GST and Income Tax on Corporate Guarantees | A Deep Dive

- Blog|GST & Customs|

- 10 Min Read

- By Taxmann

- |

- Last Updated on 7 May, 2024

What is Corporate Guarantees? A corporate guarantee is a form of assurance where one entity, typically a corporation, agrees to take responsibility for the financial obligations or performance of another entity if that second entity fails to meet its obligations. This is often used in business transactions to provide security to a lender or a business partner that the commitments will be upheld. Here are some common scenarios where corporate guarantees are used: – Credit Support: A parent company might provide a corporate guarantee to a lender on behalf of a subsidiary. This guarantees that if the subsidiary fails to repay a loan, the parent company will cover the debt. – Lease Agreements: Corporations sometimes use guarantees to secure leasing agreements for office spaces or equipment, promising to fulfill the lease obligations if the primary lessee fails to do so. – Project Bidding: In project contracts or bids, a company may use a corporate guarantee to assure the project owner that it has the financial backing to support the project and handle associated risks. Corporate guarantees are a critical tool in business finance, enhancing the creditworthiness of an entity and enabling it to secure loans, leases, or contracts that might otherwise be unavailable due to perceived risks.

Table of Contents

- Background of Contract of Guarantee

- Apex Court Views under Service Tax Law

- Relevant GST Legal Provisions

- Our Comments

- Income Tax & Regulatory

- Conclusion

1. Background of Contract of Guarantee

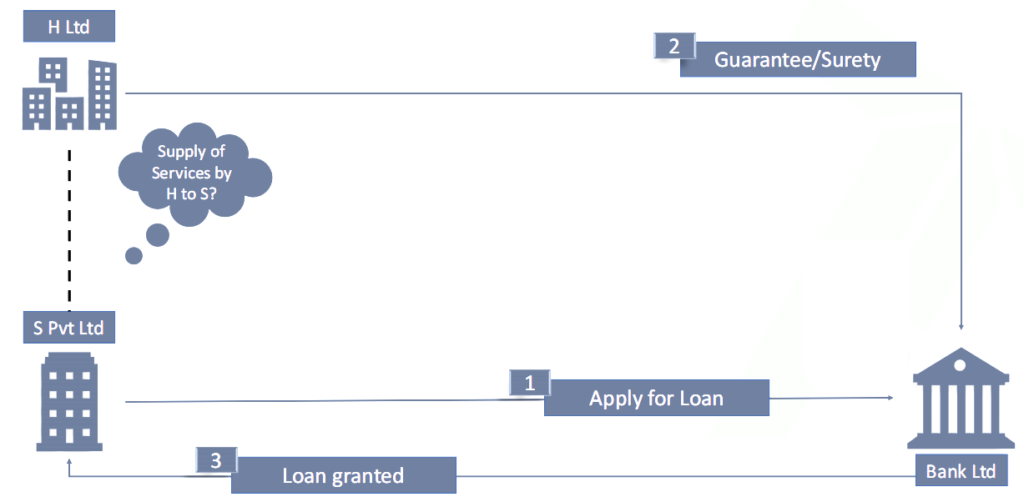

1.1 Transaction Background

1.2 Indian Contract Act

1.2.1 Meaning

A contract of guarantee is a contract to perform the promise or discharge the liability of a third person in case of his default.

(Section 126 of Indian Contract Act)

1.2.2 Parties

- Surety: Person who gives the guarantee

- Principal Debtor: Person in respect of whom default guarantee is given

- Creditor: Person to whom guarantee is given

(Section 126 of Indian Contract Act)

1.2.3 Consideration

Anything done or any promise made for the benefit of the principle debtor, may be sufficient consideration to the surety for giving the guarantee.

(Section 127 of Indian Contract Act)

1.3 Companies Act

Section 185: L/G/S/I to Directors or person to whom directors are interested

1. Compliance (L/G/S/I given to person whom director is interested)

- Passing of SR

- Use of fund for principal business activity

2. Exception -Wholly owned subsidiary

- Funds are used for principal business activity

3. Inter Co Loans, Investment, Guarantee and Security: Section 186 of Co Act, 2013

4. Approvals Needed:

- Unanimous Board Approval

- SR in specified cases

- Approval from Financial Institution in specified cases

5. Other conditions/compliances:

- No Default in payment of deposits/interest

- Max. 2 layers of investments

- ROI > GOI

- Maintain Register u/s 189

6. Exceptions:

- Banking /Investment/Insurance Cos

- L/G/I in Wholly Owned Subsidiary

- Infra Companies (in specified cases)

2. Apex Court views under Service Tax Law

- Service Tax (‘ST’) was levied on services provided by one person to another for a consideration

- Apex Court recently held that if consideration is not charged, ST cannot be levied

Tribunal Conclusion:

The criticality of ‘consideration’ for determination of service, as defined in section 65B(44) of Finance Act, 1994, for the disputed period after introduction of ‘negative list’ regime of taxation has been rightly construed by the adjudicating authority. Any activity must, for the purpose of taxability under Finance Act, 1994, not only, in relation to another, reveal a ‘provider’, but also the flow of ‘consideration’ for rendering of the service. In the absence of any of these two elements, taxability under Section 66B of Finance Act, 1994 will not arise. It is clear that there is no consideration insofar as ‘corporate guarantee’ issued by respondent on behalf of their subsidiary companies is concerned.

Commissioner of CGST & CE v. Edelweiss Financial Services Ltd. [2023] 149 taxmann.com 75 (Mum.-CESTAT)

Apex Court Conclusion:

The above would suggest that this was a case where the assessee had not received any consideration while providing corporate guarantee to its group companies. No effort was made on behalf of the Revenue to assail the above finding or to demonstrate that issuance of corporate guarantees to group companies without consideration would be a taxable service. In these circumstances, in view of such conclusive finding of both forums, we see no reason to admit this case basing upon the pending Civil Appeal No. 428 @ Diary No. 42703/2019, particularly when it has not been demonstrated that the factual matrix of the pending case is identical to the present one.

Commissioner of CGST and Central Excise v. Edelweiss Financial Services Ltd. [2023] 149 taxmann.com 76 (SC)

2.1 Impact and Way Forward

2.1.1 Relevant Under GST?

- Consideration between related persons is not a pre-condition for taxability under GST laws

- Hence, reliance may not be required to be placed on ST judgements

- However, it may be relevant where guarantee is issued in respect of unrelated person

2.1.2 Way forward for ST Litigation?

- Revisit the grounds of litigation based on judgment of Apex Court

- File appropriate correspondence with Authority/Court

- Apply for the refund of pre-deposit already paid for litigation

3. Relevant GST Legal Provisions

3.1 Levy Under GST

3.1.1 Levy

- GST is levied on the supply of goods or services or both

- Supply has been defined to include all forms of supply such as sale, exchange, barter etc. by a person for a consideration in the course or furtherance of business

- Supply of goods/services between related persons, in the course or furtherance of business, taxable even if there is no consideration

3.1.2 Meaning of Goods and Services

- ‘Goods’ mean every kind of movable property, and it excludes money and securities from its scope but includes the actionable claim etc.

(Actionable claim other than lottery betting and gambling is neither treated as supply of goods nor supply of services)

- Services means anything other than goods

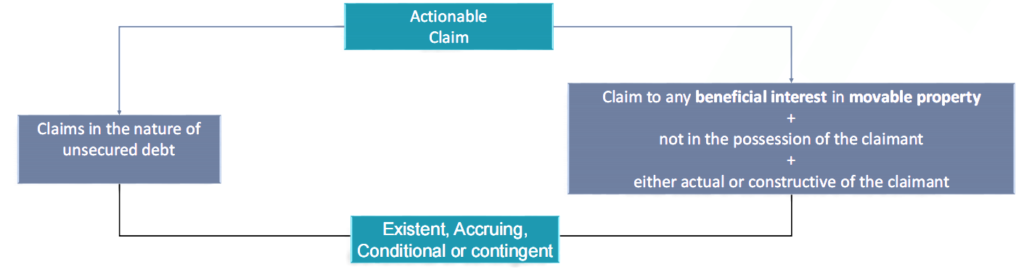

3.1.3 ‘Actionable claim’ means

- A claim to any debt, other than a debt secured by mortgage of immovable property or by hypothecation or pledge of movable property, or

- to any beneficial interest in movable property not in the possession, either actual or constructive, of the claimant, which the civil courts recognise as affording grounds for relief, whether such debt or beneficial interest be existent, accruing, conditional or contingent.

3.2 Valuation

- Generally, GST is levied on transaction value

- However, for supply between related persons law disregards transaction value concept and determines value using below methods sequentially

- Open Market Value (Rule-28)

- Value of supply of like kind & quality (Rule-29)

- 110% of Cost of Provision of Services (Rule 30)

- Best judgement Assessment (Rule 31)

Value declared in invoice deemed to be open market value (Second Proviso to Rule 28)

Any value declared in the invoice shall be treated as Open Market Value where the recipient party is entitled to the ‘Full Input Tax Credit’.

4. Our Comments

4.1 Questions to Ponder

4.1.1 Whether Extending Guarantee is a Supply of services by H to S?

- Whether any benefit provided to Subsidiary?

- Is it a Shareholder’s Function?

- Whether impugned activity is in the course or furtherance of Holding Company business?

- Whether activity performed for subsidiary is an actionable claim?

4.1.2 How to Value?

- Whether Open Market Value of impugned services is available?

- What is like kind or Quality in the given case?

- Whether Bank Guarantee can be taken as a base?

- Safe harbor Rules -1%

4.2 Analysis – Whether Transaction is a Supply?

4.2.1 Actionable Claim

- It can be viewed as unsecured contingent debt and hence actionable claim

- Assurance services by Holding co. has given rise to an actionable claim which if transferred by Bank may not be taxable. However, assurance services per-se are taxable.

- Actionable claim accrued due to performance of services may not be equated with supply of actionable claim.

- Alternative view: There is no assurance services rather there is transfer of actionable claim in the form of issuance of corporate guarantees [refer Sunrise Associates v. Government of NCT of Delhi [2006] 4 STT 105 (SC)]

4.2.2 Shareholder Function

- There are judgements under Income tax laws that treat the given activity as shareholder function and thus not taxable.

- Commercial prudence is to protect investment interest and not to earn any commission.

- Definition of international transaction was specifically amended to include guarantee within its scope.

- Further, the updated OECD guidelines on Financial Transactions explains and recognizes the taxability of Corporate Guarantees.

4.2.3 In the Course of furtherance of business

- Whether enabling subsidiary to get funds is in the course or furtherance of holding’s business?

- Does it impact the routine business operation, performance or profitability of holding company in any ways?

- Will benefit in the form of capital appreciation be covered in the expression in the course or furtherance of business?

4.3 Analysis – How to Value (if taxable)?

4.3.1 Open Market Value

- Transaction of providing CG are not provided to unrelated parties in open market but are provided between related entities ONLY.

- Open market value may not be ascertainable for corporate guarantees.

4.3.2 Like Kind or Quality

- There is no similar or like services to compare.

- Can we take reference of Bank Guarantee? –No.

- Settled jurisprudence: A bank guarantee is set on certain parameters such as Guarantee tenure, Credit rating, Relationship, Fees charged by banks for providing bank guarantee is determinable in the open market.

Ansal Engineering Projects Ltd. v. Tehri Hydro Development Corporation Ltd. (1996) 5 SCC 450

CIT –LTU v. Glenmark Pharmaceuticals Ltd [2019] 101 taxmann.com 84/260 Taxman 249 (Bom.)

4.3.3 110% of Cost

- Costs for providing CG is not determinable or there would be very minimal direct costs (such as agreements executed with the lender).

- Is other costs determinable actually?

- Lender accepts CG based on various parameters such as credit worthiness developed over a period, net worth, DE ratio, Company’s Goodwill, etc. Costs involved in developing such parameters is not determinable.

4.3.4 Residual Method

- Value of supply determined by using reasonable means consistent with principles & general provisions of Valuation (i.e. Section 15 & Valuation provisions given under the CGST Rules).

- Rule 31 is vague and ambiguous (does not lay down as to what constitutes reasonable means?)

- No effective machinery provision for determining the value of services of providing CG? Levy on supply could not be imposed in the absence of the machinery provisions:

– CIT v. B.C. Srinivasa Setty [1981] 5 Taxman 1 (SC)

– Suresh Kumar Bansal vs UOI [2016] 70 taxmann.com 55/56 GST 90 (Delhi)

– CCE&C Kerala vs Larsen and Turbo Ltd (2015 (39) S.T.R. 913 (S.C.)

4.4 Analysis – CG given to Subsidiary Outside of India

- Will CG provided for subsidiary outside India qualify as Export of Services (as there is no realisation of consideration)?

- Can it be argued that this condition is deemed to be satisfied as law itself deem that there is no requirement to have consideration to qualify a transaction as supply?

It is well settled that the legislature is competent to create a legal fiction. A deeming provision is enacted for the purpose of assuming the existence of a fact which does not really exist. When the legislature creates a legal fiction, the court must ascertain for what purpose the fiction is created and after ascertaining this, to assume all those facts and consequences which are incidental or inevitable corollaries for giving effect to the fiction.

Manish Trivedi v. State of Rajasthan: (2014) 14 SCC 420

- Law does not compel the doing of impossible things and therefore, the statutory provision laying down a condition is construed as not applicable to a particular case where the performance of such condition is not possible.

- Application of legal maxim:

– ‘Lex non cogitad impossibilia’ means that the law does not demand the impossible.

– ‘Impotentia excusat legem’ means that in cases when there is a disability that makes it impossible to obey the law, the alleged disobedience of law is excused.

- Note that first and second Proviso to Rule 37 (1) of CGST Rules stipulates that condition of payment of consideration within in 180 days is not required to be satisfied in case of related party transaction where consideration is presumed or where the value of supply is being enhanced in terms of Section 15(2)(b). Notably, there is no similar exception provided for exports.

- It would surely be litigative and hence appropriate position should be taken.

5. Income Tax & Regulatory

5.1 Shareholder Activities – OECD Guidance

- Activities performed typically by a Parent entity/regional Hold. Co. on account of its ownership interest in group entities

- Group entities do not demand performance of such activities i.e. activities are undertaken by the HO to safeguard its ownership interest, furtherance of its own business, etc.

- Costs pertaining to such activities are borne and allocated at the HO level i.e. no cost recharge to group entities

- Whether CG issuance is a shareholder’s activity? -Should it be considered as international transaction?

5.2 International Transaction

- “international transaction” means a transaction between two or more AEs, either or both of whom are non-residents, in the nature of …….., or provision of services, or lending or borrowing money, or any other transaction having a bearing on the profits……….

- Explanation “international transaction” shall include –

(c) capital financing, including any type of long-term or short-term borrowing, lending or guarantee,………………;

5.3 Micro Ink Ltd. v. Addl. CIT [2015] 63 taxmann.com 353/2016] 157 ITD 132 (Ahm.-Trib.)

- CG prima facie is in the nature of shareholder activity as it was provided, or compensated for lack of, core strength for raising the finances from banks

- CG issued by the assessee not in the nature of ‘provision for service’ and but a shareholder activity i.e. issuance of Corporate Guarantees in the nature of quasi-capital or shareholder activity

- Issuance of CG should not be considered as ‘International Transaction’

5.4 Prolifics Corp. Ltd. vs. DCIT [2015] 55 taxmann.com 226/68 SOT 104 (Hyd-Trib.) (URO)

- CG’s involve express guarantee or implied guarantee which increases creditworthiness of AEs, if provided by main company. In case of default, Guarantor has to fulfil the liability

- There is a service provided to AE in increasing is creditworthiness in obtaining loans in market (be from Financial institutions or from others). Whilst there may not be immediate charge on Profit & Loss account, but inherent risk cannot be ruled out in providing guarantees

- Issuance of CG is an International Transaction and adjustment for Guarantee Commission to be made

5.5 Valuation

- 0.50% of the loan amount was accepted as ALP by Bom HC and various ITAT decisions

CIT vs. Everest Kento Cylinders Ltd. [2015] 58 taxmann.com 254/232 Taxman 307/378 ITR 57 (Bom.) - Recently Mumbai ITAT in case of has accepted 0.35%, based on yield approach i.e. differential interest rate when loans are guaranteed vis-à-vis when loans are not guaranteed, adjusted for other factors viz. loan tenor, etc.

Macrotech Developers Limited vs. DCIT (ITA Nos. 2266 & 2239/Mum/2022)

5.6 Safe Harbor Rules

- Circumstances under which the tax authorities will accept the transfer price declared by the taxpayer

- For Corporate Guarantees issued to a Wholly Owned Subsidiary, CBDT has prescribed 1% or more of the amount guaranteed as Safe Harbor

5.7 Withholding Tax

- Guarantee Commission paid to overseas HO treated as Income deemed to accrue or arise in India

- Taxable as Other Income under DTAAs

- In DTAAs, where no other Income article exists, possible to take a view that Guarantee Commission should not be taxable

5.8 FEMA

- Erstwhile ODI regime: Issuance of corporate guarantees on behalf of second generation or subsequent level step down operating subsidiaries will be considered under the approval route

- Approval requirement dispensed in the new ODI regime

6. Conclusion

- Assess the potential risks and benefits before deciding to provide a corporate guarantees

- Give due consideration to tax (Income Tax and GST) and regulatory aspects

- Maintain the proper documentation for the corporate guarantees provided for

- Consider charging an arm’s length price to manage the risk of litigation (Reference of Safe harbor rules, TP valuation, independent valuation, etc. may be taken for valuing the services)

- Not paying tax (where consideration is not charged) would surely be litigative and may settle at higher judicial level (HC or above)

- In such cases GST may be charged on any appropriate value if ITC is available, otherwise a commercial call may be taken

- Guarantee Commission paid outside India, relevant TP need to be analysed to determine withholding tax

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA