GST Appeal Filing Procedure – Forms | Timelines | Process

- Blog|GST & Customs|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 31 December, 2025

The GST Appeal Filing Procedure refers to the statutorily prescribed process under the Central Goods and Services Tax (CGST) Act, 2017 and the CGST Rules through which an aggrieved taxpayer or the tax department challenges an order passed by a GST adjudicating authority before a higher appellate forum. It involves filing an appeal within the prescribed time limits, in the specified form, through the GST common portal, along with mandatory pre-deposit and supporting documents, seeking relief against an adverse order relating to assessment, demand, refund, registration, penalty, or other GST matters.

Table of Contents

Check out Taxmann's GST Appeals & Appellate Tribunal which is a comprehensive, practitioner-focused commentary that simplifies the entire GST appellate framework—from filing APL-01 before the Appellate Authority to advancing matters before the GST Appellate teTribunal (GSTAT). It offers detailed explanations of FORM GST APL-01 and APL-05, mandatory disclosures, procedural requirements, and the GSTAT (Procedure) Rules, supported by practical drafting tools and templates. The book provides clear guidance on handling disputes relating to valuation, classification, ITC, refunds, penalties, and procedural violations. With its structured coverage of appeals, revision, rectification, and litigation strategy, this 2026 Edition serves as an essential reference for GST professionals, litigators, corporate tax teams, departmental officers, and researchers.

1. Forms for Filing an Appeal

Exercising the option of filing an appeal is a crucial decision. The right to appeal is a valuable right and the person aggrieved is expected to exercise such option only after assessment of relevant facts of the case, legal provisions of law relevant to the case, judicial pronouncement etc. This analysis helps a person to identify the possibility of getting relief against the injustice arising from the order passed. Filing an appeal also involves the financial cost. One will also have to look into the opportunity cost involved in filing an appeal in terms of time and effort involved and the possibility of getting a favourable outcome and penal action in cases where the outcome is adverse. Therefore, the pros and cons of filing an appeal must be analysed before proceeding to file an appeal. A person is required to file an appeal in the prescribed manner and form. The form and manner of filing an appeal is prescribed in Chapter XIII of the CGST Rules. The following forms are notified for filing of appeal at different stages of appeal:

| Sr. No. | Stage of Appeal | Form Notified |

| 1. | Appeal to Appellate Authority by Aggrieved Person | Form GST APL – 01 |

| 2. | Appeal to Appellate Authority by Department | Form GST APL – 03 |

| 3. | Appeal to Appellate Tribunal | Form GST APL – 05 |

| 4. | Cross-objections before the Appellate Tribunal | Form GST APL – 06 |

| 5. | Application to the Appellate Tribunal by the Department | Form GST APL – 07 |

| 6. | Appeal to the High Court | Form GST APL – 08 |

2. Procedure for Filing First Appeal Before Appellate Authority

Appellate Authority is the first forum of appeal where the decisions or orders of the Adjudicating Authority are appealable under section 107 of the CGST Act. The appeal can be filed by either of the following persons:

(a) Person aggrieved by such decision or order

(b) Department

Section 107(2) of the CGST Act categorically differentiates the Department from the aggrieved person. Therefore, the Department cannot be called as an aggrieved person. The differentiation is needed as the time limit for filing an appeal and the form for filing an appeal is different in the case of an appeal by the Department. The step-by-step process of filing an appeal in both cases is discussed as under:

2.1 Procedure for Filing an Appeal by Aggrieved Person

Rule 108 of the CGST Rules provides the procedure for filing an appeal under section 107(1) of the CGST Act by the aggrieved person before the Appellate Authority. Rule 108(1) of the CGST Rules provides that an appeal to the Appellate Authority under sub-section (1) of Section 107 shall be filed in FORM GST APL-01, along with the relevant documents, electronically

and a provisional acknowledgement shall be issued to the appellant immediately. Therefore, FORM GST APL-01 is notified as the form of appeal for filing an appeal before the Appellate Authority. The aggrieved person is required to prepare an appeal memorandum and make the written submission in FORM GST APL-01.

2.1.1 Contents of FORM GST APL-01 – FORM GSTAPL-01 contains the following details

| Sr. No. | Particulars | Description |

| 1. | Details of aggrieved person | The appellant is required to provide the basic details such as:

– GSTIN/Temporary ID/UIN; – Legal name of the appellant; – Trade name, if any; and – Address. |

| 2. | Details of order | The appellant herein requires providing the details of the order number and date, designation and address of the officer who has passed the order and date of communication of an order. |

| 3. | Name of the authorised representative | The appellant is required to provide the name of the authorised person who shall sign the appeal memorandum. |

| 4. | Brief issue of the case under dispute | The appellant is required to brief the issue involved in the case. The list of issues is defined in the form on the common portal. |

| 5. | Description and classification of goods/services in dispute | The appellant is required to provide the description and the tariff classification of the goods or services (i.e. HSN or SAC) in respect of which dispute has arisen. |

| 6. | Period of dispute | The appellant needs to provide the period for which the dispute relates. |

| 7. | Amount of Dispute | The appellant is required to provide the amount of tax along with interest, penalty, fees and other charges against each head of CGST, SGST, IGST and Cess. |

| 8. | Market Value of seized goods | The appellant is supposed to provide the market value of the seized goods, wherever applicable. |

| 9. | Whether the appellant wishes to be heard in person | The appellant is required to provide if he wishes to be heard in person before the Appellate Authority. |

| 10. | Statement of Facts | The detailed facts of the case, the appellant is required to provide herein. |

| 11. | Grounds of appeal | The appellant is required to submit the grounds on which he is filing an appeal before the Appellant Authority. |

| 12. | Prayer | In the prayer part, the appellant requests the Appellate Authority to provide relief against the order passed by the Adjudicating Authority. |

| 13. | Amount of demand created, admitted and disputed | The appellant is required to provide the details of the demand created, admitted and the amount for which the appellant wants to contest. |

| 14. | Details of payment of admitted amount and pre-deposit | The appellant is required to provide the details of payment of the admitted amount and pre-deposit paid. |

| 15. | Whether appeal is being filed after the prescribed period | The appellant is required to provide whether the appeal is filed within the stipulated time period and the reason for delay if the appeal is filed beyond the prescribed time along with the period of delay. |

Most of the fields mentioned above are auto-populated when an appeal is filed electronically on the GST common portal. However, the appellant is required to make a written submission on certain points such as the Statement of Facts and Grounds of Appeal and such written submission along with necessary documents would be required to be uploaded on the portal in PDF format.

2.1.2 Manner of filing of an appeal

The Appellant is required to file an appeal before the Appellate Authority electronically in FORM GST APL-01 along with the requisite documents. Therefore, the appellant must understand the functionality of filing an appeal on the GST common portal before filing an appeal. The Appellant can file an appeal on the GST common portal using the following steps:

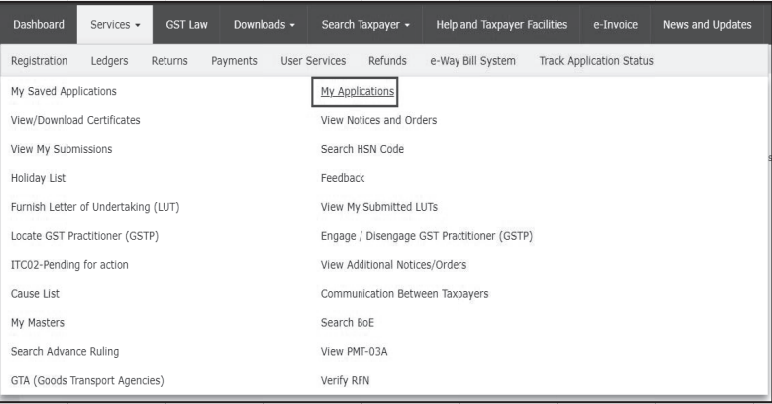

Step 1 – Log in to GST Common Portal – Access the common portal using the URL www.gst.gov.in > login using valid credentials > On the dashboard Click the Services > User Services > My Application

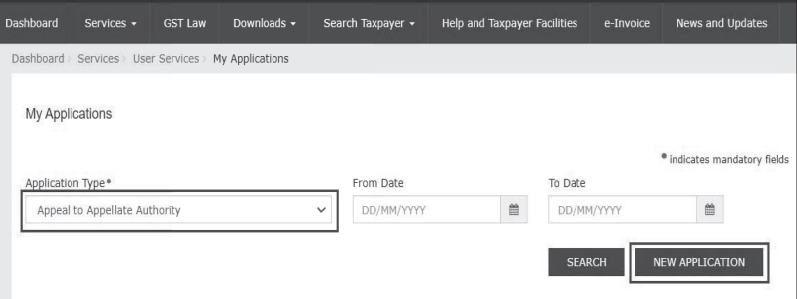

Step 2 – Select the Appeal to Appellate Authority Option – Select “Appeal to Appellate Authority” option from the list of application types available in my application menu and click on “New Application”

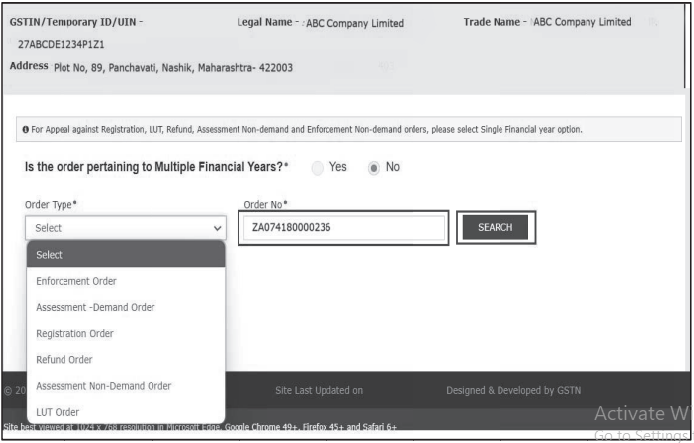

Step 3 – Select the Order Type and Insert the Order Number – The Portal will redirect to the FORM GST APL-01 – Appeal to Appellate Authority page by clicking on the “New application button”. Select the option Yes if the order pertaining to Multiple Financial Years or No to proceed with a single Financial Year. Select the Order Type from the drop-down list.

The types of orders issued by Adjudicating Authority under GST law are categorised into different types on the Common portal. The appellant would be required to select the applicable one from the following categories:

- Enforcement order

- Assessment – Demand order

- Assessment non-demand order

- Registration order

- Refund order

- Assessment Non-Demand order

- LUT Order

After selecting the category and filling in the order number in the “Order No” field, the appellant can search the details of the order. In case the appellant applied for the rectification of the order, the appeal cannot be filed against the original order. However, an appeal against the rectified order can be filed.

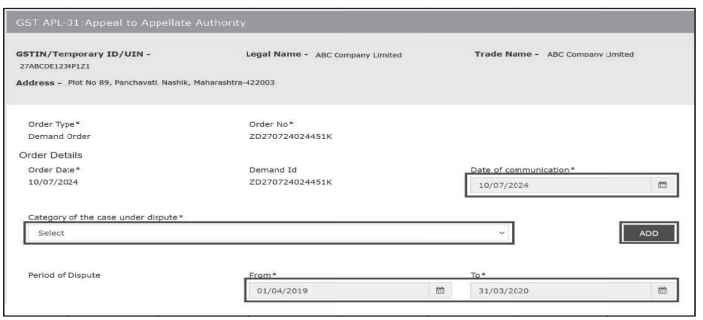

Step 4 – Select the Category of the Case Under Dispute – After searching for the details of the case, the appellant is required to select the category of the case under dispute from the drop-down. The Common portal categorises the type of dispute in the following categories:

- Misclassification of any goods or services or both

- Wrong applicability of a notification issued under the provisions of this Act

- Incorrect determination of time and value of supply of goods or services or both

- Incorrect admissibility of input tax credit of tax paid or deemed to have been paid

- Incorrect determination of the liability to pay tax on any goods or services or both

- Whether applicant is required to be registered

- Whether any particular thing done by the applicant results in supply of goods or services or both

- Rejection of application for registration on incorrect ground

- Cancellation of registration for incorrect reasons

- Transfer/Initiation of recovery/special mode of recovery

- Tax wrongfully collected/Tax collected not paid to Government

- Determination of tax not paid or short paid

- Refund on wrong ground/refund not granted/ interest on delayed refund

- Fraud or wilful suppression of fact

- Anti-profiteering related matter; and

- Others

The appellant can add more than one category, where the appeal is filed for more than one issue. Similarly, the appellant can click on the delete button to delete the category. The date of communication and period of dispute shall be auto-populated. However, the appellant can edit the same.

The appellant can add more than one category, where the appeal is filed for more than one issue. Similarly, the appellant can click on the delete button to delete the category. The date of communication and period of dispute shall be auto-populated. However, the appellant can edit the same.

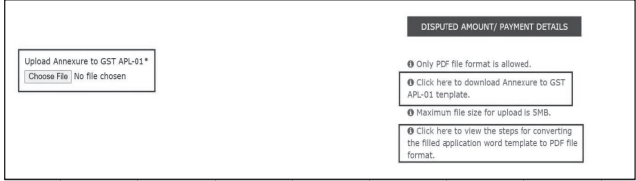

Step 5 – Preparation and Uploading of Annexures to Appeal – The appellant would be required to upload a PDF copy of the written submissions prepared by him as discussed. The appellant can download the templates of annexures to FORM GST APL-01 that are available on the “GST APL-01 – Appeal to Appellate Authority” page. The appellant is required to upload the annexures to appeal in PDF format. The maximum size of the annexures to appeal is restricted up to 5 MB.

Step 6 – Details of Demand Created, Admitted and Disputed – After uploading annexures to GST-APL-01, the appellant would be required to furnish the details of disputed amount and payment details. The appellant needs to provide the following:

- The amount of total demand created by the Adjudicating Authority

- The amount which the appellant has admitted out of above details; and

- The remaining amount which is in dispute

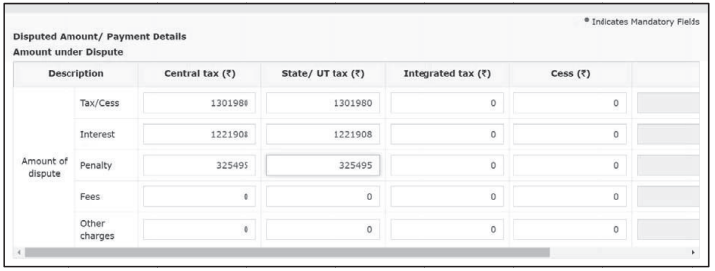

After clicking on the disputed amount/payment details tab, the appellant shall be redirected to Disputed Amount/Payment Details page. The page is divided into 5 different tables. In the first table the appellant is required to provide the details of amount under dispute

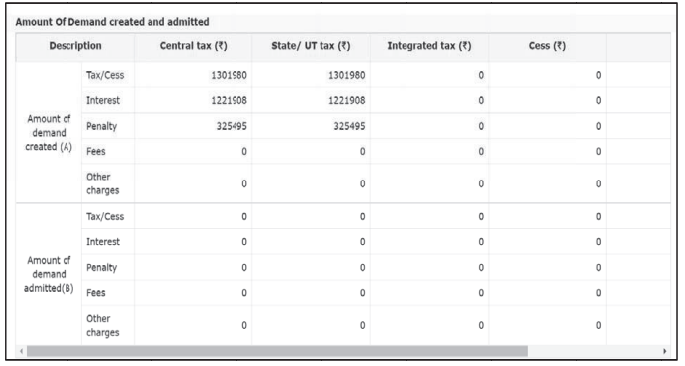

Amount of demand created and admitted is the second table which the appellant requires to confirm. The Table is further divided into following two sub-tables:

Amount of demand created and admitted is the second table which the appellant requires to confirm. The Table is further divided into following two sub-tables:

(1) Amount of demand created and

(2) Amount of demand admitted

The figures of Amount of demand admitted table is auto calculated by the portal after reporting figures in the table of amount of dispute.

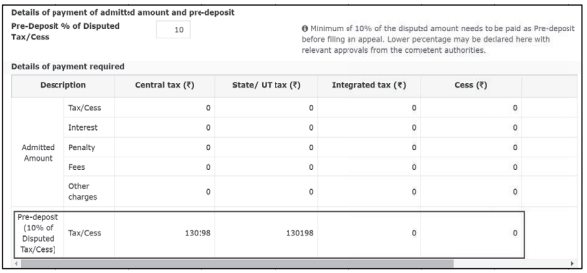

Details of payment of pre-deposit is another important table in which system calculates the pre-deposit amount. The amount is auto calculated by the common portal.

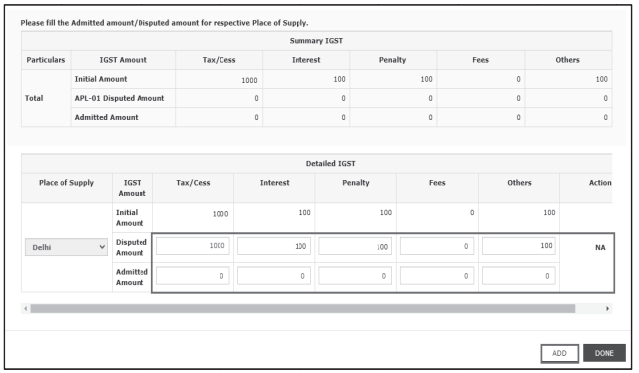

In case of liability under IGST head, the appellant is required to provide the place of supply wise disputed amount and admitted amount as under—

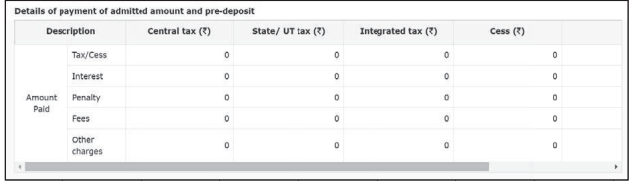

Details of payment of admitted amount and pre-deposit appears in the following table:

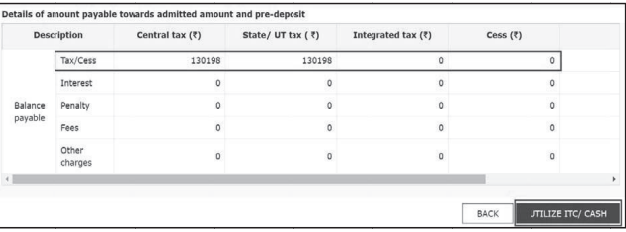

Remaining amount of amount payable on account of admitted amount and pre-deposit will be auto populated in the last table as under:

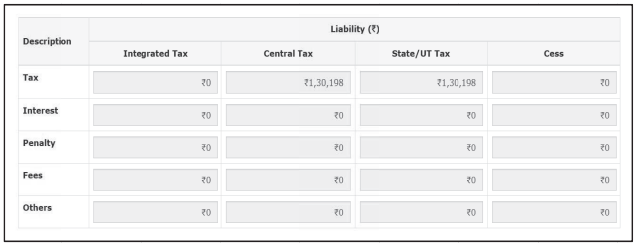

The Appellant is required to make the payment by clicking on Utilise ITC/CASH. Total liability would be shown on the next page which is frozen, and the appellant cannot make changes in said table.

The Appellant is allowed to make the payment of admitted liability and pre-deposit from Electronic Cash Ledger and Electronic Credit Ledger. The appellant can make the payment as per the availability of balance and as per the provisions of pre-deposit from Electronic Cash Ledger and Electronic Credit Ledger. The appellant can make the payment of admitted liability and pre-deposit by clicking on the Set off button.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA