracted? In this case, it can be argued that such gifts are arising from business or profession as it can be said that the gift would not have been received but for carrying on the business of dealer/distributor. Another test to be applied is whether the purchase by the buyer is business/professional purchase or personal purchase. If it is the former, section 194R would be attracted. If it is the latter, section 194R would not be attracted.

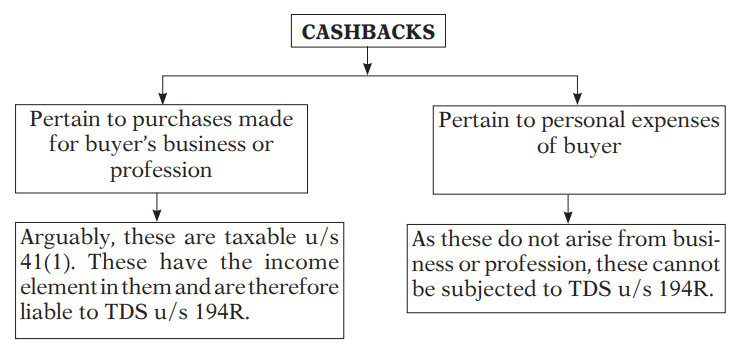

FAQ 3. Are Cashbacks perquisite or benefit for Section 194R?

In response to Question 1 of Circular No. 12/2022, dated 16.06.2022, CBDT has clarified that

“The deductor is not required to check whether the amount of benefit or perquisite that he is providing would be taxable in the hands of the recipient under clause (iv) of section 28 of the Act. The amount could be taxable under any other section like section 41(1) etc. Section 194R of the Act casts an obligation on the person responsible for providing any benefit or perquisite to a resident, to deduct tax at source @ 10%. There is no further requirement to check whether the amount is taxable in the hands of the recipient or under which section it is taxable.”

This clarification overlooks the fact that what is given can be termed as “benefit” or “perquisite” only if it can be income in the hands of the recipient. If cash backs are received in relation to purchases of goods or services for buyer’s business/profession, these may be taxable as business income in the hands of the buyer. An arguable case is made out to tax them on the basis of section 41(1). Since, these take the character of income, they are liable for TDS under section 194R.

A question arises what is the cash backs are received from e-commerce website or for use of an app in respect of purchases or payments for personal use as distinct from for the purposes of business? Question arises whether cash back on personal purchases is ‘income? Lord Mac Naghten famously said

“Income Tax, if I may be pardoned for saying so is a tax on income. It is not meant to be a tax on anything else,…,”

The word ‘income’ in its popular ordinary connotation would mean ‘coming in’. In ordinary popular parlance, one says

“I saved money on my purchases and payment of bills by using the app”.

Savings in expenditure or outgo would not be ‘income’ except where specifically so defined in the Act e.g. accommodation provided by employer to employee on concessional rent, sweat equity or ESOPs allotted to employee at less than FMV, immovable property purchased at less than stamp duty value, specified movable property purchased at less than FMV. Income is increase in wealth during a year. Cash backs save on expenses but are not a source of income. They do not increase one’s wealth. If one earns nothing but spends what one has, the cash backs would not ensure one’s wealth increases at the end of the period. On the contrary, one’s wealth would decrease.

In terms of section 190, TDS cannot be deducted from any payment which has no income element in it. [Zephyr Biomedicals v. JCIT [2020] 122 taxmann.com 124 (Bom.); See Para 24.3]

At the same time, it would be income in the hands of recipient if one pays electricity bill of ` 1000 but is given a cash back of ` 20,000 under a scheme. This clearly is income for recipient as it augments one’s wealth. It may be a perquisite or benefit but it does not arise out of business or profession of the recipient (if it is his household electricity bill or distinct from electricity bill of his shop/office). Therefore, it cannot be subjected to TDS under section 194R.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

Good Note on 194R for clarity.