Audit of Trusts and NGOs in Form 10B & 10BB – FY 2022-23 | AY 2023-24

- Blog|Account & Audit|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 25 September, 2023

Table of Contents

- Introduction, Applicability of Audit and Key Issues

- Form 10BB and Key Issues

- Revised Form 10B and Key Issues

1. Introduction, Applicability of Audit and Key Issues

1.1 Requirement of Audit under the Income-tax Act

1.1.1 Requirement of Audit

Mandatory for a trust to get its books of accounts audited to avail the exemption under Section 11 and Section 12.

As per Section 12A(1) –

“(b) where the total income of the trust or institution as computed under this Act without giving effect to the provisions of sections 11 and 12 exceeds the maximum amount which is not chargeable to income-tax in any previous year,—

(i) ……

(ii) the accounts of the trust or institution for that year have been audited by an accountant defined in the Explanation below sub-section (2) of section 288 before the specified date* referred to in section 44AB and the person in receipt of the income furnishes by that date the report of such audit in the prescribed form duly signed and verified by such accountant and setting forth such particulars, as may be prescribed;”

*Specified date ………. means date one month prior to the due date for furnishing the return of income u/s. 139(1)

1.1.2 Implications of not Filing Audit Report

Implication upto AY 2022-23

If the audit report is not submitted as prescribed, then the benefits of Sections 11 and 12 shall be withdrawn for that year.

Implication after AY 2023-24

From AY 2023-24, the income in such cases shall be computed as per Sections 13(10) and 13(11).

1.2 Forms for filing Audit Report under the Income-tax Act

1.2.1 CBDT Notified New Audit Report Forms

- Rules 16CC and 17B of the Income-tax Rules, 1962 have been substituted w.e.f. 01-04-2023 vide Income-tax amendment (3rd Amendment) Rules, 2023.

- CBDT notified new audit reports Form 10B and 10BB to be furnished by charitable or religious trusts and other institutions.

- Amended Rules: 16CC and 17B (w.e.f. 01/04/2023)

- Change in Form in which Audit report is to be given

- Change in the format of the Audit report

- Comprehensive change in annexures forming part of the Audit Report

1.2.2 Rationale Behind New Forms

- Pre-amended Form 10B was in force w.e.f. 01-04-1973 & Form 10BB was in force w.e.f. 25-07-2006.

- On 21st May 2019, CBDT released a draft notification with modified 8 pages of Form 10B, which was also put in the public domain for public comments but never made effective.

- Every year, a number of amendments were made for charitable institutions including bringing uniformity in two regimes [Section 12AB and 10(23C)].

- Present Form 10B/10BB does not include various data being used to fill ITR -7.

- Hence, there seems to be a rationale for modifying Form 10B/10BB in the present context of charity taxation and the requirement of ITR 7 vis-à-vis the requirement of conditions for renewal of registration.

- The amended Form 10B is very comprehensive, and the key information is to be filled in (with code number) as mentioned in the notes, therefore, easy to analyse the data and capture the related information by the Income Tax department.

1.2.3 Change in Form

Pre-Amended Position

There were two types of Forms: Form 10B, which was applicable for 12AB registered trusts, and Form 10BB, which was applicable for 10(23C) approved entities.

Amended Position

- Now there is no separate Form for 12AB registered or 10(23C) approved NGOs

- Common Forms are specified for both regimes

- Same names of form: Form 10B and Form 10BB

- Form 10B is basically for a bigger size specified category of NGO, and Form 10BB is for other cases not covered in Form 10B

1.3 Applicability of Form 10B/10BB

1.3.1 Who has to File Form 10B/10BB

Who is required to file Form 10B?

- If the total income of the trust or institution, without giving effect to the provisions of sections 11 and 12 or Section 10(23C) (iv), (v), (vi), (via) of the Act, exceeds rupees five crores during the previous year; or

- If such trust or institution has received any foreign contribution during the previous year; or

- If such trust or institution has applied any part of its income outside India during the previous year.

Who is required to file Form 10BB

- Any other case not covered in Form 10B.

1.4 Case Studies to Follow

1.4.1 Key Issues

Which form should be used in the following scenarios?

- If an FC-registered organization receives neither fresh foreign grant nor any bank interest or any other nature of FC and submit NIL FC return

- If an FC-registered organization receives foreign contributions only in the form of bank interest

- When the FCRA registration of an NGO has been cancelled or its renewal has not been granted, and the organization has received bank interest?

Which audit report form should be used when the institution has incurred expenditures in foreign currency, or when the income has been applied outside of India?

Form 10B is required to be submitted if total income before giving effect of Section 11 exceeds Rs. 5 Crore, whether this limit of Rs. 5 Cr shall be calculated:

- On the basis of income computed on a commercial basis and available for application?

- Whether voluntary contribution towards corpus shall be included.

- Whether capital gain deemed to be utilised under section 11(1A) shall be included.

1.5 Amendment in the contents of Audit Report

1.5.1 Comparison of Previous Form and New Form

| Basis of Difference | Pre-Amended Position | Amended Position |

| Financial Statement to be examined | the Balance Sheet and the Profit & Loss A/c | The Balance Sheet and Income & Expenditure Account or Profit & Loss A/c. |

| Information on place of maintaining of books of account | proper books of account have been maintained by the head office and branches | The amended format requires Auditors to include the following:

“In * my/our opinion, proper books of account have been maintained at the registered office or at the address mentioned at row 11/14 of the Annexure” |

| Opinion by the Auditor on the Financial Statement | in the case of the profit and loss account, of the profit or loss of its accounting year ending on ……… | in the case of the Income and Expenditure account or Profit and Loss account, of the income and application/profit or loss of its accounting year ending on …….. |

| Certification of Annexure | Not Required. | True and Correct |

1.5.2 Observations/Qualifications

True & Correct view of Annexure:

In *my/our opinion and to the best of *my/our information and according to explanations given to *me/us, the particulars given in the Annexure are true and correct subject to following observations or qualifications, if any—

(a) …………………….

(b)..…………………..

(c)..…………………..

True & Fair view of Amount of application:

In * my/our opinion and to the best of * my/our information, and according to information given to * me/us, the said accounts give a true and fair view—

i. in the case of the balance sheet, of the state of affairs of the above named * fund or trust or institution or university or other educational institution or hospital or other medical institution as on____________; and

ii. in the case of the Income and Expenditure account or Profit and Loss account, of the income and application/ profit or loss of its accounting year ending on ……..

subject to the following observations/qualifications—

(a) …………………….

(b) ..…………………..

(c) ..…………………..

1.6 Case Studies to Follow

1.6.1 Key Issues

In * my/our opinion, proper books of account have been maintained at the registered office or at the address mentioned at row 11/14 of the Annexure

- How the auditor shall satisfy himself that the books of accounts have been maintained at the address mentioned in Form 10B/10BB?

- Whether the auditor also needs to report on the maintenance of specified documents as per Rule 17AA.

- How the Auditor should report: If books of accounts are maintained but specified documents are not maintained.

The financial statement is named Income & Expenditure A/c, but the auditor is required to report a True and fair view of Income and Application: Whether it is possible to report application from the normal Income & expenditure account.

Should the receipt and payment account also be included as a part of the financial statement?

2. Form 10BB and Key Issues

2.1 Contents of Form 10BB

| Sl. No. | Content |

Form 10BB |

|

01. |

Clauses | 32 |

|

02. |

Sections | 09 |

| 03. | Schedules |

06 |

| 04. | Notes |

06 |

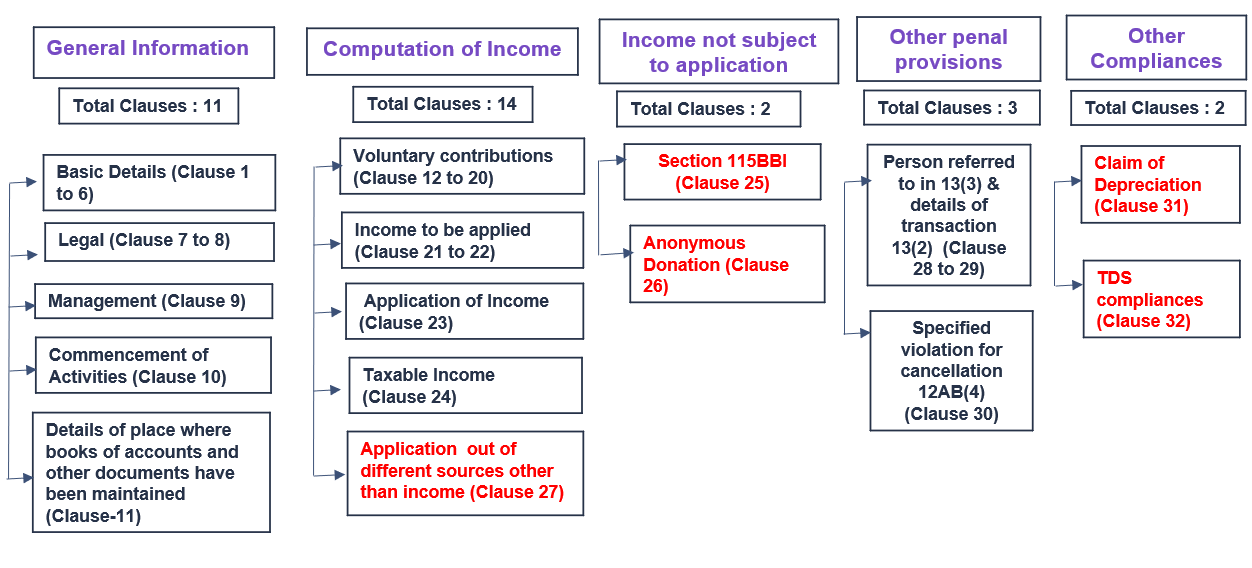

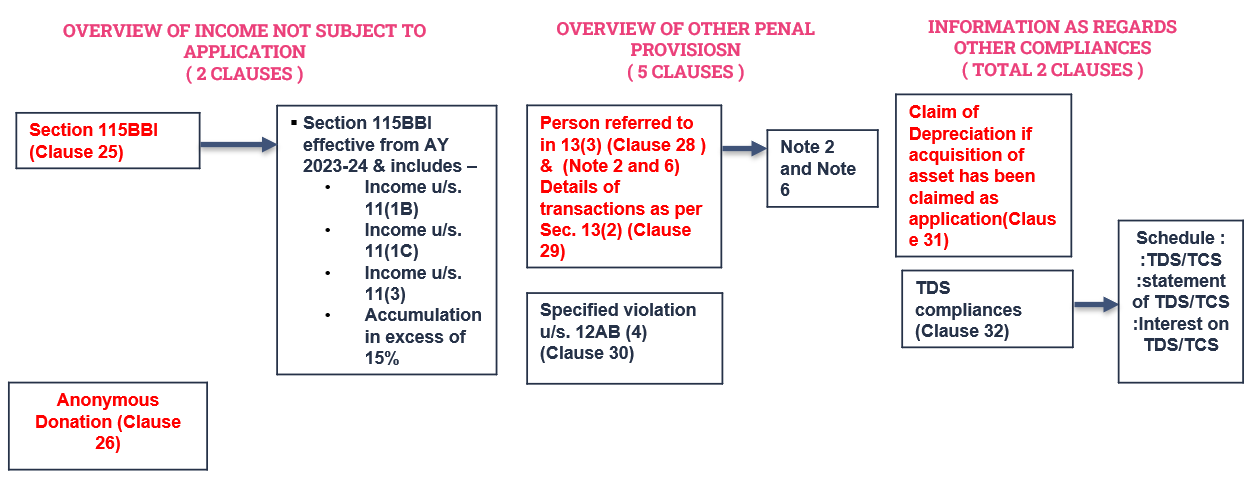

2.2 Overview of Form 10BB

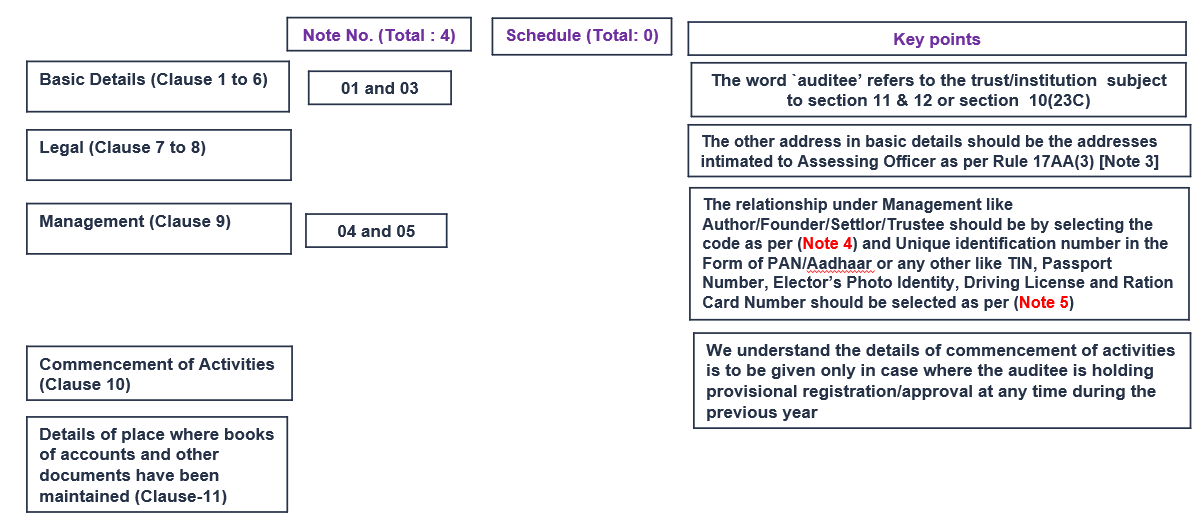

2.3 Overview of General Information

2.4 Case Studies to Follow

2.4.1 Key Issues

Which date is to be mentioned as the commencement date of activities, and what is the auditor’s relevance of mentioning this date?

Clause 9 required the details of Management, which includes settlor, trustee, General Body Member as well as Governing Body Members:

- Whether a list of only governing Body Members/Trustee can be given or all the required information should be given?

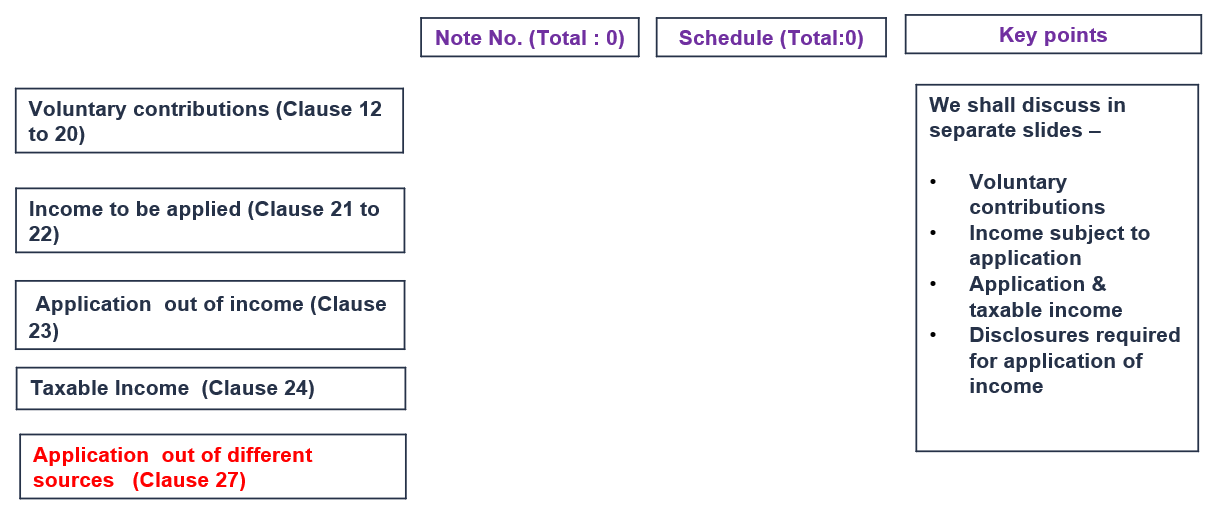

2.4.2 Overview of Computation of Income

2.4.3 Voluntary Contributions (Clause 12 to 20)

- Whether auditee has filed form No. 10BD for the previous year < if No then skip to row 14>

- Total sum of donations reported in Form No. 10BD

- Donations not to be reported in Form No. 10BD

- Total Voluntary Contributions received by the auditee during the previous year [13+14]

- Total Foreign Contribution out of total Voluntary Contribution stated in 15

- Voluntary Contributions forming part of corpus (which are included in 15)

- Anonymous donations taxable @ 30% u/s. 115BBC

- Application outside India for which approval u/s. 11(1)(c) has been obtained

- Voluntary contributions required to be applied by the auditee during the previous year [Total VC(15) – {17(VC forming part of corpus)+18 (Anonymous Donation) + 19 (Application outside India}]

2.4.4 Income to Be Applied (Clause 21 to 22)

- Voluntary Contribution required to be applied

- Income other than Voluntary Contribution

- Total income subject to Application (20+21)

Income other than voluntary contribution has no detailed schedule. Hence it should include all other income, including:

- Income from Trust Property

- Business income u/s. 11(4)

- Incidental income u/s. 11(4A)

AI schedule of the ITR-7 should be referred

2.4.5 Key Issues

Whether income other than voluntary contribution should be on a commercial or on a gross basis?

Whether capital gain deemed utilized u/s 11(1A) to be included as a part of income other than voluntary contribution?

2.4.6 Application of Income and Taxable Income

- Application of income (excluding app. Not eligible and reported in S.No. 27)

(i) Amount applied for Charitable & religious purpose during the year

(ii) Amount not actually paid during the previous year [if included in (i)]

(iii) Amount actually paid during the previous year which accrued during any earlier previous year but not claimed as application if income in earlier previous year

(iv) Total amount applied in India on payment basis

(v) Amount invested or deposited back to corpus fund

(vi) Repayment of loan or borrowing

(vii to xv) Amount to be disallowed from application

vii) Disallowance due to TDS violation (Sch- TDS Disallowable)

viii) Cash payment exceeding Rs. 10,000/- [Sch-40A(3) and 40A(3A)]

ix) Inter Charity donation towards corpus

x) Inter Charity donations not having the same objects

xi) Donation to any person other than registered/approved institution

xii) Application outside India for which no approval has been taken

xiii) Application outside India for which approval u/s. 11(1)(c) has been taken

xiv) Applying for any purpose beyond the object

xv) Any other disallowance (Please specify)

(xvi) Total allowable application [{23(iv)+23(v)+23(vi)} – {23(vii) to 23(xv)}]

Add: (xvii) Accumulation under section 11(2) – Form 10

(xviii) Deemed application – Form 9A

(xix) Statutory Accumulation up to 15%

- Taxable Income [22 (income applied during the year)-{23(xvi)+23(xvii)+23(xviii)+23(xix)}]

2.4.7 Application of Income Out of Different Sources (Clause 27)

Application of income out of the following sources during the previous year:

(A) Income accumulated under third proviso to clause 10(23C) or Section 11(2) – (Form 10)

(B) Income deemed to be applied under clause (2) of Explanation 1 under section 11(1) – (Form 9A)

(C) Statutory Accumulation u/s. 15%

(D) Corpus

(E) Borrowed Fund

(F) Any Other (Please Specify)

2.4.8 Key Issues

The income only by way of accrued interest from Fixed deposit amounting to Rs 11 lakhs, and the amount spent is Rs 10 lakhs out of the opening bank balance:

- What shall be the amount of application out of income?

Whether application out of 11(2) can be reported if the amount is applied out of the opening bank balance and without liquidating the tied-up fixed deposit.

In case excess of expenditure over income: How to identify and determine the amount of application with the nature of expenditure out of Income?

Whether donations to any person other than registered/approved institutions are to be disallowed while calculating the amount of application?

Whether Donation to any person shall also include donation/financial assistance to an individual for self-consumption?

What shall be the implications of the following:

- Donations to other organization not having the same objects

- Donations applied beyond the object and applied beyond section 2(15)

2.4.9 Overview

2.4.10 Key Issues

Reporting of persons specified under Section 13(3):

- List of the person making a substantial contribution

- List of other specified person

- How to determine and certify the amount of benefit

- What audit evidence should be kept If the benefit is certified to be Nil?

Specified Violation under Section 12AB(4):

- How to asses and certify the specified violation

- What audit evidence should be kept if the specified violation is certified to be NO?

3. Form 10B and Key Issues

3.1 Contents of Form 10B

| Sl. No. | Content |

Form 10BB |

|

01. |

Clauses | 49 |

|

02. |

Sections | 22 |

| 03. | Schedules |

26 |

| 04. | Notes |

12 |

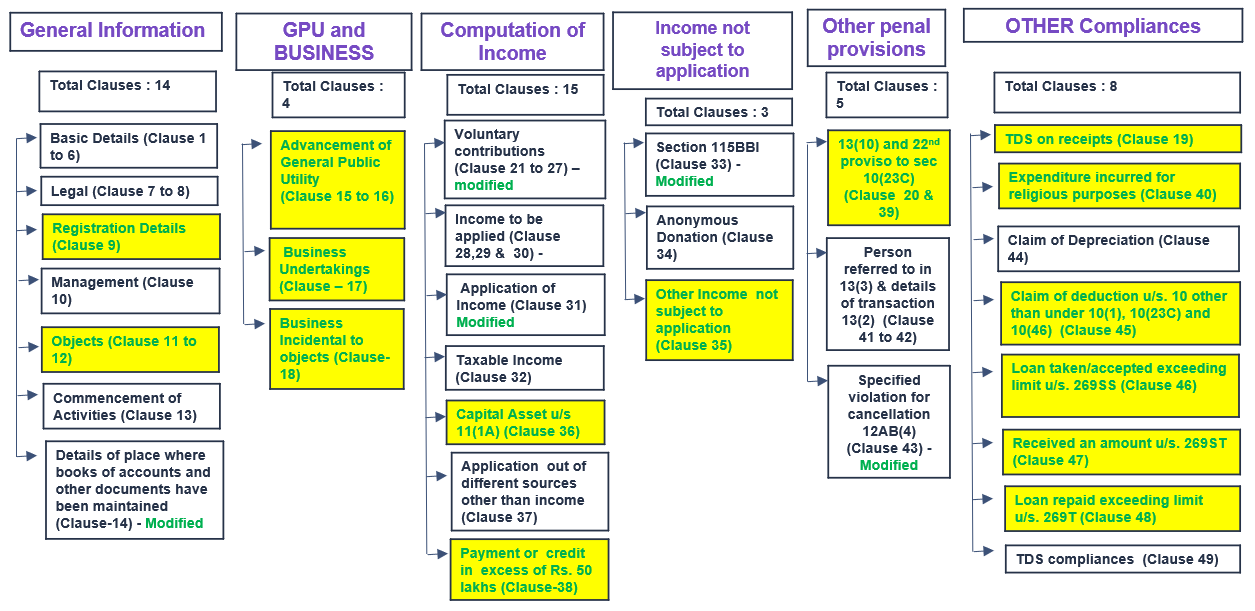

2.2 Overview of Form 10B

3.3 Contents of Form 10B

Clauses and their Key Points

Registration Details (Clause 9): Details of registration should be by selecting the code as mentioned in Note 4

Objects (Clause 11 to 12): The object as per Sec. 2(15) should be selected the code as per Note 7

Details of place where books of accounts and other documents have been maintained (Clause-14): Rule 17AA requires 8 books of accounts & 10 documents to be maintained & clause 14 requires details of these 18 books of accounts & other documents with code No. from 01 to 18:

- Whether maintained or not

- Whether maintained at registered office or at other place et..

- Whether these books of accounts have been audited

Other Income not subject to application (Clause 35): Other Income includes-

- Income chargeable u/s. 12(2)

- Income as per Explanation 3(b) [80G(2)(b) cases]

- Income chargeable u/s. 11(4)

13(10) and 22nd proviso to sec 10(23C) (Clause 20 & 39): Section 13(10) effective from AY 2023-24 provides for a different method of computation of income for violation of Sec. 2(15), condition to registration

Person referred to in 13(3) & details of transactions as per Sec. 13(2) (Clause 41 to 42): SP-a,b,c,d,e1/e2, f1/f2, g, h

3.4 Case Studies to Follow for Clause 15, 16, 17 & 18 GPU, Business (11(4) & Business (11(4A)

3.4.1 Key Issues – Clause 15: GPU

15. Whether any activity is being carried on by the auditee which is in the nature of trade, commerce or business referred to in proviso to clause (15) of section 2?

When an activity shall be deemed to be in the nature of trade, commerce & business?

How the 20% limit is to be calculated:

a. On the basis of total organizational receipt (or) receipt of the GPU section

b. The receipt: whether net sales or net profit to be compared with net income from trust property

3.4.2 Key Issues – Clause 17: Business Undertaking

When a business shall be held to be a business undertaking for the purpose of Section 11(4)?

Whether separate set of books of account for Sec. 11(4) business to be maintained or it can be merge with separate set of books of accounts maintained for Sec. 11(4A)?

Tax Audit Report is required by the Rule is to be only for business undertaking u/s. 11(4) or combine report with Sec. 11(4) & 11(4A) or for the organisation as a whole?

3.4.3 Key Issues – Clause 18: Business Incidental to Objects

When shall business be classified as incidental to the attainment of the main object?

Whether independent business to feed charity can be incidental business? If not, then what are auditors responsibility while certifying 10B/10BB

3.4.4 Voluntary Contributions (Clause 21 to 27)

- Whether auditee has filed form No. 10BD for the previous year < if No then skip to row 23>

- Total sum of donations reported in Form No. 10BD

- Donations not to be reported in Form No. 10BD

- (i) and (ii) Donations recd. in terms of Section 80G (2)(b)

- (iii)Donation not subject to 80G benefit –

(a). Cash donations exceeding Rs. 2000/-

(b). Donations recd. From other charitable institutions - (iv) Donations where identification of donors is not available

- (v) Donation received in Kind

- (vi) Anonymous Donation

– Taxable

– Exempt portion subject to application - (vii) Any other reason

- (viii) Total donations not reported in Form No. 10BD

- Total Voluntary Contributions received by the auditee during the previous year [22+23(viii)]

- Total foreign contribution out of the total voluntary contribution stated in 24

- Exempt amount of Corpus donations

- Voluntary contributions required to be applied by the auditee during the previous year [Total VC(24) – { taxable donation of anonymous donation u/s. 115BBC(23(vi)(d))+Corpus Donation}]

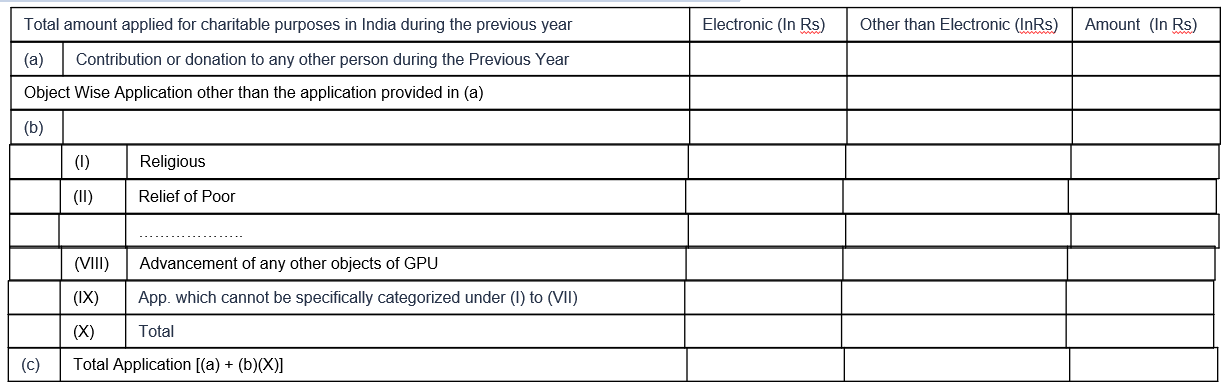

3.4.5 Application of Income (Clause 31)

- Application which cannot be specifically categorized under purpose wise application

- Details of application in excess of Rs. 50 lakhs to a person [Clause 31(ii)]

- Application to be bifurcated between revenue and capital [Clause 31(vi)]

- Capital Asset u/s 11(1A) [Clause 36]

3.5 Case Studies to Follow

3.5.1 Key Issues

How do we certify the purpose-wise expenditure when the purpose is not defined in the Income Tax Act?

How do we treat the administrative cost, which may be in relation to the project and may be in relation to General Administration while filling the purpose-wise application?

How to classify capital expenses while summarizing purpose-wise applications?

For example, Ambulance/Vehicle for common use/Program use.

Whether there will be reporting u/s 13(10) and 13(11) in the following cases:

- The audit report is yet to be uploaded at the time of signing the audit report

- Income Tax return to be submitted once audit report is signed and uploaded

- If there is substantive compliance to the Books of Accounts maintained:

- when there is general and substantive compliance with the provisions of a rule, it is sufficient. [CIT v. Leroy Somer and Controls India (P.) Ltd., [2013] 37 taxmann.com 407/218 Taxman 216/[2014] 360 ITR 532 (Delhi), cited in Worlds Window Impex (India) (P.) Ltd. vs. Asstt. CIT, [2016] 69 taxmann.com 406 (Delhi – Trib.)]

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA