Framework for Financial Statement in accordance with Ind AS – Purpose, Scope, Objective

- Blog|Account & Audit|

- 20 Min Read

- By Taxmann

- |

- Last Updated on 25 August, 2022

Table of Contents

2. Objectives, usefulness and limitations of general purpose financial reporting

3. Qualitative characteristics of useful financial information

4. The cost constraint on useful financial reporting

5. Financial statements and Reporting Entity

6. The elements of financial statements

7. Recognition and Derecognition

8. Measurement

9. Presentation and disclosure

11. Concepts of capital and capital maintenance

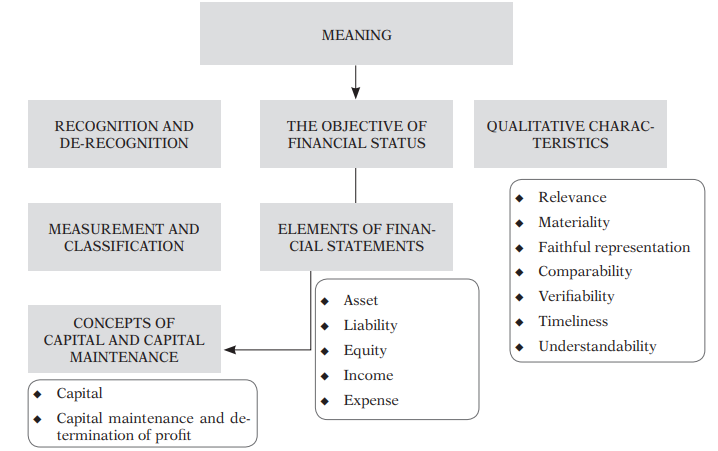

1. Conceptual Framework

The Institute of Chartered Accountants of India (ICAI) in the past had issued a pronouncement with title “Framework for the Preparation and Presentation of Financial Statements under Indian Accounting Standard” which was based on framework issued by International Accounting Standard Board (IASB). In 2018, the IASB has issued revised framework and correspondingly, ICAI has also issued Conceptual Framework for Financial Reporting under Indian Accounting Standards (Conceptual Framework) in 2020. The new framework is applicable to both the standard settler activities and preparer of the financial statements.

Conceptual Framework is not a Standard and nothin1g in this does not override any of the provision of Ind ASs. It describes the concept upon which the Ind ASs are based and hence which determines how financial statements are prepared and the information they contain. The Conceptual Framework helps ICAI to form Ind ASs that bring transparency, accountability and efficiency to financial markets. This also helps all parties in understanding and interpreting the Ind ASs.

2. Objectives, usefulness and limitations of general purpose financial reporting

The objective of general purpose financial reporting is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders and other creditors in making decisions relating to providing resources to the entity. Those decisions involve decisions about:

(a) buying, selling, or holding equity and debt instruments,

(b) providing or settling loans and other forms of credit; or

(c) exercising rights to vote on, or otherwise influence, management’s actions that affect the use of the entity’s economic resources.

Existing and potential investors, lenders and other creditors need information to help them make assessments and decisions. Such information includes:

-

- Information about the economic resources of the entity, claims against the entity and changes in those resources and claims.

- How efficiently and effectively the entity’s management and governing board have discharged their responsibilities to use the entity’s economic resources.

However, general purpose financial reports do not and cannot provide all of the information that existing and potential investors, lenders and other creditors need. General purpose financial reports are not designed to show the value of a reporting entity but they provide information to help existing and potential investors, lenders and other creditors to estimate the value of the reporting entity. Other parties, such as regulators and members of the public other than investors, lenders and other creditors, may also find general purpose financial reports useful. However, those reports are not primarily directed to these other groups.

To a large extent, financial reports are based on estimates, judgments and models rather than exact depictions. The Conceptual Framework establishes the concepts that underlie those estimates, judgments and models.

3. Qualitative characteristics of useful financial information

If financial information is to be useful, it must be relevant and faithfully represent what it purports to represent. The usefulness of financial information is enhanced if it is comparable, verifiable, timely and understandable.

| Fundamental qualitative characteristics | Enhancing qualitative characteristics |

|

|

|

|

|

|

|

The above points are discussed in detail as below:

| Relevance | Relevant financial information is capable of making a difference in the decisions made by users. Information may be capable of making a difference in a decision even if some users choose not to take advantage of it or are already aware of it from other sources. |

| Materiality | Information is material if omitting, misstating or obscuring it could reasonably be expected to influence decisions that the primary users of general purpose financial reports make on the basis of those reports, which provide financial information about a specific reporting entity.

In other words, materiality is an entity-specific aspect of relevance based on the nature or magnitude, or both, of the items to which the information relates in the context of an individual entity’s financial report. Consequently, a uniform quantitative threshold for materiality cannot be specified or predetermined what could be material in a particular situation. |

| Faithful representation | To be useful, financial information must not only represent relevant phenomena, but it must also faithfully represent the substance of the phenomena that it purports to represent.

In many circumstances, the substance of an economic phenomenon and its legal form are the same. If they are not the same, providing information only about the legal form would not faithfully represent the economic phenomenon. Faithful representation does not mean accurate in all respects. |

Comparability, verifiability, timeliness and understandability are qualitative characteristics that enhance the usefulness of information that both is relevant and provides a faithful representation of what it purports to represent.

| Comparability | Users’ decisions involve choosing between alternatives, for example, selling or holding an investment, or investing in one reporting entity or another. Consequently, information about a reporting entity is more useful if it can be compared with similar information about other entities and with similar information about the same entity for another period or another date.

Comparability is the qualitative characteristic that enables users to identify and understand similarities in, and differences among, items. Unlike the other qualitative characteristics, comparability does not relate to a single item. A comparison requires at least two items. |

| Verifiability | Verifiability means that different knowledgeable and independent observers could reach consensus, although not necessarily complete agreement, that a particular depiction is a faithful representation. Quantified information need not be a single point estimate to be verifiable. A range of possible amounts and the related probabilities can also be verified.

Verification can be direct or indirect. Direct verification means verifying an amount or other representation through direct observation, for example, by counting cash. Indirect verification means checking the inputs to a model, formula or other technique and recalculating the outputs using the same methodology. |

| Timeliness | Timeliness means having information available to decision-makers in time to be capable of influencing their decisions. Generally, the older the information is the less useful it is. However, some information may continue to be timely long after the end of a reporting period because, for example, some users may need to identify and assess trends. |

| Understandability | Classifying, characterising and presenting information clearly and concisely makes it understandable.

Some phenomena are inherently complex and cannot be made easy to understand. Excluding information about those phenomena from financial reports might make the information in those financial reports easier to understand. However, those reports would be incomplete and therefore possibly misleading. |

4. The cost constraint on useful financial reporting

Cost is a pervasive constraint on the information that can be provided by financial reporting. Reporting financial information imposes costs, and it is important that those costs are justified by the benefits of reporting that information.

There are several types of costs which are incurred in financial reporting. There are:

-

- Providers of financial information expend most of the effort involved in collecting, processing, verifying and disseminating financial information, but users ultimately bear those costs in the form of reduced returns.

- Costs of analysing and interpreting the information provided. If needed information is not provided, users incur additional costs to obtain that information elsewhere or to estimate it.

In applying the cost constraint, the ICAI assesses whether the benefits of reporting particular information are likely to justify the costs incurred to provide and use that information. When applying the cost constraint in formulating a proposed Ind AS, the ICAI seeks information from providers of financial information, users, auditors, academics and others about the expected nature and quantity of the benefits and costs of that Ind AS. In most situations, assessments are based on a combination of quantitative and qualitative information.

5. Financial statements and Reporting Entity

Financial statements of an entity provide information about economic resources of the reporting entity, claims against it, and changes in those resources and claims, that meet the definitions of the elements of financial statements.

Financial statements are prepared for a specified period of time (reporting period) and provide information about:

-

- assets and liabilities—including unrecognised assets and liabilities—and equity that existed at the end of the reporting period, or during the reporting period; and

- income and expenses for the reporting period.

Information about possible future transactions and other possible future events (forward-looking information) is included in financial statements if it:

-

- relates to the entity’s assets or liabilities—including unrecognised assets or liabilities—or equity that existed at the end of the reporting period, or during the reporting period, or to income or expenses for the reporting period; and

- is useful to users of financial statements.

A reporting entity is an entity that is required, or chooses, to prepare financial statements which can be a single entity or a portion of an entity or can comprise more than one entity. And it is not necessarily a legal entity.

Sometimes one entity (parent) has control over another entity (subsidiary). If a reporting entity comprises both the parent and its subsidiaries, the reporting entity’s financial statements are referred to as ‘consolidated financial statements’. If a reporting entity is the parent alone, the reporting entity’s financial statements are referred to as ‘unconsolidated financial statements’.

Information provided in unconsolidated financial statements is typically not sufficient to meet the information needs of existing and potential investors, lenders and other creditors of the parent. Accordingly, when consolidated financial statements are required, unconsolidated financial statements cannot serve as a substitute for consolidated financial statements. Nevertheless, a parent may be required, or choose, to prepare unconsolidated financial statements in addition to consolidated financial statements.

6. The elements of financial statements

6.1 The elements of financial statements can be segregated into two categories:

| Related to financial position | Related to financial performance |

|

|

|

|

|

| Item | Element | Definition or description |

| Economic resource | Asset | A present economic resource controlled by the entity as a result of past events. |

| An economic resource is a right that has the potential to produce economic benefits. | ||

| Claim | Liability | A present obligation of the entity to transfer an economic resource as a result of past events. |

| Equity | The residual interest in the assets of the entity after deducting all its liabilities. | |

| Changes in economic resources and claims, reflecting financial performance | Income | Increases in assets, or decreases in liabilities, that result in increases in equity, other than those relating to contributions from holders of equity claims. |

| Expenses | Decreases in assets, or increases in liabilities, that result in decreases in equity, other than those relating to distributions to holders of equity claims. | |

| Other changes in economic resources and claims | – | Contributions from holders of equity claims, and distributions to them.

Exchanges of assets or liabilities that do not result in increases or decreases in equity. |

6.2 Definition of an Asset

An asset is a present economic resource controlled by the entity as a result of past events.

This definition of asset has following three aspects:

-

- Right

- Potential to produce economic benefits

- Control

| Right | Rights that have the potential to produce economic benefits take many forms, including rights that correspond to an obligation of another party and rights that do not correspond to an obligation of another party. Many rights are established by contract, legislation or similar means. However, an entity might also obtain rights in other ways.

Not all of an entity’s rights are assets of that entity—to be assets of the entity, the rights must both have the potential to produce for the entity economic benefits beyond the economic benefits available to all other parties and be controlled by the entity. For example, rights available to all parties without significant cost—for instance, rights of access to public goods, such as public rights of way over land, or know-how that is in the public domain—are typically not assets for the entities that hold them. |

| Potential to produce economic benefits | An economic resource is a right that has the potential to produce economic benefits. For that potential to exist, it does not need to be certain, or even likely, that the right will produce economic benefits. It is only necessary that the right already exists and that, in at least one circumstance, it would produce for the entity economic benefits beyond those available to all other parties. |

| Control | An entity controls an economic resource if it has the present ability to direct the use of the economic resource and obtain the economic benefits that may flow from it. Control includes the present ability to prevent other parties from directing the use of the economic resource and from obtaining the economic benefits that may flow from it. It follows that, if one party controls an economic resource, no other party controls that resource.

Control of an economic resource usually arises from an ability to enforce legal rights. However, control can also arise if an entity has other means of ensuring that it, and no other party, has the present ability to direct the use of the economic resource and obtain the benefits that may flow from it. For an entity to control an economic resource, the future economic benefits from that resource must flow to the entity either directly or indirectly rather than to another party. |

6.3 Definition of a Liability

A liability is a present obligation of the entity to transfer an economic resource as a result of past events.

For a liability to exist, three criteria must all be satisfied:

-

- the entity has an obligation

- the obligation is to transfer an economic resource and

- the obligation is a present obligation that exists as a result of past events

| Obligation | Transfer of an economic resource | Present obligation as a result of past events |

|

|

|

|

|

(a) the entity has already obtained economic benefits or taken an action; and (b) as a consequence, the entity will or may have to transfer an economic resource that it would not otherwise have had to transfer. |

|

|

|

|

|

|

|

|

6.4 Definition of equity

Equity is the residual interest in the assets of the entity after deducting all its liabilities. Equity claims are claims on the residual interest in the assets of the entity after deducting all its liabilities. Such claims may be established by contract, legislation or similar means, and include, to the extent that they do not meet the definition of a liability:

-

- shares of various types, issued by the entity; and

- some obligations of the entity to issue another equity claim.

Sometimes, legal, regulatory or other requirements affect particular components of equity, such as share capital or retained earnings. For example, some such requirements permit an entity to make distributions to holders of equity claims only if the entity has sufficient reserves that those requirements specify as being distributable.

6.5 Definitions of income and expenses

| Income | Expenses |

|

|

|

|

Income and expenses are the elements of financial statements that relate to an entity’s financial performance. Users of financial statements need information about both an entity’s financial position and its financial performance. Hence, although income and expenses are defined in terms of changes in assets and liabilities, information about income and expenses is just as important as information about assets and liabilities.

7. Recognition and Derecognition

| Recognition | Derecognition |

|

1. any assets and liabilities retained after the transaction or other event that led to the derecognition (including any asset or liability acquired, incurred or created as part of the transaction or other event); and 2. the change in the entity’s assets and liabilities as a result of that transaction or other event. |

Recognition links the elements (assets, liabilities, income and expenses), the balance sheet and the statement of profit and loss as follows:

-

- in the balance sheet at the beginning and end of the reporting period, total assets minus total liabilities equal total equity; and

- recognised changes in equity during the reporting period comprise:

(i) income minus expenses recognised in the statement of profit and loss; plus

(ii) contributions from holders of equity claims, minus distributions to holders of equity claims.

8. Measurement

Elements recognised in financial statements are quantified in monetary terms. A measurement basis is an identified feature—for example, historical cost, fair value or fulfilment value—of an item being measured. Applying a measurement basis to an asset or liability creates a measure for that asset or liability and for related income and expenses.

8.1 Measurement bases

| Historical cost | Current value |

|

a. Fair value b. Value in use for assets and fulfilment value for liabilities- c. Current cost — The current cost of an asset is the cost of an equivalent asset at the measurement date plus the transaction costs and the current cost of a liability is the consideration that would be received for an equivalent liability at the measurement date minus the transaction costs that would be incurred at that date. |

8.2 Factors to consider when selecting a measurement basis

In selecting a measurement basis for an asset or liability and for the related income and expenses, it is necessary to consider the nature of the information that the measurement basis will produce in both the balance sheet and the statement of profit and loss.

In most cases, no single factor will determine which measurement basis should be selected. The relative importance of each factor will depend on facts and circumstances.

There are certain factors which needs to be considered in selecting a measurement basis for recognised assets and recognised liabilities. Some of these factors may also apply in selecting a measurement basis for information provided in the notes, for recognised or unrecognised items. The choice of measurement basis for an asset or liability, and for the related income and expenses, is determined by considering both initial measurement and subsequent measurement.

These factors are further discussed as below:

| Relevance | The relevance of information provided by a measurement basis for an asset or liability and for the related income and expenses is affected by:

|

| Faithful representation | When assets and liabilities are related in some way, using different measurement bases for those assets and liabilities can create a measurement inconsistency (accounting mismatch).

If financial statements contain measurement inconsistencies, those financial statements may not faithfully represent some aspects of the entity’s financial position and financial performance. Although a perfectly faithful representation is free from error, this does not mean that measures must be perfectly accurate in all respects. |

8.3 More than one measurement basis

Sometimes, consideration of the factors described above may lead to the conclusion that more than one measurement basis is needed for an asset or liability and for related income and expenses in order to provide relevant information that faithfully represents both the entity’s financial position and its financial performance.

In most cases, the most understandable way to provide that information is:

-

- to use a single measurement basis both for the asset or liability in the balance sheet and for related income and expenses in the statement of profit and loss

- to provide in the notes additional information applying a different measurement basis.

However, in some cases, that information is more relevant, or results in a more faithful representation of both the entity’s financial position and its financial performance, through the use of:

-

- a current value measurement basis for the asset or liability in the balance sheet; and

- a different measurement basis for the related income and expenses in the profit or loss section of statement of profit and loss.

8.4 Measurement of equity

The total carrying amount of equity (total equity) is not measured directly. It equals the total of the carrying amounts of all recognised assets less the total of the carrying amounts of all recognised liabilities.

Because general purpose financial statements are not designed to show an entity’s value, the total carrying amount of equity will not generally equal:

-

- the aggregate market value of equity claims on the entity;

- the amount that could be raised by selling the entity as a whole on a going concern basis; or

- the amount that could be raised by selling all of the entity’s assets and settling all of its liabilities.

Although total equity is not measured directly, it may be appropriate to measure directly the carrying amount of some individual classes of equity and some components of equity. Nevertheless, because total equity is measured as a residual, at least one class of equity cannot be measured directly. Similarly, at least one component of equity cannot be measured directly.

The total carrying amount of an individual class of equity or component of equity is normally positive, but can be negative in some circumstances. Similarly, total equity is generally positive, but it can be negative, depending on which assets and liabilities are recognised and on how they are measured.

9. Presentation and disclosure

A reporting entity communicates information about its assets, liabilities, equity, income and expenses by presenting and disclosing information in its financial statements. Just as cost constrains other financial reporting decisions, it also constrains decisions about presentation and disclosure. Hence, in making decisions about presentation and disclosure, it is important to consider whether the benefits provided to users of financial statements by presenting or disclosing particular information are likely to justify the costs of providing and using that information.

To facilitate effective communication of information in financial statements, when developing presentation and disclosure requirements in Ind ASs a balance is needed between:

-

- giving entities the flexibility to provide relevant information that faithfully represents the entity’s assets, liabilities, equity, income and expenses; and

- requiring information that is comparable, both from period to period for a reporting entity and in a single reporting period across entities.

9.1 Classification of assets and liabilities

Classification is the sorting of assets, liabilities, equity, income or expenses on the basis of shared characteristics for presentation and disclosure purposes. Such characteristics include—but are not limited to—the nature of the item, its role (or function) within the business activities conducted by the entity, and how it is measured.

Classification is applied to the unit of account selected for an asset or liability. However, it may sometimes be appropriate to separate an asset or liability into components that have different characteristics and to classify those components separately. That would be appropriate when classifying those components separately would enhance the usefulness of the resulting financial information.

For example, it could be appropriate to separate an asset or liability into current and non-current components and to classify those components separately.

Offsetting occurs when an entity recognises and measures both an asset and liability as separate units of account, but groups them into a single net amount in the balance sheet. Offsetting classifies dissimilar items together and therefore is generally not appropriate.

Offsetting assets and liabilities differs from treating a set of rights and obligations as a single unit of account.

9.2 Classification of equity

To provide useful information, it may be necessary to classify equity claims separately if those equity claims have different characteristics.

Similarly, to provide useful information, it may be necessary to classify components of equity separately if some of those components are subject to particular legal, regulatory or other requirements. For example, in some jurisdictions, an entity is permitted to make distributions to holders of equity claims only if the entity has sufficient reserves specified as distributable. Separate presentation or disclosure of those reserves may provide useful information.

9.3 Classification of income and expenses

Income and expenses are classified and included either:

-

- in the profit or loss section of statement of profit and loss; or

- outside the profit or loss section of statement of profit and loss, in other comprehensive income.

Because the profit or loss section of statement of profit and loss is the primary source of information about an entity’s financial performance for the period, all income and expenses are, in principle, included in that statement.

In principle, income and expenses included in other comprehensive income in one period are reclassified from other comprehensive income into the profit or loss section of statement of profit and loss in a future period when doing so results in the profit or loss section of statement of profit and loss providing more relevant information, or providing a more faithful representation of the entity’s financial performance for that future period.

9.4 Aggregation

Aggregation is the adding together of assets, liabilities, equity, income or expenses that have shared characteristics and are included in the same classification.

Aggregation makes information more useful by summarising a large volume of detail. However, aggregation conceals some of that detail. Hence, a balance needs to be found so that relevant information is not obscured either by a large amount of insignificant detail or by excessive aggregation.

Different levels of aggregation may be needed in different parts of the financial statements. For example, typically, the balance sheet and the statement of profit and loss provide summarised information and more detailed information is provided in the notes.

10. Executory contracts

An executory contract is a contract, or a portion of a contract, that is equally unperformed—neither party has fulfilled any of its obligations, nor both parties have partially fulfilled their obligations to an equal extent.

An executory contract establishes a combined right and obligation to exchange economic resources. The right and obligation are interdependent and cannot be separated. Hence, the combined right and obligation constitute a single asset or liability. The entity has an asset if the terms of the exchange are currently favourable; it has a liability if the terms of the exchange are currently unfavourable. Whether such an asset or liability is included in the financial statements depends on both the recognition criteria and the measurement basis selected for the asset or liability, including, if applicable, any test for whether the contract is onerous.

To the extent that either party fulfils its obligations under the contract, the contract is no longer executory. If the reporting entity performs first under the contract, that performance is the event that changes the reporting entity’s right and obligation to exchange economic resources into a right to receive an economic resource. That right is an asset. If the other party performs first, that performance is the event that changes the reporting entity’s right and obligation to exchange economic resources into an obligation to transfer an economic resource. That obligation is a liability.

11. Concepts of capital and capital maintenance

11.1 Capital

-

- Financial Concept – Capital (i.e., money invested) is synonymous with the net assets of equity of the entity.

- Physical Concept – Capital is regarded as the productive capacity of the entity based on, for example, units of output per day.

These two concept’s give rise to the concepts of capital maintenance.

11.2 Concepts of capital maintenance and the determination of profit

-

- Financial capital maintenance: Profit is earned only if the financial (or money) amount of the net assets at the end of the period exceeds the financial (or money) amount of net assets at the beginning of the period, after excluding any distributions to, and contributions from, owners during the period.

Historical cost accounting uses financial capital maintenance in money terms.

- Financial capital maintenance: Profit is earned only if the financial (or money) amount of the net assets at the end of the period exceeds the financial (or money) amount of net assets at the beginning of the period, after excluding any distributions to, and contributions from, owners during the period.

-

- Physical capital maintenance: Profit is earned only if the physical productive capacity (or operating capability) of the entity (or the resources or funds needed to achieve that capacity) at the end of the period exceeds the physical productive capacity at the beginning of the period, after excluding any distributions to, and contributions from, owners during the period.

Both concepts can be measured in either nominal monetary units or units of constant purchasing power. Physical capital maintenance requires that current cost be adapted as the basis for measurement, whereas financial capital maintenance does not call for any particular measurement basis.

Overview of Conceptual Framework

Also Read: Indian Accounting Standards

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA