A Comprehensive Guide to Ind AS 2 | Inventories

- Blog|Account & Audit|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 5 June, 2023

Table of Contents

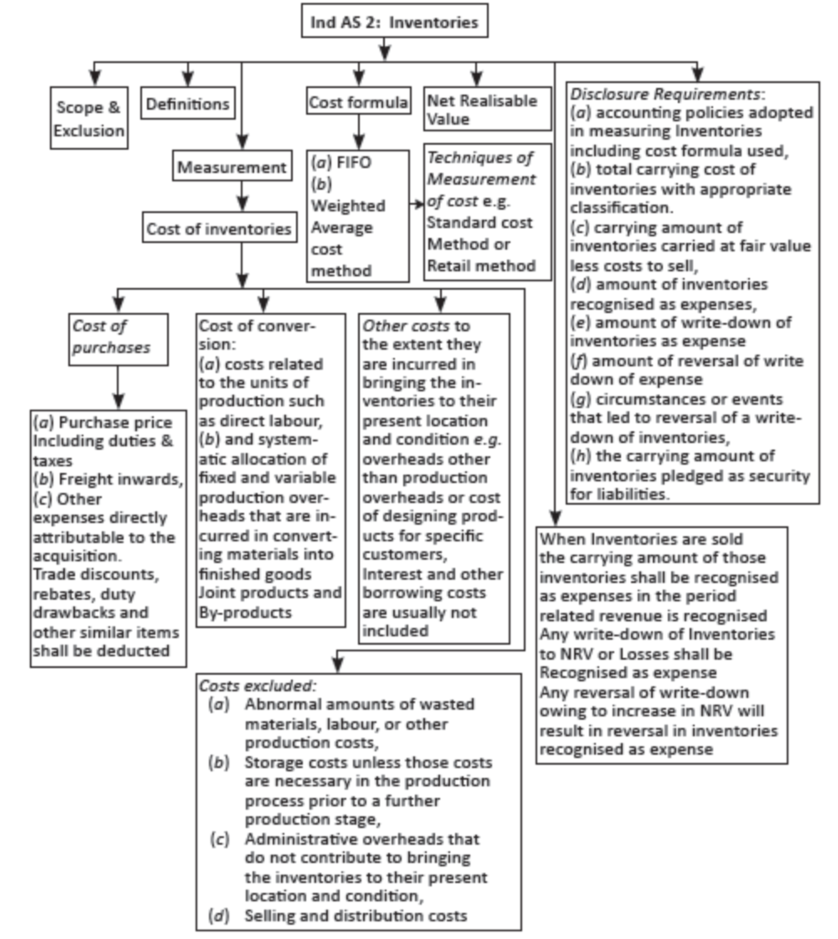

- Objective

- Scope

- Exclusion

- Definitions (Para 6)

- Recognition Principles

- Measurement of Inventories (Para 9)

- Cost of Inventories

- Costs Excluded from Valuation of Inventories

- Borrowing Costs and Inventories

- Inventories Purchased on Deferred Settlement Terms

- Cost of Agricultural Produce Harvested from Biological Assets

- Techniques for the Measurement of Cost

- Inventories: Cost Formulaes

Check out Taxmann's Illustrated Guide to Indian Accounting Standards (Ind AS) which offers an in-depth examination of Ind AS, as amended by the Companies (Indian Accounting Standards) (Amendment) Rules 2023, and meticulously analyses the revised Schedule III of the Companies Act 2013. It presents process flow diagrams for significant Ind ASs, accompanied by charts, illustrations, and case studies that elucidate the intricacies of each standard. Definitions and practical guidance are also included, enabling readers to grasp and comprehend the nuances of each Ind AS.

1. Objective

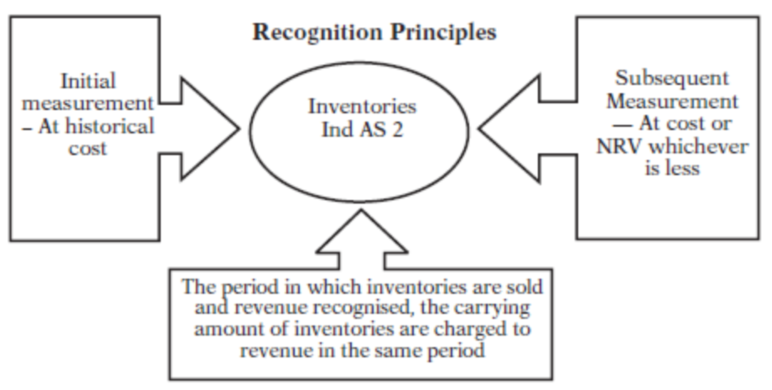

The objective of this Ind AS is to prescribe the accounting treatment for inventories. This standard deals in determination of cost of inventories as an asset and its subsequent recognition as expense, when the related revenues are recognised. It also provides guidance on the cost formulas that are used to assign costs to inventories.

2. Scope

This Standard applies to all inventories, except:

(a) Financial instruments (Ind AS 109, Financial Instruments and Ind AS 32, Financial Instruments : Presentation); and

(b) Biological assets (i.e., living animals or plants) related to agricultural activity and agricultural produce at the point of harvest (Ind AS 41, Agriculture).

3. Exclusion

This Standard does not apply to the measurement of inventories held by:

(a) Producers of agricultural and forest products, agricultural produce after harvest, and minerals and mineral products, to the extent that they are measured at net realisable value in accordance with well-

established practices in those industries. When such inventories are measured at net realisable value, changes in that value are recognised in profit or loss in the period of the change.

(b) Commodity broker-traders who measure their inventories at fair value less costs to sell. When such inventories are measured at fair value less costs to sell, changes in fair value less costs to sell are recognised in profit or loss in the period of the change.

The inventories referred to in paragraph 3(a) are measured at net realisable value at certain stages of production and therefore, these inventories are excluded from only the measurement requirements of this Standard.

This occurs, for example, when agricultural crops have been harvested or minerals have been extracted and sale is assured under a forward contract or a government guarantee, or when an active market exists and there is a negligible risk of failure to sell.

The inventories referred to in paragraph 3(b) are principally acquired with the purpose of selling in the near future and generating a profit from fluctuations in price or broker-traders’ margin. When these inventories are measured at fair value less costs to sell, they are excluded from only the measurement requirements of this Standard.

4. Definitions (Para 6)

Inventories are assets:

(a) Held for sale in the ordinary course of business;

(b) In the process of production for such sale; or

(c) In the form of materials or supplies to be consumed in the production process or in the rendering of services.

Net realisable value (NRV) is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale.

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. (See Ind AS 113, Fair Value Measurement.)

Net realisable value vs. Fair value

- Net realisable value refers to the net amount that an entity expects to realise from the sale of inventory in the ordinary course of business. Whereas fair value reflects the price at which an orderly transaction to sell the same inventory in the principal (or most advantageous) market for that inventory would take place between market participants at the measurement date.

- The former is an entity-specific value; the latter is not.

- Net realisable value for inventories may not equal fair value less costs to sell.

5. Recognition Principles

Recognition principle enunciated by the Standard is diagrammatically represented as under:

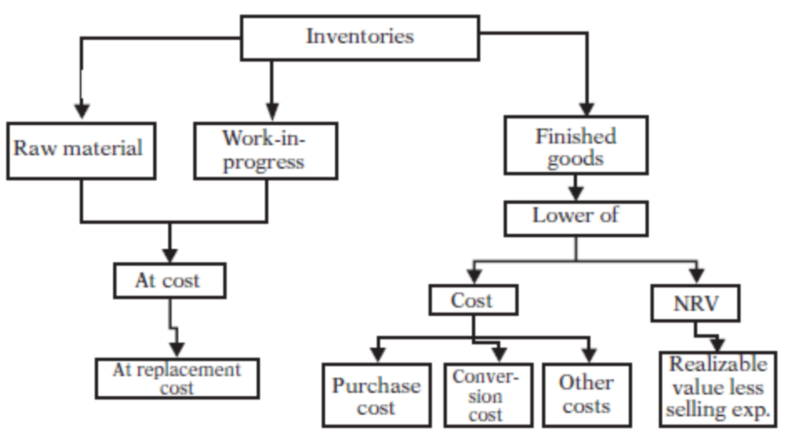

6. Measurement of Inventories (Para 9)

Inventories shall be measured at lower of cost and net realisable value as shown below :

Ind AS 2: Inventories

Inventories shall be measured at the lower of cost and net realizable value

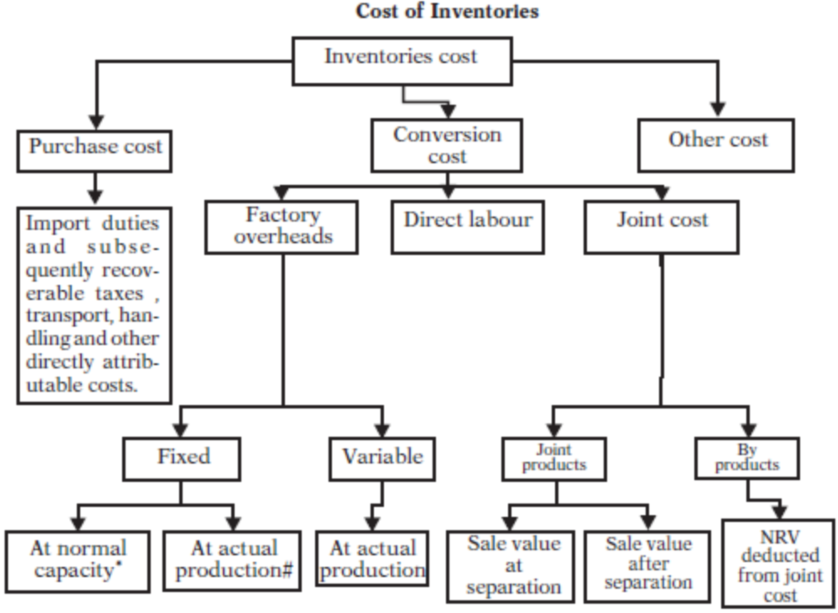

7. Cost of Inventories

According to para 10, the cost of inventories shall comprise all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition.

7.1 The cost of purchase of inventories comprise

The purchase price, import duties and other taxes (other than those subsequently recoverable by the entity from the taxing authorities), and transport, handling and other costs directly attributable to the acquisition of finished goods, materials and services. Trade discounts, rebates and other similar items are deducted in determining the costs of purchase.

7.2 The costs of conversion of inventories include

(a) Costs directly related to the units of production, such as direct labour.

(b) They also include a systematic allocation of fixed and variable production overheads that are incurred in converting materials into finished goods.

7.3 Fixed production overheads

| Fixed production overheads | Those indirect costs of production that remain relatively constant regardless of the volume of production, such as depreciation and maintenance of factory buildings and the cost of factory management and administration. |

The allocation of fixed production overheads for the purpose of their inclusion in the costs of conversion is based on the normal capacity of the production facilities.

7.4 Normal capacity

| Normal capacity | The production expected to be achieved on an average over a number of periods or seasons under normal circumstances, taking into account the loss of capacity resulting from planned maintenance. |

The actual level of production may be used if it approximates normal

capacity. The amount of fixed overhead allocated to each unit of production is not increased as a consequence of low production or idle plant. Unallocated overheads are recognised as an expense in the period in which they are incurred. In periods of abnormally high production, the amount of fixed overhead allocated to each unit of production is decreased so that inventories are not measured above cost.

Illustration 1

Beta Ltd. incurs a fixed production of ` 1,00,00,000 every year. Its normal capacity of production is 1,00,000 units. In the year 2018, 90,000 units were produced and in 2019, 1,10,000 units were produced.

In 2018 the actual production is short of normal capacity and therefore production overhead will be allocated on the basis of normal capacity. Therefore fixed production overhead will be ` 1,00,00,000/1,00,000 units = ` 100 per unit.

In 2019 the actual production is more than the normal capacity and therefore production overhead will be allocated on the basis of actual production. Therefore fixed production overhead will be ` 1,00,00,000/1,10,000 units = ` 90.9 per unit.

7.5 Variable production overheads

| Variable production overheads | Those indirect costs of production that vary directly, or nearly directly, with the volume of production, such as indirect materials and Indirect labour. |

Variable production overheads are assigned to each unit of production on the basis of the actual use of the production facilities.

Illustration 2

At Mc B’s store, the fuel consumed for cooking French fries is a variable overhead (indirect material). For every 100 meals which include French fries, Mc B needs fuel of ` 5. Therefore, per meal overhead cost is Re. 0.05. Mc B uses raw material of Re. 1 and pays wages of Re. 0.50 per unit.

Accordingly, total variable cost of the product is Re. 1.00 raw material + Re. 0.50 wages + Re. 0.05 variable overheads which is equal to ` 1.55.

7.6 Other costs

It included in the cost of inventories only to the extent that they are incurred in bringing the inventories to their present location and condition.

* When actual production is almost equal or lower than normal capacity

# When actual production is higher than normal capacity.

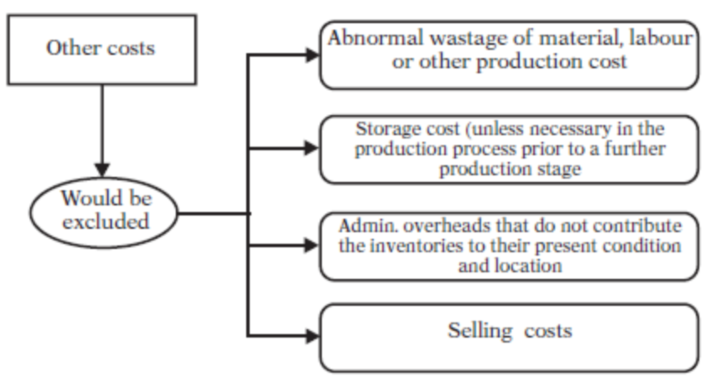

8. Costs Excluded from Valuation of Inventories

According to para 16, costs which are excluded from valuation of inventories and recognised as expenses for the period in which they are incurred are:

(a) Abnormal amounts of wasted materials, labour or other production costs

(b) Storage costs, unless those costs are necessary in the production process before a further production stage

(c) Administrative overheads that do not contribute to bringing inventories in their present location and condition and

(d) Selling costs

Ind AS 2: Inventories

Illustration 3

Alpha Ltd. purchased raw materials for ` 2,00,000 less a rebate of 5%. It paid

` 30,000 as customs duty including ` 15,000 towards a special duty, against which it will avail credit. It spent ` 5,000 on ocean freight, clearing agents charges of ` 4,000, ` 10,000 on warehouse rent and ` 5,000 on security guard’s wages.

Please determine the cost of inventory.

Solution

| Particulars | ` | ` |

| Purchase price

Less: Rebate (5%) Customs duty Less: Special duty (to be refunded) Add: Ocean freight Add: Clearing agents charges |

2,00,000 (10,000) 30,000 (15,000) |

1,90,000

15,000 5,000 4,000 |

| Total | 2,14,000 |

Please note Warehouse rent of ` 10,000 and Security guard’s wages of ` 5,000 not included as they are not incurred in acquiring the inventory.

9. Borrowing Costs and Inventories

Ind AS 23, Borrowing costs identifies limited circumstances where borrowing costs are included in the cost of inventories.

10. Inventories Purchased on Deferred Settlement Terms

Para 18: An entity may purchase inventories on deferred settlement terms. When the arrangement effectively contains a financing element, that element, for example a difference between the purchase price for normal credit terms and the amount paid, is recognised as interest expense over the period of the financing.

Company A purchased Material X on April 01 202X. The cash equivalent price of the material is Rs 100,000. Company A negotiated with suppliers and the final terms and conditions are as below:

- Payment terms: To be paid after 1 year

- Amount: Rs 150,000

In this case, the payment is deferred beyond normal credit terms and therefore the difference of Rs 50,000 (150,000 – 100,000) will be recognised as interest cost over the period of 1 year and Material X will be recorded only at Rs 100,000 which is the cash equivalent price of the material.

11. Cost of Agricultural Produce Harvested from Biological Assets

In accordance with Ind AS 41, Agriculture, inventories comprising agricultural produce that an entity has harvested from its biological assets are measured on initial recognition at their fair value less costs to sell at the point of harvest.

This is the cost of the inventories at that date for application of this Standard.

12. Techniques for the Measurement of Cost

According to para 21, techniques for the measurement of the cost of inventories, such as the standard cost method or the retail method, may be used for convenience if the results approximate cost. Standard costs take into normal levels of materials and supplies, labour, efficiency and capacity utilisation. They are regularly reviewed and revised where necessary.

In accordance with para 22, the retail method is often used in the retail industry for measuring inventories of large number of rapidly changing items with similar margins for which it is impracticable to use other costing methods. The cost of the inventory is determined by reducing the sales value of the inventory by the appropriate percentage gross margin. The percentage used takes into consideration inventory that has been marked down to below its original selling price. An average percentage for each retail department is often used.

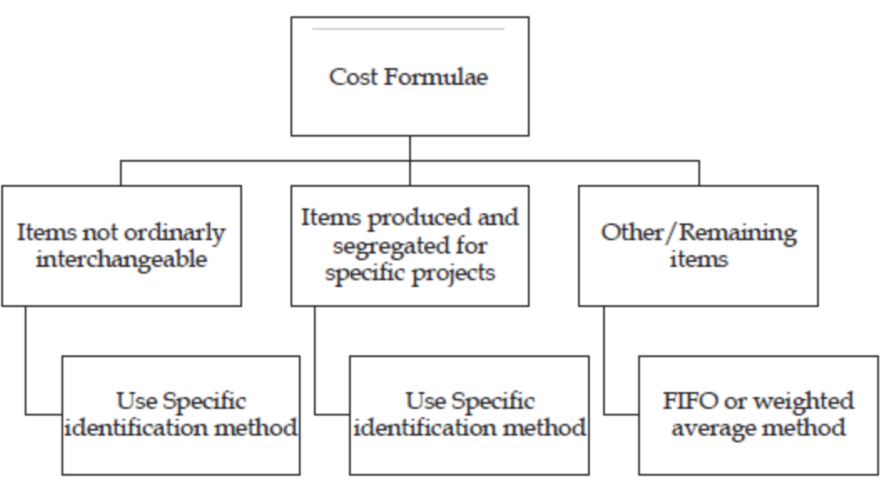

13. Inventories: Cost Formulaes

The cost of inventories of items that are not ordinarily interchangeable and goods or services produced and segregated for specific projects shall be assigned by using specific identification of their individual costs.

The cost of inventories, other than those dealt above shall be assigned by using the first-in, first-out (FIFO) or weighted average cost formula. An entity shall use the same cost formula for all inventories having a similar nature and use to the entity. For inventories with a different nature or use, different cost formulas may be justified.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA