Business Cycle – Deciphering the Phases | Causes | Features

- Other Laws|Blog|

- 7 Min Read

- By Taxmann

- |

- Last Updated on 24 March, 2025

Business Cycle refers to the recurring pattern of expansion and contraction in economic activity that takes place over time in a market economy. It represents the fluctuations in key economic indicators such as gross domestic product (GDP), employment, investment, and consumer spending.

Table of content

- Phases of Business Cycle

- Examples of Business Cycles

- Features of Business Cycles

- Types of Indicators

- Causes of Business Cycles

- Important Terms

Check out Taxmann's Business Economics (Economics) | Study Material which is stands out with its simple and lucid language, detailed explanations supported by diagrams and tables, and comprehensive coverage of essential topics. Designed for exam success, it includes a variety of MCQs for extensive practice and Fast Track Notes for efficient revision. Developed with the author's teaching expertise and student feedback, this book effectively addresses common challenges, making it a reliable companion for CA aspirants. CA Foundation | New Syllabus | Jan./May 2025 Exams

1. Phases of Business Cycle

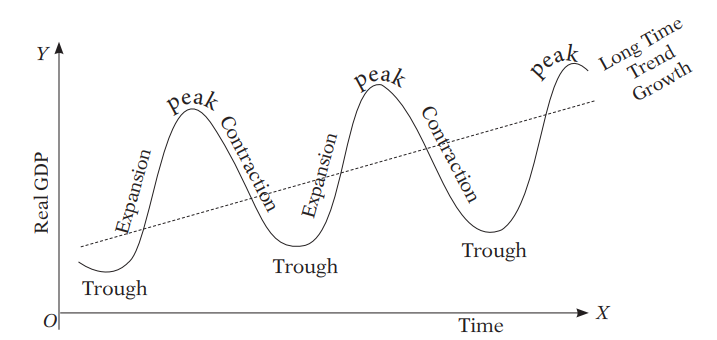

Business cycle or booms and slumps in the economic activities reflect the upward & downward movements in economic variables. A typical business cycle has four distinct phases. These are –

- Expansion [also called Boom or Upswing]

- Peak or Boom or Prosperity

- Contraction

- Trough or Depression

1.1 Expansion

- The expansion phase is characterised by increase in national output, employment, aggregate demand, capital and consumer expenditure, sales, profits, rising stock prices and bank credit.

- This state continues till there is full employment of resources and production is at its maximum possible level using available productive resources.

- Involuntary unemployment is almost zero and whatever unemployment is there is either frictional (i.e. due to change of jobs, or suspended work due to strikes or due to imperfect mobility of labour) or structural (i.e. unemployment caused due to structural changes)

- Prices and costs also tend to rise faster. Good amounts of net investment occur, and demand for all types of goods and services rises. There is altogether increasing prosperity and people enjoy high standard of living due to high levels of consumer spending, business confidence, production, factor incomes, profits, and investment. The growth rate eventually slows down and reaches its peak.

1.2 Peak

- In the later stages of expansion, inputs are difficult to find as they are short of their demand and therefore input prices increase. Output prices also rise rapidly leading to increased cost of living and greater strain on fixed income earners.

- Consumers begin to review their consumption expenditure on housing, durable goods etc. Actual demand stagnates. This is the end of expansion and it occurs when economic growth has reached a point where it will stabilize for a short time and then move in the reverse direction.

1.3 Contraction

- As mentioned above, once peak is reached, increase in demand is halted and starts decreasing in certain sectors. During contraction, there is fall in the levels of investment and employment.

- Producers do not instantaneously recognise the pulse of the economy and continue anticipating higher levels of demand, and therefore, maintain their existing levels of investment and production. Supply far exceeds demand. Initially, this happens only in few sectors and at a slow pace, but rapidly spreads to all sectors. Producers knowing, they have indulged in excessive investment and over production, respond by holding back future investment plans, cancellation, and stoppage of orders for equipment and all types of inputs including labour. This in turn generates a chain of reactions in the input markets and producers of capital goods and raw materials in turn respond by cancelling and curtailing their orders.

- This is the turning point and the beginning of recession. Decrease in input demand pulls input prices down; incomes of wage and interest earners gradually decline resulting in decreased demand for goods and services.

- Producers lower their prices in order to dispose off their inventories and for meeting their financial obligations.

- Consumers, in their turn, expect further decreases in prices and postpone their purchases. With reduced consumer spending, aggregate demand falls, generally causing fall in prices. The discrepancy between demand and supply gets widened further.

- This process gathers speed and recession becomes severe. Investments start declining; production and employment decline resulting in further decline in incomes, demand and consumption of both capital goods and consumer goods.

- Business firms become pessimistic about the future state of the economy and there is a fall in profit expectations which induces them to reduce investments. Bank credit shrinks as borrowings for investment declines, investor confidence is at its lowest, stock prices fall and unemployment increases despite fall in wage rates.

- The process of recession is complete and the severe contraction in the economic activities pushes the economy into the phase of depression.

1.4 Trough and Depression

- Depression is the severe form of recession and is characterized by extremely sluggish economic activities.

- During this phase of the business cycle, growth rate becomes negative and the level of national income and expenditure declines rapidly. Demand for products and services decreases, prices are at their lowest and decline rapidly forcing firms to shut down several production facilities. Since companies are unable to sustain their work force, there is mounting unemployment which leaves the consumers with very little disposable income.

- A typical feature of depression is the fall in the interest rate. With lower rate of interest, people’s demand for holding liquid money (i.e. in cash) increases. Despite lower interest rates, the demand for credit declines because investors’ confidence has fallen.

- Often, it also happens that the availability of credit also falls due to possible banking or financial crisis. Industries, especially capital and consumer durable goods industry, suffer from excess capacity. Large number of bankruptcies and liquidation significantly reduce the magnitude of trade and commerce.

- At the depth of depression, all economic activities touch the bottom and the phase of trough is reached. For example, the great depression of 1929-33 is still cited for the enormous misery and human sufferings it caused.

1.5 Recovery

- The economy cannot continue to contract endlessly. It reaches the lowest level of economic activity called trough and then starts recovering. Trough generally lasts for some time and marks the end of pessimism and the beginning of optimism. This reverses the process. The process of reversal is initially felt in the labour market. Pervasive unemployment forces the workers to accept wages lower than the prevailing rates.

- A time comes when business confidence takes off and gets better, consequently they start to invest again and to build stocks; the banking system starts expanding credit; technological advancements require fresh investments into new types of machines and capital goods; employment increases, aggregate demand picks up and prices gradually rise.

- The spurring of investment causes recovery of the economy. This acts as a turning point from depression to expansion. As investment rises, production increases, employment improves, income improves and consumers begin to increase their expenditure.

- Increased spending causes increased aggregate demand and in order to fulfil the demand more goods and services are produced. Employment of labour increases, unemployment falls and expansion takes place in the economic activity.

- It is to be reemphasized that no economy follows a perfectly timed cycle and that the business cycles are anything but regular. They vary in intensity and length. There is no set pattern which they follow. Some cycles may have longer periods of boom, others may have longer period of depression. It is very difficult to predict the turning points of business cycles.

2. Examples of Business Cycles

- Great Depression of 1930

- Information Technology Bubble Burst of 2000

- Global Economic Crisis (2008-2009) [Most Recent Example]

3. Features of Business Cycles

Different business cycles differ in duration and intensity. But there are certain features which they commonly exhibit:

- Business cycles occur periodically although they do not exhibit the same regularity. The duration of these cycles varies. The intensity of fluctuations also varies.

- Business cycles have distinct phases of expansion, peak, contraction and trough. These phases seldom display smoothness and regularity. The length of each phase is also not definite.

- Business cycles generally originate in free market economies. They are pervasive as well. Disturbances in one or more sectors get easily transmitted to all other sectors.

- Although all sectors are adversely affected by business cycles, some sectors such as capital goods industries, durable consumer goods industry etc, are disproportionately affected. Moreover, compared to agricultural sector, the industrials sector is more prone to the adverse effects of trade cycles.

- Business cycles are exceedingly complex phenomena; they do not have uniform characteristics and causes. They are caused by varying factors. Therefore, it is difficult to make an accurate prediction of trade cycles before their occurrence.

- Repercussions of business cycles get simultaneously felt on nearly all economic variables viz. output, employment, investment, consumption, interest, trade and price levels.

- Business cycles are contagious and are international in character. They begin in one country and mostly spread to other countries through trade relations. For example, the great depression of 1930s in the USA and Great Britain affected almost all the countries, especially the capitalist countries of the world.

- Business cycles have serious consequences on the well-being of the society.

Economists use changes in a variety of activities to measure the business cycle and to predict where the economy is headed towards. These are called indicators.

4. Types of Indicators

a) Leading Indicators – A leading indicator is a measurable economic factor that changes before the economy starts to follow a particular pattern or trend. In other words, those variables that change before the real output changes are called ‘Leading indicators’. Leading indicators often change prior to large economic adjustments. In simple words it is a measurable economic factor that changes before the economy starts to follow a particular pattern or trend. i.e. they change before the real output changes. Leading indicators, though widely used to predict changes in the economy, are not always accurate.

Examples – changes in stock prices, profit margins and profits, indices such as housing, interest rates and prices are generally seen as precursors of upturns or downturns

b) Lagging Indicators – Lagging indicators reflect the economy’s historical performance and changes in these indicators are observable only after an economic trend or pattern has already occurred. In other words, variables that change after the real output changes are called ‘Lagging indicators’. If leading indicators signal the onset of business cycles, lagging indicators confirm these trends. We can say that it is an indicator that changes after real output changes.

Examples – Unemployment, corporate profits, labour cost per unit of output, interest rates, the consumer price index and commercial lending activity

c) Coincident Indicators – Coincident economic indicators, also called concurrent indicators, coincide, or occur simultaneously with the business-cycle movements. Since they coincide closely with changes in the cycle of economic activity, they describe the current state of the business cycle. In other words, these indicators give information about the rate of change of the expansion or contraction of an economy more or less at the same point of time it happens. We can say that it is an indicator that coincides or occur simultaneously with the business-cycle movements.

Examples – Gross Domestic Product, industrial production, inflation, personal income, retail sales and financial market trends such as stock market prices

5. Causes of Business Cycles

5.1 Internal Causes

- Fluctuations in Effective Demand

- Fluctuations in investment

- Variations in government spending

- Macroeconomic policies

- Money Supply

- Psychological factors

5.2 External Causes

- Wars

- Post War Reconstruction

- Technology shocks

- Natural Factors

- Population growth

6. Important Terms

- Procyclical – means something with a positive effect i.e. moving in the same direction as the overall state of an economy. For example GDP, Labour, marginal cost and Residential investment.

- Countercyclical – means an indicator that tends to move in opposite direction as the overall state of an economy i.e. negative effect. For example, stock market, unemployment etc.

- Acyclical – means an indicator that tends to move independent from overall state of an economy. For example, Fashion trend and economic growth.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA